|

Competitive Equilibrium

Competitive equilibrium (also called: Walrasian equilibrium) is a concept of economic equilibrium, introduced by Kenneth Arrow and Gérard Debreu in 1951, appropriate for the analysis of commodity markets with flexible prices and many traders, and serving as the benchmark of efficiency in economic analysis. It relies crucially on the assumption of a competitive environment where each trader decides upon a quantity that is so small compared to the total quantity traded in the market that their individual transactions have no influence on the prices. Competitive markets are an ideal standard by which other market structures are evaluated. Definitions A competitive equilibrium (CE) consists of two elements: * A price function P. It takes as argument a vector representing a bundle of commodities, and returns a positive real number that represents its price. Usually the price function is linear - it is represented as a vector of prices, a price for each commodity type. * An allocation ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Equilibrium

In economics, economic equilibrium is a situation in which the economic forces of supply and demand are balanced, meaning that economic variables will no longer change. Market equilibrium in this case is a condition where a market price is established through competition such that the amount of goods or services sought by buyers is equal to the amount of goods or services produced by sellers. This price is often called the competitive price or market clearing price and will tend not to change unless demand or supply changes, and quantity is called the "competitive quantity" or market clearing quantity. Understanding economic equilibrium An economic equilibrium is a situation when the economic agent cannot change the situation by adopting any strategy. The concept has been borrowed from the physical sciences. Take a system where physical forces are balanced for instance.This economically interpreted means no further change ensues. Properties of equilibrium Three basic prope ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finding An Equilibrium

Find, FIND or Finding may refer to: Computing * find (Unix), a command on UNIX platforms * find (Windows), a command on DOS/Windows platforms Books * ''The Find'' (2010), by Kathy Page * ''The Find'' (2014), by William Hope Hodgson Film and television * "The Find", an episode of '' Beyond Belief: Fact or Fiction'' * "The Find", an episode of reality TV show '' The Curse of Oak Island'' Music * ''Find'' (Hidden in Plain View EP), 2001 * ''Find'' (SS501 EP) * '' The Find'', a 2005 hip hop album by Ohmega Watts People * Áed Find (died 778), king of Dál Riata (modern-day Scotland) * Caittil Find, Norse-Gaelic warrior contingent leader * Cumméne Find (died 669), seventh abbot of Iona, Scotland Other uses * Find, in archaeology * Finding (jewelcrafting), jewellery components * Meteorite find, a found meteorite not observed to have fallen * Foundation for Innovative New Diagnostics, a not-for-profit organisation * Facial Images National Database See also * Discovery (o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Unit Demand

In economics, a unit demand agent is an agent who wants to buy a single item, which may be of one of different types. A typical example is a buyer who needs a new car. There are many different types of cars, but usually a buyer will choose only one of them, based on the quality and the price. If there are ''m'' different item-types, then a unit-demand valuation function is typically represented by ''m'' values v_1,\dots,v_m, with v_j representing the subjective value that the agent derives from item j. If the agent receives a set A of items, then his total utility is given by: :u(A)=\max_v_j since he enjoys the most valuable item from A and ignores the rest. Therefore, if the price of item j is p_j, then a unit-demand buyer will typically want to buy a single item – the item j for which the net utility v_j - p_j is maximized. Ordinal and cardinal definitions A unit-demand valuation is formally defined by: * For a preference relation: for every set B there is a subset A\subsete ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Complementary Goods

In economics, a complementary good is a good whose appeal increases with the popularity of its complement. Technically, it displays a negative cross elasticity of demand and that demand for it increases when the price of another good decreases. If A is a complement to B, an increase in the price of A will result in a negative movement along the demand curve of A and cause the demand curve for B to shift inward; less of each good will be demanded. Conversely, a decrease in the price of A will result in a positive movement along the demand curve of A and cause the demand curve of B to shift outward; more of each good will be demanded. This is in contrast to a substitute good, whose demand decreases when its substitute's price decreases. When two goods are complements, they experience ''joint demand'' - the demand of one good is linked to the demand for another good. Therefore, if a higher quantity is demanded of one good, a higher quantity will also be demanded of the other, an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Substitute Good

In microeconomics, substitute goods are two goods that can be used for the same purpose by consumers. That is, a consumer perceives both goods as similar or comparable, so that having more of one good causes the consumer to desire less of the other good. Contrary to complementary goods and independent goods, substitute goods may replace each other in use due to changing economic conditions. An example of substitute goods is Coca-Cola and Pepsi; the interchangeable aspect of these goods is due to the similarity of the purpose they serve, i.e. fulfilling customers' desire for a soft drink. These types of substitutes can be referred to as close substitutes. Substitute goods are commodity which the consumer demanded to be used in place of another good. Economic theory describes two goods as being close substitutes if three conditions hold: # products have the same or similar performance characteristics # products have the same or similar occasion for use and # products are sold in th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Independent Goods

Independent goods are goods that have a zero cross elasticity of demand. Changes in the price of one good will have no effect on the demand for an independent good. Thus independent goods are neither complements nor substitutes. For example, a person's demand for nails is usually independent of his or her demand for bread, since they are two unrelated types of goods. Note that this concept is subjective and depends on the consumer's personal utility function. A Cobb-Douglas utility function implies that goods are independent. For goods in quantities ''X''1 and ''X''2, prices ''p''1 and ''p''2, income ''m'', and utility function parameter ''a'', the utility function : u(X_1, X_2) = X_1^a X_2^, when optimized subject to the budget constraint that expenditure on the two goods cannot exceed income, gives rise to this demand function for good 1: X_1= am/p_1, which does not depend on ''p''2. See also * Consumer theory * Good (economics and accounting) In economics, goods are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Examples

Example may refer to: * ''exempli gratia'' (e.g.), usually read out in English as "for example" * .example, reserved as a domain name that may not be installed as a top-level domain of the Internet ** example.com, example.net, example.org, and example.edu: second-level domain names reserved for use in documentation as examples * HMS ''Example'' (P165), an Archer-class patrol and training vessel of the Royal Navy Arts * ''The Example'', a 1634 play by James Shirley * ''The Example'' (comics), a 2009 graphic novel by Tom Taylor and Colin Wilson * Example (musician), the British dance musician Elliot John Gleave (born 1982) * ''Example'' (album), a 1995 album by American rock band For Squirrels See also * Exemplar (other), a prototype or model which others can use to understand a topic better * Exemplum An exemplum (Latin for "example", exempla, ''exempli gratia'' = "for example", abbr.: ''e.g.'') is a moral anecdote, brief or extended, real or fictitious, us ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Equilibrium Computation

Market equilibrium computation (also called competitive equilibrium computation or clearing-prices computation) is a computational problem in the intersection of economics and computer science. The input to this problem is a ''market'', consisting of a set of ''resources'' and a set of ''agents''. There are various kinds of markets, such as Fisher market and Arrow–Debreu market, with divisible or indivisible resources. The required output is a ''competitive equilibrium'', consisting of a ''price-vector'' (a price for each resource), and an ''allocation'' (a resource-bundle for each agent), such that each agent gets the best bundle possible (for him) given the budget, and the market ''clears'' (all resources are allocated). Market equilibrium computation is interesting due to the fact that a competitive equilibrium is always Pareto efficient. The special case of a Fisher market, in which all buyers have equal incomes, is particularly interesting, since in this setting a competiti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Linear Utilities

In economics and consumer theory, a linear utility function is a function of the form: ::u(x_1,x_2,\dots,x_m) = w_1 x_1 + w_2 x_2 + \dots w_m x_m or, in vector form: ::u(\overrightarrow) = \overrightarrow \cdot \overrightarrow where: * m is the number of different goods in the economy. * \overrightarrow is a vector of size m that represents a bundle. The element x_i represents the amount of good i in the bundle. * \overrightarrow is a vector of size m that represents the subjective preferences of the consumer. The element w_i represents the relative value that the consumer assigns to good i. If w_i=0, this means that the consumer thinks that product i is totally worthless. The higher w_i is, the more valuable a unit of this product is for the consumer. A consumer with a linear utility function has the following properties: * The preferences are strictly monotone: having a larger quantity of even a single good strictly increases the utility. * The preferences are weakly convex, b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Brouwer Fixed-point Theorem

Brouwer's fixed-point theorem is a fixed-point theorem in topology, named after Luitzen Egbertus Jan Brouwer, L. E. J. (Bertus) Brouwer. It states that for any continuous function f mapping a nonempty compactness, compact convex set to itself, there is a point x_0 such that f(x_0)=x_0. The simplest forms of Brouwer's theorem are for continuous functions f from a closed interval I in the real numbers to itself or from a closed Disk (mathematics), disk D to itself. A more general form than the latter is for continuous functions from a nonempty convex compact subset K of Euclidean space to itself. Among hundreds of fixed-point theorems, Brouwer's is particularly well known, due in part to its use across numerous fields of mathematics. In its original field, this result is one of the key theorems characterizing the topology of Euclidean spaces, along with the Jordan curve theorem, the hairy ball theorem, the invariance of dimension and the Borsuk–Ulam theorem. This gives it a place ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Excess Demand Function

In microeconomics, excess demand, also known as shortage, is a phenomenon where the demand for goods and services exceeds that which the firms can produce. In microeconomics, an excess demand function is a function expressing excess demand for a product—the excess of quantity demanded over quantity supplied—in terms of the product's price and possibly other determinants. It is the product's demand function minus its supply function. In a pure exchange economy, the excess demand is the sum of all agents' demands minus the sum of all agents' initial endowments. A product's excess supply function is the negative of the excess demand function—it is the product's supply function minus its demand function. In most cases the first derivative of excess demand with respect to price is negative, meaning that a higher price leads to lower excess demand. The price of the product is said to be the equilibrium price if it is such that the value of the excess demand functio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

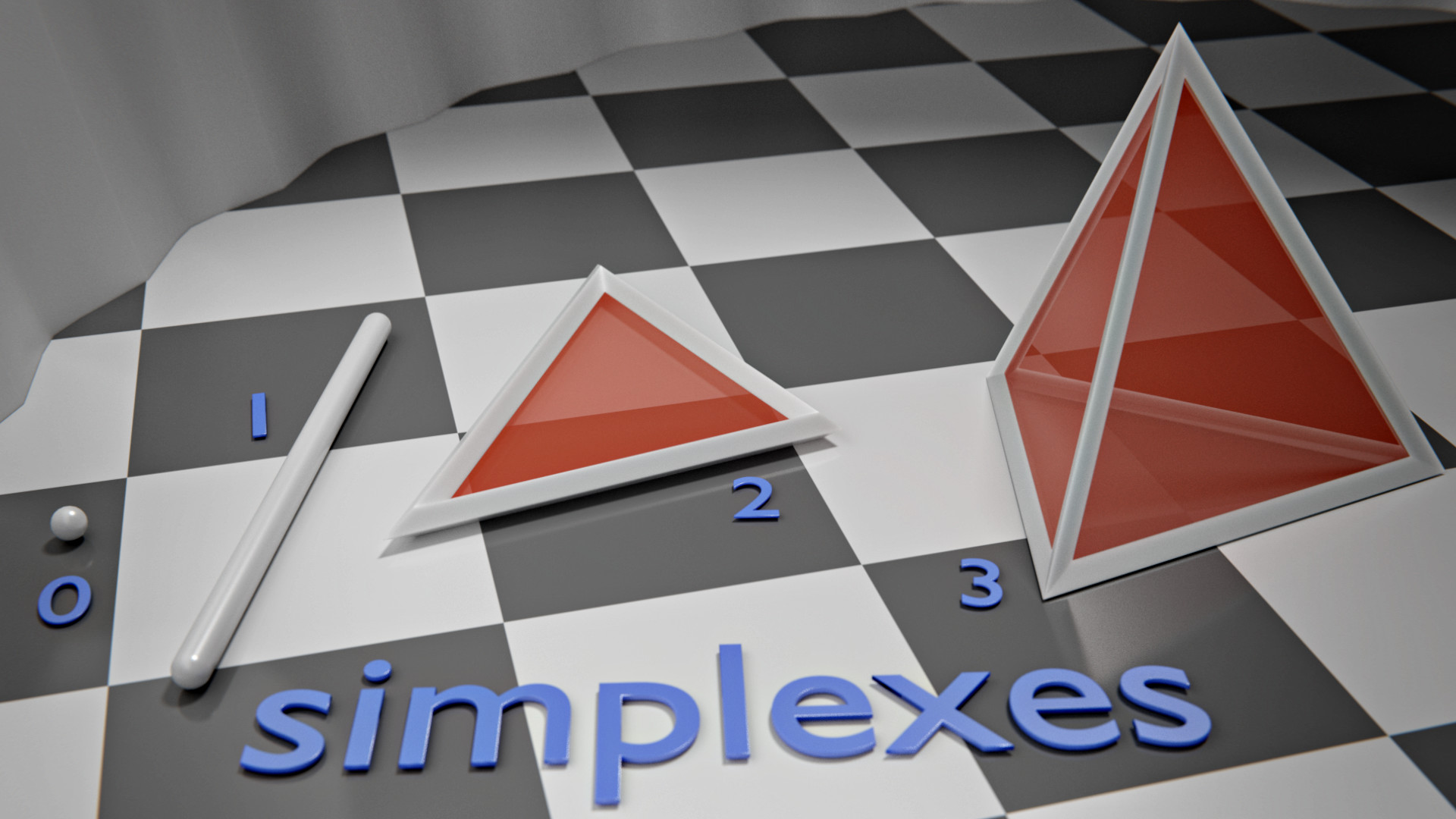

Unit Simplex

In geometry, a simplex (plural: simplexes or simplices) is a generalization of the notion of a triangle or tetrahedron to arbitrary dimensions. The simplex is so-named because it represents the simplest possible polytope in any given dimension. For example, * a 0-dimensional simplex is a point (mathematics), point, * a 1-dimensional simplex is a line segment, * a 2-dimensional simplex is a triangle, * a 3-dimensional simplex is a tetrahedron, and * a Four-dimensional space, 4-dimensional simplex is a 5-cell. Specifically, a -simplex is a -dimensional polytope that is the convex hull of its Vertex (geometry), vertices. More formally, suppose the points u_0, \dots, u_k are affinely independent, which means that the vectors u_1 - u_0,\dots, u_k-u_0 are linearly independent. Then, the simplex determined by them is the set of points C = \left\. A regular simplex is a simplex that is also a regular polytope. A regular -simplex may be constructed from a regular -simplex by connecti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |