Tax haven on:

[Wikipedia]

[Google]

[Amazon]

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a

The legal definition and the economic definition of taxes differ in some ways such that economists do not regard many transfers to governments as taxes. For example, some transfers to the public sector are comparable to prices. Examples include tuition at public universities and fees for utilities provided by local governments. Governments also obtain resources by "creating" money and coins (for example, by printing bills and by minting coins), through voluntary gifts (for example, contributions to public universities and museums), by imposing penalties (such as traffic fines), by borrowing and confiscating criminal proceeds. From the view of economists, a tax is a non-penal, yet compulsory transfer of resources from the private to the public sector, levied on a basis of predetermined criteria and without reference to specific benefits received.

In modern taxation systems, governments levy taxes in money; but in-kind and '' corvée'' taxation are characteristic of traditional or pre- capitalist states and their functional equivalents. The method of taxation and the government expenditure of taxes raised is often highly debated in politics and

The legal definition and the economic definition of taxes differ in some ways such that economists do not regard many transfers to governments as taxes. For example, some transfers to the public sector are comparable to prices. Examples include tuition at public universities and fees for utilities provided by local governments. Governments also obtain resources by "creating" money and coins (for example, by printing bills and by minting coins), through voluntary gifts (for example, contributions to public universities and museums), by imposing penalties (such as traffic fines), by borrowing and confiscating criminal proceeds. From the view of economists, a tax is a non-penal, yet compulsory transfer of resources from the private to the public sector, levied on a basis of predetermined criteria and without reference to specific benefits received.

In modern taxation systems, governments levy taxes in money; but in-kind and '' corvée'' taxation are characteristic of traditional or pre- capitalist states and their functional equivalents. The method of taxation and the government expenditure of taxes raised is often highly debated in politics and

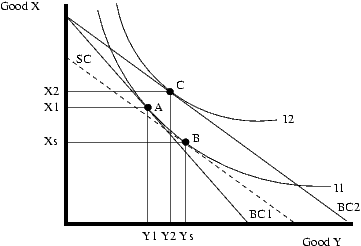

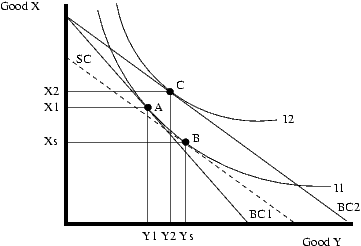

If we consider, for instance, two normal goods, ''x'' and ''y,'' whose prices are respectively ''px'' and ''py'' and an individual budget constraint given by the equation ''xpx'' + ''ypy'' = Y, where Y is the income, the slope of the budget constraint, in a graph where is represented good ''x'' on the vertical axis and good ''y'' on the horizontal axes, is equal to -''py''/''px'' . The initial equilibrium is in the point (C), in which budget constraint and

If we consider, for instance, two normal goods, ''x'' and ''y,'' whose prices are respectively ''px'' and ''py'' and an individual budget constraint given by the equation ''xpx'' + ''ypy'' = Y, where Y is the income, the slope of the budget constraint, in a graph where is represented good ''x'' on the vertical axis and good ''y'' on the horizontal axes, is equal to -''py''/''px'' . The initial equilibrium is in the point (C), in which budget constraint and  Another example can be the introduction of an income lump-sum tax (''xpx'' + ''ypy'' = Y - T), with a parallel shift downward of the budget constraint, can be produced a higher revenue with the same loss of consumers' utility compared with the property tax case, from another point of view, the same revenue can be produced with a lower utility sacrifice. The lower utility (with the same revenue) or the lower revenue (with the same utility) given by a distortionary tax are called excess pressure. The same result, reached with an income lump-sum tax, can be obtained with these following types of taxes (all of them cause only a budget constraint's shift without causing a substitution effect), the budget constraint's slope remains the same (-''px''/''py''):

* A general tax on consumption: (Budget constraint: ''px''(1 + τ)''x'' + ''py''(1 + τ)''y ='' Y)

* A proportional income tax: (Budget constraint: ''xpx'' + ''ypy'' = Y(1 - ''t''))

When the t and τ rates are chosen respecting this equation (where t is the rate of income tax and tau is the consumption tax's rate):

the effects of the two taxes are the same.

A tax effectively changes the relative prices of products. Therefore, most economists, especially neoclassical economists, argue that taxation creates

Another example can be the introduction of an income lump-sum tax (''xpx'' + ''ypy'' = Y - T), with a parallel shift downward of the budget constraint, can be produced a higher revenue with the same loss of consumers' utility compared with the property tax case, from another point of view, the same revenue can be produced with a lower utility sacrifice. The lower utility (with the same revenue) or the lower revenue (with the same utility) given by a distortionary tax are called excess pressure. The same result, reached with an income lump-sum tax, can be obtained with these following types of taxes (all of them cause only a budget constraint's shift without causing a substitution effect), the budget constraint's slope remains the same (-''px''/''py''):

* A general tax on consumption: (Budget constraint: ''px''(1 + τ)''x'' + ''py''(1 + τ)''y ='' Y)

* A proportional income tax: (Budget constraint: ''xpx'' + ''ypy'' = Y(1 - ''t''))

When the t and τ rates are chosen respecting this equation (where t is the rate of income tax and tau is the consumption tax's rate):

the effects of the two taxes are the same.

A tax effectively changes the relative prices of products. Therefore, most economists, especially neoclassical economists, argue that taxation creates  The

The

Many countries provide publicly funded retirement or healthcare systems. In connection with these systems, the country typically requires employers and/or employees to make compulsory payments. These payments are often computed by reference to wages or earnings from self-employment. Tax rates are generally fixed, but a different rate may be imposed on employers than on employees. Some systems provide an upper limit on earnings subject to the tax. A few systems provide that the tax is payable only on wages above a particular amount. Such upper or lower limits may apply for retirement but not for health-care components of the tax. Some have argued that such taxes on wages are a form of "forced savings" and not really a tax, while others point to redistribution through such systems between generations (from newer cohorts to older cohorts) and across income levels (from higher income levels to lower income-levels) which suggests that such programs are really taxed and spending programs.

Many countries provide publicly funded retirement or healthcare systems. In connection with these systems, the country typically requires employers and/or employees to make compulsory payments. These payments are often computed by reference to wages or earnings from self-employment. Tax rates are generally fixed, but a different rate may be imposed on employers than on employees. Some systems provide an upper limit on earnings subject to the tax. A few systems provide that the tax is payable only on wages above a particular amount. Such upper or lower limits may apply for retirement but not for health-care components of the tax. Some have argued that such taxes on wages are a form of "forced savings" and not really a tax, while others point to redistribution through such systems between generations (from newer cohorts to older cohorts) and across income levels (from higher income levels to lower income-levels) which suggests that such programs are really taxed and spending programs.

Federation of Tax Administrators

website. In the United States, there is a growing movement for the replacement of all federal payroll and income taxes (both corporate and personal) with a national retail sales tax and monthly tax rebate to households of citizens and legal resident aliens. The tax proposal is named

The first known system of taxation was in

The first known system of taxation was in

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a government

A government is the system or group of people governing an organized community, generally a state.

In the case of its broad associative definition, government normally consists of legislature, executive, and judiciary. Government ...

al organization in order to fund government spending

Government spending or expenditure includes all government consumption, investment, and transfer payments. In national income accounting, the acquisition by governments of goods and services for current use, to directly satisfy the individual o ...

and various public expenditures (regional, local, or national), and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax reliefs. The first known taxation took place in Ancient Egypt around 3000–2800 BC. A failure to pay in a timely manner (non-compliance

In general, compliance means conforming to a rule, such as a specification, policy, standard or law. Compliance has traditionally been explained by reference to the deterrence theory, according to which punishing a behavior will decrease the viol ...

), along with evasion of or resistance to taxation, is punishable by law. Taxes consist of direct

Direct may refer to:

Mathematics

* Directed set, in order theory

* Direct limit of (pre), sheaves

* Direct sum of modules, a construction in abstract algebra which combines several vector spaces

Computing

* Direct access (disambiguation), a ...

or indirect tax

An indirect tax (such as sales tax, per unit tax, value added tax (VAT), or goods and services tax (GST), excise, consumption tax, tariff) is a tax that is levied upon goods and services before they reach the customer who ultimately pays the i ...

es and may be paid in money or as its labor equivalent.

Most countries have a tax system in place, in order to pay for public, common societal, or agreed national needs and for the functions of government. Some levy a flat percentage rate of taxation on personal annual income, but most scale taxes are progressive based on brackets of annual income amounts. Most countries charge a tax on an individual's income as well as on corporate income. Countries or subunits often also impose wealth taxes, inheritance tax

An inheritance tax is a tax paid by a person who inherits money or property of a person who has died, whereas an estate tax is a levy on the estate (money and property) of a person who has died.

International tax law distinguishes between an es ...

es, estate taxes

An inheritance tax is a tax paid by a person who inherits money or property of a person who has died, whereas an estate tax is a levy on the estate (money and property) of a person who has died.

International tax law distinguishes between an es ...

, gift taxes, property taxes, sales tax

A sales tax is a tax paid to a governing body for the sales of certain goods and services. Usually laws allow the seller to collect funds for the tax from the consumer at the point of purchase. When a tax on goods or services is paid to a govern ...

es, use taxes, payroll taxes, duties

A duty (from "due" meaning "that which is owing"; fro, deu, did, past participle of ''devoir''; la, debere, debitum, whence "debt") is a commitment or expectation to perform some action in general or if certain circumstances arise. A duty may ...

and/or tariffs.

In economic terms, taxation transfers wealth from households or businesses to the government. This has effects on economic growth

Economic growth can be defined as the increase or improvement in the inflation-adjusted market value of the goods and services produced by an economy in a financial year. Statisticians conventionally measure such growth as the percent rate of ...

and economic welfare that can be both increased (known as fiscal multiplier

In economics, the fiscal multiplier (not to be confused with the money multiplier) is the ratio of change in national income arising from a change in government spending. More generally, the exogenous spending multiplier is the ratio of change ...

) or decreased (known as excess burden of taxation). Consequently, taxation is a highly debated topic by some, although taxation is deemed necessary by general consensus in order for society to function and grow in an orderly and equitable manner, others such as libertarians and anarcho-capitalists denounce taxation broadly or in its entirety, classifying it as theft or extortion through coercion and the use of force

In physics, a force is an influence that can change the motion of an object. A force can cause an object with mass to change its velocity (e.g. moving from a state of rest), i.e., to accelerate. Force can also be described intuitively as a p ...

.

Overview

The legal definition and the economic definition of taxes differ in some ways such that economists do not regard many transfers to governments as taxes. For example, some transfers to the public sector are comparable to prices. Examples include tuition at public universities and fees for utilities provided by local governments. Governments also obtain resources by "creating" money and coins (for example, by printing bills and by minting coins), through voluntary gifts (for example, contributions to public universities and museums), by imposing penalties (such as traffic fines), by borrowing and confiscating criminal proceeds. From the view of economists, a tax is a non-penal, yet compulsory transfer of resources from the private to the public sector, levied on a basis of predetermined criteria and without reference to specific benefits received.

In modern taxation systems, governments levy taxes in money; but in-kind and '' corvée'' taxation are characteristic of traditional or pre- capitalist states and their functional equivalents. The method of taxation and the government expenditure of taxes raised is often highly debated in politics and

The legal definition and the economic definition of taxes differ in some ways such that economists do not regard many transfers to governments as taxes. For example, some transfers to the public sector are comparable to prices. Examples include tuition at public universities and fees for utilities provided by local governments. Governments also obtain resources by "creating" money and coins (for example, by printing bills and by minting coins), through voluntary gifts (for example, contributions to public universities and museums), by imposing penalties (such as traffic fines), by borrowing and confiscating criminal proceeds. From the view of economists, a tax is a non-penal, yet compulsory transfer of resources from the private to the public sector, levied on a basis of predetermined criteria and without reference to specific benefits received.

In modern taxation systems, governments levy taxes in money; but in-kind and '' corvée'' taxation are characteristic of traditional or pre- capitalist states and their functional equivalents. The method of taxation and the government expenditure of taxes raised is often highly debated in politics and economics

Economics () is the social science that studies the production, distribution, and consumption of goods and services.

Economics focuses on the behaviour and interactions of economic agents and how economies work. Microeconomics analy ...

. Tax collection is performed by a government agency such as the Internal Revenue Service

The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory t ...

(IRS) in the United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 U.S. state, states, a Washington, D.C., federal district, five ma ...

, His Majesty's Revenue and Customs (HMRC) in the United Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Europe, off the north-western coast of the European mainland, continental mainland. It comprises England, Scotlan ...

, the Canada Revenue Agency or the Australian Taxation Office. When taxes are not fully paid, the state may impose civil penalties (such as fines or forfeiture

Forfeit or forfeiture may refer to:

Arts, entertainment, and media

* ''Forfeit'', a 2007 thriller film starring Billy Burke

* "Forfeit", a song by Chevelle from '' Wonder What's Next''

* '' Forfeit/Fortune'', a 2008 album by Crooked Fingers

...

) or criminal penalties (such as incarceration

Imprisonment is the restraint of a person's liberty, for any cause whatsoever, whether by authority of the government, or by a person acting without such authority. In the latter case it is "false imprisonment". Imprisonment does not necessari ...

) on the non-paying entity or individual.

Purposes and effects

The levying of taxes aims to raise revenue to fund governing or to alter prices in order to affectdemand

In economics, demand is the quantity of a good that consumers are willing and able to purchase at various prices during a given time. The relationship between price and quantity demand is also called the demand curve. Demand for a specific item ...

. States and their functional equivalents throughout history have used the money provided by taxation to carry out many functions. Some of these include expenditures on economic infrastructure

Infrastructure is the set of facilities and systems that serve a country, city, or other area, and encompasses the services and facilities necessary for its economy, households and firms to function. Infrastructure is composed of public and priv ...

( roads, public transportation, sanitation, legal systems, public security, public education

Education is a purposeful activity directed at achieving certain aims, such as transmitting knowledge or fostering skills and character traits. These aims may include the development of understanding, rationality, kindness, and honesty. ...

, public health system

Health, according to the World Health Organization, is "a state of complete physical, mental and social well-being and not merely the absence of disease and infirmity".World Health Organization. (2006)''Constitution of the World Health Organiza ...

s), military

A military, also known collectively as armed forces, is a heavily armed, highly organized force primarily intended for warfare. It is typically authorized and maintained by a sovereign state, with its members identifiable by their distin ...

, scientific research & development, culture

Culture () is an umbrella term which encompasses the social behavior, institutions, and norms found in human societies, as well as the knowledge, beliefs, arts, laws, customs, capabilities, and habits of the individuals in these grou ...

and the arts, public works, distribution Distribution may refer to:

Mathematics

*Distribution (mathematics), generalized functions used to formulate solutions of partial differential equations

*Probability distribution, the probability of a particular value or value range of a varia ...

, data collection and dissemination, public insurance, and the operation of government itself. A government's ability to raise taxes is called its fiscal capacity.

When expenditures exceed tax revenue

In accounting, revenue is the total amount of income generated by the sale of goods and services related to the primary operations of the business.

Commercial revenue may also be referred to as sales or as turnover. Some companies receive rev ...

, a government accumulates government debt. A portion of taxes may be used to service past debts. Governments also use taxes to fund welfare and public services. These services can include education systems, pension

A pension (, from Latin ''pensiō'', "payment") is a fund into which a sum of money is added during an employee's employment years and from which payments are drawn to support the person's retirement from work in the form of periodic payments ...

s for the elderly

Old age refers to ages nearing or surpassing the life expectancy of human beings, and is thus the end of the human life cycle. Terms and euphemisms for people at this age include old people, the elderly (worldwide usage), OAPs (British usage ...

, unemployment benefits, transfer payments, subsidies and public transportation. Energy, water and waste management systems are also common public utilities.

According to the proponents of the chartalist theory of money creation

Money creation, or money issuance, is the process by which the money supply of a country, or of an economic or monetary region,Such as the Eurozone or ECCAS is increased. In most modern economies, money creation is controlled by the central bank ...

, taxes are not needed for government revenue, as long as the government in question is able to issue fiat money. According to this view, the purpose of taxation is to maintain the stability of the currency, express public policy regarding the distribution of wealth, subsidizing certain industries or population groups or isolating the costs of certain benefits, such as highways or social security.

Effects of taxes can be divided into two fundamental categories:

* Taxes cause an income effect

The theory of consumer choice is the branch of microeconomics that relates preferences to consumption expenditures and to consumer demand curves. It analyzes how consumers maximize the desirability of their consumption as measured by their pre ...

because they reduce purchasing power to taxpayers.

* Taxes cause a substitution effect when taxation causes a substitution between taxed goods and untaxed goods.

If we consider, for instance, two normal goods, ''x'' and ''y,'' whose prices are respectively ''px'' and ''py'' and an individual budget constraint given by the equation ''xpx'' + ''ypy'' = Y, where Y is the income, the slope of the budget constraint, in a graph where is represented good ''x'' on the vertical axis and good ''y'' on the horizontal axes, is equal to -''py''/''px'' . The initial equilibrium is in the point (C), in which budget constraint and

If we consider, for instance, two normal goods, ''x'' and ''y,'' whose prices are respectively ''px'' and ''py'' and an individual budget constraint given by the equation ''xpx'' + ''ypy'' = Y, where Y is the income, the slope of the budget constraint, in a graph where is represented good ''x'' on the vertical axis and good ''y'' on the horizontal axes, is equal to -''py''/''px'' . The initial equilibrium is in the point (C), in which budget constraint and indifference curve

In economics, an indifference curve connects points on a graph representing different quantities of two goods, points between which a consumer is ''indifferent''. That is, any combinations of two products indicated by the curve will provide the c ...

are tangent, introducing an '' ad valorem tax'' on the ''y'' good (budget constraint: ''pxx'' + ''py''(1 + ''τ'')''y ='' Y'')'', the budget constraint's slope becomes equal to -''py''(1 + τ)/''px''. The new equilibrium is now in the tangent point (A) with a lower indifferent curve.

As can be noticed the tax's introduction causes two consequences:

# It changes the consumers' real income (less purchasing power)

# It raises the relative price of ''y'' good.

The income effect shows the variation of ''y'' good quantity given by the change of real income. The substitution effect shows the variation of ''y'' good determined by relative prices' variation. This kind of taxation (that causes the substitution effect) can be considered distortionary.

market distortion In neoclassical economics, a market distortion is any event in which a market reaches a market clearing price for an item that is substantially different from the price that a market would achieve while operating under conditions of perfect competit ...

and results in economic inefficiency unless there are (positive or negative) externalities associated with the activities that are taxed that need to be internalized to reach an efficient market outcome. They have therefore sought to identify the kind of tax system that would minimize this distortion. Recent scholarship suggests that in the United States of America, the federal government effectively taxes investments in higher education more heavily than it subsidizes higher education, thereby contributing to a shortage of skilled workers and unusually high differences in pre-tax earnings between highly educated and less-educated workers.

Taxes can even have effects on labor supply: we can consider a model in which the consumer chooses the number of hours spent working and the amount spent on consumption. Let us suppose that only one good exists and no income is saved.

Consumers have a given number of hours (H) that is divided between work (L) and free time (F = H - L). The hourly wage is called ''w'' and it tells us the free time's opportunity cost

In microeconomic theory, the opportunity cost of a particular activity is the value or benefit given up by engaging in that activity, relative to engaging in an alternative activity. More effective it means if you chose one activity (for example ...

, i.e. the income to which the individual renounces consuming an additional hour of free time. Consumption and hours of work have a positive relationship, more hours of work mean more earnings and, assuming that workers don't save money, more earnings imply an increase in consumption (Y = C = ''w''L). Free time and consumption can be considered as two normal goods (workers have to decide between working one hour more, that would mean consuming more or having one more hour of free time) and the budget constraint is negatively inclined (Y = ''w''(H - F)). The indifference curve

In economics, an indifference curve connects points on a graph representing different quantities of two goods, points between which a consumer is ''indifferent''. That is, any combinations of two products indicated by the curve will provide the c ...

related to these two goods has a negative slope and free time becomes more and more important with high levels of consumption. This is because a high level of consumption means that people are already spending many hours working, so, in this situation, they need more free time than consume and it implies that they have to be paid with a higher salary to work an additional hour. A proportional income tax, changing budget constraint's slope (now Y = ''w''(1 - ''t'')(H - F)), implies both substitution and income effects. The problem now is that the two effects go in opposite ways: the income effect tells us that, with an income tax, the consumer feels poorer and for this reason he wants to work more, causing an increase in labor offer. On the other hand, the substitution effect tells us that free time, being a normal good, is now more convenient compared to consume and it implies a decrease in labor offer. Therefore, the total effect can be both an increase or a decrease of labor offer, depending on the indifference curve's shape.

Laffer curve

In economics, the Laffer curve illustrates a theoretical relationship between rates of taxation and the resulting levels of the government's tax revenue. The Laffer curve assumes that no tax revenue is raised at the extreme tax rates of 0% and ...

depicts the amount of government revenue as a function of the rate of taxation. It shows that for a tax rate above a certain critical rate, government revenue starts decreasing as the tax rate rises, as a consequence of a decline in labor supply. This theory supports that, if the tax rate is above that critical point, a decrease in the tax rate should imply a rise in labor supply that in turn would lead to an increase in government revenue.

Governments use different kinds of taxes and vary the tax rates. They do this in order to distribute the tax burden among individuals or classes of the population involved in taxable activities, such as the business sector, or to redistribute resources between individuals or classes in the population. Historically, taxes on the poor supported the nobility

Nobility is a social class found in many societies that have an aristocracy (class), aristocracy. It is normally ranked immediately below Royal family, royalty. Nobility has often been an Estates of the realm, estate of the realm with many e ...

; modern social-security systems aim to support the poor, the disabled, or the retired by taxes on those who are still working. In addition, taxes are applied to fund foreign aid and military ventures, to influence the macroeconomic performance of the economy (a government's strategy for doing this is called its fiscal policy; see also tax exemption), or to modify patterns of consumption or employment within an economy, by making some classes of the transaction more or less attractive.

A state's tax system often reflects its communal values and the values of those in current political power. To create a system of taxation, a state must make choices regarding the distribution of the tax burden—who will pay taxes and how much they will pay—and how the taxes collected will be spent. In democratic nations where the public elects those in charge of establishing or administering the tax system, these choices reflect the type of community that the public wishes to create. In countries where the public does not have a significant amount of influence over the system of taxation, that system may reflect more closely the values of those in power.

All large businesses incur administrative costs in the process of delivering revenue collected from customers to the suppliers of the goods or services being purchased. Taxation is no different, as governments are large organizations; the resource collected from the public through taxation is always greater than the amount which can be used by the government. The difference is called the compliance cost and includes (for example) the labor cost and other expenses incurred in complying with tax laws and rules. The collection of a tax in order to spend it on a specified purpose, for example collecting a tax on alcohol to pay directly for alcoholism-rehabilitation centers, is called hypothecation. Finance ministers often dislike this practice, since it reduces their freedom of action. Some economic theorists regard hypothecation as intellectually dishonest since, in reality, money is fungible. Furthermore, it often happens that taxes or excises initially levied to fund some specific government programs are then later diverted to the government general fund. In some cases, such taxes are collected in fundamentally inefficient ways, for example, through highway tolls.

Since governments also resolve commercial disputes, especially in countries with common law

In law, common law (also known as judicial precedent, judge-made law, or case law) is the body of law created by judges and similar quasi-judicial tribunals by virtue of being stated in written opinions."The common law is not a brooding omniprese ...

, similar arguments are sometimes used to justify a sales tax

A sales tax is a tax paid to a governing body for the sales of certain goods and services. Usually laws allow the seller to collect funds for the tax from the consumer at the point of purchase. When a tax on goods or services is paid to a govern ...

or value added tax

A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally. It is levied on the price of a product or service at each stage of production, distribution, or sale to the end ...

. Some ( libertarians, for example) portray most or all forms of taxes as immoral due to their involuntary (and therefore eventually coercive or violent) nature. The most extreme anti-tax view, anarcho-capitalism, holds that all social services should be voluntarily bought by the people using them.

Types

TheOrganisation for Economic Co-operation and Development

The Organisation for Economic Co-operation and Development (OECD; french: Organisation de coopération et de développement économiques, ''OCDE'') is an intergovernmental organization, intergovernmental organisation with 38 member countries ...

(OECD) publishes an analysis of the tax systems of member countries. As part of such analysis, OECD has developed a definition and system of classification of internal taxes, generally followed below. In addition, many countries impose taxes ( tariffs) on the import of goods.

Income

Income tax

Many jurisdictions tax the income of individuals and of business entities, includingcorporation

A corporation is an organization—usually a group of people or a company—authorized by the state to act as a single entity (a legal entity recognized by private and public law "born out of statute"; a legal person in legal context) and ...

s. Generally, the authorities impose a tax on net profits from a business, on net gains, and on other income. Computation of income subject to tax may be determined under accounting principles used in the jurisdiction, which tax-law principles in the jurisdiction may modify or replace. The incidence of taxation varies by system, and some systems may be viewed as progressive

Progressive may refer to:

Politics

* Progressivism, a political philosophy in support of social reform

** Progressivism in the United States, the political philosophy in the American context

* Progressive realism, an American foreign policy par ...

or regressive. Rates of tax may vary or be constant (flat) by income level. Many systems allow individuals certain personal allowances and other non-business reductions to taxable income, although business deductions tend to be favored over personal deductions.

Tax-collection agencies often collect personal income tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Tax ...

on a pay-as-you-earn basis, with corrections made after the end of the tax year. These corrections take one of two forms:

* payments to the government, from taxpayers who have not paid enough during the tax year

* tax refunds from the government to those who have overpaid

Income-tax systems often make deductions available that reduce the total tax liability by reducing total taxable income. They may allow losses from one type of income to count against another - for example, a loss on the stock market may be deducted against taxes paid on wages. Other tax systems may isolate the loss, such that business losses can only be deducted against business income tax by carrying forward the loss to later tax years.

Negative income tax

In economics, a negative income tax (abbreviated NIT) is a progressive income tax system where people earning below a certain amount receive supplemental payment from the government instead of paying taxes to the government.Capital gains

Most jurisdictions imposing an income tax treat capital gains as part of income subject to tax. Capital gain is generally a gain on sale of capital assets—that is, those assets not held for sale in the ordinary course of business. Capital assets include personal assets in many jurisdictions. Some jurisdictions provide preferential rates of tax or only partial taxation for capital gains. Some jurisdictions impose different rates or levels of capital-gains taxation based on the length of time the asset was held. Because tax rates are often much lower for capital gains than for ordinary income, there is widespread controversy and dispute about the proper definition of capital.Corporate

Corporate tax refers to income tax, capital tax, net-worth tax, or other taxes imposed on corporations. Rates of tax and the taxable base for corporations may differ from those for individuals or for other taxable persons.Social-security contributions

Payroll or workforce

Unemployment and similar taxes are often imposed on employers based on the total payroll. These taxes may be imposed in both the country and sub-country levels.Wealth

A wealth tax is levied on the total value of personal assets, including: bank deposits, real estate, assets in insurance and pension plans, ownership of unincorporated businesses, financial securities, and personal trusts. (recommending a net wealth tax for the US of 0.05% for the first $100,000 in assets to 0.3% for assets over $1,000,000) Liabilities (primarily mortgages and other loans) are typically deducted, hence it is sometimes called a net wealth tax.Property

Recurrent property taxes may be imposed on immovable property (real property) and on some classes of movable property. In addition, recurrent taxes may be imposed on the net wealth of individuals or corporations. Many jurisdictions impose estate tax, gift tax or otherinheritance tax

An inheritance tax is a tax paid by a person who inherits money or property of a person who has died, whereas an estate tax is a levy on the estate (money and property) of a person who has died.

International tax law distinguishes between an es ...

es on property at death or at the time of gift transfer. Some jurisdictions impose taxes on financial or capital transactions.

Property taxes

A property tax (or millage tax) is an '' ad valorem'' tax levy on the value of a property that the owner of the property is required to pay to a government in which the property is situated. Multiple jurisdictions may tax the same property. There are three general varieties of property: land, improvements to land (immovable man-made things, e.g. buildings), and personal property (movable things). Real estate or realty is the combination of land and improvements to the land. Property taxes are usually charged on a recurrent basis (e.g., yearly). A common type of property tax is an annual charge on the ownership of real estate, where the tax base is the estimated value of the property. For a period of over 150 years from 1695, the government of England levied a window tax, with the result that one can still see listed buildings with windows bricked up in order to save their owner's money. A similar tax on hearths existed in France and elsewhere, with similar results. The two most common types of event-driven property taxes arestamp duty

Stamp duty is a tax that is levied on single property purchases or documents (including, historically, the majority of legal documents such as cheques, receipts, military commissions, marriage licences and land transactions). A physical revenu ...

, charged upon change of ownership, and inheritance tax

An inheritance tax is a tax paid by a person who inherits money or property of a person who has died, whereas an estate tax is a levy on the estate (money and property) of a person who has died.

International tax law distinguishes between an es ...

, which many countries impose on the estates of the deceased.

In contrast with a tax on real estate (land and buildings), a land-value tax (or LVT) is levied only on the unimproved value of the land ("land" in this instance may mean either the economic term, i.e., all-natural resources, or the natural resources associated with specific areas of the Earth's surface: "lots" or "land parcels"). Proponents of the land-value tax argue that it is economically justified, as it will not deter production, distort market mechanisms or otherwise create deadweight losses the way other taxes do.

When real estate is held by a higher government unit or some other entity not subject to taxation by the local government, the taxing authority may receive a payment in lieu of taxes to compensate it for some or all of the foregone tax revenues.

In many jurisdictions (including many American states), there is a general tax levied periodically on residents who own personal property

property is property that is movable. In common law systems, personal property may also be called chattels or personalty. In civil law systems, personal property is often called movable property or movables—any property that can be moved fr ...

(personalty) within the jurisdiction. Vehicle and boat registration fees are subsets of this kind of tax. The tax is often designed with blanket coverage and large exceptions for things like food and clothing. Household goods are often exempt when kept or used within the household. Any otherwise non-exempt object can lose its exemption if regularly kept outside the household. Thus, tax collectors often monitor newspaper articles for stories about wealthy people who have lent art to museums for public display, because the artworks have then become subject to personal property tax. If an artwork had to be sent to another state for some touch-ups, it may have become subject to personal property tax in ''that'' state as well.

Inheritance

Inheritance tax, estate tax, and death tax or duty are the names given to various taxes that arise on the death of an individual. In United States tax law, there is a distinction between an estate tax and an inheritance tax: the former taxes the personal representatives of the deceased, while the latter taxes the beneficiaries of the estate. However, this distinction does not apply in other jurisdictions; for example, if using this terminology UK inheritance tax would be an estate tax.Expatriation

An expatriation tax is a tax on individuals who renounce theircitizenship

Citizenship is a "relationship between an individual and a state to which the individual owes allegiance and in turn is entitled to its protection".

Each state determines the conditions under which it will recognize persons as its citizens, and ...

or residence. The tax is often imposed based on a deemed disposition of all the individual's property. One example is the United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 U.S. state, states, a Washington, D.C., federal district, five ma ...

under the '' American Jobs Creation Act'', where any individual who has a net worth of $2 million or an average income-tax liability of $127,000 who renounces his or her citizenship and leaves the country is automatically assumed to have done so for tax avoidance reasons and is subject to a higher tax rate.

Transfer

Historically, in many countries, a contract needs to have a stamp affixed to make it valid. The charge for the stamp is either a fixed amount or a percentage of the value of the transaction. In most countries, the stamp has been abolished butstamp duty

Stamp duty is a tax that is levied on single property purchases or documents (including, historically, the majority of legal documents such as cheques, receipts, military commissions, marriage licences and land transactions). A physical revenu ...

remains. Stamp duty is levied in the UK on the purchase of shares and securities, the issue of bearer instruments, and certain partnership transactions. Its modern derivatives, stamp duty reserve tax and stamp duty land tax

Stamp duty in the United Kingdom is a form of tax charged on legal instruments (written documents), and historically required a physical stamp to be attached to or impressed upon the document in question. The more modern versions of the tax no l ...

, are respectively charged on transactions involving securities and land. Stamp duty has the effect of discouraging speculative purchases of assets by decreasing liquidity. In the United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 U.S. state, states, a Washington, D.C., federal district, five ma ...

, transfer tax is often charged by the state or local government and (in the case of real property transfers) can be tied to the recording of the deed or other transfer documents.

Wealth (net worth)

Some countries' governments will require a declaration of the taxpayers' balance sheet (assets and liabilities), and from that exact a tax onnet worth

Net worth is the value of all the non-financial and financial assets owned by an individual or institution minus the value of all its outstanding liabilities. Since financial assets minus outstanding liabilities equal net financial assets, net ...

(assets minus liabilities), as a percentage of the net worth, or a percentage of the net worth exceeding a certain level. The tax may be levied on " natural" or " legal persons."

Goods and services

Value added

A value-added tax (VAT), also known as Goods and Services Tax (G.S.T), Single Business Tax, or Turnover Tax in some countries, applies the equivalent of a sales tax to every operation that creates value. To give an example, sheet steel is imported by a machine manufacturer. That manufacturer will pay the VAT on the purchase price, remitting that amount to the government. The manufacturer will then transform the steel into a machine, selling the machine for a higher price to a wholesale distributor. The manufacturer will collect the VAT on the higher price but will remit to the government only the excess related to the "value-added" (the price over the cost of the sheet steel). The wholesale distributor will then continue the process, charging the retail distributor the VAT on the entire price to the retailer, but remitting only the amount related to the distribution mark-up to the government. The last VAT amount is paid by the eventual retail customer who cannot recover any of the previously paid VAT. For a VAT and sales tax of identical rates, the total tax paid is the same, but it is paid at differing points in the process. VAT is usually administrated by requiring the company to complete a VAT return, giving details of VAT it has been charged (referred to as input tax) and VAT it has charged to others (referred to as output tax). The difference between output tax and input tax is payable to the Local Tax Authority. Many tax authorities have introduced automated VAT which has increased accountability and auditability, by utilizing computer systems, thereby also enabling anti-cybercrime offices as well.Sales

Sales taxes are levied when a commodity is sold to its final consumer. Retail organizations contend that such taxes discourage retail sales. The question of whether they are generally progressive or regressive is a subject of much current debate. People with higher incomes spend a lower proportion of them, so a flat-rate sales tax will tend to be regressive. It is therefore common to exempt food, utilities, and other necessities from sales taxes, since poor people spend a higher proportion of their incomes on these commodities, so such exemptions make the tax more progressive. This is the classic "You pay for what you spend" tax, as only those who spend money on non-exempt (i.e. luxury) items pay the tax. A small number of U.S. states rely entirely on sales taxes for state revenue, as those states do not levy a state income tax. Such states tend to have a moderate to a large amount of tourism or inter-state travel that occurs within their borders, allowing the state to benefit from taxes from people the state would otherwise not tax. In this way, the state is able to reduce the tax burden on its citizens. The U.S. states that do not levy a state income tax are Alaska, Tennessee, Florida, Nevada, South Dakota, Texas, Washington state, and Wyoming. Additionally, New Hampshire and Tennessee levy state income taxes only ondividends

A dividend is a distribution of profits by a corporation to its shareholders. When a corporation earns a profit or surplus, it is able to pay a portion of the profit as a dividend to shareholders. Any amount not distributed is taken to be re-in ...

and interest income. Of the above states, only Alaska and New Hampshire do not levy a state sales tax. Additional information can be obtained at thFederation of Tax Administrators

website. In the United States, there is a growing movement for the replacement of all federal payroll and income taxes (both corporate and personal) with a national retail sales tax and monthly tax rebate to households of citizens and legal resident aliens. The tax proposal is named

FairTax

FairTax was a single rate tax proposal in 2005, 2008 and 2009 in the United States that includes complete dismantling of the Internal Revenue Service. The proposal would eliminate all federal income taxes (including the alternative minimum ta ...

. In Canada, the federal sales tax is called the Goods and Services Tax (GST) and now stands at 5%. The provinces of British Columbia, Saskatchewan, Manitoba, and Prince Edward Island also have a provincial sales tax ST The provinces of Nova Scotia, New Brunswick, Newfoundland & Labrador, and Ontario have harmonized their provincial sales taxes with the GST—Harmonized Sales Tax ST and thus is a full VAT. The province of Quebec collects the Quebec Sales Tax STwhich is based on the GST with certain differences. Most businesses can claim back the GST, HST, and QST they pay, and so effectively it is the final consumer who pays the tax.

Excises

An excise duty is anindirect tax

An indirect tax (such as sales tax, per unit tax, value added tax (VAT), or goods and services tax (GST), excise, consumption tax, tariff) is a tax that is levied upon goods and services before they reach the customer who ultimately pays the i ...

imposed upon goods during the process of their manufacture, production or distribution, and is usually proportionate to their quantity or value. Excise duties were first introduced into England in the year 1643, as part of a scheme of revenue and taxation devised by parliamentarian John Pym and approved by the Long Parliament. These duties consisted of charges on beer, ale, cider, cherry wine, and tobacco, to which list were afterward added paper, soap, candles, malt, hops, and sweets. The basic principle of excise duties was that they were taxes on the production, manufacture, or distribution of articles which could not be taxed through the customs house, and revenue derived from that source is called excise revenue proper. The fundamental conception of the term is that of a tax on articles produced or manufactured in a country. In the taxation of such articles of luxury as spirits, beer, tobacco, and cigars, it has been the practice to place a certain duty on the importation of these articles (a customs duty).

Excises (or exemptions from them) are also used to modify consumption patterns of a certain area (social engineering Social engineering may refer to:

* Social engineering (political science), a means of influencing particular attitudes and social behaviors on a large scale

* Social engineering (security), obtaining confidential information by manipulating and/or ...

). For example, a high excise is used to discourage alcohol consumption, relative to other goods. This may be combined with hypothecation if the proceeds are then used to pay for the costs of treating illness caused by alcohol use disorder. Similar taxes may exist on tobacco, pornography

Pornography (often shortened to porn or porno) is the portrayal of sexual subject matter for the exclusive purpose of sexual arousal. Primarily intended for adults,

, etc., and they may be collectively referred to as " sin taxes". A carbon tax is a tax on the consumption of carbon-based non-renewable fuels, such as petrol, diesel-fuel, jet fuels, and natural gas. The object is to reduce the release of carbon into the atmosphere. In the United Kingdom, vehicle excise duty is an annual tax on vehicle ownership.

Tariff

An import or export tariff (also called customs duty or impost) is a charge for the movement of goods through a political border. Tariffs discourage trade, and they may be used by governments to protect domestic industries. A proportion of tariff revenues is often hypothecated to pay the government to maintain a navy or border police. The classic ways of cheating a tariff aresmuggling

Smuggling is the illegal transportation of objects, substances, information or people, such as out of a house or buildings, into a prison, or across an international border, in violation of applicable laws or other regulations.

There are vario ...

or declaring a false value of goods. Tax, tariff and trade rules in modern times are usually set together because of their common impact on industrial policy

An industrial policy (IP) or industrial strategy of a country is its official strategic effort to encourage the development and growth of all or part of the economy, often focused on all or part of the manufacturing sector. The government takes m ...

, investment policy, and agricultural policy. A trade bloc is a group of allied countries agreeing to minimize or eliminate tariffs against trade with each other, and possibly to impose protective tariffs on imports from outside the bloc. A customs union has a common external tariff, and the participating countries share the revenues from tariffs on goods entering the customs union.

In some societies, tariffs also could be imposed by local authorities on the movement of goods between regions (or via specific internal gateways). A notable example is the '' likin'', which became an important revenue source for local governments in the late Qing China

The Qing dynasty ( ), officially the Great Qing,, was a Manchu people, Manchu-led Dynasties in Chinese history, imperial dynasty of China and the last orthodox dynasty in Chinese history. It emerged from the Later Jin (1616–1636), La ...

.

Other

License fees

Occupational taxes or license fees may be imposed on businesses or individuals engaged in certain businesses. Many jurisdictions impose a tax on vehicles.Poll

A poll tax, also called a ''per capita tax'', or ''capitation tax'', is a tax that levies a set amount per individual. It is an example of the concept of fixed tax. One of the earliest taxes mentioned in theBible

The Bible (from Koine Greek , , 'the books') is a collection of religious texts or scriptures that are held to be sacred in Christianity, Judaism, Samaritanism, and many other religions. The Bible is an anthologya compilation of texts o ...

of a half-shekel per annum from each adult Jew (Ex. 30:11–16) was a form of the poll tax. Poll taxes are administratively cheap because they are easy to compute and collect and difficult to cheat. Economists have considered poll taxes economically efficient because people are presumed to be in fixed supply and poll taxes, therefore, do not lead to economic distortions. However, poll taxes are very unpopular because poorer people pay a higher proportion of their income than richer people. In addition, the supply of people is in fact not fixed over time: on average, couples will choose to have fewer children if a poll tax is imposed. The introduction of a poll tax in medieval England was the primary cause of the 1381 Peasants' Revolt. Scotland was the first to be used to test the new poll tax in 1989 with England and Wales in 1990. The change from progressive local taxation based on property values to a single-rate form of taxation regardless of ability to pay (the Community Charge, but more popularly referred to as the Poll Tax), led to widespread refusal to pay and to incidents of civil unrest, known colloquially as the ' Poll Tax Riots'.

Other

Some types of taxes have been proposed but not actually adopted in any major jurisdiction. These include: * Bank tax * Financial transaction taxes including currency transaction taxesDescriptive labels

Ad valorem and per unit

An ''ad valorem'' tax is one where the tax base is the value of a good, service, or property. Sales taxes, tariffs, property taxes, inheritance taxes, and value-added taxes are different types of ad valorem tax. An ad valorem tax is typically imposed at the time of a transaction (sales tax or value-added tax (VAT)) but it may be imposed on an annual basis (property tax) or in connection with another significant event (inheritance tax or tariffs). In contrast to ad valorem taxation is a ''per unit'' tax, where the tax base is the quantity of something, regardless of its price. Anexcise tax

file:Lincoln Beer Stamp 1871.JPG, upright=1.2, 1871 U.S. Revenue stamp for 1/6 barrel of beer. Brewers would receive the stamp sheets, cut them into individual stamps, cancel them, and paste them over the Bunghole, bung of the beer barrel so when ...

is an example.

Consumption

Consumption tax refers to any tax on non-investment spending and can be implemented by means of a sales tax, consumer value-added tax, or by modifying an income tax to allow for unlimited deductions for investment or savings.Environmental

This includes natural resources consumption tax, greenhouse gas tax ( Carbon tax), "sulfuric tax", and others. The stated purpose is to reduce the environmental impact by repricing. Economists describe environmental impacts as negative externalities. As early as 1920, Arthur Pigou suggested a tax to deal with externalities (see also the section on Increased economic welfare below). The proper implementation of environmental taxes has been the subject of a long-lasting debate.Proportional, progressive, regressive, and lump-sum

An important feature of tax systems is the percentage of the tax burden as it relates to income or consumption. The terms progressive, regressive, and proportional are used to describe the way the rate progresses from low to high, from high to low, or proportionally. The terms describe a distribution effect, which can be applied to any type of tax system (income or consumption) that meets the definition. * A progressive tax is a tax imposed so that theeffective tax rate

In a tax system, the tax rate is the ratio (usually expressed as a percentage) at which a business or person is taxed. There are several methods used to present a tax rate: statutory, average, marginal, and effective. These rates can also be ...

increases as the amount to which the rate is applied increases.

* The opposite of a progressive tax is a regressive tax, where the effective tax rate decreases as the amount to which the rate is applied increases. This effect is commonly produced where means testing is used to withdraw tax allowances or state benefits.

* In between is a proportional tax, where the effective tax rate is fixed, while the amount to which the rate is applied increases.

* A lump-sum tax is a tax that is a fixed amount, no matter the change in circumstance of the taxed entity. This in actuality is a regressive tax as those with lower income must use a higher percentage of their income than those with higher income and therefore the effect of the tax reduces as a function of income.

The terms can also be used to apply meaning to the taxation of select consumption, such as a tax on luxury goods and the exemption of basic necessities may be described as having progressive effects as it increases a tax burden on high end consumption and decreases a tax burden on low end consumption.

Direct and indirect

Taxes are sometimes referred to as "direct taxes" or "indirect taxes". The meaning of these terms can vary in different contexts, which can sometimes lead to confusion. An economic definition, by Atkinson, states that "...direct taxes may be adjusted to the individual characteristics of the taxpayer, whereas indirect taxes are levied on transactions irrespective of the circumstances of buyer or seller." According to this definition, for example, income tax is "direct", and sales tax is "indirect". In law, the terms may have different meanings. In U.S. constitutional law, for instance, direct taxes refer to poll taxes and property taxes, which are based on simple existence or ownership. Indirect taxes are imposed on events, rights, privileges, and activities. Thus, a tax on the sale of the property would be considered an indirect tax, whereas the tax on simply owning the property itself would be a direct tax.Fees and effective

Governments may charge user fees, tolls, or other types of assessments in exchange of particular goods, services, or use of property. These are generally not considered taxes, as long as they are levied as payment for a direct benefit to the individual paying. Such fees include: * Tolls: a fee charged to travel via a road,bridge

A bridge is a structure built to span a physical obstacle (such as a body of water, valley, road, or rail) without blocking the way underneath. It is constructed for the purpose of providing passage over the obstacle, which is usually somethi ...

, tunnel, canal

Canals or artificial waterways are waterways or engineered channels built for drainage management (e.g. flood control and irrigation) or for conveyancing water transport vehicles (e.g. water taxi). They carry free, calm surface fl ...

, waterway

A waterway is any navigable body of water. Broad distinctions are useful to avoid ambiguity, and disambiguation will be of varying importance depending on the nuance of the equivalent word in other languages. A first distinction is necessary ...

or other transportation facilities. Historically tolls have been used to pay for public bridge, road, and tunnel projects. They have also been used in privately constructed transport links. The toll is likely to be a fixed charge, possibly graduated for vehicle type, or for distance on long routes.

* User fees, such as those charged for use of parks or other government-owned facilities.

* Ruling fees charged by governmental agencies to make determinations in particular situations.

Some scholars refer to certain economic effects as taxes, though they are not levies imposed by governments. These include:

* Inflation tax: the economic disadvantage suffered by holders of cash and cash equivalents

Cash and cash equivalents (CCE) are the most liquid current assets found on a business's balance sheet. Cash equivalents are short-term commitments "with temporarily idle cash and easily convertible into a known cash amount". An investment normal ...

in one denomination of currency

A currency, "in circulation", from la, currens, -entis, literally meaning "running" or "traversing" is a standardization of money in any form, in use or circulation as a medium of exchange, for example banknotes and coins.

A more general ...

due to the effects of expansionary monetary policy

* Financial repression: Government policies such as interest-rate caps on government debt, financial regulations such as reserve requirements and capital controls, and barriers to entry in markets where the government owns or controls businesses.

History

The first known system of taxation was in

The first known system of taxation was in