|

Monetary Policy

Monetary policy is the policy adopted by the monetary authority of a nation to affect monetary and other financial conditions to accomplish broader objectives like high employment and price stability (normally interpreted as a low and stable rate of inflation). Further purposes of a monetary policy may be to contribute to economic stability or to maintain predictable exchange rates with other currencies. Today most central banks in developed countries conduct their monetary policy within an inflation targeting framework, whereas the monetary policies of most developing countries' central banks target some kind of a fixed exchange rate system. A third monetary policy strategy, targeting the money supply, was widely followed during the 1980s, but has diminished in popularity since then, though it is still the official strategy in a number of emerging economies. The tools of monetary policy vary from central bank to central bank, depending on the country's stage of development, inst ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monetary Authority

A central bank, reserve bank, national bank, or monetary authority is an institution that manages the monetary policy of a country or monetary union. In contrast to a commercial bank, a central bank possesses a monopoly on increasing the monetary base. Many central banks also have supervisory or regulatory powers to ensure the stability of commercial banks in their jurisdiction, to prevent bank runs, and, in some cases, to enforce policies on financial consumer protection, and against bank fraud, money laundering, or terrorism financing. Central banks play a crucial role in macroeconomic forecasting, which is essential for guiding monetary policy decisions, especially during times of economic turbulence. Central banks in most developed nations are usually set up to be institutionally independent from political interference, even though governments typically have governance rights over them, legislative bodies exercise scrutiny, and central banks frequently do show responsivenes ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fiscal Policy

In economics and political science, fiscal policy is the use of government revenue collection ( taxes or tax cuts) and expenditure to influence a country's economy. The use of government revenue expenditures to influence macroeconomic variables developed in reaction to the Great Depression of the 1930s, when the previous laissez-faire approach to economic management became unworkable. Fiscal policy is based on the theories of the British economist John Maynard Keynes, whose Keynesian economics theorised that government changes in the levels of taxation and government spending influence aggregate demand and the level of economic activity. Fiscal and monetary policy are the key strategies used by a country's government and central bank to advance its economic objectives. The combination of these policies enables these authorities to target inflation and to increase employment. In modern economies, inflation is conventionally considered "healthy" in the range of 2%–3%. Add ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Paper Money

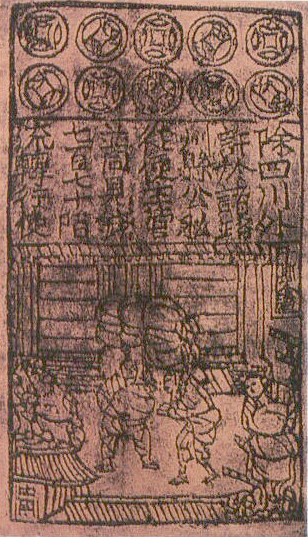

Paper money, often referred to as a note or a bill (North American English), is a type of negotiable promissory note that is payable to the bearer on demand, making it a form of currency. The main types of paper money are government notes, which are directly issued by political authorities, and banknotes issued by banks, namely banks of issue including central banks. In some cases, paper money may be issued by other entities than governments or banks, for example merchants in pre-modern China and Japan. "Banknote" is often used synonymously for paper money, not least by collectors, but in a narrow sense banknotes are only the subset of paper money that is issued by banks. Paper money is often, but not always, legal tender, meaning that courts of law are required to recognize them as satisfactory payment of money debts. Counterfeiting, including the forgery of paper money, is an inherent challenge. It is countered by anticounterfeiting measures in the printing of paper money. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Middle Ages

In the history of Europe, the Middle Ages or medieval period lasted approximately from the 5th to the late 15th centuries, similarly to the post-classical period of global history. It began with the fall of the Western Roman Empire and transitioned into the Renaissance and the Age of Discovery. The Middle Ages is the middle period of the three traditional divisions of Western history: classical antiquity, the medieval period, and the modern period. The medieval period is itself subdivided into the Early, High, and Late Middle Ages. Population decline, counterurbanisation, the collapse of centralised authority, invasions, and mass migrations of tribes, which had begun in late antiquity, continued into the Early Middle Ages. The large-scale movements of the Migration Period, including various Germanic peoples, formed new kingdoms in what remained of the Western Roman Empire. In the 7th century, North Africa and the Middle East—once part of the Byzantine Empire� ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Roman Empire

The Roman Empire ruled the Mediterranean and much of Europe, Western Asia and North Africa. The Roman people, Romans conquered most of this during the Roman Republic, Republic, and it was ruled by emperors following Octavian's assumption of effective sole rule in 27 BC. The Western Roman Empire, western empire collapsed in 476 AD, but the Byzantine Empire, eastern empire lasted until the fall of Constantinople in 1453. By 100 BC, the city of Rome had expanded its rule from the Italian peninsula to most of the Mediterranean Sea, Mediterranean and beyond. However, it was severely destabilised by List of Roman civil wars and revolts, civil wars and political conflicts, which culminated in the Wars of Augustus, victory of Octavian over Mark Antony and Cleopatra at the Battle of Actium in 31 BC, and the subsequent conquest of the Ptolemaic Kingdom in Egypt. In 27 BC, the Roman Senate granted Octavian overarching military power () and the new title of ''Augustus (title), Augustus'' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Debasement

A debasement of coinage is the practice of lowering the intrinsic value of coins, especially when used in connection with commodity money, such as gold or silver coins, while continuing to circulate it at face value. A coin is said to be debased if the quantity of gold, silver, copper or nickel in the coin is reduced. Examples Roman Empire In Roman currency, the value of the denarius was gradually decreased over time as the Ancient Rome, Roman government altered both the size and the silver content of the coin. Originally, the silver used was nearly pure, weighing about 4.5 grams. From time to time, this was reduced. During the Julio-Claudian dynasty, the denarius contained approximately 4 grams of silver, and then was reduced to 3.8 grams under Nero. The denarius continued to shrink in size and purity, until by the second half of the third century, it was only about 2% silver, and was replaced by the Argenteus. Ottoman Empire Weight of akçe in grams of silver and ind ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ancient China

The history of China spans several millennia across a wide geographical area. Each region now considered part of the Chinese world has experienced periods of unity, fracture, prosperity, and strife. Chinese civilization first emerged in the Yellow River valley, which along with the Yangtze River, Yangtze basin constitutes the geographic core of the Sinosphere, Chinese cultural sphere. China maintains a rich diversity of ethnic and linguistic people groups. The Chinese historiography, traditional lens for viewing Chinese history is the Dynasties of China, dynastic cycle: imperial dynasties rise and fall, and are ascribed certain achievements. This lens also tends to assume Chinese civilization can be traced as an unbroken thread Five thousand years of Chinese civilization, many thousands of years into the past, making it one of the Cradle of civilization, cradles of civilization. At various times, states representative of a dominant Chinese culture have directly controlled areas ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ancient Lydia

Lydia (; ) was an Iron Age kingdom situated in western Anatolia, in modern-day Turkey. Later, it became an important province of the Achaemenid Empire and then the Roman Empire. Its capital was Sardis. At some point before 800 BC, the Lydian people achieved some sort of political cohesion, and existed as an independent kingdom by the 600s BC. At its greatest extent, during the 7th century BC, it covered all of western Anatolia. In 546 BC, it became a satrapy of the Achaemenid Empire, known as ''Sparda'' in Old Persian. In 133 BC, it became part of the Roman province of Asia. Lydian coins, made of electrum, are among the oldest in existence, dated to around the 7th century BC. Geography Lydia is generally located east of ancient Ionia in the modern western Turkish provinces of Uşak, Manisa and inland İzmir.Rhodes, P.J. ''A History of the Classical Greek World 478–323 BC''. 2nd edition. Chichester: Wiley-Blackwell, 2010, p. 6. The boundaries of historical ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Billets De 5000

In European militaries, a billet is a living-quarters to which a soldier is assigned to sleep. In American usage, it refers to a specific personnel position, assignment, or duty station to which a soldier can be assigned. Historically, a billet was a private dwelling that was required to accept a soldier. Soldiers are generally billeted in barracks or garrisons when not on combat duty, although in some armies soldiers with families are permitted to maintain a home off-post. Used for a building, the term ''billet'' is more commonly used in British English; United States standard terms are ''quarters'', ''barracks'', ''Single (Soldier) Housing'' or ''Family Housing''. British history Originally, a billet (from French ) was a note, commonly used in the 18th and early 19th centuries as a "billet of invitation". In this sense, the term was used to denote an order issued to a soldier entitling him to quarters with a certain person. From this meaning, the word billet came to be loosely ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Macroeconomics

Macroeconomics is a branch of economics that deals with the performance, structure, behavior, and decision-making of an economy as a whole. This includes regional, national, and global economies. Macroeconomists study topics such as output (economics), output/Gross domestic product, GDP (gross domestic product) and national income, unemployment (including Unemployment#Measurement, unemployment rates), price index, price indices and inflation, Consumption (economics), consumption, saving, investment (macroeconomics), investment, Energy economics, energy, international trade, and international finance. Macroeconomics and microeconomics are the two most general fields in economics. The focus of macroeconomics is often on a country (or larger entities like the whole world) and how its markets interact to produce large-scale phenomena that economists refer to as aggregate variables. In microeconomics the focus of analysis is often a single market, such as whether changes in supply or ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monetary Economics

Monetary economics is the branch of economics that studies the different theories of money: it provides a framework for analyzing money and considers its functions (as medium of exchange, store of value, and unit of account), and it considers how money can gain acceptance purely because of its convenience as a Public good (economics), public good. The discipline has historically prefigured, and remains integrally linked to, macroeconomics. This branch also examines the effects of monetary systems, including regulation of money and associated financial institutions and international aspects. Modern analysis has attempted to provide microfoundations for the demand for money and to distinguish valid nominal value, nominal and real monetary relationships for micro or macro uses, including their influence on the aggregate demand for output. Its methods include deriving and testing the implications of money as a substitute for other assets and as based on explicit frictions. History I ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Central Bank Independence

Central bank independence refers to the degree of autonomy and freedom a central bank has in conducting its monetary policy and managing the financial system. It is a key aspect of modern central banking, and has its roots in the recognition that monetary policy decisions should be based on the best interests of the economy as a whole, rather than being influenced by short-term political considerations. The concept of central bank independence emerged in the 1920s and was broadly approved by the conclusions of the Brussels International Financial Conference (1920). Since the 1980s, there has been a substantial increase in central bank independence worldwide. The purpose of central bank independence is to enhance the effectiveness of monetary policy and ensure the stability of the financial system. Independent central banks are better able to carry out their mandates, which include maintaining price stability, ensuring the stability of the financial system, and implementing moneta ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |