Sukuk on:

[Wikipedia]

[Google]

[Amazon]

Sukuk ( ar, صكوك, ṣukūk; plural of ar, صك, ṣakk, legal instrument, deed, cheque, links=no) is the Arabic name for financial certificates, also commonly referred to as "

Liquidity Management Centre As of July 2014 sukuk.com listed fifteen sukuk on the secondary market for Gulf Sukuk.

An example of a sukuk was a $100 million security used to finance the construction and delivery of cooling plants in

An example of a sukuk was a $100 million security used to finance the construction and delivery of cooling plants in

, IMF, April 2015, p.6-7 * "Complex financial products and corporate structures" in some countries/jurisdictions because "regulatory and supervisory frameworks" do not "address the unique risks of the industry". Consequently, what is needed is "increased regulatory clarity and harmonization, better cooperation between Islamic and conventional financial standard-setters, and further improvement of supervisory tools". * "Underdeveloped" safety nets and resolution frameworks. In many places these include complete Islamic deposit insurance systems where premiums are invested in Shariah-compliant assets, or Shariah-compliant " lenders-of-last-resort". * Regulators who "do not always have the capacity (or willingness) to ensure Shariah compliance." ''State of the Global Islamic Economy Report'', 2015/16:70 ;Defaults In three years during and following the

'' do'' give their holders recourse to the originator, and so more closely resemble conventional bonds.

Other critics include non-orthodox economist Mahmoud El-Gamal, who has complained that while providers of sukuk (and other Islamic finance instruments) will often describe their "distinguishing feature" as the "prohibition of interest", they will then

''Islamic capital markets: Products, regulation and development''

ed. Salman Syed Ali, pp.10, Jeddah, Islamic Research and Training Institute, Islamic Development Bank. In 2011, Safari conducted various statistical and econometrics tests to check the argument that sukuk securities are merely the same as conventional bond. However, his results on the comparison of

'' The Saun Daily'', Malaysia, 12 February 2013 RAM Rating Services Bhd CEO Foo Su Yin says the total issuance of sukuk corporate bonds in 2012 was RM 71.7 billion while conventional bonds totalled RM48.3 billion. As at 2011, Malaysia was the highest global sukuk issuer by issuing 69 percent of world's total issuances.

10 October 2012 for $1.5B

, and one being in Turkish Lira (issued o

2 October 2012 for 1.62LRY

. According to data from Sukuk.com, the US Dollars issuance was oversubscribed and was initially planned to be for $1 billion, but because of strong demand from the Middle East it was increased to $1.5 billion. Turkey returned to the Sukuk market i

October 2013 with a $1.25B issuance

Government issues first Islamic bond

Britain becomes the first country outside the Islamic world to issue sovereign Sukuk., gov.uk HM Treasury , 25 June 2014 The Sukuk was linked to the rental income of UK government property.

sharia

Sharia (; ar, شريعة, sharīʿa ) is a body of religious law that forms a part of the Islamic tradition. It is derived from the religious precepts of Islam and is based on the sacred scriptures of Islam, particularly the Quran and the H ...

compliant" bonds.

Sukuk are defined by the AAOIFI ( Accounting and Auditing Organization for Islamic Financial Institutions) as "securities

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any for ...

of equal denomination representing individual ownership interests in a portfolio of eligible existing or future asset

In financial accounting, an asset is any resource owned or controlled by a business or an economic entity. It is anything (tangible or intangible) that can be used to produce positive economic value. Assets represent value of ownership that c ...

s." The Fiqh

''Fiqh'' (; ar, فقه ) is Islamic jurisprudence. Muhammad-> Companions-> Followers-> Fiqh.

The commands and prohibitions chosen by God were revealed through the agency of the Prophet in both the Quran and the Sunnah (words, deeds, and e ...

academy of the OIC legitimized the use of sukuk in February 1988.Visser, Hans. 2009. ''Islamic finance: Principles and practice.'' Cheltenham, UK and Northampton MA, Edward Elgar. p.63 Khan, ''What Is Wrong with Islamic Economics?'', 2013: p.251

Sukuk were developed as an alternative to conventional bonds which are not considered permissible by many Muslims as they pay interest

In finance and economics, interest is payment from a borrower or deposit-taking financial institution to a lender or depositor of an amount above repayment of the principal sum (that is, the amount borrowed), at a particular rate. It is distin ...

(prohibited or discouraged as Riba

The Royal Institute of British Architects (RIBA) is a professional body for architects primarily in the United Kingdom, but also internationally, founded for the advancement of architecture under its royal charter granted in 1837, three supp ...

, or usury

Usury () is the practice of making unethical or immoral monetary loans that unfairly enrich the lender. The term may be used in a moral sense—condemning taking advantage of others' misfortunes—or in a legal sense, where an interest rate is c ...

), and also may finance businesses involved in activities not permitted under Sharia

Sharia (; ar, شريعة, sharīʿa ) is a body of religious law that forms a part of the Islamic tradition. It is derived from the religious precepts of Islam and is based on the sacred scriptures of Islam, particularly the Quran and the H ...

(gambling, alcohol, pork, etc.). Sukuk securities are structured to comply with Sharia by paying profit, not interest—generally by involving a tangible asset

In financial accounting, an asset is any resource owned or controlled by a business or an economic entity. It is anything (tangible or intangible) that can be used to produce positive economic value. Assets represent value of ownership that can ...

in the investment. For example, Sukuk securities may have partial ownership of a property built by the investment company (and held in a Special Purpose Vehicle

A special-purpose entity (SPE; or, in Europe and India, special-purpose vehicle/SPV; or, in some cases in each EU jurisdiction, FVC, financial vehicle corporation) is a legal entity (usually a limited company of some type or, sometimes, a limited ...

), so that sukuk holders can collect the property's profit as rent

Rent may refer to:

Economics

*Renting, an agreement where a payment is made for the temporary use of a good, service or property

*Economic rent, any payment in excess of the cost of production

*Rent-seeking, attempting to increase one's share of e ...

, (which is allowed under Islamic law). Because they represent ownership of real assets and (at least in theory) do not guarantee repayment of initial investment, sukuk resemble equity

Equity may refer to:

Finance, accounting and ownership

*Equity (finance), ownership of assets that have liabilities attached to them

** Stock, equity based on original contributions of cash or other value to a business

** Home equity, the diff ...

instruments, but like a bond (and unlike equity) regular payments cease upon their expiration. However, most sukuk are "asset-based" rather than "asset-backed"—their assets are not truly owned by their Special Purpose Vehicle

A special-purpose entity (SPE; or, in Europe and India, special-purpose vehicle/SPV; or, in some cases in each EU jurisdiction, FVC, financial vehicle corporation) is a legal entity (usually a limited company of some type or, sometimes, a limited ...

, and their holders have recourse to the originator if there is a shortfall in payments.

Different types of sukuk are based on different structures of Islamic contracts (Murabaha, Ijara, Istisna, Musharaka, Istithmar, etc.) depending on the project the sukuk is financing. Jamaldeen, ''Islamic Finance For Dummies'', 2012:214

According to the State of the Global Islamic Economy Report 2016/17, of the $2.004 trillion of assets being managed in a sharia compliant manner in 2014, $342 billion were sukuk, being made up of 2,354 sukuk issues.

History

In the classical period ofIslam

Islam (; ar, ۘالِإسلَام, , ) is an Abrahamic monotheistic religion centred primarily around the Quran, a religious text considered by Muslims to be the direct word of God (or '' Allah'') as it was revealed to Muhammad, the ...

, Sakk (sukuk) meant any document representing a contract

A contract is a legally enforceable agreement between two or more parties that creates, defines, and governs mutual rights and obligations between them. A contract typically involves the transfer of goods, services, money, or a promise to tr ...

or conveyance

Conveyance may refer to:

* Conveyance, the documentation of the transfer of ownership of land from one party to another—see conveyancing

* Public conveyance, a shared passenger transportation service

* A means of transport

* Water conveyance, ...

of rights, obligations or monies done in conformity with the Shariah

Sharia (; ar, شريعة, sharīʿa ) is a body of religious law that forms a part of the Islamic tradition. It is derived from the religious precepts of Islam and is based on the sacred scriptures of Islam, particularly the Quran and the ...

. The term was used to refer to forms of papers representing financial obligations originating from trade and other commercial activities in the Islamic pre-modern period.

According to Camille Paldi, the first sukuk transaction took place in Damascus

)), is an adjective which means "spacious".

, motto =

, image_flag = Flag of Damascus.svg

, image_seal = Emblem of Damascus.svg

, seal_type = Seal

, map_caption =

, ...

in its Great Mosque in the 7th century AD. Muslim traders are known to have used the cheque or ''ṣakk'' system since the time of Harun al-Rashid

Abu Ja'far Harun ibn Muhammad al-Mahdi ( ar

, أبو جعفر هارون ابن محمد المهدي) or Harun ibn al-Mahdi (; or 766 – 24 March 809), famously known as Harun al-Rashid ( ar, هَارُون الرَشِيد, translit=Hārūn ...

(9th century) of the Abbasid Caliphate

The Abbasid Caliphate ( or ; ar, الْخِلَافَةُ الْعَبَّاسِيَّة, ') was the third caliphate to succeed the Islamic prophet Muhammad. It was founded by a dynasty descended from Muhammad's uncle, Abbas ibn Abdul-Muttal ...

.Subhi Y. Labib (1969), "Capitalism in Medieval Islam", ''The Journal of Economic History'' 29 (1), pp. 79–96 2–3

The modern Western word "cheque" appears to have been derived from "''sakk''" (singular of ''sukuk''), which during the Middle Ages referred to a written agreement "to pay for goods when they were delivered" and was used to "avoid money having to be transported across dangerous terrain".

;Modern

Answering a need to provide short and medium term instruments so that balance sheets of Islamic financial institutions could be more liquid, the Fiqh academy of the OIC (Organization of Islamic Countries) legitimized the use of sukuk in February 1988.

In 1990 one of the first contemporary sukuk—worth RM125 million—were issued by Malaysia Shell MDS Sdn Bhd, on the basis of ''bai' bithaman ajil''.International Islamic Financial Market, 2012. ''Sukuk report: A comprehensive study of the global sukuk market'', http://iifm.net/media/pdf/iifm_suku_report_2.pdf There were no other sukuk issued until 2000 when the market began to take off. Saeed, Salah, "Development of Sukuk", 2013: In 2000, the government of Sudan issued domestic sovereign short-term sukuk worth 77 million Sudanese pounds on the basis of ''musharaka''. In 2001, the sukuk market went international with the issuance of the first US-dollar-denominated ''ijara sukuk'', worth $100 million by the Central Bank of Bahrain. Since then many sovereign and corporate sukuk issues have been offered in various jurisdictions. Khan, ''What Is Wrong with Islamic Economics?'', 2013: p.306-7

To standardize the growing market, the AAOIF issued "Shari’ah Standard No.17" on 'Investment Sukuk' in May 2003. It became effective starting 1 January 2004.

Industry

As of early 2017, there were US$328 billion worth of sukuk outstanding worldwide. As of the end of 2016, there were about 146 US Dollar-denominated, Islamic fixed income securities issued in the global markets, that wereinvestment-grade

In investment, the bond credit rating represents the credit worthiness of corporate or government bonds. It is not the same as an individual's credit score. The ratings are published by credit rating agencies and used by investment professionals ...

, and had a duration of at least one year. These securities—which make up the Citi

Citigroup Inc. or Citi (stylized as citi) is an American multinational investment bank and financial services corporation headquartered in New York City. The company was formed by the merger of banking giant Citicorp and financial conglomer ...

Sukuk Index—had an average maturity of 4.54 years, and most were issued by governments. The top four issuers by market weight—making up over 40% of the market—were: ISLAMIC DEVELOPMENT BANK

The Islamic Development Bank ( ar, البنك الإسلامي للتنمية, abbreviated as IsDB) is a multilateral development finance institution that is focused on Islamic finance for infrastructure development and located in Jeddah, Saudi ...

, PERUSAHAAN PENERBIT SBSN INDOIII, SAUDI ELECTRICITY CO, SOQ SUKUK A QSC. About 3/4 of the sukuk market is domestic, not international. Most sukuk are not investment grade however, Khan, ''Islamic Banking in Pakistan'', 2015: p.108 and as of 2015, there were 2,354 sukuk issues in total, including local currency denominated, non-global market sukuk, according to Thomson Reuters & Dinar Standard. According to the Malaysian International Islamic Financial Centre, as of 2013 the biggest issuers of sukuk were governments (65.6%), and the second largest were power and utility companies (13.6%).

Secondary market

Sukuk securities tend to be bought and held. As a result, few securities enter the secondary market to be traded. Furthermore, only public Sukuk are able to enter this market, as they are listed on stock exchanges. The secondary market—whilst developing—remains a niche segment with virtually all of the trading done at the institution level. The size of the secondary market remains unknown, though LMC Bahrain states they traded $55.5 million of Sukuk in 2007.Trades executed in the secondary marketLiquidity Management Centre As of July 2014 sukuk.com listed fifteen sukuk on the secondary market for Gulf Sukuk.

Principles

Ali Arsalan Tariq states that Islamic finance—including sukuk—is based on a set of several prohibitions: # Transactions in unethical goods and services; # Earning returns from a loan contract (Riba/Interest); # Compensation-based restructuring of debts; # Excessive uncertainty in contracts (''Gharar

''Gharar'' ( ar, غرر) literally means uncertainty, hazard, chance or risk. It is a negative element in ''mu'amalat'' ''fiqh'' (transactional Islamic jurisprudence), like '' riba'' (usury) and '' maysir'' (gambling).

One Islamic dictionary (''A ...

'');

# Gambling and chance-based games (''Qimar'');

# Trading in debt contracts at discount, and;

# Forward foreign exchange transactions.

As Shari’ah considers money to be a measuring tool for value and not an asset

In financial accounting, an asset is any resource owned or controlled by a business or an economic entity. It is anything (tangible or intangible) that can be used to produce positive economic value. Assets represent value of ownership that c ...

in itself, it requires that one should not receive income

Income is the consumption and saving opportunity gained by an entity within a specified timeframe, which is generally expressed in monetary terms. Income is difficult to define conceptually and the definition may be different across fields. Fo ...

from money (or anything that has the genus

Genus ( plural genera ) is a taxonomic rank used in the biological classification of living and fossil organisms as well as viruses. In the hierarchy of biological classification, genus comes above species and below family. In binomial nom ...

of money) alone, as this (simplistically, interest

In finance and economics, interest is payment from a borrower or deposit-taking financial institution to a lender or depositor of an amount above repayment of the principal sum (that is, the amount borrowed), at a particular rate. It is distin ...

) is "''riba

The Royal Institute of British Architects (RIBA) is a professional body for architects primarily in the United Kingdom, but also internationally, founded for the advancement of architecture under its royal charter granted in 1837, three supp ...

''", and forbidden. From a Sharia perspective, certificates of debt are not tradable except at their par value (although a different view is held by many in Malaysia).

While a bond is a contractual debt obligation of the issuer to pay to bondholders, on

certain specified dates, interest and principal; a Sukuk is a certificate giving Sukuk holders an undivided beneficial ownership in the underlying assets. Consequently, Sukuk holders are entitled to share in the revenues generated by the Sukuk assets as well as being entitled to share in the proceeds of the realization of the Sukuk assets.

Similarities with bonds

* Sukuk and bonds are sold to investors who receive a stream of payments until the date of the maturity of the sukuk or bond, at which time they get their original investment (in the case of sukuk a full payment is not guaranteed) back. Jamaldeen, ''Islamic Finance For Dummies'', 2012:207-13 * Sukuk and bonds are intended to provide investment with less risk thanequities

In finance, stock (also capital stock) consists of all the shares by which ownership of a corporation or company is divided.Longman Business English Dictionary: "stock - ''especially AmE'' one of the shares into which ownership of a company ...

(such as shares of stock) and so are often used to "balance a portfolio" of investment instruments. Jamaldeen, ''Islamic Finance For Dummies'', 2012:208

* Both Sukuk and bonds must issue a disclosure document known as a prospectus to describe the security they are selling.

* To give investors an idea of how much risk is involved in particular sukuk/bonds, rating agencies rate the credit worthiness

A credit risk is risk of default on a debt that may arise from a borrower failing to make required payments. In the first resort, the risk is that of the lender and includes lost principal and interest, disruption to cash flows, and increased c ...

of the issuers of the sukuk/bond. Jamaldeen, ''Islamic Finance For Dummies'', 2012:212-3

* Both sukuk and bonds are initially sold by their issuers. After that they (or some sukuk and bonds) may be bought and sold by brokers and agents, mostly on the over-the-counter

Over-the-counter (OTC) drugs are medicines sold directly to a consumer without a requirement for a prescription from a healthcare professional, as opposed to prescription drugs, which may be supplied only to consumers possessing a valid prescr ...

(OTC) market, but are also available on some stock exchanges around the world. Jamaldeen, ''Islamic Finance For Dummies'', 2012:211-2

Differences from bonds

* Ownership: Sukuk should indicate partial ownership of an asset. Bonds indicate a debt obligation. Jamaldeen, ''Islamic Finance For Dummies'', 2012:211 * Compliance: The assets that back sukuk should be compliant with Shariah. Bonds need only comply with laws of country/locality they are issued in. * Pricing: The face value of a sukuk is priced according to the value of the assets backing them. Bond pricing is based on credit rating, i.e. the issuer's credit worthiness. * Rewards and risks: Sukuk can increase in value when the assets increase in value. Returns from bonds correspond to fixed interest. (Because most bonds' interest rates are fixed, most increase in value when the ''market'' interest rates fall.) * Sales: When you sell sukuk, you are selling ownership in the assets backing them. (In instances where the certificate represents a debt to the holder, the certificate will not be tradable on the secondary market and instead should be held until maturity.) The sale of bonds is the sale of debt. * Principal: Sukuk investors (in theory) share the risk of the underlying asset and may not get all their initial investment (the face value of the sukuk) back. (The value payable to the Sukuk-holder on maturity should be the current market value of the assets or enterprise and not the principal originally invested, according to Taqi Usamani.) Usmani, ''Sukuk and their Contemporary Applications'', 2007:3–4 Bond investors are guaranteed the return of their initial investment/principal. Jamaldeen, ''Islamic Finance For Dummies'', 2012:210 In practice some sukuk are issued with repurchase guarantees. * Conventional bonds are issued with underwriters. Sukuk underwriters do not usually conduct the issuance and may not be required. Sukuk use Special Purpose Vehicles to be the trustee/issuer of the sukuk. Jamaldeen, ''Islamic Finance For Dummies'', 2012:214-5Definitions, structure and characteristics

;Definitions The AAOIFI ( Accounting and Auditing Organization for Islamic Financial Institutions, the body which issues standards on accounting, auditing, governance, ethical, and Shari'a standards) defines Sukuk as "securities of equal denomination representing individual ownership interests in a portfolio of eligible existing or future assets," or "'certificates of equal value representing undivided shares in the ownership of tangible assets,usufruct

Usufruct () is a limited real right (or ''in rem'' right) found in civil-law and mixed jurisdictions that unites the two property interests of ''usus'' and ''fructus'':

* ''Usus'' (''use'') is the right to use or enjoy a thing possessed, direct ...

s and services or (in the ownership of) the assets of particular projects or special investment activity'."

The Islamic Financial Services Board defines sukuk as "certificates with each sakk representing a proportional undivided ownership right in tangible assets, or a pool of predominantly tangible assets, or a business venture. These assets may be in a specific project or investment activity in accordance with Sharia rules and principles.The Securities Commission of Malaysia defined sukuk as a document or certificate, which represents the value of an asset. ;Need Sharia forbids both the trading of short-term debt instruments except at face value, and the drawing upon the established interbank money markets (both being seen as transactions involve interest and excessive uncertainty (''

Gharar

''Gharar'' ( ar, غرر) literally means uncertainty, hazard, chance or risk. It is a negative element in ''mu'amalat'' ''fiqh'' (transactional Islamic jurisprudence), like '' riba'' (usury) and '' maysir'' (gambling).

One Islamic dictionary (''A ...

'')). As a consequence, prior to the development of the sukuk market, the balance sheets of Islamic financial institutions tended to be highly illiquid and lacking in short and medium term investment opportunities for their current assets.

;Structure and characteristics

Sukuk are structured in several different ways. (The AAOIFI has laid down 14 different types of sukuk.) While a conventional bond is a promise to repay a loan, sukuk constitute partial ownership in a debt, asset, project, business or investment.

* debt ('' Sukuk Murabaha''). These sukuk are not common because their payments to investors represent debt and are therefore not tradable or negotiable according to sharia. (If diluted with other non-murahaha sukuk in a mixed portfolio they may be traded). Jamaldeen, ''Islamic Finance For Dummies'', 2012:220

* asset (''Sukuk Al Ijara

Sukuk ( ar, صكوك, ṣukūk; plural of ar, صك, ṣakk, legal instrument, deed, cheque, links=no) is the Arabic name for financial certificates, also commonly referred to as "sharia compliant" bonds.

Sukuk are defined by the AAOIFI ( Acco ...

''). These are "essentially" rental or lease contracts, or conventional lease-revenue bonds. With these sukuk, the borrower's tangible asset is 'sold' to the financier and then 'leased' back to the borrowers. The borrowers then make regular payments back to the financiers from the income stream generated by the asset. They are the most common type of sukuk (as of 2015), Khan, ''Islamic Banking in Pakistan'', 2015: p.106 and have been described (by Faleel Jamaldeen) as well known because of there simplicity, tradability and ability to provide a fixed flow of income.

* asset at a future date. ('' Sukuk al-Salam''). In this sukuk the SPV does not buy an asset but agrees to buy one at a future date in exchange for advance payments. The asset is then sold in the future for its cost plus a profit by an agent. On (or before) the date agreed to in the contract, the seller delivers the asset to the agent who sells the asset who passes the proceeds (minus expenses/fees) on to the SPV, which distributes the proceeds to the sukuk holders. Jamaldeen, ''Islamic Finance For Dummies'', 2012:221-2 ''Sukuk al-Salam'' are (at least usually) used to support a company's short term liquidity requirements. Holders receive payment not with a regular flow of income, but at maturity—similar to a zero-coupon bond

A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero- ...

. An example of this kind of sukuk are 91-day CBB Sukuk Al-Salam issued by Central Bank of Bahrain.

* project ('' Sukuk Al Istisna''). These sukuk are complex and cannot be traded in the secondary market or sold to a third party for less than its face value. Jamaldeen, ''Islamic Finance For Dummies'', 2012:225

* business (''Sukuk Al Musharaka

Sukuk ( ar, صكوك, ṣukūk; plural of ar, صك, ṣakk, legal instrument, deed, cheque, links=no) is the Arabic name for financial certificates, also commonly referred to as "sharia compliant" bonds.

Sukuk are defined by the AAOIFI ( Acco ...

''). These sukuk holders are also the owners of the originator issuing the sukuk and participate in the decision-making. These sukuk can be traded in the secondary market. Jamaldeen, ''Islamic Finance For Dummies'', 2012:224

* or investment (''Sukuk Al Istithmar

Sukuk ( ar, صكوك, ṣukūk; plural of ar, صك, ṣakk, legal instrument, deed, cheque, links=no) is the Arabic name for financial certificates, also commonly referred to as "sharia compliant" bonds.

Sukuk are defined by the AAOIFI ( Acco ...

'').

The most commonly used sukuk structures replicate the cash flows of conventional bonds. Such structures are listed on exchanges, commonly the Luxembourg Stock Exchange

The Luxembourg Stock Exchange, LuxSE (french: Bourse de Luxembourg) is based in Luxembourg City at 35A boulevard Joseph II.

The chairman of the board is Alain Kinsch and the chief executive officer is Julie Becker.

The exchange has pre-opening ...

and London Stock Exchange

London Stock Exchange (LSE) is a stock exchange in the City of London, England, United Kingdom. , the total market value of all companies trading on LSE was £3.9 trillion. Its current premises are situated in Paternoster Square close to St Pau ...

in Europe, and made tradable through conventional organisations like Euroclear

Euroclear is a Belgium-based financial services company that specializes in the settlement of securities transactions, as well as the safekeeping and asset servicing of these securities. It was founded in 1968 as part of J.P. Morgan & Co. to set ...

or Clearstream

Clearstream is a financial services company that specializes in the settlement of securities transactions and is owned by Deutsche Börse AG. It provides settlement and custody as well as other related services for securities across all asse ...

. A key technique to achieve capital protection without amounting to a loan is a binding promise to repurchase certain assets; e.g. in the case of ''Sukuk Al Ijara'', by the issuer. In the meantime a rent is being paid, which is often benchmarked to an interest rate (LIBOR

The London Inter-Bank Offered Rate is an interest-rate average calculated from estimates submitted by the leading banks in London. Each bank estimates what it would be charged were it to borrow from other banks. The resulting average rate is u ...

is the most common though its use is criticized by some Sharia Scholars).

The most accepted structure, which is tradable, is thereafter the ''Sukuk Al Ijara''. Debt certificates can only be bought before the finance occurs and then held to maturity, from an Islamic perspective. This is critical for debt trading at market value without incurring the prohibited ''riba

The Royal Institute of British Architects (RIBA) is a professional body for architects primarily in the United Kingdom, but also internationally, founded for the advancement of architecture under its royal charter granted in 1837, three supp ...

'' (interest on money

Money is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular country or socio-economic context. The primary functions which distinguish money ar ...

).

Issuing and payment process

Step-by-step process of issuing a sukuk based on an asset: # The originator—a business firm requiring capital—creates aspecial purpose vehicle

A special-purpose entity (SPE; or, in Europe and India, special-purpose vehicle/SPV; or, in some cases in each EU jurisdiction, FVC, financial vehicle corporation) is a legal entity (usually a limited company of some type or, sometimes, a limited ...

(SPV), an independent entity and structures. The SPV protects the sukuk assets from creditors if the originator has financial troubles. It specifies what asset or activity the sukuk will support, how large the issuance of sukuk will be, their face amounts, interest rates, maturity date. SPV are often located in "tax-efficient jurisdictions" such as Bahrain, Luxembourg or the Cayman Islands. Jamaldeen, ''Islamic Finance For Dummies'', 2012:217

# The SPV issues the sukuk offering it for sale to investors with an agreement spelling out the relationship between obligator and sukuk holders (depending on the type of sukuk this can be lessor and lessee, partner, etc.).

# With the money from the sale of sukuk certificates, the SPV passes offering to the originator who makes the sharia compliant asset purchase, lease, joint venture, etc. (again depending on the type of sukuk).

# The SPV purchases assets (such as land, building, machinery) from the originator.

# The sale proceeds are paid to the originator/debtor as the price of the assets.

# The SPV, acting as a trustee on behalf of the sukuk-holders, arranges to lease the assets back to the originator who pays the sukuk-holders the lease income.

# The originator buys back the asset from the SPV at a nominal price on termination of the lease.Balala, Mahah-Hanaan. 2011. ''Islamic finance and law''. London and New York: I.B. Tauris. p.145

In this type of sukuk, fixed interest of a conventional bond is replaced by fixed lease income. Islamic economist Muhammad Akram Khan complains that sukuk are "different from conventional finance in form and formalities rather than substance", and "may even be more expensive" for the income provided than a conventional bond. Khan, ''What Is Wrong with Islamic Economics?'', 2013: p.51-2

Example

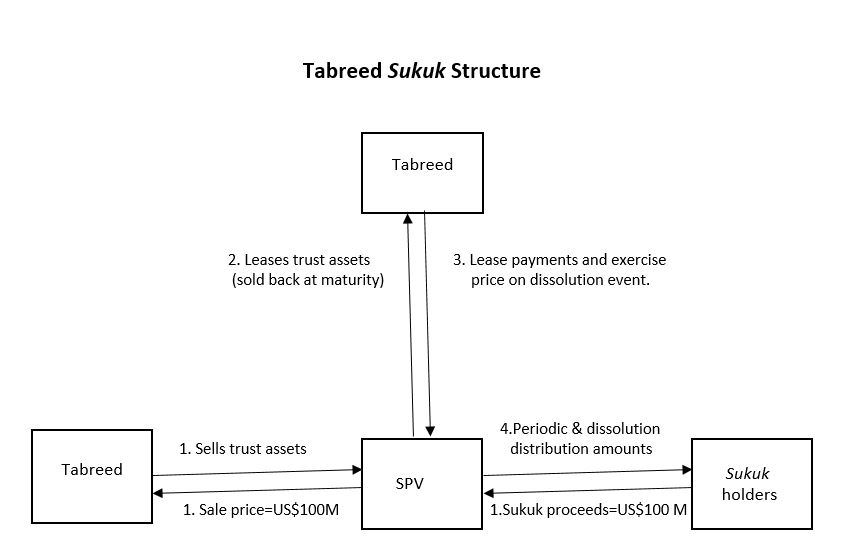

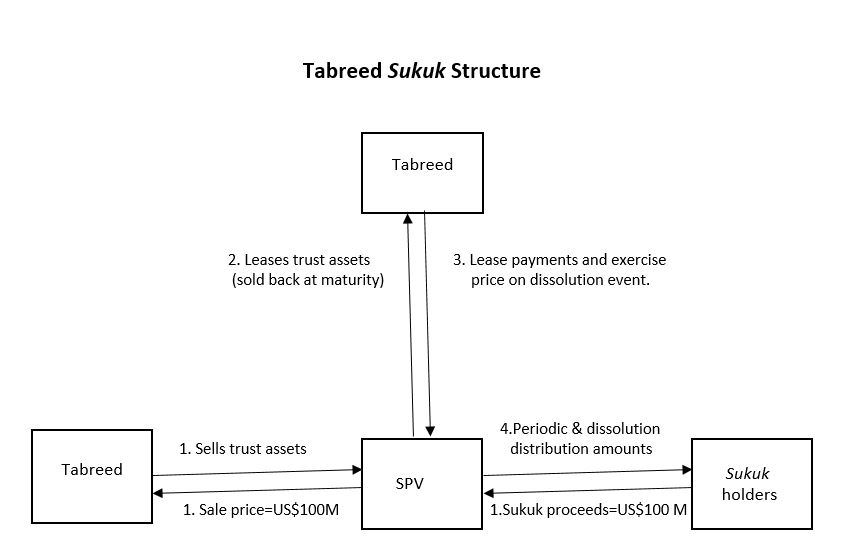

An example of a sukuk was a $100 million security used to finance the construction and delivery of cooling plants in

An example of a sukuk was a $100 million security used to finance the construction and delivery of cooling plants in Abu Dhabi

Abu Dhabi (, ; ar, أَبُو ظَبْيٍ ' ) is the Capital city, capital and List of cities in the United Arab Emirates, second-most populous city (after Dubai) of the United Arab Emirates. It is also the capital of the Emirate of Abu Dha ...

. This sukuk had an istisna'a and ijara structure and was issued by the Tabreed Financing Corporation (or National Central Cooling Company PJSC) in March 2004.

* Tabreed created an SPV (incorporated in the Cayman Islands), which sold certificates of sukuk bonds.

* With the proceeds of this sale it bought some partially completed central cooling plants ("assets" held in trust for the sukuk). (1)

* The SPV leased the trust assets to the Tabreed (2)

* which made rental payments to the SPV (3)

* which passed the payments on to sukuk holders (4).

* When the sukuk matured the trust assets are bought back from the SPV and the sukuk holders got their principal back.

If some "dissolution event" (e.g. destruction of the leased property) had interrupted the payment of rent this would have prompted "the continuation of payments in the form of repurchase price". This reduced the risk structure of the sukuk to that (or near that) of conventional bonds, which permits the sukuk to earn the same or close to the same credit ratings that conventional bonds earn. Consequently, they are able to be sold at an interest rater lower than they might otherwise, although their transactions costs are higher than conventional bonds because of the creation of SPVs, as well as payment of various jurist and legal fees for structuring the bond issuance.

Challenges, criticism and controversy

Challenges

According to a 2015 IMF report, the supply of Sukuk, "falls short of demand" and, with some exceptions "issuance takes place without a comprehensive strategy to develop the domestic market".Sukuk are seen as well-suited for infrastructure financing because of their risk-sharing property could also help fill financing gaps. National authorities should, therefore, focus on developing the necessary infrastructure, including promoting true securitization and enhanced clarity over investors' rights, and on stepping up regular sovereign issuance to provide a benchmark for the private sector. Increased sovereign issuance should be underpinned by sound public financial management."Key challenges" to the Islamic finance industry as a whole—including sukuk—as of 2016 include (according to the ''State of the Global Islamic Economy Report'', 2015/16 and the

IMF

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster glob ...

) are

* "Low levels" of awareness and understanding of Islamic finance products and services among the public, leading them to not buy;

* A "scarcity of Shariah-compliant monetary policy

Monetary policy is the policy adopted by the monetary authority of a nation to control either the interest rate payable for federal funds, very short-term borrowing (borrowing by banks from each other to meet their short-term needs) or the money s ...

instruments" and a lack of understanding of "the monetary transmission mechanism"Islamic Finance: Opportunities, Challenges, and Policy Options, IMF, April 2015, p.6-7 * "Complex financial products and corporate structures" in some countries/jurisdictions because "regulatory and supervisory frameworks" do not "address the unique risks of the industry". Consequently, what is needed is "increased regulatory clarity and harmonization, better cooperation between Islamic and conventional financial standard-setters, and further improvement of supervisory tools". * "Underdeveloped" safety nets and resolution frameworks. In many places these include complete Islamic deposit insurance systems where premiums are invested in Shariah-compliant assets, or Shariah-compliant " lenders-of-last-resort". * Regulators who "do not always have the capacity (or willingness) to ensure Shariah compliance." ''State of the Global Islamic Economy Report'', 2015/16:70 ;Defaults In three years during and following the

Financial crisis of 2007–2008

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of ...

– 2008, 2009, 2010 – there were at least 21 substantial sukuk defaults,

and several large near defaults such as that of Dubai World saved by a $10 billion loan from Abu Dhabi

Abu Dhabi (, ; ar, أَبُو ظَبْيٍ ' ) is the Capital city, capital and List of cities in the United Arab Emirates, second-most populous city (after Dubai) of the United Arab Emirates. It is also the capital of the Emirate of Abu Dha ...

Khan, ''Islamic Banking in Pakistan'', 2015: p.109 As of 2009, there were a number of cases where the ''sukuk'' had defaulted or were in serious trouble.MacFarlane, Isla. 2009. Sukuk slide. ''Islamic Business and Finance'', 43 (June), p.24 http://cpifinancial.net In May 2009, Investment Dar of Kuwait defaulted on $100 million ''sukuk''. Saad Group set up a committee to restructure $650 million Golden Belt 1 ''sukuk''. Standard & Poor's cut the rating of that ''sukuk'' "owing to the non-availability of vital information".

Another source (Mushtak Parker) claims there "have been a mere three or four" sukuk defaults – East Cameron sukuk in Louisiana (a dispute relating to the profit-sharing arrangement of the instrument); the Investment Dar sukuk (to do with "cash flow problems of the company and its subsidiaries, albeit it had a side dispute with an investor, Blom Bank relating to the syariah aspects of the contracts"); and the "notorious" Saad/Al Gosaibi sukuk default ("more a market failure and an internecine dispute between the two Saudi partners").

;Protection from originator's default

At least one of the three major bond rating agencies for the US has indicated doubts about the "validity" of transfer of assets from the originator in sukuk in the "event of an insolvency of the originator" and attempts by creditors to seize the assets. "Fitch has not reviewed any transaction to date that would satisfy these requirements."

Underscoring Fitch's concern was the bankruptcy of East Cameron Partners ECP which issued a multiple-award-winning sukuk in 2006 but filed for bankruptcy in October 2008, prompting a legal dispute about the creditors' right to $167.67 million in ''sukuk'' assets. (The final decision of the case "did not clearly resolve this issue".) Another major rating agency, S&P, downgraded the sukuk of Dubai Islamic bank and Sharjah Islamic Bank.

According to Ibrahim Warde as of 2010,

What is till unclear is what happens to sukuk when they fail – an issue that has not been tested in court. In Malaysia, some sukuk issues have junk status, and two other sukuk are already in default: the Easter Cameron Gas company in the United States and Investment Dar of Kuwait. One of the unresolved questions is whether sukuk holders should stand in the line of creditors or in the line of the owners of underlying assets."Warde, Ibrahim. 2000, 2010. ''Islamic finance in the global economy'', Edinburgh: Edinburgh University Press. p.152In reviewing cases of sukuk defaults and bankruptcies, Muddassir Siddiqui complained that

"Through reading many cases that have so far been litigated in courts around the world, I have found that in almost all cases, the courts have struggled to reconcile the substance and form of the contract. Was it a sale, lease, construction or partnership contract or a financing arrangement between the parties?"According to Rodney Wilson, when sukuk payments are delayed or fail, "the means of redress are potentially more complex than for conventional notes and bonds". In particular "under Shari’ah leniency towards debtors is favoured", which inevitably raises

moral hazard

In economics, a moral hazard is a situation where an economic actor has an incentive to increase its exposure to risk because it does not bear the full costs of that risk. For example, when a corporation is insured, it may take on higher risk ...

problems.

;Discrediting Sharia compliance

There have been at least two cases of companies seeking to restructure their debt (i.e. pay creditors less), claiming that debt they had issued was not in compliance with sharia. In a 2009 court filing Investment Dar, a Kuwaiti company claimed a transaction "was taking deposits at interest".

In June 2017, an independent gas company (Dana Gas PJSC) declared two of its sukuk – with a total worth of $700 million – no longer sharia

Sharia (; ar, شريعة, sharīʿa ) is a body of religious law that forms a part of the Islamic tradition. It is derived from the religious precepts of Islam and is based on the sacred scriptures of Islam, particularly the Quran and the H ...

compliant, and offered to exchange the sukuk with a new one which would pay "less than half of the current profit rates and without a conversion feature". The Sukuk were issued in 2013 and due to mature on 30 October 2017. Dana refused to make payments on them, alleging that "changes in Islamic finance over recent years have made the bonds unlawful in the UAE". A month earlier, Dana had announced plans to restructure the debt, stating it needed to "focus on short to medium-term cash preservation."

Sukuk holders, represented by fund manager BlackRock

BlackRock, Inc. is an American multi-national investment company based in New York City. Founded in 1988, initially as a risk management and fixed income institutional asset manager, BlackRock is the world's largest asset manager, with trill ...

and Deutsche Bank

Deutsche Bank AG (), sometimes referred to simply as Deutsche, is a German multinational investment bank and financial services company headquartered in Frankfurt, Germany, and dual-listed on the Frankfurt Stock Exchange and the New York St ...

, have been arguing against Dana in a London High Court. In October 2017, a court in the emirate of Sharjah in the UAE—where Dana had filed for protection—postponed a ruling on the sukuk. The issue has been called "one of the greatest challenges that the Islamic finance industry has faced in recent times", but the idea that the case is "a blow to Islamic finance" has also been dismissed as "poppycock".

Criticism and controversy

Sukuk have been criticized as evading the restrictions on ''riba

The Royal Institute of British Architects (RIBA) is a professional body for architects primarily in the United Kingdom, but also internationally, founded for the advancement of architecture under its royal charter granted in 1837, three supp ...

,''Warde, Ibrahim. 2000, 2010. ''Islamic finance in the global economy'', Edinburgh: Edinburgh University Press. p.151Ali, Salman S. 2008. Islamic capital market: Current State and developmental challenges. Introduction of ''Islamic capital markets: Products, regulation and development'', ed. Salman Syed Ali, p.9, Jeddah, Islamic Research and Training Institute, Islamic Development Bank. and imitating conventional bonds.

In February 2008, the AAOIFI's board of scholars, led by Sheik Muhammad Taqi Usmani

Muhammad Taqi Usmani (born 5 October 1943) is a Pakistani Islamic scholar and former judge who is the current president of the Wifaq ul Madaris Al-Arabia and the vice president and Hadith professor of the Darul Uloom Karachi. An intellectual ...

, stated that as many as 85 percent of sukuk sold to date may not comply with all the precepts of Shariah. In a paper entitled "Sukuk and their Contemporary Applications" released in November 2007, Usmani, ''Sukuk and their Contemporary Applications'', 2007: Usmani identified the following three key structuring elements that differentiate Sukuk from conventional bonds:

* Sukuk must represent ownership shares in assets or commercial or industrial enterprises that bring profits or revenues

* Payments to Sukuk-holders should be the share of profits (after costs) of the assets or enterprise

* The value payable to the Sukuk-holder on maturity should be the current market value of the assets or enterprise and not the principal originally invested.

Usmani stated that by complex mechanisms Sukuk had taken on the same characteristics as conventional interest-bearing bonds, as they do not return to investors more than a fixed percentage of the principal, based on interest rates, while guaranteeing the return of investors' principal at maturity. Usmani, ''Sukuk and their Contemporary Applications'', 2007:4 Usmani's estimate that 85% of all Sukuk in issuance were not Shariah-compliant was based on the existence of guaranteed returns and/or repurchase obligations from the issuer—a violation of shariah.

Following Usmani's criticisms the global sukuk market shrunk from US$50 billion in 2007 to approximately $14.9 billion in 2008, although how much of this was due to his criticisms or the Global Financial Crisis

Global means of or referring to a globe and may also refer to:

Entertainment

* ''Global'' (Paul van Dyk album), 2003

* ''Global'' (Bunji Garlin album), 2007

* ''Global'' (Humanoid album), 1989

* ''Global'' (Todd Rundgren album), 2015

* Bruno ...

is a matter of debate.

The ''Financial Times

The ''Financial Times'' (''FT'') is a British daily newspaper printed in broadsheet and published digitally that focuses on business and economic current affairs. Based in London, England, the paper is owned by a Japanese holding company, Nik ...

'' has described this as an "ongoing" debate over "form versus substance" in Islamic finance, identifying two kinds of sukuk – "asset-backed" sukuk and the more numerous, less strict, allegedly non-compliant "asset based" sukuk. In "asset-backed" sukuk there is "a true sale between the originator and the special purpose vehicle

A special-purpose entity (SPE; or, in Europe and India, special-purpose vehicle/SPV; or, in some cases in each EU jurisdiction, FVC, financial vehicle corporation) is a legal entity (usually a limited company of some type or, sometimes, a limited ...

(SPV) that issues the sukuk and sukuk holders do not have recourse to the originator". Asset prices may vary over time. In contrast "asset-based" sukuk proceed to report the interest rate that Islamic instruments pay. For instance, Reuters' 13 August 2002, coverage of Bahrain's $800 million sukuk ... followed their characterization of Islamic financial products as "interest-free" with a report that those sukuk will pay "4 percent annual profit". El-Gamal, ''Islamic Finance'', 2006: p.2He also complains that despite claims that sukuk—unlike conventional bonds—share the risk of their underlying asset and may increase or decrease in value, in sukuk such as the Tabreed sukuk mentioned above, steady payment of "rent" is written into the sukuk contract giving them a risk structure "essentially" the same as conventional bonds. El-Gamal, ''Islamic Finance'', 2006: p.6 Another observer, Salman Ali, found that many of the ''sukuk'' structures "do not conform to the ''Shariah''". According to Ali, while most of the sukuk make an effort to remain "within Shariah bounds", they "replicate conventional debt instruments". They often combine more than one contract, "which individually may be ''Shariah''-compliant" but when combined "may defeat the objective of the shariah". Furthermore, the sukuk rate of return is often "tied" to the Libor (London interbank offered rate) or Euribor (euro interbank offered rate) interest rate "rather than to the underlying business" that the sukuk is financing. This makes the sukuk "so similar to conventional debt instruments that it is difficult to tell one from the other". Ali believes this may be why rating agencies such as Standard & Poors and Moody's apply the same methodology for rating sukuk as for conventional debt instruments.Ali, Salman S. 2008. Islamic capital market: Current State and developmental challenges. Introduction o

''Islamic capital markets: Products, regulation and development''

ed. Salman Syed Ali, pp.10, Jeddah, Islamic Research and Training Institute, Islamic Development Bank. In 2011, Safari conducted various statistical and econometrics tests to check the argument that sukuk securities are merely the same as conventional bond. However, his results on the comparison of

yield to maturity

The yield to maturity (YTM), book yield or redemption yield of a bond or other fixed-interest security, such as gilts, is an estimate of the total rate of return anticipated to be earned by an investor who buys a bond at a given market price, h ...

of sukuk and that of conventional bonds show that sukuk securities are different from conventional bonds. In response to this argument, it was pointed out that yield to maturity reflects the interplay of supply and demand which may be affected by a financial product's packaging and target market rather than just the substance of the product alone. In 2011 Goldman Sachs

Goldman Sachs () is an American multinational investment bank and financial services company. Founded in 1869, Goldman Sachs is headquartered at 200 West Street in Lower Manhattan, with regional headquarters in London, Warsaw, Bangalore, Ho ...

abandoned a $2 billion sukuk programme it had registered with the Irish Stock Exchange

Euronext Dublin (formerly The Irish Stock Exchange, ISE; ga, Stocmhalartán na hÉireann) is Ireland's main stock exchange, and has been in existence since 1793.

The Euronext Dublin lists debt and fund securities and is used as a European ga ...

, after some analysts stated that its sukuk "might violate Islamic bans on interest payments and monetary speculation" (in 2014 it successfully drew about $1.5 billion in orders for the five-year sukuk).

Countries using Sukuk

Bahrain

Bahrain is a major issuer of sukuk.Bangladesh

In August 2020, Bangladesh Bank took initiatives to implement sukuk with the help of national private Islamic banks.Brunei

Starting in 2006 the Brunei Government issued short-term Sukuk Al-Ijarah securities. As of 2017 they have issued over B$9.605 billion worth.Egypt

On 8 May 2013, Egyptian President Muhammad Morsi approved a law allowing the government to issue sukuk, however as of May 2013 the relevant regulations have not been specified and this law has been replaced by amending some new articles in the capital market low and its executive regulations. As of 2016 the Egyptian government stated it would use "innovative financial tools for the implementation of government projects", such as Sukuk.Gambia

In 2007, Gambia replaced Sudan as one of the ten countries issuing sukuk. It has one of the lowest amount of sukuk issuance, with $12.6 mil as of 2008.Indonesia

According to islamicfinance.com, at end-2013 outstanding stock in Indonesia's sukuk market was US$12.3 billion, with growth coming driven from the government sector.Iran

Although the first use of Islamic financial instruments in Iran goes back to 1994 with the issuance of Musharakah sukuk byTehran

Tehran (; fa, تهران ) is the largest city in Tehran Province and the capital of Iran. With a population of around 9 million in the city and around 16 million in the larger metropolitan area of Greater Tehran, Tehran is the most popul ...

Municipality to finance Navab project, the enactment of Iran securities market law, and new instruments and financial institutions development law was done respectively in 2005 and 2010 to pave the way for the appliance of such instruments to develop financial system of the country. The first Ijarah sukuk was issued in Iranian Capital Market in January 2011 for financing Mahan Air

Mahan Airlines, operating under the name Mahan Air ( fa, هواپیمایی ماهان, Havâpeymâyi-ye Mâhân), is a privately owned Iranian airline based in Tehran, Iran. It operates scheduled domestic services and international flights to ...

company with the value of 291,500 million Rials.

Malaysia

More than half of sukuk issued worldwide are inMalaysian ringgit

The Malaysian ringgit (; plural: ringgit; symbol: RM; currency code: MYR; Malay name: ''Ringgit Malaysia''; formerly the Malaysian dollar) is the currency of Malaysia. It is divided into 100 ''sen'' (formerly ''cents''). The ringgit is issu ...

, with the United States dollar coming second. Malaysia is one of the few countries that makes it mandatory for sukuk and other debt papers to be rated."Malaysia to maintain stronghold in global sukuk market, says RAM"'' The Saun Daily'', Malaysia, 12 February 2013 RAM Rating Services Bhd CEO Foo Su Yin says the total issuance of sukuk corporate bonds in 2012 was RM 71.7 billion while conventional bonds totalled RM48.3 billion. As at 2011, Malaysia was the highest global sukuk issuer by issuing 69 percent of world's total issuances.

Kazakhstan

In June 2012,Kazakhstan

Kazakhstan, officially the Republic of Kazakhstan, is a transcontinental country located mainly in Central Asia and partly in Eastern Europe. It borders Russia to the north and west, China to the east, Kyrgyzstan to the southeast, Uzbeki ...

finalized its debut sukuk which will be issued by the Development Bank of Kazakhstan (DBK) in the Malaysian market. The DBK, which is 100% owned by the government of Kazakhstan, is working with HSBC and Royal Bank of Scotland (RBS) to manage the ringgit-denominated issuance which is effectively a quasi-sovereign offering. The issuance will be listed on the Kazakhstan Stock Exchange, which has developed the infrastructure to list Islamic financial products such as ''Ijara'' and ''Musharaka Sukuk'' and investment funds.

Kuwait

Pakistan

Pakistan issued a sukuk of $1 billion to fund a trade deficit with a yield of 5%.Qatar

Qatar authorities and government related companies are looking into funding for its infrastructure projects by issuing Sukuk. In 2011 Qatar issued 11 percent of global Sukuk.Saudi Arabia

Saudi Aramco, A Saudi Arabian national petroleum and natural gas company, issued its first ever Sukuk on 6 April 2017. Raising approximately 11.25bn Riyals ($3bn), the move was prompted as a response to the low oil prices. Later in the same month, the Saudi government raised US$9 billion in sukuk. Half were five-year sukuk with 100 basis pointswap spread Swap spreads are the difference between the swap rate (a fixed interest rate) and a corresponding government bond yield with the same maturity ( Treasury securities in the case of the United States).

For example, if the current market rate for a f ...

and the other half had a ten-year tenor with 140 basis point spread. In September 2017, the government sold further domestic sukuk worth 7 billion riyals (US$1.9 billion) and another 4.77 billion riyals (US$1.27 billion) were sold in December. These combined five-year sukuks priced at 2.75%, seven-year ones at 3.25%, and a ten-year tranche at 3.45%.

Singapore

Singapore was the first non-Muslim majority country to issue a Sovereign Sukuk in 2009. Called the MAS Sukuk domestically, it is issued via a wholly owned subsidiary of the Monetary Authority of Singapore – Singapore Sukuk Pte Ltd. The Singapore MAS Sukuk is treated similarly to the conventional Singapore Government Securities ("SGS") in aspects such as compliance with liquidity requirements. Since then there have been several Sukuk issuances in Singapore by local and foreign issuers. Singapore City Development Limited issued the first Ijara Sukuk in 2009, and Khazanah Shd Bhd issued a SGD1.5 billion Sukuk in 2010 to finance its acquisition of parkway holdings. In 2013, there were 2 new Sukuk Programmes arranged for Singapore listed companies – Swiber Holdings & Vallianz Holdings, with the former issuing a SGD150 million 5-year sukuk in Aug 2013.Somalia

TheSomalia Stock Exchange

The Somali Stock Exchange (SSE), also known as the Somalia Stock Exchange, is the national bourse of Somalia founded by SEF.

Overview

The Somali Stock Exchange (SSE) was founded by the management of the Somali Economic Forum (SEF), whose prin ...

(SSE) is the national bourse of Somalia

Somalia, , Osmanya script: 𐒈𐒝𐒑𐒛𐒐𐒘𐒕𐒖; ar, الصومال, aṣ-Ṣūmāl officially the Federal Republic of SomaliaThe ''Federal Republic of Somalia'' is the country's name per Article 1 of thProvisional Constitut ...

. In August 2012, the SSE signed a Memorandum of Understanding to assist it in technical development. The agreement includes identifying appropriate expertise and support. Sharia

Sharia (; ar, شريعة, sharīʿa ) is a body of religious law that forms a part of the Islamic tradition. It is derived from the religious precepts of Islam and is based on the sacred scriptures of Islam, particularly the Quran and the H ...

compliant sukuk bonds and halal

''Halal'' (; ar, حلال, ) is an Arabic word that translates to "permissible" in English. In the Quran, the word ''halal'' is contrasted with '' haram'' (forbidden). This binary opposition was elaborated into a more complex classification k ...

equities

In finance, stock (also capital stock) consists of all the shares by which ownership of a corporation or company is divided.Longman Business English Dictionary: "stock - ''especially AmE'' one of the shares into which ownership of a company ...

are also envisioned as part of the deal as the nascent stock market develops.

Turkey

Turkey issued its debut sukuk in October 2012. The October 2012 issuance was a double issuance, with one being in US Dollars (issued o10 October 2012 for $1.5B

, and one being in Turkish Lira (issued o

2 October 2012 for 1.62LRY

. According to data from Sukuk.com, the US Dollars issuance was oversubscribed and was initially planned to be for $1 billion, but because of strong demand from the Middle East it was increased to $1.5 billion. Turkey returned to the Sukuk market i

October 2013 with a $1.25B issuance

United Arab Emirates

As of January 2015, NASDAQ Dubai has listed 18 sukuk valued at a total $24 billion. The latest of these is Fly Dubai. The UAE has also attracted Western investment in the form of GE, which sold a 5-year, $500 million sukuk in 2009, and investment bankerGoldman Sachs

Goldman Sachs () is an American multinational investment bank and financial services company. Founded in 1869, Goldman Sachs is headquartered at 200 West Street in Lower Manhattan, with regional headquarters in London, Warsaw, Bangalore, Ho ...

, which became first conventional U.S. bank to issue sukuk in 2014. Jamaldeen, ''Islamic Finance For Dummies'', 2012:207

United Kingdom

On 25 June 2014,HM Treasury

His Majesty's Treasury (HM Treasury), occasionally referred to as the Exchequer, or more informally the Treasury, is a Departments of the Government of the United Kingdom, department of Government of the United Kingdom, His Majesty's Government ...

became the first country outside of the Islamic world to issue a sukuk. This £200 million issue was 11.5 times oversubscribed and was priced at the same level as the equivalent UK Gilts (UK government bonds) at 2.036% pa.Britain becomes the first country outside the Islamic world to issue sovereign Sukuk., gov.uk HM Treasury , 25 June 2014

Hong Kong

Hong Kong has issued two sovereign Sukuk as of middle of 2015. It issued its first issuance consisting of a 5-year $1 billion Ijara Sukuk in September 2014 offering a profit rate of 2.005%. It issued its second sovereign Sukuk in June 2015 also for $1 billion with a 5-year maturity which used an innovative Wakala structure offering a profit rate of 1.894%.See also

* Islamic banking and financing *Murabaha

''Murabaḥah'', ''murabaḥa'', or ''murâbaḥah'' ( ar, مرابحة, derived from ''ribh'' ar, ربح, meaning profit) was originally a term of ''fiqh'' (Islamic jurisprudence) for a sales contract where the buyer and seller agree on the m ...

* Profit and loss sharing

Profit and Loss Sharing (also called PLS or participatory banking) refers to Sharia-compliant forms of equity financing such as mudarabah and musharakah. These mechanisms comply with the religious prohibition on interest on loans that most Muslim ...

* Gemach

Gemach ( he, גמ"ח, plural, , ''gemachim'', an abbreviation for , ''gemilut chasadim'', "acts of kindness") is a Jewish free-loan fund that subscribes to both the positive Torah commandment of lending money and the Torah prohibition against cha ...

Notes

References

Sources

* * * * * * * {{Islam topics, state=collapsed Islamic banking Sharia legal terminology Islamic banking and finance terminology Bonds (finance)