|

Equities

In finance, stock (also capital stock) consists of all the shares by which ownership of a corporation or company is divided.Longman Business English Dictionary: "stock - ''especially AmE'' one of the shares into which ownership of a company is divided, or these shares considered together" "When a company issues shares or stocks ''especially AmE'', it makes them available for people to buy for the first time." (Especially in American English, the word "stocks" is also used to refer to shares.) A single share of the stock means fractional ownership of the corporation in proportion to the total number of shares. This typically entitles the shareholder (stockholder) to that fraction of the company's earnings, proceeds from liquidation of assets (after discharge of all senior claims such as secured and unsecured debt), or voting power, often dividing these up in proportion to the amount of money each stockholder has invested. Not all stock is necessarily equal, as certain classe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Share (finance)

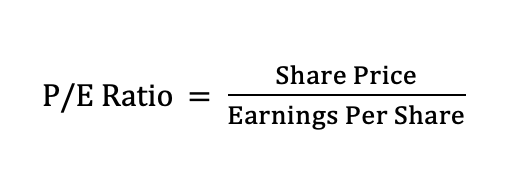

In financial markets, a share is a unit of equity ownership in the capital stock of a corporation, and can refer to units of mutual funds, limited partnerships, and real estate investment trusts. Share capital refers to all of the shares of an enterprise. The owner of shares in a company is a shareholder (or stockholder) of the corporation. A share is an indivisible unit of capital, expressing the ownership relationship between the company and the shareholder. The denominated value of a share is its face value, and the total of the face value of issued shares represent the capital of a company, which may not reflect the market value of those shares. The income received from the ownership of shares is a dividend. There are different types of shares such as equity shares, preference shares, deferred shares, redeemable shares, bonus shares, right shares, and employee stock option plan shares. Valuation Shares are valued according to the various principles in different marke ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Republic Of Ireland

Ireland ( ga, Éire ), also known as the Republic of Ireland (), is a country in north-western Europe consisting of 26 of the 32 Counties of Ireland, counties of the island of Ireland. The capital and largest city is Dublin, on the eastern side of the island. Around 2.1 million of the country's population of 5.13 million people resides in the Greater Dublin Area. The sovereign state shares its only land border with Northern Ireland, which is Countries of the United Kingdom, part of the United Kingdom. It is otherwise surrounded by the Atlantic Ocean, with the Celtic Sea to the south, St George's Channel to the south-east, and the Irish Sea to the east. It is a Unitary state, unitary, parliamentary republic. The legislature, the , consists of a lower house, ; an upper house, ; and an elected President of Ireland, President () who serves as the largely ceremonial head of state, but with some important powers and duties. The head of government is the (Prime Minister, liter ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Class B Share

In finance, a Class B share or Class C share is a designation for a share class of a common or preferred stock that typically has strengthened voting rights or other benefits compared to a Class A share that may have been created. The equity structure, or how many types of shares are offered, is determined by the corporate charter. B share can also refer to various terms relating to stock classes: * B share (mainland China), a class of stock on the Shanghai and Shenzhen stock exchanges * B share (NYSE), a class of stock on the New York Stock Exchange Most of the time, Class B shares may have lower repayment priorities in the event a company declares bankruptcy. Each company’s classes of stock differs and more information is often included in the company’s prospectus. If held long term, Class B shares may also be converted to Class A shares. There are also different reasons for creating Class B shares within a company—there are, however, similar arrangements which comp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hybrid Investment

Hybrid investments, also known as derivatives or just hybrids, are a form of investment that combines equity and debt like features, allowing companies to protect themselves against financial risks in securities transactions. This form of investment is essential for traders and investment professionals to diversify their asset portfolio. Hybrid Investments work to maintain a sense of security for both the business and investor. Types of Hybrid Investments The two most popular types of Hybrid Investments are Preferred Stock and Convertible Bonds. Preferred Stocks – Stockholders receive dividend payments on a regular basis and gain funds when share values rise on security exchanges. Convertible Bonds – Bondholders periodically receive interest payments. An exchange of bonds for a specified number of equity shares is acceptable, but only in accordance with the convertible bond covenant. Investors buying these products look to accumulate periodic fixed-interest payments and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Restricted Stock

Restricted stock, also known as restricted securities, is stock of a company that is not fully transferable (from the stock-issuing company to the person receiving the stock award) until certain conditions (restrictions) have been met. Upon satisfaction of those conditions, the stock is no longer restricted, and becomes transferable to the person holding the award. Restricted stock is often used as a form of employee compensation, in which case it typically becomes transferable ("vests") upon the satisfaction of certain conditions, such as continued employment for a period of time or the achievement of particular product-development milestones, earnings per share goals or other financial targets. Restricted stock is a popular alternative to stock options, particularly for executives, due to favorable accounting rules and income tax treatment. Restricted stock units (RSUs) have more recently become popular among venture companies as a hybrid of stock options and restricted stock. R ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Equity (finance)

In finance, equity is ownership of assets that may have debts or other liabilities attached to them. Equity is measured for accounting purposes by subtracting liabilities from the value of the assets. For example, if someone owns a car worth $24,000 and owes $10,000 on the loan used to buy the car, the difference of $14,000 is equity. Equity can apply to a single asset, such as a car or house, or to an entire business. A business that needs to start up or expand its operations can sell its equity in order to raise cash that does not have to be repaid on a set schedule. In government finance or other non-profit settings, equity is known as "net position" or "net assets". Origins The term "equity" describes this type of ownership in English because it was regulated through the system of equity law that developed in England during the Late Middle Ages to meet the growing demands of commercial activity. While the older common law courts dealt with questions of property title, eq ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Option (finance)

In finance, an option is a contract which conveys to its owner, the ''holder'', the right, but not the obligation, to buy or sell a specific quantity of an underlying asset or instrument at a specified strike price on or before a specified date, depending on the style of the option. Options are typically acquired by purchase, as a form of compensation, or as part of a complex financial transaction. Thus, they are also a form of asset and have a valuation that may depend on a complex relationship between underlying asset price, time until expiration, market volatility, the risk-free rate of interest, and the strike price of the option. Options may be traded between private parties in ''over-the-counter'' (OTC) transactions, or they may be exchange-traded in live, public markets in the form of standardized contracts. Definition and application An option is a contract that allows the holder the right to buy or sell an underlying asset or financial instrument at a specified st ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dividend

A dividend is a distribution of profits by a corporation to its shareholders. When a corporation earns a profit or surplus, it is able to pay a portion of the profit as a dividend to shareholders. Any amount not distributed is taken to be re-invested in the business (called retained earnings). The current year profit as well as the retained earnings of previous years are available for distribution; a corporation is usually prohibited from paying a dividend out of its capital. Distribution to shareholders may be in cash (usually a deposit into a bank account) or, if the corporation has a dividend reinvestment plan, the amount can be paid by the issue of further shares or by share repurchase. In some cases, the distribution may be of assets. The dividend received by a shareholder is income of the shareholder and may be subject to income tax (see dividend tax). The tax treatment of this income varies considerably between jurisdictions. The corporation does not receive a tax dedu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Preferred Stock

Preferred stock (also called preferred shares, preference shares, or simply preferreds) is a component of share capital that may have any combination of features not possessed by common stock, including properties of both an equity and a debt instrument, and is generally considered a hybrid instrument. Preferred stocks are senior (i.e., higher ranking) to common stock but subordinate to bonds in terms of claim (or rights to their share of the assets of the company, given that such assets are payable to the returnee stock bond) and may have priority over common stock (ordinary shares) in the payment of dividends and upon liquidation. Terms of the preferred stock are described in the issuing company's articles of association or articles of incorporation. Like bonds, preferred stocks are rated by major credit rating agencies. Their ratings are generally lower than those of bonds, because preferred dividends do not carry the same guarantees as interest payments from bonds, and becaus ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Voting Rights

Suffrage, political franchise, or simply franchise, is the right to vote in representative democracy, public, political elections and referendums (although the term is sometimes used for any right to vote). In some languages, and occasionally in English, the right to vote is called active suffrage, as distinct from passive suffrage, which is the right to stand for election. The combination of active and passive suffrage is sometimes called ''full suffrage''. In most democracies, eligible voters can vote in elections of representatives. Voting on issues by referendum may also be available. For example, in Switzerland, this is permitted at all levels of government. In the United States, some U.S. state, states such as California, Washington, and Wisconsin have exercised their shared sovereignty to offer citizens the opportunity to write, propose, and vote on referendums; other states and the United States federal government, federal government have not. Referendums in the United K ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Preferred Stock

Preferred stock (also called preferred shares, preference shares, or simply preferreds) is a component of share capital that may have any combination of features not possessed by common stock, including properties of both an equity and a debt instrument, and is generally considered a hybrid instrument. Preferred stocks are senior (i.e., higher ranking) to common stock but subordinate to bonds in terms of claim (or rights to their share of the assets of the company, given that such assets are payable to the returnee stock bond) and may have priority over common stock (ordinary shares) in the payment of dividends and upon liquidation. Terms of the preferred stock are described in the issuing company's articles of association or articles of incorporation. Like bonds, preferred stocks are rated by major credit rating agencies. Their ratings are generally lower than those of bonds, because preferred dividends do not carry the same guarantees as interest payments from bonds, and becaus ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Common Stock

Common stock is a form of corporate equity ownership, a type of security. The terms voting share and ordinary share are also used frequently outside of the United States. They are known as equity shares or ordinary shares in the UK and other Commonwealth realms. This type of share gives the stockholder the right to share in the profits of the company, and to vote on matters of corporate policy and the composition of the members of the board of directors. The owners of common stock do not own any particular assets of the company, which belong to all the shareholders in common. A corporation may issue both ordinary and preference shares, in which case the preference shareholders have priority to receive dividends. In the event of liquidation, ordinary shareholders receive any remaining funds after bondholders, creditors (including employees), and preference shareholders are paid. When the liquidation happens through bankruptcy, the ordinary shareholders typically receive nothing. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |