Economy of the Republic of Ireland on:

[Wikipedia]

[Google]

[Amazon]

The economy of the Republic of Ireland is a highly developed knowledge economy, focused on services in high-tech, life sciences, financial services and agribusiness, including

, Sean Dorgan, the chief executive of IDA. 23 June 2006 Between 1985 and 2002, private sector jobs increased 59%. The economy shifted from an agriculture to a knowledge economy, focusing on services and high-tech industries. Economic growth averaged 10% from 1995 to 2000, and 7% from 2001 to 2004. Industry, which accounts for 46% of GDP and about 80% of exports, has replaced agriculture as the country's leading sector.

Historian R. F. Foster argues the cause was a combination of a new sense of initiative and the entry of American corporations such as

Historian R. F. Foster argues the cause was a combination of a new sense of initiative and the entry of American corporations such as

It was the first country in the EU to officially enter a recession related to the Financial crisis 2008, as declared by the Central Statistics Office. At this point, Ireland now had the second-highest level of household debt in the world (190% of household income). The country's credit rating was downgraded to "AA-" by Standard & Poor's ratings agency in August 2010 due to the cost of supporting the banks, which would weaken the Government's financial flexibility over the medium term. It transpired that the cost of recapitalising the banks was greater than expected at that time, and, in response to the mounting costs, the country's credit rating was again downgraded by Standard & Poor's to "A".

The

It was the first country in the EU to officially enter a recession related to the Financial crisis 2008, as declared by the Central Statistics Office. At this point, Ireland now had the second-highest level of household debt in the world (190% of household income). The country's credit rating was downgraded to "AA-" by Standard & Poor's ratings agency in August 2010 due to the cost of supporting the banks, which would weaken the Government's financial flexibility over the medium term. It transpired that the cost of recapitalising the banks was greater than expected at that time, and, in response to the mounting costs, the country's credit rating was again downgraded by Standard & Poor's to "A".

The  The second problem, unacknowledged by management of Irish banks, the financial regulator and the Irish government, is

The second problem, unacknowledged by management of Irish banks, the financial regulator and the Irish government, is

In 2016 official CSO figures indicated that the economic recovery had led to 26.3% growth in GDP in 2015 and 18.7% growth in GNP. The figures were widely ridiculed including by Nobel Prize winning economist

In 2016 official CSO figures indicated that the economic recovery had led to 26.3% growth in GDP in 2015 and 18.7% growth in GNP. The figures were widely ridiculed including by Nobel Prize winning economist

Energy in Ireland 1990 – 2004: Trends, issues, forecasts and indicators

(pdf), p10, 20, 26. A 2006 forecast by Sustainable Energy Ireland predicts that oil will no longer be used for electrical generation but natural gas will be dominant at 71.3% of the total share, coal at 9.2%, and renewable energy at 8.2% of the market. New or potential sources include the

]

Exports play an important role in Ireland's economic growth. The country is one of the largest exporters of pharmaceuticals, medical devices and software-related goods and services in the world.

A series of significant discoveries of base metal deposits have been made, including the giant ore deposit at

]

Exports play an important role in Ireland's economic growth. The country is one of the largest exporters of pharmaceuticals, medical devices and software-related goods and services in the world.

A series of significant discoveries of base metal deposits have been made, including the giant ore deposit at

Ireland

The World Factbook. Retrieved on 8 August 2006. Peat extraction has historically been important, especially from midland bogs, however more efficient fuels and environmental protection of bogs has reduced peat's importance to the economy. Natural gas extraction occurs in the Kinsale Gas Field and the Corrib Gas Field in the southern and western counties, where there is 19.82 bn cubic metres of proven reserves.

The percentage of the population at risk of

The percentage of the population at risk of

online

* Coulter, Colin, and Angela Nagle, eds. ''Ireland under austerity: Neoliberal crisis, neoliberal solutions'' (2015

excerpt

* Daly, Mary E. ''Sixties Ireland: reshaping the economy, state and society, 1957–1973'' (Cambridge University Press, 2016). * Girvin, Brian. "Before the Celtic Tiger: Change Without Modernisation in Ireland 1959-1989." ''Economic & Social Review'' 41.3 (2010). * O'Hagan, John, and Francis O'Toole. ''The Economy of Ireland: Policy-making in a Global Context'' (Macmillan International Higher Education, 2017). * Mercille, Julien. ''The political economy and media coverage of the European economic crisis: The case of Ireland'' (Routledge, 2014). * Muñoz de Bustillo, Rafael, and José Ignacio Antón. "From sending to host societies: immigration in Greece, Ireland and Spain in the 21st century." ''Industrial Relations Journal'' 41.6 (2010): 563–583.

Irish Industrial Development Authority ("IDA Ireland")

Irish National Treasury Management Agency ("NTMA")

EU Commission Ireland Portal

OECD Ireland Portal

IMF Ireland Portal

The Economist Ireland Portal

Irishecononomy.ie website

Finfacts Ireland website

{{DEFAULTSORT:Economy Of The Republic Of Ireland

agrifood

The food industry is a complex, global network of diverse businesses that supplies most of the food consumed by the world's population. The food industry today has become highly diversified, with manufacturing ranging from small, traditiona ...

. Ireland

Ireland ( ; ga, Éire ; Ulster Scots dialect, Ulster-Scots: ) is an island in the Atlantic Ocean, North Atlantic Ocean, in Northwestern Europe, north-western Europe. It is separated from Great Britain to its east by the North Channel (Grea ...

is an open economy

An open economy is a type of economy where not only domestic factors but also entities in other countries engage in trade of products (goods and services). Trade can take the form of managerial exchange, technology transfers, and all kinds of goo ...

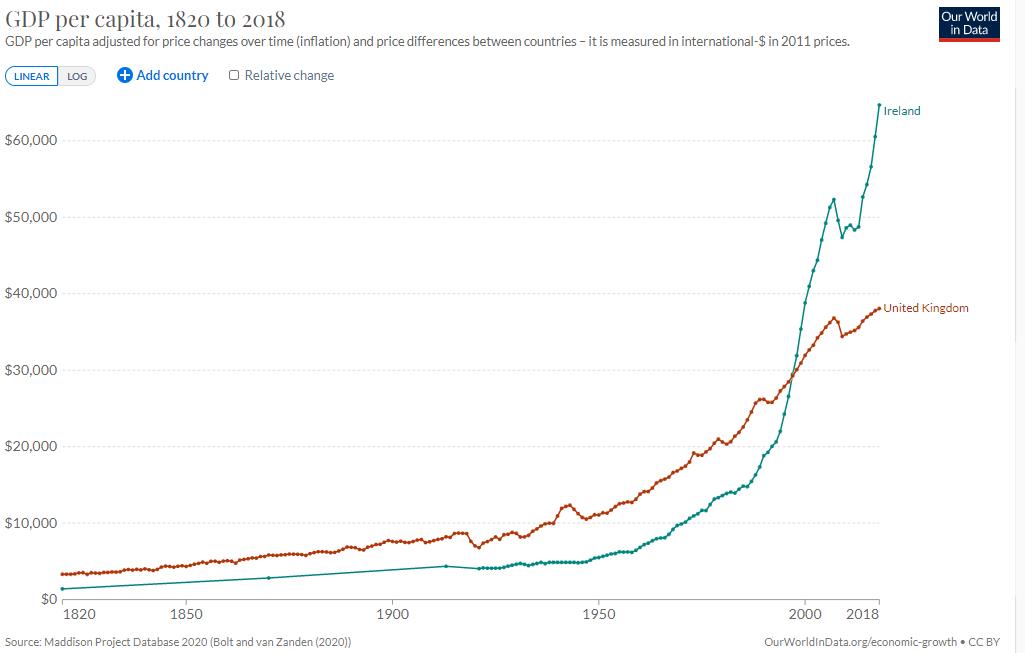

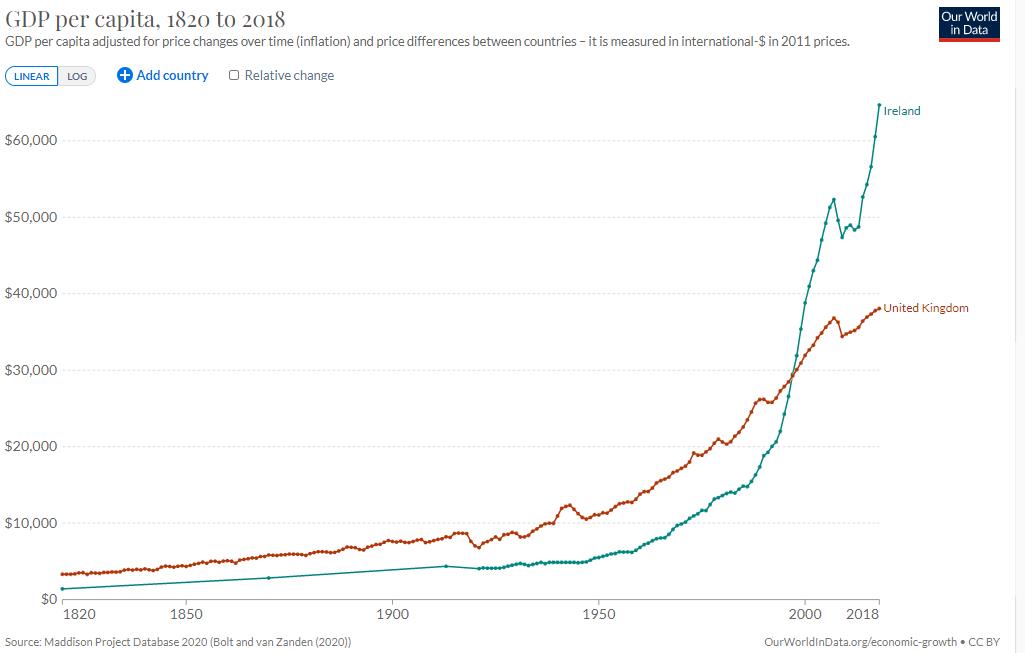

(3rd on the Index of Economic Freedom) and ranks first for high-value foreign direct investment (FDI) flows. In the global GDP per capita tables, Ireland ranks 3rd of 192 in the IMF table and 4th of 187 in the World Bank

The World Bank is an international financial institution that provides loans and grants to the governments of low- and middle-income countries for the purpose of pursuing capital projects. The World Bank is the collective name for the Inte ...

ranking.

Following a period of continuous growth at an annual level from 1984 to 2007, the post-2008 Irish financial crisis severely affected the economy, compounding domestic economic problems related to the collapse of the Irish property bubble

The Irish property bubble was the speculative excess element of a long-term price increase of real estate in the Republic of Ireland from the early 2000s to 2007, a period known as the later part of the Celtic Tiger. In 2006, the prices peaked ...

. Ireland first experienced a short technical recession from Q2-Q3 2007, followed by a recession from Q1 2008 – Q4 2009.

After a year with stagnant economic activity in 2010, the Irish real GDP rose by 2.2% in 2011 and 0.2% in 2012. This growth was mainly driven by improvements in the export sector. The European sovereign-debt crisis

The European debt crisis, often also referred to as the eurozone crisis or the European sovereign debt crisis, is a multi-year debt crisis that took place in the European Union (EU) from 2009 until the mid to late 2010s. Several eurozone memb ...

caused a new Irish recession to start in Q3 2012, which was still ongoing as of Q2 2013. By mid-2013 the European Commission

The European Commission (EC) is the executive of the European Union (EU). It operates as a cabinet government, with 27 members of the Commission (informally known as "Commissioners") headed by a President. It includes an administrative body ...

's economic forecast for Ireland predicted its growth rates would return to a positive 1.1% in 2013 and 2.2% in 2014. An inflated 2015 GDP growth of 26.3% (GNP growth of 18.7%) was officially partially ascribed to tax inversion practices by multinationals switching domiciles. This growth in GDP, dubbed "leprechaun economics

Leprechaun economics was a term coined by economist Paul Krugman to describe the 26.3 per cent rise in Irish 2015 GDP, later revised to 34.4 per cent, in a 12 July 2016 publication by the Irish Central Statistics Office (CSO), restating 2015 ...

" by American economist Paul Krugman

Paul Robin Krugman ( ; born February 28, 1953) is an American economist, who is Distinguished Professor of Economics at the Graduate Center of the City University of New York, and a columnist for ''The New York Times''. In 2008, Krugman was ...

, was shown to be driven by Apple Inc.

Apple Inc. is an American multinational technology company headquartered in Cupertino, California, United States. Apple is the largest technology company by revenue (totaling in 2021) and, as of June 2022, is the world's biggest company ...

's restructuring of its Irish subsidiary in January 2015. The distortion of Ireland's economic statistics (including GNI, GNP

The gross national income (GNI), previously known as gross national product (GNP), is the total domestic and foreign output claimed by residents of a country, consisting of gross domestic product (GDP), plus factor incomes earned by foreign ...

and GDP

Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced and sold (not resold) in a specific time period by countries. Due to its complex and subjective nature this measure is ofte ...

) by the tax practices of some multinationals, led the Central Bank of Ireland to propose an alternative measure ( modified GNI or GNI*) to more accurately reflect the true state of the economy from that year onwards.

Foreign-owned multinationals continue to contribute significantly to Ireland's economy, making up 14 of the top 20 Irish firms (by turnover), employing 23% of the private sector labour-force and paying 80% of the collected corporation tax.

Economic contributors and measures

Foreign-owned multinationals make up a significant percentage of Ireland's GDP. The " multinational tax schemes" used by some of these multinational firms contribute to a distortion in Ireland's economic statistics; including GNI,GNP

The gross national income (GNI), previously known as gross national product (GNP), is the total domestic and foreign output claimed by residents of a country, consisting of gross domestic product (GDP), plus factor incomes earned by foreign ...

and GDP

Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced and sold (not resold) in a specific time period by countries. Due to its complex and subjective nature this measure is ofte ...

. For example, the Organisation for Economic Co-operation and Development (OECD) shows Ireland with average leverage on a gross public debt-to-GDP basis (78.8% in 2016), but with the second highest leverage (after Japan) on a gross public debt-per capita basis ($62,686 in 2016). This disconnect led to the 2017 development by the Central Bank of Ireland of Irish modified GNI (or GNI*) for measuring the Irish economy (2016 GDP is 143% of Irish 2016 GNI*, and OECD Irish gross public debt-to-GNI* is 116.5%). Ireland's GNI* per capita ranks it similar to Germany. According to an OECD report, productivity growth among foreign owned entities averaged 10.9% for 2017 and was a lower 2.5% for indigenous firms.

The distortion of Irish economic data by US multinational tax schemes was a key contributor to the build-up of leverage in the Celtic Tiger

The "Celtic Tiger" ( ga, An Tíogar Ceilteach) is a term referring to the economy of Ireland from the mid-1990s to the late 2000s, a period of rapid real economic growth fuelled by foreign direct investment. The boom was dampened by a subseque ...

, amplifying both Irish consumer optimism (who borrowed to 190% of disposable income, OECD highest), and global capital markets optimism about Ireland (enabled Irish banks to lend over 180% of deposit base, OECD highest). Global capital markets, who ignored Ireland's private sector credit, and OECD/IMF warnings, when Irish GDP was rising during the Celtic Tiger, took fright in the financial crisis. Their withdrawal precipitated a deep Irish property correction, which led to a crisis in the Irish banking system.

A particularly dramatic growth in Ireland's 2015 GDP (from 1% in 2013, to 8% in 2014, to 25% in 2015) was shown to be largely driven by Apple restructuring their double Irish

The Double Irish arrangement was a base erosion and profit shifting (BEPS) corporate tax avoidance tool used mostly by United States multinationals since the late 1980s to avoid corporate taxation on non-U.S. profits. It was the largest tax ...

subsidiary, ASI, in January 2015. A follow up EU Commission report into Ireland's national accounts showed that even before this, 23% of Ireland's GDP was multinational net royalty payments

A royalty payment is a payment made by one party to another that owns a particular asset, for the right to ongoing use of that asset. Royalties are typically agreed upon as a percentage of gross or net revenues derived from the use of an asset o ...

, implying Irish GDP was inflated to 130% of "true" GDP (before the Apple growth). This led to the Central Bank of Ireland proposing a new replacement metric, modified gross national income

Modified gross national income, Modified GNI or GNI* was created by the Central Bank of Ireland in February 2017 as a new way to measure the Irish economy, and Irish indebtedness, due to the increasing distortion that the base erosion and prof ...

(or GNI*), to better represent the "true" Irish economy.

Given the importance of US multinationals to Ireland's economy (80% of Irish multinational employment, and 14 of the 20 largest Irish firms), the passing of the Tax Cuts and Jobs Act of 2017

The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018, , is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs A ...

is a challenge to Ireland. Parts of the US TCJA

The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018, , is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs A ...

are targeted at Irish multinational tax schemes, especially the move to a modern "territorial tax" system, the introduction of a lower FDII tax on intellectual property

Intellectual property (IP) is a category of property that includes intangible creations of the human intellect. There are many types of intellectual property, and some countries recognize more than others. The best-known types are patents, cop ...

, and the counter-Irish GILTI tax regime. Additionally, the EU's proposed Digital Sales Tax and stated desire for a Common Consolidated Corporate Tax Base

The Common Consolidated Corporate Tax Base (CCCTB) is a proposal for a common tax scheme for the European Union developed by the European Commission and first proposed in March 2011 that provides a single set of rules for how EU corporations calcu ...

, is also seen as an attempt to restrict the use of the Irish multinational tax schemes by US technology firms.

The stabilisation of the Irish credit bubble required a large transfer of debt from the private sector balance sheet (highest OECD leverage), to the public sector balance sheet (almost unleveraged, pre-crisis), via Irish bank bailouts and public deficit spending. The transfer of this debt means that Ireland, in 2017, had one of the highest levels of both public sector indebtedness, and private sector indebtedness, in the EU-28/OECD.

History

Since the Irish Free State

From the 1920s, Ireland had high trade barriers such as high tariffs, particularly during theEconomic War

The Anglo-Irish Trade War (also called the Economic War) was a retaliatory trade war between the Irish Free State and the United Kingdom from 1932 to 1938. The Irish government refused to continue reimbursing Britain with land annuities from fi ...

with Britain in the 1930s, and a policy of import substitution. During the 1950s, 400,000 people emigrated from Ireland. It became increasingly clear that economic nationalism was unsustainable. While other European countries enjoyed fast growth, Ireland suffered economic stagnation. The policy changes were drawn together in ''Economic Development'', an official paper by T. K. Whitaker published in 1958 that advocated free trade

Free trade is a trade policy that does not restrict imports or exports. It can also be understood as the free market idea applied to international trade. In government, free trade is predominantly advocated by political parties that hold econ ...

, foreign investment, and growth rather than fiscal restraint as the prime objective of economic management.

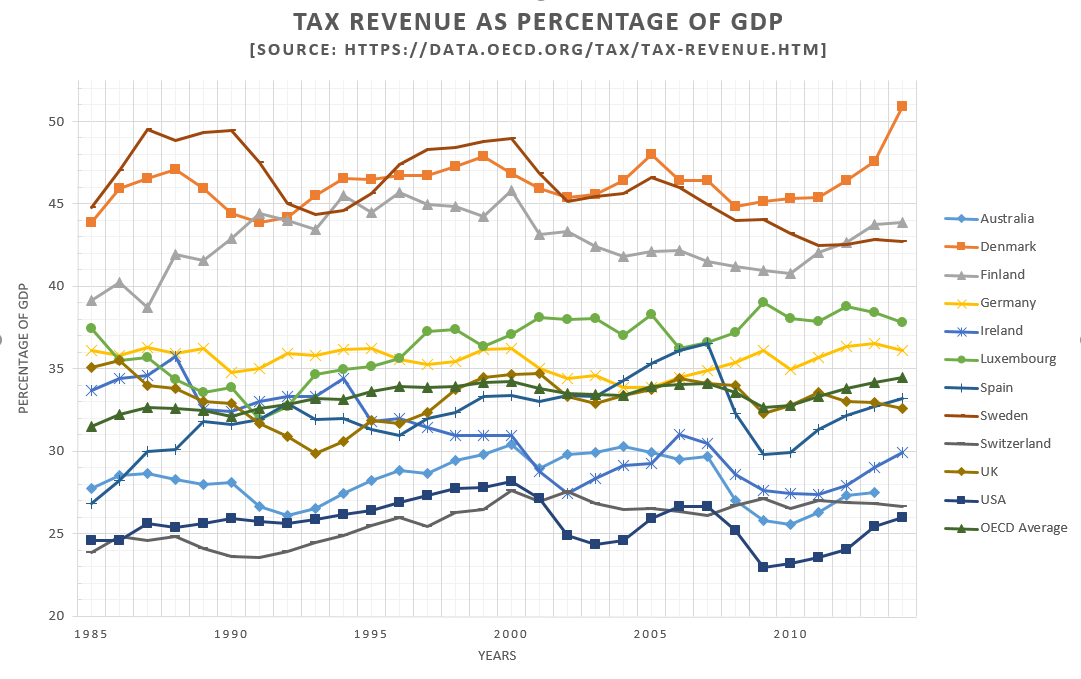

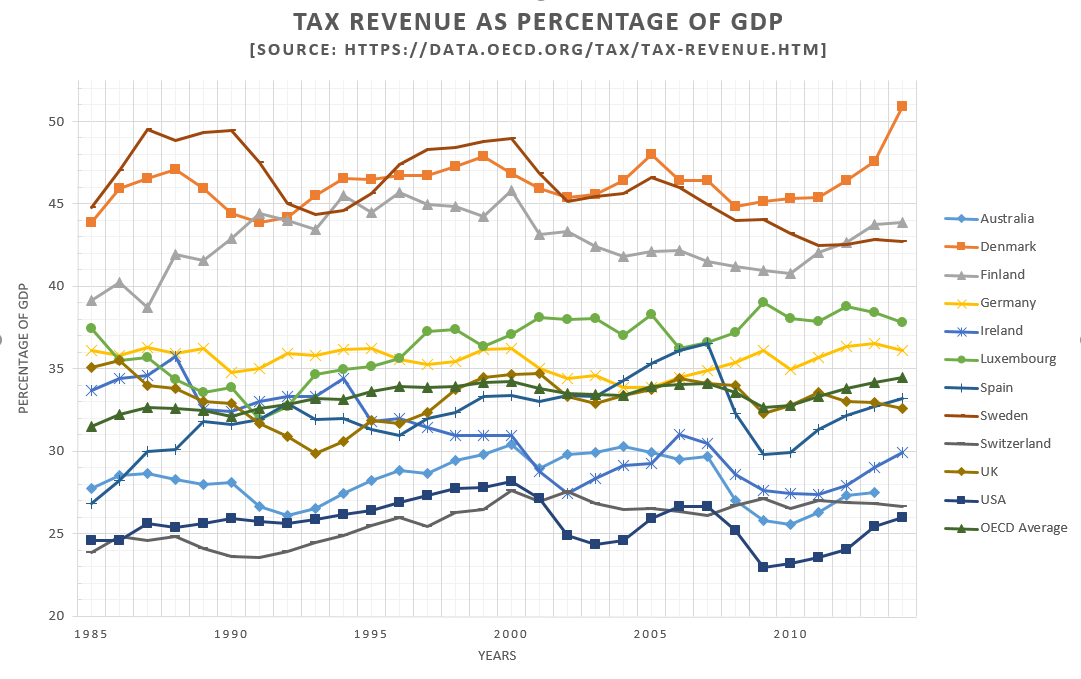

In the 1970s, the population increased by 15% and national income increased at an annual rate of about 4%. Employment increased by around 1% per year, but the state sector amounted to a large part of that. Public sector employment was a third of the total workforce by 1980. Budget deficits and public debt increased, leading to the crisis in the 1980s. During the 1980s, underlying economic problems became pronounced. Middle income workers were taxed 60% of their marginal income, unemployment had risen to 20%, annual overseas emigration reached over 1% of population, and public deficits reached 15% of GDP.

In 1987 Fianna Fáil

Fianna Fáil (, ; meaning 'Soldiers of Destiny' or 'Warriors of Fál'), officially Fianna Fáil – The Republican Party ( ga, audio=ga-Fianna Fáil.ogg, Fianna Fáil – An Páirtí Poblachtánach), is a conservative and Christia ...

reduced public spending, cut taxes, and promoted competition. Ryanair used Ireland's deregulated aviation market and helped European regulators to see benefits of competition in transport markets. Intel

Intel Corporation is an American multinational corporation and technology company headquartered in Santa Clara, California. It is the world's largest semiconductor chip manufacturer by revenue, and is one of the developers of the x86 seri ...

invested in 1989 and was followed by a number of technology companies such as Microsoft

Microsoft Corporation is an American multinational technology corporation producing computer software, consumer electronics, personal computers, and related services headquartered at the Microsoft Redmond campus located in Redmond, Washin ...

and Google

Google LLC () is an American Multinational corporation, multinational technology company focusing on Search Engine, search engine technology, online advertising, cloud computing, software, computer software, quantum computing, e-commerce, ar ...

. A consensus exists among all government parties about the sustained economic growth."How Ireland became the Celtic Tiger", Sean Dorgan, the chief executive of IDA. 23 June 2006 Between 1985 and 2002, private sector jobs increased 59%. The economy shifted from an agriculture to a knowledge economy, focusing on services and high-tech industries. Economic growth averaged 10% from 1995 to 2000, and 7% from 2001 to 2004. Industry, which accounts for 46% of GDP and about 80% of exports, has replaced agriculture as the country's leading sector.

Celtic Tiger (1995–2007)

Historian R. F. Foster argues the cause was a combination of a new sense of initiative and the entry of American corporations such as

Historian R. F. Foster argues the cause was a combination of a new sense of initiative and the entry of American corporations such as Intel

Intel Corporation is an American multinational corporation and technology company headquartered in Santa Clara, California. It is the world's largest semiconductor chip manufacturer by revenue, and is one of the developers of the x86 seri ...

. He concludes the chief factors were low taxation, pro-business regulatory policies, and a young, tech-savvy workforce. For many multinationals the decision to do business in Ireland was made easier still by generous incentives from the Industrial Development Authority

Industrial Development Agency (IDA Ireland) ( ga, An Ghníomhaireacht Forbartha Tionscail) is the agency responsible for the attraction and retention of inward foreign direct investment (FDI) into Ireland. The agency was founded in 1949 as the I ...

. In addition European Union

The European Union (EU) is a supranational political and economic union of member states that are located primarily in Europe. The union has a total area of and an estimated total population of about 447million. The EU has often been de ...

membership was helpful, giving the country lucrative access to markets that it had previously reached only through the United Kingdom, and pumping huge subsidies and investment capital into the Irish economy.

The economy benefited from a rise in consumer spending, construction, and business investment. Since 1987, a key part of economic policy has been Social Partnership

Social partnership ( ga, Pairtíocht sóisialta) is the term used for the tripartite, triennial national pay agreements reached in Ireland.

The process was initiated in 1987, following a period of high inflation and weak economic growth which le ...

, which is a neo-corporatist set of voluntary 'pay pacts' between the Government, employers and trade unions. The 1995 to 2000 period of high economic growth was called the Celtic Tiger, a reference to the tiger economies

A tiger economy is the economy of a country which undergoes rapid economic growth, usually accompanied by an increase in the standard of living. The term was originally used for the Four Asian Tigers (South Korea, Taiwan, Hong Kong, and Singapore) ...

of East Asia. Charles Smith, article: 'Ireland', in Wankel, C. (ed.) ''Encyclopedia of Business in Today's World'', California, USA, 2009.

GDP growth continued to be relatively robust, with a rate of about 6% in 2001, over 4% in 2004, and 4.7% in 2005. With high growth came high inflation. Prices in Dublin

Dublin (; , or ) is the capital and largest city of Ireland. On a bay at the mouth of the River Liffey, it is in the province of Leinster, bordered on the south by the Dublin Mountains, a part of the Wicklow Mountains range. At the 2016 c ...

were considerably higher than elsewhere in the country, especially in the property market. – CSO However, property prices were falling following the recent economic recession

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by variou ...

. At the end of July 2008, the annual rate of inflation was at 4.4% (as measured by the CPI

A consumer price index (CPI) is a price index, the price of a weighted average market basket of consumer goods and services purchased by households. Changes in measured CPI track changes in prices over time.

Overview

A CPI is a statistic ...

) or 3.6% (as measured by the HICP The Harmonised Index of Consumer Prices (HICP) is an indicator of inflation and price stability for the European Central Bank (ECB). It is a consumer price index which is compiled according to a methodology that has been harmonised across EU countr ...

) – Central Statistics Office. Retrieved on 8 August 2008. and inflation actually dropped slightly from the previous month.

In terms of GDP per capita, Ireland is ranked as one of the wealthiest countries in the OECD and the EU-27, at 4th in the OECD-28 rankings. In terms of GNP

The gross national income (GNI), previously known as gross national product (GNP), is the total domestic and foreign output claimed by residents of a country, consisting of gross domestic product (GDP), plus factor incomes earned by foreign ...

per capita, a better measure of national income, Ireland ranks below the OECD average, despite significant growth in recent years, at 10th in the OECD-28 rankings. GDP is significantly greater than GNP

The gross national income (GNI), previously known as gross national product (GNP), is the total domestic and foreign output claimed by residents of a country, consisting of gross domestic product (GDP), plus factor incomes earned by foreign ...

(national income) due to the large number of multinational firms based in Ireland. A 2005 study by ''The Economist'' found Ireland to have the best quality of life

Quality of life (QOL) is defined by the World Health Organization as "an individual's perception of their position in life in the context of the culture and value systems in which they live and in relation to their goals, expectations, standards ...

in the world. – The Economist

The positive reports and economic statistics masked several underlying imbalances. The construction sector, which was inherently cyclical in nature, accounted for a significant component of Ireland's GDP. A recent downturn in residential property market sentiment has highlighted the over-exposure of the Irish economy to construction, which now presents a threat to economic growth.

Despite several successive years of economic growth and significant improvements since 2000, Ireland's population is marginally more at risk of poverty than the EU-15 average and 6.8% of the population suffer "consistent poverty".

Economic downturn (2008–2013)

It was the first country in the EU to officially enter a recession related to the Financial crisis 2008, as declared by the Central Statistics Office. At this point, Ireland now had the second-highest level of household debt in the world (190% of household income). The country's credit rating was downgraded to "AA-" by Standard & Poor's ratings agency in August 2010 due to the cost of supporting the banks, which would weaken the Government's financial flexibility over the medium term. It transpired that the cost of recapitalising the banks was greater than expected at that time, and, in response to the mounting costs, the country's credit rating was again downgraded by Standard & Poor's to "A".

The

It was the first country in the EU to officially enter a recession related to the Financial crisis 2008, as declared by the Central Statistics Office. At this point, Ireland now had the second-highest level of household debt in the world (190% of household income). The country's credit rating was downgraded to "AA-" by Standard & Poor's ratings agency in August 2010 due to the cost of supporting the banks, which would weaken the Government's financial flexibility over the medium term. It transpired that the cost of recapitalising the banks was greater than expected at that time, and, in response to the mounting costs, the country's credit rating was again downgraded by Standard & Poor's to "A".

The global recession

A global recession is recession that affects many countries around the world—that is, a period of global economic slowdown or declining economic output.

Definitions

The International Monetary Fund defines a global recession as "a decline i ...

has significantly impacted the Irish economy. Economic growth was 4.7% in 2007, but −1.7% in 2008 and −7.1% in 2009. In mid-2010, Ireland looked like it was about to exit recession following growth of 0.3% in Q4 of 2009 and 2.7% in Q1 of 2010. The government forecast a 0.3% expansion. However the economy experienced Q2 negative growth of −1.2%, and in the fourth quarter, the GDP shrunk by 1.6%. Overall, the GDP was reduced by 1% in 2010, making it the third consecutive year of negative growth. On the other hand, Ireland recorded the biggest month-on-month rise for industrial production across the eurozone

The euro area, commonly called eurozone (EZ), is a currency union of 19 member states of the European Union (EU) that have adopted the euro ( €) as their primary currency and sole legal tender, and have thus fully implemented EMU polici ...

in 2010, with 7.9% growth in September compared to August, followed by Estonia

Estonia, formally the Republic of Estonia, is a country by the Baltic Sea in Northern Europe. It is bordered to the north by the Gulf of Finland across from Finland, to the west by the sea across from Sweden, to the south by Latvia, a ...

(3.6%) and Denmark

)

, song = ( en, "King Christian stood by the lofty mast")

, song_type = National and royal anthem

, image_map = EU-Denmark.svg

, map_caption =

, subdivision_type = Sovereign state

, subdivision_name = Kingdom of Denmark

, establish ...

(2.7%).

The second problem, unacknowledged by management of Irish banks, the financial regulator and the Irish government, is

The second problem, unacknowledged by management of Irish banks, the financial regulator and the Irish government, is solvency

Solvency, in finance or business, is the degree to which the current assets of an individual or entity exceed the current liabilities of that individual or entity. Solvency can also be described as the ability of a corporation to meet its long-t ...

. The question concerning solvency had arisen due to domestic problems in the Irish property market. Irish financial institutions had substantial exposure to property developers in their loan portfolio. In 2008, property developers had an over-supply of property, with much unsold as demand significantly diminished. The employment growth of the past that attracted many immigrants from Eastern Europe and propped up demand for property was replaced by rising unemployment.

Irish property developers speculated

The modern division of philosophy into theoretical philosophy and practical philosophyImmanuel Kant, ''Lectures on Ethics'', Cambridge University Press, 2001, p. 41 ("On Universal Practical Philosophy"). Original text: Immanuel Kant, ''Kant’s Ges ...

billions of Euros in overvalued land parcels such as urban brownfield and greenfield sites. They also speculated in agricultural land which, in 2007, had an average value of €23,600 per acre ($32,000 per acre or €60,000 per hectare) which is several multiples above the value of equivalent land in other European countries. Lending to builders and developers has grown to such an extent that it equals 28% of all bank lending, or "''the approximate value of all public deposits with retail banks. Effectively, the Irish banking system has taken all its shareholders' equity, with a substantial chunk of its depositors' cash on top, and handed it over to builders and property speculators.....By comparison, just before the Japanese bubble burst in late 1989, construction and property development had grown to a little over 25 per cent of bank lending.''"

Irish banks correctly identify a systematic risk of triggering an even more severe financial crisis in Ireland if they were to call in the loans as they fall due. The loans are subject to terms and conditions, referred to as "covenants". These covenants are being waived in fear of provoking the (inevitable) bankruptcy of many property developers and banks are thought to be "''lending some developers further cash to pay their interest bills, which means that they are not classified as 'bad debts' by the banks''". Furthermore, the banks' "impairment" (bad debt) provisions are still at very low levels.

This does not appear to be consistent with the real negative changes taking place in property market fundamentals.

On 30 September 2008, the Irish Government declared a guarantee that intends to safeguard the Irish banking system. The Irish National guarantee, backed by taxpayer funds, covers "''all deposits (retail, commercial, institutional and interbank), covered bonds, senior debt and dated subordinated debt''". In exchange for the bailout, the government did not take preferred equity stakes in the banks (which dilute shareholder value) nor did they demand that top banking executives' salaries and bonuses be capped, or that board members be replaced.

Despite the Government guarantees to the banks, their shareholder value continued to decline and on 2009-01-15, the Government nationalised Anglo Irish Bank

Anglo Irish Bank was an Irish bank headquartered in Dublin from 1964 to 2011. It began to wind down after nationalisation in 2009. In July 2011 Anglo Irish merged with the Irish Nationwide Building Society, forming a new company named the Iri ...

, which had a market capitalisation of less than 2% of its peak in 2007. Subsequent to this, further pressure came on the other two large Irish banks, who on 2009-01-19, had share values fall by between 47 and 50% in one day. As of 11 October 2008, leaked reports of possible actions by the government to artificially prop up the property developers have been revealed.

In contrast, on 7 October 2008, Danske Bank wrote off a substantial sum largely due to property-related losses incurred by its Irish subsidiary – National Irish Bank

Danske Bank, formerly known as the National Irish Bank, is a bank operating in the Republic of Ireland. The bank is a subsidiary of the Danske Bank Group which is headquartered in Copenhagen.

Danske Bank is organised in three business units ...

. The 3.18% charge against the loan book of its Irish operations is the first significant write off to take place and is a modest indication of the extent of the more substantial future charges to be incurred by the over-exposed domestic banks. Asset write-downs by the domestically-owned Irish banks are only now slowly beginning to take place

In November 2010 the Irish government published a National Recovery plan, which aimed to restore order to the public finances and to bring its deficit in line with the EU target of 3% of economic output by 2015. The plan envisaged a budget adjustment of €15 billion (€10 billion in public expenditure cuts and €5 billion in taxes) over a four-year period. This was front-loaded in 2011, when measures totalling €6 billion took place. Subsequent budgetary adjustments of €3 billion per year were put in place up to 2015, to reduce the government deficit to less than 3% of GDP. VAT

A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally. It is levied on the price of a product or service at each stage of production, distribution, or sale to the en ...

would increase to 23% by 2014. A property tax

A property tax or millage rate is an ad valorem tax on the value of a property.In the OECD classification scheme, tax on property includes "taxes on immovable property or net wealth, taxes on the change of ownership of property through inhe ...

was re-introduced in 2012. This was initially charged in 2012 as a flat rate on all properties and subsequently charged at a level of 0.18% of the estimated market-value of a property from 2013. Domestic water charges are to be introduced in 2015. Expenditure cuts included reductions in public sector pay levels, reductions in the number of public sector employees through early retirement schemes, reduced social welfare payments and reduced health spending.

As a result of increased taxation and decreased government spending the Central Statistics Office (Ireland) reported that the Irish government deficit had decreased from 32.5% of GDP in 2010 (a level boosted by one-off support payments to the financial sector) to 5.7% of GDP in 2013.

In addition Ireland's unemployment rate

Unemployment, according to the OECD (Organisation for Economic Co-operation and Development), is people above a specified age (usually 15) not being in paid employment or self-employment but currently available for work during the refere ...

fell from a peak of 15.1% in February 2012 to 10.6% in December 2014. The number of people in employment increased by 58,000 (3.1% increase in employment rate) in the year to September 2013. On 27 February 2014 the government launched its ''Action Plan for Jobs 2014'', which followed similar plans initiated in 2013 and 2012.

Signs of recovery (2014–2016)

The term "Celtic Phoenix" was coined by journalist and satirist Paul Howard, which has been occasionally used by some economic commentators and media outlets to describe the indicators of economic growth in some sectors in Ireland since 2014. In late 2013, Ireland exited an EU/ECB/IMF bailout. The Irish economy began to recover in 2014, growing by 4.8%, making Ireland the fastest growing economy in the European Union. Contributing factors to growth included a recovering construction sector, quantitative easing, a weak euro, and low oil prices. This growth helped to reduce national debt to 109% of GDP, and the budget deficit fell to 3.1% in the fourth quarter. The headline unemployment rate remained steady at 10%, though the youth unemployment rate remained higher than the EU average, at over 20%. Emigration had continued to play a significant factor in unemployment statistics, though the emigration rate also began to fall in 2014. Property prices also increased in 2014, growing fastest inDublin

Dublin (; , or ) is the capital and largest city of Ireland. On a bay at the mouth of the River Liffey, it is in the province of Leinster, bordered on the south by the Dublin Mountains, a part of the Wicklow Mountains range. At the 2016 c ...

. This was due to a housing shortage, especially in the Dublin area. The demand for housing caused some recovery in the Irish construction and property sectors. By early 2015, house price increases nationally began to outpace those in Dublin. Cork

Cork or CORK may refer to:

Materials

* Cork (material), an impermeable buoyant plant product

** Cork (plug), a cylindrical or conical object used to seal a container

***Wine cork

Places Ireland

* Cork (city)

** Metropolitan Cork, also known as G ...

saw house prices rise by 7.2%, while Galway

Galway ( ; ga, Gaillimh, ) is a city in the West of Ireland, in the province of Connacht, which is the county town of County Galway. It lies on the River Corrib between Lough Corrib and Galway Bay, and is the sixth most populous city on ...

prices rose by 6.8%. Prices in Limerick

Limerick ( ; ga, Luimneach ) is a western city in Ireland situated within County Limerick. It is in the province of Munster and is located in the Mid-West which comprises part of the Southern Region. With a population of 94,192 at the 2016 ...

were 6.7% higher while in Waterford

"Waterford remains the untaken city"

, mapsize = 220px

, pushpin_map = Ireland#Europe

, pushpin_map_caption = Location within Ireland##Location within Europe

, pushpin_relief = 1

, coordinates ...

there was a 4.9% increase. The housing crisis resulted in over 20,000 applicants being on the social housing list in the Dublin City Council

Dublin City Council ( ga, Comhairle Cathrach Bhaile Átha Cliath) is the authority responsible for local government in the city of Dublin in Ireland. As a city council, it is governed by the Local Government Act 2001. Until 2001, the council was ...

area for the first time. In May 2015, the Insolvency Service of Ireland reported to the Oireachtas Justice Committee that 110,000 mortgages were in arrears, and 37,000 of those are in arrears of over 720 days.

On 14 October 2014, Minister for Finance Michael Noonan and Minister for Public Expenditure and Reform Brendan Howlin

Brendan Howlin (born 9 May 1956) is an Irish Labour Party politician who has been a Teachta Dála (TD) for the Wexford constituency since 1987. He previously served as Leader of the Labour Party from 2016 to 2020, Minister for Public Expendit ...

introduced the budget for 2015, the first in seven years to include tax cuts and spending increases. The budget reversed some of the austerity measures that had been introduced over the previous six years, with increased spending and tax cuts worth just over €1bn.

In April 2015, during a "Spring Economic Statement", Noonan and Howlin outlined the government's plans and projections up to the year 2020. This included policy statements on expansionary budgets, deficit management plans and proposed cuts to the Universal Social Charge and other taxes.

In October 2014, German finance minister, Wolfgang Schäuble

Wolfgang Schäuble (; born 18 September 1942) is a German lawyer, politician and statesman whose political career has spanned for more than five decades. A member of the Christian Democratic Union (CDU), he is one of the longest-serving politi ...

said that Germany was "jealous" at how the Irish economy had recovered after its bailout. He also said that Ireland had made a significant contribution to the stabilisation of the euro

The euro ( symbol: €; code: EUR) is the official currency of 19 out of the member states of the European Union (EU). This group of states is known as the eurozone or, officially, the euro area, and includes about 340 million citizens . ...

. While Taoiseach Enda Kenny

Enda Kenny (born 24 April 1951) is an Irish former Fine Gael politician who served as Taoiseach from 2011 to 2017, Leader of Fine Gael from 2002 to 2017, Minister for Defence from May to July 2014 and 2016 to 2017, Leader of the Opposition from ...

praised the economic growth, and said that Ireland would seek to avoid returning to a "boom and bust" cycle, he noted that other areas of the economy remained fragile. The European Commission

The European Commission (EC) is the executive of the European Union (EU). It operates as a cabinet government, with 27 members of the Commission (informally known as "Commissioners") headed by a President. It includes an administrative body ...

also acknowledged the recovery and growth, but warned that any extra government revenue should be used to further reduce the national debt.

Some other commentators have suggested that, depending on the Eurozone, world economic outlook as well as other internal and external factors, the growth seen in Ireland in 2014 and early 2015 may not indicate a longer-term pattern for sustainable economic improvement. Other commentators have noted that recovery figures do not account for emigration, youth unemployment, child poverty, homelessness and other factors.

On 23 June 2016, the United Kingdom voted to leave the European Union, which was widely reported as likely having a negative impact on trade between the UK and Ireland, and the Irish economy in general. Other commentators, for example the Financial Times, suggested that some London-based financial institutions might move operations to Dublin

Dublin (; , or ) is the capital and largest city of Ireland. On a bay at the mouth of the River Liffey, it is in the province of Leinster, bordered on the south by the Dublin Mountains, a part of the Wicklow Mountains range. At the 2016 c ...

after Brexit

Brexit (; a portmanteau of "British exit") was the withdrawal of the United Kingdom (UK) from the European Union (EU) at 23:00 GMT on 31 January 2020 (00:00 1 February 2020 CET).The UK also left the European Atomic Energy Community (EAEC ...

.

In 2016 official CSO figures indicated that the economic recovery had led to 26.3% growth in GDP in 2015 and 18.7% growth in GNP. The figures were widely ridiculed including by Nobel Prize winning economist

In 2016 official CSO figures indicated that the economic recovery had led to 26.3% growth in GDP in 2015 and 18.7% growth in GNP. The figures were widely ridiculed including by Nobel Prize winning economist Paul Krugman

Paul Robin Krugman ( ; born February 28, 1953) is an American economist, who is Distinguished Professor of Economics at the Graduate Center of the City University of New York, and a columnist for ''The New York Times''. In 2008, Krugman was ...

who labelled them "leprechaun economics

Leprechaun economics was a term coined by economist Paul Krugman to describe the 26.3 per cent rise in Irish 2015 GDP, later revised to 34.4 per cent, in a 12 July 2016 publication by the Irish Central Statistics Office (CSO), restating 2015 ...

". The official explanation was that the closure of the "double Irish

The Double Irish arrangement was a base erosion and profit shifting (BEPS) corporate tax avoidance tool used mostly by United States multinationals since the late 1980s to avoid corporate taxation on non-U.S. profits. It was the largest tax ...

" scheme at end 2014 (phased out by 2020), led some multinationals to relocate "intangible assets" to Ireland. It was subsequently shown in 2018 that it was due to Apple's January 2015 restructuring of their "double Irish

The Double Irish arrangement was a base erosion and profit shifting (BEPS) corporate tax avoidance tool used mostly by United States multinationals since the late 1980s to avoid corporate taxation on non-U.S. profits. It was the largest tax ...

" structure, Apple Sales International ("ASI"). While the markets had always taken Irish economic statistics with a degree of caution (given the increasing gap between Irish GNI and Irish GDP/GNP), the size of this increase drew attention to the level of distortion US " multinational tax schemes" (like "double Irish") were having on Ireland's statistics. For example, on a "per capita" basis, Ireland is one of the most leveraged economies in the OECD, while on a "% of GDP" basis, it is rapidly de-leveraging.

In response to this, the Central Bank of Ireland created a special steering group, the result of which was a new metric, "Modified gross national income

Modified gross national income, Modified GNI or GNI* was created by the Central Bank of Ireland in February 2017 as a new way to measure the Irish economy, and Irish indebtedness, due to the increasing distortion that the base erosion and prof ...

" or "Irish GNI*", for Irish economic analysis. For 2016, Irish GNI* would be 30% below Irish GDP, while Irish Government Net Debt/GNI* would be 106% (vs. Irish Net Debt/GDP of 73%). Commentators who had been tracking the widening gap between Irish GNI and Irish GDP/GNP since the growth of the "double Irish

The Double Irish arrangement was a base erosion and profit shifting (BEPS) corporate tax avoidance tool used mostly by United States multinationals since the late 1980s to avoid corporate taxation on non-U.S. profits. It was the largest tax ...

" in the mid-2000s (see tables), and the even stronger effect of the "capital allowances for intangible assets" scheme on distorting GNI/GNP/GDP, noted that GNI* still materially over-stated the true Irish economy. By 2017, a number of Irish financial commentators bemoaned the inaccuracy of Irish economic GDP/GNP statistics.

Challenge to low tax model (2017 onwards)

During the Irish economic crisis, specific Irish tax schemes were loosened to attract foreign capital to re-balance Ireland's debt. Schemes that were low-tax, became almost zero-tax ("capital allowances for intangible assets

The Double Irish arrangement was a base erosion and profit shifting (BEPS) corporate tax avoidance tool used mostly by United States multinationals since the late 1980s to avoid corporate taxation on non-U.S. profits. It was the largest tax ...

" in 2009). Schemes that were restricted, became more available (i.e. " Section 110 SPVs" in 2012). These schemes attracted the foreign capital that led Ireland's post-crisis recovery. It also saw Ireland rise up the league tables of corporate "tax havens

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or ...

", and blacklisted by Brazil. A major 2017 study into " offshore financial centers", identified Ireland as a top 5 global Conduit OFC.

This made Ireland the most popular destination for US corporate tax inversions. When Pfizer and Irish-based Allergan announced the largest corporate tax inversion in history at $160bn (84% of Ireland's 2016 GNI* of €190bn), it forced the Obama administration to block US tax inversions. None have occurred since.

Ireland had also become a base for US technology multinationals. By 2014 (see table), Apple's Irish ASI subsidiary was handling €34bn annually of untaxed profits (20% of Ireland's 2014 GNI*). The EU forced Ireland to close the "double Irish

The Double Irish arrangement was a base erosion and profit shifting (BEPS) corporate tax avoidance tool used mostly by United States multinationals since the late 1980s to avoid corporate taxation on non-U.S. profits. It was the largest tax ...

", but it was replaced (Apple's " capital allowances" and Microsoft's " single malt").

By 2017, IDA Ireland

Industrial Development Agency (IDA Ireland) ( ga, An Ghníomhaireacht Forbartha Tionscail) is the agency responsible for the attraction and retention of inward foreign direct investment (FDI) into Ireland. The agency was founded in 1949 as the ...

estimated multinationals (US comprise 80%), contributed €28.3bn in cash to the Irish Exchequer (corporate taxes, wages, and capital spend), and were responsible for an even larger Irish economic impact then could be accurately measured (i.e. new office construction, second order services etc.). The OECD estimated that foreign multinationals provide 80% of domestic value-add and 47% of employment in Irish Manufacturing, and 40% of domestic value-add and 28% of employment in Irish Services. In addition, the OECD estimate that foreign multinationals employ one quarter of the Irish private sector workforce.

However, the US and the EU became more resolute to curb what they saw as excessive tax avoidance by US multinationals in Ireland. A 2018 study published via the Center for International Relations

The Center for International Relations (CIR) is a nonpartisan and nonprofit, tax exempt 501(c)(3) organization that publishes various materials about international relations and current affairs. The organization is based in the Washington, D.C. ...

suggested that due to the tax practices of US corporations, Ireland's pattern of trade was more aligned with NAFTA countries than with EU countries.

The US Tax Cuts and Jobs Act of 2017

The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018, , is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs A ...

was passed with Ireland directly in mind. The TCJA moves the US from the "worldwide tax" system (which is the reason why US multinationals use Ireland) to a modern "territorial tax" system (which is the reason why non-US multinationals hardly use Ireland - there are no non-US/non-UK foreign firms in Ireland's top 50 firms by turnover, and only one by employees - German retailer Lidl

Lidl Stiftung & Co. KG (; ) is a German international discount retailer chain that operates over 11,000 stores across Europe and the United States. Headquartered in Neckarsulm, Baden-Württemberg, the company belongs to the Schwarz Group, whi ...

). The FDII tax regime gives US-based "intellectual property

Intellectual property (IP) is a category of property that includes intangible creations of the human intellect. There are many types of intellectual property, and some countries recognize more than others. The best-known types are patents, cop ...

" ("IP") an low-tax 13.125% rate. The GILTI tax regime places a penalty on foreign-based IP (i.e. like in Ireland) that brings its effective rate above the FDII rate (i.e. incentivizes re-location of IP to the US). Experts believe that the TCJA neutralises Ireland's " multinational tax schemes".

The EU Commission's impending 2018 "digital tax" is also designed to curb the Irish "multinational tax schemes". By taxing turnover, it acts as an "override" on the Irish "multinational tax schemes". It has been described by Seamus Coffey, Chairperson of the Irish Fiscal Advisory Council as "a more serious threat to Ireland than Brexit

Brexit (; a portmanteau of "British exit") was the withdrawal of the United Kingdom (UK) from the European Union (EU) at 23:00 GMT on 31 January 2020 (00:00 1 February 2020 CET).The UK also left the European Atomic Energy Community (EAEC ...

".

Data

The following table shows the main economic indicators in 1980–2021 (with IMF staff estimates in 2022–2027). Inflation under 5% is in green.Sectors

Aircraft leasing

There are 1,200 directly employed in leasing, with Irish lessors managing more than €100 billion in assets. This means that Ireland manages nearly 22% of the fleet of aircraft worldwide and a 40% share of Global fleet of leased aircraft. Ireland has 14 of the top 15 lessors by fleet size.Alcoholic beverage industry

The drinks industry employs approximately 92,000 people and contributes 2 billion euro annually to the Irish economy making it one of the biggest sectors. It supports jobs in agriculture, distilling and brewing. It is subdivided into 5 areas; beer (employing 1,800 people directly and 35,000 indirectly), cider (supporting 5,000 jobs), spirits (supporting 14,700 jobs), whiskey (employing 748 people with turnover of 400 million euro) and wine (employing 1,100 directly).Engineering

The multinational engineering sector employs over 18,500 people and contributes approximately 4.2 billion euro annually. This includes approximately 180 companies in areas such of industrial products and services, aerospace, automotive and clean tech.Energy generation

Bord Gáis

Cucerdea ( hu, Oláhkocsárd, Hungarian pronunciation: ) is a commune in Mureș County, Transylvania, Romania. It is composed of three villages: Bord (''Bord''), Cucerdea, and Șeulia de Mureș (''Oláhsályi'').

The commune is located in the sout ...

is responsible for the supply and distribution of natural gas, which was first brought ashore in 1976 from the Kinsale Head gas field

The Kinsale Head gas field is a depleted offshore natural gas field in the Celtic Sea, located off the southern coast of County Cork, Ireland. Discovered in 1971 near the Old Head of Kinsale, it met Ireland's gas needs until 1996. The gas fiel ...

. Electrical generation from peat consumption, as a percent of total electrical generation, was reduced from 18.8% to 6.1%, between 1990 and 2004.Howley, Martin, Fergal O'Leary, and Brian Ó Gallachóir (January 2006)Energy in Ireland 1990 – 2004: Trends, issues, forecasts and indicators

(pdf), p10, 20, 26. A 2006 forecast by Sustainable Energy Ireland predicts that oil will no longer be used for electrical generation but natural gas will be dominant at 71.3% of the total share, coal at 9.2%, and renewable energy at 8.2% of the market. New or potential sources include the

Corrib gas field

The Corrib gas project ( ga, Tionscanamh Ghás Aiceanta na Coiribe) is a developed natural gas deposit located in the Atlantic Ocean, approximately off the northwest coast of County Mayo, Ireland. The project includes a natural gas pipeline and ...

and the Shannon Liquefied Natural Gas terminal.

Ireland is one of a group of countries that are likely to benefit geopolitically from a global transition to renewable energy. It is ranked number 12 among 156 countries in the index of geopolitical gains and losses after energy transition (the "GeGaLo Index").

Exports

]

Exports play an important role in Ireland's economic growth. The country is one of the largest exporters of pharmaceuticals, medical devices and software-related goods and services in the world.

A series of significant discoveries of base metal deposits have been made, including the giant ore deposit at

]

Exports play an important role in Ireland's economic growth. The country is one of the largest exporters of pharmaceuticals, medical devices and software-related goods and services in the world.

A series of significant discoveries of base metal deposits have been made, including the giant ore deposit at Tara Mine

Tara Mines is a zinc and lead mine near Navan, County Meath, Ireland. Tara is an underground mine where the orebody lies between 50 and 900 metres below the surface in carbonate-hosted lead-zinc ore deposits.

The deposit was discovered in 1970 ...

. Zinc-lead ores are also currently mined from two other underground operations in Lisheen

Lisheen Mine is a former lead-zinc-silver mine located between the villages of Moyne and Templetuohy in County Tipperary, Ireland. In the Rathdowney Trend, Lisheen was an underground mine where the Lisheen deposit lies at an average depth of 170 ...

and Galmoy. Ireland now ranks as the seventh largest producer of zinc concentrates in the world, and the twelfth largest producer of lead concentrates. The combined output from these mines make Ireland the largest zinc producer in Europe and the second largest producer of lead.

In its ''Globalization Index 2010'' published in January 2011 Ernst and Young

Ernst & Young Global Limited, trade name EY, is a multinational professional services partnership headquartered in London, England. EY is one of the largest professional services networks in the world. Along with Deloitte, KPMG and Pricewaterh ...

with the Economist Intelligence Unit

The Economist Intelligence Unit (EIU) is the research and analysis division of the Economist Group, providing forecasting and advisory services through research and analysis, such as monthly country reports, five-year country economic forecasts, ...

ranked Ireland second after Hong Kong. The index ranks 60 countries according to their degree of globalisation relative to their GDP. While the Irish economy had significant debt problems in 2011, exporting remained a success.

Financial services

The financial services sector employs approximately 35,000 people and contributes 2 billion euro in taxes annually to the economy. Ireland is the seventh largest provider of wholesale financial services in Europe. A number of these firms are located at theInternational Financial Services Centre

The International Financial Services Centre (IFSC) is an area of central Dublin and part of the CBD established in the 1980s as an urban regeneration area and special economic zone (SEZ) on the derelict state-owned former port authority lan ...

(IFSC) in Dublin.

Information and communications technology

The Information and communications technology (ICT) sector employs over 37,000 people and generates 35 billion annually. The top ten ICT companies are located in Ireland, with over 200 companies in total. A number of these ICT companies are based in Dublin at developments like theSilicon Docks

Silicon Docks is a nickname for the area in Dublin, Ireland around Grand Canal Dock, stretching to the IFSC, city centre east, and city centre south near the Grand Canal. The nickname makes reference to Silicon Valley, and was adopted because o ...

. This includes Google, Facebook, Twitter, LinkedIn, Amazon, eBay, PayPal and Microsoft; several of which have their EMEA / Europe & Middle East headquarters in Ireland. Others operate their European headquarters from Cork

Cork or CORK may refer to:

Materials

* Cork (material), an impermeable buoyant plant product

** Cork (plug), a cylindrical or conical object used to seal a container

***Wine cork

Places Ireland

* Cork (city)

** Metropolitan Cork, also known as G ...

, including Apple, EMC and Johnson Controls.

Medical technologies

The Medical technology (MedTech) sector employs nearly 25,000 people and generates 9.4 billion Euro annually, with over one hundred companies in the country.Pharmaceuticals

The pharmaceutical sector employs approximately 50,000 people and is responsible for 55 billion euro of exports. A number of these companies are based inCounty Cork

County Cork ( ga, Contae Chorcaí) is the largest and the southernmost county of Ireland, named after the city of Cork, the state's second-largest city. It is in the province of Munster and the Southern Region. Its largest market towns a ...

, at Little Island and Ringaskiddy

Ringaskiddy () is a village in County Cork, Ireland. It is located on the western side of Cork Harbour, south of Cobh, and is 15 kilometres from Cork city, to which it is connected by the N28 road. The village is a port with passenger fer ...

.

Software

The software sector employs approximately 24,000 people and contributes 16 billion Euro to the economy. Ireland is the world's second largest exporter of software. The top 10 global technology firms have operations in Ireland including Apple, Google, Facebook and Microsoft. Ireland is home to over 900 software companies.Primary sector

Theprimary sector of the economy

The primary sector of the economy includes any industry involved in the extraction and production of raw materials, such as farming, logging, fishing, forestry and mining.

The primary sector tends to make up a larger portion of the economy i ...

(including agriculture, forestry, mining and fishing) constitutes about 5% of Irish GDP, and 8% of Irish employment. One of Ireland's main agricultural resources is its large fertile pastures, particularly in the midland and southern regions.

According to ''Teagasc Teagasc (, meaning "Instruction") is the State-sponsored bodies of the Republic of Ireland, semi-state authority in the Republic of Ireland responsible for research and development, training and advisory services in the agri-food sector.

The offici ...

'', the Irish agri-food sector generated 7% of gross value added (€13.9 billion) during 2016, and accounted for 8.5% of national employment and 9.8% of Ireland's merchandise exports. This included cattle, beef, and dairy product exports. Ireland's agri-food exports include several high-value dairy brands, and are led by a number of Irish companies including Kerry Group

Kerry Group plc is a public food company headquartered in Ireland. It is quoted on the Dublin ISEQ and London stock exchanges.

Given the company's origins in the co-operative movement, farmer-suppliers of the company retain a significant in ...

, Glanbia

Glanbia plc ( ) is an Irish global nutrition group with operations in 32 countries. It has leading market positions in sports nutrition, cheese, dairy ingredients, speciality non-dairy ingredients and vitamin and mineral premixes. Glanbia produc ...

, Greencore

Greencore Group plc is a food company in Ireland. It was established by the Irish government in 1991, when Irish Sugar was privatised, but today Greencore's products are mainly convenience foods, not only in Ireland but also in the United Kingd ...

and Ornua.

In the late nineteenth century, the island was mostly deforested. In 2005, after years of national afforestation programmes, about 9% of Ireland has become forested. It is still one of the least forested countries in the EU and heavily relies on imported wood. Its coastline – once abundant in fish, particularly cod

Cod is the common name for the demersal fish genus '' Gadus'', belonging to the family Gadidae. Cod is also used as part of the common name for a number of other fish species, and one species that belongs to genus ''Gadus'' is commonly not call ...

– has suffered overfishing and since 1995 the fisheries industry has focused more on aquaculture. Freshwater salmon and trout stocks in Ireland's waterways have also been depleted but are being better managed. Ireland is a major exporter of zinc to the EU and mining also produces significant quantities of lead and alumina.

Beyond this, the country has significant deposits of gypsum

Gypsum is a soft sulfate mineral composed of calcium sulfate dihydrate, with the chemical formula . It is widely mined and is used as a fertilizer and as the main constituent in many forms of plaster, blackboard or sidewalk chalk, and drywal ...

, limestone

Limestone ( calcium carbonate ) is a type of carbonate sedimentary rock which is the main source of the material lime. It is composed mostly of the minerals calcite and aragonite, which are different crystal forms of . Limestone forms whe ...

, and smaller quantities of copper, silver, gold, barite, and dolomite Dolomite may refer to:

*Dolomite (mineral), a carbonate mineral

*Dolomite (rock), also known as dolostone, a sedimentary carbonate rock

*Dolomite, Alabama, United States, an unincorporated community

*Dolomite, California, United States, an unincor ...

.CIA (2006)Ireland

The World Factbook. Retrieved on 8 August 2006. Peat extraction has historically been important, especially from midland bogs, however more efficient fuels and environmental protection of bogs has reduced peat's importance to the economy. Natural gas extraction occurs in the Kinsale Gas Field and the Corrib Gas Field in the southern and western counties, where there is 19.82 bn cubic metres of proven reserves.

Agriculture

In 2017, agriculture was estimated to contribute approximately 1% of GDP. During 2019, Ireland produced (in addition to smaller productions of other agricultural products), 1.4 million tons ofbarley

Barley (''Hordeum vulgare''), a member of the grass family, is a major cereal grain grown in temperate climates globally. It was one of the first cultivated grains, particularly in Eurasia as early as 10,000 years ago. Globally 70% of barley p ...

, 595 thousand tons of wheat

Wheat is a grass widely cultivated for its seed, a cereal grain that is a worldwide staple food. The many species of wheat together make up the genus ''Triticum'' ; the most widely grown is common wheat (''T. aestivum''). The archaeologi ...

, 382 thousand tons of potato

The potato is a starchy food, a tuber of the plant ''Solanum tuberosum'' and is a root vegetable native to the Americas. The plant is a perennial in the nightshade family Solanaceae.

Wild potato species can be found from the southern Unit ...

, and 193 thousand tons of oats

The oat (''Avena sativa''), sometimes called the common oat, is a species of cereal grain grown for its seed, which is known by the same name (usually in the plural, unlike other cereals and pseudocereals). While oats are suitable for human co ...

. In the same year, Ireland produced 8.2 billion liters of cow's milk

Milk is a white liquid food produced by the mammary glands of mammals. It is the primary source of nutrition for young mammals (including breastfed human infants) before they are able to digest solid food. Immune factors and immune-modulati ...

(making it the 20th largest producer in the world), 304 thousand tons of pork

Pork is the culinary name for the meat of the domestic pig (''Sus domesticus''). It is the most commonly consumed meat worldwide, with evidence of pig husbandry dating back to 5000 BCE.

Pork is eaten both freshly cooked and preserved; ...

, 141 thousand tons of chicken meat

Chicken is the most common type of poultry in the world. Owing to the relative ease and low cost of raising chickens—in comparison to mammals such as cattle or hogs—chicken meat (commonly called just "chicken") and chicken eggs have becom ...

, and 66 thousand tons of lamb meat

Lamb, hogget, and mutton, generically sheep meat, are the meat of domestic sheep, ''Ovis aries''. A sheep in its first year is a lamb and its meat is also lamb. The meat from sheep in their second year is hogget. Older sheep meat is mutton. Gen ...

.

Secondary and tertiary sectors

The construction sector in Ireland has been severely affected by theIrish property bubble

The Irish property bubble was the speculative excess element of a long-term price increase of real estate in the Republic of Ireland from the early 2000s to 2007, a period known as the later part of the Celtic Tiger. In 2006, the prices peaked ...

and the 2008-2013 Irish banking crisis and as a result contributes less to the economy than during the period 2002–2007.

While there are over 60 credit institutions incorporated in Ireland, the banking system is dominated by the AIB Bank, Bank of Ireland and Ulster Bank

Ulster Bank ( ga, Banc Uladh) is a large retail bank, and one of the traditional Big Four (banking)#Ireland, Big Four Irish clearing banks. The Ulster Bank Group is subdivided into two separate legal entities: NatWest, National Westminster Ban ...

. There is a large Credit Union

A credit union, a type of financial institution similar to a commercial bank, is a member-owned nonprofit financial cooperative. Credit unions generally provide services to members similar to retail banks, including deposit accounts, provisi ...

movement within the country which offers an alternative to the banks. The Irish Stock Exchange

Euronext Dublin (formerly The Irish Stock Exchange, ISE; ga, Stocmhalartán na hÉireann) is Ireland's main stock exchange, and has been in existence since 1793.

The Euronext Dublin lists debt and fund securities and is used as a European g ...

is in Dublin

Dublin (; , or ) is the capital and largest city of Ireland. On a bay at the mouth of the River Liffey, it is in the province of Leinster, bordered on the south by the Dublin Mountains, a part of the Wicklow Mountains range. At the 2016 c ...

, however, due to its small size, many firms also maintain listings on either the London Stock Exchange

London Stock Exchange (LSE) is a stock exchange in the City of London, England, United Kingdom. , the total market value of all companies trading on LSE was £3.9 trillion. Its current premises are situated in Paternoster Square close to St P ...

or the NASDAQ. That being said, the Irish Stock Exchange has a leading position as a listing domicile for cross-border funds. By accessing the Irish Stock Exchange, investment companies can market their shares to a wider range of investors (under MiFID

Markets in Financial Instruments Directive 20142014/65/EU commonly known as MiFID 2 (Markets in financial instruments directive 2), is a legal act of the European Union. Together with Regulation (EU) No 600/2014 it provides a legal framework fo ...

although this will change somewhat with the introduction of the AIFM Directive. Service providers abound for the cross-border funds business and Ireland has been recently rated with a DAW Index score of 4 in 2012. Similarly, the insurance industry in Ireland is a leader in both retail markets and corporate customers in the EU, in large part due to the International Financial Services Centre

The International Financial Services Centre (IFSC) is an area of central Dublin and part of the CBD established in the 1980s as an urban regeneration area and special economic zone (SEZ) on the derelict state-owned former port authority lan ...

.

Taxation and welfare

Welfare benefits

As of December 2007, Ireland's net unemployment benefits for long-term unemployed people across four family types (single people, lone parents, single-income couples with and without children) was the third highest of the OECD countries (jointly withIceland

Iceland ( is, Ísland; ) is a Nordic island country in the North Atlantic Ocean and in the Arctic Ocean. Iceland is the most sparsely populated country in Europe. Iceland's capital and largest city is Reykjavík, which (along with its s ...

) after Denmark

)

, song = ( en, "King Christian stood by the lofty mast")

, song_type = National and royal anthem

, image_map = EU-Denmark.svg

, map_caption =

, subdivision_type = Sovereign state

, subdivision_name = Kingdom of Denmark

, establish ...

and Switzerland. Jobseeker's Allowance or Jobseeker's Benefit for a single person in Ireland is €208 per week, as of January 2022.

State provided old age pensions

A pension (, from Latin ''pensiō'', "payment") is a fund into which a sum of money is added during an employee's employment years and from which payments are drawn to support the person's retirement from work in the form of periodic payments ...

are also relatively generous in Ireland. The maximum weekly rate for the State Pension (Contributory) is €248.30 for a single pensioner

A pensioner is a person who receives a pension, most commonly because of retirement from the workforce. This is a term typically used in the United Kingdom (along with OAP, initialism of old-age pensioner), Ireland and Australia where someone of p ...

aged between 66 and 80. The maximum weekly rate for the State Pension (Non-Contributory) is €237 for a single pensioner aged between 66 and 80.

Wealth distribution and taxation

The percentage of the population at risk of

The percentage of the population at risk of relative poverty

The poverty threshold, poverty limit, poverty line or breadline is the minimum level of income deemed adequate in a particular country. The poverty line is usually calculated by estimating the total cost of one year's worth of necessities for t ...

was 21% in 2004 – one of the highest rates in the European Union. Ireland's inequality of income distribution score on the Gini coefficient scale was 30.4 in 2000, slightly below the OECD average of 31. Sustained increases in the value of residential property during the 1990s and up to late 2006 was a key factor in the increase in personal wealth in Ireland, with Ireland ranking second only to Japan in personal wealth in 2006. However, residential property values and equities

In finance, stock (also capital stock) consists of all the shares by which ownership of a corporation or company is divided.Longman Business English Dictionary: "stock - ''especially AmE'' one of the shares into which ownership of a company ...

have fallen substantially since the beginning of 2007 and major declines in personal wealth expected.

From 1975 to 2005, tax revenues fluctuated at around 30% of GDP (see graph right).

Currency

Before the introduction of the euro notes andcoins

A coin is a small, flat (usually depending on the country or value), round piece of metal or plastic used primarily as a medium of exchange or legal tender. They are standardized in weight, and produced in large quantities at a mint in order t ...

in January 2002, Ireland used the Irish pound or ''punt''. In January 1999 Ireland was one of eleven European Union member states which launched the European Single Currency, the euro

The euro ( symbol: €; code: EUR) is the official currency of 19 out of the member states of the European Union (EU). This group of states is known as the eurozone or, officially, the euro area, and includes about 340 million citizens . ...

. Euro banknotes are issued in €5, €10, €20, €50, €100, €200 and €500 denominations and share the common design used across Europe, however like other countries in the eurozone, Ireland has its own unique design on one face of euro coins. The government decided on a single national design for all Irish coin denominations, which show a Celtic harp, a traditional symbol of Ireland, decorated with the year of issue and the word ''Éire'' which means "Ireland" in the Irish language.

See also

*Economy of Dublin

Dublin is the largest city and capital of Ireland, and is the country's economic hub. As well as being the location of the national parliament and most of the civil service, Dublin is also the focal point of media in the country. Much of Irelan ...

*Economy of Cork

The second largest city in Ireland, Cork, has an economy focused on the city centre, which as of 2011, supported employment for 24,092 people. According to 2006 figures, the top five employers in the area were public sector organisations, and in ...

*Economy of Limerick

Limerick is the third largest city in the Republic of Ireland and is the capital of Ireland's Mid-West Region comprising the counties of Limerick, Clare and North Tipperary. Traditionally Limerick's economy was mainly agricultural of which a l ...

*Economy of Northern Ireland

The economy of Northern Ireland is the smallest of the four constituents of the United Kingdom and the smaller of the two jurisdictions on the island of Ireland. At the time of the Partition of Ireland in 1922, and for a period afterwards, Nor ...

*International Financial Services Centre

The International Financial Services Centre (IFSC) is an area of central Dublin and part of the CBD established in the 1980s as an urban regeneration area and special economic zone (SEZ) on the derelict state-owned former port authority lan ...

* Corporation tax in the Republic of Ireland

* Irish Fiscal Advisory Council

References

Further reading

* Clark, Charles, Catherine Kavanagh, and Niamh Lenihan. ''Measuring Progress: Economy, Society and Environment in Ireland'' (Dublin: Social Justice Ireland, 2017)online

* Coulter, Colin, and Angela Nagle, eds. ''Ireland under austerity: Neoliberal crisis, neoliberal solutions'' (2015

excerpt