|

EURIBOR

The Euro Interbank Offered Rate (Euribor) is a daily reference rate, published by the European Money Markets Institute, based on the averaged interest rates at which Eurozone banks offer to lend unsecured funds to other banks in the euro wholesale money market (or interbank market). Prior to 2015, the rate was published by the European Banking Federation. Scope Euribors are used as a reference rate for euro-denominated forward rate agreements, short-term interest rate futures contracts and interest rate swaps, in very much the same way as LIBORs are commonly used for Sterling and US dollar-denominated instruments. They thus provide the basis for some of the world's most liquid and active interest rate markets. Domestic reference rates, like Paris' PIBOR, Frankfurt's FIBOR, and Helsinki's Helibor merged into Euribor on EMU day on 1 January 1999. Euribor should be distinguished from the less commonly used "Euro LIBOR" rates set in London by 16 major banks. Technical feature ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

LIBOR

The London Inter-Bank Offered Rate is an interest-rate average calculated from estimates submitted by the leading banks in London. Each bank estimates what it would be charged were it to borrow from other banks. The resulting average rate is usually abbreviated to Libor () or LIBOR, or more officially to ICE LIBOR (for Intercontinental Exchange LIBOR). It was formerly known as BBA Libor (for British Bankers' Association Libor or the trademark bba libor) before the responsibility for the administration was transferred to Intercontinental Exchange. It is the primary benchmark, along with the Euribor, for short-term interest rates around the world. Libor was phased out at the end of 2021, and market participants are being encouraged to transition to risk-free interest rates. As of late 2022, parts of it have been discontinued, and the rest is scheduled to end within 2023; the Secured Overnight Financing Rate (SOFR) is its replacement. Libor rates are calculated for five currenci ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest Rate Swap

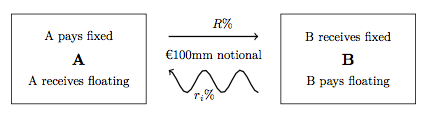

In finance, an interest rate swap (IRS) is an interest rate derivative (IRD). It involves exchange of interest rates between two parties. In particular it is a "linear" IRD and one of the most liquid, benchmark products. It has associations with forward rate agreements (FRAs), and with zero coupon swaps (ZCSs). In its December 2014 statistics release, the Bank for International Settlements reported that interest rate swaps were the largest component of the global OTC derivative market, representing 60%, with the notional amount outstanding in OTC interest rate swaps of $381 trillion, and the gross market value of $14 trillion. Interest rate swaps can be traded as an index through the FTSE MTIRS Index. Interest rate swaps General description An interest rate swap's (IRS's) effective description is a derivative contract, agreed between two counterparties, which specifies the nature of an exchange of payments benchmarked against an interest rate index. The most common IRS ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Forward Rate Agreement

In finance, a forward rate agreement (FRA) is an interest rate derivative (IRD). In particular it is a linear IRD with strong associations with interest rate swaps (IRSs). General description A forward rate agreement's (FRA's) effective description is a cash for difference derivative contract, between two parties, benchmarked against an interest rate index. That index is commonly an interbank offered rate (-IBOR) of specific tenor in different currencies, for example LIBOR in USD, GBP, EURIBOR in EUR or STIBOR in SEK. An FRA between two counterparties requires a fixed rate, notional amount, chosen interest rate index tenor and date to be completely specified.Pricing and Trading Interest Rate Derivatives: A Practical Guide to Swaps J H M Darbyshire, 2017, Extended description ...

|

European Banking Federation

The European Banking Federation is a trade association representing national banking associations in countries of the European Union and the European Free Trade Association. It represents over 3500 banks and about 2.6 million employees. It was established in 1960. Members In November 2022 the members were: *Austria - The Austrian Bankers' Association *Belgium - Febelfin *Bulgaria - Association of Banks in Bulgaria *Croatia - Croatian Banking Association *Cyprus - Association of Cyprus Commercial Banks *Czech Republic - Czech Banking Association *Denmark - Finance Denmark - FD *Estonia - The Estonian Banking Association *Finland - The Federation of Finnish Financial Services *France - French Banking Federation *Germany - Bundesverband deutscher Banken *Greece - The Hellenic Bank Association *Hungary - The Hungarian Banking Association *Iceland - Icelandic Financial Services Association *Ireland - Irish Banking Federation *Italy - Italian Banking Association *Latvia - As ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Futures Contract

In finance, a futures contract (sometimes called a futures) is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The asset transacted is usually a commodity or financial instrument. The predetermined price of the contract is known as the ''forward price''. The specified time in the future when delivery and payment occur is known as the ''delivery date''. Because it derives its value from the value of the underlying asset, a futures contract is a derivative. Contracts are traded at futures exchanges, which act as a marketplace between buyers and sellers. The buyer of a contract is said to be the long position holder and the selling party is said to be the short position holder. As both parties risk their counter-party reneging if the price goes against them, the contract may involve both parties lodging as security a margin of the value of the contract with a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Spot Rate

In finance, a spot contract, spot transaction, or simply spot, is a contract of buying or selling a commodity, security or currency for immediate settlement (payment and delivery) on the spot date, which is normally two business days after the trade date. The settlement price (or rate) is called spot price (or spot rate). A spot contract is in contrast with a forward contract or futures contract where contract terms are agreed now but delivery and payment will occur at a future date. Spot prices and future price expectations Depending on the item being traded, spot prices can indicate market expectations of future price movements in different ways. For a security or non-perishable commodity (e.g. silver), the spot price reflects market expectations of future price movements. In theory, the difference in spot and forward prices should be equal to the finance charges, plus any earnings due to the holder of the security, according to the cost of carry model. For example, on a s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Truncated Mean

A truncated mean or trimmed mean is a statistical measure of central tendency, much like the mean and median. It involves the calculation of the mean after discarding given parts of a probability distribution or sample at the high and low end, and typically discarding an equal amount of both. This number of points to be discarded is usually given as a percentage of the total number of points, but may also be given as a fixed number of points. For most statistical applications, 5 to 25 percent of the ends are discarded. For example, given a set of 8 points, trimming by 12.5% would discard the minimum and maximum value in the sample: the smallest and largest values, and would compute the mean of the remaining 6 points. The 25% trimmed mean (when the lowest 25% and the highest 25% are discarded) is known as the interquartile mean. The median can be regarded as a fully truncated mean and is most robust. As with other trimmed estimators, the main advantage of the trimmed mean is robu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

TARGET

Target may refer to: Physical items * Shooting target, used in marksmanship training and various shooting sports ** Bullseye (target), the goal one for which one aims in many of these sports ** Aiming point, in field artillery, fixed at a specific target * Color chart (or reference card), the reference target used in digital imaging for accurate color reproduction Places * Target, Allier, France * Target Lake, a lake in Minnesota Terms * Target market, marketing strategy ** Target audience, intended audience or readership of a publication, advertisement, or type of message * In mathematics, the target of a function is also called the codomain * Target (cricket), the total number of runs a team needs to win People * Target (rapper), stage name of Croatian hip-hop artist Nenad Šimun * DJ Target, stage name of English grime DJ Darren Joseph, member of Roll Deep * Gui-Jean-Baptiste Target (1733–1807), French lawyer Art and media * The Target, a comic book charact ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Day Count Convention

In finance, a day count convention determines how interest accrues over time for a variety of investments, including bonds, notes, loans, mortgages, medium-term notes, swaps, and forward rate agreements (FRAs). This determines the number of days between two coupon payments, thus calculating the amount transferred on payment dates and also the accrued interest for dates between payments. The day count is also used to quantify periods of time when discounting a cash-flow to its present value. When a security such as a bond is sold between interest payment dates, the seller is eligible to some fraction of the coupon amount. The day count convention is used in many other formulas in financial mathematics as well. Development The need for day count conventions is a direct consequence of interest-earning investments. Different conventions were developed to address often conflicting requirements, including ease of calculation, constancy of time period (day, month, or year) and the need ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

London

London is the capital and largest city of England and the United Kingdom, with a population of just under 9 million. It stands on the River Thames in south-east England at the head of a estuary down to the North Sea, and has been a major settlement for two millennia. The City of London, its ancient core and financial centre, was founded by the Romans as '' Londinium'' and retains its medieval boundaries.See also: Independent city § National capitals The City of Westminster, to the west of the City of London, has for centuries hosted the national government and parliament. Since the 19th century, the name "London" has also referred to the metropolis around this core, historically split between the counties of Middlesex, Essex, Surrey, Kent, and Hertfordshire, which largely comprises Greater London, governed by the Greater London Authority.The Greater London Authority consists of the Mayor of London and the London Assembly. The London Mayor is distinguished fr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1 January 1999 And Continuing

1 (one, unit, unity) is a number representing a single or the only entity. 1 is also a numerical digit and represents a single unit of counting or measurement. For example, a line segment of ''unit length'' is a line segment of length 1. In conventions of sign where zero is considered neither positive nor negative, 1 is the first and smallest positive integer. It is also sometimes considered the first of the infinite sequence of natural numbers, followed by 2, although by other definitions 1 is the second natural number, following 0. The fundamental mathematical property of 1 is to be a multiplicative identity, meaning that any number multiplied by 1 equals the same number. Most if not all properties of 1 can be deduced from this. In advanced mathematics, a multiplicative identity is often denoted 1, even if it is not a number. 1 is by convention not considered a prime number; this was not universally accepted until the mid-20th century. Additionally, 1 is the s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Helibor

Helibor (''Helsinki Interbank Offered Rate'') was a reference rate that was used in 1987–1998 on the Finnish interbank market. It was calculated each day as an average of the interest rates at which the banks offered to lend unsecured, Finnish markka nominated funds to each other. Helibor was quoted for 1, 2, 3, 6, 9 and 12 month maturities. It was widely used as a reference rate for company loansMika VaihekoskiThe Finnish Stock Market: Recent Trends and Important Events Liiketaloudellinen Aikakauskirja — The Finnish Journal of Business Economics, 4/1997. and housing loans.G. Geoffrey Booth et alThe financing of residential real estate in Finland: an overview. Journal of Housing Research 5(2). 1994. Before deregulation and floating the currency, it was rather high compared to the rest of the Western world, meaning that for instance mortgage interest rates were regularly ca. 15%. This so-called ''Suomi-lisä'' was removed by deregulation. The Bank of Finland began publishing H ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |