|

HM Revenue And Customs

HM Revenue and Customs (His Majesty's Revenue and Customs, or HMRC) is a non-ministerial government department, non-ministerial Departments of the United Kingdom Government, department of the His Majesty's Government, UK Government responsible for the tax collection, collection of Taxation in the United Kingdom, taxes, the payment of some forms of Welfare state in the United Kingdom, state support, the administration of other regulatory Regime#Politics, regimes including the national minimum wage and the issuance of national insurance numbers. HMRC was formed by the merger of the Inland Revenue and HM Customs and Excise, which took effect on 18 April 2005. The department's logo is the St Edward's Crown enclosed within a circle. Prior to the Elizabeth II, Queen's death on 8 September 2022, the department was known as ''Her'' Majesty's Revenue and Customs and has since been amended to reflect the change of monarch. Departmental responsibilities The department is responsible for the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inland Revenue

The Inland Revenue was, until April 2005, a department of the British Government responsible for the collection of direct taxation, including income tax, national insurance contributions, capital gains tax, inheritance tax, corporation tax, petroleum revenue tax and stamp duty. More recently, the Inland Revenue also administered the Tax Credits schemes, whereby monies, such as Working Tax Credit (WTC) and Child Tax Credit (CTC), are paid by the Government into a recipient's bank account or as part of their wages. The Inland Revenue was also responsible for the payment of child benefit. The Inland Revenue was merged with HM Customs and Excise to form HM Revenue and Customs which came into existence on 18 April 2005. The former Inland Revenue thus became part of HM Revenue and Customs. The current name was promoted by the use of the expression "from Revenue and Customs" in a series of annual radio, and to a lesser extent, television public information broadcasts in t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Elizabeth II

Elizabeth II (Elizabeth Alexandra Mary; 21 April 1926 – 8 September 2022) was Queen of the United Kingdom and other Commonwealth realms from 6 February 1952 until her death in 2022. She was queen regnant of 32 sovereign states during her lifetime, and was head of state of 15 realms at the time of her death. Her reign of 70 years and 214 days was the longest of any British monarch and the longest verified reign of any female monarch in history. Elizabeth was born in Mayfair, London, as the first child of the Duke and Duchess of York (later King George VI and Queen Elizabeth The Queen Mother). Her father acceded to the throne in 1936 upon the abdication of his brother Edward VIII, making the ten-year-old Princess Elizabeth the heir presumptive. She was educated privately at home and began to undertake public duties during the Second World War, serving in the Auxiliary Territorial Service. In November 1947, she married Philip Mountbatten, a former pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Child Benefit

Child benefit or children's allowance is a social security payment which is distributed to the parents or guardians of children, teenagers and in some cases, young adults. A number of countries operate different versions of the program. In most countries, child benefit is means-tested and the amount of child benefit paid is usually dependent on the number of children one has. Conditions for payment A number of conditional cash transfer programs in Latin America and Africa link payment to the receivers' actions, such as enrolling children into schools, and health check-ups and vaccinations. In the UK, in 2011 CentreForum proposed an additional child benefit dependent on parenting activities. Australia In Australia, Child benefit payments are currently called Family Tax Benefit. Family Tax Benefit is income tested and is linked to the Australian Income tax system. It can be claimed as fortnightly payments or as an annual lump sum. It may be payable for dependant children from ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Insurance

National Insurance (NI) is a fundamental component of the welfare state in the United Kingdom. It acts as a form of social security, since payment of NI contributions establishes entitlement to certain state benefits for workers and their families. Introduced by the National Insurance Act 1911 and expanded by the Labour government in 1948, the system has been subjected to numerous amendments in succeeding years. Initially, it was a contributory form of insurance against illness and unemployment, and eventually provided retirement pensions and other benefits. Currently, workers pay contributions from the age of 16 years, until the age they become eligible for the State pension. Contributions are due from employed people earning at or above a threshold called the Lower Earnings Limit, the value of which is reviewed each year. Self-employed people contribute partly through a fixed weekly or monthly payment and partly on a percentage of net profits above a threshold, which is rev ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Climate Change Levy

The Climate Change Levy (CCL) is a tax on energy delivered to non-domestic users in the United Kingdom. Scope and purpose Introduced on 1 April 2001 under the Finance Act 2000, it was forecast to cut annual emissions by 2.5 million tonnes by 2010, and forms part of the UK's Climate Change Programme. The levy applies to most energy users, with the notable exceptions of those in the domestic and transport sectors. Electricity from nuclear is taxed even though it causes no direct carbon emissions. Originally electricity generated from new renewables and approved cogeneration schemes was not taxed, but the July 2015 Budget removed this exemption from 1 August 2015, raising £450m/year. Rates From when it was introduced, the levy was frozen at 0.43p/kWh on electricity, 0.15p/kWh on coal and 0.15p/kWh on gas. A reduction of up to 90% from the levy may be gained by energy-intensive users provided they sign a Climate Change Agreement. Revenue from the levy was offset by a 0.3 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Air Passenger Duty

Air Passenger Duty (APD) is an excise duty which is charged on the carriage of passengers flying from a United Kingdom or Isle of Man airport on an aircraft that has an authorised take-off weight of more than 5.7 tonnes or more than twenty seats for passengers. The duty is not payable by inbound international passengers who are bookedNotice 550 Section 4.1 HMRC to continue their journey (to an international destination) within 24 hours of their scheduled time of arrival in the UK. (The same exemption applies to booked onward domestic flights, but the time limits are shorter and more complex.) If a passenger "stops-over" for more than 24 hours (or the domestic limit, if applicable), duty is payable in f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stamp Duty Land Tax

Stamp duty in the United Kingdom is a form of tax charged on legal instruments (written documents), and historically required a physical stamp to be attached to or impressed upon the document in question. The more modern versions of the tax no longer require a physical stamp. History of UK stamp duties Stamp duty was first introduced in England on 28 June 1694, during the reign of William III and Mary II, under "An act for granting to their Majesties several duties upon vellum, parchment and paper, for four years, towards carrying on the war against France". Dagnall, H. (1994) ''Creating a Good Impression: three hundred years of The Stamp Office and stamp duties.'' London: HMSO, p. 3. In the 1702/03 financial year 3,932,933 stamps were embossed in England for a total value of £91,206.10s.4d. Stamp duty was so successful that it continues to this day through a series of Stamp Acts. Similar duties have been levied in the Netherlands, France and elsewhere. During the 18t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Excise Duties

file:Lincoln Beer Stamp 1871.JPG, upright=1.2, 1871 U.S. Revenue stamp for 1/6 barrel of beer. Brewers would receive the stamp sheets, cut them into individual stamps, cancel them, and paste them over the Bunghole, bung of the beer barrel so when the barrel was tapped it would destroy the stamp. An excise, or excise tax, is any duty (economics), duty on manufactured goods (economics), goods that is levied at the moment of manufacture rather than at sale. Excises are often associated with customs duties, which are levied on pre-existing goods when they cross a designated border in a specific direction; customs are levied on goods that become taxable items at the ''border'', while excise is levied on goods that came into existence ''inland''. An excise is considered an indirect tax, meaning that the producer or seller who pays the levy to the government is expected to try to recover their loss by raising the price paid by the eventual buyer of the goods. Excises are typically impo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Value Added Tax

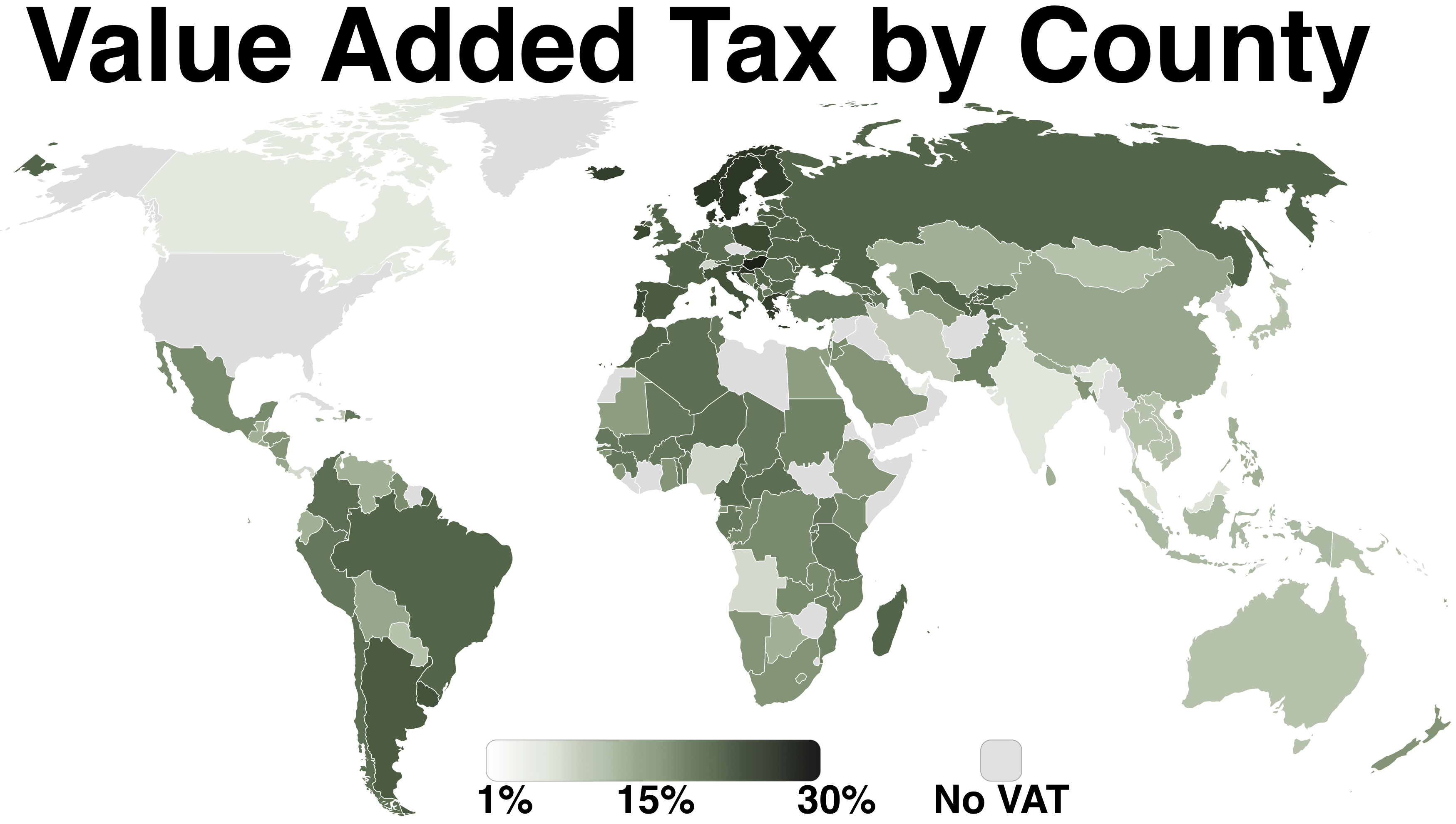

A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally. It is levied on the price of a product or service at each stage of production, distribution, or sale to the end consumer. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services, it can reclaim the tax paid. It is similar to, and is often compared with, a sales tax. VAT is an indirect tax because the person who ultimately bears the burden of the tax is not necessarily the same person as the one who pays the tax to the tax authorities. Not all localities require VAT to be charged, and exports are often exempt. VAT is usually implemented as a destination-based tax, where the tax rate is based on the location of the consumer and applied to the sales price. The terms VAT, GST, and the more general consumption tax are sometimes used interchangeably. VAT raises about a fifth of total tax revenues ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Indirect Tax

An indirect tax (such as sales tax, per unit tax, value added tax A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally. It is levied on the price of a product or service at each stage of production, distribution, or sale to the en ... (VAT), or goods and services tax (GST), excise, consumption tax, tariff) is a tax that is levied upon goods and services before they reach the customer who ultimately pays the indirect tax as a part of market price of the good or service purchased. Alternatively, if the entity who pays taxes to the tax collecting authority does not suffer a corresponding reduction in income, i.e., impact and tax incidence are not on the same entity meaning that tax can be shifted or passed on, then the tax is indirect. An indirect tax is collected by an intermediary (such as a retail store) from the person (such as the consumer) who pays the tax included in the price of a purchased ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inheritance Tax

An inheritance tax is a tax paid by a person who inherits money or property of a person who has died, whereas an estate tax is a levy on the estate (money and property) of a person who has died. International tax law distinguishes between an estate tax and an inheritance tax—an estate tax is assessed on the assets of the deceased, while an inheritance tax is assessed on the legacies received by the estate's beneficiaries. However, this distinction is not always observed; for example, the UK's "inheritance tax" is a tax on the assets of the deceased, and strictly speaking is therefore an estate tax. For historical reasons, the term death duty is still used colloquially (though not legally) in the UK and some Commonwealth countries. For political, statutory and other reasons, the term death tax is sometimes used to refer to estate tax in the United States. Varieties of inheritance and estate taxes * Belgium, droits de succession or erfbelasting (Inheritance tax). Collected at ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Gains Tax

A capital gains tax (CGT) is the tax on profits realized on the sale of a non-inventory asset. The most common capital gains are realized from the sale of stocks, bonds, precious metals, real estate, and property. Not all countries impose a capital gains tax and most have different rates of taxation for individuals versus corporations. Countries that do not impose a capital gains tax include Bahrain, Barbados, Belize, Cayman Islands, Isle of Man, Jamaica, New Zealand, Sri Lanka, Singapore, and others. In some countries, such as New Zealand and Singapore, professional traders and those who trade frequently are taxed on such profits as a business income. In Sweden, the Investment Savings Account (ISK – ''Investeringssparkonto'') was introduced in 2012 in response to a decision by Parliament to stimulate saving in funds and equities. There is no tax on capital gains in ISKs; instead, the saver pays an annual standard low rate of tax. Fund savers nowadays mainly choose to save in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |