|

Internet Tax

Internet tax is a tax on Internet-based services. A number of jurisdictions have introduced an Internet tax and others are considering doing so mainly as a result of successful tax avoidance by multinational corporations that operate within the digital economy. Internet taxes prominently target companies including Facebook, Google, Amazon, Airbnb, Uber. As of 2019, several countries have passed various Internet tax laws including France and Italy (at 3%) as well as the Czech Republic (7%). Forms of Internet taxation Internet access tax Internet access taxes normally take the form of taxation on Internet service provider (ISP) access charges. ISPs levy these charges on users. Currently, these fees are typically imposed at the state level. There is no national tax on ISP user charges. No uniform description of Internet access taxes is possible; they fall within the category of sales taxes in some states, and telecommunications taxes in others; and they are considered service charge ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internet

The Internet (or internet) is the global system of interconnected computer networks that uses the Internet protocol suite (TCP/IP) to communicate between networks and devices. It is a '' network of networks'' that consists of private, public, academic, business, and government networks of local to global scope, linked by a broad array of electronic, wireless, and optical networking technologies. The Internet carries a vast range of information resources and services, such as the inter-linked hypertext documents and applications of the World Wide Web (WWW), electronic mail, telephony, and file sharing. The origins of the Internet date back to the development of packet switching and research commissioned by the United States Department of Defense in the 1960s to enable time-sharing of computers. The primary precursor network, the ARPANET, initially served as a backbone for interconnection of regional academic and military networks in the 1970s to enable resource shari ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internet Tax Freedom Act

The 1998 Internet Tax Freedom Act is a United States law authored by Representative Christopher Cox and Senator Ron Wyden, and signed into law as title XI of on October 21, 1998 by President Bill Clinton in an effort to promote and preserve the commercial, educational, and informational potential of the Internet. The law bars federal, state and local governments from taxing Internet access and from imposing discriminatory Internet-only taxes such as bit taxes, bandwidth taxes, and email taxes. It also bars multiple taxes on electronic commerce. One of the principal sponsors of the Act argued that the law also codifies the U.S. Supreme Court's Quill Corp. v. North Dakota decision and stipulates that no state shall collect a sales tax from retail purchases made over the internet or through a mail-order catalog unless the seller has a physical presence in the state attempting to collect such tax. If a seller does have a physical presence in a state, then that seller may be requir ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Christopher Cox

Charles Christopher Cox (born October 16, 1952) is an American attorney and politician who served as chair of the U.S. Securities and Exchange Commission, a 17-year Republican member of the United States House of Representatives, and member of the White House staff in the Reagan Administration. Prior to his Washington service he was a practicing attorney, teacher, and entrepreneur. Following his retirement from government in 2009, he returned to law practice and currently serves as a director, trustee, and advisor to several for-profit and nonprofit organizations. Early life and education Cox was born in St. Paul, Minnesota. After graduating from Saint Thomas Academy in Mendota Heights, Minnesota in 1970, Cox earned a Bachelor of Arts degree the University of Southern California in 1973, following an accelerated three-year course. He was also a member of Delta Tau Delta fraternity. In 1977, he earned both an M.B.A. from Harvard Business School and a J.D. from Harvard Law School ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States House Of Representatives

The United States House of Representatives, often referred to as the House of Representatives, the U.S. House, or simply the House, is the Lower house, lower chamber of the United States Congress, with the United States Senate, Senate being the Upper house, upper chamber. Together they comprise the national Bicameralism, bicameral legislature of the United States. The House's composition was established by Article One of the United States Constitution. The House is composed of representatives who, pursuant to the Uniform Congressional District Act, sit in single member List of United States congressional districts, congressional districts allocated to each U.S. state, state on a basis of population as measured by the United States Census, with each district having one representative, provided that each state is entitled to at least one. Since its inception in 1789, all representatives have been directly elected, although universal suffrage did not come to effect until after ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Duke University

Duke University is a private research university in Durham, North Carolina. Founded by Methodists and Quakers in the present-day city of Trinity in 1838, the school moved to Durham in 1892. In 1924, tobacco and electric power industrialist James Buchanan Duke established The Duke Endowment and the institution changed its name to honor his deceased father, Washington Duke. The campus spans over on three contiguous sub-campuses in Durham, and a marine lab in Beaufort. The West Campus—designed largely by architect Julian Abele, an African American architect who graduated first in his class at the University of Pennsylvania School of Design—incorporates Gothic architecture with the Duke Chapel at the campus' center and highest point of elevation, is adjacent to the Medical Center. East Campus, away, home to all first-years, contains Georgian-style architecture. The university administers two concurrent schools in Asia, Duke-NUS Medical School in Singapore (established in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Use Tax

A use tax is a type of tax levied in the United States by numerous state governments. It is essentially the same as a sales tax but is applied not where a product or service was sold but where a merchant bought a product or service and then converted it for its own use, without having paid tax when it was initially purchased. Use taxes are functionally equivalent to sales taxes. They are typically levied upon the use, storage, enjoyment, or other consumption in the state of tangible personal property that has not been subjected to a sales tax. Introduction Use tax is assessed upon tangible personal property and taxable services purchased by a resident or entity doing business in the taxing state upon the use, storage, enjoyment or consumption of the good or service, regardless of origin of the purchase. Use taxes are designed to discourage the purchase of products that are not subject to the sales tax within a taxing jurisdiction. Use tax may be applied to purchases from out-of-s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

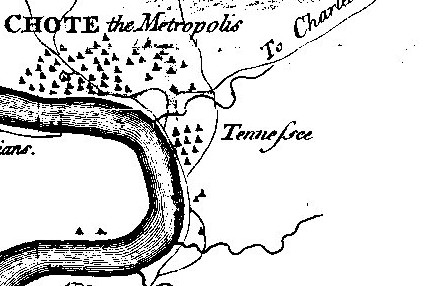

Tennessee

Tennessee ( , ), officially the State of Tennessee, is a landlocked state in the Southeastern region of the United States. Tennessee is the 36th-largest by area and the 15th-most populous of the 50 states. It is bordered by Kentucky to the north, Virginia to the northeast, North Carolina to the east, Georgia, Alabama, and Mississippi to the south, Arkansas to the southwest, and Missouri to the northwest. Tennessee is geographically, culturally, and legally divided into three Grand Divisions of East, Middle, and West Tennessee. Nashville is the state's capital and largest city, and anchors its largest metropolitan area. Other major cities include Memphis, Knoxville, Chattanooga, and Clarksville. Tennessee's population as of the 2020 United States census is approximately 6.9 million. Tennessee is rooted in the Watauga Association, a 1772 frontier pact generally regarded as the first constitutional government west of the Appalachian Mountains. Its name derives from "Tanas ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nebraska

Nebraska () is a state in the Midwestern region of the United States. It is bordered by South Dakota to the north; Iowa to the east and Missouri to the southeast, both across the Missouri River; Kansas to the south; Colorado to the southwest; and Wyoming to the west. It is the only triply landlocked U.S. state. Indigenous peoples, including Omaha, Missouria, Ponca, Pawnee, Otoe, and various branches of the Lakota ( Sioux) tribes, lived in the region for thousands of years before European exploration. The state is crossed by many historic trails, including that of the Lewis and Clark Expedition. Nebraska's area is just over with a population of over 1.9 million. Its capital is Lincoln, and its largest city is Omaha, which is on the Missouri River. Nebraska was admitted into the United States in 1867, two years after the end of the American Civil War. The Nebraska Legislature is unlike any other American legislature in that it is unicameral, and its members are elected ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Connecticut

Connecticut () is the southernmost state in the New England region of the Northeastern United States. It is bordered by Rhode Island to the east, Massachusetts to the north, New York to the west, and Long Island Sound to the south. Its capital is Hartford and its most populous city is Bridgeport. Historically the state is part of New England as well as the tri-state area with New York and New Jersey. The state is named for the Connecticut River which approximately bisects the state. The word "Connecticut" is derived from various anglicized spellings of "Quinnetuket”, a Mohegan-Pequot word for "long tidal river". Connecticut's first European settlers were Dutchmen who established a small, short-lived settlement called House of Hope in Hartford at the confluence of the Park and Connecticut Rivers. Half of Connecticut was initially claimed by the Dutch colony New Netherland, which included much of the land between the Connecticut and Delaware Rivers, although the firs ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax-free Shopping

Tax-free shopping (TFS) is the buying of goods in another country or state and obtaining a refund of the sales tax which has been collected by the retailer on those goods. The sales tax may be variously described as a sales tax, value added tax, goods and services tax (GST), value added tax (VAT), or consumption tax. Promoting tax-free shopping and making it easier for tourists to claim the refund back has helped to attract travellers to many countries. TFS is subject to national regulations, such as minimum spend and restrictions on the types of products on which it can be claimed. Refunds can only be claimed on goods which are exported. Buying goods tax free does not mean travellers are exempt from paying applicable taxes on their purchases when they get home; however, they will generally be able to benefit from an allowance of a certain amount on import. Tax-free shopping countries Fifty-four of the 130 countries that levy VAT/GST allow foreign visitors to have their taxes rei ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commerce Clause

The Commerce Clause describes an enumerated power listed in the United States Constitution ( Article I, Section 8, Clause 3). The clause states that the United States Congress shall have power "to regulate Commerce with foreign Nations, and among the several States, and with the Indian Tribes". Courts and commentators have tended to discuss each of these three areas of commerce as a separate power granted to Congress. It is common to see the individual components of the Commerce Clause referred to under specific terms: the Foreign Commerce Clause, the Interstate Commerce Clause, and the Indian Commerce Clause. Dispute exists within the courts as to the range of powers granted to Congress by the Commerce Clause. As noted below, it is often paired with the Necessary and Proper Clause, and the combination used to take a more broad, expansive perspective of these powers. During the Marshall Court era (1801–1835), interpretation of the Commerce Clause gave Congress jurisdiction ove ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal person, legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or national), and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax reliefs. The first known taxation took place in Ancient Egypt around 3000–2800 BC. A failure to pay in a timely manner (Tax noncompliance, non-compliance), along with evasion of or resistance to taxation, is punishable by law. Taxes consist of direct tax, direct or indirect taxes and may be paid in money or as its labor equivalent. Most countries have a tax system in place, in order to pay for public, common societal, or agreed national needs and for the functions of government. Some levy a flat tax, flat percentag ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |