|

Insurable Risk

Insurability can mean either whether a particular type of loss (risk) can be insured in theory, or whether a particular client is insurable for by a particular company because of particular circumstance and the quality assigned by an insurance provider pertaining to the risk that a given client would have. An individual with very low insurability may be said to be uninsurable, and an insurance company will refuse to issue a policy to such an applicant. For example, an individual with a terminal illness and a life expectancy of 6 months would be uninsurable for term life insurance. This is because the probability is so high for the individual to die within the term of the insurance, that he/she would present far too high a liability for the insurance company. A similar, and stereotypical, example would be earthquake insurance in California. Insurability is sometimes an issue in case law of torts and contracts. It also comes up in issues involving tontines and insurance fraud ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurance Company

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. An entity which provides insurance is known as an insurer, insurance company, insurance carrier, or underwriter. A person or entity who buys insurance is known as a policyholder, while a person or entity covered under the policy is called an insured. The insurance transaction involves the policyholder assuming a guaranteed, known, and relatively small loss in the form of a payment to the insurer (a premium) in exchange for the insurer's promise to compensate the insured in the event of a covered loss. The loss may or may not be financial, but it must be reducible to financial terms. Furthermore, it usually involves something in which the insured has an insurable interest established by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Law Of Large Numbers

In probability theory, the law of large numbers (LLN) is a theorem that describes the result of performing the same experiment a large number of times. According to the law, the average of the results obtained from a large number of trials should be close to the expected value and tends to become closer to the expected value as more trials are performed. The LLN is important because it guarantees stable long-term results for the averages of some random events. For example, while a casino may lose money in a single spin of the roulette wheel, its earnings will tend towards a predictable percentage over a large number of spins. Any winning streak by a player will eventually be overcome by the parameters of the game. Importantly, the law applies (as the name indicates) only when a ''large number'' of observations are considered. There is no principle that a small number of observations will coincide with the expected value or that a streak of one value will immediately be "balanc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Married Women's Property Act 1882

The Married Women's Property Act 1882 (45 & 46 Vict. c.75) was an Act of the Parliament of the United Kingdom that significantly altered English law regarding the property rights of married women, which besides other matters allowed married women to own and control property in their own right. The Act applied in England (and Wales) and Ireland, but did not extend to Scotland. The Married Women's Property Act was a model for similar legislation in other British territories. For example, Victoria passed legislation in 1884, New South Wales in 1889, and the remaining Australian colonies passed similar legislation between 1890 and 1897. English women's property rights English common law defined the role of the wife as a ''feme covert'', emphasising her subordination to her husband, and putting her under the "protection and influence of her husband, her baron, or lord". Upon marriage, the husband and wife became one person under the law, as the property of the wife was surrendered t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Legal Citation

Legal citation is the practice of crediting and referring to authoritative documents and sources. The most common sources of authority cited are court decisions (cases), statutes, regulations, government documents, treaties, and scholarly writing. Typically, a proper legal citation will inform the reader about a source's authority, how strongly the source supports the writer's proposition, its age, and other, relevant information. This is an example citation to a United States Supreme Court court case: :::''Griswold v. Connecticut'', 381 U.S. 479, 480 (1965). This citation gives helpful information about the cited authority to the reader. * The names of the parties are Griswold and Connecticut. Generally, the name of the plaintiff (or, on appeal, petitioner) appears first, whereas the name of the defendant (or, on appeal, respondent) appears second. Thus, the case is '' Griswold v. Connecticut''. * The case is reported in volume 381 of the United States Reports (abbreviated ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Life Insurance

Life insurance (or life assurance, especially in the Commonwealth of Nations) is a contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person (often the policyholder). Depending on the contract, other events such as terminal illness or critical illness can also trigger payment. The policyholder typically pays a premium, either regularly or as one lump sum. The benefits may include other expenses, such as funeral expenses. Life policies are legal contracts and the terms of each contract describe the limitations of the insured events. Often, specific exclusions written into the contract limit the liability of the insurer; common examples include claims relating to suicide, fraud, war, riot, and civil commotion. Difficulties may arise where an event is not clearly defined, for example, the insured knowingly incurred a risk by consenting to an experimental ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Beneficiary

A beneficiary (also, in trust law, '' cestui que use'') in the broadest sense is a natural person or other legal entity who receives money or other benefits from a benefactor. For example, the beneficiary of a life insurance policy is the person who receives the payment of the amount of insurance after the death of the insured. Most beneficiaries may be designed to designate where the assets will go when the owner(s) dies. However, if the primary beneficiary or beneficiaries are not alive or do not qualify under the restrictions, the assets will probably pass to the ''contingent beneficiaries''. Other restrictions such as being married or more creative ones can be used by a benefactor to attempt to control the behavior of the beneficiaries. Some situations such as retirement accounts do not allow any restrictions beyond death of the primary beneficiaries, but trusts allow any restrictions that are not illegal or for an illegal purpose. The concept of a "beneficiary" will also freq ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reinsurance

Reinsurance is insurance that an insurance company purchases from another insurance company to insulate itself (at least in part) from the risk of a major claims event. With reinsurance, the company passes on ("cedes") some part of its own insurance liabilities to the other insurance company. The company that purchases the reinsurance policy is called a "ceding company" or "cedent" or "cedant" under most arrangements. The company issuing the reinsurance policy is referred to as the "reinsurer". In the classic case, reinsurance allows insurance companies to remain solvent after major claims events, such as major disasters like hurricanes and wildfires. In addition to its basic role in risk management, reinsurance is sometimes used to reduce the ceding company's capital requirements, or for tax mitigation or other purposes. The reinsurer may be either a specialist reinsurance company, which only undertakes reinsurance business, or another insurance company. Insurance companies ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

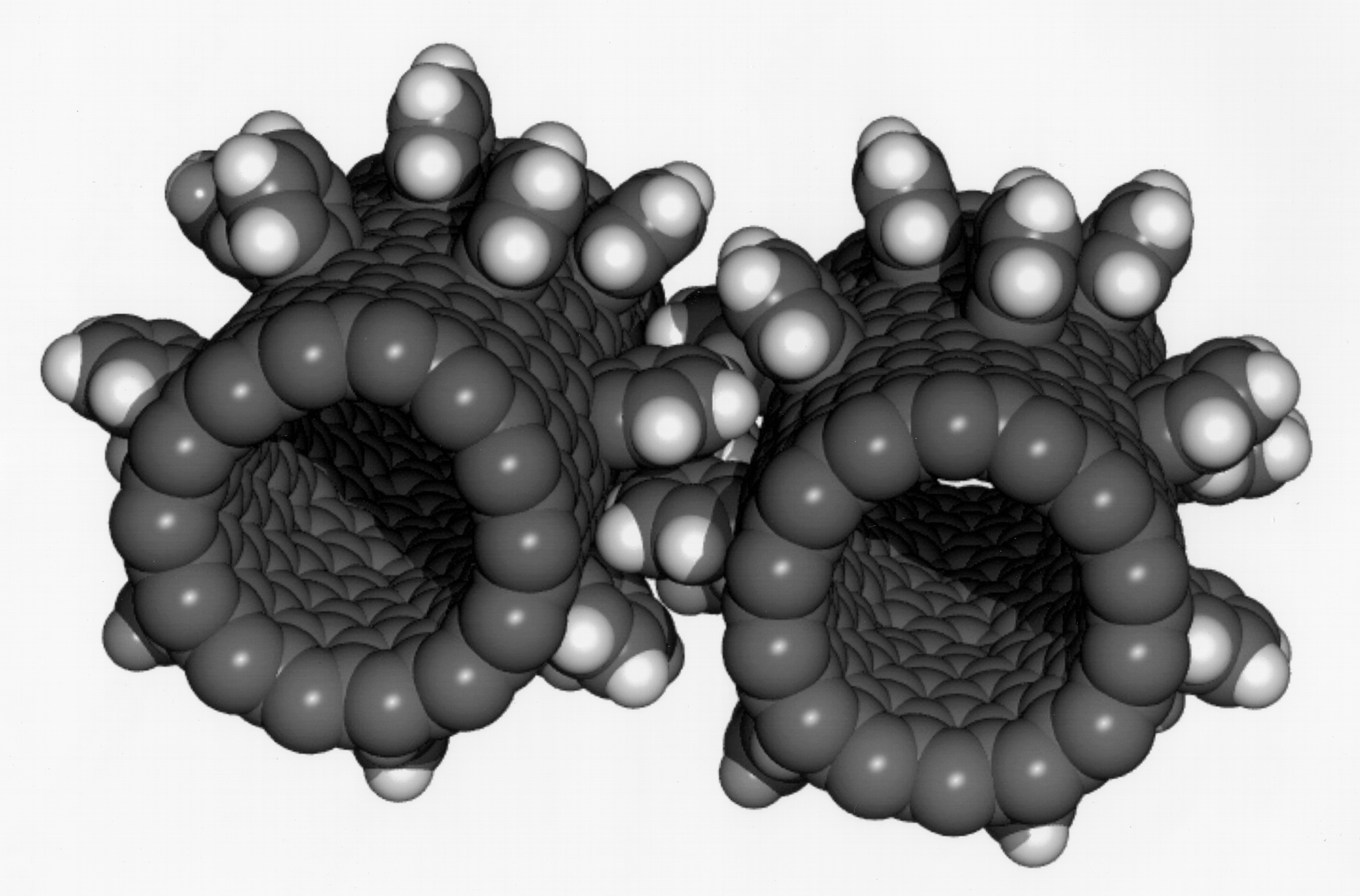

Nanotechnology

Nanotechnology, also shortened to nanotech, is the use of matter on an atomic, molecular, and supramolecular scale for industrial purposes. The earliest, widespread description of nanotechnology referred to the particular technological goal of precisely manipulating atoms and molecules for fabrication of macroscale products, also now referred to as molecular nanotechnology. A more generalized description of nanotechnology was subsequently established by the National Nanotechnology Initiative, which defined nanotechnology as the manipulation of matter with at least one dimension sized from 1 to 100 nanometers (nm). This definition reflects the fact that quantum mechanical effects are important at this quantum-realm scale, and so the definition shifted from a particular technological goal to a research category inclusive of all types of research and technologies that deal with the special properties of matter which occur below the given size threshold. It is therefore commo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Flood Insurance

Flood insurance is the specific insurance coverage issued against property loss from flooding. To determine risk factors for specific properties, insurers will often refer to topographical maps that denote lowlands, floodplains and other areas that are susceptible to flooding. In the United States Nationwide, only 20 percent of American homes at risk for floods are covered by flood insurance. Most private insurers do not insure against the peril of flood due to the prevalence of adverse selection, which is the purchase of insurance by persons most affected by the specific peril of flood. In traditional insurance, insurers use the economic law of large numbers to charge a relatively small fee to large numbers of people in order to pay the claims of the small numbers of claimants who have suffered a loss. Some insurers provide privately written primary flood insurance for high-value residential properties, and for low-value and high value buildings, including through The Natur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Percentage

In mathematics, a percentage (from la, per centum, "by a hundred") is a number or ratio expressed as a fraction of 100. It is often denoted using the percent sign, "%", although the abbreviations "pct.", "pct" and sometimes "pc" are also used. A percentage is a dimensionless number (pure number); it has no unit of measurement. Examples For example, 45% (read as "forty-five per cent") is equal to the fraction , the ratio 45:55 (or 45:100 when comparing to the total rather than the other portion), or 0.45. Percentages are often used to express a proportionate part of a total. (Similarly, one can also express a number as a fraction of 1,000, using the term " per mille" or the symbol "".) Example 1 If 50% of the total number of students in the class are male, that means that 50 out of every 100 students are male. If there are 500 students, then 250 of them are male. Example 2 An increase of $0.15 on a price of $2.50 is an increase by a fraction of = 0.06. Expressed a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Catastrophe Modeling

:''This article refers to the use of computers to estimate losses caused by disasters. For other meanings of the word catastrophe, including catastrophe theory in mathematics, see catastrophe (other).'' Catastrophe modeling (also known as cat modeling) is the process of using computer-assisted calculations to estimate the losses that could be sustained due to a catastrophic event such as a hurricane or earthquake. Cat modeling is especially applicable to analyzing risks in the insurance industry and is at the confluence of actuarial science, engineering, meteorology, and seismology. Catastrophes/ Perils Natural catastrophes (sometimes referred to as "nat cat") that are modeled include: * Hurricane (main peril is wind damage; some models can also include storm surge and rainfall) * Earthquake (main peril is ground shaking; some models can also include tsunami, fire following earthquakes, liquefaction, landslide, and sprinkler leakage damage) * severe thunderstorm or ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Independence (probability Theory)

Independence is a fundamental notion in probability theory, as in statistics and the theory of stochastic processes. Two events are independent, statistically independent, or stochastically independent if, informally speaking, the occurrence of one does not affect the probability of occurrence of the other or, equivalently, does not affect the odds. Similarly, two random variables are independent if the realization of one does not affect the probability distribution of the other. When dealing with collections of more than two events, two notions of independence need to be distinguished. The events are called pairwise independent if any two events in the collection are independent of each other, while mutual independence (or collective independence) of events means, informally speaking, that each event is independent of any combination of other events in the collection. A similar notion exists for collections of random variables. Mutual independence implies pairwise independe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)