Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of

risk management, primarily used to

hedge

A hedge or hedgerow is a line of closely spaced shrubs and sometimes trees, planted and trained to form a barrier or to mark the boundary of an area, such as between neighbouring properties. Hedges that are used to separate a road from adjoin ...

against the risk of a contingent or uncertain loss.

An entity which provides insurance is known as an insurer, insurance company, insurance carrier, or

underwriter

Underwriting (UW) services are provided by some large financial institutions, such as banks, insurance companies and investment houses, whereby they guarantee payment in case of damage or financial loss and accept the financial risk for liabilit ...

. A person or entity who buys insurance is known as a policyholder, while a person or entity covered under the policy is called an insured. The insurance transaction involves the policyholder assuming a guaranteed, known, and relatively small loss in the form of a payment to the insurer (a premium) in exchange for the insurer's promise to compensate the insured in the event of a covered loss. The loss may or may not be financial, but it must be reducible to financial terms. Furthermore, it usually involves something in which the insured has an

insurable interest

Insurable interest exists when an insured person derives a financial or other kind of benefit from the continuous existence, without repairment or damage, of the insured object (or in the case of a person, their continued survival). A person has an ...

established by ownership, possession, or pre-existing relationship.

The insured receives a

contract

A contract is a legally enforceable agreement between two or more parties that creates, defines, and governs mutual rights and obligations between them. A contract typically involves the transfer of goods, services, money, or a promise to tr ...

, called the

insurance policy

In insurance, the insurance policy is a contract (generally a standard form contract) between the insurer and the policyholder, which determines the claims which the insurer is legally required to pay. In exchange for an initial payment, known a ...

, which details the conditions and circumstances under which the insurer will compensate the insured, or their designated beneficiary or assignee. The amount of money charged by the insurer to the policyholder for the coverage set forth in the insurance policy is called the premium. If the insured experiences a loss which is potentially covered by the insurance policy, the insured submits a claim to the insurer for processing by a

claims adjuster

A claims adjuster, desk adjuster, field adjuster, or general adjuster (claim adjuster, claims handler, claim handler or loss adjuster in the United Kingdom, Ireland, Australia, South Africa, the Caribbean and New Zealand) investigates insurance cla ...

. A mandatory

out-of-pocket expense

An out-of-pocket expense (or out-of-pocket cost, OOP) is the direct payment of money that may or may not be later reimbursed from a third-party source.

For example, when operating a vehicle, gasoline, parking fees and tolls are considered out-of ...

required by an insurance policy before an insurer will pay a claim is called a

deductible

In an insurance policy, the deductible (in British English, the excess) is the amount paid

out of pocket by the policy holder before an insurance provider will pay any expenses. In general usage, the term ''deductible'' may be used to describe o ...

(or if required by a

health insurance policy, a

copayment

A copayment or copay (called a gap in Australian English) is a fixed amount for a covered service, paid by a patient to the provider of service before receiving the service. It may be defined in an insurance policy and paid by an insured person e ...

). The insurer may

hedge

A hedge or hedgerow is a line of closely spaced shrubs and sometimes trees, planted and trained to form a barrier or to mark the boundary of an area, such as between neighbouring properties. Hedges that are used to separate a road from adjoin ...

its own risk by taking out

reinsurance, whereby another insurance company agrees to carry some of the risks, especially if the primary insurer deems the risk too large for it to carry.

History

Early methods

Methods for transferring or distributing risk were practiced by

Babylonian,

Chinese

Chinese can refer to:

* Something related to China

* Chinese people, people of Chinese nationality, citizenship, and/or ethnicity

**''Zhonghua minzu'', the supra-ethnic concept of the Chinese nation

** List of ethnic groups in China, people of ...

and

Indian

Indian or Indians may refer to:

Peoples South Asia

* Indian people, people of Indian nationality, or people who have an Indian ancestor

** Non-resident Indian, a citizen of India who has temporarily emigrated to another country

* South Asia ...

traders as long ago as the

3rd and

2nd

A second is the base unit of time in the International System of Units (SI).

Second, Seconds or 2nd may also refer to:

Mathematics

* 2 (number), as an ordinal (also written as ''2nd'' or ''2d'')

* Second of arc, an angular measurement unit, ...

millennia

A millennium (plural millennia or millenniums) is a period of one thousand years, sometimes called a kiloannum (ka), or kiloyear (ky). Normally, the word is used specifically for periods of a thousand years that begin at the starting point (ini ...

BC, respectively. Chinese merchants travelling treacherous river rapids would redistribute their wares across many vessels to limit the loss due to any single vessel capsizing.

''Codex Hammurabi'' Law 238 (c. 1755–1750 BC) stipulated that a

sea captain,

ship-manager, or

ship charterer that saved a ship from

total loss

In insurance claims, a total loss or write-off is a situation where the lost value, repair cost or salvage cost of a damaged property exceeds its insured value, and simply replacing the old property with a new equivalent is more cost-effect ...

was

only required to pay one-half the value of the ship to the

ship-owner

A ship-owner is the owner of a merchant vessel (commercial ship) and is involved in the shipping industry. In the commercial sense of the term, a shipowner is someone who equips and exploits a ship, usually for delivering cargo at a certain fre ...

.

In the ''

Digesta seu Pandectae'' (533), the second volume of the

codification of laws ordered by

Justinian I

Justinian I (; la, Iustinianus, ; grc-gre, Ἰουστινιανός ; 48214 November 565), also known as Justinian the Great, was the Byzantine emperor from 527 to 565.

His reign is marked by the ambitious but only partly realized ''renova ...

(527–565), a

legal opinion written by the

Roman jurist Paulus in 235 AD was included about the ''

Lex Rhodia

Lex or LEX may refer to:

Arts and entertainment

* ''Lex'', a daily featured column in the ''Financial Times''

Games

* Lex, the mascot of the word-forming puzzle video game ''Bookworm''

* Lex, the protagonist of the word-forming puzzle video ga ...

'' ("Rhodian law"). It articulates the

general average

The law of general average is a principle of maritime law whereby all stakeholders in a sea venture proportionately share any losses resulting from a voluntary sacrifice of part of the ship or cargo to save the whole in an emergency. For inst ...

principle of

marine insurance

Marine insurance covers the physical loss or damage of ships, cargo, terminals, and any transport by which the property is transferred, acquired, or held between the points of origin and the final destination. Cargo insurance is the sub-branch o ...

established on the island of

Rhodes

Rhodes (; el, Ρόδος , translit=Ródos ) is the largest and the historical capital of the Dodecanese islands of Greece. Administratively, the island forms a separate municipality within the Rhodes regional unit, which is part of the S ...

in approximately 1000 to 800 BC, plausibly by the

Phoenicians

Phoenicia () was an ancient thalassocratic civilization originating in the Levant region of the eastern Mediterranean, primarily located in modern Lebanon. The territory of the Phoenician city-states extended and shrank throughout their histor ...

during the proposed

Dorian invasion and emergence of the purported

Sea Peoples

The Sea Peoples are a hypothesized seafaring confederation that attacked ancient Egypt and other regions in the East Mediterranean prior to and during the Late Bronze Age collapse (1200–900 BCE).. Quote: "First coined in 1881 by the Fren ...

during the

Greek Dark Ages (c. 1100–c. 750).

The law of general average is the fundamental

principle that underlies all insurance.

In 1816, an archeological excavation in

Minya, Egypt produced a

Nerva–Antonine dynasty-era

tablet from the ruins of the

Temple of Antinous in

Antinoöpolis,

Aegyptus. The tablet

prescribed the rules and

membership dues of a

burial society A burial society is a type of benefit/friendly society. These groups historically existed in England and elsewhere, and were constituted for the purpose of providing by voluntary subscriptions for the funeral expenses of the husband, wife or child ...

collegium

A (plural ), or college, was any association in ancient Rome that acted as a legal entity. Following the passage of the ''Lex Julia'' during the reign of Julius Caesar as Consul and Dictator of the Roman Republic (49–44 BC), and their rea ...

established in

Lanuvium

Lanuvium, modern Lanuvio, is an ancient city of Latium vetus, some southeast of Rome, a little southwest of the Via Appia.

Situated on an isolated hill projecting south from the main mass of the Alban Hills, Lanuvium commanded an extensive vie ...

,

Italia

Italy ( it, Italia ), officially the Italian Republic, ) or the Republic of Italy, is a country in Southern Europe. It is located in the middle of the Mediterranean Sea, and its territory largely coincides with the Italy (geographical region) ...

in approximately 133 AD during the reign of

Hadrian (117–138) of the

Roman Empire

The Roman Empire ( la, Imperium Romanum ; grc-gre, Βασιλεία τῶν Ῥωμαίων, Basileía tôn Rhōmaíōn) was the post- Republican period of ancient Rome. As a polity, it included large territorial holdings around the Mediter ...

.

In 1851 AD, future

U.S. Supreme Court

The Supreme Court of the United States (SCOTUS) is the highest court in the federal judiciary of the United States. It has ultimate appellate jurisdiction over all U.S. federal court cases, and over state court cases that involve a point o ...

Associate Justice

Associate justice or associate judge (or simply associate) is a judicial panel member who is not the chief justice in some jurisdictions. The title "Associate Justice" is used for members of the Supreme Court of the United States and some sta ...

Joseph P. Bradley

Joseph Philo Bradley (March 14, 1813 – January 22, 1892) was an American jurist who served as an associate justice of the Supreme Court of the United States from 1870 to 1892. He was also a member of the Electoral Commission that decided t ...

(1870–1892 AD), once employed as an

actuary for the

Mutual Benefit Life Insurance Company

The Mutual Benefit Life Insurance Company was a life insurance company that was chartered in 1845 and based in Newark in Essex County, New Jersey, United States. The company was headed by Frederick Frelinghuysen (1848–1924). The company w ...

, submitted an article to the ''

Journal of the Institute of Actuaries''. His article detailed an historical account of a

Severan dynasty

The Severan dynasty was a Roman imperial dynasty that ruled the Roman Empire between 193 and 235, during the Roman imperial period. The dynasty was founded by the emperor Septimius Severus (), who rose to power after the Year of the Five Empero ...

-era

life table

In actuarial science and demography, a life table (also called a mortality table or actuarial table) is a table which shows, for each age, what the probability is that a person of that age will die before their next birthday ("probability of death ...

compiled by the

Roman jurist Ulpian

Ulpian (; la, Gnaeus Domitius Annius Ulpianus; c. 170223? 228?) was a Roman jurist born in Tyre. He was considered one of the great legal authorities of his time and was one of the five jurists upon whom decisions were to be based according to ...

in approximately 220 AD that was also included in the ''Digesta''.

Concepts of insurance has been also found in 3rd century BC Hindu scriptures such as

Dharmasastra,

Arthashastra and

Manusmriti

The ''Manusmṛiti'' ( sa, मनुस्मृति), also known as the ''Mānava-Dharmaśāstra'' or Laws of Manu, is one of the many legal texts and constitution among the many ' of Hinduism. In ancient India, the sages often wrote thei ...

. The ancient Greeks had marine loans. Money was advanced on a ship or cargo, to be repaid with large interest if the voyage prospers. However, the money would not be repaid at all if the ship were lost, thus making the rate of interest high enough to pay for not only for the use of the capital but also for the risk of losing it (fully described by

Demosthenes

Demosthenes (; el, Δημοσθένης, translit=Dēmosthénēs; ; 384 – 12 October 322 BC) was a Greek statesman and orator in ancient Athens. His orations constitute a significant expression of contemporary Athenian intellectual pr ...

). Loans of this character have ever since been common in maritime lands under the name of

bottomry A bottomry, or bottomage, is an arrangement in which the master of a ship borrows money upon the ''bottom'' or keel of it, so as to forfeit the ship itself to the creditor, if the money with interest is not paid at the time appointed at the ship's s ...

and respondentia bonds.

The direct insurance of sea-risks for a premium paid independently of loans began in

Belgium

Belgium, ; french: Belgique ; german: Belgien officially the Kingdom of Belgium, is a country in Northwestern Europe. The country is bordered by the Netherlands to the north, Germany to the east, Luxembourg to the southeast, France to th ...

about 1300 AD.

[

Separate insurance contracts (i.e., insurance policies not bundled with loans or other kinds of contracts) were invented in ]Genoa

Genoa ( ; it, Genova ; lij, Zêna ). is the capital of the Italian region of Liguria and the sixth-largest city in Italy. In 2015, 594,733 people lived within the city's administrative limits. As of the 2011 Italian census, the Province of ...

in the 14th century, as were insurance pools backed by pledges of landed estates. The first known insurance contract dates from Genoa in 1347. In the next century, maritime insurance developed widely, and premiums were varied with risks. These new insurance contracts allowed insurance to be separated from investment, a separation of roles that first proved useful in marine insurance

Marine insurance covers the physical loss or damage of ships, cargo, terminals, and any transport by which the property is transferred, acquired, or held between the points of origin and the final destination. Cargo insurance is the sub-branch o ...

.

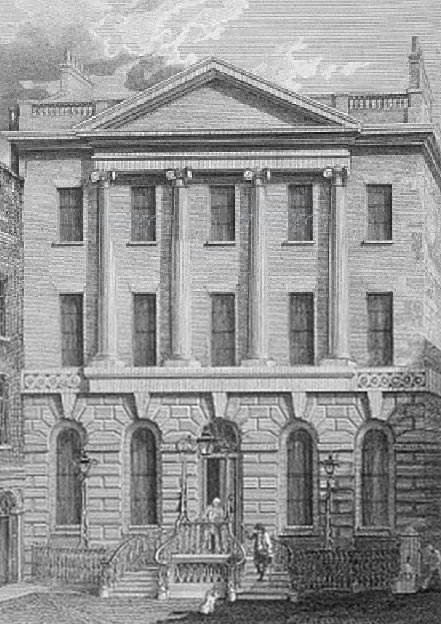

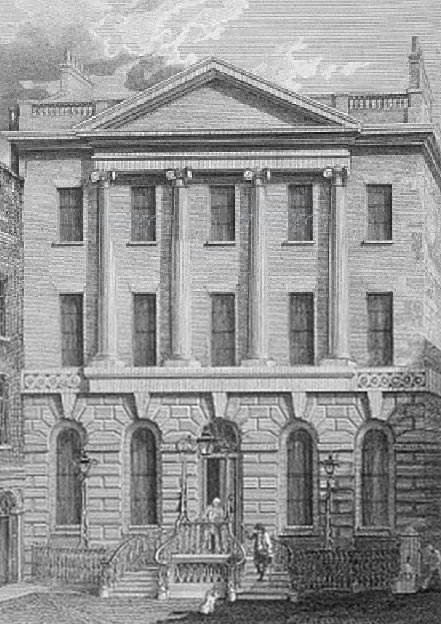

The earliest known policy of life insurance was made in the Royal Exchange, London

The Royal Exchange in London was founded in the 16th century by the merchant Sir Thomas Gresham on the suggestion of his factor Richard Clough to act as a centre of commerce for the City of London. The site was provided by the City of London ...

, on the 18th of June 1583, for £383, 6s. 8d. for twelve months on the life of William Gibbons.[

]

Modern methods

Insurance became far more sophisticated in Enlightenment-era Europe

Europe is a large peninsula conventionally considered a continent in its own right because of its great physical size and the weight of its history and traditions. Europe is also considered a subcontinent of Eurasia and it is located entirel ...

, where specialized varieties developed.

Property insurance

Property insurance provides protection against most risks to property, such as fire, theft and some weather damage. This includes specialized forms of insurance such as fire insurance, flood insurance, earthquake insurance, home insurance, or ...

as we know it today can be traced to the Great Fire of London, which in 1666 devoured more than 13,000 houses. The devastating effects of the fire converted the development of insurance "from a matter of convenience into one of urgency, a change of opinion reflected in Sir Christopher Wren's inclusion of a site for "the Insurance Office" in his new plan for London in 1667." A number of attempted fire insurance schemes came to nothing, but in 1681, economist

An economist is a professional and practitioner in the social science discipline of economics.

The individual may also study, develop, and apply theories and concepts from economics and write about economic policy. Within this field there are ...

Nicholas Barbon

Nicholas Barbon ( 1640 – 1698) was an English economist, physician, and financial speculator. Historians of mercantilism consider him to be one of the first proponents of the free market.

In the aftermath of the Great Fire of London, he be ...

and eleven associates established the first fire insurance company, the "Insurance Office for Houses", at the back of the Royal Exchange to insure brick and frame homes. Initially, 5,000 homes were insured by his Insurance Office.

At the same time, the first insurance schemes for the underwriting

Underwriting (UW) services are provided by some large financial institutions, such as banks, insurance companies and investment houses, whereby they guarantee payment in case of damage or financial loss and accept the financial risk for liabili ...

of business venture

Venture capital (often abbreviated as VC) is a form of private equity financing that is provided by venture capital firms or funds to startups, early-stage, and emerging companies that have been deemed to have high growth potential or which ha ...

s became available. By the end of the seventeenth century, London's growth as a centre for trade was increasing due to the demand for marine insurance

Marine insurance covers the physical loss or damage of ships, cargo, terminals, and any transport by which the property is transferred, acquired, or held between the points of origin and the final destination. Cargo insurance is the sub-branch o ...

. In the late 1680s, Edward Lloyd opened a coffee house, which became the meeting place for parties in the shipping industry wishing to insure cargoes and ships, including those willing to underwrite such ventures. These informal beginnings led to the establishment of the insurance market Lloyd's of London

Lloyd's of London, generally known simply as Lloyd's, is an insurance and reinsurance market located in London, England. Unlike most of its competitors in the industry, it is not an insurance company; rather, Lloyd's is a corporate body gove ...

and several related shipping and insurance businesses.

Life insurance policies were taken out in the early 18th century. The first company to offer life insurance was the

Life insurance policies were taken out in the early 18th century. The first company to offer life insurance was the Amicable Society for a Perpetual Assurance Office

Amicable Society for a Perpetual Assurance Office (a.k.a. "Amicable Society") is considered the first life insurance company in the world.Anzovin, p. 121 ''The first life insurance company known of record was founded in 1706 by the Bishop of Oxfo ...

, founded in London in 1706 by William Talbot and Sir Thomas Allen.[Anzovin, Steven, ''Famous First Facts'' 2000, item # 2422, H. W. Wilson Company, p. 121 ''The first life insurance company known of record was founded in 1706 by the Bishop of Oxford and the financier Thomas Allen in London, England. The company, called the Amicable Society for a Perpetual Assurance Office, collected annual premiums from policyholders and paid the nominees of deceased members from a common fund.''] Upon the same principle, Edward Rowe Mores established the Society for Equitable Assurances on Lives and Survivorship in 1762.

It was the world's first mutual insurer

A mutual insurance company is an insurance company owned entirely by its policyholders. Any profits earned by a mutual insurance company are either retained within the company or rebated to policyholders in the form of dividend distributions or re ...

and it pioneered age based premiums based on mortality rate

Mortality rate, or death rate, is a measure of the number of deaths (in general, or due to a specific cause) in a particular population, scaled to the size of that population, per unit of time. Mortality rate is typically expressed in units of d ...

laying "the framework for scientific insurance practice and development" and "the basis of modern life assurance upon which all life assurance schemes were subsequently based."railway

Rail transport (also known as train transport) is a means of transport that transfers passengers and goods on wheeled vehicles running on rails, which are incorporated in tracks. In contrast to road transport, where the vehicles run on a pre ...

system.

The first international insurance rule was the York Antwerp Rules (YAR) for the distribution of costs between ship and cargo in the event of general average. In 1873 the "Association for the Reform and Codification of the Law of Nations", the forerunner of the International Law Association

The International Law Association (ILA) is a non-profit organisation based in Great Britain that — according to its constitution — promotes "the study, clarification and development of international law" and "the furtherance of international ...

(ILA), was founded in Brussels. It published the first YAR in 1890, before switching to the present title of the "International Law Association" in 1895.

By the late 19th century governments began to initiate national insurance programs against sickness and old age. Germany

Germany,, officially the Federal Republic of Germany, is a country in Central Europe. It is the second most populous country in Europe after Russia, and the most populous member state of the European Union. Germany is situated betwe ...

built on a tradition of welfare programs in Prussia and Saxony that began as early as in the 1840s. In the 1880s Chancellor Otto von Bismarck introduced old age pensions, accident insurance and medical care that formed the basis for Germany's welfare state

A welfare state is a form of government in which the state (or a well-established network of social institutions) protects and promotes the economic and social well-being of its citizens, based upon the principles of equal opportunity, equita ...

.[E. P. Hennock, ''The Origin of the Welfare State in England and Germany, 1850–1914: Social Policies Compared'' (2007)] In Britain more extensive legislation was introduced by the Liberal

Liberal or liberalism may refer to:

Politics

* a supporter of liberalism

** Liberalism by country

* an adherent of a Liberal Party

* Liberalism (international relations)

* Sexually liberal feminism

* Social liberalism

Arts, entertainment and m ...

government in the 1911 National Insurance Act. This gave the British working classes the first contributory system of insurance against illness and unemployment. This system was greatly expanded after the Second World War

World War II or the Second World War, often abbreviated as WWII or WW2, was a world war that lasted from 1939 to 1945. It involved the vast majority of the world's countries—including all of the great powers—forming two opposi ...

under the influence of the Beveridge Report

The Beveridge Report, officially entitled ''Social Insurance and Allied Services'' (Command paper, Cmd. 6404), is a government report, published in November 1942, influential in the founding of the welfare state in the United Kingdom. It was draft ...

, to form the first modern welfare state

A welfare state is a form of government in which the state (or a well-established network of social institutions) protects and promotes the economic and social well-being of its citizens, based upon the principles of equal opportunity, equita ...

.Global Federation of Insurance Associations

Global means of or referring to a globe and may also refer to:

Entertainment

* Global (Paul van Dyk album), ''Global'' (Paul van Dyk album), 2003

* Global (Bunji Garlin album), ''Global'' (Bunji Garlin album), 2007

* Global (Humanoid album), ''Gl ...

(GFIA), which was formally founded in 2012 to aim to increase insurance industry effectiveness in providing input to international regulatory bodies and to contribute more effectively to the international dialogue on issues of common interest. It consists of its 40 member associations and 1 observer association in 67 countries, which companies account for around 89% of total insurance premiums worldwide.

Principles

Insurance involves pooling funds from ''many'' insured entities (known as exposures) to pay for the losses that only some insureds may incur. The insured entities are therefore protected from risk for a fee, with the fee being dependent upon the frequency and severity of the event occurring. In order to be an insurable risk

Insurability can mean either whether a particular type of loss (risk) can be insured in theory, or whether a particular client is insurable for by a particular company because of particular circumstance and the quality assigned by an insurance p ...

, the risk insured against must meet certain characteristics. Insurance as a financial intermediary

A financial intermediary is an institution or individual that serves as a middleman among diverse parties in order to facilitate financial transactions. Common types include commercial banks, investment banks, stockbrokers, pooled investment funds ...

is a commercial enterprise and a major part of the financial services industry, but individual entities can also self-insure through saving money for possible future losses.

Insurability

Risk which can be insured by private companies typically share seven common characteristics:

# Large number of similar exposure units: Since insurance operates through pooling resources, the majority of insurance policies cover individual members of large classes, allowing insurers to benefit from the law of large numbers in which predicted losses are similar to the actual losses. Exceptions include Lloyd's of London

Lloyd's of London, generally known simply as Lloyd's, is an insurance and reinsurance market located in London, England. Unlike most of its competitors in the industry, it is not an insurance company; rather, Lloyd's is a corporate body gove ...

, which is famous for insuring the life or health of actors, sports figures, and other famous individuals. However, all exposures will have particular differences, which may lead to different premium rates.

# Definite loss: This type of loss takes place at a known time and place from a known cause. The classic example involves the death of an insured person on a life-insurance policy. Fire

Fire is the rapid oxidation of a material (the fuel) in the exothermic chemical process of combustion, releasing heat, light, and various reaction products.

At a certain point in the combustion reaction, called the ignition point, flames a ...

, automobile accidents, and worker injuries may all easily meet this criterion. Other types of losses may only be definite in theory. Occupational disease

An occupational disease is any chronic ailment that occurs as a result of work or occupational activity. It is an aspect of occupational safety and health. An occupational disease is typically identified when it is shown that it is more prevale ...

, for instance, may involve prolonged exposure to injurious conditions where no specific time, place, or cause is identifiable. Ideally, the time, place, and cause of a loss should be clear enough that a reasonable person, with sufficient information, could objectively verify all three elements.

# Accidental loss: The event that constitutes the trigger of a claim should be fortuitous, or at least outside the control of the beneficiary of the insurance. The loss should be pure, in the sense that it results from an event for which there is only the opportunity for cost. Events that contain speculative elements such as ordinary business risks or even purchasing a lottery ticket are generally not considered insurable.

# Large loss: The size of the loss must be meaningful from the perspective of the insured. Insurance premiums need to cover both the expected cost of losses, plus the cost of issuing and administering the policy, adjusting losses, and supplying the capital needed to reasonably assure that the insurer will be able to pay claims. For small losses, these latter costs may be several times the size of the expected cost of losses. There is hardly any point in paying such costs unless the protection offered has real value to a buyer.

# Affordable premium: If the likelihood of an insured event is so high, or the cost of the event so large, that the resulting premium is large relative to the amount of protection offered, then it is not likely that insurance will be purchased, even if on offer. Furthermore, as the accounting profession formally recognizes in financial accounting standards, the premium cannot be so large that there is not a reasonable chance of a significant loss to the insurer. If there is no such chance of loss, then the transaction may have the form of insurance, but not the substance (see the U.S. Financial Accounting Standards Board pronouncement number 113: "Accounting and Reporting for Reinsurance of Short-Duration and Long-Duration Contracts").

# Calculable loss: There are two elements that must be at least estimable, if not formally calculable: the probability of loss and the attendant cost. Probability of loss is generally an empirical exercise, while cost has more to do with the ability of a reasonable person in possession of a copy of the insurance policy and a proof of loss associated with a claim presented under that policy to make a reasonably definite and objective evaluation of the amount of the loss recoverable as a result of the claim.

# Limited risk of catastrophically large losses: Insurable losses are ideally independent and non-catastrophic, meaning that the losses do not happen all at once and that individual losses are not severe enough to bankrupt the insurer; insurers may prefer to limit their exposure to a loss from a single event to some small portion of their capital base. Capital constrains insurers' ability to sell earthquake insurance

Earthquake insurance is a form of property insurance that pays the policyholder in the event of an earthquake that causes damage to the property. Most ordinary homeowners insurance policies do not cover earthquake damage.

Most earthquake insuranc ...

as well as wind insurance in hurricane zones. In the United States, the federal government insures flood risk

A flood is an overflow of water ( or rarely other fluids) that submerges land that is usually dry. In the sense of "flowing water", the word may also be applied to the inflow of the tide. Floods are an area of study of the discipline hydrolog ...

in specifically identified areas. In commercial fire insurance, it is possible to find single properties whose total exposed value is well in excess of any individual insurer's capital constraint. Such properties are generally shared among several insurers or are insured by a single insurer which syndicates the risk into the reinsurance market.

Legal

When a company insures an individual entity, there are basic legal requirements and regulations. Several commonly cited legal principles of insurance include:

# Indemnity

In contract law, an indemnity is a contractual obligation of one party (the ''indemnitor'') to compensate the loss incurred by another party (the ''indemnitee'') due to the relevant acts of the indemnitor or any other party. The duty to indemni ...

– the insurance company indemnifies or compensates the insured in the case of certain losses only up to the insured's interest.

# Benefit insurance – as it is stated in the study books of The Chartered Insurance Institute, the insurance company does not have the right of recovery from the party who caused the injury and must compensate the Insured regardless of the fact that Insured had already sued the negligent party for the damages (for example, personal accident insurance)

# Insurable interest

Insurable interest exists when an insured person derives a financial or other kind of benefit from the continuous existence, without repairment or damage, of the insured object (or in the case of a person, their continued survival). A person has an ...

– the insured typically must directly suffer from the loss. Insurable interest must exist whether property insurance or insurance on a person is involved. The concept requires that the insured have a "stake" in the loss or damage to the life or property insured. What that "stake" is will be determined by the kind of insurance involved and the nature of the property ownership or relationship between the persons. The requirement of an insurable interest is what distinguishes insurance from gambling

Gambling (also known as betting or gaming) is the wagering of something of value ("the stakes") on a random event with the intent of winning something else of value, where instances of strategy are discounted. Gambling thus requires three el ...

.

# Utmost good faith – (Uberrima fides

''Uberrima fides'' (sometimes seen in its genitive form ''uberrimae fidei'') is a Latin phrase meaning "utmost good faith" (literally, "most abundant faith"). It is the name of a legal doctrine which governs insurance contracts. This means that a ...

) the insured and the insurer are bound by a good faith bond of honesty and fairness. Material facts must be disclosed.

# Contribution – insurers, which have similar obligations to the insured, contribute in the indemnification, according to some method.

# Subrogation – the insurance company acquires legal rights to pursue recoveries on behalf of the insured; for example, the insurer may sue those liable for the insured's loss. The Insurers can waive their subrogation rights by using the special clauses.

# Causa proxima, or proximate cause

In law and insurance, a proximate cause is an event sufficiently related to an injury that the courts deem the event to be the cause of that injury. There are two types of causation in the law: cause-in-fact, and proximate (or legal) cause. Ca ...

– the cause of loss (the peril) must be covered under the insuring agreement of the policy, and the dominant cause must not be excluded

# Mitigation – In case of any loss or casualty, the asset owner must attempt to keep loss to a minimum, as if the asset was not insured.

Indemnification

To "indemnify" means to make whole again, or to be reinstated to the position that one was in, to the extent possible, prior to the happening of a specified event or peril. Accordingly, life insurance is generally not considered to be indemnity insurance, but rather "contingent" insurance (i.e., a claim arises on the occurrence of a specified event). There are generally three types of insurance contracts that seek to indemnify an insured:

# A "reimbursement" policy

# A "pay on behalf" or "on behalf of policy"[C. Kulp & J. Hall, Casualty Insurance, Fourth Edition, 1968, page 35]

# An "indemnification" policy

From an insured's standpoint, the result is usually the same: the insurer pays the loss and claims expenses.

If the Insured has a "reimbursement" policy, the insured can be required to pay for a loss and then be "reimbursed" by the insurance carrier for the loss and out of pocket costs including, with the permission of the insurer, claim expenses.contract

A contract is a legally enforceable agreement between two or more parties that creates, defines, and governs mutual rights and obligations between them. A contract typically involves the transfer of goods, services, money, or a promise to tr ...

, called an insurance policy

In insurance, the insurance policy is a contract (generally a standard form contract) between the insurer and the policyholder, which determines the claims which the insurer is legally required to pay. In exchange for an initial payment, known a ...

. Generally, an insurance contract includes, at a minimum, the following elements: identification of participating parties (the insurer, the insured, the beneficiaries), the premium, the period of coverage, the particular loss event covered, the amount of coverage (i.e., the amount to be paid to the insured or beneficiary in the event of a loss), and exclusions (events not covered). An insured is thus said to be " indemnified" against the loss covered in the policy.

When insured parties experience a loss for a specified peril, the coverage entitles the policyholder to make a claim against the insurer for the covered amount of loss as specified by the policy. The fee paid by the insured to the insurer for assuming the risk is called the premium. Insurance premiums from many insureds are used to fund accounts reserved for later payment of claims – in theory for a relatively few claimants – and for overhead costs. So long as an insurer maintains adequate funds set aside for anticipated losses (called reserves), the remaining margin is an insurer's profit.

Exclusions

Policies typically include a number of exclusions, for example:

* Nuclear exclusion clause

The nuclear exclusion clause is a clause which excludes damage caused by nuclear and radiation accidents from regular insurance policies of, for example, home owners.

: Example: ''Notwithstanding anything to the contrary herein, it is hereby und ...

, excluding damage caused by nuclear and radiation accidents

* War exclusion clause, excluding damage from acts of war or terrorism.

Insurers may prohibit certain activities which are considered dangerous and therefore excluded from coverage. One system for classifying activities according to whether they are authorised by insurers refers to "green light" approved activities and events, "yellow light" activities and events which require insurer consultation and/or waivers of liability, and "red light" activities and events which are prohibited and outside the scope of insurance cover.

Social effects

Insurance can have various effects on society through the way that it changes who bears the cost of losses and damage. On one hand it can increase fraud; on the other it can help societies and individuals prepare for catastrophes and mitigate the effects of catastrophes on both households and societies.

Insurance can influence the probability of losses through moral hazard

In economics, a moral hazard is a situation where an economic actor has an incentive to increase its exposure to risk because it does not bear the full costs of that risk. For example, when a corporation is insured, it may take on higher risk ...

, insurance fraud, and preventive steps by the insurance company. Insurance scholars have typically used moral hazard

In economics, a moral hazard is a situation where an economic actor has an incentive to increase its exposure to risk because it does not bear the full costs of that risk. For example, when a corporation is insured, it may take on higher risk ...

to refer to the increased loss due to unintentional carelessness and insurance fraud to refer to increased risk due to intentional carelessness or indifference.building code

A building code (also building control or building regulations) is a set of rules that specify the standards for constructed objects such as buildings and non-building structures. Buildings must conform to the code to obtain planning permiss ...

s.

Methods of insurance

According to the study books of The Chartered Insurance Institute, there are variant methods of insurance as follows:

# Co-insurance – risks shared between insurers (sometimes referred to as "Retention")

# Dual insurance – having two or more policies with overlapping coverage of a risk (both the individual policies would not pay separately – under a concept named contribution, they would contribute together to make up the policyholder's losses. However, in case of contingency insurances such as life insurance, dual payment is allowed)

# Self-insurance – situations where risk is not transferred to insurance companies and solely retained by the entities or individuals themselves

# Reinsurance – situations when the insurer passes some part of or all risks to another Insurer, called the reinsurer

Insurers' business model

Insurers may use the subscription business model, collecting premium payments periodically in return for on-going and/or compounding

In the field of pharmacy, compounding (performed in compounding pharmacies) is preparation of a custom formulation of a medication to fit a unique need of a patient that cannot be met with commercially available products. This may be done for me ...

benefits offered to policyholders.

Underwriting and investing

Insurers' business model aims to collect more in premium and investment income than is paid out in losses, and to also offer a competitive price which consumers will accept. Profit can be reduced to a simple equation:

:Profit = earned premium

An insurance policy may be canceled before the end of the policy period. This has the effect of ending the policy coverage on the date of the policy cancellation.

Cancellation methods

Three different calculation methods are commonly used. Cancell ...

+ investment income – incurred loss – underwriting expenses.

Insurers make money in two ways:

* Through underwriting

Underwriting (UW) services are provided by some large financial institutions, such as banks, insurance companies and investment houses, whereby they guarantee payment in case of damage or financial loss and accept the financial risk for liabili ...

, the process by which insurers select the risks to insure and decide how much in premiums to charge for accepting those risks, and taking the brunt of the risk should it come to fruition.

* By investing

Investment is the dedication of money to purchase of an asset to attain an increase in value over a period of time. Investment requires a sacrifice of some present asset, such as time, money, or effort.

In finance, the purpose of investing i ...

the premiums they collect from insured parties

The most complicated aspect of insuring is the actuarial science of ratemaking (price-setting) of policies, which uses statistics and probability

Probability is the branch of mathematics concerning numerical descriptions of how likely an event is to occur, or how likely it is that a proposition is true. The probability of an event is a number between 0 and 1, where, roughly speakin ...

to approximate the rate of future claims based on a given risk. After producing rates, the insurer will use discretion to reject or accept risks through the underwriting process.

At the most basic level, initial rate-making involves looking at the frequency

Frequency is the number of occurrences of a repeating event per unit of time. It is also occasionally referred to as ''temporal frequency'' for clarity, and is distinct from ''angular frequency''. Frequency is measured in hertz (Hz) which is eq ...

and severity of insured perils and the expected average payout resulting from these perils. Thereafter an insurance company will collect historical loss-data, bring the loss data to present value

In economics and finance, present value (PV), also known as present discounted value, is the value of an expected income stream determined as of the date of valuation. The present value is usually less than the future value because money has inte ...

, and compare these prior losses to the premium collected in order to assess rate adequacy. Loss ratio

A loss ratio is a ratio of losses to gains, used normally in a financial context. It is the opposite of the gross profit ratio (commonly known as the ''gross profit margin'').

Insurance loss ratio

For insurance, the loss ratio is the ratio of tot ...

s and expense loads are also used. Rating for different risk characteristics involves - at the most basic level - comparing the losses with "loss relativities"—a policy with twice as many losses would, therefore, be charged twice as much. More complex multivariate analyses are sometimes used when multiple characteristics are involved and a univariate analysis could produce confounded results. Other statistical methods may be used in assessing the probability of future losses.

Upon termination of a given policy, the amount of premium collected minus the amount paid out in claims is the insurer's underwriting profit on that policy. Underwriting performance is measured by something called the "combined ratio", which is the ratio of expenses/losses to premiums. A combined ratio of less than 100% indicates an underwriting profit, while anything over 100 indicates an underwriting loss. A company with a combined ratio over 100% may nevertheless remain profitable due to investment earnings.

Insurance companies earn investment profits on "float". Float, or available reserve, is the amount of money on hand at any given moment that an insurer has collected in insurance premiums but has not paid out in claims. Insurers start investing insurance premiums as soon as they are collected and continue to earn interest or other income on them until claims are paid out. The Association of British Insurers

The Association of British Insurers or ABI is a trade association made up of insurance companies in the United Kingdom.

History

The ABI began in 1985 after several specialised insurance industry trade associations joined to form one trade associa ...

(grouping together 400 insurance companies and 94% of UK insurance services) has almost 20% of the investments in the London Stock Exchange

London Stock Exchange (LSE) is a stock exchange in the City of London, England, United Kingdom. , the total market value of all companies trading on LSE was £3.9 trillion. Its current premises are situated in Paternoster Square close to St P ...

. In 2007, U.S. industry profits from float totaled $58 billion. In a 2009 letter to investors, Warren Buffett wrote, "we were ''paid'' $2.8 billion to hold our float in 2008".

In the United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territori ...

, the underwriting loss of property

Property is a system of rights that gives people legal control of valuable things, and also refers to the valuable things themselves. Depending on the nature of the property, an owner of property may have the right to consume, alter, share, r ...

and casualty insurance Casualty insurance is a defined term which broadly encompasses insurance not directly concerned with life insurance, health insurance, or property insurance.

Casualty insurance is mainly liability coverage of an individual or organization for ne ...

companies was $142.3 billion in the five years ending 2003. But overall profit for the same period was $68.4 billion, as the result of float. Some insurance-industry insiders, most notably Hank Greenberg

Henry Benjamin Greenberg (born Hyman Greenberg; January 1, 1911 – September 4, 1986), nicknamed "Hammerin' Hank", "Hankus Pankus", or "The Hebrew Hammer", was an American professional baseball player and team executive. He played in Major Leagu ...

, do not believe that it is possible to sustain a profit from float forever without an underwriting profit as well, but this opinion is not universally held. Reliance on float for profit has led some industry experts to call insurance companies "investment companies that raise the money for their investments by selling insurance".

Naturally, the float method is difficult to carry out in an economically depressed period. Bear market

A market trend is a perceived tendency of financial markets to move in a particular direction over time. Analysts classify these trends as ''secular'' for long time-frames, ''primary'' for medium time-frames, and ''secondary'' for short time-fram ...

s do cause insurers to shift away from investments and to toughen up their underwriting standards, so a poor economy generally means high insurance-premiums. This tendency to swing between profitable and unprofitable periods over time is commonly known as the underwriting, or insurance, cycle.

Claims

Claims and loss handling is the materialized utility of insurance; it is the actual "product" paid for. Claims may be filed by insureds directly with the insurer or through brokers or agents. The insurer may require that the claim be filed on its own proprietary forms, or may accept claims on a standard industry form, such as those produced by ACORD

The Association for Cooperative Operations Research and Development (ACORD) is a non-profit organization in the insurance industry. ACORD publishes and maintains an archive of standardized forms. ACORD has also developed a comprehensive library of ...

.

Insurance company claims departments employ a large number of claims adjuster

A claims adjuster, desk adjuster, field adjuster, or general adjuster (claim adjuster, claims handler, claim handler or loss adjuster in the United Kingdom, Ireland, Australia, South Africa, the Caribbean and New Zealand) investigates insurance cla ...

s supported by a staff of records management and data entry clerk

A data entry clerk, also known as data preparation and control operator, data registration and control operator, and data preparation and registration operator, is a member of staff employed to enter or update data into a computer system. Data is o ...

s. Incoming claims are classified based on severity and are assigned to adjusters whose settlement authority varies with their knowledge and experience. The adjuster undertakes an investigation of each claim, usually in close cooperation with the insured, determines if coverage is available under the terms of the insurance contract, and if so, the reasonable monetary value of the claim, and authorizes payment.

The policyholder may hire their own public adjuster

A public adjuster is a professional claims handler/claims adjuster who represents the insured/policyholder in their insurance claim. Depending on the state, licensed public adjusters are required to prove competency in a variety of ways; written e ...

to negotiate the settlement with the insurance company on their behalf. For policies that are complicated, where claims may be complex, the insured may take out a separate insurance policy add-on, called loss recovery insurance, which covers the cost of a public adjuster in the case of a claim.

Adjusting liability insurance claims is particularly difficult because there is a third party involved, the plaintiff

A plaintiff ( Π in legal shorthand) is the party who initiates a lawsuit (also known as an ''action'') before a court. By doing so, the plaintiff seeks a legal remedy. If this search is successful, the court will issue judgment in favor of t ...

, who is under no contractual obligation to cooperate with the insurer and may in fact regard the insurer as a deep pocket

Deep pocket is an American slang term; it usually means "extensive financial wealth or resources". It is typically used in reference to big companies or organizations (ex: the American tobacco companies have "deep pockets"), although it can be us ...

. The adjuster must obtain legal counsel for the insured (either inside "house" counsel or outside "panel" counsel), monitor litigation that may take years to complete, and appear in person or over the telephone with settlement authority at a mandatory settlement conference when requested by the judge.

If a claims adjuster suspects under-insurance, the condition of average

Condition of average (also called ''underinsurance'' in the U.S., or ''principle of average'', ''subject to average'', or ''pro rata condition of average'' in Commonwealth countries) is the insurance term used when calculating a payout against a ...

may come into play to limit the insurance company's exposure.

In managing the claims handling function, insurers seek to balance the elements of customer satisfaction, administrative handling expenses, and claims overpayment leakages. As part of this balancing act, fraudulent insurance practices are a major business risk that must be managed and overcome. Disputes between insurers and insureds over the validity of claims or claims handling practices occasionally escalate into litigation (see insurance bad faith

Insurance bad faith is a tort unique to the law of the United States (but with parallels elsewhere, particularly Canada) that an insurance company commits by violating the "implied covenant of good faith and fair dealing" which automatically exis ...

).

Marketing

Insurers will often use insurance agents

An insurance broker is an intermediary who sells, solicits, or negotiates insurance on behalf of a client for compensation. An insurance broker is distinct from an insurance agent in that a broker typically acts on behalf of a client by negotia ...

to initially market or underwrite

Underwriting (UW) services are provided by some large financial institutions, such as banks, insurance companies and investment houses, whereby they guarantee payment in case of damage or financial loss and accept the financial risk for liabilit ...

their customers. Agents can be captive, meaning they write only for one company, or independent, meaning that they can issue policies from several companies. The existence and success of companies using insurance agents is likely due to the availability of improved and personalised services. Companies also use Broking firms, Banks and other corporate entities (like Self Help Groups, Microfinance Institutions, NGOs, etc.) to market their products.

Types

Any risk that can be quantified can potentially be insured. Specific kinds of risk that may give rise to claims are known as perils. An insurance policy will set out in detail which perils are covered by the policy and which are not. Below are non-exhaustive lists of the many different types of insurance that exist. A single policy may cover risks in one or more of the categories set out below. For example, vehicle insurance

Vehicle insurance (also known as car insurance, motor insurance, or auto insurance) is insurance for cars, trucks, motorcycles, and other road vehicles. Its primary use is to provide financial protection against physical damage or bodily injury ...

would typically cover both the property risk (theft or damage to the vehicle) and the liability risk (legal claims arising from an accident

An accident is an unintended, normally unwanted event that was not directly caused by humans. The term ''accident'' implies that nobody should be blamed, but the event may have been caused by unrecognized or unaddressed risks. Most researche ...

). A home insurance

Home insurance, also commonly called homeowner's insurance (often abbreviated in the US real estate industry as HOI), is a type of property insurance that covers a private residence. It is an insurance policy that combines various personal insura ...

policy in the United States typically includes coverage for damage to the home and the owner's belongings, certain legal claims against the owner, and even a small amount of coverage for medical expenses of guests who are injured on the owner's property.

Business insurance can take a number of different forms, such as the various kinds of professional liability insurance, also called professional indemnity (PI), which are discussed below under that name; and the business owner's policy (BOP), which packages into one policy many of the kinds of coverage that a business owner needs, in a way analogous to how homeowners' insurance packages the coverages that a homeowner needs.

Vehicle insurance

Vehicle insurance protects the policyholder against financial loss in the event of an incident involving a vehicle they own, such as in a traffic collision.

Coverage typically includes:

* Property coverage, for damage to or theft of the car

* Liability coverage, for the legal responsibility to others for bodily injury or property damage

* Medical coverage, for the cost of treating injuries, rehabilitation and sometimes lost wages and funeral expenses

Vehicle insurance protects the policyholder against financial loss in the event of an incident involving a vehicle they own, such as in a traffic collision.

Coverage typically includes:

* Property coverage, for damage to or theft of the car

* Liability coverage, for the legal responsibility to others for bodily injury or property damage

* Medical coverage, for the cost of treating injuries, rehabilitation and sometimes lost wages and funeral expenses

Gap insurance

Gap insurance covers the excess amount on an auto loan in an instance where the policyholder's insurance company does not cover the entire loan. Depending on the company's specific policies it might or might not cover the deductible as well. This coverage is marketed for those who put low down payment

Down payment (also called a deposit in British English), is an initial up-front partial payment for the purchase of expensive items/services such as a car or a house. It is usually paid in cash or equivalent at the time of finalizing the transactio ...

s, have high interest rates on their loans, and those with 60-month or longer terms. Gap insurance is typically offered by a finance company when the vehicle owner purchases their vehicle, but many auto insurance companies offer this coverage to consumers as well.

Health insurance

Health insurance policies cover the cost of medical treatments. Dental insurance, like medical insurance, protects policyholders for dental costs. In most developed countries, all citizens receive some health coverage from their governments, paid through taxation. In most countries, health insurance is often part of an employer's benefits.

Health insurance policies cover the cost of medical treatments. Dental insurance, like medical insurance, protects policyholders for dental costs. In most developed countries, all citizens receive some health coverage from their governments, paid through taxation. In most countries, health insurance is often part of an employer's benefits.

Income protection insurance

* Disability insurance policies provide financial support in the event of the policyholder becoming unable to work because of disabling illness or injury. It provides monthly support to help pay such obligations as

* Disability insurance policies provide financial support in the event of the policyholder becoming unable to work because of disabling illness or injury. It provides monthly support to help pay such obligations as mortgage loan

A mortgage loan or simply mortgage (), in civil law jurisdicions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any ...

s and credit card

A credit card is a payment card issued to users (cardholders) to enable the cardholder to pay a merchant for goods and services based on the cardholder's accrued debt (i.e., promise to the card issuer to pay them for the amounts plus the o ...

s. Short-term and long-term disability policies are available to individuals, but considering the expense, long-term policies are generally obtained only by those with at least six-figure incomes, such as doctors, lawyers, etc. Short-term disability insurance covers a person for a period typically up to six months, paying a stipend each month to cover medical bills and other necessities.

* Long-term disability insurance covers an individual's expenses for the long term, up until such time as they are considered permanently disabled and thereafter Insurance companies will often try to encourage the person back into employment in preference to and before declaring them unable to work at all and therefore totally disabled.

* Disability overhead insurance allows business owners to cover the overhead expenses of their business while they are unable to work.

* Total permanent disability insurance Total Permanent Disability ''(TPD)'' is a phrase used in the insurance industry and in law. Generally speaking, it means that because of a sickness or injury, a person is unable to work in their own or any occupation for which they are suited by tr ...

provides benefits when a person is permanently disabled and can no longer work in their profession, often taken as an adjunct to life insurance.

* Workers' compensation

Workers' compensation or workers' comp is a form of insurance providing wage replacement and medical benefits to employees injured in the course of employment in exchange for mandatory relinquishment of the employee's right to sue his or her emp ...

insurance replaces all or part of a worker's wage

A wage is payment made by an employer to an employee for work done in a specific period of time. Some examples of wage payments include compensatory payments such as ''minimum wage'', '' prevailing wage'', and ''yearly bonuses,'' and remune ...

s lost and accompanying medical expenses incurred because of a job-related injury.

Casualty insurance

Casualty insurance insures against accidents, not necessarily tied to any specific property. It is a broad spectrum of insurance that a number of other types of insurance could be classified, such as auto, workers compensation, and some liability insurances.

* Crime insurance is a form of casualty insurance that covers the policyholder against losses arising from the criminal act

In ordinary language, a crime is an unlawful act punishable by a state or other authority. The term ''crime'' does not, in modern criminal law, have any simple and universally accepted definition,Farmer, Lindsay: "Crime, definitions of", in Ca ...

s of third parties. For example, a company can obtain crime insurance to cover losses arising from theft

Theft is the act of taking another person's property or services without that person's permission or consent with the intent to deprive the rightful owner of it. The word ''theft'' is also used as a synonym or informal shorthand term for som ...

or embezzlement.

* Terrorism insurance

Terrorism insurance is insurance purchased by property owners to cover their potential losses and liabilities that might occur due to terrorist activities.

It is considered to be a difficult product for insurance companies, as the odds of terroris ...

provides protection against any loss or damage caused by terrorist

Terrorism, in its broadest sense, is the use of criminal violence to provoke a state of terror or fear, mostly with the intention to achieve political or religious aims. The term is used in this regard primarily to refer to intentional violen ...

activities. In the United States in the wake of 9/11, the Terrorism Risk Insurance Act

The Terrorism Risk Insurance Act (TRIA) (, ) is a United States federal law signed into law by President George W. Bush on November 26, 2002. The Act created a federal "backstop" for insurance claims related to acts of terrorism. The Act "prov ...

2002 (TRIA) set up a federal program providing a transparent system of shared public and private compensation for insured losses resulting from acts of terrorism. The program was extended until the end of 2014 by the Terrorism Risk Insurance Program Reauthorization Act 2007 (TRIPRA).

* Kidnap and ransom insurance

Kidnap and ransom insurance or K&R insurance is designed to protect individuals and corporations operating in high-risk areas around the world. Locations most often named in policies include Mexico, Venezuela, Haiti, and Nigeria, certain other coun ...

is designed to protect individuals and corporations operating in high-risk areas around the world against the perils of kidnap, extortion, wrongful detention and hijacking.

* Political risk insurance Political risk insurance is a type of insurance that can be taken out by businesses, of any size, against political risk—the risk that revolution or other political conditions will result in a loss.

Political risk insurance is available for seve ...

is a form of casualty insurance that can be taken out by businesses with operations in countries in which there is a risk that revolution

In political science, a revolution (Latin: ''revolutio'', "a turn around") is a fundamental and relatively sudden change in political power and political organization which occurs when the population revolts against the government, typically due ...

or other political

Politics (from , ) is the set of activities that are associated with making decisions in groups, or other forms of power relations among individuals, such as the distribution of resources or status. The branch of social science that stud ...

conditions could result in a loss.

Life insurance

Life insurance provides a monetary benefit to a decedent's family or other designated beneficiary, and may specifically provide for income to an insured person's family, burial, funeral and other final expenses. Life insurance policies often allow the option of having the proceeds paid to the beneficiary either in a lump sum cash payment or an

Life insurance provides a monetary benefit to a decedent's family or other designated beneficiary, and may specifically provide for income to an insured person's family, burial, funeral and other final expenses. Life insurance policies often allow the option of having the proceeds paid to the beneficiary either in a lump sum cash payment or an annuity

In investment, an annuity is a series of payments made at equal intervals.Kellison, Stephen G. (1970). ''The Theory of Interest''. Homewood, Illinois: Richard D. Irwin, Inc. p. 45 Examples of annuities are regular deposits to a savings account, ...

. In most states, a person cannot purchase a policy on another person without their knowledge.

Annuities provide a stream of payments and are generally classified as insurance because they are issued by insurance companies, are regulated as insurance, and require the same kinds of actuarial and investment management expertise that life insurance requires. Annuities and pensions that pay a benefit for life are sometimes regarded as insurance against the possibility that a retiree

A pensioner is a person who receives a pension, most commonly because of retirement from the workforce. This is a term typically used in the United Kingdom (along with OAP, initialism of old-age pensioner), Ireland and Australia where someone of p ...

will outlive his or her financial resources. In that sense, they are the complement of life insurance and, from an underwriting perspective, are the mirror image of life insurance.

Certain life insurance contracts accumulate cash

In economics, cash is money in the physical form of currency, such as banknotes and coins.

In bookkeeping and financial accounting, cash is current assets comprising currency or currency equivalents that can be accessed immediately or near-im ...

values, which may be taken by the insured if the policy is surrendered or which may be borrowed against. Some policies, such as annuities and endowment policies

An endowment policy is a life insurance contract designed to pay a lump sum after a specific term (on its 'maturity') or on death. Typical maturities are ten, fifteen or twenty years up to a certain age limit. Some policies also pay out in the ...

, are financial instruments to accumulate or liquidate

Liquidation is the process in accounting by which a company is brought to an end in Canada, United Kingdom, United States, Ireland, Australia, New Zealand, Italy, and many other countries. The assets and property of the company are redistr ...

wealth

Wealth is the abundance of valuable financial assets or physical possessions which can be converted into a form that can be used for transactions. This includes the core meaning as held in the originating Old English word , which is from an I ...

when it is needed.

In many countries, such as the United States and the UK, the tax law

Tax law or revenue law is an area of legal study in which public or sanctioned authorities, such as federal, state and municipal governments (as in the case of the US) use a body of rules and procedures (laws) to assess and collect taxes in a ...

provides that the interest on this cash value is not taxable under certain circumstances. This leads to widespread use of life insurance as a tax-efficient method of saving

Saving is income not spent, or deferred consumption. Methods of saving include putting money aside in, for example, a deposit account, a pension account, an investment fund, or as cash. Saving also involves reducing expenditures, such as recur ...

as well as protection in the event of early death.

In the United States, the tax on interest income on life insurance policies and annuities is generally deferred. However, in some cases the benefit derived from tax deferral Tax deferral refers to instances where a taxpayer can delay paying taxes to some future period. In theory, the net taxes paid should be the same. Taxes can sometimes be deferred indefinitely, or may be taxed at a lower rate in the future, particular ...

may be offset by a low return. This depends upon the insuring company, the type of policy and other variables (mortality, market return, etc.). Moreover, other income tax saving vehicles (e.g., IRAs, 401(k) plans, Roth IRAs) may be better alternatives for value accumulation.

Burial insurance

Burial insurance is an old type of life insurance which is paid out upon death to cover final expenses, such as the cost of a funeral. The Greeks

The Greeks or Hellenes (; el, Έλληνες, ''Éllines'' ) are an ethnic group and nation indigenous to the Eastern Mediterranean and the Black Sea regions, namely Greece, Cyprus, Albania, Italy, Turkey, Egypt, and, to a lesser extent, oth ...

and Romans

Roman or Romans most often refers to:

*Rome, the capital city of Italy

* Ancient Rome, Roman civilization from 8th century BC to 5th century AD

*Roman people, the people of ancient Rome

*''Epistle to the Romans'', shortened to ''Romans'', a lette ...

introduced burial insurance c. 600 CE when they organized guild

A guild ( ) is an association of artisans and merchants who oversee the practice of their craft/trade in a particular area. The earliest types of guild formed as organizations of tradesmen belonging to a professional association. They sometimes ...

s called "benevolent societies" which cared for the surviving families and paid funeral expenses of members upon death. Guilds in the Middle Ages

In the history of Europe, the Middle Ages or medieval period lasted approximately from the late 5th to the late 15th centuries, similar to the post-classical period of global history. It began with the fall of the Western Roman Empire ...

served a similar purpose, as did friendly societies during Victorian times.

Property

Property insurance provides protection against risks to property, such as

Property insurance provides protection against risks to property, such as fire

Fire is the rapid oxidation of a material (the fuel) in the exothermic chemical process of combustion, releasing heat, light, and various reaction products.

At a certain point in the combustion reaction, called the ignition point, flames a ...

, theft

Theft is the act of taking another person's property or services without that person's permission or consent with the intent to deprive the rightful owner of it. The word ''theft'' is also used as a synonym or informal shorthand term for som ...

or weather

Weather is the state of the atmosphere, describing for example the degree to which it is hot or cold, wet or dry, calm or stormy, clear or cloud cover, cloudy. On Earth, most weather phenomena occur in the lowest layer of the planet's atmos ...

damage. This may include specialized forms of insurance such as fire insurance, flood insurance

Flood insurance is the specific insurance coverage issued against property loss from flooding. To determine risk factors for specific properties, insurers will often refer to topographical maps that denote lowlands, floodplains and other areas tha ...

, earthquake insurance

Earthquake insurance is a form of property insurance that pays the policyholder in the event of an earthquake that causes damage to the property. Most ordinary homeowners insurance policies do not cover earthquake damage.

Most earthquake insuranc ...

, home insurance

Home insurance, also commonly called homeowner's insurance (often abbreviated in the US real estate industry as HOI), is a type of property insurance that covers a private residence. It is an insurance policy that combines various personal insura ...

, inland marine insurance or boiler insurance

Boiler insurance (Boiler cover) is a type of insurance that covers repairs and in some instances, the replacement of a home boiler. It can also cover other parts of the central heating

A central heating system provides warmth to a number of ...

.

The term ''property insurance'' may, like casualty insurance, be used as a broad category of various subtypes of insurance, some of which are listed below:

*

* Aviation insurance

Aviation insurance is insurance coverage geared specifically to the operation of aircraft and the risks involved in aviation. Aviation insurance policies are distinctly different from those for other areas of transportation and tend to incorporate ...

protects aircraft

An aircraft is a vehicle that is able to fly by gaining support from the air. It counters the force of gravity by using either static lift or by using the dynamic lift of an airfoil, or in a few cases the downward thrust from jet engine ...

hulls and spares, and associated liability risks, such as passenger and third-party liability. Airport

An airport is an aerodrome with extended facilities, mostly for commercial air transport. Airports usually consists of a landing area, which comprises an aerially accessible open space including at least one operationally active surfa ...

s may also appear under this subcategory, including air traffic control and refuelling operations for international airports through to smaller domestic exposures.

* Boiler insurance

Boiler insurance (Boiler cover) is a type of insurance that covers repairs and in some instances, the replacement of a home boiler. It can also cover other parts of the central heating

A central heating system provides warmth to a number of ...

(also known as boiler and machinery insurance, or equipment breakdown insurance) insures against accidental physical damage to boilers, equipment or machinery.

* Builder's risk insurance

Builder's risk insurance (Contractor's All Risk insurance – CAR insurance) is a special type of property insurance which indemnifies against damage to buildings while they are under construction. Builder's risk insurance is "coverage that pro ...

insures against the risk of physical loss or damage to property during construction. Builder's risk insurance is typically written on an "all risk" basis covering damage arising from any cause (including the negligence of the insured) not otherwise expressly excluded. Builder's risk insurance is coverage that protects a person's or organization's insurable interest in materials, fixtures or equipment being used in the construction or renovation of a building or structure should those items sustain physical loss or damage from an insured peril.

* Crop insurance

Crop insurance is purchased by agricultural producers, and subsidized by the federal government, to protect against either the loss of their crops due to natural disasters, such as hail, drought, and floods, or the loss of revenue due to declines ...

may be purchased by farmers to reduce or manage various risks associated with growing crops. Such risks include crop loss or damage caused by weather, hail, drought, frost damage, pestsIndex-based insurance

Index-based insurance, also known as index-linked insurance or, simply, index insurance, is primarily used in agriculture. Because of the high cost of assessing losses, traditional insurance based on paying indemnities for actual losses incurred i ...