|

LIBOR

The London Inter-Bank Offered Rate is an interest-rate average calculated from estimates submitted by the leading banks in London. Each bank estimates what it would be charged were it to borrow from other banks. The resulting average rate is usually abbreviated to Libor () or LIBOR, or more officially to ICE LIBOR (for Intercontinental Exchange LIBOR). It was formerly known as BBA Libor (for British Bankers' Association Libor or the trademark bba libor) before the responsibility for the administration was transferred to Intercontinental Exchange. It is the primary benchmark, along with the Euribor, for short-term interest rates around the world. Libor was phased out at the end of 2021, and market participants are being encouraged to transition to risk-free interest rates. As of late 2022, parts of it have been discontinued, and the rest is scheduled to end within 2023; the Secured Overnight Financing Rate ( SOFR) is its replacement. Libor rates are calculated for five cu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

SOFR

Secured Overnight Financing Rate (SOFR) is a secured interbank overnight interest rate. SOFR is a reference rate (that is, a rate used by parties in commercial contracts that is outside their direct control) established as an alternative to LIBOR. LIBOR has been published in a number of currencies and underpins financial contracts all over the world. Because LIBOR is derived from banks' daily quotes of borrowing costs, banks were able to manipulate the rates through lying in the surveys. Deeming it prone to manipulation, UK regulators decided to discontinue LIBOR in 2021. In 2022, the LIBOR Act passed by the U.S. Congress established SOFR as a default replacement rate for LIBOR contracts that lack mechanisms to deal with LIBOR's cessation. The Act also grants a safe harbor to LIBOR contracts that transition to SOFR. Previously, SOFR was seen as the likely successor of LIBOR in the US since at least 2021. SOFR uses actual costs of transactions in the overnight repo market, cal ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest Rate Swap

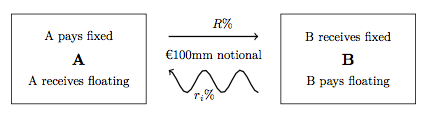

In finance, an interest rate swap (IRS) is an interest rate derivative (IRD). It involves exchange of interest rates between two parties. In particular it is a "linear" IRD and one of the most liquid, benchmark products. It has associations with forward rate agreements (FRAs), and with zero coupon swaps (ZCSs). In its December 2014 statistics release, the Bank for International Settlements reported that interest rate swaps were the largest component of the global OTC derivative market, representing 60%, with the notional amount outstanding in OTC interest rate swaps of $381 trillion, and the gross market value of $14 trillion. Interest rate swaps can be traded as an index through the FTSE MTIRS Index. Interest rate swaps General description An interest rate swap's (IRS's) effective description is a derivative contract, agreed between two counterparties, which specifies the nature of an exchange of payments benchmarked against an interest rate index. The most common IRS ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

British Bankers' Association

The British Bankers' Association (BBA) was a trade association for the UK banking and financial services sector. From 1 July 2017, it was merged into UK Finance. It represented members from a wide range of banking and financial services. The association lobbied for its members and gave its view on the legislative and regulatory system for banking in the UK. Role The BBA described itself as the leading trade association for the UK banking sector with more than 230 member banks headquartered in over 50 countries with operations in 180 jurisdictions worldwide. Structure The BBA was a trade association owned and governed by its members. BBA board The board was the governing body of the Association. It agreed major strategies and policies. Member segment advisory boards Member segment advisory boards provided a forum to inform the agenda of the BBA board and policy committees. There was a member segment advisory board for the major retail banks, challenger banks, small banks, maj ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Forward Rate Agreement

In finance, a forward rate agreement (FRA) is an interest rate derivative (IRD). In particular it is a linear IRD with strong associations with interest rate swaps (IRSs). General description A forward rate agreement's (FRA's) effective description is a cash for difference derivative contract, between two parties, benchmarked against an interest rate index. That index is commonly an interbank offered rate (-IBOR) of specific tenor in different currencies, for example LIBOR in USD, GBP, EURIBOR in EUR or STIBOR in SEK. An FRA between two counterparties requires a fixed rate, notional amount, chosen interest rate index tenor and date to be completely specified.Pricing and Trading Interest Rate Derivatives: A Practical Guide to Swaps J H M Darbyshire, 2017, Extended descriptio ...

|

Eurodollar

Eurodollars are U.S. dollars held in time deposit accounts in banks outside the United States, which thus are not subject to the legal jurisdiction of the U.S. Federal Reserve. Consequently, such deposits are subject to much less regulation than deposits within the U.S. The term was originally applied to U.S. dollar accounts held in banks situated in Europe, but it expanded over the years to cover US dollar accounts held anywhere outside the U.S. Thus, a U.S. dollar-denominated deposit in Tokyo or Beijing would likewise be deemed a Eurodollar deposit (sometimes an Asiadollar). The offshore locations of the Eurodollar make it exposed to potential country risk and economic risk. There is no connection with the euro currency of the European Union. More generally, the ''euro-'' prefix can be used to indicate any currency held in a country where it is not the official currency, broadly termed " eurocurrency", for example, Euroyen or even Euroeuro. History After World War II, the q ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Euribor

The Euro Interbank Offered Rate (Euribor) is a daily reference rate, published by the European Money Markets Institute, based on the averaged interest rates at which Eurozone banks offer to lend unsecured funds to other banks in the euro wholesale money market (or interbank market). Prior to 2015, the rate was published by the European Banking Federation. Scope Euribors are used as a reference rate for euro-denominated forward rate agreements, short-term interest rate futures contracts and interest rate swaps, in very much the same way as LIBORs are commonly used for Sterling Sterling may refer to: Common meanings * Sterling silver, a grade of silver * Sterling (currency), the currency of the United Kingdom ** Pound sterling, the primary unit of that currency Places United Kingdom * Stirling, a Scottish city w ... and US dollar-denominated instruments. They thus provide the basis for some of the world's most liquid and active interest rate markets. D ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Barclays Bank

Barclays () is a British multinational universal bank, headquartered in London, England. Barclays operates as two divisions, Barclays UK and Barclays International, supported by a service company, Barclays Execution Services. Barclays traces its origins to the goldsmith banking business established in the City of London in 1690. James Barclay became a partner in the business in 1736. In 1896, twelve banks in London and the English provinces, including Goslings Bank, Backhouse's Bank and Gurney, Peckover and Company, united as a joint-stock bank under the name Barclays and Co. Over the following decades, Barclays expanded to become a nationwide bank. In 1967, Barclays deployed the world's first cash dispenser. Barclays has made numerous corporate acquisitions, including of London, Provincial and South Western Bank in 1918, British Linen Bank in 1919, Mercantile Credit in 1975, the Woolwich in 2000 and the North American operations of Lehman Brothers in 2008. Barclays has a pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Services Authority

The Financial Services Authority (FSA) was a quasi-judicial body accountable for the regulation of the financial services industry in the United Kingdom between 2001 and 2013. It was founded as the Securities and Investments Board (SIB) in 1985. Its board was appointed by the Treasury, although it operated independently of government. It was structured as a company limited by guarantee and was funded entirely by fees charged to the financial services industry. Due to perceived regulatory failure of the banks during the financial crisis of 2007–2008, the UK government decided to restructure financial regulation and abolish the FSA. On 19 December 2012, the ''Financial Services Act 2012'' received royal assent, abolishing the FSA with effect from 1 April 2013. Its responsibilities were then split between two new agencies: the Financial Conduct Authority and the Prudential Regulation Authority of the Bank of England. Until its abolition, Lord Turner of Ecchinswell was the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

American Bar Association

The American Bar Association (ABA) is a voluntary bar association of lawyers and law students, which is not specific to any jurisdiction in the United States. Founded in 1878, the ABA's most important stated activities are the setting of academic standards for law schools, and the formulation of model ethical codes related to the legal profession. As of fiscal year 2017, the ABA had 194,000 dues-paying members, constituting approximately 14.4% of American attorneys. In 1979, half of all lawyers in the U.S. were members of the ABA. The organization's national headquarters are in Chicago, Illinois, and it also maintains a significant branch office in Washington, D.C. History The ABA was founded on August 21, 1878, in Saratoga Springs, New York, by 75 lawyers from 20 states and the District of Columbia. According to the ABA website: The purpose of the original organization, as set forth in its first constitution, was "the advancement of the science of jurisprudence, the pro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Foreign Exchange Option

In finance, a foreign exchange option (commonly shortened to just FX option or currency option) is a derivative financial instrument that gives the right but not the obligation to exchange money denominated in one currency into another currency at a pre-agreed exchange rate on a specified date. See Foreign exchange derivative. The foreign exchange options market is the deepest, largest and most liquid market for options of any kind. Most trading is over the counter (OTC) and is lightly regulated, but a fraction is traded on exchanges like the International Securities Exchange, Philadelphia Stock Exchange, or the Chicago Mercantile Exchange for options on futures contracts. The global market for exchange-traded currency options was notionally valued by the Bank for International Settlements at $158.3 trillion in 2005. Example For example, a GBPUSD contract could give the owner the right to sell £1,000,000 and buy $2,000,000 on December 31. In this case the pre-agreed exchang ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Londres 353

Londres may refer to: Locations * London, capital of the United Kingdom and England, called ''Londres'' in French, Spanish, Portuguese, Catalan, Galician, and Filipino * Londres, Catamarca, Argentina, formally "San Juan de la Ribera de Londres" or "Londres de la Nueva Inglaterra" * Londres, Costa Rica, small rural Costa Rican community about east of Quepos on the Rio Naranjo river * Nueva Londres, a town in the Caaguazú department of Paraguay People with the surname * Albert Londres (1884–1932), French journalist and writer * Richie Londres, also known as Altered Beats, English musician, hip hop record producer, lead guitarist and multi-instrumentalist Other uses *Albert Londres Prize, prize in the name of Albert Londres *Radio Londres, a radio broadcast from 1940 to 1944 from the BBC in London to Nazi occupied France * Londres Nova, Mars, capital of the Martian Congressional Republic in the Expanse series See also * London (other) London is the capital city ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Of England

The Bank of England is the central bank of the United Kingdom and the model on which most modern central banks have been based. Established in 1694 to act as the English Government's banker, and still one of the bankers for the Government of the United Kingdom, it is the world's eighth-oldest bank. It was privately owned by stockholders from its foundation in 1694 until it was nationalised in 1946 by the Attlee ministry. The Bank became an independent public organisation in 1998, wholly owned by the Treasury Solicitor on behalf of the government, with a mandate to support the economic policies of the government of the day, but independence in maintaining price stability. The Bank is one of eight banks authorised to issue banknotes in the United Kingdom, has a monopoly on the issue of banknotes in England and Wales, and regulates the issue of banknotes by commercial banks in Scotland and Northern Ireland. The Bank's Monetary Policy Committee has devolved responsibi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |