|

Arrow–Debreu Model

In mathematical economics, the Arrow–Debreu model suggests that under certain economic assumptions (convex preferences, perfect competition, and demand independence) there must be a set of prices such that aggregate supplies will equal aggregate demands for every commodity in the economy. The model is central to the theory of general (economic) equilibrium and it is often used as a general reference for other microeconomic models. It is named after Kenneth Arrow, Gérard Debreu, and sometimes also Lionel W. McKenzie for his independent proof of equilibrium existence in 1954 as well as his later improvements in 1959. The A-D model is one of the most general models of competitive economy and is a crucial part of general equilibrium theory, as it can be used to prove the existence of general equilibrium (or Walrasian equilibrium) of an economy. In general, there may be many equilibria; however, with extra assumptions on consumer preferences, namely that their utility function ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sonnenschein–Mantel–Debreu Theorem

The Sonnenschein–Mantel–Debreu theorem is an important result in general equilibrium economics, proved by Gérard Debreu, , and Hugo F. Sonnenschein in the 1970s. It states that the excess demand curve for an exchange economy populated with utility-maximizing rational agents can take the shape of any function that is continuous, has homogeneity degree zero, and is in accordance with Walras's law. This implies that the excess demand function does not take a well-behaved form even if each agent has a well-behaved utility function. Market processes will not necessarily reach a unique and stable equilibrium point. More recently, Jordi Andreu, Pierre-André Chiappori, and Ivar Ekeland extended this result to market demand curves, both for individual commodities and for the aggregate demand of an economy as a whole. This means that demand curves may take on highly irregular shapes, even if all individual agents in the market are perfectly rational. In contrast with usual assum ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mathematical Economics

Mathematical economics is the application of mathematical methods to represent theories and analyze problems in economics. Often, these applied methods are beyond simple geometry, and may include differential and integral calculus, difference and differential equations, matrix algebra, mathematical programming, or other computational methods. Proponents of this approach claim that it allows the formulation of theoretical relationships with rigor, generality, and simplicity. Mathematics allows economists to form meaningful, testable propositions about wide-ranging and complex subjects which could less easily be expressed informally. Further, the language of mathematics allows economists to make specific, positive claims about controversial or contentious subjects that would be impossible without mathematics. Much of economic theory is currently presented in terms of mathematical economic models, a set of stylized and simplified mathematical relationships asserted to clarify ass ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Kakutani Fixed-point Theorem

In mathematical analysis, the Kakutani fixed-point theorem is a fixed-point theorem for set-valued functions. It provides sufficient conditions for a set-valued function defined on a convex set, convex, compact set, compact subset of a Euclidean space to have a fixed point (mathematics), fixed point, i.e. a point which is map (mathematics), mapped to a set containing it. The Kakutani fixed point theorem is a generalization of the Brouwer fixed point theorem. The Brouwer fixed point theorem is a fundamental result in topology which proves the existence of fixed points for continuous function (topology), continuous functions defined on compact, convex subsets of Euclidean spaces. Kakutani's theorem extends this to set-valued functions. The theorem was developed by Shizuo Kakutani in 1941, and was used by John Forbes Nash, Jr., John Nash in his description of Nash equilibrium, Nash equilibria. It has subsequently found widespread application in game theory and economics. Statement K ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Complete Market

In economics, a complete market (aka Arrow-Debreu market or complete system of markets) is a market with two conditions: # Negligible transaction costs and therefore also perfect information, # there is a price for every asset in every possible state of the world In such a market, the complete set of possible bets on future states of the world can be constructed with existing assets without friction. Here, goods are state-contingent; that is, a good includes the time and state of the world in which it is consumed. For instance, an umbrella tomorrow if it rains is a distinct good from an umbrella tomorrow if it is clear. The study of complete markets is central to state-preference theory. The theory can be traced to the work of Kenneth Arrow (1964), Gérard Debreu (1959), Arrow & Debreu (1954) and Lionel McKenzie (1954). Arrow and Debreu were awarded the Nobel Memorial Prize in Economics (Arrow in 1972, Debreu in 1983), largely for their work in developing the theory of complete mar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commodity

In economics, a commodity is an economic good, usually a resource, that has full or substantial fungibility: that is, the market treats instances of the good as equivalent or nearly so with no regard to who produced them. The price of a commodity good is typically determined as a function of its market as a whole: well-established physical commodities have actively traded spot and derivative markets. The wide availability of commodities typically leads to smaller profit margins and diminishes the importance of factors (such as brand name) other than price. Most commodities are raw materials, basic resources, agricultural, or mining products, such as iron ore, sugar, or grains like rice and wheat. Commodities can also be mass-produced unspecialized products such as chemical substance, chemicals and computer memory. Popular commodities include Petroleum, crude oil, Maize, corn, and gold. Other definitions of commodity include something useful or valued and an alternative ter ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Shapley–Folkman Lemma

The Shapley–Folkman lemma is a result in convex geometry that describes the Minkowski addition of sets in a vector space. It is named after mathematicians Lloyd Shapley and Jon Folkman, but was first published by the economist Ross M. Starr. The lemma may be intuitively understood as saying that, if the number of summed sets exceeds the dimension of the vector space, then their Minkowski sum is approximately convex. Related results provide more refined statements about ''how close'' the approximation is. For example, the Shapley–Folkman theorem provides an upper bound on the distance between any point in the Minkowski sum and its convex hull. This upper bound is sharpened by the Shapley–Folkman–Starr theorem (alternatively, Starr's corollary). The Shapley–Folkman lemma has applications in economics, optimization and probability theory. In economics, it can be used to extend results proved for convex preferences to non-convex preferences. In op ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

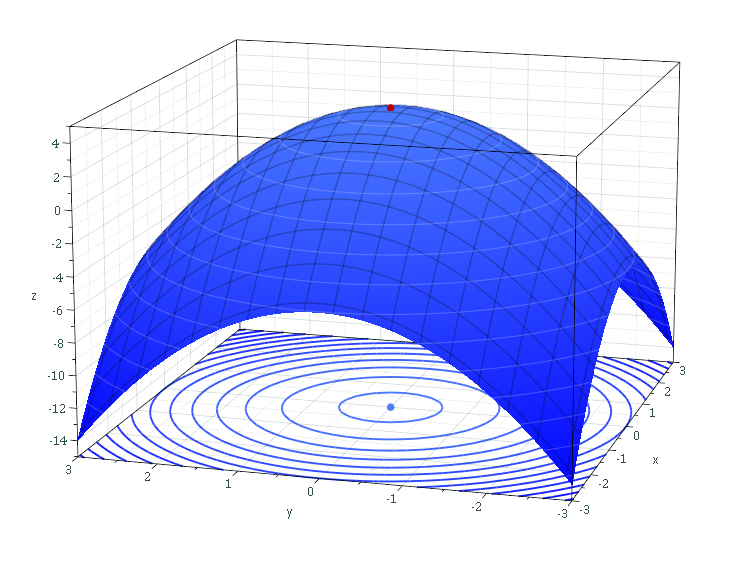

Convex Set

In geometry, a subset of a Euclidean space, or more generally an affine space over the reals, is convex if, given any two points in the subset, the subset contains the whole line segment that joins them. Equivalently, a convex set or a convex region is a subset that intersects every line into a single line segment (possibly empty). For example, a solid cube is a convex set, but anything that is hollow or has an indent, for example, a crescent shape, is not convex. The boundary of a convex set is always a convex curve. The intersection of all the convex sets that contain a given subset of Euclidean space is called the convex hull of . It is the smallest convex set containing . A convex function is a real-valued function defined on an interval with the property that its epigraph (the set of points on or above the graph of the function) is a convex set. Convex minimization is a subfield of optimization that studies the problem of minimizing convex functions over convex se ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

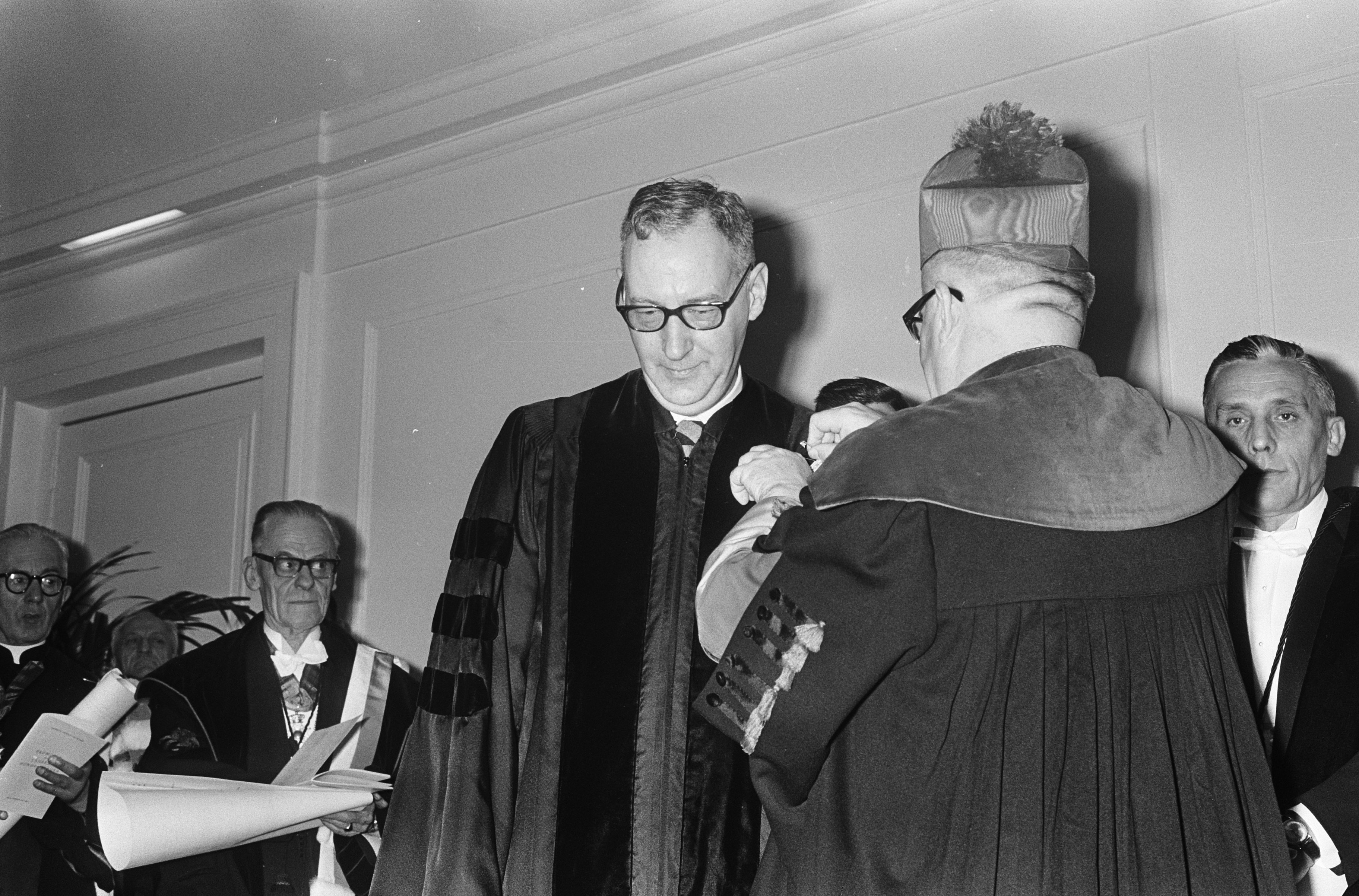

Tjalling Koopmans

Tjalling Charles Koopmans (August 28, 1910 – February 26, 1985) was a Dutch-American mathematician and economist. He was the joint winner with Leonid Kantorovich of the 1975 Nobel Memorial Prize in Economic Sciences for his work on the theory of the optimum allocation of resources. Koopmans showed that on the basis of certain efficiency criteria, it is possible to make important deductions concerning optimum price systems. Biography Koopmans was born in 's-Graveland, Netherlands. He began his university education at the Utrecht University at seventeen, specializing in mathematics. Three years later, in 1930, he switched to theoretical physics. In 1933, he met Jan Tinbergen, the winner of the 1969 Nobel Memorial Prize in Economics, and moved to Amsterdam to study mathematical economics under him. In addition to mathematical economics, Koopmans extended his explorations to econometrics and statistics. In 1936 he graduated from Leiden University with a PhD, under the directio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |