1997 financial crisis on:

[Wikipedia]

[Google]

[Amazon]

The Asian financial crisis was a period of financial crisis that gripped much of

The Asian financial crisis was a period of financial crisis that gripped much of

The causes of the debacle are many and disputed. Thailand's economy developed into an

The causes of the debacle are many and disputed. Thailand's economy developed into an

Very high interest rates, which can be extremely damaging to a healthy economy, wreaked further havoc on economies in an already fragile state, while the central banks were hemorrhaging foreign reserves, of which they had finite amounts. When it became clear that the tide of capital fleeing these countries was not to be stopped, the authorities ceased defending their fixed exchange rates and allowed their currencies to float. The resulting depreciated value of those currencies meant that foreign currency-denominated liabilities grew substantially in domestic currency terms, causing more bankruptcies and further deepening the crisis.

Other economists, including

Very high interest rates, which can be extremely damaging to a healthy economy, wreaked further havoc on economies in an already fragile state, while the central banks were hemorrhaging foreign reserves, of which they had finite amounts. When it became clear that the tide of capital fleeing these countries was not to be stopped, the authorities ceased defending their fixed exchange rates and allowed their currencies to float. The resulting depreciated value of those currencies meant that foreign currency-denominated liabilities grew substantially in domestic currency terms, causing more bankruptcies and further deepening the crisis.

Other economists, including

In June 1997, Indonesia seemed far from crisis. Unlike Thailand, Indonesia had low inflation, a

In June 1997, Indonesia seemed far from crisis. Unlike Thailand, Indonesia had low inflation, a

Amongst other stimuli, the crisis resulted in the bankruptcy of major Korean companies, provoking not only corporations, but also government officials towards corruption. The

Amongst other stimuli, the crisis resulted in the bankruptcy of major Korean companies, provoking not only corporations, but also government officials towards corruption. The

China's nonconvertible capital account and its foreign exchange control were decisive in limiting the impact of the crisis.

The Chinese currency, the

China's nonconvertible capital account and its foreign exchange control were decisive in limiting the impact of the crisis.

The Chinese currency, the

The above tabulation shows that despite the prompt raising of interest rates to 32% in the Philippines upon the onset of crisis in mid-July 1997, and to 65% in Indonesia upon the intensification of crisis in 1998, their local currencies depreciated just the same and did not perform better than those of South Korea, Thailand, and Malaysia, which countries had their high interest rates set at generally lower than 20% during the Asian crisis. This created grave doubts on the credibility of IMF and the validity of its high-interest-rate prescription to economic crisis.

The economic crisis also led to a political upheaval, most notably culminating in the resignations of President

The above tabulation shows that despite the prompt raising of interest rates to 32% in the Philippines upon the onset of crisis in mid-July 1997, and to 65% in Indonesia upon the intensification of crisis in 1998, their local currencies depreciated just the same and did not perform better than those of South Korea, Thailand, and Malaysia, which countries had their high interest rates set at generally lower than 20% during the Asian crisis. This created grave doubts on the credibility of IMF and the validity of its high-interest-rate prescription to economic crisis.

The economic crisis also led to a political upheaval, most notably culminating in the resignations of President

online

* Haggard Stephan: ''The Political Economy of the Asian Financial Crisis'' (2000) * Hollingsworth, David Anthony (2007, rev. 2008) "The Rise, the Fall, and the Recovery of Southeast Asia's Minidragons: How Can Their History Be Lessons We Shall Learn During the Twenty-First Century and Beyond?" Lexington Books. (, 9780739119815) * Kaufman, GG., Krueger, TH., Hunter, WC. (1999) ''The Asian Financial Crisis: Origins, Implications and Solutions''. Springer. * Khan, Saleheen, Faridul Islam, and Syed Ahmed. (2005) "The Asian crisis: an economic analysis of the causes." ''Journal of Developing Areas'' (2005): 169–190

online

* Muchhala, Bhumika, ed. (2007)

Ten Years After: Revisiting the Asian Financial Crisis

'. Washington, DC:

6. Defeating the World Financial Storm

China Youth Publishing House (2000).

''Coping with the Asian Financial Crisis: The Singapore Experience''

Institute of Southeast Asian Studies. * Tiwari, Rajnish (2003)

''Post-crisis Exchange Rate Regimes in Southeast Asia''

Seminar Paper, University of Hamburg. * Kilgour, Andrea (1999)

*

''Some Lessons From The East Asian Miracle''

The World Bank Research Observer. * Weisbrot, Mark (August 2007)

''Ten Years After: The Lasting Impact of the Asian Financial Crisis''

Is Thailand on the road to recovery

article by Australian photo-journalist John Le Fevre that looks at the effects of the Asian Economic Crisis on Thailand's construction industry

Women bear brunt of crisis

article by Australian photo-journalist John Le Fevre examining the effects of the Asian Economic Crisis on Asia's female workforce

The Crash

(transcript only), from the PBS series Frontline

Impact on Indonesia

from th

Dean Peter Krogh Foreign Affairs Digital Archives

Asia's Financial Sector: 12 Things to Know

Asian Development Bank {{Authority control 1990s economic history Asian Financial Crisis, 1997 Asian Financial Crisis, 1997 Asian Financial Crisis, 1997 Asian Financial Crisis, 1997 1997 in Thailand Economic history of Japan Economic history of Malaysia Economic history of South Korea Economic history of the People's Republic of China Economic history of the Philippines Economic history of Asia Economy of Indonesia Economy of Singapore Economy of South Korea Economic history of Thailand Finance in China Finance in Hong Kong History of Hong Kong Economic history of Singapore New Order (Indonesia) Stock market crashes 1997 in Japan Asian financial crisis Presidency of Eduardo Frei Ruiz-Tagle

East Asia

East Asia is the eastern region of Asia, which is defined in both geographical and ethno-cultural terms. The modern states of East Asia include China, Japan, Mongolia, North Korea, South Korea, and Taiwan. China, North Korea, South Korea and ...

and Southeast Asia

Southeast Asia, also spelled South East Asia and South-East Asia, and also known as Southeastern Asia, South-eastern Asia or SEA, is the geographical United Nations geoscheme for Asia#South-eastern Asia, south-eastern region of Asia, consistin ...

beginning in July 1997 and raised fears of a worldwide economic meltdown due to financial contagion

Financial contagion refers to "the spread of market disturbances mostly on the downside from one country to the other, a process observed through co-movements in exchange rates, stock prices, sovereign spreads, and capital flows". Financial contag ...

. However, the recovery in 1998–1999 was rapid and worries of a meltdown subsided.

The crisis started in Thailand

Thailand ( ), historically known as Siam () and officially the Kingdom of Thailand, is a country in Southeast Asia, located at the centre of the Indochinese Peninsula, spanning , with a population of almost 70 million. The country is bo ...

(known in Thailand as the '' Tom Yam Kung crisis''; th, วิกฤตต้มยำกุ้ง) on 2 July, with the financial collapse of the Thai baht after the Thai government was forced to float the baht due to lack of foreign currency to support its currency peg to the U.S. dollar

The United States dollar ( symbol: $; code: USD; also abbreviated US$ or U.S. Dollar, to distinguish it from other dollar-denominated currencies; referred to as the dollar, U.S. dollar, American dollar, or colloquially buck) is the officia ...

. Capital flight ensued almost immediately, beginning an international chain reaction. At the time, Thailand had acquired a burden of foreign debt

A country's gross external debt (or foreign debt) is the liabilities that are owed to nonresidents by residents. The debtors can be governments, corporations or citizens. External debt may be denominated in domestic or foreign currency. It incl ...

. As the crisis spread, most of Southeast Asia and later South Korea and Japan saw slumping currencies, devalued stock markets and other asset prices, and a precipitous rise in private debt

In economics, consumer debt is the amount owed by consumers (as opposed to amounts owed by businesses or governments). It includes debts incurred on purchase of goods that are consumable and/or do not appreciate. In macroeconomic terms, it is ...

.

South Korea

South Korea, officially the Republic of Korea (ROK), is a country in East Asia, constituting the southern part of the Korea, Korean Peninsula and sharing a Korean Demilitarized Zone, land border with North Korea. Its western border is formed ...

, Indonesia

Indonesia, officially the Republic of Indonesia, is a country in Southeast Asia and Oceania between the Indian and Pacific oceans. It consists of over 17,000 islands, including Sumatra, Java, Sulawesi, and parts of Borneo and New Guine ...

and Thailand

Thailand ( ), historically known as Siam () and officially the Kingdom of Thailand, is a country in Southeast Asia, located at the centre of the Indochinese Peninsula, spanning , with a population of almost 70 million. The country is bo ...

were the countries most affected by the crisis. Hong Kong

Hong Kong ( (US) or (UK); , ), officially the Hong Kong Special Administrative Region of the People's Republic of China ( abbr. Hong Kong SAR or HKSAR), is a city and special administrative region of China on the eastern Pearl River Delt ...

, Laos

Laos (, ''Lāo'' )), officially the Lao People's Democratic Republic ( Lao: ສາທາລະນະລັດ ປະຊາທິປະໄຕ ປະຊາຊົນລາວ, French: République démocratique populaire lao), is a socialist ...

, Malaysia

Malaysia ( ; ) is a country in Southeast Asia. The federation, federal constitutional monarchy consists of States and federal territories of Malaysia, thirteen states and three federal territories, separated by the South China Sea into two r ...

and the Philippines

The Philippines (; fil, Pilipinas, links=no), officially the Republic of the Philippines ( fil, Republika ng Pilipinas, links=no),

* bik, Republika kan Filipinas

* ceb, Republika sa Pilipinas

* cbk, República de Filipinas

* hil, Republ ...

were also hurt by the slump. Brunei

Brunei ( , ), formally Brunei Darussalam ( ms, Negara Brunei Darussalam, Jawi alphabet, Jawi: , ), is a country located on the north coast of the island of Borneo in Southeast Asia. Apart from its South China Sea coast, it is completely sur ...

, mainland China

"Mainland China" is a geopolitical term defined as the territory governed by the People's Republic of China (including islands like Hainan or Chongming), excluding dependent territories of the PRC, and other territories within Greater China. ...

, Singapore

Singapore (), officially the Republic of Singapore, is a sovereign island country and city-state in maritime Southeast Asia. It lies about one degree of latitude () north of the equator, off the southern tip of the Malay Peninsula, borde ...

, Taiwan

Taiwan, officially the Republic of China (ROC), is a country in East Asia, at the junction of the East and South China Seas in the northwestern Pacific Ocean, with the People's Republic of China (PRC) to the northwest, Japan to the nort ...

, and Vietnam

Vietnam or Viet Nam ( vi, Việt Nam, ), officially the Socialist Republic of Vietnam,., group="n" is a country in Southeast Asia, at the eastern edge of mainland Southeast Asia, with an area of and population of 96 million, making i ...

were less affected, although all suffered from a loss of demand and confidence throughout the region. Japan

Japan ( ja, 日本, or , and formally , ''Nihonkoku'') is an island country in East Asia. It is situated in the northwest Pacific Ocean, and is bordered on the west by the Sea of Japan, while extending from the Sea of Okhotsk in the north ...

was also affected, though less significantly.

Foreign debt-to-GDP ratio

In economics, the debt-to-GDP ratio is the ratio between a country's government debt (measured in units of currency) and its gross domestic product (GDP) (measured in units of currency per year). While it is a "ratio", it is technically measured i ...

s rose from 100% to 167% in the four large Association of Southeast Asian Nations

ASEAN ( , ), officially the Association of Southeast Asian Nations, is a political and economic union of 10 member states in Southeast Asia, which promotes intergovernmental cooperation and facilitates economic, political, security, militar ...

(ASEAN) economies in 1993–96, then shot up beyond 180% during the worst of the crisis. In South Korea, the ratios rose from 13% to 21% and then as high as 40%, while the other northern newly industrialized countries fared much better. Only in Thailand and South Korea did debt service-to-exports ratios rise.

Although most of the governments of Asia had seemingly sound fiscal policies

In economics and political science, fiscal policy is the use of government revenue collection (taxes or tax cuts) and expenditure to influence a country's economy. The use of government revenue expenditures to influence macroeconomic variables d ...

, the International Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster globa ...

(IMF) stepped in to initiate a $40 billion program to stabilize the currencies of South Korea, Thailand, and Indonesia, economies particularly hard hit by the crisis. The efforts to stem a global economic crisis did little to stabilize the domestic situation in Indonesia, however. After 30 years in power, Indonesian President Suharto

Suharto (; ; 8 June 1921 – 27 January 2008) was an Indonesian army officer and politician, who served as the second and the longest serving president of Indonesia. Widely regarded as a military dictator by international observers, Suharto ...

was forced to step down on 21 May 1998 in the wake of widespread rioting that followed sharp price increases caused by a drastic devaluation of the rupiah. The effects of the crisis lingered through 1998. In 1998, growth in the Philippines dropped to virtually zero. Only Singapore and Taiwan proved relatively insulated from the shock, but both suffered serious hits in passing, the former due to its size and geographical location between Malaysia and Indonesia. By 1999, however, analysts saw signs that the economies of Asia were beginning to recover. After the crisis, economies in the region worked toward financial stability and better financial supervision.

Until 1999, Asia attracted almost half of the total capital

Capital may refer to:

Common uses

* Capital city, a municipality of primary status

** List of national capital cities

* Capital letter, an upper-case letter Economics and social sciences

* Capital (economics), the durable produced goods used f ...

inflow into developing countries

A developing country is a sovereign state with a lesser developed industrial base and a lower Human Development Index (HDI) relative to other countries. However, this definition is not universally agreed upon. There is also no clear agreem ...

. The economies of Southeast Asia in particular maintained high interest rates attractive to foreign investors looking for a high rate of return. As a result, the region's economies received a large inflow of money and experienced a dramatic run-up in asset prices. At the same time, the regional economies of Thailand, Malaysia, Indonesia, Singapore and South Korea experienced high growth rates, of 8–12% GDP, in the late 1980s and early 1990s. This achievement was widely acclaimed by financial institutions including IMF and World Bank

The World Bank is an international financial institution that provides loans and grants to the governments of low- and middle-income countries for the purpose of pursuing capital projects. The World Bank is the collective name for the Interna ...

, and was known as part of the " Asian economic miracle".

Credit bubbles and fixed currency exchange rates

The causes of the debacle are many and disputed. Thailand's economy developed into an

The causes of the debacle are many and disputed. Thailand's economy developed into an economic bubble

An economic bubble (also called a speculative bubble or a financial bubble) is a period when current asset prices greatly exceed their intrinsic valuation, being the valuation that the underlying long-term fundamentals justify. Bubbles can be c ...

fueled by hot money. More and more was required as the size of the bubble grew. The same type of situation happened in Malaysia and Indonesia, which had the added complication of what was called "crony capitalism

Crony capitalism, sometimes called cronyism, is an economic system in which businesses thrive not as a result of free enterprise, but rather as a return on money amassed through collusion between a business class and the political class. This is ...

". The short-term capital flow was expensive and often highly conditioned for quick profit

Profit may refer to:

Business and law

* Profit (accounting), the difference between the purchase price and the costs of bringing to market

* Profit (economics), normal profit and economic profit

* Profit (real property), a nonpossessory intere ...

. Development money went in a largely uncontrolled manner to certain people only – not necessarily the best suited or most efficient, but those closest to the centers of power. Weak corporate governance also led to inefficient investment and declining profitability.

In the mid-1990s, Thailand, Indonesia and South Korea had large private current account Current account or Current Account may refer to:

* Current account (balance of payments), a country's balance of trade, net of factor income and cash transfers

* Current account (banking)

A transaction account, also called a checking account, ch ...

deficits, and the maintenance of fixed exchange rates encouraged external borrowing and led to excessive exposure to foreign exchange risk

Foreign exchange risk (also known as FX risk, exchange rate risk or currency risk) is a financial risk that exists when a financial transaction is denominated in a currency other than the domestic currency of the company. The exchange risk arises ...

in both the financial and corporate sectors.

In the mid-1990s, a series of external shocks began to change the economic environment. The devaluation of the Chinese renminbi

The renminbi (; symbol: ¥; ISO code: CNY; abbreviation: RMB) is the official currency of the People's Republic of China and one of the world's most traded currencies, ranking as the fifth most traded currency in the world as of April 2022. ...

, and the Japanese yen

The is the official currency of Japan. It is the third-most traded currency in the foreign exchange market, after the United States dollar (US$) and the euro. It is also widely used as a third reserve currency after the US dollar and the e ...

due to the Plaza Accord of 1985, the raising of U.S. interest rates which led to a strong U.S. dollar, and the sharp decline in semiconductor prices, all adversely affected their growth. As the U.S. economy

The United States is a highly developed mixed-market economy and has the world's largest nominal GDP and net wealth. It has the second-largest by purchasing power parity (PPP) behind China. It has the world's seventh-highest per capita GDP ...

recovered from a recession in the early 1990s, the U.S. Federal Reserve Bank

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States of America. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a ...

under Alan Greenspan

Alan Greenspan (born March 6, 1926) is an American economist who served as the 13th chairman of the Federal Reserve from 1987 to 2006. He works as a private adviser and provides consulting for firms through his company, Greenspan Associates LLC. ...

began to raise U.S. interest rates to head off inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reductio ...

.

This made the United States a more attractive investment destination relative to Southeast Asia, which had been attracting hot money flows through high short-term interest rates, and raised the value of the U.S. dollar. For the Southeast Asian nations which had currencies pegged to the U.S. dollar, the higher U.S. dollar caused their own exports to become more expensive and less competitive in the global markets. At the same time, Southeast Asia's export growth slowed dramatically in the spring of 1996, deteriorating their current account position.

Some economists have advanced the growing exports of China as a factor contributing to ASEAN nations' export growth slowdown, though these economists maintain the main cause of their crises was excessive real estate speculation. China had begun to compete effectively with other Asian exporters particularly in the 1990s after the implementation of a number of export-oriented reforms. Other economists dispute China's impact, noting that both ASEAN and China experienced simultaneous rapid export growth in the early 1990s.

Many economists believe that the Asian crisis was created not by market psychology or technology, but by policies that distorted incentives within the lender–borrower relationship. The resulting large quantities of credit that became available generated a highly leveraged

In finance, leverage (or gearing in the United Kingdom and Australia) is any technique involving borrowing funds to buy things, hoping that future profits will be many times more than the cost of borrowing. This technique is named after a lever ...

economic climate, and pushed up asset prices to an unsustainable level, particularly those in non-productive sectors of the economy such as real-estate. These asset prices eventually began to collapse, causing individuals and companies to default

Default may refer to:

Law

* Default (law), the failure to do something required by law

** Default (finance), failure to satisfy the terms of a loan obligation or failure to pay back a loan

** Default judgment, a binding judgment in favor of ei ...

on debt obligations.

Panic among lenders and withdrawal of credit

The resulting panic among lenders led to a large withdrawal of credit from the crisis countries, causing acredit crunch

A credit crunch (also known as a credit squeeze, credit tightening or credit crisis) is a sudden reduction in the general availability of loans (or credit) or a sudden tightening of the conditions required to obtain a loan from banks. A credit cr ...

and further bankruptcies. In addition, as foreign investors attempted to withdraw their money, the exchange market

An exchange, bourse (), trading exchange or trading venue is an organized market where (especially) tradable securities, commodities, foreign exchange, futures, and options contracts are bought and sold.

History

12th century: Brokers on the ...

was flooded with the currencies of the crisis countries, putting depreciative pressure on their exchange rates. To prevent currency values collapsing, these countries' governments raised domestic interest rates to exceedingly high levels (to help diminish flight of capital

Capital flight, in economics, occurs when assets or money rapidly flow out of a country, due to an event of economic consequence or as the result of a political event such as regime change or economic globalization. Such events could be an increas ...

by making lending more attractive to investors) and intervened in the exchange market, buying up any excess domestic currency at the fixed exchange rate with foreign reserves

Foreign exchange reserves (also called forex reserves or FX reserves) are cash and other reserve assets such as gold held by a central bank or other monetary authority that are primarily available to balance payments of the country, influence ...

. Neither of these policy responses could be sustained for long, as several countries had insufficient levels of foreign exchange reserves.

Very high interest rates, which can be extremely damaging to a healthy economy, wreaked further havoc on economies in an already fragile state, while the central banks were hemorrhaging foreign reserves, of which they had finite amounts. When it became clear that the tide of capital fleeing these countries was not to be stopped, the authorities ceased defending their fixed exchange rates and allowed their currencies to float. The resulting depreciated value of those currencies meant that foreign currency-denominated liabilities grew substantially in domestic currency terms, causing more bankruptcies and further deepening the crisis.

Other economists, including

Very high interest rates, which can be extremely damaging to a healthy economy, wreaked further havoc on economies in an already fragile state, while the central banks were hemorrhaging foreign reserves, of which they had finite amounts. When it became clear that the tide of capital fleeing these countries was not to be stopped, the authorities ceased defending their fixed exchange rates and allowed their currencies to float. The resulting depreciated value of those currencies meant that foreign currency-denominated liabilities grew substantially in domestic currency terms, causing more bankruptcies and further deepening the crisis.

Other economists, including Joseph Stiglitz

Joseph Eugene Stiglitz (; born February 9, 1943) is an American New Keynesian economist, a public policy analyst, and a full professor at Columbia University. He is a recipient of the Nobel Memorial Prize in Economic Sciences (2001) and the Joh ...

and Jeffrey Sachs, have downplayed the role of the real economy in the crisis compared to the financial markets. The rapidity with which the crisis happened has prompted Sachs and others to compare it to a classic bank run

A bank run or run on the bank occurs when many clients withdraw their money from a bank, because they believe the bank may cease to function in the near future. In other words, it is when, in a fractional-reserve banking system (where banks no ...

prompted by a sudden risk shock. Sachs pointed to strict monetary and contractionary fiscal policies implemented by the governments on the advice of the IMF in the wake of the crisis, while Frederic Mishkin

Frederic Stanley "Rick" Mishkin (born January 11, 1951) is an American economist and Alfred Lerner professor of Banking and Financial Institutions at the Graduate School of Business, Columbia University. He was a member of the Federal Reserve Boa ...

points to the role of asymmetric information

In contract theory and economics, information asymmetry deals with the study of decisions in transactions where one party has more or better information than the other.

Information asymmetry creates an imbalance of power in transactions, which can ...

in the financial markets that led to a "herd mentality

Herd mentality, mob mentality or pack mentality describes how people can be influenced by their peers to adopt certain behaviors on a largely emotional, rather than rational, basis. When individuals are affected by mob mentality, they may make dif ...

" among investors that magnified a small risk in the real economy. The crisis has thus attracted attention from behavioral economists interested in market psychology

Behavioral economics studies the effects of Psychology, psychological, cognitive bias, cognitive, emotional, cultural and social factors on the decision making, decisions of individuals or institutions, such as how those decisions vary from t ...

.

Another possible cause of the sudden risk shock may also be attributable to the handover of Hong Kong sovereignty on 1 July 1997. During the 1990s, hot money flew into the Southeast Asia region through financial hub

A financial centre ( BE), financial center ( AE), or financial hub, is a location with a concentration of participants in banking, asset management, insurance or financial markets with venues and supporting services for these activities to tak ...

s, especially Hong Kong. The investors were often ignorant of the actual fundamentals or risk profiles of the respective economies, and once the crisis gripped the region, the political uncertainty regarding the future of Hong Kong as an Asian financial centre led some investors to withdraw from Asia altogether. This shrink in investments only worsened the financial conditions in Asia (subsequently leading to the depreciation of the Thai baht on 2 July 1997).

Several case studies on the topic of the application of network analysis Network analysis can refer to:

* Network theory, the analysis of relations through mathematical graphs

** Social network analysis, network theory applied to social relations

* Network analysis (electrical circuits)

See also

*Network planning and ...

of a financial system help to explain the interconnectivity

In telecommunications, interconnection is the physical linking of a carrier's network with equipment or facilities not belonging to that network. The term may refer to a connection between a carrier's facilities and the equipment belonging to ...

of financial market

A financial market is a market in which people trade financial securities and derivatives at low transaction costs. Some of the securities include stocks and bonds, raw materials and precious metals, which are known in the financial markets ...

s, as well as the significance of the robustness

Robustness is the property of being strong and healthy in constitution. When it is transposed into a system, it refers to the ability of tolerating perturbations that might affect the system’s functional body. In the same line ''robustness'' ca ...

of hubs (or main nodes). Albert-László Barabási "Unfolding the science behind the idea of six degrees of separation" by Andrew Sheng, Adj. Prof., Tsinghua University

Tsinghua University (; abbreviation, abbr. THU) is a National university, national Public university, public research university in Beijing, China. The university is funded by the Ministry of Education of the People's Republic of China, Minis ...

and University of Malaya University of Chicago Any negative externalities

In economics, an externality or external cost is an indirect cost or benefit to an uninvolved third party that arises as an effect of another party's (or parties') activity. Externalities can be considered as unpriced goods involved in either co ...

in the hubs creates a ripple effect

A ripple effect occurs when an initial disturbance to a system propagates outward to disturb an increasingly larger portion of the system, like ripples expanding across the water when an object is dropped into it.

The ripple effect is often used ...

through the financial system and the economy (as well as any connected economies) as a whole. Albert-László Barabási "Unfolding the science behind the idea of six degrees of separation" by Andrew Sheng, Adj. Prof., Tsinghua University

Tsinghua University (; abbreviation, abbr. THU) is a National university, national Public university, public research university in Beijing, China. The university is funded by the Ministry of Education of the People's Republic of China, Minis ...

and University of Malaya

The foreign ministers of the 10 ASEAN countries believed that the well co-ordinated manipulation of their currencies was a deliberate attempt to destabilize the ASEAN economies. Malaysian Prime Minister Mahathir Mohamad

Mahathir bin Mohamad ( ms, محاضير بن محمد, label= Jawi, script=arab, italic=unset; ; born 10 July 1925) is a Malaysian politician, author, and physician who served as the 4th and 7th Prime Minister of Malaysia. He held the office ...

accused George Soros of ruining Malaysia's economy with "massive currency speculation

In finance, speculation is the purchase of an asset (a commodity, goods, or real estate) with the hope that it will become more valuable shortly. (It can also refer to short sales in which the speculator hopes for a decline in value.)

Many ...

". Soros claims to have been a buyer of the ringgit during its fall, having sold it short in 1997.

At the 30th ASEAN Ministerial Meeting held in Subang Jaya

Subang Jaya is a city in Petaling District, Selangor, Malaysia. It comprises the southern third district of Petaling. It consists of the neighbourhoods from SS12 to SS19, UEP Subang Jaya (USJ), Putra Heights, Batu Tiga as well as PJS7, PJS9 ...

, Malaysia, the foreign ministers issued a joint declaration on 25 July 1997 expressing serious concern and called for further intensification of ASEAN's cooperation to safeguard and promote ASEAN's interest in this regard. Coincidentally, on that same day, the central bankers of most of the affected countries were at the EMEAP (Executive Meeting of East Asia Pacific) meeting in Shanghai, and they failed to make the "New Arrangement to Borrow" operational. A year earlier, the finance ministers of these same countries had attended the 3rd APEC

The Asia-Pacific Economic Cooperation (APEC ) is an inter-governmental forum for 21 member economies in the Pacific Rim that promotes free trade throughout the Asia-Pacific region.

finance ministers meeting in Kyoto

Kyoto (; Japanese: , ''Kyōto'' ), officially , is the capital city of Kyoto Prefecture in Japan. Located in the Kansai region on the island of Honshu, Kyoto forms a part of the Keihanshin metropolitan area along with Osaka and Kobe. , the ci ...

, Japan, on 17 March 1996, and according to that joint declaration, they had been unable to double the amounts available under the "General Agreement to Borrow" and the "Emergency Finance Mechanism".

IMF role

The scope and the severity of the collapses led to an urgent need for outside intervention. Since the countries melting down were among the richest in their region, and in the world, and since hundreds of billions of dollars were at stake, any response to the crisis was likely to be cooperative and international. TheInternational Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster globa ...

created a series of bailouts

A bailout is the provision of financial help to a corporation or country which otherwise would be on the brink of bankruptcy.

A bailout differs from the term ''bail-in'' (coined in 2010) under which the bondholders or depositors of global syst ...

("rescue packages") for the most-affected economies to enable them to avoid default

Default may refer to:

Law

* Default (law), the failure to do something required by law

** Default (finance), failure to satisfy the terms of a loan obligation or failure to pay back a loan

** Default judgment, a binding judgment in favor of ei ...

, tying the packages to currency, banking and financial system reforms. Due to IMF's involvement in the financial crisis, the term IMF Crisis became a way to refer to the Asian Financial Crisis in countries that were affected.

Economic reforms

The IMF's support was conditional on a series of economic reforms, the "structural adjustment

Structural adjustment programs (SAPs) consist of loans (structural adjustment loans; SALs) provided by the International Monetary Fund (IMF) and the World Bank (WB) to countries that experience economic crises. Their purpose is to adjust the coun ...

package" (SAP). The SAPs called on crisis-struck nations to reduce government spending and deficits, allow insolvent

In accounting, insolvency is the state of being unable to pay the debts, by a person or company (debtor), at maturity; those in a state of insolvency are said to be ''insolvent''. There are two forms: cash-flow insolvency and balance-sheet inso ...

banks and financial institutions to fail, and aggressively raise interest rates. The reasoning was that these steps would restore confidence in the nations' fiscal solvency

Solvency, in finance or business, is the degree to which the current assets of an individual or entity exceed the current liabilities of that individual or entity. Solvency can also be described as the ability of a corporation to meet its long-ter ...

, penalize insolvent companies, and protect currency values. Above all, it was stipulated that IMF-funded capital had to be administered rationally in the future, with no favored parties receiving funds by preference. In at least one of the affected countries the restrictions on foreign ownership were greatly reduced.

There were to be adequate government controls set up to supervise all financial activities, ones that were to be independent, in theory, of private interest. Insolvent institutions had to be closed, and insolvency itself had to be clearly defined. In addition, financial systems were to become "transparent", that is, provide the kind of financial information used in the West to make financial decisions.

As countries fell into crisis, many local businesses and governments that had taken out loans in US dollars, which suddenly became much more expensive relative to the local currency which formed their earned income, found themselves unable to pay their creditors. The dynamics of the situation were similar to that of the Latin American debt crisis

The Latin American debt crisis ( es, Crisis de la deuda latinoamericana; pt, Crise da dívida latino-americana) was a financial crisis that originated in the early 1980s (and for some countries starting in the 1970s), often known as ''La Décad ...

. The effects of the SAPs were mixed and their impact controversial. Critics, however, noted the contractionary nature of these policies, arguing that in a recession

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various ...

, the traditional Keynesian response was to increase government spending, prop up major companies, and lower interest rates.

The reasoning was that by stimulating the economy and staving off recession, governments could restore confidence while preventing economic loss

Economic loss is a term of art which refers to financial loss and damage suffered by a person which is seen only on a balance sheet and not as physical injury to person or property. There is a fundamental distinction between pure economic loss and ...

. They pointed out that the U.S. government had pursued expansionary policies, such as lowering interest rates, increasing government spending, and cutting taxes, when the United States itself entered a recession in 2001, and arguably the same in the fiscal and monetary policies during the 2008–2009 Global Financial Crisis.

Many commentators in retrospect criticized the IMF for encouraging the developing economies of Asia down the path of "fast-track capitalism", meaning liberalization of the financial sector (elimination of restrictions on capital flows), maintenance of high domestic interest rates to attract portfolio investment

Portfolio investments are investments in the form of a group (portfolio) of assets, including transactions in equity, securities, such as common stock, and debt securities, such as banknotes, bonds, and debentures.

Portfolio investments are p ...

and bank capital, and pegging of the national currency to the dollar to reassure foreign investors against currency risk.

IMF and high interest rates

The conventional high-interest-rate economic strategy is normally employed by monetary authorities to attain the chain objectives of tightenedmoney supply

In macroeconomics, the money supply (or money stock) refers to the total volume of currency held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include Circulation (curren ...

, discouraged currency speculation

In finance, speculation is the purchase of an asset (a commodity, goods, or real estate) with the hope that it will become more valuable shortly. (It can also refer to short sales in which the speculator hopes for a decline in value.)

Many ...

, stabilized exchange rate, curbed currency depreciation, and ultimately contained inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reductio ...

.

In the Asian meltdown, highest IMF officials rationalized their prescribed high interest rates as follows:

From then IMF First Deputy managing director, Stanley Fischer

Stanley Fischer ( he, סטנלי פישר; born October 15, 1943) is an Israeli American economist who served as the 20th Vice Chair of the Federal Reserve from 2014 to 2017. Fisher previously served as the 8th governor of the Bank of Israel fro ...

in 1998:

When their governments "approached the IMF, the reserves of Thailand and South Korea were perilously low, and the Indonesian Rupiah was excessively depreciated. Thus, the first order of business was... to restore confidence in the currency. To achieve this, countries have to make it more attractive to hold domestic currency, which in turn, requires increasing interest rates temporarily, even if higher interest costs complicate the situation of weak banks and corporations... Why not operate with lower interest rates and a greater devaluation? This is a relevant tradeoff, but there can be no question that the degree of devaluation in the Asian countries is excessive, both from the viewpoint of the individual countries, and from the viewpoint of the international system. Looking first to the individual country, companies with substantial foreign currency debts, as so many companies in these countries have, stood to suffer far more from… currency (depreciation) than from a temporary rise in domestic interest rates…. Thus, on macroeconomics… monetary policy has to be kept tight to restore confidence in the currency....From the then IMF managing director Michel Camdessus:

To reverse (currency depreciation), countries have to make it more attractive to hold domestic currency, and that means temporarily raising interest rates, even if this (hurts) weak banks and corporations.

Countries/Regions affected

Thailand

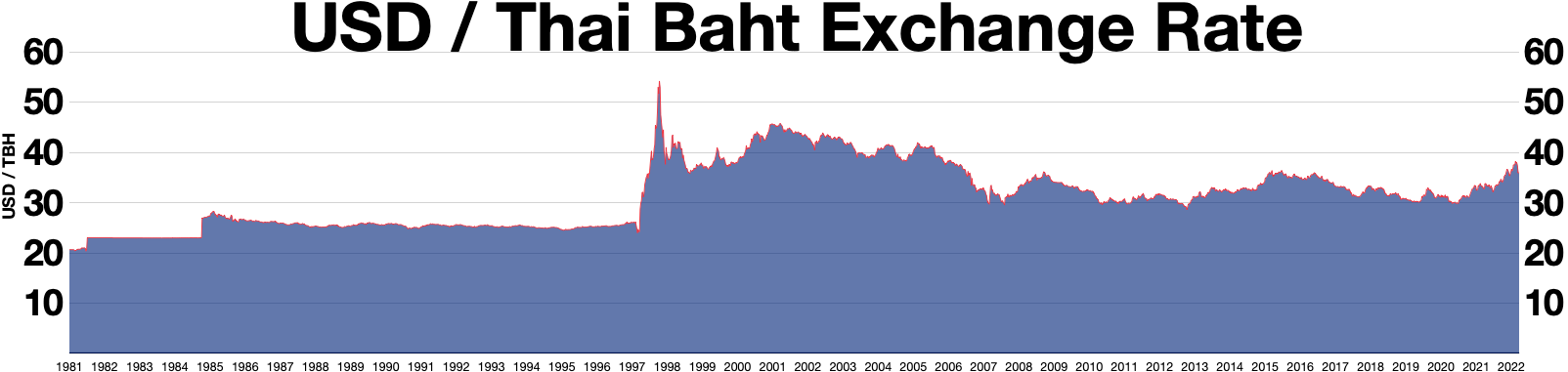

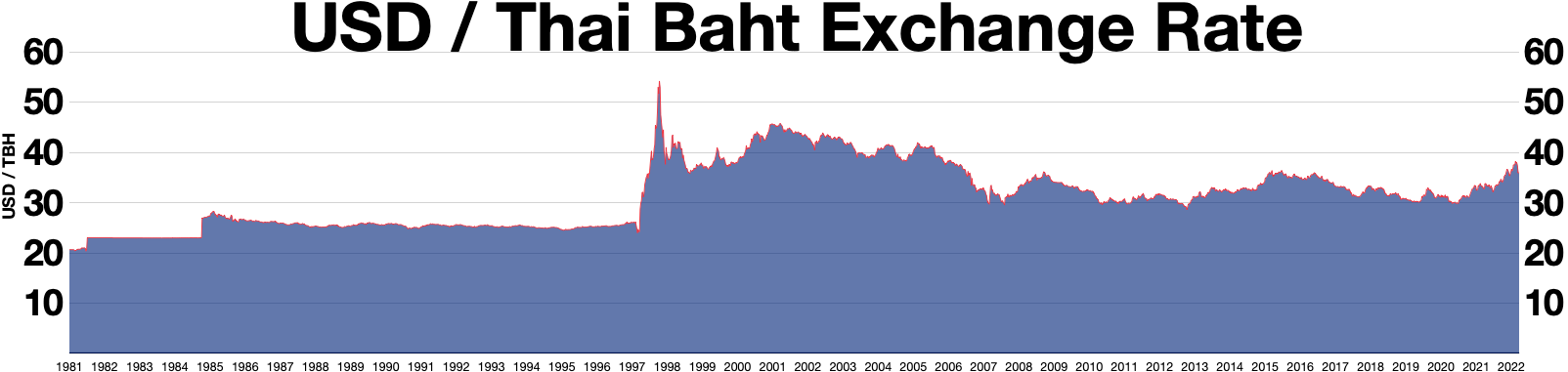

From 1985 to 1996, Thailand's economy grew at an average of over 9% per year, the highest economic growth rate of any country at the time. Inflation was kept reasonably low within a range of 3.4–5.7%. The baht was pegged at 25 to the U.S. dollar. On 14 and 15 May 1997, the Thai baht was hit by massive speculative attacks. On 30 June 1997, Prime Minister Chavalit Yongchaiyudh said that he would not devalue the baht. However, Thailand lacked the foreign reserves to support the USD–Baht currency peg, and the Thai government was eventually forced to float the Baht, on 2 July 1997, allowing the value of the Baht to be set by the currency market. This caused a chain reaction of events, eventually culminating into a region-wide crisis. Thailand's booming economy came to a halt amid massive layoffs in finance, real estate, and construction that resulted in huge numbers of workers returning to their villages in the countryside and 600,000 foreign workers being sent back to their home countries. The baht devalued swiftly and lost more than half of its value. The baht reached its lowest point of 56 units to the U.S. dollar in January 1998. The Thai stock market dropped 75%. Finance One, the largest Thai finance company until then, collapsed. On 11 August 1997, the IMF unveiled a rescue package for Thailand with more than $17 billion, subject to conditions such as passing laws relating to bankruptcy (reorganizing and restructuring) procedures and establishing strong regulation frameworks for banks and other financial institutions. The IMF approved on 20 August 1997, another bailout package of $2.9 billion. Poverty and inequality increased while employment, wages and social welfare all declined as a result of the crisis. Following the 1997 Asian financial crisis, income in the northeast, the poorest part of the country, rose by 46 percent from 1998 to 2006. Nationwide poverty fell from 21.3 to 11.3 percent. Thailand's Gini coefficient, a measure of income inequality, fell from .525 in 2000 to .499 in 2004 (it had risen from 1996 to 2000) versus 1997 Asian financial crisis. By 2001, Thailand's economy had recovered. The increasing tax revenues allowed the country to balance its budget and repay its debts to the IMF in 2003, four years ahead of schedule. The Thai baht continued to appreciate to 29 Baht to the U.S. dollar in October 2010.Indonesia

In June 1997, Indonesia seemed far from crisis. Unlike Thailand, Indonesia had low inflation, a

In June 1997, Indonesia seemed far from crisis. Unlike Thailand, Indonesia had low inflation, a trade surplus

The balance of trade, commercial balance, or net exports (sometimes symbolized as NX), is the difference between the monetary value of a nation's exports and imports over a certain time period. Sometimes a distinction is made between a balance ...

of more than $900 million, huge foreign exchange reserves of more than $20 billion, and a good banking sector. However, a large number of Indonesian corporations had been borrowing in U.S. dollars. This practice had worked well for these corporations during the preceding years, as the rupiah had strengthened respective to the dollar; their effective levels of debt and financing costs had decreased as the local currency's value rose.

In July 1997, when Thailand floated the baht, Indonesia's monetary authorities widened the rupiah currency trading band

A currency band is a range of values for the exchange rate for a country’s currency which the country’s central bank acts to keep the exchange rate within.

The central bank selects a range, or "band", of values at which to set their currenc ...

from 8% to 12%. As a result, the rupiah suddenly came under severe attack in August. Therefore, on the 14th of the month, the managed floating exchange regime was replaced by a free-floating exchange rate arrangement. The rupiah dropped further due to the shift. The IMF came forward with a rescue package of $23 billion, but the rupiah was sinking further amid fears over corporate debts, massive selling of rupiah, and strong demand for dollars. The rupiah and the Jakarta Stock Exchange touched a historic low in September. Moody's eventually downgraded Indonesia's long-term debt to " junk bond".

Although the rupiah crisis began in July and August 1997, it intensified in November when the effects of that summer devaluation showed up on corporate balance sheets. Companies that had borrowed in dollars had to face the higher costs imposed upon them by the rupiah's decline, and many reacted by buying dollars through selling rupiah, undermining the value of the latter further. Before the crisis, the exchange rate between the rupiah and the dollar was roughly 2,600 rupiah to 1 U.S. dollar. The rate plunged to over 11,000 rupiah to 1 U.S. dollar on 9 January 1998, with spot rates over 14,000 during 23–26 January and trading again over 14,000 for about six weeks during June–July 1998. On 31 December 1998, the rate was almost exactly 8,000 to 1 U.S. dollar. Indonesia lost 13.5% of its GDP that year.

In February 1998, President Suharto

Suharto (; ; 8 June 1921 – 27 January 2008) was an Indonesian army officer and politician, who served as the second and the longest serving president of Indonesia. Widely regarded as a military dictator by international observers, Suharto ...

sacked the incumbent Bank Indonesia governor, J. Soedradjad Djiwandono

J. Soedradjad Djiwandono (EYD: Sudrajad Jiwandono, also written Sudrajad Djiwandono, Soedradjat Djiwandono and Sudrajat Djiwandono; born 7 August 1938) is an Indonesian economist who was Governor of Bank Indonesia, the nation's central bank, from ...

, but this proved insufficient. Amidst widespread rioting in May 1998, Suharto resigned under public pressure and Vice President B. J. Habibie

Bacharuddin Jusuf Habibie (; 25 June 1936 – 11 September 2019) was an Indonesian engineer and politician who was the third president of Indonesia from 1998 to 1999. Less than three months after his inauguration as the seventh vice preside ...

replaced him.

As a result of the financial crisis that hit the country, many factors arising from all aspects, including sports broadcasting on Indonesian television, including:

* ANTV lost their television rights to broadcast the 1998 Formula One World Championship

The 1998 FIA Formula One World Championship was the 52nd season of FIA Formula One motor racing. It featured the 1998 Formula One World Championship for Drivers and the 1998 Formula One World Championship for Constructors, which were conteste ...

despite their Formula One broadcasting rights contract in Indonesia lasting until 1999; as a result, the 1998 season was not aired on Indonesian television. RCTI

RCTI (''Rajawali Citra Televisi Indonesia'') is a West Jakarta-based Indonesian free-to-air television network. It is best known for its soap operas, celebrity bulletins, news, and sports programmes. It was first launched in 1989, origina ...

finally re-secured the broadcast rights for the season.

*ANTV also stopped the coverage of 1997-98 Serie A, 1997-98 Bundesliga, and the 1997-98 La Liga, before the end of their respective seasons. However, it did not affect the 1997-98 FA Premier League, as they had already broadcast it up to the end of the season.

*All television stations have limited broadcast schedules, with an average ending broadcast hour at 11:30 PM or 12:00 AM.

Additionally, the Indonesian motorcycle Grand Prix

The Indonesian motorcycle Grand Prix is a motorcycling event that is part of the Grand Prix motorcycle racing World Championship. There have been three Grand Prix events held; in 1996 and 1997, both at the Sentul International Circuit, Bogor, ...

, which was held at Sentul, was dropped from the 1998 Superbike and MotoGP

Grand Prix motorcycle racing is the premier class of motorcycle road racing events held on road circuits sanctioned by the Fédération Internationale de Motocyclisme (FIM). Independent motorcycle racing events have been held since the start ...

calendars. World Rally Championship also dropped the Rally Indonesia from their 1998 calendar.

South Korea

The banking sector was burdened with non-performing loans as its large corporations were funding aggressive expansions. During that time, there was a haste to build great conglomerates to compete on the world stage. Many businesses ultimately failed to ensure returns and profitability. Thechaebol

A chaebol (, ; ) is a large industrial South Korean conglomerate run and controlled by an individual or family. A chaebol often consists of multiple diversified affiliates, controlled by a person or group whose power over the group often exc ...

, South Korean conglomerates, simply absorbed more and more capital investment. Eventually, excess debt led to major failures and takeovers.

Amongst other stimuli, the crisis resulted in the bankruptcy of major Korean companies, provoking not only corporations, but also government officials towards corruption. The

Amongst other stimuli, the crisis resulted in the bankruptcy of major Korean companies, provoking not only corporations, but also government officials towards corruption. The Hanbo scandal The Hanbo scandal (also known as Hanbogate) refers to the late-1990s corruption involving senior South Korean government officials and top executives of the Hanbo Steel (한보그룹) conglomerate, then South Korea’s second biggest steelmaker and ...

of early 1997 exposed South Koreas economic weaknesses and corruption problems to the international financial community. Later that year, in July, South Korea's third-largest car maker, Kia Motors, asked for emergency loans. The domino effect of collapsing large South Korean companies drove the interest rates up and international investors away.

In the wake of the Asian market downturn, Moody's lowered the credit rating of South Korea from A1 to A3, on 28 November 1997, and downgraded again to B2 on 11 December. That contributed to a further decline in South Korean shares since stock markets were already bearish in November. The Seoul stock exchange fell by 4% on 7 November 1997. On 8 November, it plunged by 7%, its biggest one-day drop to that date. And on 24 November, stocks fell a further 7.2% on fears that the IMF would demand tough reforms. In 1998, Hyundai Motor Company

Hyundai Motor Company, often abbreviated to Hyundai Motors ( )

and commonly known as Hyundai (, ; ), is a South Korean multinational automotive manufacturer headquartered in Seoul, South Korea, and founded in 1967. Currently, the company o ...

took over Kia Motors. Samsung Motors' $5 billion venture was dissolved due to the crisis, and eventually Daewoo Motors was sold to the American company General Motors

The General Motors Company (GM) is an American Multinational corporation, multinational Automotive industry, automotive manufacturing company headquartered in Detroit, Michigan, United States. It is the largest automaker in the United States and ...

(GM).

The International Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster globa ...

(IMF) provided US$58.4 billion as a bailout package. In return, Korea was required to take restructuring measures. The ceiling on foreign investment in Korean companies was raised from 26 percent to 100 percent. In addition, the Korean government started financial sector reform program. Under the program, 787 insolvent financial institutions were closed or merged by June 2003. The number of financial institutions in which foreign investors invested has increased rapidly. Examples include New Bridge Capital's takeover of Korea First Bank.

The South Korean won

The Korean Republic won, unofficially the South Korean won ( Symbol: ₩; Code: KRW; Korean: 대한민국 원) is the official currency of South Korea. A single won is divided into 100 jeon, the monetary subunit. The jeon is no longer used f ...

, meanwhile, weakened to more than 1,700 per U.S. dollar from around 800, but later managed to recover. However, like the chaebol, South Korea's government did not escape unscathed. Its national debt

A country's gross government debt (also called public debt, or sovereign debt) is the financial liabilities of the government sector. Changes in government debt over time reflect primarily borrowing due to past government deficits. A deficit oc ...

-to-GDP ratio more than doubled (approximately 13% to 30%) as a result of the crisis.

Philippines

In May 1997, the Bangko Sentral ng Pilipinas, the country's central bank, raised interest rates by 1.75 percentage points and again by 2 points on 19 June. Thailand triggered the crisis on 2 July and on 3 July, the Bangko Sentral intervened to defend thepeso

The peso is the monetary unit of several countries in the Americas, and the Philippines. Originating in the Spanish Empire, the word translates to "weight". In most countries the peso uses the Dollar sign, same sign, "$", as many currencies na ...

, raising the overnight rate from 15% to 32% at the onset of the Asian crisis in mid-July 1997. The peso dropped from 26 pesos per dollar at the start of the crisis to 46.50 pesos in early 1998 to 53 pesos as in July 2001.

The Philippine GDP contracted by 0.6% during the worst part of the crisis, but grew by 3% by 2001, despite scandals of the administration of Joseph Estrada

Joseph Ejercito Estrada, (; born Jose Marcelo Ejercito; April 19, 1937), also known by the nickname Erap, is a Filipino politician and former actor. He served as the 13th president of the Philippines from 1998 to 2001, the 9th vice preside ...

in 2001, most notably the "jueteng" scandal, causing the PSE Composite Index

The PSE Composite Index, commonly known previously as the PHISIX and currently as the PSEi, is a stock market index of the Philippine Stock Exchange consisting of 30 companies.

As the PSE's only broad-base index, it is frequently seen as an ind ...

, the main index of the Philippine Stock Exchange, to fall to 1,000 points from a high of 3,448 points in 1997. The peso's value declined to around 55.75 pesos to the U.S. dollar. Later that year, Estrada was on the verge of impeachment but his allies in the senate voted against continuing the proceedings.

This led to popular protests culminating in the "EDSA II Revolution

The Second EDSA Revolution, also known as the Second People Power Revolution, EDSA 2001, or EDSA II (pronounced ''EDSA Two'' or ''EDSA Dos''), was a political protest from January 17–20, 2001, which peacefully overthrew the government of Jose ...

", which effected his resignation and elevated Gloria Macapagal Arroyo

Maria Gloria Macaraeg Macapagal Arroyo (, born April 5, 1947), often referred to by her initials GMA, is a Filipino academic and politician serving as one of the Deputy Speaker of the House of Representatives of the Philippines, House Deputy Spe ...

to the presidency. Arroyo lessened the crisis in the country. The Philippine peso rose to about 50 pesos by the year's end and traded at around 41 pesos to a dollar in late 2007. The stock market also reached an all-time high in 2007 and the economy was growing by more than 7 percent, its highest in nearly two decades.

China

China's nonconvertible capital account and its foreign exchange control were decisive in limiting the impact of the crisis.

The Chinese currency, the

China's nonconvertible capital account and its foreign exchange control were decisive in limiting the impact of the crisis.

The Chinese currency, the renminbi

The renminbi (; symbol: ¥; ISO code: CNY; abbreviation: RMB) is the official currency of the People's Republic of China and one of the world's most traded currencies, ranking as the fifth most traded currency in the world as of April 2022. ...

(RMB), had been pegged in 1994 to the U.S. dollar

The United States dollar ( symbol: $; code: USD; also abbreviated US$ or U.S. Dollar, to distinguish it from other dollar-denominated currencies; referred to as the dollar, U.S. dollar, American dollar, or colloquially buck) is the officia ...

at a ratio of 8.3 RMB to the dollar. Having largely kept itself above the fray throughout 1997–1998, there was heavy speculation in the Western press that China would soon be forced to devalue its currency to protect the competitiveness of its exports vis-a-vis those of the ASEAN

ASEAN ( , ), officially the Association of Southeast Asian Nations, is a political and economic union of 10 member states in Southeast Asia, which promotes intergovernmental cooperation and facilitates economic, political, security, militar ...

nations, whose exports became cheaper relative to China's. However, the RMB's non- convertibility protected its value from currency speculators, and the decision was made to maintain the peg of the currency, thereby improving the country's standing within Asia. The currency peg was partly scrapped in July 2005, rising 2.3% against the dollar, reflecting pressure from the United States.

Unlike investments of many of the Southeast Asian nations, almost all of China's foreign investment took the form of factories on the ground rather than securities, which insulated the country from rapid capital flight. While China was unaffected by the crisis compared to Southeast Asia and South Korea, GDP growth slowed sharply in 1998 and 1999, calling attention to structural problems within its economy. In particular, the Asian financial crisis convinced the Chinese government of the need to resolve the issues of its enormous financial weaknesses, such as having too many non-performing loans within its banking system, and relying heavily on trade with the United States.

Hong Kong

In October 1997, theHong Kong dollar

The Hong Kong dollar (, currency symbol, sign: HK$; ISO 4217, code: HKD) is the official currency of the Hong Kong, Hong Kong Special Administrative Region. It is subdivided into 100 cent (currency), cents or 1000 Mill (currency), mils. The H ...

, which had been pegged at 7.8 to the U.S. dollar since 1983, came under speculative pressure because Hong Kong's inflation rate had been significantly higher than the United States' for years. Monetary authorities spent more than $1 billion to defend the local currency. Since Hong Kong had more than $80 billion in foreign reserves

Foreign exchange reserves (also called forex reserves or FX reserves) are cash and other reserve assets such as gold held by a central bank or other monetary authority that are primarily available to balance payments of the country, influence ...

, which is equivalent to 700% of its M1 money supply and 45% of its M3 money supply, the Hong Kong Monetary Authority

The Hong Kong Monetary Authority (HKMA) is Hong Kong's central bank, central banking institution. It is a government authority founded on 1 April 1993 when the Office of the Exchange Fund and the Office of the Commissioner of Banking merged. Th ...

(effectively the region's central bank) managed to maintain the peg.

Stock markets became more and more volatile; between 20 and 23 October the Hang Seng Index

The Hang Seng Index (HSI) is a freefloat-adjusted market- capitalization-weighted stock-market index in Hong Kong. It is used to record and monitor daily changes of the largest companies of the Hong Kong stock market and is the main indicator ...

dropped 23%. The Hong Kong Monetary Authority then promised to protect the currency. On 23 October 1997, it raised overnight interest rates from 8% to 23%, and at one point to '280%'.The HKMA had recognized that speculators were taking advantage of the city's unique currency-board

In public finance, a currency board is a monetary authority which is required to maintain a fixed exchange rate with a foreign currency. This policy objective requires the conventional objectives of a central bank to be subordinated to the exchan ...

system, in which overnight rates( HIBOR) automatically increase in proportion to large net sales of the local currency. The rate hike, however, increased downward pressure on the stock market, allowing speculators to profit by short selling shares. The HKMA started buying component shares of the Hang Seng Index in mid-August 1998.

The HKMA and Donald Tsang

Sir Donald Tsang Yam-kuen (; born 7 October 1944) is a former Hong Kong civil servant who served as the second Chief Executive of Hong Kong from 2005 to 2012.

Tsang joined the colonial civil service as an Executive Officer in 1967, occupyi ...

, the then Financial Secretary, declared war on speculators. The Government ended up buying approximately HK$120 billion (US$15 billion) worth of shares in various companies, and became the largest shareholder of some of those companies (e.g., the government owned 10% of HSBC

HSBC Holdings plc is a British multinational universal bank and financial services holding company. It is the largest bank in Europe by total assets ahead of BNP Paribas, with US$2.953 trillion as of December 2021. In 2021, HSBC had $10.8 tri ...

) at the end of August, when hostilities ended with the closing of the August Hang Seng Index futures contract. In 1999, the Government started selling those shares by launching the Tracker Fund of Hong Kong

Tracker Fund of Hong Kong or TraHK is a unit trust which provides investment results that correspond to the performance of the Hang Seng Index in the Hong Kong stock market.

History

In 1998, the Hong Kong SAR Government acquired a substant ...

, making a profit of about HK$30 billion (US$4 billion).

Malaysia

In July 1997, within days of the Thai baht devaluation, the Malaysianringgit

The Malaysian ringgit (; plural: ringgit; symbol: RM; currency code: MYR; Malay name: ''Ringgit Malaysia''; formerly the Malaysian dollar) is the currency of Malaysia. It is divided into 100 ''sen'' (formerly ''cents''). The ringgit is issued ...

was heavily traded by speculators. The overnight rate jumped from under 8% to over 40%. This led to rating downgrades and a general sell off on the stock and currency markets. By end of 1997, ratings had fallen many notches from investment grade to junk, the KLSE had lost more than 50% from above 1,200 to under 600, and the ringgit had lost 50% of its value, falling from above 2.50 to under 4.57 on (23 January 1998) to the dollar. The then prime minister, Mahathir Mohamad

Mahathir bin Mohamad ( ms, محاضير بن محمد, label= Jawi, script=arab, italic=unset; ; born 10 July 1925) is a Malaysian politician, author, and physician who served as the 4th and 7th Prime Minister of Malaysia. He held the office ...

imposed strict capital controls and introduced a 3.80 peg against the U.S. dollar.

Malaysian moves involved fixing the local currency to the U.S. dollar, stopping the overseas trade in ringgit currency and other ringgit assets therefore making offshore use of the ringgit invalid, restricting the amount of currency and investments that residents can take abroad, and imposed for foreign portfolio funds, a minimum one-year "stay period" which since has been converted to an exit tax. The decision to make ringgit held abroad invalid has also dried up sources of ringgit held abroad that speculators borrow from to manipulate the ringgit, for example by "selling short

In finance, being short in an asset means investing in such a way that the investor will profit if the value of the asset falls. This is the opposite of a more conventional "long" position, where the investor will profit if the value of the ...

". Those who did, had to repurchase the limited ringgit at higher prices, making it unattractive to them. It also fully suspended the trading of CLOB (Central Limit Order Book) counters, indefinitely freezing approximately $4.47 billion worth of shares and affecting 172,000 investors, most of them Singaporeans, which became a political issue between the two countries.

In 1998, the output of the real economy declined plunging the country into its first recession for many years. The construction sector contracted 23.5%, manufacturing shrunk 9% and the agriculture sector 5.9%. Overall, the country's gross domestic product plunged 6.2% in 1998. During that year, the ringgit plunged below 4.7 and the KLSE fell below 270 points. In September that year, various defensive measures were announced to overcome the crisis.

The principal measure taken were to move the ringgit from a free float to a fixed exchange rate regime. Bank Negara

The Central Bank of Malaysia (BNM; ms, Bank Negara Malaysia) is the Malaysian central bank. Established on 26 January 1959 as the Central Bank of Malaya (''Bank Negara Tanah Melayu''), its main purpose is to issue currency, act as banker and ad ...

fixed the ringgit at 3.8 to the dollar. Capital controls were imposed while aid offered from the IMF was refused. Various task force agencies were formed. The Corporate Debt Restructuring Committee dealt with corporate loans. Danaharta

Khazanah Nasional Berhad is the sovereign wealth fund of the Government of Malaysia, entrusted with growing the nation's long-term wealth via distinct commercial and strategic objectives. Khazanah's commercial objective is to grow financial as ...

discounted and bought bad loans from banks to facilitate orderly asset realization. Danamodal

Market capitalization, sometimes referred to as market cap, is the total value of a publicly traded company's outstanding common shares owned by stockholders.

Market capitalization is equal to the market price per common share multiplied by t ...

recapitalized banks.

Growth then settled at a slower but more sustainable pace. The massive current account deficit became a fairly substantial surplus. Banks were better capitalized and NPLs were realised in an orderly way. Small banks were bought out by strong ones. A large number of PLCs were unable to regulate their financial affairs and were delisted. Compared to the 1997 current account, by 2005, Malaysia was estimated to have a $14.06 billion surplus. Asset values however, have not returned to their pre-crisis highs. Foreign investor confidence was still low, partially due to the lack of transparency shown in how the CLOB counters had been dealt with.

In 2005 the last of the crisis measures were removed as taken off the fixed exchange system. But unlike the pre-crisis days, it did not appear to be a free float, but a managed float, like the Singapore dollar

The Singapore dollar (sign: S$; code: SGD) is the official currency of the Republic of Singapore. It is divided into 100 cents. It is normally abbreviated with the dollar sign $, or S$ to distinguish it from other dollar-denominated currenci ...

.

Mongolia

Mongolia was adversely affected by the ''Asian financial crisis'' of 1997–98 and suffered a further loss of income as a result of the Russian crisis in 1999.Economic growth

Economic growth can be defined as the increase or improvement in the inflation-adjusted market value of the goods and services produced by an economy in a financial year. Statisticians conventionally measure such growth as the percent rate of ...

picked up in 1997–99 after stalling in 1996 due to a series of natural disaster

A natural disaster is "the negative impact following an actual occurrence of natural hazard in the event that it significantly harms a community". A natural disaster can cause loss of life or damage property, and typically leaves some econ ...

s and increases in world prices of copper

Copper is a chemical element with the symbol Cu (from la, cuprum) and atomic number 29. It is a soft, malleable, and ductile metal with very high thermal and electrical conductivity. A freshly exposed surface of pure copper has a pinkis ...

and cashmere. Public revenues and exports collapsed in 1998 and 1999 due to the repercussions of the Asian financial crisis. In August and September 1999, the economy suffered from a temporary Russian ban on exports of oil and oil products. Mongolia joined the World Trade Organization

The World Trade Organization (WTO) is an intergovernmental organization that regulates and facilitates international trade. With effective cooperation

in the United Nations System, governments use the organization to establish, revise, and e ...

(WTO) in 1997. The international donor community pledged over $300 million per year at the last Consultative Group Meeting, held in Ulaanbaatar

Ulaanbaatar (; mn, Улаанбаатар, , "Red Hero"), previously anglicized as Ulan Bator, is the capital and most populous city of Mongolia. It is the coldest capital city in the world, on average. The municipality is located in north ce ...

in June 1999.

Singapore

As the financial crisis spread, the economy ofSingapore

Singapore (), officially the Republic of Singapore, is a sovereign island country and city-state in maritime Southeast Asia. It lies about one degree of latitude () north of the equator, off the southern tip of the Malay Peninsula, borde ...

dipped into a short recession

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various ...

. The short duration and milder effect on its economy was credited to the active management by the government. For example, the Monetary Authority of Singapore allowed for a gradual 20% depreciation of the Singapore dollar

The Singapore dollar (sign: S$; code: SGD) is the official currency of the Republic of Singapore. It is divided into 100 cents. It is normally abbreviated with the dollar sign $, or S$ to distinguish it from other dollar-denominated currenci ...

to cushion and guide the economy to a soft landing. The timing of government programs such as the Interim Upgrading Program and other construction related projects were brought forward.Ngian Kee Jin: p. 12

Instead of allowing the labor markets to work, the National Wage Council pre-emptively agreed to Central Provident Fund cuts to lower labor costs, with limited impact on disposable income and local demand. Unlike in Hong Kong, no attempt was made to directly intervene in the capital market

A capital market is a financial market in which long-term debt (over a year) or equity-backed securities are bought and sold, in contrast to a money market where short-term debt is bought and sold. Capital markets channel the wealth of savers t ...

s and the ''Straits Times'' Index was allowed to drop 60%. In less than a year, the Singaporean economy fully recovered and continued on its growth trajectory.

Japan

The crisis had also put pressure on Japan, whose economy is particularly prominent in the region. Asian countries usually ran atrade deficit

The balance of trade, commercial balance, or net exports (sometimes symbolized as NX), is the difference between the monetary value of a nation's exports and imports over a certain time period. Sometimes a distinction is made between a balance ...

with Japan because its economy was more than twice the size of the rest of Asia together; about 40% of Japan's exports go to Asia. The Japanese yen

The is the official currency of Japan. It is the third-most traded currency in the foreign exchange market, after the United States dollar (US$) and the euro. It is also widely used as a third reserve currency after the US dollar and the ...

fell to 147 as mass selling began, but Japan was the world's largest holder of currency reserves at the time, so it was easily defended, and quickly bounced back. A run on the banks was narrowly averted on 26 November 1997 when TV networks decided not to report on long queues that had formed outside banks, before the central bank had ordered that they be let in. The real GDP growth rate slowed dramatically in 1997, from 5% to 1.6%, and even sank into recession in 1998 due to intense competition from cheapened rivals; also in 1998 the government had to bail out several banks. The Asian financial crisis also led to more bankruptcies in Japan. In addition, with South Korea's devalued currency and China's steady gains, many companies complained outright that they could not compete.

Another longer-term result was the changing relationship between the United States and Japan, with the United States no longer openly supporting the highly artificial trade environment and exchange rates that governed economic relations between the two countries for almost five decades after World War II.

United States

The U.S. Treasury was deeply involved with the IMF in finding solutions. The American markets were severely hit. On 27 October 1997, the Dow Jones industrial plunged 554 points or 7.2%, amid ongoing worries about the Asian economies. During the crisis, it fell 12%. The crisis led to a drop inconsumer

A consumer is a person or a group who intends to order, or uses purchased goods, products, or services primarily for personal, social, family, household and similar needs, who is not directly related to entrepreneurial or business activities. T ...

and spending confidence (see 27 October 1997 mini-crash). Nevertheless the economy grew at a very robust 4.5% for the entire year, and did very well in 1998 as well.

Consequences

Asia

The crisis had significantmacroeconomic

Macroeconomics (from the Greek prefix ''makro-'' meaning "large" + ''economics'') is a branch of economics dealing with performance, structure, behavior, and decision-making of an economy as a whole.

For example, using interest rates, taxes, and ...

-level effects, including sharp reductions in values of currencies, stock market

A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks (also called shares), which represent ownership claims on businesses; these may include ''securities'' listed on a public stock exchange, as ...

s, and other asset prices of several Asian countries