Trust Law In England And Wales on:

[Wikipedia]

[Google]

[Amazon]

English trust law concerns the protection of assets, usually when they are held by one party for another's benefit.

English trust law concerns the protection of assets, usually when they are held by one party for another's benefit.

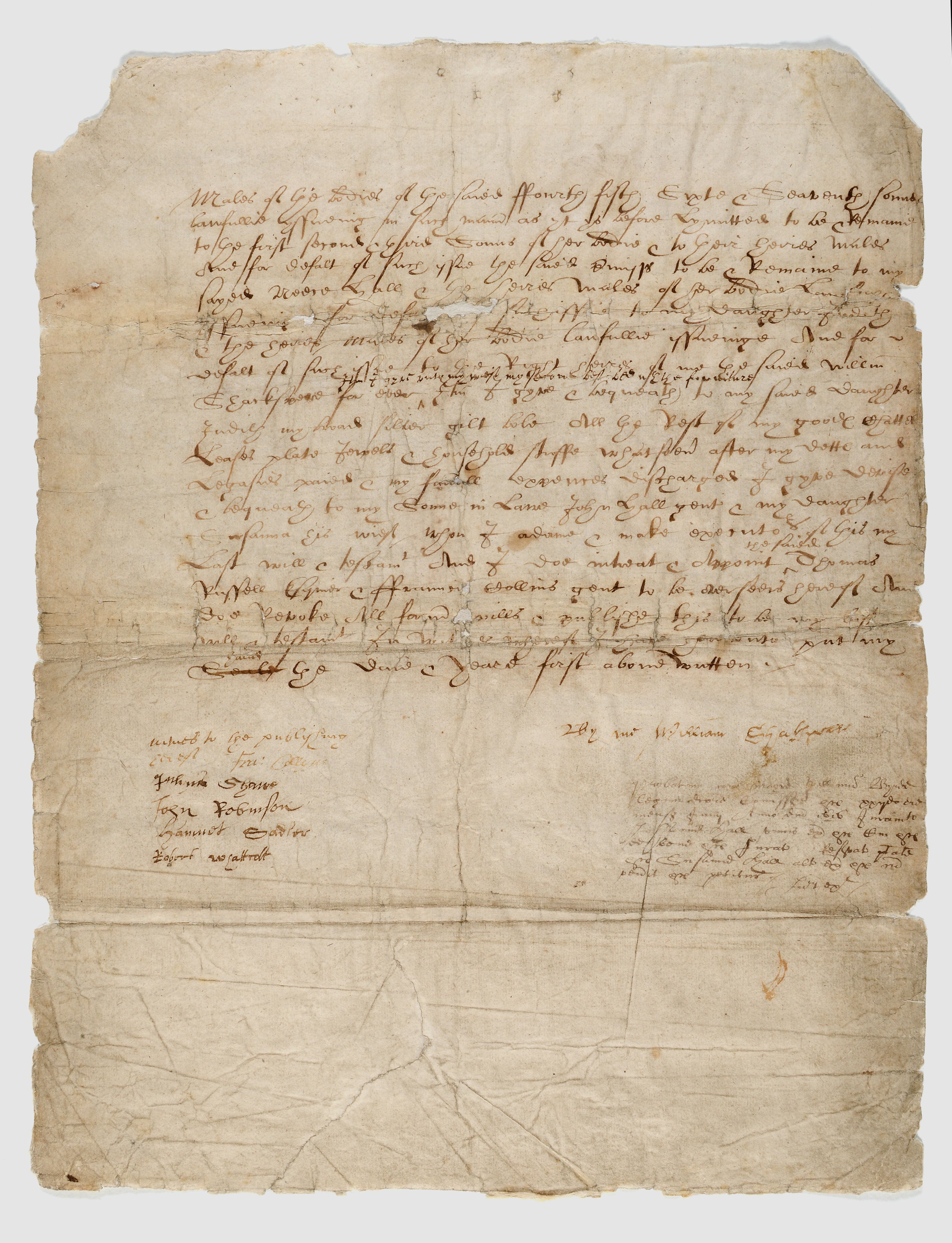

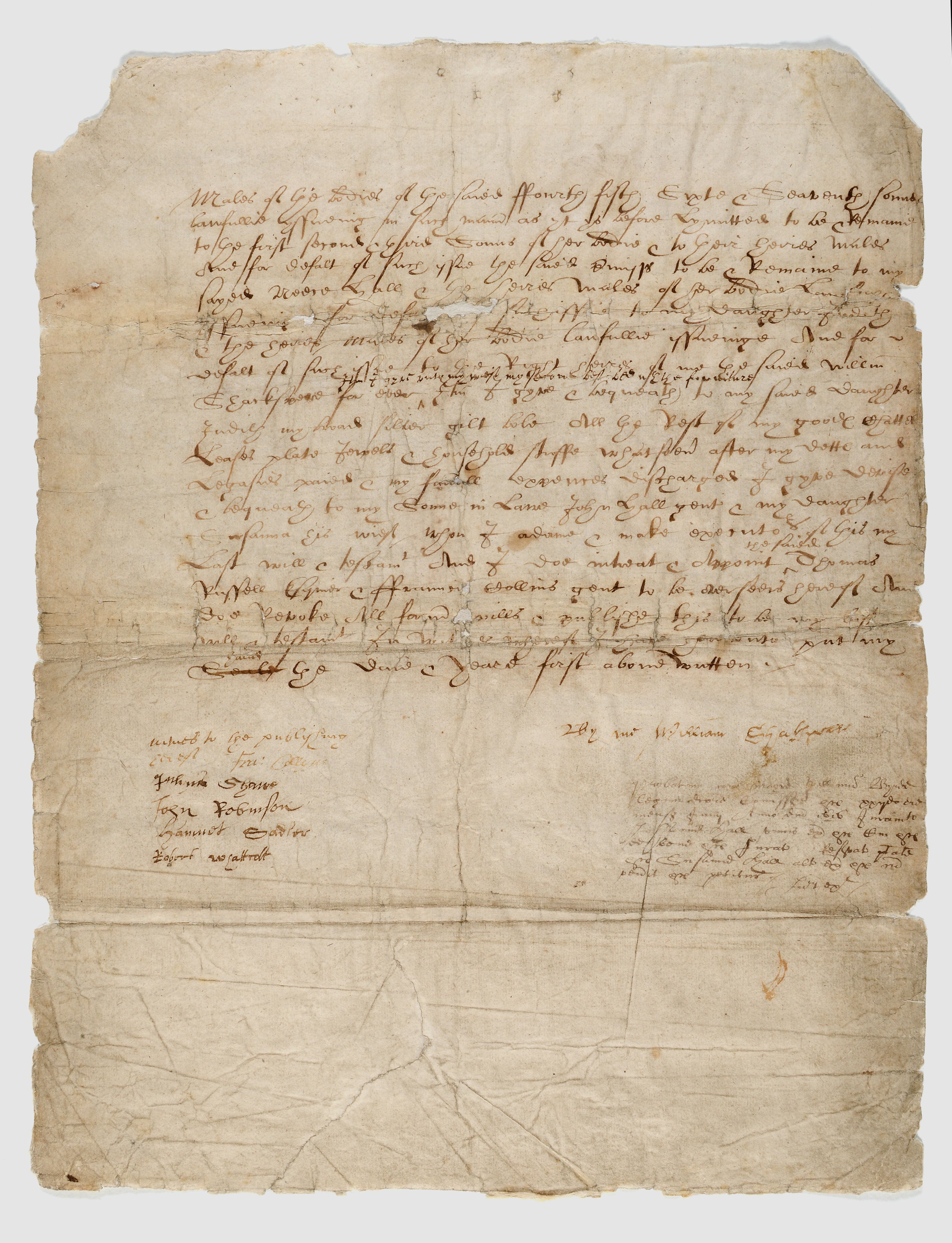

During the 15th century and 16th century, "uses" or "trusts" were also employed to avoid the payment of feudal taxation. If a person died, the law stated a landlord was entitled to money before the land passed to an heir, and the landlord got all of the property under the doctrine of

During the 15th century and 16th century, "uses" or "trusts" were also employed to avoid the payment of feudal taxation. If a person died, the law stated a landlord was entitled to money before the land passed to an heir, and the landlord got all of the property under the doctrine of  By the late 17th century, it had become an ever more widely held view that equitable rules and the law of trusts varied unpredictably, as the jurist

By the late 17th century, it had become an ever more widely held view that equitable rules and the law of trusts varied unpredictably, as the jurist  Over the 20th century, trusts came to be used for multiple purposes beyond the classical role of parcelling out wealthy families' estates, wills, or charities. First, as more working-class people became more affluent, they began to be able to save for retirement through

Over the 20th century, trusts came to be used for multiple purposes beyond the classical role of parcelling out wealthy families' estates, wills, or charities. First, as more working-class people became more affluent, they began to be able to save for retirement through

In its essence the word "trust" applies to any situation where one person holds

In its essence the word "trust" applies to any situation where one person holds

Much like a contract, express trusts are usually formed based on the expressed intentions of a person who owns some property to in future have it managed by a trustee, and used for another person's benefit. Often the courts see cases where people have recently died, and expressed a wish to use property for another person, but have not used legal terminology. In principle, this does not matter. In ''

Much like a contract, express trusts are usually formed based on the expressed intentions of a person who owns some property to in future have it managed by a trustee, and used for another person's benefit. Often the courts see cases where people have recently died, and expressed a wish to use property for another person, but have not used legal terminology. In principle, this does not matter. In ''

However, the courts have had difficulty in defining appropriate principles for cases where trusts are declared over property that many people have an interest in. This is especially true where the person who possesses that property has gone

However, the courts have had difficulty in defining appropriate principles for cases where trusts are declared over property that many people have an interest in. This is especially true where the person who possesses that property has gone

There are commonly said to be three (or maybe four) small exceptions to the rule against enforcing non-charitable purpose trusts, and there is one certain and major loophole. First, trusts can be created for building and maintaining graves and funeral monuments. Second, trusts have been allowed for the saying of private masses. Third, it was (long before the

There are commonly said to be three (or maybe four) small exceptions to the rule against enforcing non-charitable purpose trusts, and there is one certain and major loophole. First, trusts can be created for building and maintaining graves and funeral monuments. Second, trusts have been allowed for the saying of private masses. Third, it was (long before the

Another way of thinking about associations' property, that came to be the dominant and practical view, was first stated by Brightman J in '' Re Recher's Will Trusts''. Here it was said that, if no words are used that indicate a trust is intended, a "gift takes effect in favour of the existing members of the association as an accretion to the funds which are the subject-matter of the contract". In other words, property will be held according to the members' contractual terms of their association. This matters for deciding whether a gift will succeed or be held to fail, although that possibility is unlikely on any contemporary view. It also matters where an association is being wound up, and there is a dispute over who should take the remaining property. In a recent decision, ''

Another way of thinking about associations' property, that came to be the dominant and practical view, was first stated by Brightman J in '' Re Recher's Will Trusts''. Here it was said that, if no words are used that indicate a trust is intended, a "gift takes effect in favour of the existing members of the association as an accretion to the funds which are the subject-matter of the contract". In other words, property will be held according to the members' contractual terms of their association. This matters for deciding whether a gift will succeed or be held to fail, although that possibility is unlikely on any contemporary view. It also matters where an association is being wound up, and there is a dispute over who should take the remaining property. In a recent decision, ''

Because pension schemes save up significant amounts of money, which many people rely on in retirement, protection against an employer's

Because pension schemes save up significant amounts of money, which many people rely on in retirement, protection against an employer's

Despite the name, "

Despite the name, "

While express trusts arise primarily because of a conscious plan that settlors, trustees or beneficiaries

While express trusts arise primarily because of a conscious plan that settlors, trustees or beneficiaries

As well as resulting trusts, where the courts have presumed that the transferor would have intended the property return, there are resulting trusts which arise by automatic operation of the law. A key example is where property is transferred to a trustee, but too much is handed over. The surplus will be held by the recipient on a resulting trust. For example, in the Privy Council case of ''

As well as resulting trusts, where the courts have presumed that the transferor would have intended the property return, there are resulting trusts which arise by automatic operation of the law. A key example is where property is transferred to a trustee, but too much is handed over. The surplus will be held by the recipient on a resulting trust. For example, in the Privy Council case of ''

The constructive trusts that are usually seen as responding to consent (for instance, like a commercial

The constructive trusts that are usually seen as responding to consent (for instance, like a commercial

Once a trust has been validly formed, the trust's terms guide its operation. While professionally drafted trust instruments often contain a full description of how trustees are appointed, how they should manage the property, and their rights and obligations, the law supplies a comprehensive set of default rules. Some were codified in the

Once a trust has been validly formed, the trust's terms guide its operation. While professionally drafted trust instruments often contain a full description of how trustees are appointed, how they should manage the property, and their rights and obligations, the law supplies a comprehensive set of default rules. Some were codified in the

The core duty of a trustee is to pursue the interests of the beneficiaries, or anyone else the trust permits, except the interests of the trustee himself. Put positively, this is described as the "fiduciary duty of loyalty". The term "fiduciary" simply means someone in a position of trust and confidence, and because a trustee is the core example of this, English law has for three centuries consistently reaffirmed that trustees, put negatively, may have no possibility of a conflict of interest. Shortly after the United Kingdom was formed, it had its first stock market crash in the South Sea Bubble, a crash where corrupt directors, trustees or politicians ruined the economy. Soon after, the Chancery Court decided ''Keech v Sandford''. On a much smaller scale than the recent economic collapse, Keech claimed he was entitled to the profits his trustee, Sandford, had made by buying the lease on a market in Romford, now in East London. While Keech was still an infant, Sandford alleged he had been told by the market landlord that there would be no renewal for a child beneficiary. Only then, alleged Sandford, did he inquire and contract to purchase the lease in his own name. Lord King LC held this was irrelevant, because no matter how honest, the consequences of allowing a relaxed approach to trustee duties would be worse.

The remedy for beneficiaries is

The core duty of a trustee is to pursue the interests of the beneficiaries, or anyone else the trust permits, except the interests of the trustee himself. Put positively, this is described as the "fiduciary duty of loyalty". The term "fiduciary" simply means someone in a position of trust and confidence, and because a trustee is the core example of this, English law has for three centuries consistently reaffirmed that trustees, put negatively, may have no possibility of a conflict of interest. Shortly after the United Kingdom was formed, it had its first stock market crash in the South Sea Bubble, a crash where corrupt directors, trustees or politicians ruined the economy. Soon after, the Chancery Court decided ''Keech v Sandford''. On a much smaller scale than the recent economic collapse, Keech claimed he was entitled to the profits his trustee, Sandford, had made by buying the lease on a market in Romford, now in East London. While Keech was still an infant, Sandford alleged he had been told by the market landlord that there would be no renewal for a child beneficiary. Only then, alleged Sandford, did he inquire and contract to purchase the lease in his own name. Lord King LC held this was irrelevant, because no matter how honest, the consequences of allowing a relaxed approach to trustee duties would be worse.

The remedy for beneficiaries is

The duty of care owed by trustees and fiduciaries has its partner in the common law of negligence, and was also long recognised by courts of equity. Millett LJ, however, in ''Bristol and West Building Society v Mothew'' emphasised that although recognised in equity, and applicable to fiduciaries, the duty of care is not itself a fiduciary duty, like the rule against conflicts of interest. This means that like ordinary negligence actions, the common law requirements for proving causation of loss apply, and the remedy for breach of duty is of compensation for losses rather than restitution of gains. In ''Mothew'' this meant that a solicitor (who occupies a fiduciary position, like a trustee) who negligently told a building society that its client had no second mortgage was not liable for the loss in the property's value after the client defaulted. Mr Mothew successfully argued that Bristol & West would have granted the loan in any case, and so his advice did not cause their loss.

The duty of care was codified in the

The duty of care owed by trustees and fiduciaries has its partner in the common law of negligence, and was also long recognised by courts of equity. Millett LJ, however, in ''Bristol and West Building Society v Mothew'' emphasised that although recognised in equity, and applicable to fiduciaries, the duty of care is not itself a fiduciary duty, like the rule against conflicts of interest. This means that like ordinary negligence actions, the common law requirements for proving causation of loss apply, and the remedy for breach of duty is of compensation for losses rather than restitution of gains. In ''Mothew'' this meant that a solicitor (who occupies a fiduciary position, like a trustee) who negligently told a building society that its client had no second mortgage was not liable for the loss in the property's value after the client defaulted. Mr Mothew successfully argued that Bristol & West would have granted the loan in any case, and so his advice did not cause their loss.

The duty of care was codified in the

First, the courts have said that in choosing investments, trustees may not disregard the financial implications of the investment choice. In ''Cowan v Scargill'' the trustees of pensions represented by Arthur Scargill and the National Union of Mineworkers (Great Britain), National Union of Mineworkers wished the pension fund to invest more in the troubled UK mining industry, by excluding investments, for instance, in competing industries, while the trustees appointed by the employer did not. Megarry J held the action would violate a trustee's duty if this action was taken. Drawing a parallel of refusing to invest in South African companies (during Apartheid) he warned that "the best interests of the beneficiaries are normally their best financial interests." Although this was thought in some quarters to preclude ethical investment, it was made clear in ''Harries v Church Commissioners for England'' that the terms of a trust deed may explicitly authorise or prohibit certain investments, that if the object of a trust is, for example, Christian charity then a trustee could plainly invest in "Christian" things. In ''Harries'', Donald Nicholls VC held that unless financial performance could be proven to be harmed, a trustee for church clergy retirement could take ethical considerations into account when investing money, and so avoid investments contrary to the religion's principles. By analogy, a trade union pension trustee could refuse to invest in apartheid South Africa, while the government there suppressed unions. The government commissioned report by Roy Goode on ''Pension Law Reform'' confirmed the view that trustees may have an ethical investment policy and use their discretion in following it. The modern approach in trust law is consistent with the UK company law duty of directors to pay regard to all stakeholders, not merely shareholders, in a company's management. Trustees must simply invest according to general principles of the duty of care, and diversification.

The second primary area where courts have sought to constrain trustee discretion, but recently have retreated, is in the rule that trustees' decisions may be interfered with if irrelevant issues are taken into account, or relevant issues are ignored. There had been suggestions that a decision could be wholly void, which led to a flood of claims where trustees had failed to get advice on taxation of trust transactions and were sometimes successful in having the transaction annulled and escaping payments to the Revenue. However, in the leading case, ''Pitt v Holt'' the Supreme Court reaffirmed that poorly considered decisions may only become voidable (and so cannot be cancelled if a third party, like the Revenue, is affected) and only if mistakes are "fundamental" can a transaction be wholly void. In one appeal, a trustee for her husband's worker compensation got poor advice and was liable for more inheritance tax, and in the second, a trustee for his children got poor advice and was liable for more capital gains tax. The UK Supreme Court found that both transactions were valid. If a trustee had acted in breach of duty, but within its powers, then a transaction was voidable. However, on the facts, the trustees seeking advice had fulfilled their duty (and so the advisers could be liable for negligence instead).

First, the courts have said that in choosing investments, trustees may not disregard the financial implications of the investment choice. In ''Cowan v Scargill'' the trustees of pensions represented by Arthur Scargill and the National Union of Mineworkers (Great Britain), National Union of Mineworkers wished the pension fund to invest more in the troubled UK mining industry, by excluding investments, for instance, in competing industries, while the trustees appointed by the employer did not. Megarry J held the action would violate a trustee's duty if this action was taken. Drawing a parallel of refusing to invest in South African companies (during Apartheid) he warned that "the best interests of the beneficiaries are normally their best financial interests." Although this was thought in some quarters to preclude ethical investment, it was made clear in ''Harries v Church Commissioners for England'' that the terms of a trust deed may explicitly authorise or prohibit certain investments, that if the object of a trust is, for example, Christian charity then a trustee could plainly invest in "Christian" things. In ''Harries'', Donald Nicholls VC held that unless financial performance could be proven to be harmed, a trustee for church clergy retirement could take ethical considerations into account when investing money, and so avoid investments contrary to the religion's principles. By analogy, a trade union pension trustee could refuse to invest in apartheid South Africa, while the government there suppressed unions. The government commissioned report by Roy Goode on ''Pension Law Reform'' confirmed the view that trustees may have an ethical investment policy and use their discretion in following it. The modern approach in trust law is consistent with the UK company law duty of directors to pay regard to all stakeholders, not merely shareholders, in a company's management. Trustees must simply invest according to general principles of the duty of care, and diversification.

The second primary area where courts have sought to constrain trustee discretion, but recently have retreated, is in the rule that trustees' decisions may be interfered with if irrelevant issues are taken into account, or relevant issues are ignored. There had been suggestions that a decision could be wholly void, which led to a flood of claims where trustees had failed to get advice on taxation of trust transactions and were sometimes successful in having the transaction annulled and escaping payments to the Revenue. However, in the leading case, ''Pitt v Holt'' the Supreme Court reaffirmed that poorly considered decisions may only become voidable (and so cannot be cancelled if a third party, like the Revenue, is affected) and only if mistakes are "fundamental" can a transaction be wholly void. In one appeal, a trustee for her husband's worker compensation got poor advice and was liable for more inheritance tax, and in the second, a trustee for his children got poor advice and was liable for more capital gains tax. The UK Supreme Court found that both transactions were valid. If a trustee had acted in breach of duty, but within its powers, then a transaction was voidable. However, on the facts, the trustees seeking advice had fulfilled their duty (and so the advisers could be liable for negligence instead).

When trustees fail in their main duties, the law imposes remedies according to the nature of the breach. In general, breaches of rules surrounding performance of the trust's terms can be remedied through an award of specific performance, or compensation. Breaches of the duty of care will trigger a right to damages, compensation. Breaches of the duty to avoid conflicts of interest, and misapplications of property will give rise to a restitutionary claim, to restore the property taken away. In these last two situations, the courts of equity developed further principles of liability that could be applied even when a trustee had gone bankrupt. Some recipients of property that came from a breach of trust, as well as people who had assisted in a breach of trust, might incur liability. Equity recognised not merely a personal, but also a property, proprietary claim over assets taken in breach of trust, and perhaps also profits made in breach of the duty of loyalty. A proprietary claim meant that the claimant could demand the thing in priority to other creditors of the bankrupt trustee. Alternatively, the courts would follow an asset or trace its value if the trust property was exchanged for some other asset. If trust property had been given to a third party, the trust fund could claim back the property as of right, unless the recipient was a ''bona fide'' Bona fide purchaser, purchaser. Generally, any recipient of trust property who knew about the breach of trust (or maybe ought to have known) could be made to give back the value, even if they had themselves exchanged the thing for other assets. Lastly, against people who may never have received trust property but had assisted in a breach of trust, and had done so Dishonesty, dishonestly, a claim arose to return the property's value.

When trustees fail in their main duties, the law imposes remedies according to the nature of the breach. In general, breaches of rules surrounding performance of the trust's terms can be remedied through an award of specific performance, or compensation. Breaches of the duty of care will trigger a right to damages, compensation. Breaches of the duty to avoid conflicts of interest, and misapplications of property will give rise to a restitutionary claim, to restore the property taken away. In these last two situations, the courts of equity developed further principles of liability that could be applied even when a trustee had gone bankrupt. Some recipients of property that came from a breach of trust, as well as people who had assisted in a breach of trust, might incur liability. Equity recognised not merely a personal, but also a property, proprietary claim over assets taken in breach of trust, and perhaps also profits made in breach of the duty of loyalty. A proprietary claim meant that the claimant could demand the thing in priority to other creditors of the bankrupt trustee. Alternatively, the courts would follow an asset or trace its value if the trust property was exchanged for some other asset. If trust property had been given to a third party, the trust fund could claim back the property as of right, unless the recipient was a ''bona fide'' Bona fide purchaser, purchaser. Generally, any recipient of trust property who knew about the breach of trust (or maybe ought to have known) could be made to give back the value, even if they had themselves exchanged the thing for other assets. Lastly, against people who may never have received trust property but had assisted in a breach of trust, and had done so Dishonesty, dishonestly, a claim arose to return the property's value.

If a trustee has broken a duty owed to the trust, there are three main remedies. First, specific performance may generally be awarded in cases where the beneficiary merely wishes to compel a trustee to follow the trust's terms, or to prevent an anticipated breach. Second, for losses, beneficiaries may claim damages, compensation. The applicable principles are disputed, given the historical language of requiring a trustee to "account" for things which go wrong. One view suggested that at the very moment a trustee breaches a duty, for instance by making an erroneous investment without considering relevant matters, beneficiaries have a right to see the trust accounts are surcharged, to erase the transpiring loss (and "falsified" to restore to the trust fund unauthorised gains). In ''Target Holdings Ltd v Redferns'' the argument was taken to a new level, where a solicitor (a fiduciary, like a trustee) was given £1.5m by Target Holdings Ltd to hold for a loan for some property developers, but released the money before it was meant to (when purchase of the development property was completed). The money did reach the developers, but the venture was a flop, and money lost. Target Holdings Ltd attempted to sue Redferns for the whole sum, but the House of Lords held that the loss was caused by the venture flop, not the solicitor's action outside instructions. It was, however, observed that the common law rules of Remoteness (law), remoteness would not apply. Similarly in ''Swindle v Harrison'' a solicitor, Mr Swindle, could not be sued for the loss of Ms Harrison's second home's value after he gave her negligent and dishonest advice about loans, because she would have taken the loan and made the purchase anyway, and the house value drop was unrelated to his breach of duty.

The third kind of remedy, for unauthorised gains, is

If a trustee has broken a duty owed to the trust, there are three main remedies. First, specific performance may generally be awarded in cases where the beneficiary merely wishes to compel a trustee to follow the trust's terms, or to prevent an anticipated breach. Second, for losses, beneficiaries may claim damages, compensation. The applicable principles are disputed, given the historical language of requiring a trustee to "account" for things which go wrong. One view suggested that at the very moment a trustee breaches a duty, for instance by making an erroneous investment without considering relevant matters, beneficiaries have a right to see the trust accounts are surcharged, to erase the transpiring loss (and "falsified" to restore to the trust fund unauthorised gains). In ''Target Holdings Ltd v Redferns'' the argument was taken to a new level, where a solicitor (a fiduciary, like a trustee) was given £1.5m by Target Holdings Ltd to hold for a loan for some property developers, but released the money before it was meant to (when purchase of the development property was completed). The money did reach the developers, but the venture was a flop, and money lost. Target Holdings Ltd attempted to sue Redferns for the whole sum, but the House of Lords held that the loss was caused by the venture flop, not the solicitor's action outside instructions. It was, however, observed that the common law rules of Remoteness (law), remoteness would not apply. Similarly in ''Swindle v Harrison'' a solicitor, Mr Swindle, could not be sued for the loss of Ms Harrison's second home's value after he gave her negligent and dishonest advice about loans, because she would have taken the loan and made the purchase anyway, and the house value drop was unrelated to his breach of duty.

The third kind of remedy, for unauthorised gains, is

When trust assets are mixed up with property of the trustee, or other people, the general approach of the courts is to resolve the issues in favour of the wronged beneficiary. For example, in ''Re Hallett's Estate'', a solicitor sold £2145 worth of bonds he was meant to hold for his client and put the money in his account. Although money had subsequently been drawn and redeposited in the account, the balance of £3000 was enough to return all the money to his clients. According to Lord Jessel MR, a fiduciary "cannot be heard to say that he took away the trust money when he had a right to take away his own money". Again, in ''Re Oatway'', a trustee who took money and made a deposit with his bank account, and then bought shares which rose in value, was held by Joyce J to have used the beneficiary's money on the shares. This was the most beneficial result possible. When trust assets are mixed up with money from other beneficiaries, the courts have had more difficulty. Originally, by the rule in ''Clayton's case'', it was said that the money taken out of a bank account would be presumed to come from the first person's money that was put in. So in that case it meant that when a banking partnership, before it went insolvent, made payments to one of its depositors, Mr Clayton, the payments made discharged the debt of the first partner that died. However, this "first in, first out" rule is essentially disapplied in all but the simplest cases. In ''Barlow Clowes International Ltd v Vaughan'' Woolf LJ held that it would not apply if it might be 'impracticable or result in injustice', or if it ran contrary to the parties intentions. There, Vaughan was one of a multitude of investors in Barlow Clowes' managed fund portfolios. Their investments had been numerous, of different sizes and over long periods of time, and each investor knew that they had bought into a collective investment scheme. Accordingly, when Barlow Clowes went insolvent, each investor was held to simply share the loss proportionately, or ''pari passu''. A third alternative, said by Leggatt LJ to generally be fairer (though complex to compute) is to share losses through a "rolling ''pari passu''" system. Given the complexity of the accounts, and the trading of each investor, this approach was not used in ''Vaughan'', but it would have seen a proportionate reduction of all account holders' interest at each step of an account's depletion. A significant topic of debate, however, is whether the courts should allow tracing into an asset which has been bought on credit. The weight of authority suggests this is possible, either through subrogation, or on the justification that the assets of a recipient who pays off a debt on a thing are "swollen". In ''Bishopsgate Investment Management Ltd v Homan'', however, the Court of Appeal held that pensioners of the crooked newspaper owner,

When trust assets are mixed up with property of the trustee, or other people, the general approach of the courts is to resolve the issues in favour of the wronged beneficiary. For example, in ''Re Hallett's Estate'', a solicitor sold £2145 worth of bonds he was meant to hold for his client and put the money in his account. Although money had subsequently been drawn and redeposited in the account, the balance of £3000 was enough to return all the money to his clients. According to Lord Jessel MR, a fiduciary "cannot be heard to say that he took away the trust money when he had a right to take away his own money". Again, in ''Re Oatway'', a trustee who took money and made a deposit with his bank account, and then bought shares which rose in value, was held by Joyce J to have used the beneficiary's money on the shares. This was the most beneficial result possible. When trust assets are mixed up with money from other beneficiaries, the courts have had more difficulty. Originally, by the rule in ''Clayton's case'', it was said that the money taken out of a bank account would be presumed to come from the first person's money that was put in. So in that case it meant that when a banking partnership, before it went insolvent, made payments to one of its depositors, Mr Clayton, the payments made discharged the debt of the first partner that died. However, this "first in, first out" rule is essentially disapplied in all but the simplest cases. In ''Barlow Clowes International Ltd v Vaughan'' Woolf LJ held that it would not apply if it might be 'impracticable or result in injustice', or if it ran contrary to the parties intentions. There, Vaughan was one of a multitude of investors in Barlow Clowes' managed fund portfolios. Their investments had been numerous, of different sizes and over long periods of time, and each investor knew that they had bought into a collective investment scheme. Accordingly, when Barlow Clowes went insolvent, each investor was held to simply share the loss proportionately, or ''pari passu''. A third alternative, said by Leggatt LJ to generally be fairer (though complex to compute) is to share losses through a "rolling ''pari passu''" system. Given the complexity of the accounts, and the trading of each investor, this approach was not used in ''Vaughan'', but it would have seen a proportionate reduction of all account holders' interest at each step of an account's depletion. A significant topic of debate, however, is whether the courts should allow tracing into an asset which has been bought on credit. The weight of authority suggests this is possible, either through subrogation, or on the justification that the assets of a recipient who pays off a debt on a thing are "swollen". In ''Bishopsgate Investment Management Ltd v Homan'', however, the Court of Appeal held that pensioners of the crooked newspaper owner,

Traditionally,

Traditionally,

The courts had been divided over what, in addition to an act of "assistance" was an appropriate mental element of fault, if any. In ''Abu-Saleh'' it was thought that it was also not enough for Ms Abu-Saleh have been dishonest about the wrong thing (tax evasion, rather than breach of trust), but this view was held to be wrong by Lord Hoffmann in the leading case, ''Barlow Clowes International Ltd v Eurotrust International Ltd''. Before this, in ''Royal Brunei Airlines Sdn Bhd v Tan'', the Privy Council had resolved that "dishonesty" was a necessary element. It was also irrelevant whether the trustee was dishonest if the assistant that was actually being sued was dishonest. This meant that when Mr Tan, the managing director of a travel booking company, took booking money that his company was supposed to hold on trust for Royal Brunei Airlines, and used it for his own business, Mr Tan was liable to repay all sums personally. It did not matter whether the trustee (the company) was dishonest or not. By contrast, in ''

The courts had been divided over what, in addition to an act of "assistance" was an appropriate mental element of fault, if any. In ''Abu-Saleh'' it was thought that it was also not enough for Ms Abu-Saleh have been dishonest about the wrong thing (tax evasion, rather than breach of trust), but this view was held to be wrong by Lord Hoffmann in the leading case, ''Barlow Clowes International Ltd v Eurotrust International Ltd''. Before this, in ''Royal Brunei Airlines Sdn Bhd v Tan'', the Privy Council had resolved that "dishonesty" was a necessary element. It was also irrelevant whether the trustee was dishonest if the assistant that was actually being sued was dishonest. This meant that when Mr Tan, the managing director of a travel booking company, took booking money that his company was supposed to hold on trust for Royal Brunei Airlines, and used it for his own business, Mr Tan was liable to repay all sums personally. It did not matter whether the trustee (the company) was dishonest or not. By contrast, in ''

reprinted 1916

edited by AH Chaytor and WJ Whittaker *JE Martin, ''Hanbury & Martin: Modern Equity'' (19th edn Sweet & Maxwell 2012) *C Mitchell, ''Hayton and Mitchell's Commentary and Cases on the Law of Trusts and Equitable Remedies'' (13th edn Sweet & Maxwell 2010) *C Mitchell, D Hayton and P Matthews, ''Underhill and Hayton's Law Relating to Trusts and Trustees'' (17th edn Butterworths, 2006) *C Mitchell and P Mitchell (eds), ''Landmark Cases in Equity'' (2012) *G Moffat, ''Trusts Law: Text and Materials'' (5th edn Cambridge University Press 2009) *C Webb and T Akkouh, ''Trusts Law'' (Palgrave 2008) *S Worthington, ''Equity'' (2nd edn Clarendon 2006) ;Reports *Law Reform Committee, The Powers and Duties of Trustees (1982) Cmnd 8773

List of leading trusts cases on bailii.org

{{UK law English trusts law English property law

English trust law concerns the protection of assets, usually when they are held by one party for another's benefit.

English trust law concerns the protection of assets, usually when they are held by one party for another's benefit. Trusts

A trust is a legal relationship in which the holder of a right gives it to another person or entity who must keep and use it solely for another's benefit. In the Anglo-American common law, the party who entrusts the right is known as the "settl ...

were a creation of the English law

English law is the common law legal system of England and Wales, comprising mainly criminal law and civil law, each branch having its own courts and procedures.

Principal elements of English law

Although the common law has, historically, be ...

of property

Property is a system of rights that gives people legal control of valuable things, and also refers to the valuable things themselves. Depending on the nature of the property, an owner of property may have the right to consume, alter, share, r ...

and obligations

An obligation is a course of action that someone is required to take, whether legal or moral. Obligations are constraints; they limit freedom. People who are under obligations may choose to freely act under obligations. Obligation exists when ther ...

, and share a subsequent history with countries across the Commonwealth

A commonwealth is a traditional English term for a political community founded for the common good. Historically, it has been synonymous with "republic". The noun "commonwealth", meaning "public welfare, general good or advantage", dates from the ...

and the United States. Trusts developed when claimants in property disputes were dissatisfied with the common law

In law, common law (also known as judicial precedent, judge-made law, or case law) is the body of law created by judges and similar quasi-judicial tribunals by virtue of being stated in written opinions."The common law is not a brooding omnipresen ...

courts and petitioned the King for a just and equitable result. On the King's behalf, the Lord Chancellor

The lord chancellor, formally the lord high chancellor of Great Britain, is the highest-ranking traditional minister among the Great Officers of State in Scotland and England in the United Kingdom, nominally outranking the prime minister. The ...

developed a parallel justice system in the Court of Chancery

The Court of Chancery was a court of equity in England and Wales that followed a set of loose rules to avoid a slow pace of change and possible harshness (or "inequity") of the Common law#History, common law. The Chancery had jurisdiction over ...

, commonly referred as equity

Equity may refer to:

Finance, accounting and ownership

* Equity (finance), ownership of assets that have liabilities attached to them

** Stock, equity based on original contributions of cash or other value to a business

** Home equity, the dif ...

. Historically, trusts have mostly been used where people have left money in a will

Will may refer to:

Common meanings

* Will and testament, instructions for the disposition of one's property after death

* Will (philosophy), or willpower

* Will (sociology)

* Will, volition (psychology)

* Will, a modal verb - see Shall and will

...

, or created family settlements, charities

A charitable organization or charity is an organization whose primary objectives are philanthropy and social well-being (e.g. educational, religious or other activities serving the public interest or common good).

The legal definition of a cha ...

, or some types of business venture. After the Judicature Act 1873

The Supreme Court of Judicature Act 1873 (sometimes known as the Judicature Act 1873) was an Act of the Parliament of the United Kingdom in 1873. It reorganised the English court system to establish the High Court and the Court of Appeal, and ...

, England's courts of equity and common law were merged, and equitable principles took precedence. Today, trusts play an important role in financial investment, especially in unit trust

A unit trust is a form of collective investment constituted under a trust deed.

A unit trust pools investors' money into a single fund, which is managed by a fund manager. Unit trusts offer access to a wide range of investments, and depending on ...

s and in pension trusts (where trustees and fund managers invest assets for people who wish to save for retirement). Although people are generally free to set the terms of trusts in any way they like, there is a growing body of legislation to protect beneficiaries or regulate the trust relationship, including the Trustee Act 1925

The Trustee Act 1925c 19 is an Act of Parliament of the United Kingdom passed on 9 April 1925, which codified and updated the regulation of trustees' powers and appointment. It accompanied the land reform legislation of the 1920s. It came into eff ...

, Trustee Investments Act 1961, Recognition of Trusts Act 1987

The Recognition of Trusts Act 1987 is a UK Act of Parliament that requires and entitles that courts in the United Kingdom recognise the validity of trusts which are created abroad.

The Act implemented the Hague Trust Convention, agreed internatio ...

, Financial Services and Markets Act 2000

The Financial Services and Markets Act 2000c 8 is an Act of the Parliament of the United Kingdom that created the Financial Services Authority (FSA) as a regulator for insurance, investment business and banking, and the Financial Ombudsman Serv ...

, Trustee Act 2000

The Trustee Act 2000c 29 is an Act of the Parliament of the United Kingdom that regulates the duties of trustees in English trust law. Reform in these areas had been advised as early as 1982, and finally came about through the Trustee Bill 2000 ...

, Pensions Act 1995

The Pensions Act 1995c 26 is a piece of United Kingdom legislation to improve the running of pension schemes.

Background

Following the death of Robert Maxwell, it became clear that he had embezzled a large amount of money from the pension fund o ...

, Pensions Act 2004

The Pensions Act 2004 (c 35) is an Act of the Parliament of the United Kingdom to improve the running of pension schemes.

Background

In the years following the introduction of the Pensions Act 1995, it was widely perceived that it was failing t ...

and Charities Act 2011

The Charities Act 2011c 25 is a UK Act of Parliament. It consolidated the bulk of the Charities Act 2006, outstanding provisions of the Charities Act 1993, and various other enactments.

Repeals

Legislation repealed in its entirety by the 2011 A ...

.

Trusts are usually created by a settlor In law a settlor is a person who settles property on trust law for the benefit of beneficiaries. In some legal systems, a settlor is also referred to as a trustor, or occasionally, a grantor or donor. Where the trust is a testamentary trust, the se ...

, who gives assets to one or more trustees

Trustee (or the holding of a trusteeship) is a legal term which, in its broadest sense, is a synonym for anyone in a position of trust and so can refer to any individual who holds property, authority, or a position of trust or responsibility to t ...

who undertake to use the assets for the benefit of beneficiaries

A beneficiary (also, in trust law, '' cestui que use'') in the broadest sense is a natural person or other legal entity who receives money or other benefits from a benefactor. For example, the beneficiary of a life insurance policy is the perso ...

. As in contract law

A contract is a legally enforceable agreement between two or more parties that creates, defines, and governs mutual rights and obligations between them. A contract typically involves the transfer of goods, services, money, or a promise to tran ...

no formality

A formality is an established procedure or set of specific behaviors and utterances, conceptually similar to a ritual although typically secular and less involved. A formality may be as simple as a handshake upon making new acquaintances in Weste ...

is required to make a trust, except where statute demands it (such as when there are transfers of land or shares

In financial markets, a share is a unit of equity ownership in the capital stock of a corporation, and can refer to units of mutual funds, limited partnerships, and real estate investment trusts. Share capital refers to all of the shares of an ...

, or by means of wills). To protect the settlor, English law demands a reasonable degree of certainty that a trust was intended. To be able to enforce the trust's terms, the courts also require reasonable certainty about which assets were entrusted, and which people were meant to be the trust's beneficiaries.

English law, unlike that of some offshore tax havens and of the United States, requires that a trust have at least one beneficiary unless it is a "charitable trust". The Charity Commission

, type = Non-ministerial government department

, seal =

, seal_caption =

, logo = Charity Commission for England and Wales logo.svg

, logo_caption =

, formed =

, preceding1 =

, ...

monitors how charity trustees perform their duties, and ensures that charities serve the public interest. Pensions and investment trusts are closely regulated to protect people's savings and to ensure that trustees or fund managers are accountable. Beyond these expressly created trusts, English law recognises "resulting" and "constructive" trusts that arise by automatic operation of law to prevent unjust enrichment

In laws of equity, unjust enrichment occurs when one person is enriched at the expense of another in circumstances that the law sees as unjust. Where an individual is unjustly enriched, the law imposes an obligation upon the recipient to make res ...

, to correct wrongdoing

A wrong (from Old English – 'crooked') is an act that is illegal or immoral. Legal wrongs are usually quite clearly defined in the law of a state and/or jurisdiction. They can be divided into civil wrongs and crimes (or ''criminal offenses'') ...

or to create property rights where intentions are unclear. Although the word "trust" is used, resulting and constructive trusts are different from express trusts because they mainly create property

Property is a system of rights that gives people legal control of valuable things, and also refers to the valuable things themselves. Depending on the nature of the property, an owner of property may have the right to consume, alter, share, r ...

-based remedies to protect people's rights, and do not merely flow (like a contract

A contract is a legally enforceable agreement between two or more parties that creates, defines, and governs mutual rights and obligations between them. A contract typically involves the transfer of goods, services, money, or a promise to tran ...

or an express trust) from the consent of the parties. Generally speaking, however, trustees owe a range of duties to their beneficiaries. If a trust document is silent, trustees must avoid any possibility of a conflict of interest

A conflict of interest (COI) is a situation in which a person or organization is involved in multiple interests, financial or otherwise, and serving one interest could involve working against another. Typically, this relates to situations i ...

, manage the trust's affairs with reasonable care and skill, and only act for purposes consistent with the trust's terms. Some of these duties can be excluded, except where the statute makes duties compulsory, but all trustees must act in good faith

In human interactions, good faith ( la, bona fides) is a sincere intention to be fair, open, and honest, regardless of the outcome of the interaction. Some Latin phrases have lost their literal meaning over centuries, but that is not the case ...

in the best interests of the beneficiaries. If trustees breach their duties, the beneficiaries may make a claim for all property wrongfully paid away to be restored, and may trace and follow what was trust property and claim restitution

The law of restitution is the law of gains-based recovery, in which a court orders the defendant to ''give up'' their gains to the claimant. It should be contrasted with the law of compensation, the law of loss-based recovery, in which a court o ...

from any third party who ought to have known of the breach of trust.

History

Statements of equitable principle stretch back to the Ancient Greeks in the work ofAristotle

Aristotle (; grc-gre, Ἀριστοτέλης ''Aristotélēs'', ; 384–322 BC) was a Greek philosopher and polymath during the Classical period in Ancient Greece. Taught by Plato, he was the founder of the Peripatetic school of phil ...

, while examples of rules analogous to trusts were found in the Roman law

Roman law is the law, legal system of ancient Rome, including the legal developments spanning over a thousand years of jurisprudence, from the Twelve Tables (c. 449 BC), to the ''Corpus Juris Civilis'' (AD 529) ordered by Eastern Roman emperor J ...

testamentary institution of the ''fideicommissum

A ''fideicommissum'' is a type of bequest in which the beneficiary is encumbered to convey parts of the decedent's estate to someone else. For example, if a father leaves the family house to his firstborn, on condition that they will bequeath it to ...

'', and the Islamic

Islam (; ar, ۘالِإسلَام, , ) is an Abrahamic monotheistic religion centred primarily around the Quran, a religious text considered by Muslims to be the direct word of God (or '' Allah'') as it was revealed to Muhammad, the mai ...

proprietary institution of the ''Waqf

A waqf ( ar, وَقْف; ), also known as hubous () or '' mortmain'' property is an inalienable charitable endowment under Islamic law. It typically involves donating a building, plot of land or other assets for Muslim religious or charitabl ...

''. However, English trusts law is a largely indigenous development that began in the Middle Ages, from the time of the 11th and 12th century crusades

The Crusades were a series of religious wars initiated, supported, and sometimes directed by the Latin Church in the medieval period. The best known of these Crusades are those to the Holy Land in the period between 1095 and 1291 that were in ...

. After William the Conqueror

William I; ang, WillelmI (Bates ''William the Conqueror'' p. 33– 9 September 1087), usually known as William the Conqueror and sometimes William the Bastard, was the first House of Normandy, Norman List of English monarchs#House of Norman ...

became King in 1066, one "common law

In law, common law (also known as judicial precedent, judge-made law, or case law) is the body of law created by judges and similar quasi-judicial tribunals by virtue of being stated in written opinions."The common law is not a brooding omnipresen ...

" of England was created. Common law courts regarded property as an indivisible entity, as it had been under Roman law

Roman law is the law, legal system of ancient Rome, including the legal developments spanning over a thousand years of jurisprudence, from the Twelve Tables (c. 449 BC), to the ''Corpus Juris Civilis'' (AD 529) ordered by Eastern Roman emperor J ...

and continental versions of civil law. During the crusades

The Crusades were a series of religious wars initiated, supported, and sometimes directed by the Latin Church in the medieval period. The best known of these Crusades are those to the Holy Land in the period between 1095 and 1291 that were in ...

, landowners who went to fight would transfer title to their land to a person they trusted so that feudal services could be performed and received. But many who returned found that the people they entrusted refused to transfer their title deed back. Sometimes, common law courts would not acknowledge that anybody had rights in the property except the holder of the legal title deeds. So claimants petitioned the King to sidestep the common law courts. The King delegated hearing of petitions to his Lord Chancellor

The lord chancellor, formally the lord high chancellor of Great Britain, is the highest-ranking traditional minister among the Great Officers of State in Scotland and England in the United Kingdom, nominally outranking the prime minister. The ...

, who established the Court of Chancery

The Court of Chancery was a court of equity in England and Wales that followed a set of loose rules to avoid a slow pace of change and possible harshness (or "inequity") of the Common law#History, common law. The Chancery had jurisdiction over ...

as more cases were heard. Where it appeared "inequitable" (i.e. unfair) to let someone with legal title hold onto land, the Lord Chancellor

The lord chancellor, formally the lord high chancellor of Great Britain, is the highest-ranking traditional minister among the Great Officers of State in Scotland and England in the United Kingdom, nominally outranking the prime minister. The ...

could declare that the real owner "in equity" (i.e. in all fairness) was another person, if this is what good conscience dictated. The Court of Chancery

The Court of Chancery was a court of equity in England and Wales that followed a set of loose rules to avoid a slow pace of change and possible harshness (or "inequity") of the Common law#History, common law. The Chancery had jurisdiction over ...

determined that the true "use" or "benefit" of property did not belong to the person on the title (or the feoffee

Under the feudal system in England, a feoffee () is a trustee who holds a fief (or "fee"), that is to say an estate in land, for the use of a beneficial owner. The term is more fully stated as a feoffee to uses of the beneficial owner. The use o ...

who held seisin Seisin (or seizin) denotes the legal possession of a feudal fiefdom or fee, that is to say an estate in land. It was used in the form of "the son and heir of X has obtained seisin of his inheritance", and thus is effectively a term concerned with co ...

). The '' cestui que use'', the owner in equity

Equity may refer to:

Finance, accounting and ownership

* Equity (finance), ownership of assets that have liabilities attached to them

** Stock, equity based on original contributions of cash or other value to a business

** Home equity, the dif ...

, could be a different person. So English law recognised a split between legal and equitable owner, between someone who controlled title and another for whose benefit the land would be used. It was the beginning of trust law

A trust is a legal relationship in which the holder of a right gives it to another person or entity who must keep and use it solely for another's benefit. In the Anglo-American common law, the party who entrusts the right is known as the "settl ...

. The same logic was useful for Franciscan

The Franciscans are a group of related Mendicant orders, mendicant Christianity, Christian Catholic religious order, religious orders within the Catholic Church. Founded in 1209 by Italian Catholic friar Francis of Assisi, these orders include t ...

friars, who would transfer title of land to others as they were precluded from holding property by their vows of poverty. When the courts said that one person's legal title to property was subject to an obligation to use that property for another person, there was a trust.

During the 15th century and 16th century, "uses" or "trusts" were also employed to avoid the payment of feudal taxation. If a person died, the law stated a landlord was entitled to money before the land passed to an heir, and the landlord got all of the property under the doctrine of

During the 15th century and 16th century, "uses" or "trusts" were also employed to avoid the payment of feudal taxation. If a person died, the law stated a landlord was entitled to money before the land passed to an heir, and the landlord got all of the property under the doctrine of escheat

Escheat is a common law doctrine that transfers the real property of a person who has died without heirs to the crown or state. It serves to ensure that property is not left in "limbo" without recognized ownership. It originally applied to a ...

if there were no heirs. Transferring title to a group of people for common use

Use may refer to:

* Use (law), an obligation on a person to whom property has been conveyed

* Use (liturgy), a special form of Roman Catholic ritual adopted for use in a particular diocese

* Use–mention distinction, the distinction between using ...

could ensure this never happened, because if one person died he could be replaced, and it was unlikely for all to die at the same time. King Henry VIII

Henry VIII (28 June 149128 January 1547) was King of England from 22 April 1509 until his death in 1547. Henry is best known for his six marriages, and for his efforts to have his first marriage (to Catherine of Aragon) annulled. His disag ...

saw that this deprived the Crown of revenue, and so in the Statute of Uses 1535 he attempted to prohibit uses, stipulating all land belonged in fact to the '' cestui que use''. Henry VIII also increased the role of the Court of Star Chamber

The Star Chamber (Latin: ''Camera stellata'') was an English court that sat at the royal Palace of Westminster, from the late to the mid-17th century (c. 1641), and was composed of Privy Counsellors and common-law judges, to supplement the judic ...

, a court with criminal jurisdiction that invented new rules as it thought fit, and often this was employed against political dissidents. However, when Henry VIII was gone, the Court of Chancery held that the Statute of Uses 1535 had no application where land was leased. People started entrusting property again for family legacies. Moreover, the primacy of equity over the common law soon was reasserted, and this time supported by King James I in 1615, in the ''Earl of Oxford's case

''Earl of Oxford's case'' (1615) 21 ER 485 is a foundational case for the common law world, that held equity (equitable principle) takes precedence over the common law.

The Lord Chancellor held: "The Cause why there is Chancery is, for that Mens ...

''. Due to its deep unpopularity the "criminal equity" jurisdiction was abolished by the Habeas Corpus Act 1640

The Habeas Corpus Act 1640 (16 Car 1 c 10) was an Act of the Parliament of England.

The Act was passed by the Long Parliament shortly after the impeachment and execution of Thomas Wentworth, 1st Earl of Strafford in 1641 and before the Engli ...

. Trusts grew more popular, and were tolerated by the Crown, as new sources of revenue from the mercantile exploits in the New World

The term ''New World'' is often used to mean the majority of Earth's Western Hemisphere, specifically the Americas."America." ''The Oxford Companion to the English Language'' (). McArthur, Tom, ed., 1992. New York: Oxford University Press, p. 3 ...

decreased the Crown's reliance on feudal dues. By the early 18th century, the use had formalised into a trust: where land was settled to be held by a trustee, for the benefit of another, the Courts of Chancery recognised the beneficiary as the true owner in equity

Equity may refer to:

Finance, accounting and ownership

* Equity (finance), ownership of assets that have liabilities attached to them

** Stock, equity based on original contributions of cash or other value to a business

** Home equity, the dif ...

.

By the late 17th century, it had become an ever more widely held view that equitable rules and the law of trusts varied unpredictably, as the jurist

By the late 17th century, it had become an ever more widely held view that equitable rules and the law of trusts varied unpredictably, as the jurist John Selden

John Selden (16 December 1584 – 30 November 1654) was an English jurist, a scholar of England's ancient laws and constitution and scholar of Jewish law. He was known as a polymath; John Milton hailed Selden in 1644 as "the chief of learned ...

remarked, according to the size of the "Chancellor's foot". Over the 18th century English property law, and trusts with it, mostly came to a standstill in legislation, but the Court of Chancery continued to develop equitable principles notably under Lord Nottingham (from 1673–1682), Lord King (1725–1733), Lord Hardwicke

Philip Yorke, 1st Earl of Hardwicke, (1 December 16906 March 1764) was an English lawyer and politician who served as Lord High Chancellor of Great Britain. He was a close confidant of the Duke of Newcastle, Prime Minister between 1754 and 1 ...

(1737–1756), and Lord Henley (1757–1766). In 1765, the first Professor of English law, William Blackstone

Sir William Blackstone (10 July 1723 – 14 February 1780) was an English jurist, judge and Tory politician of the eighteenth century. He is most noted for writing the ''Commentaries on the Laws of England''. Born into a middle-class family i ...

wrote in his ''Commentaries on the Laws of England

The ''Commentaries on the Laws of England'' are an influential 18th-century treatise on the common law of England by Sir William Blackstone, originally published by the Clarendon Press at Oxford, 1765–1770. The work is divided into four volume ...

'' that equity should not be seen as a distinct body of rules, separate from the other laws of England. For example, although it was "said that a court of equity determines according to the spirit of the rule and not according to the strictness of the letter," wrote Blackstone, "so also does a court of law" and the result was that each system of courts was attempting to reach "the same principles of justice and positive law". Blackstone's influence reached far. Chancellors became more concerned to standardise and harmonise equitable principles. At the start of the 19th century in ''Gee v Pritchard

{{italic title

''Ann Paxton Gee v William Pritchard and William Anderson'(1818) 36 ER 670is a landmark judgment of the UK Chancery court. The case related to what matters the court could consider, court consistency and what constituted property. ...

'', referring to John Selden

John Selden (16 December 1584 – 30 November 1654) was an English jurist, a scholar of England's ancient laws and constitution and scholar of Jewish law. He was known as a polymath; John Milton hailed Selden in 1644 as "the chief of learned ...

's quip, Lord Eldon

Earl of Eldon, in the County Palatine of Durham, is a title in the Peerage of the United Kingdom. It was created in 1821 for the lawyer and politician John Scott, 1st Baron Eldon, Lord Chancellor from 1801 to 1806 and again from 1807 to 1827. ...

(1801–1827) said 'Nothing would inflict upon me greater pain in quitting this place than the recollection that I had done anything to justify the reproach that the equity of this court varies like the Chancellor's foot.' The Court of Chancery

The Court of Chancery was a court of equity in England and Wales that followed a set of loose rules to avoid a slow pace of change and possible harshness (or "inequity") of the Common law#History, common law. The Chancery had jurisdiction over ...

was meant to have mitigated the petty strictnesses of the common law of property. But instead, came to be seen as cumbersome and arcane. This was partly because until 1813, there was only the Lord Chancellor

The lord chancellor, formally the lord high chancellor of Great Britain, is the highest-ranking traditional minister among the Great Officers of State in Scotland and England in the United Kingdom, nominally outranking the prime minister. The ...

and the Master of the Rolls

The Keeper or Master of the Rolls and Records of the Chancery of England, known as the Master of the Rolls, is the President of the Court of Appeal (England and Wales)#Civil Division, Civil Division of the Court of Appeal of England and Wales a ...

working as judges. Work was slow. In 1813, a Vice-Chancellor was appointed, in 1841 two more, and in 1851 two Lord Justices of Appeal in Chancery (making seven). But this did not save it from ridicule. In particular, Charles Dickens

Charles John Huffam Dickens (; 7 February 1812 – 9 June 1870) was an English writer and social critic. He created some of the world's best-known fictional characters and is regarded by many as the greatest novelist of the Victorian e ...

(1812–1870), who himself worked as a clerk near Chancery Lane

Chancery Lane is a one-way street situated in the ward of Farringdon Without in the City of London. It has formed the western boundary of the City since 1994, having previously been divided between the City of Westminster and the London Boroug ...

, wrote ''Bleak House

''Bleak House'' is a novel by Charles Dickens, first published as a 20-episode serial between March 1852 and September 1853. The novel has many characters and several sub-plots, and is told partly by the novel's heroine, Esther Summerson, and ...

'' in 1853, depicting a fictional case of ''Jarndyce v Jarndyce

''Jarndyce and Jarndyce'' (or ''Jarndyce v Jarndyce'') is a fictional probate case in ''Bleak House'' (1852–53) by Charles Dickens, progressing in the English Court of Chancery. The case is a central plot device in the novel and has become a ...

'', a Chancery matter about wills that nobody understood and dragged on for years and years. Within twenty years, separate courts of equity were abolished. Parliament merged the common law and equity courts into one system with the Supreme Court of Judicature Act 1873

The Supreme Court of Judicature Act 1873 (sometimes known as the Judicature Act 1873) was an Act of the Parliament of the United Kingdom in 1873. It reorganised the English court system to establish the High Court and the Court of Appeal, and ...

. Equitable principles would prevail over common law rules in case of conflict, but the separate identity of equity had ended. The separate identity of the trust, however, continued as strongly as before. In other parts of the Commonwealth

A commonwealth is a traditional English term for a political community founded for the common good. Historically, it has been synonymous with "republic". The noun "commonwealth", meaning "public welfare, general good or advantage", dates from the ...

(or the British Empire

The British Empire was composed of the dominions, colonies, protectorates, mandates, and other territories ruled or administered by the United Kingdom and its predecessor states. It began with the overseas possessions and trading posts esta ...

at the time) trust law principles, as then understood, were codified for the purpose of easy administration. The best example is the Indian Trusts Act 1882

Indian Trusts Act, 1882 is a law in India relating to private trusts and trustees. The Act defines what would lawfully be called as a trust and who can legally be its trustees and provides a definition for them. The Indian Trusts Amendment Bill ...

, which described a trust as meaning "an obligation annexed to the ownership of property, and arising out of a confidence reposed in and accepted by the bearer".

Over the 20th century, trusts came to be used for multiple purposes beyond the classical role of parcelling out wealthy families' estates, wills, or charities. First, as more working-class people became more affluent, they began to be able to save for retirement through

Over the 20th century, trusts came to be used for multiple purposes beyond the classical role of parcelling out wealthy families' estates, wills, or charities. First, as more working-class people became more affluent, they began to be able to save for retirement through occupational pensions

A pension (, from Latin ''pensiō'', "payment") is a fund into which a sum of money is added during an employee's employment years and from which payments are drawn to support the person's retirement from work in the form of periodic payments ...

. After the Old Age Pensions Act 1908

The Old-Age Pensions Act 1908 is an Act of Parliament of the United Kingdom of Great Britain and Ireland, passed in 1908. The Act is often regarded as one of the foundations of modern social welfare in both the present-day United Kingdom and the ...

, everyone who worked and paid National Insurance

National Insurance (NI) is a fundamental component of the welfare state in the United Kingdom. It acts as a form of social security, since payment of NI contributions establishes entitlement to certain state benefits for workers and their famil ...

would probably have access to the minimal state pension, but if people wanted to maintain their living standards, they would need more. Occupational pensions would typically be constituted through a trust deed, after being bargained for by a trade union under a collective agreement. After World War Two, the number of people with occupational pensions rose further, and gradually regulation was introduced to ensure that people's "pension promise" was protected. The settlor would usually be the employer and employee jointly, and the savings would be transferred to a trustee for the benefit of the employee. Most regulation, especially after the Robert Maxwell

Ian Robert Maxwell (born Ján Ludvík Hyman Binyamin Hoch; 10 June 1923 – 5 November 1991) was a Czechoslovak-born British media proprietor, member of parliament (MP), suspected spy, and fraudster.

Early in his life, Maxwell escaped from N ...

scandals and the Goode Report {{Short description, Government issued inquiry

''Pension Law Reform'' (1993) Cm 2342, also known as the Goode Report after its leading author, Roy Goode, was a UK government commissioned inquiry into the state of pensions in the United Kingdom, whic ...

, was directed at ensuring that the employer cannot dominate, or abuse its position through undue influence over the trustee or the trust fund. The second main use of the trust came to be in other financial investments, though not necessarily for retirement. The unit trust

A unit trust is a form of collective investment constituted under a trust deed.

A unit trust pools investors' money into a single fund, which is managed by a fund manager. Unit trusts offer access to a wide range of investments, and depending on ...

, since their launch in 1931, became a popular vehicle for holding "units" in a fund that would invest in various assets, such as company shares

In financial markets, a share is a unit of equity ownership in the capital stock of a corporation, and can refer to units of mutual funds, limited partnerships, and real estate investment trusts. Share capital refers to all of the shares of an ...

, gilts

Gilt-edged securities are bonds issued by the UK Government. The term is of British origin, and then referred to the debt securities issued by the Bank of England on behalf of His Majesty's Treasury, whose paper certificates had a gilt (or gilde ...

or government bonds

A government bond or sovereign bond is a form of bond issued by a government to support public spending. It generally includes a commitment to pay periodic interest, called coupon payments'','' and to repay the face value on the maturity date ...

or corporate bonds

A corporate bond is a bond issued by a corporation in order to raise financing for a variety of reasons such as to ongoing operations, M&A, or to expand business. The term is usually applied to longer-term debt instruments, with maturity of ...

. One person investing alone might not have much money to spread the risk of his or her investments, and so the unit trust offered an attractive way to pool many investors wealth, and share the profits (or losses). Nowadays, unit trusts have been mostly superseded by Open-ended investment companies, which do much the same thing, but are companies selling shares, rather than trusts. Nevertheless, trusts are widely used, and notorious in offshore trusts in "tax havens

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or n ...

", where people hire an accountant or lawyer to make an argument that shifting assets in some new way will avoid tax. The third main contemporary use of the trust has been in the family home, though not as an expressly declared trust. As gender inequality began to narrow, both partners to a marriage would often be contributing money, or work, to pay the mortgage, make their home, or raise children together. A number of members of the judiciary became active from the late 1960s in declaring that even if one partner was not on the legal title deeds, she or he would still have an equitable property interest in the home under a "resulting trust

A resulting trust is an implied trust that comes into existence by operation of law, where property is transferred to someone who pays nothing for it; and then is implied to have held the property for benefit of another person. The trust property ...

" or (more normally today) a "constructive trust

A constructive trust is an equitable remedy imposed by a court to benefit a party that has been wrongfully deprived of its rights due to either a person obtaining or holding a legal property right which they should not possess due to unjust enri ...

". In essence the courts would acknowledge the existence of a property right, without the trust being expressly declared. Some courts said it reflected an implicit common intention, while others said the use of the trust reflected the need to do justice. In this way, trusts continued to fulfill their historical function of mitigating strict legal rules in the interests of equity

Equity may refer to:

Finance, accounting and ownership

* Equity (finance), ownership of assets that have liabilities attached to them

** Stock, equity based on original contributions of cash or other value to a business

** Home equity, the dif ...

.

Formation of express trusts

property

Property is a system of rights that gives people legal control of valuable things, and also refers to the valuable things themselves. Depending on the nature of the property, an owner of property may have the right to consume, alter, share, r ...

on behalf of another, and the law recognises obligations to use the property for the other's benefit. The primary situation in which a trust is formed is through the express intentions of a person who "settles" property. The "settlor" will give property to someone he trusts (a "trustee") to use it for someone he cares about (a "beneficiary"). The law's basic requirement is that a trust was truly "intended", and that a gift, bailment

Bailment is a legal relationship in common law, where the owner transfers physical Possession (law), possession of personal property ("chattel") for a time, but retains ownership. The owner who surrenders custody to a property is called the "ba ...

or agency relationship was not. In addition to requiring certainty

Certainty (also known as epistemic certainty or objective certainty) is the epistemic property of beliefs which a person has no rational grounds for doubting. One standard way of defining epistemic certainty is that a belief is certain if and ...

about the settlor's intention, the courts suggest the terms of the trust should be sufficiently certain particularly regarding the property and who is to benefit. The courts also have a rule that a trust must ultimately be for people, and not for a purpose, so that if all beneficiaries are in agreement and of full age they may decide how to use the property themselves. The historical trend of construction of trusts is to find a way to enforce them. If, however, the trust is construed as being for a charitable

The practice of charity is the voluntary giving of help to those in need, as a humanitarian act, unmotivated by self-interest. There are a number of philosophies about charity, often associated with religion.

Etymology

The word ''charity'' or ...

purpose, then public policy is to ensure it is always enforced. Charitable trusts are one of a number of specific trust types, which are regulated by the Charities Act 2006

The Charities Act 2006 (c 50) is an Act of the Parliament of the United Kingdom intended to alter the regulatory framework in which charities operate, partly by amending the Charities Act 1993. The Act was mostly superseded by the Charities Act ...

. Very detailed rules also exist for pension trusts, for instance under the Pensions Act 1995

The Pensions Act 1995c 26 is a piece of United Kingdom legislation to improve the running of pension schemes.

Background

Following the death of Robert Maxwell, it became clear that he had embezzled a large amount of money from the pension fund o ...

, particularly to set out the legal duties of pension trustees, and to require a minimum level of funding.

Intention and formality

Much like a contract, express trusts are usually formed based on the expressed intentions of a person who owns some property to in future have it managed by a trustee, and used for another person's benefit. Often the courts see cases where people have recently died, and expressed a wish to use property for another person, but have not used legal terminology. In principle, this does not matter. In ''

Much like a contract, express trusts are usually formed based on the expressed intentions of a person who owns some property to in future have it managed by a trustee, and used for another person's benefit. Often the courts see cases where people have recently died, and expressed a wish to use property for another person, but have not used legal terminology. In principle, this does not matter. In ''Paul v Constance

/ 9771 W.L.R. 527 is an English trust law case. It sets out what will be sufficient to establish that someone has intended to create a trust, the first of the "three certainties". It is necessary that a settlor's "words and actions ... show a ...

'', Mr Constance had recently split up with his wife, and began to live with Ms Paul, who he played bingo

Bingo or B-I-N-G-O may refer to:

Arts and entertainment Gaming

* Bingo, a game using a printed card of numbers

** Bingo (British version), a game using a printed card of 15 numbers on three lines; most commonly played in the UK and Ireland

** Bi ...

with. Because of their close relationship, Mr Constance had often repeated that the money in his bank account, partly from bingo winnings and from a workplace accident, was "as much yours as mine". When Mr Constance died, his old wife claimed the money still belonged to her, but the Court of Appeal held that despite the lack of formal wording, and though Mr Constance had retained the legal title to the money, it was held on trust for him and Ms Paul. As Scarman LJ put it, they understood "very well indeed their own domestic situation", and even though legal terms were not used in substance this did "convey clearly a present declaration that the existing fund was as much" belonging to Ms Paul. As Lord Millett

Peter Julian Millett, Baron Millett, , (23 June 1932 – 27 May 2021) was a British barrister and judge. He was a Lord of Appeal in Ordinary from 1998 to 2004.

Biography

Early life