|

Tax Justice Network

The Tax Justice Network (or TJN) is an advocacy group consisting of a coalition of researchers and activists with a shared concern about tax avoidance, tax competition, and tax havens. Empirical results The TJN has reported on the OECD Base erosion and profit shifting (BEPS) projects and conducted their own research that the scale of corporate taxes being avoided by multinationals is an estimated $660bn in 2012 (a quarter of US multinationals’ gross profits), which is equivalent to 0.9% of World GDP. In July 2012, following a study into wealthy individuals with offshore accounts, the Tax Justice Network published claims regarding deposits worth at least $21 trillion (£13 trillion), potentially even $32 trillion, in secretive tax havens. As a result, governments suffer a lack of income taxes of up to $280 billion. In November 2020, the TJN published "The State of Tax Justice 2020" report. It claims $427 billion is lost every year to tax abuse. Focus Financial Secrecy Inde ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

London

London is the capital and List of urban areas in the United Kingdom, largest city of England and the United Kingdom, with a population of just under 9 million. It stands on the River Thames in south-east England at the head of a estuary down to the North Sea, and has been a major settlement for two millennia. The City of London, its ancient core and financial centre, was founded by the Roman Empire, Romans as ''Londinium'' and retains its medieval boundaries.See also: Independent city#National capitals, Independent city § National capitals The City of Westminster, to the west of the City of London, has for centuries hosted the national Government of the United Kingdom, government and Parliament of the United Kingdom, parliament. Since the 19th century, the name "London" has also referred to the metropolis around this core, historically split between the Counties of England, counties of Middlesex, Essex, Surrey, Kent, and Hertfordshire, which largely comprises Greater London ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

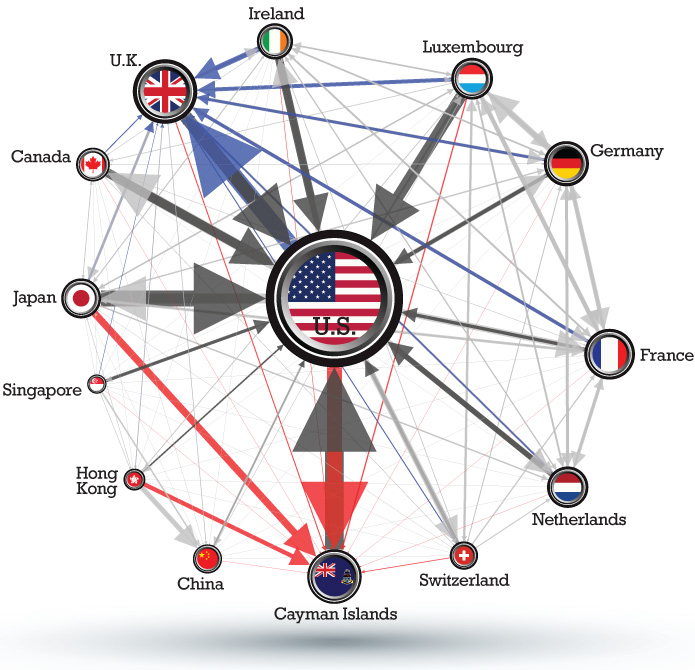

Corporate Tax Haven

Corporate haven, corporate tax haven, or multinational tax haven is used to describe a jurisdiction that multinational corporations find attractive for establishing subsidiaries or incorporation of regional or main company headquarters, mostly due to favourable tax regimes (not just the headline tax rate), and/or favourable secrecy laws (such as the avoidance of regulations or disclosure of tax schemes), and/or favourable regulatory regimes (such as weak data-protection or employment laws). Unlike traditional tax havens, modern corporate tax havens reject they have anything to do with near-zero effective tax rates, due to their need to encourage jurisdictions to enter into bilateral tax treaties which accept the haven's base erosion and profit shifting (BEPS) tools. CORPNET show each corporate tax haven is strongly connected with specific traditional tax havens (via additional BEPS tool "backdoors" like the double Irish, the dutch sandwich, and single malt). Corporate tax h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Taxation

International taxation is the study or determination of tax on a person or business subject to the tax laws of different countries, or the international aspects of an individual country's tax laws as the case may be. Governments usually limit the scope of their income taxation in some manner territorially or provide for offsets to taxation relating to extraterritorial income. The manner of limitation generally takes the form of a territorial, residence-based, or exclusionary system. Some governments have attempted to mitigate the differing limitations of each of these three broad systems by enacting a hybrid system with characteristics of two or more. Many governments tax individuals and/or enterprises on income. Such systems of taxation vary widely, and there are no broad general rules. These variations create the potential for double taxation (where the same income is taxed by different countries) and no taxation (where income is not taxed by any country). Income tax system ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business Ethics Organizations

Business is the practice of making one's living or making money by producing or buying and selling products (such as goods and services). It is also "any activity or enterprise entered into for profit." Having a business name does not separate the business entity from the owner, which means that the owner of the business is responsible and liable for debts incurred by the business. If the business acquires debts, the creditors can go after the owner's personal possessions. A business structure does not allow for corporate tax rates. The proprietor is personally taxed on all income from the business. The term is also often used colloquially (but not by lawyers or by public officials) to refer to a company, such as a corporation or cooperative. Corporations, in contrast with sole proprietors and partnerships, are a separate legal entity and provide limited liability for their owners/members, as well as being subject to corporate tax rates. A corporation is more complicated and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Avoidance

Tax avoidance is the legal usage of the tax regime in a single territory to one's own advantage to reduce the amount of tax that is payable by means that are within the law. A tax shelter is one type of tax avoidance, and tax havens are jurisdictions that facilitate reduced taxes. Tax avoidance should not be confused with tax evasion, which is illegal. Forms of tax avoidance that use legal tax laws in ways not necessarily intended by the government are often criticized in the court of public opinion and by journalists. Many corporations and businesses that take part in the practice experience a backlash from their active customers or online. Conversely, benefiting from tax laws in ways that were intended by governments is sometimes referred to as tax planning. The World Bank's World Development Report 2019 on the future of work supports increased government efforts to curb tax avoidance as part of a new social contract focused on human capital investments and expanded so ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Foundation

The Tax Foundation is an American think tank based in Washington, D.C. It was founded in 1937 by a group of businessmen in order to "monitor the tax and spending policies of government agencies". The Tax Foundation collects data and publishes research studies on U.S. tax policies at both the federal and state levels. Its stated mission is to "improve lives through tax policy research and education that leads to greater economic growth and opportunity". The Tax Foundation is organized as a 501(c)(3) tax-exempt non-profit educational and research organization, with three primary areas of research: the Center for Federal Tax Policy, the Center for State Tax Policy, and the Center for Legal Reform. The group is known for its annual reports such as ''Facts & Figures: How Does Your State Compare'', which was first produced in 1941, and its " Tax Freedom Day" brochures, which it has produced since the early 1970s. History The Tax Foundation was organized on December 5, 1937, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ireland As A Tax Haven

Ireland has been labelled as a tax haven or corporate tax haven in multiple financial reports, an allegation which the state has rejected in response. Ireland is on all academic " tax haven lists", including the , and tax NGOs. Ireland does not meet the 1998 OECD definition of a tax haven, but no OECD member, including Switzerland, ever met this definition; only Trinidad & Tobago met it in 2017. Similarly, no EU–28 country is amongst the 64 listed in the 2017 EU tax haven blacklist and greylist. In September 2016, Brazil became the first G20 country to "blacklist" Ireland as a tax haven. Ireland's base erosion and profit shifting (BEPS) tools give some foreign corporates ' of 0% to 2.5% on global profits re-routed to Ireland via their tax treaty network. Ireland's ''aggregate '' for foreign corporates is 2.2–4.5%. Ireland's BEPS tools are the world's largest BEPS flows, exceed the entire Caribbean system, and artificially inflate the US–EU trade deficit. Ireland's ta ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

ATTAC

The Association pour la Taxation des Transactions financières et pour l'Action Citoyenne (''Association for the Taxation of financial Transactions and Citizen's Action'', ATTAC) is an activist organisation originally created to promote the establishment of a tax on foreign exchange transactions. Background Originally called "Action for a Tobin Tax to Assist the Citizen", ATTAC was a single-issue movement demanding the introduction of the so-called Tobin tax on currency speculation. n the ATTAC: A new European alternative to globalisation, David Moberg, These Times magazine, May 2001/ref> ATTAC has enlarged its scope to a wide range of issues related to globalisation, and monitoring the decisions of the World Trade Organization (WTO), the Organisation for Economic Co-operation and Development (OECD,) and the International Monetary Fund (IMF). ATTAC representatives attend the meetings of the G8 with the goal of influencing policymakers' decisions. Attac spokesmen recently ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Civil Society

Civil society can be understood as the "third sector" of society, distinct from government and business, and including the family and the private sphere.''What is Civil Society'' civilsoc.org By other authors, ''civil society'' is used in the sense of 1) the aggregate of non-governmental organizations and institutions that advance the interests and will of citizens or 2) individuals and organizations in a society which are independent of the government. Sometimes the term ''civil society'' is used in the more general sense of "the elements such as freedom of speech, an independent judiciary, etc, that make up a democratic society" ('''' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Prem Sikka, Baron Sikka

Prem Nath Sikka, Baron Sikka (born 1 August 1951) is a British-Indian accountant and academic. He holds the position of Professor of Accounting at the University of Sheffield, and is Emeritus Professor of Accounting at the University of Essex. Life and career Sikka migrated to the UK from India with his family in 1966, and left school two years later with five passes at Certificate of Secondary Education, CSE. He has said of his parents that they "were working-class people – and work killed them in the end": his mother died at the age of 53 and his father, a Labour Party (UK), Labour Party activist, died at 59. He then became an accounts clerk with an insurance broker in London. He pursued his education via part-time study, gaining O-levels and A-levels before qualifying as a Chartered Certified Accountant from the Association of Chartered Certified Accountants in 1977. Sikka worked in corporate accountancy during the 1970s, before joining North East London Polytechnic as a l ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Richard Murphy (tax Campaigner)

Richard Murphy (born 21 March 1958) is a British chartered accountant and political economist who campaigns on issues of tax avoidance and tax evasion. He advises the Trades Union Congress on economics and taxation, and founded the Tax Justice Network. He is a Professor of Accounting Practice at University of Sheffield Management School. Early life Richard Murphy was born in 1958 and brought up in Ipswich. His undergraduate degree was in Economics and Accountancy at the University of Southampton, and further trained at KPMG becoming a Chartered Accountant. Career For much of his early career he was an accountant in Downham Market, Norfolk. In 1985 he co-founded an accountancy firm which became Murphy Deeks Nolan. The company was sold in 2000. Murphy was also the founder of a company that became the European distributor for the game Trivial Pursuit. Murphy has since admitted that the manufacturing operation he set up in Ireland to manufacture Trivial Pursuit was there to avo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nicholas Shaxson

Nicholas Shaxson (born 1966) is a British author, journalist and investigator. He is best known for his investigative books ''Poisoned Wells'' (2007) and '' Treasure Islands'' (2011). He has worked as a part-time writer and researcher for the Tax Justice Network, an expert-led lobbying group focused on the harmful impacts of tax avoidance, tax competition and tax havens.The Author: Nicholas Shaxson ''treasureislands.org'', 19 November 2010Shaxson, Nicholas The truth about tax havens '' |