|

Fisher Market

Fisher market is an economic model attributed to Irving Fisher. It has the following ingredients: * A set of m divisible products with pre-specified supplies (usually normalized such that the supply of each good is 1). * A set of n buyers. * For each buyer i=1,\dots,n, there is a pre-specified monetary budget B_i. Each product j has a price p_j; the prices are determined by methods described below. The price of a ''bundle'' of products is the sum of the prices of the products in the bundle. A bundle is represented by a vector x = x_1,\dots,x_m, where x_j is the quantity of product j. So the price of a bundle x is p(x)=\sum_^m p_j\cdot x_j. A bundle is ''affordable'' for a buyer if the price of that bundle is at most the buyer's budget. I.e, a bundle x is affordable for buyer i if p(x)\leq B_i. Each buyer has a preference relation over bundles, which can be represented by a utility function. The utility function of buyer i is denoted by u_i. The ''demand set'' of a buyer is the s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Model

In economics, a model is a theoretical construct representing economic processes by a set of variables and a set of logical and/or quantitative relationships between them. The economic model is a simplified, often mathematical, framework designed to illustrate complex processes. Frequently, economic models posit structural parameters. A model may have various exogenous variables, and those variables may change to create various responses by economic variables. Methodological uses of models include investigation, theorizing, and fitting theories to the world. Overview In general terms, economic models have two functions: first as a simplification of and abstraction from observed data, and second as a means of selection of data based on a paradigm of econometric study. ''Simplification'' is particularly important for economics given the enormous complexity of economic processes. This complexity can be attributed to the diversity of factors that determine economic activity; ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Irving Fisher

Irving Fisher (February 27, 1867 – April 29, 1947) was an American economist, statistician, inventor, eugenicist and progressive social campaigner. He was one of the earliest American neoclassical economists, though his later work on debt deflation has been embraced by the post-Keynesian school. Joseph Schumpeter described him as "the greatest economist the United States has ever produced", an assessment later repeated by James Tobin and Milton Friedman.Milton Friedman, ''Money Mischief: Episodes in Monetary History'', Houghton Mifflin Harcourt (1994) p. 37. Fisher made important contributions to utility theory and general equilibrium. He was also a pioneer in the rigorous study of intertemporal choice in markets, which led him to develop a theory of capital and interest rates. His research on the quantity theory of money inaugurated the school of macroeconomic thought known as "monetarism". Fisher was also a pioneer of econometrics, including the development of index nu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Preference (economics)

In economics and other social sciences, preference is the order that an agent gives to alternatives based on their relative utility. A process which results in an "optimal choice" (whether real or theoretical). Preferences are evaluations and concern matters of value, typically in relation to practical reasoning. The character of the preferences is determined purely by a person's tastes instead of the good's prices, personal income, and the availability of goods. However, people are still expected to act in their best (rational) interest. Rationality, in this context, means that when individuals are faced with a choice, they would select the option that maximizes self-interest. Moreover, in every set of alternatives, preferences arise. The belief of preference plays a key role in many disciplines, including moral philosophy and decision theory. The logical properties that preferences possess have major effects also on rational choice theory, which has a carryover effect on all mode ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Competitive Equilibrium

Competitive equilibrium (also called: Walrasian equilibrium) is a concept of economic equilibrium introduced by Kenneth Arrow and Gérard Debreu in 1951 appropriate for the analysis of commodity markets with flexible prices and many traders, and serving as the benchmark of efficiency in economic analysis. It relies crucially on the assumption of a competitive environment where each trader decides upon a quantity that is so small compared to the total quantity traded in the market that their individual transactions have no influence on the prices. Competitive markets are an ideal standard by which other market structures are evaluated. Definitions A competitive equilibrium (CE) consists of two elements: * A price function P. It takes as argument a vector representing a bundle of commodities, and returns a positive real number that represents its price. Usually the price function is linear - it is represented as a vector of prices, a price for each commodity type. * An allocation ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Walrasian Market

A Walrasian auction, introduced by Léon Walras, is a type of simultaneous auction where each agent calculates its demand for the good at every possible price and submits this to an auctioneer. The price is then set so that the total demand across all agents equals the total amount of the good. Thus, a Walrasian auction perfectly matches the supply and the demand. Walras suggested that equilibrium would always be achieved through a process of tâtonnement (French for "trial and error"), a form of hill climbing. More recently, however, the Sonnenschein–Mantel–Debreu theorem proved that such a process would not necessarily reach a unique and stable equilibrium, even if the market is populated with perfectly rational agents. Walrasian auctioneer The ''Walrasian auctioneer'' is the presumed auctioneer that matches supply and demand in a market of perfect competition. The auctioneer provides for the features of perfect competition: perfect information and no transaction costs. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Quasilinear Utilities

In economics and consumer theory, quasilinear utility functions are linear in one argument, generally the numeraire. Quasilinear preferences can be represented by the utility function u(x_1, x_2, \ldots, x_n) = x_1 + \theta (x_2, \ldots, x_n) where \theta is strictly concave. A useful property of the quasilinear utility function is that the Marshallian/Walrasian demand for x_2, \ldots, x_n does not depend on wealth and is thus not subject to a wealth effect; The absence of a wealth effect simplifies analysis and makes quasilinear utility functions a common choice for modelling. Furthermore, when utility is quasilinear, compensating variation (CV), equivalent variation (EV), and consumer surplus are algebraically equivalent. In mechanism design, quasilinear utility ensures that agents can compensate each other with side payments. Definition in terms of preferences A preference relation \succsim is quasilinear with respect to commodity 1 (called, in this case, the ''numeraire'' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Arrow–Debreu Model

In mathematical economics, the Arrow–Debreu model suggests that under certain economic assumptions (convex preferences, perfect competition, and demand independence) there must be a set of prices such that aggregate supplies will equal aggregate demands for every commodity in the economy. The model is central to the theory of general (economic) equilibrium and it is often used as a general reference for other microeconomic models. It is named after Kenneth Arrow, Gérard Debreu, and sometimes also Lionel W. McKenzie for his independent proof of equilibrium existence in 1954 as well as his later improvements in 1959. The A-D model is one of the most general models of competitive economy and is a crucial part of general equilibrium theory, as it can be used to prove the existence of general equilibrium (or Walrasian equilibrium) of an economy. In general, there may be many equilibria; however, with extra assumptions on consumer preferences, namely that their utility function ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sperner's Lemma

In mathematics, Sperner's lemma is a combinatorial result on colorings of triangulations, analogous to the Brouwer fixed point theorem, which is equivalent to it. It states that every Sperner coloring (described below) of a triangulation of an simplex contains a cell whose vertices all have different colors. The initial result of this kind was proved by Emanuel Sperner, in relation with proofs of invariance of domain. Sperner colorings have been used for effective computation of fixed points and in root-finding algorithms, and are applied in fair division (cake cutting) algorithms. Finding a Sperner coloring or equivalently a Brouwer fixed point is now believed to be an intractable computational problem, even in the plane, in the general case. The problem is PPAD-complete, a complexity class invented by Christos Papadimitriou. According to the Soviet ''Mathematical Encyclopaedia'' (ed. I.M. Vinogradov), a related 1929 theorem (of Knaster, Borsuk and Mazurkiewicz) had als ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

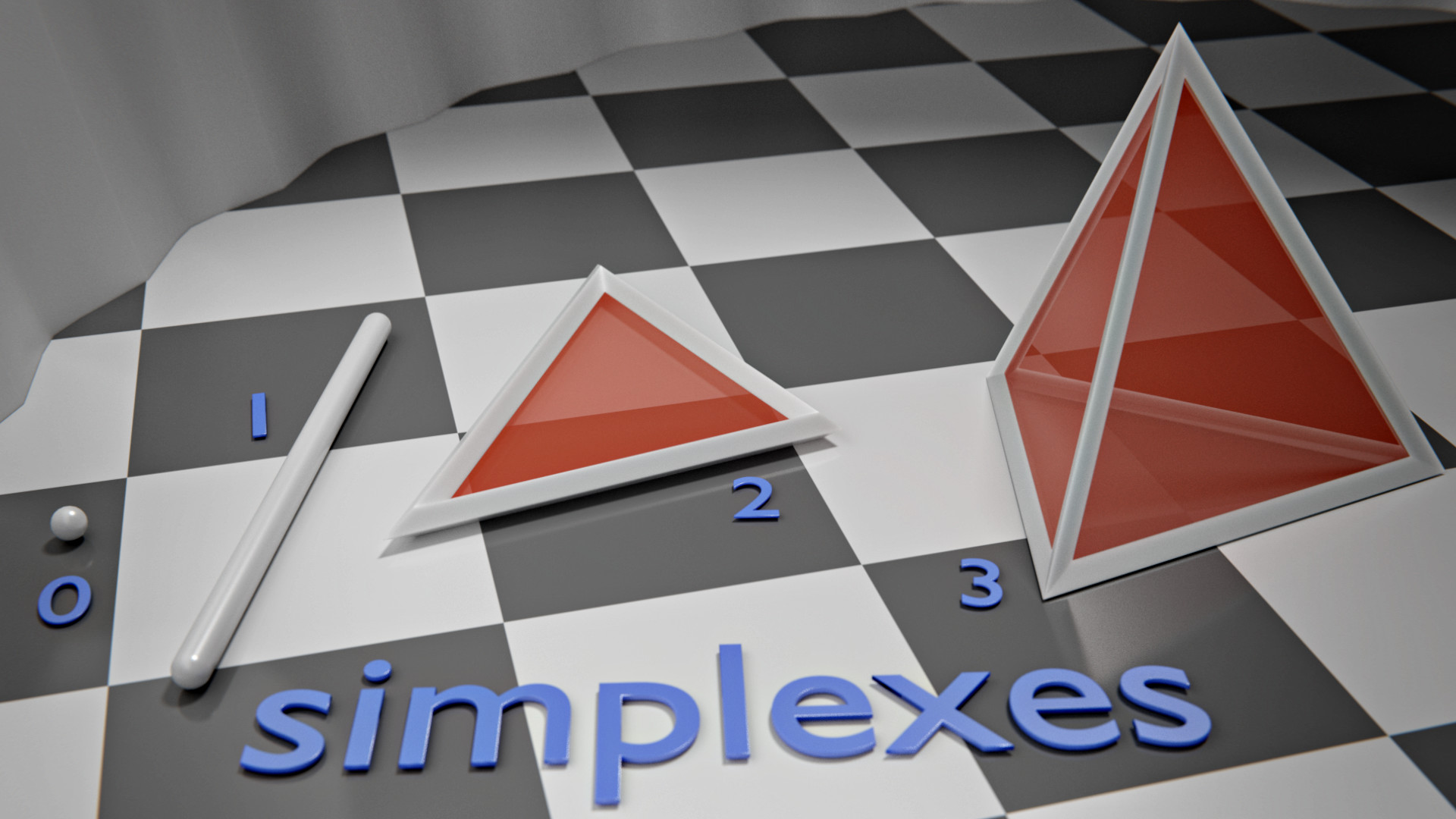

Standard Simplex

In geometry, a simplex (plural: simplexes or simplices) is a generalization of the notion of a triangle or tetrahedron to arbitrary dimensions. The simplex is so-named because it represents the simplest possible polytope in any given dimension. For example, * a 0-dimensional simplex is a point, * a 1-dimensional simplex is a line segment, * a 2-dimensional simplex is a triangle, * a 3-dimensional simplex is a tetrahedron, and * a 4-dimensional simplex is a 5-cell. Specifically, a ''k''-simplex is a ''k''-dimensional polytope which is the convex hull of its ''k'' + 1 vertices. More formally, suppose the ''k'' + 1 points u_0, \dots, u_k \in \mathbb^ are affinely independent, which means u_1 - u_0,\dots, u_k-u_0 are linearly independent. Then, the simplex determined by them is the set of points : C = \left\ This representation in terms of weighted vertices is known as the barycentric coordinate system. A regular simplex is a simplex that is also a regular polytope. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Equilibrium Computation

Market equilibrium computation (also called competitive equilibrium computation or clearing-prices computation) is a computational problem in the intersection of economics and computer science. The input to this problem is a ''market'', consisting of a set of ''resources'' and a set of ''agents''. There are various kinds of markets, such as Fisher market and Arrow–Debreu market, with divisible or indivisible resources. The required output is a ''competitive equilibrium'', consisting of a ''price-vector'' (a price for each resource), and an ''allocation'' (a resource-bundle for each agent), such that each agent gets the best bundle possible (for him) given the budget, and the market ''clears'' (all resources are allocated). Market equilibrium computation is interesting due to the fact that a competitive equilibrium is always Pareto efficient. The special case of a Fisher market, in which all buyers have equal incomes, is particularly interesting, since in this setting a competitiv ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Approximate Competitive Equilibrium From Equal Incomes

Approximate Competitive Equilibrium from Equal Incomes (A-CEEI) is a procedure for fair item assignment. It was developed by Eric Budish. Background CEEI (Competitive Equilibrium from Equal Incomes) is a fundamental rule for fair division of divisible resources. It divides the resources according to the outcome of the following hypothetical process: * Each agent receives a single unit of fiat money. This is the Equal Incomes part of CEEI. * The agents trade freely until the market attains a Competitive Equilibrium. This is a price-vector and an allocation, such that (a) each allocated bundle is optimal to its agent given his/her income - the agent cannot purchase a better bundle with the same income, and (b) the market clears - the sum of all allocations exactly equals the initial endowment. The equilibrium allocation is provably envy free and Pareto efficient. Moreover, when the agents have linear utility functions, the CEEI allocation can be computed efficiently. Unfortunately ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

PPAD (complexity)

In computer science, PPAD ("Polynomial Parity Arguments on Directed graphs") is a complexity class introduced by Christos Papadimitriou in 1994. PPAD is a subclass of TFNP based on functions that can be shown to be total by a parity argument. The class attracted significant attention in the field of algorithmic game theory because it contains the problem of computing a Nash equilibrium: this problem was shown to be complete for PPAD by Daskalakis, Goldberg and Papadimitriou with at least 3 players and later extended by Chen and Deng to 2 players.*. Definition PPAD is a subset of the class TFNP, the class of function problems in FNP that are guaranteed to be total. The TFNP formal definition is given as follows: :A binary relation P(''x'',''y'') is in TFNP if and only if there is a deterministic polynomial time algorithm that can determine whether P(''x'',''y'') holds given both ''x'' and ''y'', and for every ''x'', there exists a ''y'' such that P(''x'',''y'') holds. Subclasses ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |