|

Insurance Cycle

Insurance Cycle is a term describing the tendency of the insurance industry to swing between profitable and unprofitable periods over time is commonly known as the underwriting or insurance cycle. Definition The underwriting cycle is the tendency of property and casualty insurance premiums, profits, and availability of coverage to rise and fall with some regularity over time. A cycle begins when insurers tighten their underwriting standards and sharply raise premiums after a period of severe underwriting losses or negative stocks to capital (e.g., investment losses). Stricter standards and higher premium rates lead to an increase in profits and accumulation of capital. The increase in underwriting capacity increases competition, which in turn drives premium rates down and relaxes underwriting standards, thereby causing underwriting losses and setting the stage for the cycle to begin again."Analysis and Valuation Of Insurance Companies." Center For Excellence in Accounting and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurance

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. An entity which provides insurance is known as an insurer, insurance company, insurance carrier, or underwriter. A person or entity who buys insurance is known as a policyholder, while a person or entity covered under the policy is called an insured. The insurance transaction involves the policyholder assuming a guaranteed, known, and relatively small loss in the form of a payment to the insurer (a premium) in exchange for the insurer's promise to compensate the insured in the event of a covered loss. The loss may or may not be financial, but it must be reducible to financial terms. Furthermore, it usually involves something in which the insured has an insurable interest established by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurance Industry

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. An entity which provides insurance is known as an insurer, insurance company, insurance carrier, or underwriter. A person or entity who buys insurance is known as a policyholder, while a person or entity covered under the policy is called an insured. The insurance transaction involves the policyholder assuming a guaranteed, known, and relatively small loss in the form of a payment to the insurer (a premium) in exchange for the insurer's promise to compensate the insured in the event of a covered loss. The loss may or may not be financial, but it must be reducible to financial terms. Furthermore, it usually involves something in which the insured has an insurable interest established by o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Saturation

In economics, market saturation is a situation in which a product has become diffused (distributed) within a market; the actual level of saturation can depend on consumer purchasing power; as well as competition, prices, and technology. Theory of natural limits The ''theory of natural limits'' states: "Every product or service has a natural consumption level. We just don't know what it is until we launch it, distribute it, and promote it for a generation's time (20 years or more) after which further investment to expand the universe beyond normal limits can be a futile exercise." — Thomas G. Osenton, economist Osenton introduced the theory in his 2004 book, ''The Death of Demand: Finding Growth in a Saturated Global Economy''; it states that every product or service has a natural consumption level that is determined after a number of years of sales- and marketing-investment (usually around 20 to 25 years). In effect, a relative universe of regular users is naturally establis ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Underwriter

Underwriting (UW) services are provided by some large financial institutions, such as banks, insurance companies and investment houses, whereby they guarantee payment in case of damage or financial loss and accept the financial risk for liability arising from such guarantee. An underwriting arrangement may be created in a number of situations including insurance, issues of security in a public offering, and bank lending, among others. The person or institution that agrees to sell a minimum number of securities of the company for commission is called the underwriter. History The term "underwriting" derives from the Lloyd's of London insurance market. Financial backers (or risk takers), who would accept some of the risk on a given venture (historically a sea voyage with associated risks of shipwreck) in exchange for a insurance premium, premium, would literally write their names under the risk information that was written on a Lloyd's slip created for this purpose. Securities un ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

World Trade Center (1973–2001)

The original World Trade Center (WTC) was a large complex of seven buildings in the Financial District of Lower Manhattan in New York City. It opened on April 4, 1973, and was destroyed in 2001 during the September 11 attacks. At the time of their completion, the Twin Towers—the original 1 World Trade Center (the North Tower) at ; and 2 World Trade Center (the South Tower) at —were the tallest buildings in the world. Other buildings in the complex included the Marriott World Trade Center (3 WTC), 4 WTC, 5 WTC, 6 WTC, and 7 WTC. The complex contained of office space. The core complex was built between 1966 and 1975, at a cost of $400 million (equivalent to $3.56 billion in 2022). The idea was suggested by David Rockefeller to help stimulate urban renewal in Lower Manhattan, and his brother Nelson signed the legislation to build it. The buildings at the complex were designed by Minoru Yamasaki. In 1998, the Port Authority of New York and New Jersey decided ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

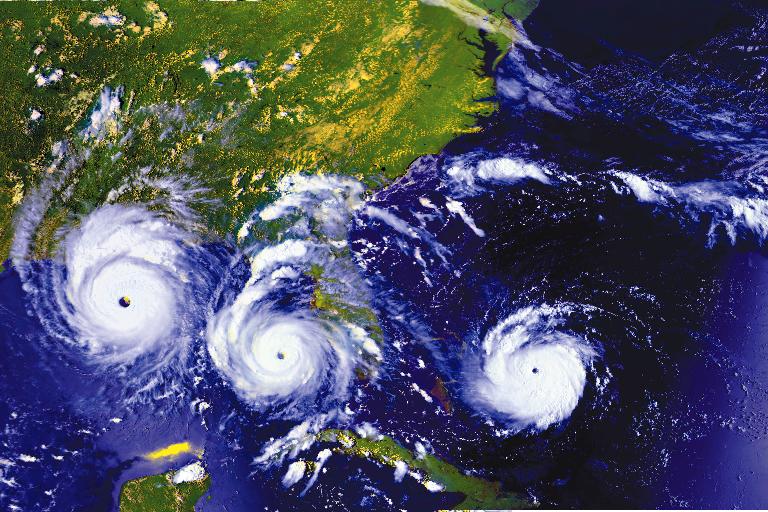

Hurricane Andrew

Hurricane Andrew was a very powerful and destructive Category 5 Atlantic hurricane that struck the Bahamas, Florida, and Louisiana in August 1992. It is the most destructive hurricane to ever hit Florida in terms of structures damaged or destroyed, and remained the costliest in financial terms until Hurricane Irma surpassed it 25 years later. Andrew was also the strongest landfalling hurricane in the United States in decades and the costliest hurricane to strike anywhere in the country, until it was surpassed by Katrina in 2005. In addition, Andrew is one of only four tropical cyclones to make landfall in the continental United States as a Category 5, alongside the 1935 Labor Day hurricane, 1969's Camille, and 2018's Michael. While the storm also caused major damage in the Bahamas and Louisiana, the greatest impact was felt in South Florida, where the storm made landfall as a Category 5 hurricane, with 1-minute sustained wind speeds as high as 165 mp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Life Insurance

Life insurance (or life assurance, especially in the Commonwealth of Nations) is a contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person (often the policyholder). Depending on the contract, other events such as terminal illness or critical illness can also trigger payment. The policyholder typically pays a premium, either regularly or as one lump sum. The benefits may include other expenses, such as funeral expenses. Life policies are legal contracts and the terms of each contract describe the limitations of the insured events. Often, specific exclusions written into the contract limit the liability of the insurer; common examples include claims relating to suicide, fraud, war, riot, and civil commotion. Difficulties may arise where an event is not clearly defined, for example, the insured knowingly incurred a risk by consenting to an experimental m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lloyd's Of London

Lloyd's of London, generally known simply as Lloyd's, is an insurance and reinsurance market located in London, England. Unlike most of its competitors in the industry, it is not an insurance company; rather, Lloyd's is a corporate body governed by the Lloyd's Act 1871 and subsequent Acts of Parliament. It operates as a partially-mutualised marketplace within which multiple financial backers, grouped in syndicates, come together to pool and spread risk. These underwriters, or "members", are a collection of both corporations and private individuals, the latter being traditionally known as "Names". The business underwritten at Lloyd's is predominantly general insurance and reinsurance, although a small number of syndicates write term life insurance. The market has its roots in marine insurance and was founded by Edward Lloyd at his coffee house on Tower Street in 1688. Today, it has a dedicated building on Lime Street which is Grade I listed. Traditionally business is tr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Property Insurance

Property insurance provides protection against most risks to property, such as fire, theft and some weather damage. This includes specialized forms of insurance such as fire insurance, flood insurance, earthquake insurance, home insurance, or boiler insurance. Property is insured in two main ways—open perils and named perils. Open perils cover all the causes of loss not specifically excluded in the policy. Common exclusions on open peril policies include damage resulting from earthquakes, floods, nuclear incidents, acts of terrorism, and war. Named perils require the actual cause of loss to be listed in the policy for insurance to be provided. The more common named perils include such damage-causing events as fire, lightning, explosion, cyber-attack, and theft. History Property insurance can be traced to the Great Fire of London, which in 1666 devoured more than 13,000 houses. The devastating effects of the fire converted the development of insurance "from a matter of conv ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reinsurance

Reinsurance is insurance that an insurance company purchases from another insurance company to insulate itself (at least in part) from the risk of a major claims event. With reinsurance, the company passes on ("cedes") some part of its own insurance liabilities to the other insurance company. The company that purchases the reinsurance policy is called a "ceding company" or "cedent" or "cedant" under most arrangements. The company issuing the reinsurance policy is referred to as the "reinsurer". In the classic case, reinsurance allows insurance companies to remain solvent after major claims events, such as major disasters like hurricanes and wildfires. In addition to its basic role in risk management, reinsurance is sometimes used to reduce the ceding company's capital requirements, or for tax mitigation or other purposes. The reinsurer may be either a specialist reinsurance company, which only undertakes reinsurance business, or another insurance company. Insurance companies ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Competition

Competition is a rivalry where two or more parties strive for a common goal which cannot be shared: where one's gain is the other's loss (an example of which is a zero-sum game). Competition can arise between entities such as organisms, individuals, economic and social groups, etc. The rivalry can be over attainment of any exclusive goal, including Recognition (sociology), recognition: Competition occurs in nature, between living organisms which co-exist in the same natural environment, environment. Animals compete over water supplies, food, mates, and other resource (biology), biological resources. Humans usually Survival of the fittest, compete for food and mates, though when these needs are met deep rivalries often arise over the pursuit of wealth, power, prestige, and celebrity, fame when in a static, repetitive, or unchanging environment. Competition is a major tenet of market economy, market economies and business, often associated with business competition as companies a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |