|

Interest On Excess Reserves

Excess reserves are bank reserves held by a bank in excess of a reserve requirement for it set by a central bank. In the United States, bank reserves for a commercial bank are represented by its cash holdings and any credit balance in an account at its Federal Reserve Bank (FRB). Holding excess reserves long term may have an opportunity cost if higher risk-adjusted interest can be earned by putting the funds elsewhere. For banks in the U.S. Federal Reserve System, excess reserves may be created by a given bank in the very short term by making short-term (usually overnight) loans on the federal funds market to another bank that may be short of its reserve requirements. Banks may also choose to hold some excess reserves to facilitate upcoming transactions or to meet contractual clearing balance requirements. The total amount of FRB credits held in all FRB accounts for all commercial banks, together with all currency and vault cash, forms the M0 monetary base. Impact on in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Reserves

Bank reserves are a commercial bank's cash holdings physically held by the bank, and deposits held in the bank's account with the central bank. Under the fractional-reserve banking system used in most countries, central banks typically set minimum reserve requirements that require commercial banks under its purview to hold cash or deposits at the central bank equivalent to at least a prescribed percentage of their liabilities, such as customer deposits. Such sums are usually termed required reserves, and any funds above the required amount are called excess reserves. These reserves are prescribed to ensure that, in the normal events, there is sufficient liquidity in the banking system to provide funds to bank customers wishing to withdraw cash. Even when there are no reserve requirements, banks often as a matter of prudent management hold reserves in case of unexpected events, such as unusually large net withdrawals by customers (such as before Christmas) or bank runs. In general ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Congressional Budget Office

The Congressional Budget Office (CBO) is a federal agency within the legislative branch of the United States government that provides budget and economic information to Congress. Inspired by California's Legislative Analyst's Office that manages the state budget in a strictly nonpartisan fashion, the CBO was created as a nonpartisan agency by the Congressional Budget and Impoundment Control Act of 1974. Whereas politicians on both sides of the aisle have criticized the CBO when its estimates have been politically inconvenient, economists and other academics overwhelmingly reject that the CBO is partisan or that it fails to produce credible forecasts. There is a consensus among economists that "adjusting for legal restrictions on what the CBO can assume about future legislation and events, the CBO has historically issued credible forecasts of the effects of both Democratic and Republican legislative proposals." History The Congressional Budget Office was created by Title II of th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Liquidity Trap

A liquidity trap is a situation, described in Keynesian economics, in which, "after the rate of interest has fallen to a certain level, liquidity preference may become virtually absolute in the sense that almost everyone prefers holding cash rather than holding a debt ( financial instrument) which yields so low a rate of interest." Keynes, John Maynard (1936) ''The General Theory of Employment, Interest and Money'', United Kingdom: Palgrave Macmillan, 2007 edition, A liquidity trap is caused when people hoard cash because they expect an adverse event such as deflation, insufficient aggregate demand, or war. Among the characteristics of a liquidity trap are interest rates that are close to zero and changes in the money supply that fail to translate into changes in the price level. Krugman, Paul R. (1998)"It's baack: Japan's Slump and the Return of the Liquidity Trap," Brookings Papers on Economic Activity Origin and definition of the term John Maynard Keynes, in his 1936 ''Gener ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Of England

The Bank of England is the central bank of the United Kingdom and the model on which most modern central banks have been based. Established in 1694 to act as the English Government's banker, and still one of the bankers for the Government of the United Kingdom, it is the world's eighth-oldest bank. It was privately owned by stockholders from its foundation in 1694 until it was nationalised in 1946 by the Attlee ministry. The Bank became an independent public organisation in 1998, wholly owned by the Treasury Solicitor on behalf of the government, with a mandate to support the economic policies of the government of the day, but independence in maintaining price stability. The Bank is one of eight banks authorised to issue banknotes in the United Kingdom, has a monopoly on the issue of banknotes in England and Wales, and regulates the issue of banknotes by commercial banks in Scotland and Northern Ireland. The Bank's Monetary Policy Committee has devolved responsibility for ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Riksbank

Sveriges Riksbank, or simply the ''Riksbank'', is the central bank of Sweden. It is the world's oldest central bank and the fourth oldest bank in operation. Etymology The first part of the word ''riksbank'', ''riks'', stems from the Swedish word ''rike'', which means ''realm'', ''kingdom'', ''empire'' or ''nation'' in English. A literal English translation of the bank's name could thus be ''Sweden's Realm's Bank''. The bank, however, doesn't translate its name to English but uses its Swedish name ''the Riksbank'' also in its English communications. History The Riksbank began operations in 1668. Previously, Sweden was served by the Stockholms Banco (also known as the Bank of Palmstruch), founded by Johan Palmstruch in 1656. Although the bank was private, it was the king who chose its management: in a letter to Palmstruch, he gave permission to its operations according to stated regulations. But Stockholms Banco collapsed as a result of the issuing of too many notes without ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

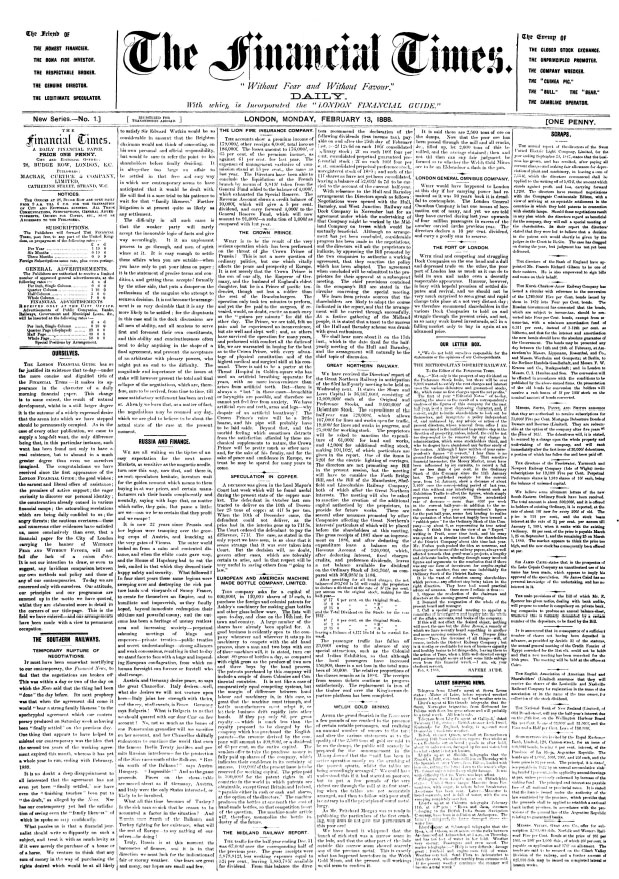

Financial Times

The ''Financial Times'' (''FT'') is a British daily newspaper printed in broadsheet and published digitally that focuses on business and economic current affairs. Based in London, England, the paper is owned by a Japanese holding company, Nikkei, with core editorial offices across Britain, the United States and continental Europe. In July 2015, Pearson sold the publication to Nikkei for £844 million (US$1.32 billion) after owning it since 1957. In 2019, it reported one million paying subscriptions, three-quarters of which were digital subscriptions. The newspaper has a prominent focus on financial journalism and economic analysis over generalist reporting, drawing both criticism and acclaim. The daily sponsors an annual book award and publishes a " Person of the Year" feature. The paper was founded in January 1888 as the ''London Financial Guide'' before rebranding a month later as the ''Financial Times''. It was first circulated around metropolitan London by James Sherid ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monetary Policy

Monetary policy is the policy adopted by the monetary authority of a nation to control either the interest rate payable for very short-term borrowing (borrowing by banks from each other to meet their short-term needs) or the money supply, often as an attempt to reduce inflation or the interest rate, to ensure price stability and general trust of the value and stability of the nation's currency. Monetary policy is a modification of the supply of money, i.e. "printing" more money, or decreasing the money supply by changing interest rates or removing excess reserves. This is in contrast to fiscal policy, which relies on taxation, government spending, and government borrowing as methods for a government to manage business cycle phenomena such as recessions. Further purposes of a monetary policy are usually to contribute to the stability of gross domestic product, to achieve and maintain low unemployment, and to maintain predictable exchange rates with other currencies. Monetary ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Expansionary

Expansionism refers to states obtaining greater territory through military empire-building or colonialism. In the classical age of conquest moral justification for territorial expansion at the direct expense of another established polity (who often faced displacement, subjugation, slavery, rape and execution) was often as unapologetic as "because we can" treading on the philosophical grounds of might makes right. As political conceptions of the nation state evolved, especially in reference to the inherent rights of the governed, more complex justifications arose. State-collapse anarchy, reunification or pan-nationalism are sometimes used to justify and legitimize expansionism when the explicit goal is to reconquer territories that have been lost or to take over ancestral lands. Lacking a viable historical claim of this nature, would-be expansionists may instead promote ideologies of promised lands (such as manifest destiny or a religious destiny in the form of a Promised Land ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Negative Interest On Excess Reserves

Negative interest on excess reserves is an instrument of unconventional monetary policy applied by central banks to encourage lending by making it costly for commercial banks to hold their excess reserves at central banks so they will lend more readily to the private sector. Such a policy is usually a response to very slow economic growth, deflation, and deleveraging. During economic downturns, central banks often lower interest rates to stimulate growth. Until late in the 20th century, it was thought that rates could not go below zero because banks would hold onto cash instead of paying a fee to deposit it. It turns out this was not quite right. Central banks in Europe and in Japan have demonstrated rates can go negative, and several have pushed them in that direction for the same reason they lowered them to zero in the first place—to provide stimulus and, where inflation is below target, to raise the inflation rate. The notion is that negative rates will provide even more incent ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fed Funds

In the United States, federal funds are overnight borrowings between banks and other entities to maintain their bank reserves at the Federal Reserve. Banks keep reserves at Federal Reserve Banks to meet their reserve requirements and to clear financial transactions. Transactions in the federal funds market enable depository institutions with reserve balances in excess of reserve requirements to lend reserves to institutions with reserve deficiencies. These loans are usually made for one day only, that is, "overnight". The interest rate at which these deals are done is called the federal funds rate. Federal funds are not collateralized; like eurodollars, they are an unsecured interbank loan. Federal funds transactions by regulated financial institutions neither increase nor decrease total reserves in the banking system as a whole. Instead, they redistribute reserves. Before 2008, this meant that otherwise idle funds could yield a return. (Since 2008, the Fed has paid inter ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

James B

James is a common English language surname and given name: *James (name), the typically masculine first name James * James (surname), various people with the last name James James or James City may also refer to: People * King James (other), various kings named James * Saint James (other) * James (musician) * James, brother of Jesus Places Canada * James Bay, a large body of water * James, Ontario United Kingdom * James College, York, James College, a college of the University of York United States * James, Georgia, an unincorporated community * James, Iowa, an unincorporated community * James City, North Carolina * James City County, Virginia ** James City (Virginia Company) ** James City Shire * James City, Pennsylvania * St. James City, Florida Arts, entertainment, and media * James (2005 film), ''James'' (2005 film), a Bollywood film * James (2008 film), ''James'' (2008 film), an Irish short film * James (2022 film), ''James'' (2022 film), an Indian Kannada ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Relations

Public relations (PR) is the practice of managing and disseminating information from an individual or an organization (such as a business, government agency, or a nonprofit organization) to the public in order to influence their perception. Public relations and publicity differ in that PR is controlled internally, whereas publicity is not controlled and contributed by external parties. Public relations may include an organization or individual gaining exposure to their audiences using topics of public interest and news items that do not require direct payment. The exposure mostly is media-based. This differentiates it from advertising as a form of marketing communications. Public relations aims to create or obtain coverage for clients for free, also known as earned media, rather than paying for marketing or advertising also known as paid media. But in the early 21st century, advertising is also a part of broader PR activities. An example of good public relations would be ge ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)

.jpg)