|

Bond (finance)

In finance, a bond is a type of security under which the issuer ( debtor) owes the holder ( creditor) a debt, and is obliged – depending on the terms – to repay the principal (i.e. amount borrowed) of the bond at the maturity date as well as interest (called the coupon) over a specified amount of time. The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods. Thus, a bond is a form of loan or IOU. Bonds provide the borrower with external funds to finance long-term investments or, in the case of government bonds, to finance current expenditure. Bonds and stocks are both securities, but the major difference between the two is that (capital) stockholders have an equity stake in a company (i.e. they are owners), whereas bondholders have a creditor stake in a company (i.e. they are lenders). As creditors, bondholders have priority over stockholders. This means they will be repaid in advance of stockholders, but will rank behind s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finance

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitability asse ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Money Market

The money market is a component of the economy that provides short-term funds. The money market deals in short-term loans, generally for a period of a year or less. As short-term securities became a commodity, the money market became a component of the financial market for assets involved in short-term borrowing, lending, buying and selling with original maturities of one year or less. Trading in money markets is done over the counter and is wholesale. There are several money market instruments in most Western countries, including treasury bills, commercial paper, banker's acceptances, deposits, certificates of deposit, bills of exchange, repurchase agreements, federal funds, and short-lived mortgage- and asset-backed securities. The instruments bear differing maturities, currencies, credit risks, and structures. A market can be described as a money market if it is composed of highly liquid, short-term assets. Money market funds typically invest in government securities, ce ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bookrunner

In investment banking, a bookrunner is usually the main underwriter or lead-manager/arranger/coordinator in equity, debt, or hybrid securities issuances. The bookrunner usually syndicates with other investment banks in order to lower its risk In simple terms, risk is the possibility of something bad happening. Risk involves uncertainty about the effects/implications of an activity with respect to something that humans value (such as health, well-being, wealth, property or the environme .... The bookrunner is listed first among all underwriters participating in the issuance. When more than one bookrunner manages a security issuance, the parties are referred to as "joint bookrunners" or a "multi-bookrunner syndicate". The bank that runs the books is the closest one to the issuer and controls the allocations of shares to investors, holding significant discretion in doing so, which places the bookrunner in a very favored position. References External linksNew Look mandate continu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Syndicate

A syndicate is a self-organizing group of individuals, companies, corporations or entities formed to transact some specific business, to pursue or promote a shared interest. Etymology The word ''syndicate'' comes from the French language, French word ''syndicat'' which means "trade union" (''syndic'' meaning "administrator"), from the Latin word ''syndicus'' which in turn comes from the Ancient Greek, Greek word σύνδικος (''syndikos''), which means "caretaker of an issue"; compare to ombudsman or Representation (politics), representative. Definition The ''Merriam Webster Dictionary'' defines syndicate as a group of people or businesses that work together as a team. This may be a council or body or association of people or an association of concerns, officially authorized to undertake a duty or negotiate business with an office or jurisdiction. It may mean an association of racketeers in organized crime. It may refer to a business concern that sells materials for publicat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Underwriting

Underwriting (UW) services are provided by some large financial institutions, such as banks, insurance companies and investment houses, whereby they guarantee payment in case of damage or financial loss and accept the financial risk for liability arising from such guarantee. An underwriting arrangement may be created in a number of situations including insurance, issues of security in a public offering, and bank lending, among others. The person or institution that agrees to sell a minimum number of securities of the company for commission is called the underwriter. History The term "underwriting" derives from the Lloyd's of London insurance market. Financial backers (or risk takers), who would accept some of the risk on a given venture (historically a sea voyage with associated risks of shipwreck) in exchange for a premium, would literally write their names under the risk information that was written on a Lloyd's slip created for this purpose. Securities underwriting In the f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Primary Market

:''"Primary market" may also refer to a market in art valuation.'' The primary market is the part of the capital market that deals with the issuance and sale of securities to purchasers directly by the issuer, with the issuer being paid the proceeds. A primary market means the market for new issues of securities, as distinguished from the secondary market, where previously issued securities are bought and sold. "A market is primary if the proceeds of sales go to the issuer of the securities sold." Buyers buy securities that were not previously traded. Concept In a primary market, companies, governments, or public sector institutions can raise funds through bond issues, and corporations can raise capital through the sale of new stock through an initial public offering (IPO). This is often done through an investment bank or underwriter or finance syndicate of securities dealers. The process of selling new shares to buyers is called underwriting. Dealers earn a commission that i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Supranational Union

A supranational union is a type of international organization that is empowered to directly exercise some of the powers and functions otherwise reserved to states. A supranational organization involves a greater transfer of or limitation of state sovereignty than other kinds of international organizations. The European Union (EU) has been described as a paradigmatic case of a supranational organization, as it has deep political, economic and social integration, which includes a common market, joint border control, a supreme court, and regular popular elections. Another method of decision-making in international organisations is intergovernmentalism in which state governments play a more prominent role. Origin as a legal concept After the dropping of atomic bombs on Hiroshima and Nagasaki in August 1945, Albert Einstein spoke and wrote frequently in the late 1940s in favour of a "supranational" organization to control all military forces except for local police forces, i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

English Language

English is a West Germanic language of the Indo-European language family, with its earliest forms spoken by the inhabitants of early medieval England. It is named after the Angles, one of the ancient Germanic peoples that migrated to the island of Great Britain. Existing on a dialect continuum with Scots, and then closest related to the Low Saxon and Frisian languages, English is genealogically West Germanic. However, its vocabulary is also distinctively influenced by dialects of France (about 29% of Modern English words) and Latin (also about 29%), plus some grammar and a small amount of core vocabulary influenced by Old Norse (a North Germanic language). Speakers of English are called Anglophones. The earliest forms of English, collectively known as Old English, evolved from a group of West Germanic (Ingvaeonic) dialects brought to Great Britain by Anglo-Saxon settlers in the 5th century and further mutated by Norse-speaking Viking settlers starting in the 8th and 9th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bond Valuation

Bond valuation is the determination of the fair price of a bond. As with any security or capital investment, the theoretical fair value of a bond is the present value of the stream of cash flows it is expected to generate. Hence, the value of a bond is obtained by discounting the bond's expected cash flows to the present using an appropriate discount rate. In practice, this discount rate is often determined by reference to similar instruments, provided that such instruments exist. Various related yield-measures are then calculated for the given price. Where the market price of bond is less than its face value (par value), the bond is selling at a discount. Conversely, if the market price of bond is greater than its face value, the bond is selling at a premium. For this and other relationships between price and yield, see below. If the bond includes embedded options, the valuation is more difficult and combines option pricing with discounting. Depending on the type of option, th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Liquidity

In business, economics or investment, market liquidity is a market's feature whereby an individual or firm can quickly purchase or sell an asset without causing a drastic change in the asset's price. Liquidity involves the trade-off between the price at which an asset can be sold, and how quickly it can be sold. In a liquid market, the trade-off is mild: one can sell quickly without having to accept a significantly lower price. In a relatively illiquid market, an asset must be discounted in order to sell quickly. Money, or cash, is the most liquid asset because it can be exchanged for goods and services instantly at face value. Overview A liquid asset has some or all of the following features: It can be sold rapidly, with minimal loss of value, anytime within market hours. The essential characteristic of a liquid market is that there are always ready and willing buyers and sellers. It is similar to, but distinct from, market depth, which relates to the trade-off between quantit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

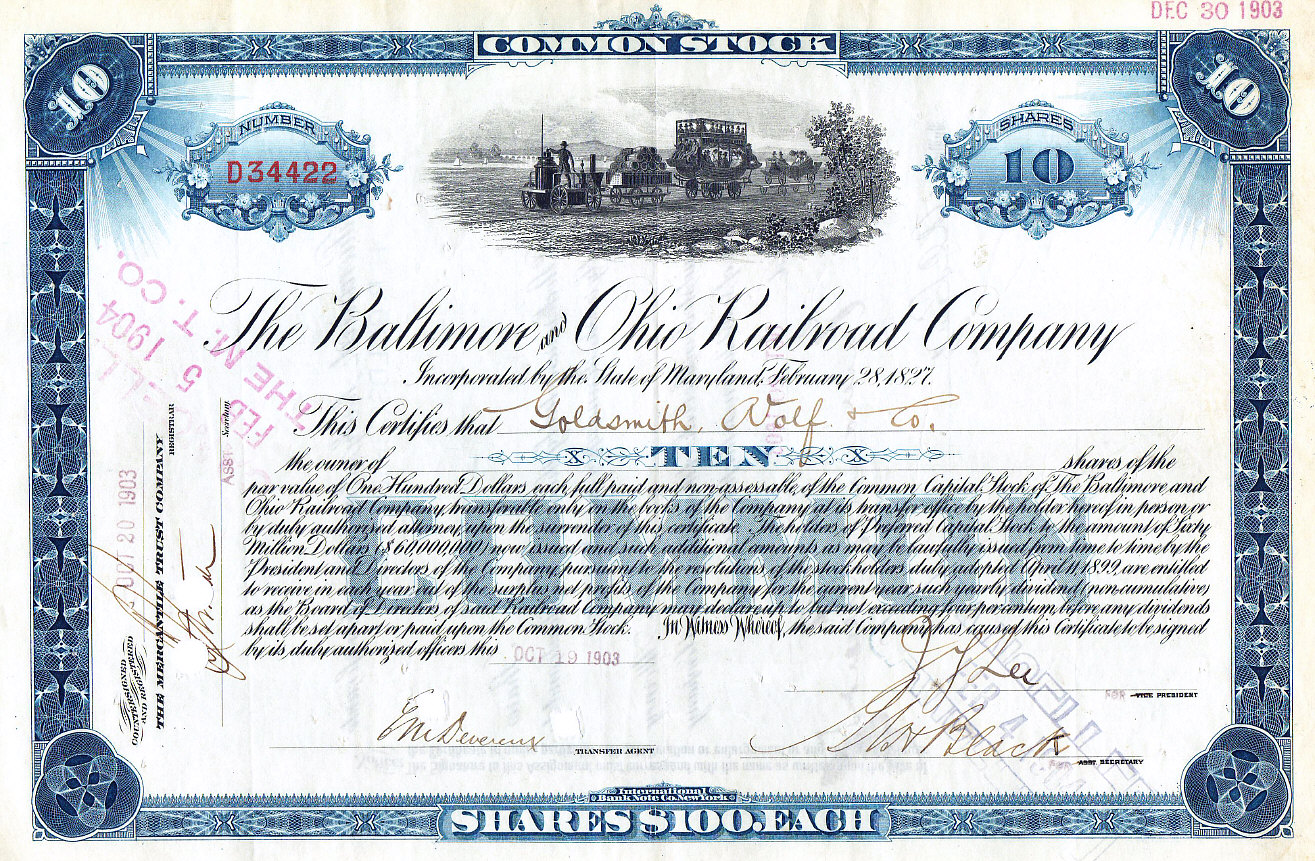

Medallion Stamp

In the United States, a medallion signature guarantee is a special signature guarantee used primarily when a client transfers or sells US securities. It is an assurance by the financial institution granting the guarantee that the signature on the transaction is genuine and that the guarantor accepts liability for any forgery. Guarantee A medallion signature guarantee is a guarantee by the transferring financial institution that the signature is genuine and the financial institution accepts liability for any forgery. A medallion signature guarantee protects shareholders by preventing unauthorized transfers and possible investor losses. A medallion signature guarantee also limits the liability of the transfer agent who accepts the certificates. A medallion signature guarantee is a binding warranty, issued by an agent of the authorized guarantor institution, that: (a) the signature was genuine; (b) the signer was an appropriate person to endorse, and (c) the signer had legal capa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Secondary Market

The secondary market, also called the aftermarket and follow on public offering, is the financial market in which previously issued financial instruments such as stock, bonds, options, and futures are bought and sold. The initial sale of the security by the issuer to a purchaser, who pays proceeds to the issuer, is the primary market. All sales after the initial sale of the security are sales in the secondary market. Whereas the term primary market refers to the market for new issues of securities, and " market is primary if the proceeds of sales go to the issuer of the securities sold," the secondary market in contrast is the market created by the later trading of such securities. With primary issuances of securities or financial instruments (the primary market), often an underwriter purchases these securities directly from issuers, such as corporations issuing shares in an IPO or private placement. Then the underwriter re-sells the securities to other buyers, in what is r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)