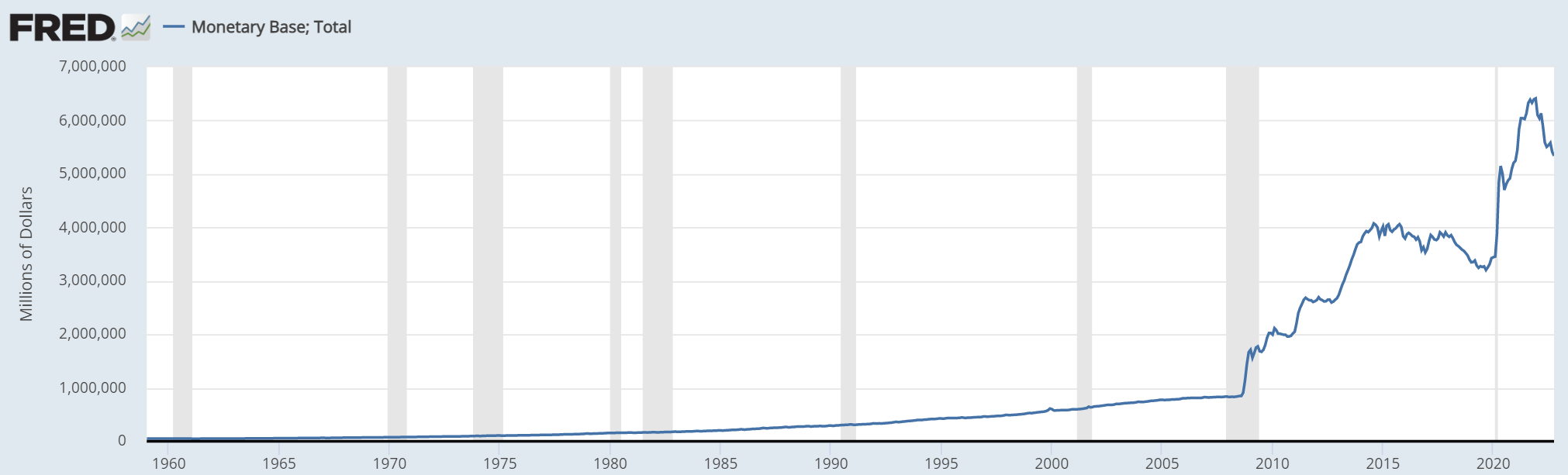

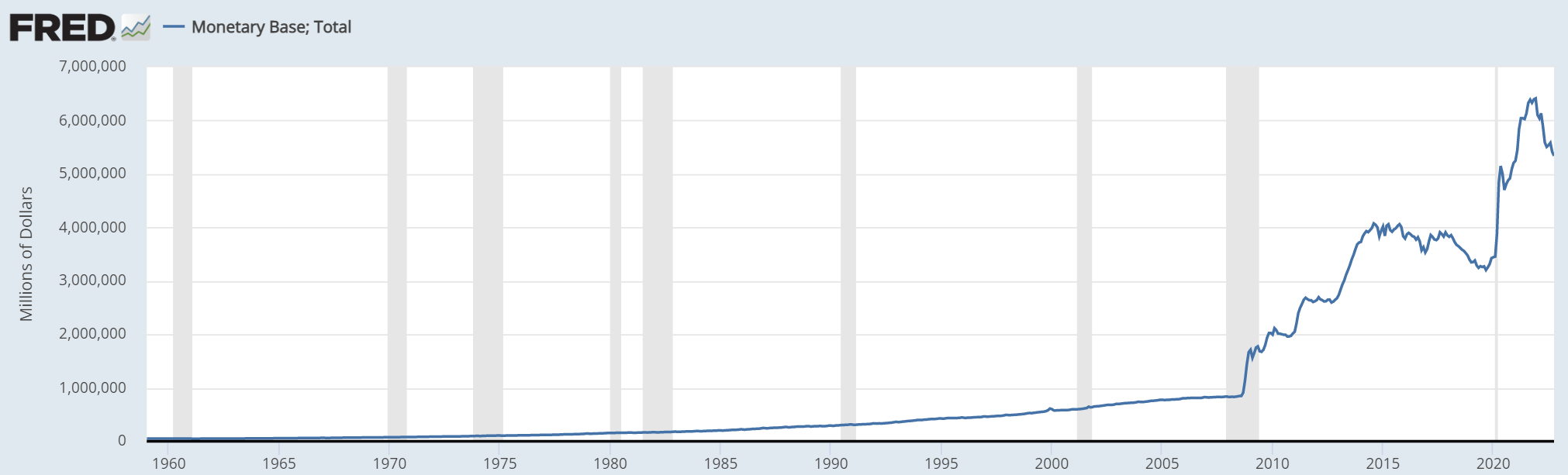

Monetary base on:

[Wikipedia]

[Google]

[Amazon]

In

In

Aggregate Reserves Of Depository Institutions And The Monetary Base (H.3)

{{Central banks Monetary economics Operations of central banks

In

In economics

Economics () is a behavioral science that studies the Production (economics), production, distribution (economics), distribution, and Consumption (economics), consumption of goods and services.

Economics focuses on the behaviour and interac ...

, the monetary base (also base money, money base, high-powered money, reserve money, outside money, central bank money or, in the UK, narrow money) in a country is the total amount of money created by the central bank. This includes:

* the total currency

A currency is a standardization of money in any form, in use or circulation as a medium of exchange, for example banknotes and coins. A more general definition is that a currency is a ''system of money'' in common use within a specific envi ...

circulating in the public,

* plus the currency that is physically held in the vaults of commercial bank

A commercial bank is a financial institution that accepts deposits from the public and gives loans for the purposes of consumption and investment to make a profit.

It can also refer to a bank or a division of a larger bank that deals with whol ...

s,

* plus the commercial banks' reserves held in the central bank

A central bank, reserve bank, national bank, or monetary authority is an institution that manages the monetary policy of a country or monetary union. In contrast to a commercial bank, a central bank possesses a monopoly on increasing the mo ...

.

The monetary base should not be confused with the money supply

In macroeconomics, money supply (or money stock) refers to the total volume of money held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include currency in circulation (i ...

, which consists of the total currency

A currency is a standardization of money in any form, in use or circulation as a medium of exchange, for example banknotes and coins. A more general definition is that a currency is a ''system of money'' in common use within a specific envi ...

circulating in the public plus certain types of non-bank deposits with commercial bank

A commercial bank is a financial institution that accepts deposits from the public and gives loans for the purposes of consumption and investment to make a profit.

It can also refer to a bank or a division of a larger bank that deals with whol ...

s.

Management

Open market operation

In macroeconomics, an open market operation (OMO) is an activity by a central bank to exchange liquidity in its currency with a bank or a group of banks. The central bank can either transact government bonds and other financial assets in the ope ...

s are monetary policy

Monetary policy is the policy adopted by the monetary authority of a nation to affect monetary and other financial conditions to accomplish broader objectives like high employment and price stability (normally interpreted as a low and stable rat ...

tools which directly expand or contract the monetary base.

The monetary base is manipulated during the conduct of monetary policy by a finance ministry

A ministry of finance is a ministry or other government agency in charge of government finance, fiscal policy, and financial regulation. It is headed by a finance minister, an executive or cabinet position .

A ministry of finance's portfolio ...

or the central bank. These institutions change the monetary base through open market operations: the buying and selling of government bonds. For example, if they buy government bonds from commercial banks, they pay for them by adding new amounts to the banks’ reserve deposits at the central bank, the latter being a component of the monetary base.

Typically, a central bank can also influence banking activities by manipulating interest rates and setting reserve requirements (how much money banks must keep on hand instead of loaning out to borrowers). Interest rates, especially on federal funds

In the United States, federal funds are overnight borrowings between banks and other entities to maintain their bank reserves at the Federal Reserve. Banks keep reserves at Federal Reserve Banks to meet their reserve requirements and to clea ...

(ultra-short-term loans between banks), are themselves influenced by open market operations.

The monetary base has traditionally been considered high-powered because its increase will typically result in a much larger increase in the supply of demand deposit

Demand deposits or checkbook money are funds held in demand accounts in commercial banks. These account balances are usually considered money and form the greater part of the narrowly defined money supply of a country. Simply put, these are dep ...

s through banks' loan-making, a ratio called the money multiplier

In monetary economics, the money multiplier is the ratio of the money supply to the monetary base (i.e. central bank money).

In some simplified expositions, the monetary multiplier is presented as simply the reciprocal of the reserve ratio, i ...

. However, for those that do not agree with the theory of the money multiplier, the monetary base can be thought of as high powered because of the fiscal multiplier

In economics, the fiscal multiplier (not to be confused with the money multiplier) is the ratio of change in national income arising from a change in government spending. More generally, the exogenous spending multiplier is the ratio of change ...

instead.

Monetary policy

Monetary policy

Monetary policy is the policy adopted by the monetary authority of a nation to affect monetary and other financial conditions to accomplish broader objectives like high employment and price stability (normally interpreted as a low and stable rat ...

is generally presumed to be the policy preserve of reserve banks, who target an interest rate. If control of the amount of base money in the economy is lost due failure by the reserve bank to meet the reserve requirements of the banking system, banks who are short of reserves will bid up the interest rate. Interest rates are set by the reserve bank to maintain an inflation rate which is considered neither too high or too low. This is usually determined using a Taylor Rule.

The quantity of reserves in the banking system is supported by the open market operations performed by the reserve banks, involving the purchase and sale of various financial instruments, commonly government debt (bonds), usually using "repos". Banks only require enough reserves to facilitate interbank settlement processes.

In some countries, reserve banks now pay interest on reserves. This adds another lever to the interest rate control mechanisms available to the reserve bank.

Following the 2008 financial crisis, quantitative easing raised the amount of reserves in the banking system, as reserve banks purchased bad debt from the banks, paying for it with reserves. This has left the banking system with an oversupply of reserves. This increase in reserves has had no effect on the level of interest rates. Reserves are never lent out by banks.

Accounting

FollowingIFRS

International Financial Reporting Standards, commonly called IFRS, are accounting standards issued by the IFRS Foundation and the International Accounting Standards Board (IASB). They constitute a standardised way of describing the company's fina ...

standards, base money is registered as a liability of the central banks' balance sheet, implying base money is by nature a debt from the central bank. However, given the special nature of central bank money – which cannot be redeemed in anything other than base money – numerous scholars such as Michael Kumhof have argued it should rather be recorded as a form of equity.

See also

*Broad money

In economics, broad money is a measure of the amount of money, or money supply, in a national economy including both highly liquid "narrow money" and less liquid forms. The European Central Bank, the OECD and the Bank of England all have their own ...

* Credit theory of money

*Monetary reform

Monetary reform is any movement or theory that proposes a system of supplying money and financing the economy that is different from the current system.

Monetary reformers may advocate any of the following, among other proposals:

* A return to ...

*Money creation

Money creation, or money issuance, is the process by which the money supply of a country, or an economic or monetary region,Such as the Eurozone or ECCAS is increased. In most modern economies, money is created by both central banks and comm ...

*

*Fractional reserve banking

Fractional-reserve banking is the system of banking in all countries worldwide, under which banks that take deposits from the public keep only part of their deposit liabilities in liquid assets as a reserve, typically lending the remainder to ...

References

External links

* * *Aggregate Reserves Of Depository Institutions And The Monetary Base (H.3)

{{Central banks Monetary economics Operations of central banks