|

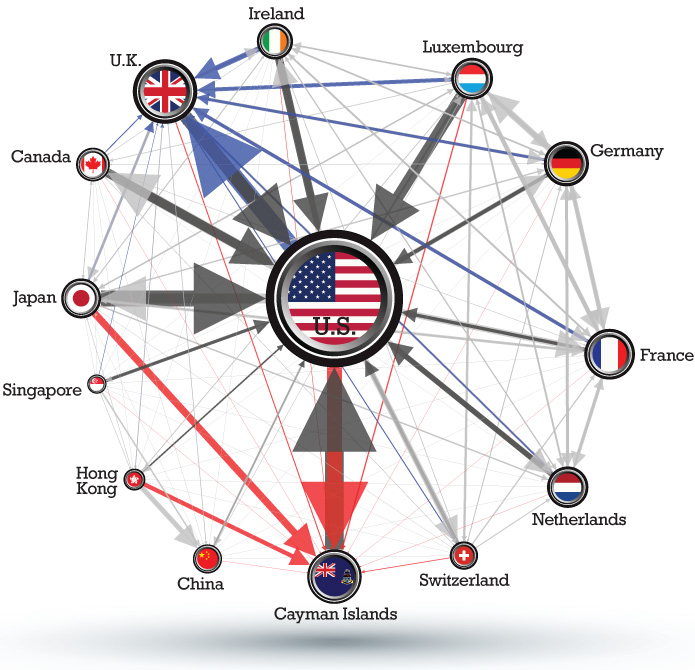

Corporate Tax Haven

Corporate haven, corporate tax haven, or multinational tax haven is used to describe a jurisdiction that multinational corporations find attractive for establishing subsidiaries or incorporation of regional or main company headquarters, mostly due to favourable tax regimes (not just the headline tax rate), and/or favourable secrecy laws (such as the avoidance of regulations or disclosure of tax schemes), and/or favourable regulatory regimes (such as weak data-protection or employment laws). Unlike traditional tax havens, modern corporate tax havens reject they have anything to do with near-zero effective tax rates, due to their need to encourage jurisdictions to enter into bilateral tax treaties which accept the haven's base erosion and profit shifting (BEPS) tools. CORPNET show each corporate tax haven is strongly connected with specific traditional tax havens (via additional BEPS tool "backdoors" like the double Irish, the dutch sandwich, and single malt). Corporate tax h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Incorporation (business)

Incorporation is the formation of a new corporation. The corporation may be a business, a nonprofit organization, sports club, or a local government of a new city or town. In the United States Specific incorporation requirements in the United States differ on a state by state basis. However, there are common pieces of information that states require to be included in the certificate of incorporation. *Business purpose *Corporation name *Registered agent *Inc. *Share par value *Number of authorized shares of stock *Directors *Preferred shares *Officers *Legal address A business purpose describes the incorporated tasks a company has to do or provide. The purpose can be general, indicating that the budding company has been formed to carry out "all lawful business" in the region. Alternatively, the purpose can be specific, furnishing a more detailed explanation of the products and/or services to be offered by their company. The chosen name should be followed with a corporate iden ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Asia-Pacific

Asia-Pacific (APAC) is the part of the world near the western Pacific Ocean. The Asia-Pacific region varies in area depending on context, but it generally includes East Asia, Russian Far East, South Asia, Southeast Asia, Australia and Pacific Islands. Definition The term may include countries in North America and South America that are on the coast of the Eastern Pacific Ocean; the Asia-Pacific Economic Cooperation, for example, includes Canada, Chile, Mexico, Peru, and the United States. Alternatively, the term sometimes comprises all of Asia and Australasia as well as Pacific island nations (Asia-Pacific and Australian continent)—for example, when dividing the world into large regions for commercial purposes (e.g., into APAC, EMEA, LATAM, and NA). Central Asia and Western Asia are almost never included. [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Patent Box

A patent box is a special very low corporate tax regime used by several countries to incentivise research and development by taxing patent revenues differently from other commercial revenues. It is also known as intellectual property box regime, innovation box or IP box. Patent boxes have also been used as base erosion and profit shifting (BEPS) tools, to avoid corporate taxes. History In the early 1970s Ireland introduced the first scheme in its Corporation Tax. Section 34 of the 1973 Finance Act allowed total tax relief in respect of royalties and other income from licenses patented in Ireland. The concept was applied in 2001 by the French Tax Authorities as a reduced rate of tax on revenue from IP licensing or the transfer of qualified IP. Within Europe, Belgium, Hungary, Luxembourg, Netherlands, Spain and the United Kingdom have also introduced similar schemes. Controversy The Irish Patent Box system is one of the key benefits for companies paying Irish corporation tax. The s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Leprechaun Economics

Leprechaun economics was a term coined by economist Paul Krugman to describe the 26.3 per cent rise in Irish 2015 GDP, later revised to 34.4 per cent, in a 12 July 2016 publication by the Irish Central Statistics Office (CSO), restating 2015 Irish national accounts. At that point, the distortion of Irish economic data by tax-driven accounting flows reached a climax. In 2020, Krugman said the term was a feature of all tax havens. While the event that caused the artificial Irish GDP growth occurred in Q1 2015, the Irish CSO had to delay its GDP revision and redact the release of its regular economic data in 2016–2017 to protect the source's identity, as required by Irish law. Only in Q1 2018 could economists confirm Apple as the source, and that this was the largest ever base erosion and profit shifting (BEPS) action, and the largest hybrid–tax inversion of a U.S. corporation. The event marked the replacement of Ireland's prohibited BEPS tool, the Double Irish, with the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Allowance

Capital allowances is the practice of allowing tax payers to get tax relief on capital expenditure by allowing it to be deducted against their annual taxable income. Generally, expenditure qualifying for capital allowances will be incurred on specified capital assets, with the deduction available normally spread over many years. The term is used in the UK and in Ireland. Capital allowances are a replacement of accounting depreciation, which is not generally an allowable deduction in UK and Irish tax returns. Capital allowances can therefore be considered a form of 'tax depreciation', a term more widely used in other tax jurisdictions such as the US. If capital expenditure does not qualify for a form of capital allowance, then it means that the business gets no immediate tax relief on such expenditure. Categories of asset Capital allowances were introduced in the UK in 1946 and may be claimed for: * plant and machinery * structures and buildings * business premises reno ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Royalty Payment

A royalty payment is a payment made by one party to another that owns a particular asset, for the right to ongoing use of that asset. Royalties are typically agreed upon as a percentage of gross or net revenues derived from the use of an asset or a fixed price per unit sold of an item of such, but there are also other modes and metrics of compensation.Guidelines for Evaluation of Transfer of Technology Agreements, United Nations, New York, 1979 A royalty interest is the right to collect a stream of future royalty payments. A license agreement defines the terms under which a resource or property are licensed by one party to another, either without restriction or subject to a limitation on term, business or geographic territory, type of product, etc. License agreements can be regulated, particularly where a government is the resource owner, or they can be private contracts that follow a general structure. However, certain types of franchising, franchise agreements have comparable p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Contract Manufacturing

A contract manufacturer (CM) is a manufacturer that contracts with a firm for components or products (in which case it is a turnkey supplier). It is a form of outsourcing. A contract manufacturer performing packaging operations is called copacker or a ''contract packager''. Brand name companies focus on product innovation, design and sales, while the manufacturing takes place in independent factories (the turnkey suppliers). Most turnkey suppliers specialize in simply manufacturing physical products, but some are also able to handle a significant part of the design and customization process if needed. Some turnkey suppliers specialize in one base component (ex. memory chips) or a base process (e.g. plastic molding). Business model In a contract manufacturing business model, the hiring firm approaches the contract manufacturer with a design or formula. The contract manufacturer will quote the parts based on processes, labor, tooling, and material costs. Typically a hiring firm w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Transfer Pricing

In taxation and accounting, transfer pricing refers to the rules and methods for pricing transactions within and between enterprises under common ownership or control. Because of the potential for cross-border controlled transactions to distort taxable income, tax authorities in many countries can adjust intragroup transfer prices that differ from what would have been charged by unrelated enterprises dealing at arm’s length (the arm’s-length principle). The OECD and World Bank recommend intragroup pricing rules based on the arm’s-length principle, and 19 of the 20 members of the G20 have adopted similar measures through bilateral treaties and domestic legislation, regulations, or administrative practice.World Bank pp. 35-51 Countries with transfer pricing legislation generally follow th''OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations''in most respects, although their rules can differ on some important details. Where adopted, transfe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Inversion

A tax inversion or corporate tax inversion is a form of tax avoidance where a corporation restructures so that the current parent is replaced by a foreign parent, and the original parent company becomes a subsidiary of the foreign parent, thus moving its tax residence to the foreign country. Executives and operational headquarters can stay in the original country. The US definition requires that the original shareholders remain a majority control of the post-inverted company. The majority of the less than 100 material tax inversions recorded since 1993 have been of US corporations (85 inversions), seeking to pay less to the US corporate tax system. The only other jurisdiction to experience a material outflow of tax inversions was the United Kingdom from 2007 to 2010 (22 inversions); however, UK inversions largely ceased post the reform of the UK corporate tax code from 2009 to 2012. The first inversion was McDermott International in 1983. Reforms by US Congress in 2004 hal ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gabriel Zucman

Gabriel Zucman (born 30 October 1986) is a French economist who is currently an associate professor of public policy and economics at the University of California, Berkeley‘s Goldman School of Public Policy. The author of '' The Hidden Wealth of Nations: The Scourge of Tax Havens'' (2015), Zucman is known for his research on tax havens and corporate tax havens. Zucman's research has found that the leading corporate tax havens are all OECD–compliant, and that tax disputes between high–tax locations and havens are very rare. His papers are some of the most cited papers on research into tax havens. Zucman is also known for his work on the quantification of the financial scale of base erosion and profit shifting (BEPS) tax avoidance techniques employed by multinationals in corporate tax havens, through which he identified Ireland as the world's largest corporate tax haven in 2018. In 2018, Zucman was the recipient of the Prize for the Best Young Economist in France, awarded ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Treaty

A tax treaty, also called double tax agreement (DTA) or double tax avoidance agreement (DTAA), is an agreement between two countries to avoid or mitigate double taxation. Such treaties may cover a range of taxes including income taxes, inheritance taxes, value added taxes, or other taxes. Besides bilateral treaties, multilateral treaties are also in place. For example, European Union (EU) countries are parties to a multilateral agreement with respect to value added taxes under auspices of the EU, while a joint treaty on mutual administrative assistance of the Council of Europe and the Organisation for Economic Co-operation and Development (OECD) is open to all countries. Tax treaties tend to reduce taxes of one treaty country for residents of the other treaty country to reduce double taxation of the same income. The provisions and goals vary significantly, with very few tax treaties being alike. Most treaties: * define which taxes are covered and who is a resident and eligible for ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)