|

Expenditure Minimization Problem

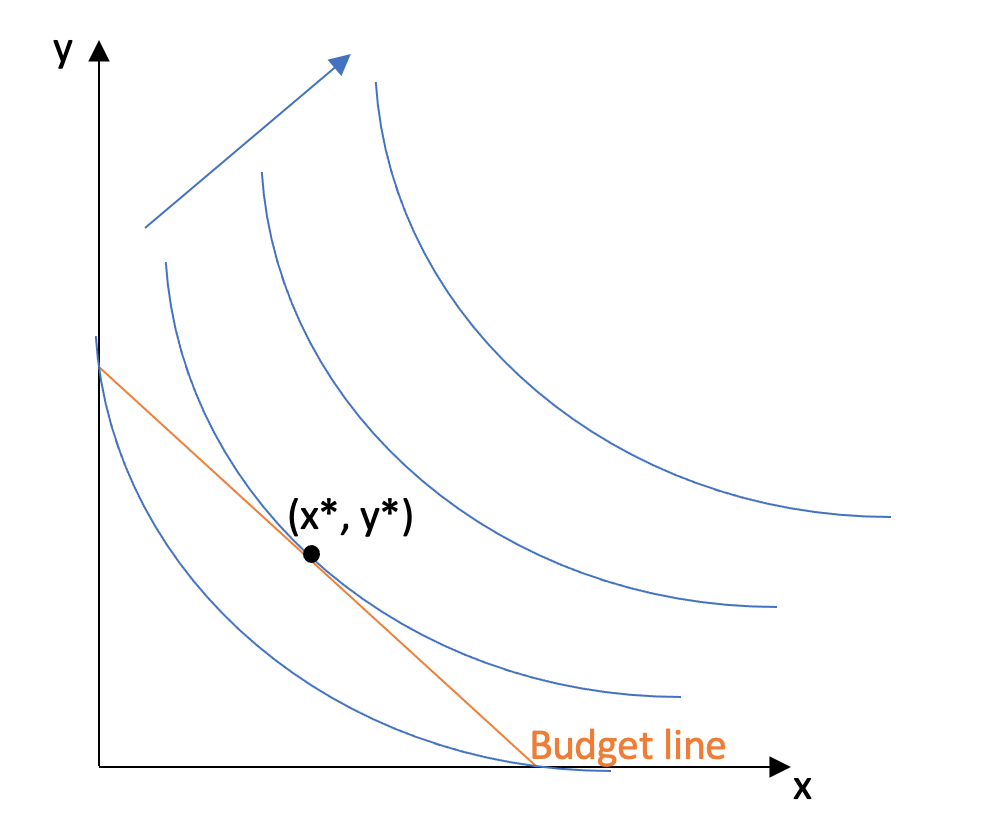

In microeconomics, the expenditure minimization problem is the dual of the utility maximization problem: "how much money do I need to reach a certain level of happiness?". This question comes in two parts. Given a consumer's utility function, prices, and a utility target, * how much money would the consumer need? This is answered by the expenditure function. * what could the consumer buy to meet this utility target while minimizing expenditure? This is answered by the Hicksian demand function. Expenditure function Formally, the expenditure function is defined as follows. Suppose the consumer has a utility function u defined on L commodities. Then the consumer's expenditure function gives the amount of money required to buy a package of commodities at given prices p that give utility of at least u^*, :e(p, u^*) = \min_ p \cdot x where :\geq = \ is the set of all packages that give utility at least as good as u^*. Hicksian demand correspondence Hicksian demand is defin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Microeconomics

Microeconomics is a branch of mainstream economics that studies the behavior of individuals and firms in making decisions regarding the allocation of scarce resources and the interactions among these individuals and firms. Microeconomics focuses on the study of individual markets, sectors, or industries as opposed to the national economy as whole, which is studied in macroeconomics. One goal of microeconomics is to analyze the market mechanisms that establish relative prices among goods and services and allocate limited resources among alternative uses. Microeconomics shows conditions under which free markets lead to desirable allocations. It also analyzes market failure, where markets fail to produce efficient results. While microeconomics focuses on firms and individuals, macroeconomics focuses on the sum total of economic activity, dealing with the issues of growth, inflation, and unemployment and with national policies relating to these issues. Microeconomics also d ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Duality (optimization)

In mathematical optimization theory, duality or the duality principle is the principle that optimization problems may be viewed from either of two perspectives, the primal problem or the dual problem. If the primal is a minimization problem then the dual is a maximization problem (and vice versa). Any feasible solution to the primal (minimization) problem is at least as large as any feasible solution to the dual (maximization) problem. Therefore, the solution to the primal is an upper bound to the solution of the dual, and the solution of the dual is a lower bound to the solution of the primal. This fact is called weak duality. In general, the optimal values of the primal and dual problems need not be equal. Their difference is called the duality gap. For convex optimization problems, the duality gap is zero under a constraint qualification condition. This fact is called strong duality. Dual problem Usually the term "dual problem" refers to the ''Lagrangian dual problem'' but oth ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Utility Maximization Problem

Utility maximization was first developed by utilitarian philosophers Jeremy Bentham and John Stuart Mill. In microeconomics, the utility maximization problem is the problem consumers face: "How should I spend my money in order to maximize my utility?" It is a type of optimal decision problem. It consists of choosing how much of each available good or service to consume, taking into account a constraint on total spending (income), the prices of the goods and their preferences. Utility maximization is an important concept in consumer theory as it shows how consumers decide to allocate their income. Because consumers are rational, they seek to extract the most benefit for themselves. However, due to bounded rationality and other biases, consumers sometimes pick bundles that do not necessarily maximize their utility. The utility maximization bundle of the consumer is also not set and can change over time depending on their individual preferences of goods, price changes and increa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumer

A consumer is a person or a group who intends to order, or uses purchased goods, products, or services primarily for personal, social, family, household and similar needs, who is not directly related to entrepreneurial or business activities. The term most commonly refers to a person who purchases goods and services for personal use. Consumer rights “Consumers, by definition, include us all," said President John F. Kennedy, offering his definition to the United States Congress on March 15, 1962. This speech became the basis for the creation of World Consumer Rights Day, now celebrated on March 15. In his speech : John Fitzgerald Kennedy outlined the integral responsibility to consumers from their respective governments to help exercise consumers' rights, including: *The right to safety: To be protected against the marketing of goods that are hazardous to health or life. *The right to be informed: To be protected against fraudulent, deceitful, or grossly misleading informat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Utility Function

As a topic of economics, utility is used to model worth or value. Its usage has evolved significantly over time. The term was introduced initially as a measure of pleasure or happiness as part of the theory of utilitarianism by moral philosophers such as Jeremy Bentham and John Stuart Mill. The term has been adapted and reapplied within neoclassical economics, which dominates modern economic theory, as a utility function that represents a single consumer's preference ordering over a choice set but is not comparable across consumers. This concept of utility is personal and based on choice rather than on pleasure received, and so is specified more rigorously than the original concept but makes it less useful (and controversial) for ethical decisions. Utility function Consider a set of alternatives among which a person can make a preference ordering. The utility obtained from these alternatives is an unknown function of the utilities obtained from each alternative, not the sum ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Expenditure Function

In microeconomics, the expenditure function gives the minimum amount of money an individual needs to spend to achieve some level of utility, given a utility function and the prices of the available goods. Formally, if there is a utility function u that describes preferences over ''n '' commodities, the expenditure function :e(p, u^*) : \textbf R^n_+ \times \textbf R \rightarrow \textbf R says what amount of money is needed to achieve a utility u^* if the ''n'' prices are given by the price vector p. This function is defined by :e(p, u^*) = \min_ p \cdot x where :\geq(u^*) = \ is the set of all bundles that give utility at least as good as u^*. Expressed equivalently, the individual minimizes expenditure x_1p_1+\dots +x_n p_n subject to the minimal utility constraint that u(x_1, \dots , x_n) \ge u^*, giving optimal quantities to consume of the various goods as x_1^*, \dots x_n^* as function of u^* and the prices; then the expenditure function is :e(p_1, \dots , p_n ; u^*)= ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hicksian Demand Function

In microeconomics, a consumer's Hicksian demand function or compensated demand function for a good is his quantity demanded as part of the solution to minimizing his expenditure on all goods while delivering a fixed level of utility. Essentially, a Hicksian demand function shows how an economic agent would react to the change in the price of a good, if the agent's income was compensated to guarantee the agent the same utility previous to the change in the price of the good—the agent will remain on the same indifference curve before and after the change in the price of the good. The function is named after John Hicks. Mathematically, :h(p, \bar) = \arg \min_x \sum_i p_i x_i : \ \ u(x) \geq \bar . where ''h''(''p'',''u'') is the Hicksian demand function, or commodity bundle demanded, at price vector ''p'' and utility level \bar. Here ''p'' is a vector of prices, and ''x'' is a vector of quantities demanded, so the sum of all ''p''''i''''x''''i'' is total expenditure ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Marshallian Demand

In microeconomics, a consumer's Marshallian demand function (named after Alfred Marshall) is the quantity they demand of a particular good as a function of its price, their income, and the prices of other goods, a more technical exposition of the standard demand function. It is a solution to the utility maximization problem of how the consumer can maximize their utility for given income and prices. A synonymous term is uncompensated demand function, because when the price rises the consumer is not compensated with higher nominal income for the fall in their real income, unlike in the Hicksian demand function. Thus the change in quantity demanded is a combination of a substitution effect and a wealth effect. Although Marshallian demand is in the context of partial equilibrium theory, it is sometimes called Walrasian demand as used in general equilibrium theory (named after Léon Walras). According to the utility maximization problem, there are ''L'' commodities with price vector ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hicksian Demand

In microeconomics, a consumer's Hicksian demand function or compensated demand function for a good is his quantity demanded as part of the solution to minimizing his expenditure on all goods while delivering a fixed level of utility. Essentially, a Hicksian demand function shows how an economic agent would react to the change in the price of a good, if the agent's income was compensated to guarantee the agent the same utility previous to the change in the price of the good—the agent will remain on the same indifference curve before and after the change in the price of the good. The function is named after John Hicks. Mathematically, :h(p, \bar) = \arg \min_x \sum_i p_i x_i : \ \ u(x) \geq \bar . where ''h''(''p'',''u'') is the Hicksian demand function, or commodity bundle demanded, at price vector ''p'' and utility level \bar. Here ''p'' is a vector of prices, and ''x'' is a vector of quantities demanded, so the sum of all ''p''''i''''x''''i'' is total expenditure ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1 Correspondence

1 (one, unit, unity) is a number representing a single or the only entity. 1 is also a numerical digit and represents a single unit of counting or measurement. For example, a line segment of ''unit length'' is a line segment of length 1. In conventions of sign where zero is considered neither positive nor negative, 1 is the first and smallest positive integer. It is also sometimes considered the first of the infinite sequence of natural numbers, followed by 2, although by other definitions 1 is the second natural number, following 0. The fundamental mathematical property of 1 is to be a multiplicative identity, meaning that any number multiplied by 1 equals the same number. Most if not all properties of 1 can be deduced from this. In advanced mathematics, a multiplicative identity is often denoted 1, even if it is not a number. 1 is by convention not considered a prime number; this was not universally accepted until the mid-20th century. Additionally, 1 is the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Local Nonsatiation

In microeconomics, the property of local nonsatiation of consumer preferences states that for any bundle of goods there is always another bundle of goods arbitrarily close that is strictly preferred to it.''Microeconomic Theory'', by A. Mas-Colell, et al. Formally, if X is the consumption set, then for any x \in X and every \varepsilon>0, there exists a y \in X such that \, y-x \, \leq \varepsilon and y is strictly preferred to x. Several things to note are: # Local nonsatiation is implied by monotonicity of preferences. However, as the converse is not true, local nonsatiation is a weaker condition. # There is no requirement that the preferred bundle ''y'' contain more of any good – hence, some goods can be "bads" and preferences can be non-monotone. # It rules out the extreme case where all goods are "bads", since the point ''x'' = 0 would then be a bliss point. # Local nonsatiation can only occur either if the consumption set is unbounded or open (in other words, it ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Utility Maximization Problem

Utility maximization was first developed by utilitarian philosophers Jeremy Bentham and John Stuart Mill. In microeconomics, the utility maximization problem is the problem consumers face: "How should I spend my money in order to maximize my utility?" It is a type of optimal decision problem. It consists of choosing how much of each available good or service to consume, taking into account a constraint on total spending (income), the prices of the goods and their preferences. Utility maximization is an important concept in consumer theory as it shows how consumers decide to allocate their income. Because consumers are rational, they seek to extract the most benefit for themselves. However, due to bounded rationality and other biases, consumers sometimes pick bundles that do not necessarily maximize their utility. The utility maximization bundle of the consumer is also not set and can change over time depending on their individual preferences of goods, price changes and increa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

_(14597240757).jpg)