Monetary Policy on:

[Wikipedia]

[Google]

[Amazon]

Monetary policy is the policy adopted by the

Monetary policy is the policy adopted by the

For many centuries there were only two forms of monetary policy: altering coinage or the printing of

For many centuries there were only two forms of monetary policy: altering coinage or the printing of  Paper money originated from

Paper money originated from

File:BankofFinlandSuomenPankkiFinlandsBank.jpg, The Bank of Finland, in

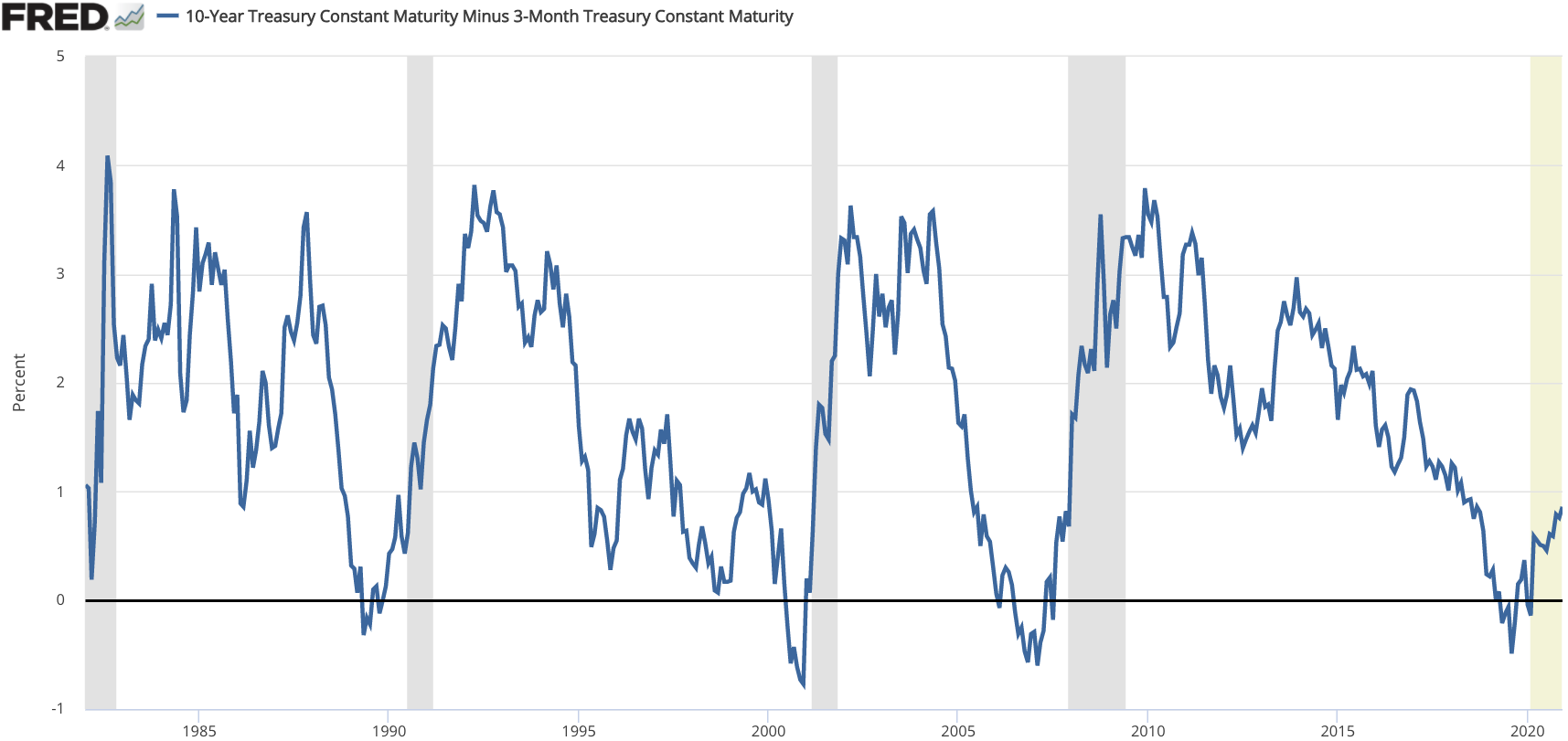

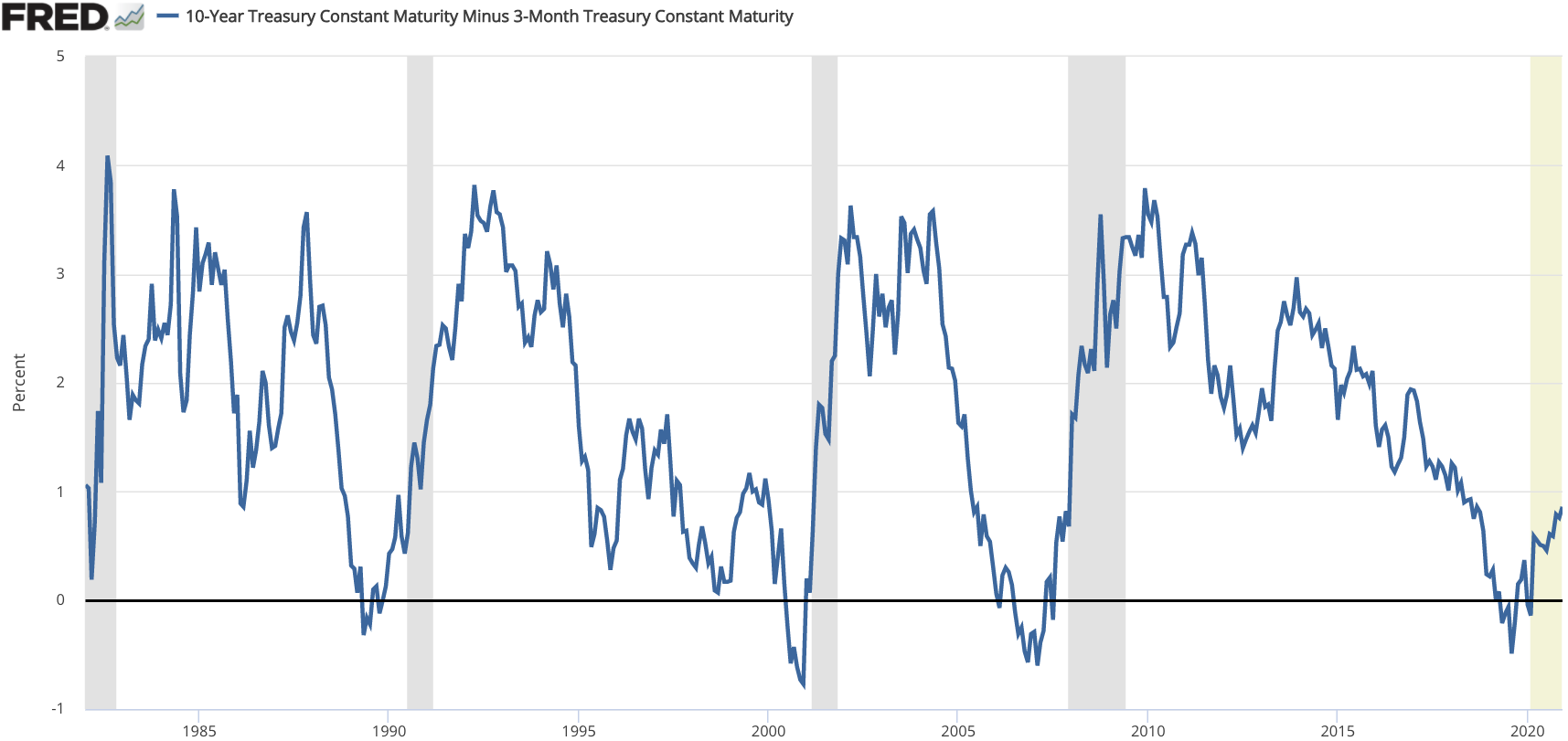

The target rates are generally short-term rates. The actual rate that borrowers and lenders receive on the market will depend on (perceived) credit risk, maturity and other factors. For example, a central bank might set a target rate for overnight lending of 4.5%, but rates for (equivalent risk) five-year bonds might be 5%, 4.75%, or, in cases of

The target rates are generally short-term rates. The actual rate that borrowers and lenders receive on the market will depend on (perceived) credit risk, maturity and other factors. For example, a central bank might set a target rate for overnight lending of 4.5%, but rates for (equivalent risk) five-year bonds might be 5%, 4.75%, or, in cases of

Through open market operations, a central bank influences the money supply in an economy. Each time it buys

Through open market operations, a central bank influences the money supply in an economy. Each time it buys  Open market operations usually take the form of:

* Buying or selling securities (" direct operations") to achieve an interest rate target in the interbank market .

* Temporary lending of money for

Open market operations usually take the form of:

* Buying or selling securities (" direct operations") to achieve an interest rate target in the interbank market .

* Temporary lending of money for

Historically,

Historically,  As the early 20th century

As the early 20th century

The Bank of Japan used to apply such policy ("window guidance") between 1962 and 1991. The

The Bank of Japan used to apply such policy ("window guidance") between 1962 and 1991. The

The different types of policy are also called monetary regimes, in parallel to

Bank for International Settlements

{{Authority control Macroeconomic policy Public finance

Monetary policy is the policy adopted by the

Monetary policy is the policy adopted by the monetary authority

In finance and economics, a monetary authority is the entity that manages a country’s currency and money supply, often with the objective of controlling inflation, interest rates, real GDP or unemployment rate. With its monetary tools, a m ...

of a nation to control either the interest rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, th ...

payable for very short-term borrowing (borrowing by banks from each other to meet their short-term needs) or the money supply

In macroeconomics, the money supply (or money stock) refers to the total volume of currency held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include currency in circul ...

, often as an attempt to reduce inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduct ...

or the interest rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, th ...

, to ensure price stability Price stability is a goal of monetary and fiscal policy aiming to support sustainable rates of economic activity. Policy is set to maintain a very low rate of inflation or deflation. For example, the European Central Bank (ECB) describes price s ...

and general trust of the value and stability of the nation's currency.

Monetary policy is a modification of the supply of money, i.e. "printing" more money, or decreasing the money supply by changing interest rates or removing excess reserves

Excess reserves are bank reserves held by a bank in excess of a reserve requirement for it set by a central bank.

In the United States, bank reserves for a commercial bank are represented by its cash holdings and any credit balance in an account ...

. This is in contrast to fiscal policy

In economics and political science, fiscal policy is the use of government revenue collection (taxes or tax cuts) and expenditure to influence a country's economy. The use of government revenue expenditures to influence macroeconomic variab ...

, which relies on tax

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or n ...

ation, government spending, and government borrowing as methods for a government to manage business cycle phenomena such as recession

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various ...

s.

Further purposes of a monetary policy are usually to contribute to the stability of gross domestic product

Gross domestic product (GDP) is a money, monetary Measurement in economics, measure of the market value of all the final goods and services produced and sold (not resold) in a specific time period by countries. Due to its complex and subjec ...

, to achieve and maintain low unemployment

Unemployment, according to the OECD (Organisation for Economic Co-operation and Development), is people above a specified age (usually 15) not being in paid employment or self-employment but currently available for work during the refere ...

, and to maintain predictable exchange rates

In finance, an exchange rate is the rate at which one currency will be exchanged for another currency. Currencies are most commonly national currencies, but may be sub-national as in the case of Hong Kong or supra-national as in the case of ...

with other currencies

A currency, "in circulation", from la, currens, -entis, literally meaning "running" or "traversing" is a standardization of money in any form, in use or circulation as a medium of exchange, for example banknotes and coins.

A more general def ...

.

Monetary economics

Monetary economics is the branch of economics that studies the different competing theories of money: it provides a framework for analyzing money and considers its functions (such as medium of exchange, store of value and unit of account), and ...

can provide insight into crafting optimal monetary policy. In developed countries

A developed country (or industrialized country, high-income country, more economically developed country (MEDC), advanced country) is a sovereign state that has a high quality of life, developed economy and advanced technological infrastruct ...

, monetary policy is generally formed separately from fiscal policy.

Monetary policy is referred to as being either expansionary or contractionary.

Expansionary policy occurs when a monetary authority uses its procedures to stimulate the economy. An expansionary policy maintains short-term interest rates at a lower than usual rate or increases the total supply of money in the economy more rapidly than usual. It is traditionally used to try to reduce unemployment

Unemployment, according to the OECD (Organisation for Economic Co-operation and Development), is people above a specified age (usually 15) not being in paid employment or self-employment but currently available for work during the refere ...

during a recession

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various ...

by decreasing interest rates in the hope that less expensive credit will entice businesses into borrowing more money and thereby expanding. This would increase aggregate demand (the overall demand for all goods and services in an economy), which would increase short-term growth as measured by increase of gross domestic product

Gross domestic product (GDP) is a money, monetary Measurement in economics, measure of the market value of all the final goods and services produced and sold (not resold) in a specific time period by countries. Due to its complex and subjec ...

(GDP). Expansionary monetary policy, by increasing the amount of currency in circulation, usually diminishes the value of the currency relative to other currencies (the exchange rate

In finance, an exchange rate is the rate at which one currency will be exchanged for another currency. Currencies are most commonly national currencies, but may be sub-national as in the case of Hong Kong or supra-national as in the case of ...

), in which case foreign purchasers will be able to purchase more with their currency in the country with the devalued currency.

Contractionary policy maintains short-term interest rates greater than usual, slows the rate of growth of the money supply, or even decreases it to slow short-term economic growth and lessen inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduct ...

. Contractionary policy can result in increased unemployment and depressed borrowing and spending by consumers and businesses, which can eventually result in an economic recession

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various ...

if implemented too vigorously.

History

Monetary policy is associated withinterest rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, th ...

s and availability of credit

Credit (from Latin verb ''credit'', meaning "one believes") is the trust which allows one party to provide money or resources to another party wherein the second party does not reimburse the first party immediately (thereby generating a debt) ...

. Instruments of monetary policy have included short-term interest rates and bank reserves through the monetary base.

For many centuries there were only two forms of monetary policy: altering coinage or the printing of

For many centuries there were only two forms of monetary policy: altering coinage or the printing of paper money

A banknote—also called a bill (North American English), paper money, or simply a note—is a type of negotiable promissory note, made by a bank or other licensed authority, payable to the bearer on demand.

Banknotes were originally issued ...

. Interest rates, while now thought of as part of monetary authority

In finance and economics, a monetary authority is the entity that manages a country’s currency and money supply, often with the objective of controlling inflation, interest rates, real GDP or unemployment rate. With its monetary tools, a m ...

, were not generally coordinated with the other forms of monetary policy during this time. Monetary policy was considered as an executive decision, and was generally implemented by the authority with seigniorage

Seigniorage , also spelled seignorage or seigneurage (from the Old French ''seigneuriage'', "right of the lord (''seigneur'') to mint money"), is the difference between the value of money and the cost to produce and distribute it. The term can be ...

(the power to coin). With the advent of larger trading networks came the ability to define the currency value in terms of gold or silver, and the price of the local currency in terms of foreign currencies. This official price could be enforced by law, even if it varied from the market price.

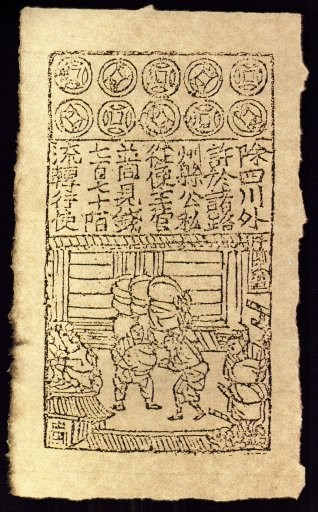

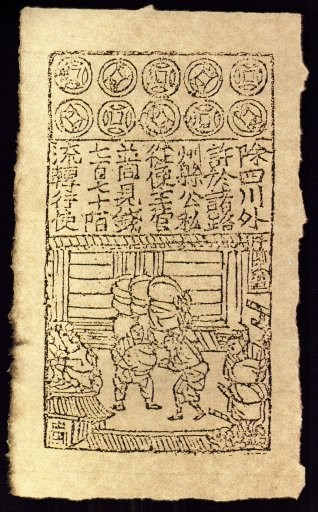

Paper money originated from

Paper money originated from promissory notes

A promissory note, sometimes referred to as a note payable, is a legal instrument (more particularly, a financing instrument and a debt instrument), in which one party (the ''maker'' or ''issuer'') promises in writing to pay a determinate sum of ...

termed "jiaozi

''Jiaozi'' (; ; pinyin: jiǎozi) are Chinese dumplings commonly eaten in China and other parts of East Asia. ''Jiaozi'' are folded to resemble Chinese sycee and have great cultural significance attached to them within China. ''Jiaozi'' are ...

" in 7th century China

China, officially the People's Republic of China (PRC), is a country in East Asia. It is the world's most populous country, with a population exceeding 1.4 billion, slightly ahead of India. China spans the equivalent of five time zones and ...

. Jiaozi did not replace metallic currency, and were used alongside the copper coins. The succeeding Yuan Dynasty

The Yuan dynasty (), officially the Great Yuan (; xng, , , literally "Great Yuan State"), was a Mongol-led imperial dynasty of China and a successor state to the Mongol Empire after its division. It was established by Kublai, the fifth ...

was the first government to use paper currency as the predominant circulating medium. In the later course of the dynasty, facing massive shortages of specie to fund war and maintain their rule, they began printing paper money without restrictions, resulting in hyperinflation

In economics, hyperinflation is a very high and typically accelerating inflation. It quickly erodes the real value of the local currency, as the prices of all goods increase. This causes people to minimize their holdings in that currency as t ...

.

With the creation of the Bank of England

The Bank of England is the central bank of the United Kingdom and the model on which most modern central banks have been based. Established in 1694 to act as the English Government's banker, and still one of the bankers for the Government of ...

in 1694, which was granted the authority to print notes backed by gold, the idea of monetary policy as independent of executive action began to be established. The purpose of monetary policy was to maintain the value of the coinage, print notes which would trade at par to specie, and prevent coins from leaving circulation. The establishment of national banks by industrializing nations was associated then with the desire to maintain the currency's relationship to the gold standard

A gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the early 1920s, and from the la ...

, and to trade in a narrow currency band

A currency band is a range of values for the exchange rate for a country’s currency which the country’s central bank acts to keep the exchange rate within.

The central bank selects a range, or "band", of values at which to set their currenc ...

with other gold-backed currencies. To accomplish this end, national banks as part of the gold standard began setting the interest rates that they charged both their own borrowers and other banks which required money for liquidity. The maintenance of a gold standard required almost monthly adjustments of interest rates.

The gold standard is a system by which the price of the national currency is fixed vis-a-vis the value of gold, and is kept constant by the government's promise to buy or sell gold at a fixed price in terms of the base currency. The gold standard might be regarded as a special case of "fixed exchange rate" policy, or as a special type of commodity price level targeting.

Nowadays this type of monetary policy is no longer used by any country.

During the period 1870–1920, the industrialized nations established central banking systems, with one of the last being the Federal Reserve

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States of America. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a ...

in 1913. By this time the role of the central bank as the "lender of last resort

A lender of last resort (LOLR) is the institution in a financial system that acts as the provider of liquidity to a financial institution which finds itself unable to obtain sufficient liquidity in the interbank lending market when other faci ...

" was established. It was also increasingly understood that interest rates had an effect on the entire economy, in no small part because of appreciation for the marginal revolution in economics, which demonstrated that people would change their decisions based on changes in their economic trade-offs.

Monetarist economists long contended that the money-supply growth could affect the macroeconomy. These included Milton Friedman

Milton Friedman (; July 31, 1912 – November 16, 2006) was an American economist and statistician who received the 1976 Nobel Memorial Prize in Economic Sciences for his research on consumption analysis, monetary history and theory and the ...

who early in his career advocated that government budget deficit

The government budget balance, also alternatively referred to as general government balance, public budget balance, or public fiscal balance, is the overall difference between government revenues and spending. A positive balance is called a ''g ...

s during recessions be financed in equal amount by money creation to help to stimulate aggregate demand for production. Later he advocated simply increasing the monetary supply at a low, constant rate, as the best way of maintaining low inflation and stable production growth. However, when U.S. Federal Reserve

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States of America. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a ...

Chairman Paul Volcker

Paul Adolph Volcker Jr. (September 5, 1927 – December 8, 2019) was an American economist who served as the 12th chairman of the Federal Reserve from 1979 to 1987. During his tenure as chairman, Volcker was widely credited with having ended th ...

tried this policy, starting in October 1979, it was found to be impractical, because of the unstable relationship between monetary aggregates and other macroeconomic variables. Even Milton Friedman later acknowledged that direct money supplying was less successful than he had hoped.

Therefore, monetary decisions presently take into account a wider range of factors, such as:

* short-term interest rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, th ...

s;

* long-term interest rates;

* velocity of money through the economy;

* exchange rate

In finance, an exchange rate is the rate at which one currency will be exchanged for another currency. Currencies are most commonly national currencies, but may be sub-national as in the case of Hong Kong or supra-national as in the case of ...

s;

* credit quality

A credit rating is an evaluation of the credit risk of a prospective debtor (an individual, a business, company or a government), predicting their ability to pay back the debt, and an implicit forecast of the likelihood of the debtor defaultin ...

;

* bonds and equities

In finance, stock (also capital stock) consists of all the shares by which ownership of a corporation or company is divided.Longman Business English Dictionary: "stock - ''especially AmE'' one of the shares into which ownership of a company ...

(debt and corporate ownership);

* government versus private sector spending and savings;

* international capital flow

In economics, capital goods or capital are "those durable produced goods that are in turn used as productive inputs for further production" of goods and services. At the macroeconomic level, "the nation's capital stock includes buildings, eq ...

s of money on large scales;

* financial derivatives

The derivative of a function is the rate of change of the function's output relative to its input value.

Derivative may also refer to:

In mathematics and economics

* Brzozowski derivative in the theory of formal languages

* Formal derivative, an ...

such as options, swaps, and futures contract

In finance, a futures contract (sometimes called a futures) is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The asset ...

s

Helsinki

Helsinki ( or ; ; sv, Helsingfors, ) is the Capital city, capital, primate city, primate, and List of cities and towns in Finland, most populous city of Finland. Located on the shore of the Gulf of Finland, it is the seat of the region of U ...

, established in 1812.

File:Basel - Bank für internationalen Zahlungsausgleich3.jpg, The headquarters of the Bank for International Settlements

The Bank for International Settlements (BIS) is an international financial institution owned by central banks that "fosters international monetary and financial cooperation and serves as a bank for central banks".

The BIS carries out its work thr ...

, in Basel

, french: link=no, Bâlois(e), it, Basilese

, neighboring_municipalities= Allschwil (BL), Hégenheim (FR-68), Binningen (BL), Birsfelden (BL), Bottmingen (BL), Huningue (FR-68), Münchenstein (BL), Muttenz (BL), Reinach (BL), Riehen (BS ...

(Switzerland

). Swiss law does not designate a ''capital'' as such, but the federal parliament and government are installed in Bern, while other federal institutions, such as the federal courts, are in other cities (Bellinzona, Lausanne, Luzern, Neuchâtel ...

).

File:RBI-Tower.jpg, The Reserve Bank of India

The Reserve Bank of India, chiefly known as RBI, is India's central bank and regulatory body responsible for regulation of the Indian banking system. It is under the ownership of Ministry of Finance, Government of India. It is responsible f ...

(established in 1935) Headquarters in Mumbai

Mumbai (, ; also known as Bombay — the official name until 1995) is the capital city of the Indian state of Maharashtra and the ''de facto'' financial centre of India. According to the United Nations, as of 2018, Mumbai is the second- ...

.

File:Central Bank of Brazil.jpg, The Central Bank of Brazil

The Central Bank of Brazil ( pt, Banco Central do Brasil) is Brazil's central bank. It was established on Thursday, 31 December 1964, a New Year's Eve.

The bank is not linked to any ministry, currently being autonomous. Like other central banks ...

(established in 1964) in Brasília

Brasília (; ) is the federal capital of Brazil and seat of government of the Federal District. The city is located at the top of the Brazilian highlands in the country's Central-West region. It was founded by President Juscelino Kubitsche ...

.

File:Banco de España (Madrid) 06.jpg, The Bank of Spain (established in 1782) in Madrid

Madrid ( , ) is the capital and most populous city of Spain. The city has almost 3.4 million inhabitants and a metropolitan area population of approximately 6.7 million. It is the second-largest city in the European Union (EU), and ...

.

Monetary policy instruments

The main monetary policy instruments available to central banks are open market operation, bankreserve requirement

Reserve requirements are central bank regulations that set the minimum amount that a commercial bank must hold in liquid assets. This minimum amount, commonly referred to as the commercial bank's reserve, is generally determined by the centra ...

, interest rate policy, re-lending and re-discount (including using the term repurchase market), and credit policy (often coordinated with trade policy

A commercial policy (also referred to as a trade policy or international trade policy) is a government's policy governing international trade. Commercial policy is an all encompassing term that is used to cover topics which involve international t ...

). While capital adequacy

A capital requirement (also known as regulatory capital, capital adequacy or capital base) is the amount of capital a bank or other financial institution has to have as required by its financial regulator. This is usually expressed as a capital a ...

is important, it is defined and regulated by the Bank for International Settlements, and central banks in practice generally do not apply stricter rules.

Conventional instrument

Thecentral bank

A central bank, reserve bank, or monetary authority is an institution that manages the currency and monetary policy of a country or monetary union,

and oversees their commercial banking system. In contrast to a commercial bank, a central ba ...

influences interest rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, th ...

s by expanding or contracting the monetary base, which consists of currency in circulation and banks' reserves on deposit at the central bank.

Central banks have three main methods of monetary policy: open market operations, the discount rate and the reserve requirement

Reserve requirements are central bank regulations that set the minimum amount that a commercial bank must hold in liquid assets. This minimum amount, commonly referred to as the commercial bank's reserve, is generally determined by the centra ...

s.

Key Interest rates & refinancing operations

By far the most visible and obvious power of many modern central banks is to influence market interest rates; contrary to popular belief, they rarely "set" rates to a fixed number. Although the mechanism differs from country to country, most use a similar mechanism based on a central bank's ability to create as muchfiat money

Fiat money (from la, fiat, "let it be done") is a type of currency that is not backed by any commodity such as gold or silver. It is typically designated by the issuing government to be legal tender. Throughout history, fiat money was sometime ...

as required.

The mechanism to move the market towards a 'target rate' (whichever specific rate is used) is generally to lend money or borrow money in theoretically unlimited quantities until the targeted market rate is sufficiently close to the target. Central banks may do so by lending money to and borrowing money from (taking deposits from) a limited number of qualified banks, or by purchasing and selling bonds. As an example of how this functions, the Bank of Canada sets a target overnight rate

The overnight rate is generally the interest rate that large banks use to borrow and lend from one another in the overnight market. In some countries (the United States, for example), the overnight rate may be the rate targeted by the central ban ...

, and a band of plus or minus 0.25%. Qualified banks borrow from each other within this band, but never above or below, because the central bank will always lend to them at the top of the band, and take deposits at the bottom of the band; in principle, the capacity to borrow and lend at the extremes of the band are unlimited. Other central banks use similar mechanisms. The target rates are generally short-term rates. The actual rate that borrowers and lenders receive on the market will depend on (perceived) credit risk, maturity and other factors. For example, a central bank might set a target rate for overnight lending of 4.5%, but rates for (equivalent risk) five-year bonds might be 5%, 4.75%, or, in cases of

The target rates are generally short-term rates. The actual rate that borrowers and lenders receive on the market will depend on (perceived) credit risk, maturity and other factors. For example, a central bank might set a target rate for overnight lending of 4.5%, but rates for (equivalent risk) five-year bonds might be 5%, 4.75%, or, in cases of inverted yield curve

In finance, an inverted yield curve happens when a yield curve graph of typically government bonds inverts in the opposite direction and the shorter term US Treasury bonds are offering a higher yield than the long-term Treasury bonds. Long ...

s, even below the short-term rate. Many central banks have one primary "headline" rate that is quoted as the "central bank rate". In practice, they will have other tools and rates that are used, but only one that is rigorously targeted and enforced.

"The rate at which the central bank lends money can indeed be chosen at will by the central bank; this is the rate that makes the financial headlines." Henry C.K. Liu explains further that "the U.S. central-bank lending rate is known as the Fed funds rate

In the United States, the federal funds rate is the interest rate at which depository institutions (banks and credit unions) lend reserve balances to other depository institutions overnight on an uncollateralized basis. Reserve balances ...

. The Fed sets a target for the Fed funds rate, which its Open Market Committee tries to match by lending or borrowing in the money market

The money market is a component of the economy that provides short-term funds. The money market deals in short-term loans, generally for a period of a year or less.

As short-term securities became a commodity, the money market became a compon ...

... a fiat money system set by command of the central bank. The Fed is the head of the central-bank because the U.S. dollar is the key reserve currency for international trade. The global money market is a USA dollar market. All other currencies markets revolve around the U.S. dollar market." Accordingly, the U.S. situation is not typical of central banks in general.

Typically a central bank controls certain types of short-term interest rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, th ...

s. These influence the stock- and bond market

The bond market (also debt market or credit market) is a financial market where participants can issue new debt, known as the primary market, or buy and sell debt securities, known as the secondary market. This is usually in the form of bonds, bu ...

s as well as mortgage

A mortgage loan or simply mortgage (), in civil law jurisdicions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any ...

and other interest rates. The European Central Bank, for example, announces its interest rate at the meeting of its Governing Council; in the case of the U.S. Federal Reserve, the Federal Reserve Board of Governors

The Board of Governors of the Federal Reserve System, commonly known as the Federal Reserve Board, is the main governing body of the Federal Reserve System. It is charged with overseeing the Federal Reserve Banks and with helping implement the mon ...

. Both the Federal Reserve and the ECB are composed of one or more central bodies that are responsible for the main decisions about interest rates and the size and type of open market operations, and several branches to execute its policies. In the case of the Federal Reserve, they are the local Federal Reserve Banks; for the ECB they are the national central banks.

A typical central bank has several interest rates or monetary policy tools it can set to influence markets.

* Marginal lending rate – a fixed rate for institutions to borrow money from the central bank. (In the USA this is called the discount rate).

* Main refinancing rate – the publicly visible interest rate the central bank announces. It is also known as ''minimum bid rate'' and serves as a bidding floor for refinancing loans. (In the USA this is called the federal funds rate

In the United States, the federal funds rate is the interest rate at which depository institutions (banks and credit unions) lend reserve balances to other depository institutions overnight on an uncollateralized basis. Reserve balances a ...

).

* Deposit rate, generally consisting of interest on reserves and sometimes also interest on excess reserves

Excess reserves are bank reserves held by a bank in excess of a reserve requirement for it set by a central bank.

In the United States, bank reserves for a commercial bank are represented by its cash holdings and any credit balance in an account ...

– the rates parties receive for deposits at the central bank.

These rates directly affect the rates in the money market, the market for short-term loans.

Some central banks (e.g. in Denmark, Sweden and the Eurozone) are currently applying negative interest rates

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, th ...

.

Open market operations

securities

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any for ...

(such as a government bond

A government bond or sovereign bond is a form of bond issued by a government to support public spending. It generally includes a commitment to pay periodic interest, called coupon payments'','' and to repay the face value on the maturity dat ...

or treasury bill), it in effect creates money. The central bank exchanges money for the security, increasing the money supply

In macroeconomics, the money supply (or money stock) refers to the total volume of currency held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include currency in circul ...

while lowering the supply of the specific security. Conversely, selling of securities by the central bank reduces the money supply. Open market operations usually take the form of:

* Buying or selling securities (" direct operations") to achieve an interest rate target in the interbank market .

* Temporary lending of money for

Open market operations usually take the form of:

* Buying or selling securities (" direct operations") to achieve an interest rate target in the interbank market .

* Temporary lending of money for collateral

Collateral may refer to:

Business and finance

* Collateral (finance), a borrower's pledge of specific property to a lender, to secure repayment of a loan

* Marketing collateral, in marketing and sales

Arts, entertainment, and media

* ''Collate ...

securities ("Reverse Operations" or " repurchase operations", otherwise known as the "repo" market). These operations are carried out on a regular basis, where fixed maturity loans (of one week and one month for the ECB) are auctioned off.

* Foreign exchange

The foreign exchange market (Forex, FX, or currency market) is a global decentralized or over-the-counter (OTC) market for the trading of currencies. This market determines foreign exchange rates for every currency. It includes all as ...

operations such as foreign exchange swap

In finance, a foreign exchange swap, forex swap, or FX swap is a simultaneous purchase and sale of identical amounts of one currency for another with two different value dates (normally spot to forward) and may use foreign exchange derivatives. ...

s.

These interventions can also influence the foreign exchange market and thus the exchange rate. For example, the People's Bank of China

The People's Bank of China (officially PBC or informally PBOC; ) is the central bank of the People's Republic of China, responsible for carrying out monetary policy and regulation of financial institutions in mainland China, as determined by ...

and the Bank of Japan have on occasion bought several hundred billions of U.S. Treasuries, presumably in order to stop the decline of the U.S. dollar

The United States dollar ( symbol: $; code: USD; also abbreviated US$ or U.S. Dollar, to distinguish it from other dollar-denominated currencies; referred to as the dollar, U.S. dollar, American dollar, or colloquially buck) is the officia ...

versus the renminbi and the yen

The is the official currency of Japan. It is the third-most traded currency in the foreign exchange market, after the United States dollar (US$) and the euro. It is also widely used as a third reserve currency after the US dollar and the e ...

.

Reserve requirements

Historically,

Historically, bank reserves

Bank reserves are a commercial bank's cash holdings physically held by the bank, and deposits held in the bank's account with the central bank. Under the fractional-reserve banking system used in most countries, central banks typically set mini ...

have formed only a small fraction of deposits

A deposit account is a bank account maintained by a financial institution in which a customer can deposit and withdraw money. Deposit accounts can be savings accounts, current accounts or any of several other types of accounts explained below.

...

, a system called fractional-reserve banking

Fractional-reserve banking is the system of banking operating in almost all countries worldwide, under which banks that take deposits from the public are required to hold a proportion of their deposit liabilities in liquid assets as a reserve, ...

. Banks would hold only a small percentage of their assets in the form of cash reserves as insurance against bank runs. Over time this process has been regulated and insured by central banks. Such legal reserve requirement

Reserve requirements are central bank regulations that set the minimum amount that a commercial bank must hold in liquid assets. This minimum amount, commonly referred to as the commercial bank's reserve, is generally determined by the centra ...

s were introduced in the 19th century as an attempt to reduce the risk of banks overextending themselves and suffering from bank runs, as this could lead to knock-on effects on other overextended banks. ''See also money multiplier.''

As the early 20th century

As the early 20th century gold standard

A gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the early 1920s, and from the la ...

was undermined by inflation and the late 20th-century fiat dollar hegemony evolved, and as banks proliferated and engaged in more complex transactions and were able to profit from dealings globally on a moment's notice, these practices became mandatory, if only to ensure that there was some limit on the ballooning of money supply.

A number of central banks have since abolished their reserve requirements over the last few decades, beginning with the Reserve Bank of New Zealand in 1985 and continuing with the Federal Reserve in 2020. For the respective banking systems, bank capital requirements provide a check on the growth of the money supply.

The People's Bank of China

The People's Bank of China (officially PBC or informally PBOC; ) is the central bank of the People's Republic of China, responsible for carrying out monetary policy and regulation of financial institutions in mainland China, as determined by ...

retains (and uses) more powers over reserves because the yuan that it manages is a non-convertible currency

Convertibility is the quality that allows money or other financial instruments to be converted into other liquid stores of value. Convertibility is an important factor in international trade, where instruments valued in different currencies mus ...

.

Loan activity by banks plays a fundamental role in determining the money supply. The central-bank money after aggregate settlement – "final money" – can take only one of two forms:

* physical cash, which is rarely used in wholesale financial markets,

* central-bank money which is rarely used by the people

The currency component of the money supply is far smaller than the deposit component. Currency, bank reserves and institutional loan agreements together make up the monetary base, called M1, M2 and M3. The Federal Reserve Bank stopped publishing M3 and counting it as part of the money supply in 2006.

Credit guidance

Central banks can directly or indirectly influence the allocation of bank lending in certain sectors of the economy by applying quotas, limits or differentiated interest rates. This allows the central bank to control both the quantity of lending and its allocation towards certain strategic sectors of the economy, for example to support the national industrial policy, or to environmental investment such as housing renovation. The Bank of Japan used to apply such policy ("window guidance") between 1962 and 1991. The

The Bank of Japan used to apply such policy ("window guidance") between 1962 and 1991. The Banque de France

The Bank of France ( French: ''Banque de France''), headquartered in Paris, is the central bank of France. Founded in 1800, it began as a private institution for managing state debts and issuing notes. It is responsible for the accounts of the ...

also widely used credit guidance during the post-war period of 1948 until 1973 .

The European Central Bank's ongoing TLTROs operations can also be described as form of credit guidance insofar as the level of interest rate ultimately paid by banks is differentiated according to the volume of lending made by commercial banks at the end of the maintenance period. If commercial banks achieve a certain lending performance threshold, they get a discount interest rate, that is lower than the standard key interest rate. For this reason, some economists have described the TLTROs as a "dual interest rates" policy. China is also applying a form of dual rate policy.

Exchange requirements

To influence the money supply, some central banks may require that some or all foreign exchange receipts (generally from exports) be exchanged for the local currency. The rate that is used to purchase local currency may be market-based or arbitrarily set by the bank. This tool is generally used in countries with non-convertible currencies or partially convertible currencies. The recipient of the local currency may be allowed to freely dispose of the funds, required to hold the funds with the central bank for some period of time, or allowed to use the funds subject to certain restrictions. In other cases, the ability to hold or use the foreign exchange may be otherwise limited. In this method, money supply is increased by the central bank when it purchases the foreign currency by issuing (selling) the local currency. The central bank may subsequently reduce the money supply by various means, including selling bonds or foreign exchange interventions.Collateral policy

In some countries, central banks may have other tools that work indirectly to limit lending practices and otherwise restrict or regulate capital markets. For example, a central bank may regulate margin lending, whereby individuals or companies may borrow against pledged securities. The margin requirement establishes a minimum ratio of the value of the securities to the amount borrowed. Central banks often have requirements for the quality of assets that may be held by financial institutions; these requirements may act as a limit on the amount of risk and leverage created by the financial system. These requirements may be direct, such as requiring certain assets to bear certain minimumcredit rating

A credit rating is an evaluation of the credit risk of a prospective debtor (an individual, a business, company or a government), predicting their ability to pay back the debt, and an implicit forecast of the likelihood of the debtor defaulting.

...

s, or indirect, by the central bank lending to counter-parties only when security of a certain quality is pledged as collateral

Collateral may refer to:

Business and finance

* Collateral (finance), a borrower's pledge of specific property to a lender, to secure repayment of a loan

* Marketing collateral, in marketing and sales

Arts, entertainment, and media

* ''Collate ...

.

Forward guidance

Forward guidance is a communication practice whereby the central bank announces its forecasts and future intentions to increase market expectations of future levels of interest rates.Unconventional monetary policy at the zero bound

Other forms of monetary policy, particularly used when interest rates are at or near 0% and there are concerns about deflation or deflation is occurring, are referred to as unconventional monetary policy. These include credit easing,quantitative easing

Quantitative easing (QE) is a monetary policy action whereby a central bank purchases predetermined amounts of government bonds or other financial assets in order to stimulate economic activity. Quantitative easing is a novel form of monetary pol ...

, forward guidance Forward guidance is a tool used by a central bank to exercise its power in monetary policy in order to influence, with their own forecasts, market expectations of future levels of interest rates.

Communication about the likely future course of mon ...

, and signalling

In signal processing, a signal is a function that conveys information about a phenomenon. Any quantity that can vary over space or time can be used as a signal to share messages between observers. The ''IEEE Transactions on Signal Processing'' ...

. In credit easing, a central bank purchases private sector assets to improve liquidity and improve access to credit. Signaling can be used to lower market expectations for lower interest rates in the future. For example, during the credit crisis of 2008, the US Federal Reserve

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States of America. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a ...

indicated rates would be low for an "extended period", and the Bank of Canada made a "conditional commitment" to keep rates at the lower bound of 25 basis points (0.25%) until the end of the second quarter of 2010.

Helicopter money

Further heterodox monetary policy proposals include the idea ofhelicopter money

Helicopter money is a proposed unconventional monetary policy, sometimes suggested as an alternative to quantitative easing (QE) when the economy is in a liquidity trap (when interest rates near zero and the economy remains in recession). Altho ...

whereby central banks would create money without assets as counterpart in their balance sheet. The money created could be distributed directly to the population as a citizen's dividend. Virtues of such money shock include the decrease of household risk aversion and the increase in demand, boosting both inflation and the output gap. This option has been increasingly discussed since March 2016 after the ECB's president Mario Draghi

Mario Draghi (; born 3 September 1947) is an Italian economist, academic, banker and civil servant who served as prime minister of Italy from February 2021 to October 2022. Prior to his appointment as prime minister, he served as President of ...

said he found the concept "very interesting". The idea was also promoted by prominent former central bankers Stanley Fischer and Philipp Hildebrand in a paper published by BlackRock

BlackRock, Inc. is an American multi-national investment company based in New York City. Founded in 1988, initially as a risk management and fixed income institutional asset manager, BlackRock is the world's largest asset manager, with trill ...

, and in France by economists Philippe Martin and Xavier Ragot from the French Council for Economic Analysis, a think tank attached to the Prime minister's office.

Some have envisaged the use of what Milton Friedman once called "helicopter money

Helicopter money is a proposed unconventional monetary policy, sometimes suggested as an alternative to quantitative easing (QE) when the economy is in a liquidity trap (when interest rates near zero and the economy remains in recession). Altho ...

" whereby the central bank would make direct transfers to citizens in order to lift inflation up to the central bank's intended target. Such policy option could be particularly effective at the zero lower bound.

Nominal anchors

A nominal anchor for monetary policy is a single variable or device which the central bank uses to pin down expectations of private agents about the nominal price level or its path or about what the central bank might do with respect to achieving that path. Monetary regimes combine long-run nominal anchoring with flexibility in the short run. Nominal variables used as anchors primarily include exchange rate targets, money supply targets, and inflation targets with interest rate policy.Feenstra, Robert C., and Alan M. Taylor. International Macroeconomics. New York: Worth, 2012. 100-05.Types

In practice, to implement any type of monetary policy the main tool used is modifying the amount ofbase money

In economics, the monetary base (also base money, money base, high-powered money, reserve money, outside money, central bank money or, in the UK, narrow money) in a country is the total amount of money created by the central bank. This include ...

in circulation. The monetary authority does this by buying or selling financial assets (usually government obligations). These open market operations

In macroeconomics, an open market operation (OMO) is an activity by a central bank to give (or take) liquidity in its currency to (or from) a bank or a group of banks. The central bank can either buy or sell government bonds (or other financial a ...

change either the amount of money or its liquidity (if less liquid forms of money are bought or sold). The multiplier effect

In macroeconomics, a multiplier is a factor of proportionality that measures how much an endogenous variable changes in response to a change in some exogenous variable.

For example, suppose variable ''x''

changes by ''k'' units, which causes an ...

of fractional reserve banking amplifies the effects of these actions on the money supply

In macroeconomics, the money supply (or money stock) refers to the total volume of currency held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include currency in circul ...

, which includes bank deposits as well as base money.

Constant market transactions by the monetary authority modify the supply of currency and this impacts other market variables such as short-term interest rates and the exchange rate.

The distinction between the various types of monetary policy lies primarily with the set of instruments and target variables that are used by the monetary authority to achieve their goals.

The different types of policy are also called monetary regimes, in parallel to

exchange-rate regime

An exchange rate regime is a way a monetary authority of a country or currency union manages the currency about other currencies and the foreign exchange market. It is closely related to monetary policy and the two are generally dependent on many ...

s. A fixed exchange rate is also an exchange-rate regime; The gold standard results in a relatively fixed regime towards the currency of other countries on the gold standard and a floating regime towards those that are not. Targeting inflation, the price level or other monetary aggregates implies floating the exchange rate unless the management of the relevant foreign currencies is tracking exactly the same variables (such as a harmonized consumer price index).

Inflation targeting

Under this policy approach, the target is to keepinflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduct ...

, under a particular definition such as the Consumer Price Index, within a desired range.

The inflation target is achieved through periodic adjustments to the central bank interest rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, th ...

target. The interest rate used is generally the overnight rate

The overnight rate is generally the interest rate that large banks use to borrow and lend from one another in the overnight market. In some countries (the United States, for example), the overnight rate may be the rate targeted by the central ban ...

at which banks lend to each other overnight for cash flow purposes. Depending on the country this particular interest rate might be called the cash rate or something similar.

As the Fisher effect

In economics, the Fisher effect is the tendency for nominal interest rates to change to follow the inflation rate. It is named after the economist Irving Fisher, who first observed and explained this relationship. Fisher proposed that the real i ...

model explains, the equation linking inflation with interest rates is the following:

:π = ''i – r''

where π is the inflation rate, ''i'' is the home nominal interest rate set by the central bank, and ''r'' is the real interest rate. Using ''i'' as an anchor, central banks can influence π.

Central banks can choose to maintain a fixed interest rate at all times, or just temporarily. The duration of this policy varies, because of the simplicity associated with changing the nominal interest rate.

The interest rate target is maintained for a specific duration using open market operations. Typically the duration that the interest rate target is kept constant will vary between months and years. This interest rate target is usually reviewed on a monthly or quarterly basis by a policy committee.

Changes to the interest rate target are made in response to various market indicators in an attempt to forecast economic trend

*all the economic indicators that are the subject of economic forecasting

**see also: econometrics

*general trends in the economy, see: economic history

Economic history is the academic learning of economies or economic events of the past. R ...

s and in so doing keep the market on track towards achieving the defined inflation target. For example, one simple method of inflation targeting called the Taylor rule

The Taylor rule is a monetary policy targeting rule. The rule was proposed in 1992 by American economist John B. Taylor for central banks to use to stabilize economic activity by appropriately setting short-term interest rates.

The rule consider ...

adjusts the interest rate in response to changes in the inflation rate and the output gap. The rule was proposed by John B. Taylor

John Brian Taylor (born December 8, 1946) is the Mary and Robert Raymond Professor of Economics at Stanford University, and the George P. Shultz Senior Fellow in Economics at Stanford University's Hoover Institution.

He taught at Columbia Univer ...

of Stanford University

Stanford University, officially Leland Stanford Junior University, is a private research university in Stanford, California. The campus occupies , among the largest in the United States, and enrolls over 17,000 students. Stanford is consider ...

.

The inflation targeting approach to monetary policy approach was pioneered in New Zealand. It has been used in Australia

Australia, officially the Commonwealth of Australia, is a Sovereign state, sovereign country comprising the mainland of the Australia (continent), Australian continent, the island of Tasmania, and numerous List of islands of Australia, sma ...

, Brazil

Brazil ( pt, Brasil; ), officially the Federative Republic of Brazil (Portuguese: ), is the largest country in both South America and Latin America. At and with over 217 million people, Brazil is the world's fifth-largest country by area ...

, Canada

Canada is a country in North America. Its ten provinces and three territories extend from the Atlantic Ocean to the Pacific Ocean and northward into the Arctic Ocean, covering over , making it the world's second-largest country by tot ...

, Chile

Chile, officially the Republic of Chile, is a country in the western part of South America. It is the southernmost country in the world, and the closest to Antarctica, occupying a long and narrow strip of land between the Andes to the east a ...

, Colombia

Colombia (, ; ), officially the Republic of Colombia, is a country in South America with insular regions in North America—near Nicaragua's Caribbean coast—as well as in the Pacific Ocean. The Colombian mainland is bordered by the Car ...

, the Czech Republic

The Czech Republic, or simply Czechia, is a landlocked country in Central Europe. Historically known as Bohemia, it is bordered by Austria to the south, Germany to the west, Poland to the northeast, and Slovakia to the southeast. The ...

, Hungary

Hungary ( hu, Magyarország ) is a landlocked country in Central Europe. Spanning of the Carpathian Basin, it is bordered by Slovakia to the north, Ukraine to the northeast, Romania to the east and southeast, Serbia to the south, Croatia a ...

, New Zealand

New Zealand ( mi, Aotearoa ) is an island country in the southwestern Pacific Ocean. It consists of two main landmasses—the North Island () and the South Island ()—and over 700 smaller islands. It is the sixth-largest island count ...

, Norway

Norway, officially the Kingdom of Norway, is a Nordic country in Northern Europe, the mainland territory of which comprises the western and northernmost portion of the Scandinavian Peninsula. The remote Arctic island of Jan Mayen and t ...

, Iceland

Iceland ( is, Ísland; ) is a Nordic island country in the North Atlantic Ocean and in the Arctic Ocean. Iceland is the most sparsely populated country in Europe. Iceland's capital and largest city is Reykjavík, which (along with its s ...

, India

India, officially the Republic of India (Hindi: ), is a country in South Asia. It is the seventh-largest country by area, the second-most populous country, and the most populous democracy in the world. Bounded by the Indian Ocean on the so ...

, Philippines

The Philippines (; fil, Pilipinas, links=no), officially the Republic of the Philippines ( fil, Republika ng Pilipinas, links=no),

* bik, Republika kan Filipinas

* ceb, Republika sa Pilipinas

* cbk, República de Filipinas

* hil, Republ ...

, Poland

Poland, officially the Republic of Poland, is a country in Central Europe. It is divided into 16 administrative provinces called voivodeships, covering an area of . Poland has a population of over 38 million and is the fifth-most populous ...

, Sweden

Sweden, formally the Kingdom of Sweden,The United Nations Group of Experts on Geographical Names states that the country's formal name is the Kingdom of SwedenUNGEGN World Geographical Names, Sweden./ref> is a Nordic country located on ...

, South Africa

South Africa, officially the Republic of South Africa (RSA), is the southernmost country in Africa. It is bounded to the south by of coastline that stretch along the South Atlantic and Indian Oceans; to the north by the neighbouring countri ...

, Turkey

Turkey ( tr, Türkiye ), officially the Republic of Türkiye ( tr, Türkiye Cumhuriyeti, links=no ), is a list of transcontinental countries, transcontinental country located mainly on the Anatolia, Anatolian Peninsula in Western Asia, with ...

, and the United Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Europe, off the north-western coast of the continental mainland. It comprises England, Scotland, Wales and North ...

.

Price level targeting

Price level targeting is a monetary policy that is similar to inflation targeting except that CPI growth in one year over or under the long term price level target is offset in subsequent years such that a targeted price-level trend is reached over time, e.g. five years, giving more certainty about future price increases to consumers. Under inflation targeting what happened in the immediate past years is not taken into account or adjusted for in the current and future years. Uncertainty in price levels can create uncertainty aroundprice

A price is the (usually not negative) quantity of payment or compensation given by one party to another in return for goods or services. In some situations, the price of production has a different name. If the product is a "good" in the ...

and wage

A wage is payment made by an employer to an employee for work done in a specific period of time. Some examples of wage payments include compensatory payments such as ''minimum wage'', '' prevailing wage'', and ''yearly bonuses,'' and remune ...

setting activity for firms and workers, and undermines any information

Information is an abstract concept that refers to that which has the power to inform. At the most fundamental level information pertains to the interpretation of that which may be sensed. Any natural process that is not completely random ...

that can be gained from relative price

A relative price is the price of a commodity such as a good or service in terms of another; i.e., the ratio of two prices. A relative price may be expressed in terms of a ratio between the prices of any two goods or the ratio between the price o ...

s, as it is more difficult for firms to determine if a change in the price

A price is the (usually not negative) quantity of payment or compensation given by one party to another in return for goods or services. In some situations, the price of production has a different name. If the product is a "good" in the ...

of a good

In most contexts, the concept of good denotes the conduct that should be preferred when posed with a choice between possible actions. Good is generally considered to be the opposite of evil and is of interest in the study of ethics, morality, ph ...

or service is because of inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduct ...

or other factors, such as an increase in the efficiency of factors of production

In economics, factors of production, resources, or inputs are what is used in the production process to produce output—that is, goods and services. The utilized amounts of the various inputs determine the quantity of output according to the rel ...

, if inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduct ...

is high and volatile. An increase in inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduct ...

also leads to a decrease in the demand for money

In monetary economics, the demand for money is the desired holding of financial assets in the form of money: that is, cash or bank deposits rather than investments. It can refer to the demand for money narrowly defined as M1 (directly spendable ...

, as it reduces the incentive

In general, incentives are anything that persuade a person to alter their behaviour. It is emphasised that incentives matter by the basic law of economists and the laws of behaviour, which state that higher incentives amount to greater levels of ...

to hold money and increases transaction cost

In economics and related disciplines, a transaction cost is a cost in making any economic trade when participating in a market. Oliver E. Williamson defines transaction costs as the costs of running an economic system of companies, and unlike pro ...

s and shoe leather cost Metaphorically, shoe leather cost is the cost of time and effort (or opportunity costs of time and effort) that people expend by holding less cash in order to reduce the inflation tax that they pay on cash holdings when there is high inflation. The ...

s.

Monetary aggregates/money supply targeting

In the 1980s, several countries used an approach based on a constant growth in the money supply. This approach was refined to include different classes of money and credit (M0, M1 etc.). In the US this approach to monetary policy was discontinued with the selection ofAlan Greenspan

Alan Greenspan (born March 6, 1926) is an American economist who served as the 13th chairman of the Federal Reserve from 1987 to 2006. He works as a private adviser and provides consulting for firms through his company, Greenspan Associates LLC. ...

as Fed Chairman.

This approach is also sometimes called monetarism

Monetarism is a school of thought in monetary economics that emphasizes the role of governments in controlling the amount of money in circulation. Monetarist theory asserts that variations in the money supply have major influences on nation ...

.

Central banks might choose to set a money supply growth target as a nominal anchor to keep prices stable in the long term. The quantity theory is a long run model, which links price levels to money supply and demand. Using this equation, we can rearrange to see the following:

:π = μ − g,

where π is the inflation rate, μ is the money supply growth rate and g is the real output growth rate. This equation suggests that controlling the money supply's growth rate can ultimately lead to price stability in the long run. To use this nominal anchor, a central bank would need to set μ equal to a constant and commit to maintaining this target.

However, targeting the money supply growth rate is considered a weak policy, because it is not stably related to the real output growth, As a result, a higher output growth rate will result in a too low level of inflation. A low output growth rate will result in inflation that would be higher than the desired level.

While monetary policy typically focuses on a price signal

A price signal is information conveyed to consumers and producers, via the prices offered or requested for, and the amount requested or offered of a product or service, which provides a signal to increase or decrease quantity supplied or quantit ...

of one form or another, this approach is focused on monetary quantities. As these quantities could have a role in the economy and business cycles depending on the households' risk aversion level, money is sometimes explicitly added in the central bank's reaction function. After the 1980s, however, central banks have shifted away from policies that focus on money supply targeting, because of the uncertainty that real output growth introduces. Some central banks, like the ECB, have chosen to combine a money supply anchor with other targets.

Nominal income/NGDP targeting

Related to money targeting,nominal income target

A nominal income target is a monetary policy target. Such targets are adopted by central banks to manage national economic activity. Nominal aggregates are not adjusted for inflation. Nominal income aggregates that can serve as targets include no ...

ing (also called Nominal GDP or NGDP targeting), originally proposed by James Meade

James Edward Meade, (23 June 1907 – 22 December 1995) was a British economist and winner of the 1977 Nobel Memorial Prize in Economic Sciences jointly with the Swedish economist Bertil Ohlin for their "pathbreaking contribution to the ...

(1978) and James Tobin

James Tobin (March 5, 1918 – March 11, 2002) was an American economist who served on the Council of Economic Advisers and consulted with the Board of Governors of the Federal Reserve System, and taught at Harvard and Yale Universities. He d ...

(1980), was advocated by Scott Sumner

Scott B. Sumner (born 1955) is an American economist. He is the Director of the Program on Monetary Policy at the Mercatus Center at George Mason University, a Research Fellow at the Independent Institute, and professor who teaches at Bentley ...

and reinforced by the market monetarist

Market monetarism is a school of macroeconomic thought that advocates that central banks target the level of nominal income instead of inflation, unemployment, or other measures of economic activity, including in times of shocks such as the burs ...

school of thought.

Central banks do not implement this monetary policy explicitly. However, numerous studies shown that such a monetary policy targeting better matches central bank losses and welfare optimizing monetary policy compared to more standard monetary policy targeting.

Fixed exchange rate targeting

This policy is based on maintaining afixed exchange rate

A fixed exchange rate, often called a pegged exchange rate, is a type of exchange rate regime in which a currency's value is fixed or pegged by a monetary authority against the value of another currency, a basket of other currencies, or another m ...

with a foreign currency. There are varying degrees of fixed exchange rates, which can be ranked in relation to how rigid the fixed exchange rate is with the anchor nation.

Under a system of fiat fixed rates, the local government or monetary authority declares a fixed exchange rate but does not actively buy or sell currency to maintain the rate. Instead, the rate is enforced by non-convertibility measures (e.g. capital control

Capital controls are residency-based measures such as transaction taxes, other limits, or outright prohibitions that a nation's government can use to regulate flows from capital markets into and out of the country's capital account. These measure ...

s, import/export licenses, etc.). In this case there is a black market exchange rate where the currency trades at its market/unofficial rate.

Under a system of fixed-convertibility, currency is bought and sold by the central bank or monetary authority on a daily basis to achieve the target exchange rate. This target rate may be a fixed level or a fixed band within which the exchange rate may fluctuate until the monetary authority intervenes to buy or sell as necessary to maintain the exchange rate within the band. (In this case, the fixed exchange rate with a fixed level can be seen as a special case of the fixed exchange rate with bands where the bands are set to zero.)

Under a system of fixed exchange rates maintained by a currency board every unit of local currency must be backed by a unit of foreign currency (correcting for the exchange rate). This ensures that the local monetary base does not inflate without being backed by hard currency and eliminates any worries about a run on the local currency by those wishing to convert the local currency to the hard (anchor) currency.

Under dollarization

Currency substitution is the use of a foreign currency in parallel to or instead of a domestic currency. The process is also known as dollarization or euroization when the foreign currency is the dollar or the euro, respectively.

Currency subs ...

, foreign currency (usually the US dollar, hence the term "dollarization") is used freely as the medium of exchange either exclusively or in parallel with local currency. This outcome can come about because the local population has lost all faith in the local currency, or it may also be a policy of the government (usually to rein in inflation and import credible monetary policy).

Theoretically, using relative purchasing power parity

Relative Purchasing Power Parity is an economic theory which predicts a relationship between the inflation rates of two countries over a specified period and the movement in the exchange rate between their two currencies over the same period. It is ...

(PPP), the rate of depreciation of the home country's currency must equal the inflation differential:

:rate of depreciation = home inflation rate – foreign inflation rate,

which implies that

:home inflation rate = foreign inflation rate + rate of depreciation.

The anchor variable is the rate of depreciation. Therefore, the rate of inflation at home must equal the rate of inflation in the foreign country plus the rate of depreciation of the exchange rate of the home country currency, relative to the other.

With a strict fixed exchange rate or a peg, the rate of depreciation of the exchange rate is set equal to zero. In the case of a crawling peg

In macroeconomics, crawling peg is an exchange rate regime that allows Currency appreciation and depreciation, depreciation or appreciation to happen gradually. It is usually seen as a part of a fixed exchange rate regime.

The system is a method ...

, the rate of depreciation is set equal to a constant. With a limited flexible band, the rate of depreciation is allowed to fluctuate within a given range.

By fixing the rate of depreciation, PPP theory concludes that the home country's inflation rate must depend on the foreign country's.

Countries may decide to use a fixed exchange rate monetary regime in order to take advantage of price stability and control inflation. In practice, more than half of nations’ monetary regimes use fixed exchange rate anchoring.

These policies often abdicate monetary policy to the foreign monetary authority or government as monetary policy in the pegging nation must align with monetary policy in the anchor nation to maintain the exchange rate. The degree to which local monetary policy becomes dependent on the anchor nation depends on factors such as capital mobility, openness, credit channels and other economic factors.

In practice

Nominal anchors are possible with various exchange rate regimes. Following the collapse of Bretton Woods, nominal anchoring has grown in importance for monetary policy makers and inflation reduction. Particularly, governments sought to use anchoring in order to curtail rapid and high inflation during the 1970s and 1980s. By the 1990s, countries began to explicitly set credible nominal anchors. In addition, many countries chose a mix of more than one target, as well as implicit targets. As a result, after the 1970s global inflation rates, on average, decreased gradually and central banks gained credibility and increasing independence. The Global Financial Crisis of 2008 sparked controversy over the use and flexibility of inflation nominal anchoring. Many economists argued that inflation targets were set too low by many monetary regimes. During the crisis, many inflation-anchoring countries reached the lower bound of zero rates, resulting in inflation rates decreasing to almost zero or even deflation.Implications

The anchors discussed in this article suggest that keeping inflation at the desired level is feasible by setting a target interest rate, money supply growth rate, price level, or rate of depreciation. However, these anchors are only valid if a central bank commits to maintaining them. This, in turn, requires that the central bank abandon their monetary policy autonomy in the long run. Should a central bank use one of these anchors to maintain a target inflation rate, they would have to forfeit using other policies. Using these anchors may prove more complicated for certain exchange rate regimes. Freely floating or managed floating regimes have more options to affect their inflation, because they enjoy more flexibility than a pegged currency or a country without a currency. The latter regimes would have to implement an exchange rate target to influence their inflation, as none of the other instruments are available to them.Credibility

The short-term effects of monetary policy can be influenced by the degree to which announcements of new policy are deemedcredible