|

Alterna Bank

CS Alterna Bank (french: Banque CS Alterna), operating as Alterna Bank (french: Banque Alterna), is a Canadian direct bank and a wholly owned subsidiary of the Ontario-based credit union Alterna Savings. The bank offers chequing and high-interest savings accounts and mortgages. Operating primarily as a direct bank since 2017, most customers access accounts using the bank's website, telephone service, and mobile apps. Unlike most other direct banks, some accounts can also be accessed through branches. There are two Alterna Bank locations in Gatineau, Québec, and Alterna Savings branches also administer deposits and loans on its behalf, to which the bank outsources most of its processes. Customers can make debit purchases using their access cards, write cheques, and make surcharge-free transactions at automated teller machines within The Exchange Network. Its flexibility has brought it attention from publications such as ''The Globe and Mail'' as a sound alternative to the Big Fiv ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Subsidiary

A subsidiary, subsidiary company or daughter company is a company owned or controlled by another company, which is called the parent company or holding company. Two or more subsidiaries that either belong to the same parent company or having a same management being substantially controlled by same entity/group are called sister companies. The subsidiary can be a company (usually with limited liability) and may be a government- or state-owned enterprise. They are a common feature of modern business life, and most multinational corporations organize their operations in this way. Examples of holding companies are Berkshire Hathaway, Jefferies Financial Group, The Walt Disney Company, Warner Bros. Discovery, or Citigroup; as well as more focused companies such as IBM, Xerox, and Microsoft. These, and others, organize their businesses into national and functional subsidiaries, often with multiple levels of subsidiaries. Details Subsidiaries are separate, distinct legal entities f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

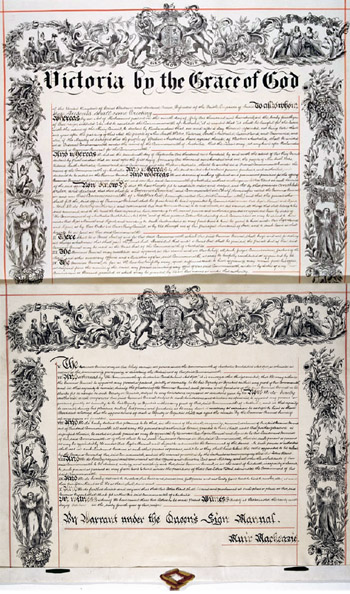

Letters Patent

Letters patent ( la, litterae patentes) ( always in the plural) are a type of legal instrument in the form of a published written order issued by a monarch, president or other head of state, generally granting an office, right, monopoly, title or status to a person or corporation. Letters patent can be used for the creation of corporations or government offices, or for granting city status or a coat of arms. Letters patent are issued for the appointment of representatives of the Crown, such as governors and governors-general of Commonwealth realms, as well as appointing a Royal Commission. In the United Kingdom, they are also issued for the creation of peers of the realm. A particular form of letters patent has evolved into the modern intellectual property patent (referred to as a utility patent or design patent in United States patent law) granting exclusive rights in an invention or design. In this case it is essential that the written grant should be in the form of a publ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1992 Establishments In Ontario

Year 199 ( CXCIX) was a common year starting on Monday (link will display the full calendar) of the Julian calendar. At the time, it was sometimes known as year 952 ''Ab urbe condita''. The denomination 199 for this year has been used since the early medieval period, when the Anno Domini calendar era became the prevalent method in Europe for naming years. Events By place Roman Empire * Mesopotamia is partitioned into two Roman provinces divided by the Euphrates, Mesopotamia and Osroene. * Emperor Septimius Severus lays siege to the city-state Hatra in Central-Mesopotamia, but fails to capture the city despite breaching the walls. * Two new legions, I Parthica and III Parthica, are formed as a permanent garrison. China * Battle of Yijing: Chinese warlord Yuan Shao defeats Gongsun Zan. Korea * Geodeung succeeds Suro of Geumgwan Gaya, as king of the Korean kingdom of Gaya (traditional date). By topic Religion * Pope Zephyrinus succeeds Pope Victor I, as the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banks Established In 1992

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in the anc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banks Of Canada

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in the anc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tangerine Bank

Tangerine Bank (operating as Tangerine) is a Canadian direct bank that is a subsidiary of Scotiabank. It offers no-fee chequing and savings accounts, Guaranteed Investment Certificates (GICs), mortgages and mutual funds (through a subsidiary). Many savings and investment products are eligible for registration under a Tax-Free Savings Account (TFSA), Registered Retirement Savings Plan (RRSP) or Registered Retirement Income Fund (RRIF). The bank was founded by ING Group in April 1997 as ING Bank of Canada (operating as ING Direct). In November 2012, it was acquired by Scotiabank. The new name for the bank was revealed in November 2013, and the Tangerine branding was rolled out beginning in April 2014. Although now wholly owned by Scotiabank, Tangerine remains a separate legal entity and thus kept its unique Institution Number (614), with all accounts being under a single transit number (00152). History The predecessor of Tangerine, ING Bank of Canada (using the trade name ING ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Simplii Financial

Simplii Financial is a direct bank and the digital banking division of the Canadian Imperial Bank of Commerce (CIBC). As of November 2021, the bank had almost two million clients. In 2021, Simplii Financial became the first in Canadian banking to enable digital identity verification – giving international students and newcomers the opportunity to open accounts completely digitally before arriving in Canada. Background Simplii Financial was established following CIBC and the supermarket chain Loblaw Companies mutually deciding to end their 20-year joint venture of providing consumer banking services under the President's Choice Financial brand. Simplii Financial shares Institution Number 010 with its parent CIBC. Its SWIFT code is CIBCCATT, and all Simplii clients share a branch-transit number of 30800. History Simplii traces its history to the 1996 President's Choice Financial co-venture between CIBC and Loblaws to provide low-fee banking services. President's Choice Financ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Motive Financial

Canadian Western Bank (CWB; french: Banque canadienne de l'Ouest), also operating as CWB Financial Group, is a Canadian bank based in Edmonton, Alberta. The bank serves clients both in Western Canada and in other provinces. The CWB Financial Group is made up of 10 banking, lending, wealth and trust companies. Its loan book is almost equally represented across BC, Alberta and Ontario. As part of its expansion plans, CWB has opened a branch in Mississauga, Ontario, just west of Toronto. History Canadian Western Bank was formed through the 1988 merger of two banks: the Bank of Alberta (founded 1984), and the Western & Pacific Bank of Canada (founded 1982). It was led by Bank of Alberta co-founders Charles Alexander Allard and Eugene Pechet. In 1993, it acquired Western Canadian branches of Metropolitan Trust. In 1994, Canadian Western Bank and North West Trust Company merged into Canadian Western Bank. In 1996, it acquired BC Bancorp (chartered in 1967), and purchased the Aetna ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of Banks In Canada

This is a list of banks in Canada, including chartered banks, credit unions, trusts, and other financial services companies that offer banking services and may be popularly referred to as "banks". The "Big Five" Canada's "big five" banks, and a few statistics (2013): The term "Big Six" is frequently used as well and includes the National Bank of Canada (2013 market cap of $8.9B), though its operations are primarily focused in the provinces of Quebec and New Brunswick. Banks by legal classification Banks in Canada are classified by their ownership as domestic banks, subsidiaries of foreign banks, or branches of foreign banks. For a greater explanation of the classifications, see ''Banking in Canada'' and ''Canada Bank Act''. Schedule I banks (domestic banks) Under the Canada Bank Act, Schedule I are banks that are not a subsidiary of a foreign bank, i.e., domestic banks, even if they have foreign shareholders. There are 35 domestic banks, included 2 federally regulated ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Canada Deposit Insurance Corporation

The Canada Deposit Insurance Corporation (CDIC; french: Société d'assurance-dépôts du Canada) is a Canadian federal Crown Corporation created by Parliament in 1967 to provide deposit insurance to depositors in Canadian commercial banks and savings institutions. CDIC insures Canadians' deposits held at Canadian banks (and other member institutions) up to C$100,000 in case of a bank failure. CDIC automatically insures many types of savings against the failure of a financial institution. However, the bank must be a CDIC member and not all savings are insured. CDIC is also Canada's resolution authority for banks, federally regulated credit unions, trust and loan companies as well as associations governed by the ''Cooperative Credit Associations Act'' that take deposits. History The Canada Deposit Insurance Corporation was created 4 March 1967 (under Schedule III, Part 1 of the '' Financial Administration Act'' and ''Canada Deposit Insurance Corporation Act''). It is simila ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Act (Canada)

The ''Bank Act'' (1991, c. 46) (the ''Act'') is an Act of Parliament, act of the Parliament of Canada respecting banks and banking. History The ''Bank Act'' was originally passed in 1871. The terms of the ''Act'' provide for a statutory review of the ''Act'' on a regular basis to ensure that legislators update the ''Act'' in order that it keep pace with developments in the financial system. Historically, this was done on a decennial basis. In 1992, this requirement was changed to every five years. The ''Act'' contains a "sunset" clause providing that it and the bank charters provided by it will expire unless the statutory review is conducted every five years. In 2016 the Federal Government proposed a 2 year extension to the review deadline. The most recent statutory review of the ''Act'' took place in 2019 with the next review scheduled for 2023. Credit unions In 2010, the Parliament of Canada passed amendments to the ''Act'' to allow Government of Canada, federal credit uni ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

TERMIUM Plus

TERMIUM Plus is an electronic linguistic and terminological database operated and maintained by the Translation Bureau of Public Services and Procurement Canada, a department of the federal government. The database offers millions of terms in English and French from various specialized fields, as well as some in Spanish and Portuguese. History TERMIUM Plus was initially developed by the Université de Montréal in October 1970, under the name Banque de Terminologie de l’Université de Montréal (BTUM). The database was under the direction of Marcel Paré, with a vision to produce the most flexible bilingual language file that would be available to all. BTUM was initially funded by private donors and government subsidies, subsequently growing with the help of professionals in the field of translation over the following years. At the end of 1974, however, the Translation Bureau under the Canadian Secretary of State department showed interest in the operation of BTUM. The goal ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |