|

Currency Speculation

In finance, speculation is the purchase of an asset (a commodity, goods, or real estate) with the hope that it will become more valuable in a brief amount of time. It can also refer to short sales in which the speculator hopes for a decline in value. Many speculators pay little attention to the fundamental value of a security and instead focus purely on price movements. In principle, speculation can involve any tradable good or financial instrument. Speculators are particularly common in the markets for stocks, bonds, commodity futures, currencies, cryptocurrency, fine art, collectibles, real estate, and financial derivatives. Speculators play one of four primary roles in financial markets, along with hedgers, who engage in transactions to offset some other pre-existing risk, arbitrageurs who seek to profit from situations where fungible instruments trade at different prices in different market segments, and investors who seek profit through long-term ownership of an in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Everybody Works But The Vacant Lot (cropped)

Everybody may refer to: Music Albums * ''Everybody'' (Chris Janson album) or the title song, 2017 * ''Everybody'' (Gods Child album), 1994 * ''Everybody'' (Hear'Say album), 2001 * ''Everybody'' (Ingrid Michaelson album) or the title song, 2009 * ''Everybody'' (Logic album) or the title song (see below), 2017 * ''Everybody'' (The Sea and Cake album), 2007 * ''Everybody'' (EP), by Shinee, or the title song (see below), 2013 Songs * "Everybody" (Britney Spears song), 2007 * "Everybody" (DJ BoBo song), 1994 * "Everybody" (Justice Crew song), 2013 * "Everybody" (Logic song), 2017 * "Everybody" (Keith Urban song), 2007 * "Everybody" (Kinky song), 1996 * "Everybody" (Hear'Say song), 2001 * "Everybody" (Madonna song), 1982 * "Everybody" (Martin Solveig song), 2005 * "Everybody" (Nicki Minaj song), 2023 * "Everybody" (Rudenko song), 2009 * "Everybody" (Shinee song), 2013 * "Everybody" (Stabilo song), 2001 * "Everybody" (Tanel Padar and Dave Benton song), representing Estonia at Eurovision ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Arbitrage

Arbitrage (, ) is the practice of taking advantage of a difference in prices in two or more marketsstriking a combination of matching deals to capitalize on the difference, the profit being the difference between the market prices at which the unit is traded. Arbitrage has the effect of causing prices of the same or very similar assets in different markets to converge. When used by academics in economics, an arbitrage is a transaction that involves no negative cash flow at any probabilistic or temporal state and a positive cash flow in at least one state; in simple terms, it is the possibility of a risk-free profit after transaction costs. For example, an arbitrage opportunity is present when there is the possibility to instantaneously buy something for a low price and sell it for a higher price. In principle and in academic use, an arbitrage is risk-free; in common use, as in statistical arbitrage, it may refer to ''expected'' profit, though losses may occur, and in practic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

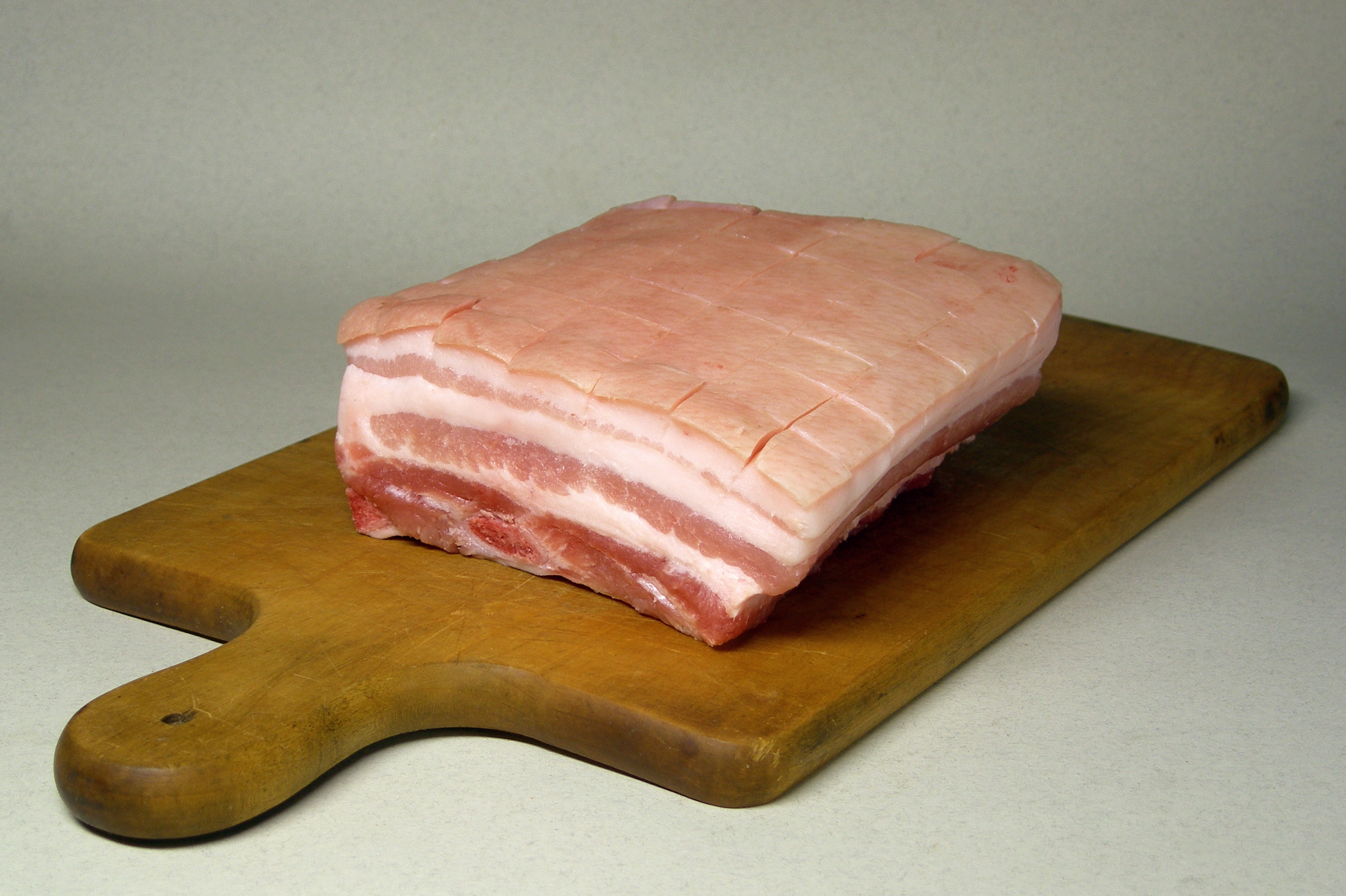

Pork Belly

Pork belly or belly pork is a boneless, fatty Primal cut, cut of pork from the Abdomen, belly of a pig. Pork belly is particularly popular in American cuisine, American, British cuisine, British, Swedish cuisine, Swedish, Danish cuisine, Danish, Norwegian cuisine, Norwegian, Polish cuisine, Polish, Hispanic cuisine, Hispanic, Filipino cuisine, Filipino, Chinese cuisine, Chinese, Korean cuisine, Korean, Vietnamese cuisine, Vietnamese, and Thai cuisine, Thai cuisine. Regional dishes France In Alsatian cuisine, pork belly is prepared as ''choucroute garnie''. China In Chinese cuisine, pork belly () is most often prepared by dicing and slowly braising with skin on, marination, or being cooked in its entirety. Pork belly is used to make Red braised pork belly, red braised pork belly () and Dongpo pork () in China (sweet and sour pork is made with pork fillet). In Guangdong, a variant called Siu yuk, crispy pork belly () is also popular. The pork is cooked and grilled for a cr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk

In simple terms, risk is the possibility of something bad happening. Risk involves uncertainty about the effects/implications of an activity with respect to something that humans value (such as health, well-being, wealth, property or the environment), often focusing on negative, undesirable consequences. Many different definitions have been proposed. One ISO standard, international standard definition of risk is the "effect of uncertainty on objectives". The understanding of risk, the methods of assessment and management, the descriptions of risk and even the definitions of risk differ in different practice areas (business, economics, Environmental science, environment, finance, information technology, health, insurance, safety, security, security, privacy, etc). This article provides links to more detailed articles on these areas. The international standard for risk management, ISO 31000, provides principles and general guidelines on managing risks faced by organizations. Defi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Liquidity

In business, economics or investment, market liquidity is a market's feature whereby an individual or firm can quickly purchase or sell an asset without causing a drastic change in the asset's price. Liquidity involves the trade-off between the price at which an asset can be sold, and how quickly it can be sold. In a liquid market, the trade-off is mild: one can sell quickly without having to accept a significantly lower price. In a relatively illiquid market, an asset must be discounted in order to sell quickly. A liquid asset is an asset which can be converted into cash within a relatively short period of time, or cash itself, which can be considered the most liquid asset because it can be exchanged for goods and services instantly at face value. Overview A liquid asset has some or all of the following features: it can be sold rapidly, with minimal loss of value, anytime within market hours. The essential characteristic of a liquid market is that there are always ready and wil ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital (economics)

In economics, capital goods or capital are "those durable produced goods that are in turn used as productive inputs for further production" of goods and services. A typical example is the machinery used in a factory. At the macroeconomic level, "the nation's capital stock includes buildings, equipment, software, and inventories during a given year." The means of production is as a "... series of heterogeneous commodities, each having specific technical characteristics ..." "capital goods", are one of the three types of intermediate goods used in the production process, the other two being land and labour. The three are also known collectively as "primary factors of production". This classification originated during the classical economics period and has remained the dominant method for classification. Capital can be increased by the use of a production process (see production function and factors of production). Outputs of the production process are normally classif ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Victor Niederhoffer

Victor Niederhoffer (born December 10, 1943) is an American hedge fund manager, champion Squash (sport), squash player, bestselling author and statistics, statistician. Life and career Niederhoffer was born in Brooklyn to a Jewish family. His paternal grandfather Martin (Martie), an accountant and Language interpretation#Judicial, court interpreter, married Birdie (née Kuminsky) in 1916.John Cassidy"The Blow-Up Artist,"''The New Yorker'', October 15, 2007Jack Raymond Greene (2006)''Encyclopedia of Police Science'',Routledge, pp. 846-52. His maternal grandparents were Sam and Gertrude Eisenberg. His father, Dr. Arthur Niederhoffer, Arthur "Artie" Niederhoffer (1917–1981), graduated from Brooklyn College in 1937, and then from Brooklyn Law School, and finally with a Ph.D. from New York University (1963). He served in the New York City Police Department for 21 years (retiring as a lieutenant), and then taught as a professor of sociology at John Jay College of Criminal Justice fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nicholas Kaldor

Nicholas Kaldor, Baron Kaldor (12 May 1908 – 30 September 1986), born Káldor Miklós, was a Hungarian-born British economist. He developed the "compensation" criteria called Kaldor–Hicks efficiency for welfare spending, welfare comparisons (1939), derived the cobweb model, and argued for certain regularities observable in economic growth, which are called Kaldor's growth laws. Kaldor worked alongside Gunnar Myrdal to develop the key concept Circular Cumulative Causation, a multicausal approach where the core variables and their linkages are delineated. Biography Káldor Miklós was born in Budapest, son of Gyula Káldor, lawyer and legal adviser to the German legation in Budapest, and Jamba, an accomplished linguist and "a well-educated, cultured woman". He was educated in Budapest, as well as in Berlin, and at the London School of Economics, where he graduated with a first-class BSc (Econ.) degree in 1930. He subsequently became an assistant lecturer and, by 1938, lecturer ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Intelligent Investor

''The Intelligent Investor'' by Benjamin Graham, first published in 1949, is a widely acclaimed book on value investing. The book provides strategies on how to successfully use value investing in the stock market. Historically, the book has been one of the most popular books on investing and Graham's legacy remains. Background and history ''The Intelligent Investor'' is based on value investing, an investment approach Graham began teaching at Columbia Business School in 1928 and subsequently refined with David Dodd. This sentiment was echoed by other Graham disciples such as Irving Kahn and Walter Schloss. Warren Buffett read the book at age 20 and began using the value investing taught by Graham to build his own investment portfolio. ''The Intelligent Investor'' also marks a significant deviation in stock selection from Graham's earlier works, such as '' Security Analysis''. Which is, instead of extensive analysis on an individual company, just apply simple earning criter ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Benjamin Graham

Benjamin Graham (; Given name, né Grossbaum; May 9, 1894 – September 21, 1976) was a British-born American financial analyst, economist, accountant, investor and professor. He is widely known as the "father of value investing", and wrote two of the discipline's founding texts: Security Analysis (book), ''Security Analysis'' (1934) with David Dodd, and ''The Intelligent Investor'' (1949). His investment philosophy stressed independent thinking, emotional detachment, and careful security analysis, emphasizing the importance of distinguishing the price of a stock from the value of its underlying business. After graduating from Columbia University at age 20, Graham started his career on Wall Street, eventually founding Graham–Newman Corp., a successful mutual fund. He also taught investing for many years at Columbia Business School, where one of his students was Warren Buffett. Graham later taught at the UCLA Anderson School of Management, Anderson School of Management at the Un ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment

Investment is traditionally defined as the "commitment of resources into something expected to gain value over time". If an investment involves money, then it can be defined as a "commitment of money to receive more money later". From a broader viewpoint, an investment can be defined as "to tailor the pattern of expenditure and receipt of resources to optimise the desirable patterns of these flows". When expenditures and receipts are defined in terms of money, then the net monetary receipt in a time period is termed cash flow, while money received in a series of several time periods is termed cash flow stream. In finance, the purpose of investing is to generate a Return (finance), return on the invested asset. The return may consist of a capital gain (profit) or loss, realised if the investment is sold, unrealised capital appreciation (or depreciation) if yet unsold. It may also consist of periodic income such as dividends, interest, or rental income. The return may also inclu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |