|

Hyperinflation

In economics, hyperinflation is a very high and typically accelerating inflation. It quickly erodes the real versus nominal value (economics), real value of the local currency, as the prices of all goods increase. This causes people to minimize their holdings in that currency as they usually switch to more stable foreign currencies. Effective capital controls and currency substitution ("dollarization") are the orthodox solutions to ending short-term hyperinflation; however, there are significant social and economic costs to these policies. Ineffective implementations of these solutions often exacerbate the situation. Many governments choose to attempt to solve structural issues without resorting to those solutions, with the goal of bringing inflation down slowly while minimizing social costs of further economic shocks; however, this can lead to a prolonged period of high inflation. Unlike low inflation, where the process of rising prices is protracted and not generally noticeab ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Inflation

In economics, inflation is an increase in the average price of goods and services in terms of money. This increase is measured using a price index, typically a consumer price index (CPI). When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money. The opposite of CPI inflation is deflation, a decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualized percentage change in a general price index. Changes in inflation are widely attributed to fluctuations in Real versus nominal value (economics), real demand for goods and services (also known as demand shocks, including changes in fiscal policy, fiscal or monetary policy), changes in available supplies such as during energy crisis, energy crises (also known as supply shocks), or changes in inflation expectations, which may be self-fulfilling. Moderat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

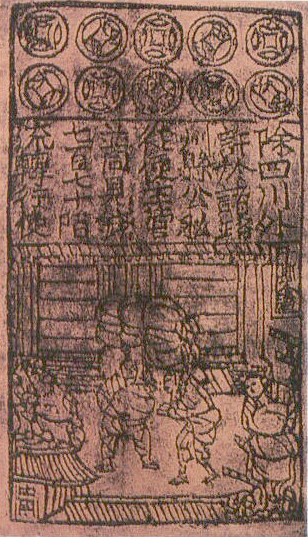

Fiat Money

Fiat money is a type of government-issued currency that is not backed by a precious metal, such as gold or silver, nor by any other tangible asset or commodity. Fiat currency is typically designated by the issuing government to be legal tender, and is authorized by government regulation. Since the end of the Bretton Woods system in 1976 by the Jamaica Accords, the major currencies in the world are fiat money. Fiat money generally does not have intrinsic value and does not have use value. It has value only because the individuals who use it as a unit of account or, in the case of currency, a medium of exchange agree on its value. They trust that it will be accepted by merchants and other people as a means of payment for liabilities. Fiat money is an alternative to commodity money, which is a currency that has intrinsic value because it contains, for example, a precious metal such as gold or silver which is embedded in the coin. Fiat also differs from representative mone ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Fiat Currency

Fiat money is a type of government-issued currency that is not backed by a precious metal, such as gold or silver, nor by any other tangible asset or commodity. Fiat currency is typically designated by the issuing government to be legal tender, and is authorized by government regulation. Since the end of the Bretton Woods system in 1976 by the Jamaica Accords, the major currencies in the world are fiat money. Fiat money generally does not have intrinsic value and does not have use value. It has value only because the individuals who use it as a unit of account or, in the case of currency, a medium of exchange agree on its value. They trust that it will be accepted by merchants and other people as a means of payment for liabilities. Fiat money is an alternative to commodity money, which is a currency that has intrinsic value because it contains, for example, a precious metal such as gold or silver which is embedded in the coin. Fiat also differs from representative money, w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Argentina Inflation

Argentina, officially the Argentine Republic, is a country in the southern half of South America. It covers an area of , making it the List of South American countries by area, second-largest country in South America after Brazil, the fourth-largest country in the Americas, and the List of countries and dependencies by area, eighth-largest country in the world. Argentina shares the bulk of the Southern Cone with Chile to the west, and is also bordered by Bolivia and Paraguay to the north, Brazil to the northeast, Uruguay and the South Atlantic Ocean to the east, and the Drake Passage to the south. Argentina is a Federation, federal state subdivided into twenty-three Provinces of Argentina, provinces, and one autonomous city, which is the federal capital and List of cities in Argentina by population, largest city of the nation, Buenos Aires. The provinces and the capital have their own constitutions, but exist under a Federalism, federal system. Argentina claims sovereignty ov ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Inflation Tax

Seigniorage , also spelled seignorage or seigneurage (), is the increase in the value of money due to money creation minus the cost of producing the additional money. Monetary seigniorage is where government bonds are exchanged for newly created money by a central bank, allowing debt monetization ("borrowing" without repaying). The increased purchasing power of the government at the expense of public purchasing power imposes what is known as an inflation tax on the public. Seignorage can also refer to: * Seigniorage derived from specie (metal coins) is a tax added to the total cost of a coin (metal content and production costs) that a customer of the mint had to pay, and which was sent to the sovereign of the political region. * Seigniorage derived from banknotes is the difference between interest earned on securities acquired in exchange for banknotes and the cost of printing and distributing the notes. Seigniorage is the positive return, or carry, on issued notes and coins ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Seigniorage

Seigniorage , also spelled seignorage or seigneurage (), is the increase in the value of money due to money creation minus the cost of producing the additional money. Monetary seigniorage is where government bonds are exchanged for newly created money by a central bank, allowing debt monetization ("borrowing" without repaying). The increased purchasing power of the government at the expense of public purchasing power imposes what is known as an inflation tax on the public. Seignorage can also refer to: * Seigniorage derived from specie (metal coins) is a tax added to the total cost of a coin (metal content and production costs) that a customer of the mint had to pay, and which was sent to the sovereign of the political region. * Seigniorage derived from banknotes is the difference between interest earned on securities acquired in exchange for banknotes and the cost of printing and distributing the notes. Seigniorage is the positive return, or carry, on issued notes and coin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Currency Substitution

Currency substitution is the use of a foreign currency in parallel to or instead of a domestic currency. Currency substitution can be full or partial. Full currency substitution can occur after a major economic crisis, such as in Ecuador, El Salvador, and Zimbabwe. Some small economies, for whom it is impractical to maintain an independent currency, use the currencies of their larger neighbours; for example, Liechtenstein uses the Swiss franc. Partial currency substitution occurs when residents of a country choose to hold a significant share of their financial assets denominated in a foreign currency. It can also occur as a gradual conversion to full currency substitution; for example, Argentina and Peru were both in the process of converting to the U.S. dollar during the 1990s. Name "Dollarization", when referring to currency substitution, does not necessarily involve use of the United States dollar. The major currencies used as substitutes are the US dollar and the euro. Or ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Government Debt

A country's gross government debt (also called public debt or sovereign debt) is the financial liabilities of the government sector. Changes in government debt over time reflect primarily borrowing due to past government deficits. A deficit occurs when a government's expenditures exceed revenues. Government debt may be owed to domestic residents, as well as to foreign residents. If owed to foreign residents, that quantity is included in the country's external debt. In 2020, the value of government debt worldwide was $87.4 US trillion, or 99% measured as a share of gross domestic product (GDP). Government debt accounted for almost 40% of all debt (which includes corporate and household debt), the highest share since the 1960s. The rise in government debt since 2007 is largely attributable to stimulus measures during the Great Recession, and the COVID-19 recession. Governments may take on debt when the government's spending desires do not match government revenue flows. Taking deb ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Money Creation

Money creation, or money issuance, is the process by which the money supply of a country, or an economic or monetary region,Such as the Eurozone or ECCAS is increased. In most modern economies, money is created by both central banks and commercial banks. Money issued by central banks is a liability, typically called reserve deposits, and is only available for use by central bank account holders, which are generally large commercial banks and foreign central banks. Central banks can increase the quantity of reserve deposits directly, by making loans to account holders, purchasing assets from account holders, or by recording an asset, such as a deferred asset, and directly increasing liabilities. However, the majority of the money supply used by the public for conducting transactions is created by the commercial banking system in the form of commercial bank deposits. Bank loans issued by commercial banks expand the quantity of bank deposits. Money creation occurs when the am ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Monetary Inflation

Monetary inflation is a sustained increase in the money supply of a country (or currency area). Depending on many factors, especially public expectations, the fundamental state and development of the economy, and the transmission mechanism, it is likely to result in price inflation, which is usually just called "inflation", which is a rise in the general level of prices of goods and services. There is general agreement among economists that there is a causal relationship between monetary inflation and price inflation. But there is neither a common view about the exact theoretical mechanisms and relationships, nor about how to accurately measure it. This relationship is also constantly changing, within a larger complex economic system. So there is a great deal of debate on the issues involved, such as how to measure the monetary base and price inflation, how to measure the effect of public expectations, how to judge the effect of financial innovations on the transmission mecha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Velocity Of Money

image:M3 Velocity in the US.png, 300px, Similar chart showing the logged velocity (green) of a broader measure of money M3 that covers M2 plus large institutional deposits. The US no longer publishes official M3 measures, so the chart only runs through 2005. Employment again shown in blue, recessions as grey bars. The velocity of money measures the number of times that one unit of currency is used to purchase goods and services within a given time period. In other words, it represents how many times per period money is changing hands, or is circulating to other owners in return for valuable goods and services. The concept relates the size of economic activity to a given money supply. The speed of money exchange is one of the variables that determine inflation. The measure of the velocity of money is usually the ratio of a country's or an economy's nominal gross national product (GNP) to its money supply. If the velocity of money is increasing, then transactions are occurring ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |