|

Market Anomaly

A market anomaly in a financial market is predictability that seems to be inconsistent with (typically risk-based) theories of asset prices. Standard theories include the capital asset pricing model and the Fama-French Three Factor Model, but a lack of agreement among academics about the proper theory leads many to refer to anomalies without a reference to a benchmark theory (Daniel and Hirschleifer 2015 and Barberis 2018, for example). Indeed, many academics simply refer to anomalies as "return predictors", avoiding the problem of defining a benchmark theory. Academics have documented more than 150 return predictors (see '' List of Anomalies Documented in Academic Journals).'' These "anomalies", however, come with many caveats. Almost all documented anomalies focus on illiquid, small stocks. Moreover, the studies do not account for trading costs. As a result, many anomalies do not offer profits, despite the presence of predictability. Additionally, return predictability decl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Market

A financial market is a market in which people trade financial securities and derivatives at low transaction costs. Some of the securities include stocks and bonds, raw materials and precious metals, which are known in the financial markets as commodities. The term "market" is sometimes used for what are more strictly ''exchanges'', that is, organizations that facilitate the trade in financial securities, e.g., a stock exchange or commodity exchange. This may be a physical location (such as the New York Stock Exchange (NYSE), London Stock Exchange (LSE), Bombay Stock Exchange (BSE) or Johannesburg Stock Exchange ( JSE Limited)) or an electronic system such as NASDAQ. Much trading of stocks takes place on an exchange; still, corporate actions (mergers, spinoffs) are outside an exchange, while any two companies or people, for whatever reason, may agree to sell the stock from the one to the other without using an exchange. Trading of currencies and bonds is largely on a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investopedia

Investopedia is a global financial media website headquartered in New York City. Founded in 1999, Investopedia provides investment dictionaries, advice, reviews, ratings, and comparisons of financial products, such as securities accounts. It is part of the Dotdash Meredith family of brands owned by IAC. History Founding and early history Investopedia was founded in 1999 by Cory Wagner and Cory Janssen in Edmonton, Alberta, Canada. At the time, Janssen was a business student at the University of Alberta. Wagner focused on business development and research and development, while Janssen focused on marketing and sales. 2000s In April 2007, Forbes Media acquired Investopedia.com for an undisclosed amount. At the time of the acquisition, Investopedia drew about 2.5 million monthly users and provided a financial dictionary with about 5,000 terms regarding personal finance, banking and accounting. It also provided articles by financial advisers and a stock market simul ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Efficient-market Hypothesis

The efficient-market hypothesis (EMH) is a hypothesis in financial economics that states that asset prices reflect all available information. A direct implication is that it is impossible to "beat the market" consistently on a risk-adjusted basis since market prices should only react to new information. Because the EMH is formulated in terms of risk adjustment, it only makes testable predictions when coupled with a particular model of risk. As a result, research in financial economics since at least the 1990s has focused on market anomalies, that is, deviations from specific models of risk. The idea that financial market returns are difficult to predict goes back to Bachelier, Mandelbrot, and Samuelson, but is closely associated with Eugene Fama, in part due to his influential 1970 review of the theoretical and empirical research. The EMH provides the basic logic for modern risk-based theories of asset prices, and frameworks such as consumption-based asset pricing and int ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Markets

A financial market is a market in which people trade financial securities and derivatives at low transaction costs. Some of the securities include stocks and bonds, raw materials and precious metals, which are known in the financial markets as commodities. The term "market" is sometimes used for what are more strictly ''exchanges'', that is, organizations that facilitate the trade in financial securities, e.g., a stock exchange or commodity exchange. This may be a physical location (such as the New York Stock Exchange (NYSE), London Stock Exchange (LSE), Bombay Stock Exchange (BSE) or Johannesburg Stock Exchange (JSE Limited)) or an electronic system such as NASDAQ. Much trading of stocks takes place on an exchange; still, corporate actions (mergers, spinoffs) are outside an exchange, while any two companies or people, for whatever reason, may agree to sell the stock from the one to the other without using an exchange. Trading of currencies and bonds is largely on a bi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Low-volatility Anomaly

In investing and finance, the low-volatility anomaly is the observation that low-volatility securities have higher returns than high-volatility securities in most markets studied. This is an example of a stock market anomaly since it contradicts the central prediction of many financial theories that higher returns can only be achieved by taking more risk. The capital asset pricing model (CAPM) predicts a positive and linear relation between the systematic risk exposure of a security (its beta) and its expected future return. However, the low-volatility anomaly falsifies this prediction of the CAPM by showing that higher beta stocks have historically underperformed lower beta stocks. Additionally, stocks with higher idiosyncratic risk often yield lower returns compared to those with lower idiosyncratic risk. The anomaly is also document within corporate bond markets. The low-volatility anomaly has also been referred to as the low-beta, minimum-variance, minimum volatility an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Neglected Firm Effect

''Xestia castanea'', the grey rustic or neglected, is a moth of the family Noctuidae. It is found from central Europe to Morocco, Turkey, Lebanon, Israel, Jordan and Syria. Technical description and variation The wingspan is 36–42 mm. Forewing pale grey, with a more or less general rufous tinge; Lines and stigmata all obscure; lower lobe of reniform dark; hindwing fuscous; anal tufts of abdomen of male reddish. — In the ab. ''cerasina'' Frr. the red tints predominate to such an extent that the whole forewing is dull deep red, while in ab. ''neglecta'' Hbn the red is wholly lost and the insect is dull grey: this is the common form in Britain, where the typical ''castanea'' is rarer and ''cerasina'' unknown; — the form ''xanthe'' Woodf. should have the ground colour yellow; — ab. ''pallida'' Tutt from Scotland is whitish ochreous; the stigmata outlined in red; submarginal line formed of red spots. Biology Adults are on wing between July and November depending on th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Turn Of The Month Effect

To turn is to rotate, either continuously like a wheel turns on its axle, or in a finite motion changing an object's orientation. Turn may also refer to: Sports and games * Turn (game), a segment of a game * Turn (poker), the fourth of five community cards * Turn (dance and gymnastics), rotation of the body * Turn (swimming), reversing direction at the end of a pool * Turn (professional wrestling), a transition between face and heel * Turn, a quality of spin bowling in cricket Science and technology * Turn (knot), a component of a knot * Turning, shaping wood or metal using a lathe * Turn (biochemistry), an element of secondary structure in proteins * Turn (unit), a unit of angle * Traversal Using Relays around NAT (TURN), a computer network protocol * A loop of wire in an electromagnetic coil Entertainment Film and television * ''Turn'' (film), a 2001 Japanese film * ''The Turn'' (film), a 2012 short film * '' Turn: Washington's Spies'', a 2014 television series on A ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

January Effect

The January effect is a hypothesis that there is a seasonal anomaly in the financial market where securities' prices increase in the month of January more than in any other month. This calendar effect would create an opportunity for investors to buy stocks for lower prices before January and sell them after their value increases. As with all calendar effects, if true, it would suggest that the market is not efficient, as market efficiency would suggest that this effect should disappear. The effect was first observed around 1942 by investment banker Sidney B. Wachtel. He noted that since 1925 small stocks had outperformed the broader market in the month of January, with most of the disparity occurring before the middle of the month. It has also been noted that when combined with the four-year US presidential cycle, historically the largest January effect occurs in year three of a president's term. The most common theory explaining this phenomenon is that individual investors, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Weekend Effect

The weekdays and weekend are the complementary parts of the week, devoted to labour and rest, respectively. The legal weekdays (British English), or workweek (American English), is the part of the seven-day week devoted to working. In most of the world, the workweek is from Monday to Friday and the weekend is Saturday and Sunday. A weekday or workday is any day of the working week. Other institutions often follow this pattern, such as places of education. The constituted weekend has varying definitions, based on determined calendar days, designated period of time, and/or regional definition of the working week (e.g., commencing after 5:00 p.m. on Friday and lasting until 6:00 p.m. on Sunday). Sometimes the term "weekend" is expanded to include the time after work hours on the last workday of the week. Weekdays and workdays can be further detailed in terms of working time, the period of time that an individual spends at paid occupational labor. In many Christian trad ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Kaplan Zingales Index

Kaplan may refer to: Places * Kapłań, Poland * Kaplan, Louisiana, U.S. * Kaplan Medical Center, a hospital in Rehovot, Israel * Kaplan Street, in Tel Aviv, Israel * Mount Kaplan, Antarctica * Kaplan Arena, at the College of William & Mary in Williamsburg, Virginia Other uses * Kaplan (surname), including a list of people with the name * Kaplan College, now Brightwood College, a system of for-profit colleges in the United States * Kaplan Educational Foundation, a non-profit educational support entity * Kaplan Foundation, dedicated to the music of Gustav Mahler * Kaplan, Inc., a for-profit education company ** Kaplan Business School, a subsidiary of Kaplan located in Australia ** Kaplan Financial Education, a division of Kaplan, Inc. ** Kaplan International Languages, a division of Kaplan, Inc. ** Kaplan University, a former subsidiary of Kaplan, Inc., now known as Purdue University Global * Kaplan turbine, a propeller-type water turbine * William "Billy" Kaplan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

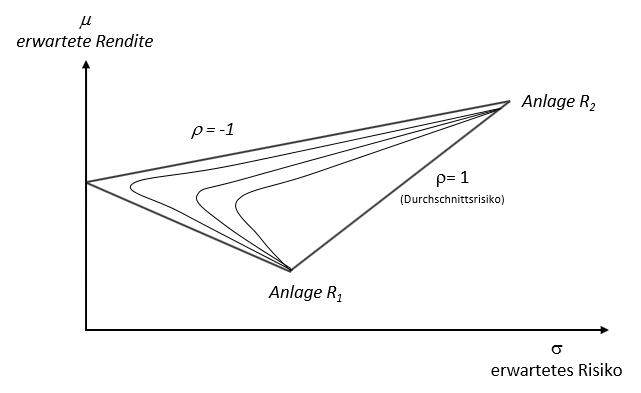

Efficient Frontier

In modern portfolio theory, the efficient frontier (or portfolio frontier) is an investment portfolio which occupies the "efficient" parts of the risk–return spectrum. Formally, it is the set of portfolios which satisfy the condition that no other portfolio exists with a higher expected return but with the same standard deviation of return (i.e., the risk). The efficient frontier was first formulated by Harry Markowitz in 1952; see Markowitz model. Overview A combination of assets, i.e. a portfolio, is referred to as "efficient" if it has the best possible expected level of return for its level of risk (which is represented by the standard deviation of the portfolio's return). Here, every possible combination of risky assets can be plotted in risk–expected return space, and the collection of all such possible portfolios defines a region in this space. In the absence of the opportunity to hold a risk-free asset, this region is the opportunity set (the feasible set) ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |