|

Indirect Tax

An indirect tax (such as sales tax, per unit tax, value added tax A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally. It is levied on the price of a product or service at each stage of production, distribution, or sale to the en ... (VAT), or goods and services tax (GST), excise, consumption tax, tariff) is a tax that is levied upon goods and services before they reach the customer who ultimately pays the indirect tax as a part of market price of the good or service purchased. Alternatively, if the entity who pays taxes to the tax collecting authority does not suffer a corresponding reduction in income, i.e., impact and tax incidence are not on the same entity meaning that tax can be shifted or passed on, then the tax is indirect. An indirect tax is collected by an intermediary (such as a retail store) from the person (such as the consumer) who pays the tax included in the price of a purchased ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sales Tax

A sales tax is a tax paid to a governing body for the sales of certain goods and services. Usually laws allow the seller to collect funds for the tax from the consumer at the point of purchase. When a tax on goods or services is paid to a governing body directly by a consumer, it is usually called a use tax. Often laws provide for the exemption of certain goods or services from sales and use tax, such as food, education, and medicines. A value-added tax (VAT) collected on goods and services is related to a sales tax. See Comparison with sales tax for key differences. Types Conventional or retail sales tax is levied on the sale of a good to its final end-user and is charged every time that item is sold retail. Sales to businesses that later resell the goods are not charged the tax. A purchaser who is not an end-user is usually issued a "resale certificate" by the taxing authority and required to provide the certificate (or its ID number) to a seller at the point of purchase ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

GDP Per Capita PPP Vs Indirect Taxes 2016

Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced and sold (not resold) in a specific time period by countries. Due to its complex and subjective nature this measure is often revised before being considered a reliable indicator. GDP (nominal) per capita does not, however, reflect differences in the cost of living and the inflation rates of the countries; therefore, using a basis of GDP per capita at purchasing power parity (PPP) may be more useful when comparing living standards between nations, while nominal GDP is more useful comparing national economies on the international market. Total GDP can also be broken down into the contribution of each industry or sector of the economy. The ratio of GDP to the total population of the region is the per capita GDP (also called the Mean Standard of Living). GDP definitions are maintained by a number of national and international economic organizations. The Or ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world." Formed in 1944, started on 27 December 1945, at the Bretton Woods Conference primarily by the ideas of Harry Dexter White and John Maynard Keynes, it came into formal existence in 1945 with 29 member countries and the goal of reconstructing the international monetary system. It now plays a central role in the management of balance of payments difficulties and international financial crises. Countries contribute funds to a pool through a quota system from which countries experiencing balance of payments problems can borrow money. , the fund had XDR 477 billi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Excise Tax In The United States

Excise tax in the United States is an indirect tax on listed items. Excise taxes can be and are made by federal, state and local governments and are not uniform throughout the United States. Certain goods, such as gasoline, diesel fuel, alcohol, and tobacco products, are taxed by multiple governments simultaneously. Some excise taxes are collected from the producer or retailer and not paid directly by the consumer, and as such often remain "hidden" in the price of a product or service, rather than being listed separately. Federal excise taxes and revenues Federal excise taxes raised $86.8 billion in fiscal year 2020, or 2.5% of total federal tax revenue. These data come from Tables 2.1 through 2.4. Fuel Federal excise taxes have been stable at 18.4¢ per gallon for gasoline and 24.4¢ per gallon for diesel fuel since 1993. This raised $37.4 billion in fiscal year 2015. These fuel taxes raised 90% of the Highway Trust Fund. The average of state taxes on fuel was 31.02¢ per ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Constitutional Law

The constitutional law of the United States is the body of law governing the interpretation and implementation of the United States Constitution. The subject concerns the scope of power of the United States federal government compared to the individual states and the fundamental rights of individuals. The ultimate authority upon the interpretation of the Constitution and the constitutionality of statutes, state and federal, lies with the Supreme Court of the United States. The Supreme Court Judicial review Early in its history, in ''Marbury v. Madison'', 5 U.S. 137 (1803) and ''Fletcher v. Peck'', 10 U.S. 87 (1810), the Supreme Court of the United States declared that the judicial power granted to it by Article III of the United States Constitution included the power of judicial review, to consider challenges to the constitutionality of a State or Federal law. The holding in these cases empowered the Supreme Court to strike down enacted laws that were contrary to the Consti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Income Taxes

A corporate tax, also called corporation tax or company tax, is a direct tax imposed on the income or capital of corporations or analogous legal entities. Many countries impose such taxes at the national level, and a similar tax may be imposed at state or local levels. The taxes may also be referred to as income tax or capital tax. A country's corporate tax may apply to: * corporations incorporated in the country, * corporations doing business in the country on income from that country, * foreign corporations who have a permanent establishment in the country, or * corporations deemed to be resident for tax purposes in the country. Company income subject to tax is often determined much like taxable income for individual taxpayers. Generally, the tax is imposed on net profits. In some jurisdictions, rules for taxing companies may differ significantly from rules for taxing individuals. Certain corporate acts or types of entities may be exempt from tax. The incidence of corporat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Personal Income Tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. The tax rate may increase as taxable income increases (referred to as graduated or progressive tax rates). The tax imposed on companies is usually known as corporate tax and is commonly levied at a flat rate. Individual income is often taxed at progressive rates where the tax rate applied to each additional unit of income increases (e.g., the first $10,000 of income taxed at 0%, the next $10,000 taxed at 1%, etc.). Most jurisdictions exempt local charitable organizations from tax. Income from investments may be taxed at different (generally lower) rates than other types of income. Credits of various sorts may be allowed that reduce tax. Some jurisdictio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ad Valorem Tax

An ''ad valorem'' tax (Latin for "according to value") is a tax whose amount is based on the value of a transaction or of property. It is typically imposed at the time of a transaction, as in the case of a sales tax or value-added tax (VAT). An ''ad valorem'' tax may also be imposed annually, as in the case of a real or personal property tax, or in connection with another significant event (e.g. inheritance tax, expatriation tax, or tariff). In some countries, a stamp duty is imposed as an ''ad valorem'' tax. Operation All ad valorem taxes are collected according to the determined value of the taxed item. In the most common application of ad valorem taxes, namely municipal property taxes, public tax assessors regularly assess the property owner's real estate in order to determine its current value. The determined value of the property is used to calculate the annual tax collected by the municipality or any other government entity upon the property owner. Ad valorem taxes ar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Per Unit Tax

A per unit tax, or specific tax, is a tax that is defined as a fixed amount for each unit of a good or service sold, such as cents per kilogram. It is thus proportional to the particular quantity of a product sold, regardless of its price. Excise taxes, for instance, fall into this tax category. By contrast, an ad valorem An ''ad valorem'' tax (Latin for "according to value") is a tax whose amount is based on the value of a transaction or of property. It is typically imposed at the time of a transaction, as in the case of a sales tax or value-added tax (VAT). An ... tax is a charge based on a fixed percentage of the product value. Per unit taxes have administrative advantages when it is easy to measure quantities of the product or service being sold. Effect on supply curve Any tax will raise cost of production hence shift the supply curve to the left. In the case of specific tax, the shift will be purely parallel because the amount of tax is the same at all prices. That amoun ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Failure

In neoclassical economics, market failure is a situation in which the allocation of goods and services by a free market is not Pareto efficient, often leading to a net loss of economic value. Market failures can be viewed as scenarios where individuals' pursuit of pure self-interest leads to results that are not efficient – that can be improved upon from the societal point of view. Paul Krugman and Robin Wells (2006). ''Economics'', New York, Worth Publishers. The first known use of the term by economists was in 1958,Francis M. Bator (1958). "The Anatomy of Market Failure," ''Quarterly Journal of Economics'', 72(3) pp351–379(press +). but the concept has been traced back to the Victorian philosopher Henry Sidgwick.Steven G. Medema (2007). "The Hesitant Hand: Mill, Sidgwick, and the Evolution of the Theory of Market Failure," ''History of Political Economy'', 39(3), p. 331��358. 200Online Working Paper. Market failures are often associated with public goods, time-incon ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

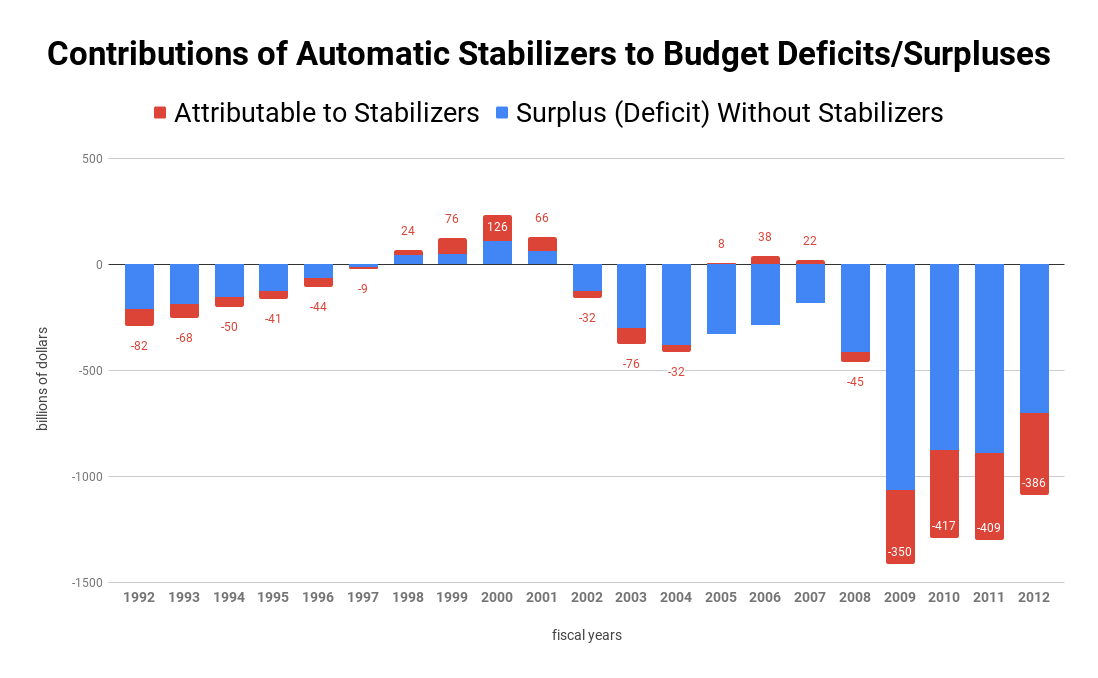

Automatic Stabilizer

In macroeconomics, automatic stabilizers are features of the structure of modern government budgets, particularly income taxes and welfare spending, that act to damp out fluctuations in real GDP. The size of the government budget deficit tends to increase when a country enters a recession, which tends to keep national income higher by maintaining aggregate demand. There may also be a multiplier effect. This effect happens automatically depending on GDP and household income, without any explicit policy action by the government, and acts to reduce the severity of recessions. Similarly, the budget deficit tends to decrease during booms, which pulls back on aggregate demand. Therefore, automatic stabilizers tend to reduce the size of the fluctuations in a country's GDP. Induced taxes Tax revenues generally depend on household income and the pace of economic activity. Household incomes fall and the economy slows down during a recession, and government tax revenues fall as well. Thi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

_1950_-_2010.gif)