|

Pushing On A String

Pushing on a string is a figure of speech for influence that is more effective in moving things in one direction than another – you can ''pull,'' but not ''push.'' If something is connected to someone by a string, they can move it toward themselves by pulling on the string, but they cannot move it away from themselves by pushing on the string. It is often used in the context of economic policy, specifically the view that "Monetary policy sasymmetric; it being easier to stop an expansion than to end a severe contraction."Sandilans, Roger G. (2001), "The New Deal and 'domesticated' Keynesianism in America, in p. 231./ref> History According to Roger G. Sandilans and John Harold Woodp. 231 it cites U. S. Congress House Banking Currency Committee, Hearings, ''Hearings, Banking Act of 1935,'' March 18, 1935, p. 377. the phrase was introduced by Congressman T. Alan Goldsborough in 1935, supporting Federal Reserve chairman Marriner Eccles in Congressional hearings on the Banking Ac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monetary Policy

Monetary policy is the policy adopted by the monetary authority of a nation to control either the interest rate payable for very short-term borrowing (borrowing by banks from each other to meet their short-term needs) or the money supply, often as an attempt to reduce inflation or the interest rate, to ensure price stability and general trust of the value and stability of the nation's currency. Monetary policy is a modification of the supply of money, i.e. "printing" more money, or decreasing the money supply by changing interest rates or removing excess reserves. This is in contrast to fiscal policy, which relies on taxation, government spending, and government borrowing as methods for a government to manage business cycle phenomena such as recessions. Further purposes of a monetary policy are usually to contribute to the stability of gross domestic product, to achieve and maintain low unemployment, and to maintain predictable exchange rates with other currencies. Monetary ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Demand Deposits

Demand deposits or checkbook money are funds held in demand accounts in commercial banks. These account balances are usually considered money and form the greater part of the narrowly defined money supply of a country. Simply put, these are deposits in the bank that can be withdrawn on demand, without any prior notice. History In the United States, demand deposits arose following the 1865 tax of 10% on the issuance of state bank notes; see history of banking in the USA. In the U.S., demand deposits only refer to funds held in checking accounts (or cheque offering accounts) other than NOW accounts; however, in a 1970s and 1980s response to the 1933 promulgation of Regulation Q in the U.S., demand deposits in some cases came to allow easier access to funds from other types of accounts (e.g. savings accounts and money market accounts). For the historical basis of the distinction between demand deposits and NOW accounts in the U.S., see Negotiable order of withdrawal account#H ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Excess Reserves

Excess reserves are bank reserves held by a bank in excess of a reserve requirement for it set by a central bank. In the United States, bank reserves for a commercial bank are represented by its cash holdings and any credit balance in an account at its Federal Reserve Bank (FRB). Holding excess reserves long term may have an opportunity cost if higher risk-adjusted interest can be earned by putting the funds elsewhere. For banks in the U.S. Federal Reserve System, excess reserves may be created by a given bank in the very short term by making short-term (usually overnight) loans on the federal funds market to another bank that may be short of its reserve requirements. Banks may also choose to hold some excess reserves to facilitate upcoming transactions or to meet contractual clearing balance requirements. The total amount of FRB credits held in all FRB accounts for all commercial banks, together with all currency and vault cash, forms the M0 monetary base. Impact on infl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monetary Base

In economics, the monetary base (also base money, money base, high-powered money, reserve money, outside money, central bank money or, in the UK, narrow money) in a country is the total amount of money created by the central bank. This includes: * the total currency circulating in the public, * plus the currency that is physically held in the vaults of commercial banks, * plus the commercial banks' reserves held in the central bank. The monetary base should not be confused with the money supply, which consists of the total currency circulating in the public plus certain types of non-bank deposits with commercial banks. Management Open market operations are monetary policy tools which directly expand or contract the monetary base. The monetary base is manipulated during the conduct of monetary policy by a finance ministry or the central bank. These institutions change the monetary base through open market operations: the buying and selling of government bonds. For exam ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Speculative Bubble

An economic bubble (also called a speculative bubble or a financial bubble) is a period when current asset prices greatly exceed their intrinsic valuation, being the valuation that the underlying long-term fundamentals justify. Bubbles can be caused by overly optimistic projections about the scale and sustainability of growth (e.g. dot-com bubble), and/or by the belief that intrinsic valuation is no longer relevant when making an investment (e.g. Tulip mania). They have appeared in most asset classes, including equities (e.g. Roaring Twenties), commodities (e.g. Uranium bubble), real estate (e.g. 2000s US housing bubble), and even esoteric assets (e.g. Cryptocurrency bubble). Bubbles usually form as a result of either excess liquidity in markets, and/or changed investor psychology. Large multi-asset bubbles (e.g. 1980s Japanese asset bubble and the 2020–21 Everything bubble), are attributed to central banking liquidity (e.g. overuse of the Fed put). In the early stages of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Crisis Of 2007–2010

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitability asse ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Great Depression

The Great Depression (19291939) was an economic shock that impacted most countries across the world. It was a period of economic depression that became evident after a major fall in stock prices in the United States. The economic contagion began around September and led to the Wall Street stock market crash of October 24 (Black Thursday). It was the longest, deepest, and most widespread depression of the 20th century. Between 1929 and 1932, worldwide gross domestic product (GDP) fell by an estimated 15%. By comparison, worldwide GDP fell by less than 1% from 2008 to 2009 during the Great Recession. Some economies started to recover by the mid-1930s. However, in many countries, the negative effects of the Great Depression lasted until the beginning of World War II. Devastating effects were seen in both rich and poor countries with falling personal income, prices, tax revenues, and profits. International trade fell by more than 50%, unemployment in the U.S. rose to 23% and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

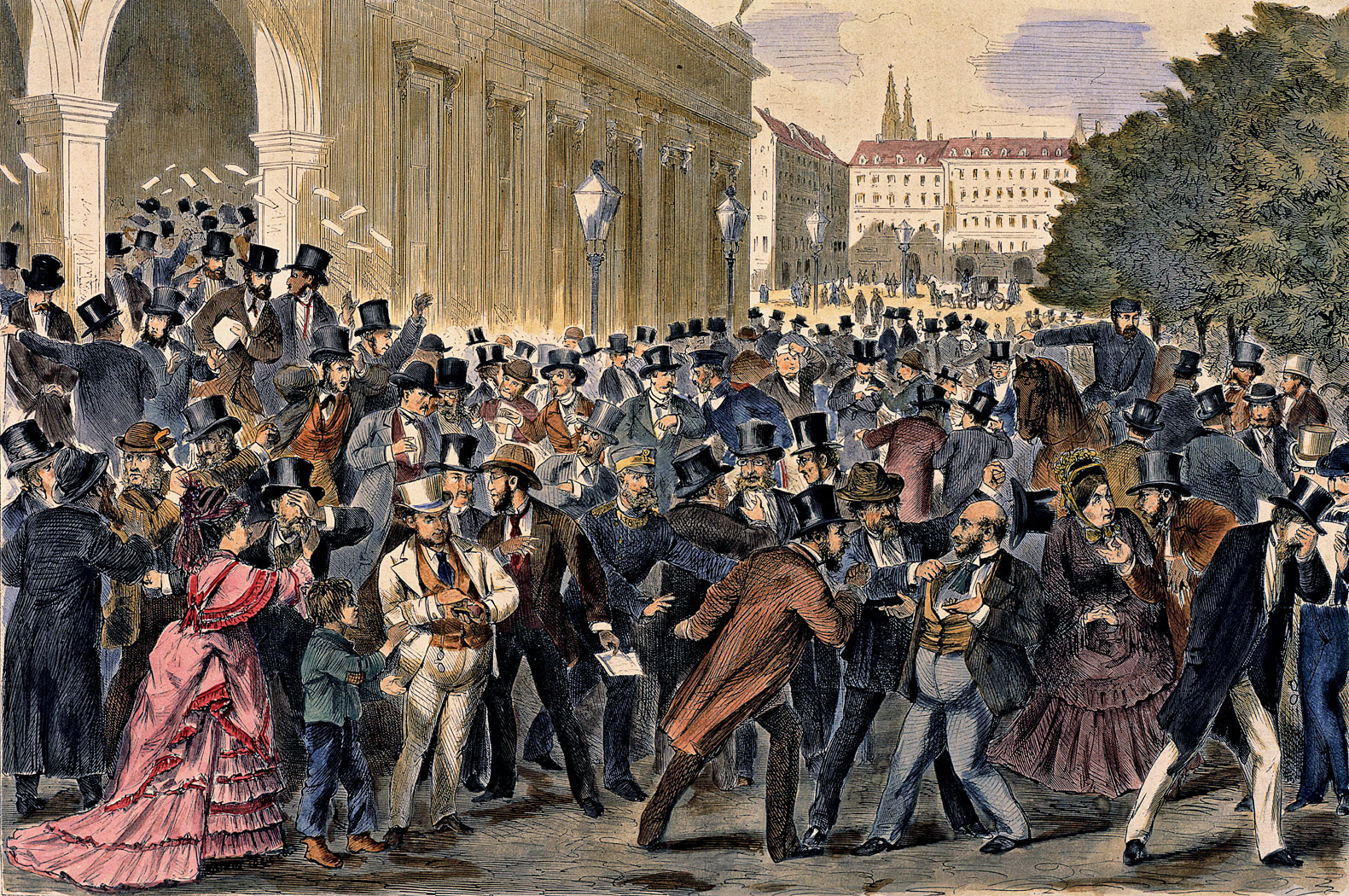

Financial Crises

A financial crisis is any of a broad variety of situations in which some financial assets suddenly lose a large part of their nominal value. In the 19th and early 20th centuries, many financial crises were associated with banking panics, and many recessions coincided with these panics. Other situations that are often called financial crises include stock market crashes and the bursting of other financial bubbles, currency crises, and sovereign defaults. Financial crises directly result in a loss of paper wealth but do not necessarily result in significant changes in the real economy (e.g. the crisis resulting from the famous tulip mania bubble in the 17th century). Many economists have offered theories about how financial crises develop and how they could be prevented. There is no consensus, however, and financial crises continue to occur from time to time. Types Banking crisis When a bank suffers a sudden rush of withdrawals by depositors, this is called a ''bank run''. Si ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Binding Constraint

In mathematics, a constraint is a condition of an optimization problem that the solution must satisfy. There are several types of constraints—primarily equality constraints, inequality constraints, and integer constraints. The set of candidate solutions that satisfy all constraints is called the feasible set. Example The following is a simple optimization problem: :\min f(\mathbf x) = x_1^2+x_2^4 subject to :x_1 \ge 1 and :x_2 = 1, where \mathbf x denotes the vector (''x''1, ''x''2). In this example, the first line defines the function to be minimized (called the objective function, loss function, or cost function). The second and third lines define two constraints, the first of which is an inequality constraint and the second of which is an equality constraint. These two constraints are hard constraints, meaning that it is required that they be satisfied; they define the feasible set of candidate solutions. Without the constraints, the solution would be (0,0), whe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Minimum Acceptable Rate Of Return

In business and for engineering economics in both industrial engineering and civil engineering practice, the minimum acceptable rate of return, often abbreviated MARR, or hurdle rate is the minimum rate of return on a project a manager or company is willing to accept before starting a project, given its risk and the opportunity cost of forgoing other projects. A synonym seen in many contexts is minimum attractive rate of return. The hurdle rate is frequently used as a synonym of cutoff rate, benchmark and cost of capital. It is used to conduct preliminary analysis of proposed projects and generally increases with increased risk. Hurdle rate determination The hurdle rate is usually determined by evaluating existing opportunities in operations expansion, rate of return for investments, and other factors deemed relevant by management. As an example, suppose a manager knows that investing in a conservative project, such as a bond investment or another project with no risk, yields a k ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Full-reserve Banking

Full-reserve banking (also known as 100% reserve banking, narrow banking, or sovereign money system) is a system of banking where banks do not lend demand deposits and instead, only lend from time deposits. It differs from fractional-reserve banking, in which banks may lend funds on deposit, while fully reserved banks would be required to keep the full amount of each customer's demand deposits in cash, available for immediate withdrawal. Monetary reforms that included full-reserve banking have been proposed in the past, notably in 1935 by a group of economists, including Irving Fisher, under the so-called "Chicago plan" as a response to the Great Depression. Currently, no country in the world requires full-reserve banking across primary credit institutions, although Iceland has considered it. In a 2018 ballot referendum, Switzerland voted overwhelmingly to reject the Sovereign Money Initiative which has full reserve banking as a prominent component of its proposed reform of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monetary Circuit Theory

Monetary circuit theory is a heterodox theory of monetary economics, particularly money creation, often associated with the post-Keynesian school. It holds that money is created endogenously by the banking sector, rather than exogenously by central bank lending; it is a theory of endogenous money. It is also called circuitism and the circulation approach. Contrast with mainstream theory The key distinction from mainstream economic theories of money creation is that circuitism holds that money is created endogenously by the banking sector, rather than exogenously by the government through central bank lending: that is, the economy creates money itself (endogenously), rather than money being provided by some outside agent (exogenously). These theoretical differences lead to a number of different consequences and policy prescriptions; circuitism rejects, among other things, the money multiplier based on reserve requirements, arguing that money is created by banks lending, which ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |