|

Tax Cut

A tax cut represents a decrease in the amount of money taken from taxpayers to go towards government revenue. Tax cuts decrease the revenue of the government and increase the disposable income of taxpayers. Tax cuts usually refer to reductions in the percentage of tax paid on income, goods and services. As they leave consumers with more disposable income, tax cuts are an example of an expansionary fiscal policy. Tax cuts also include reduction in tax in other ways, such as tax credit, deductions and loopholes. How a tax cut affects the economy depends on which tax is cut. Policies that increase disposable income for lower- and middle-income households are more likely to increase overall consumption and "hence stimulate the economy". Tax cuts in isolation boost the economy because they increase government borrowing. However, they are often accompanied by spending cuts or changes in monetary policy that can offset their stimulative effects. Types Tax cuts are typically cuts in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Revenue

Government revenue or national revenue is money received by a government from taxes and non-tax sources to enable it to undertake public expenditure. Government revenue as well as government spending are components of the government budget and important tools of the government's fiscal policy. The collection of revenue is the most basic task of a government, as revenue is necessary for the operation of government, provision of the common good (through the social contract in order to fulfill the public interest) and enforcement of its laws; this necessity of revenue was a major factor in the development of the modern bureaucratic state. Government revenue is distinct from government debt and money creation, which both serve as temporary measures of increasing a government's money supply without increasing its revenue. Sources There are a variety of sources from which government can derive revenue. The most common sources of government revenue have varied in different places an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

American Taxpayer Relief Act Of 2012

The American Taxpayer Relief Act of 2012 (ATRA) was enacted and passed by the United States Congress on January 1, 2013, and was signed into law by US President Barack Obama the next day. ATRA gave permanence to the lower rates of much of the "Bush tax cuts". The Act centers on a partial resolution to the US fiscal cliff by addressing the expiration of certain provisions of the Economic Growth and Tax Relief Reconciliation Act of 2001 and the Jobs and Growth Tax Relief Reconciliation Act of 2003 (known together as the " Bush tax cuts"), which had been temporarily extended by the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010. The Act also addressed the activation of the Budget Control Act of 2011's budget sequestration provisions. A compromise measure, the Act gives permanence to the lower rate of much of the Bush tax cuts, while retaining the higher tax rate at upper income levels that became effective on January 1 due to the expiration of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

S Corporation

An S corporation, for United States federal income tax, is a closely held corporation (or, in some cases, a limited liability company (LLC) or a partnership) that makes a valid election to be taxed under Subchapter S of Chapter 1 of the Internal Revenue Code. In general, S corporations do not pay any income taxes. Instead, the corporation's income and losses are divided among and passed through to its shareholders. The shareholders must then report the income or loss on their own individual income tax returns. Overview S corporations are ordinary business corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. The term "S corporation" means a "small business corporation" which has made an election under § 1362(a) to be taxed as an S corporation. The S corporation rules are contained in Subchapter S of Chapter 1 of the Internal Revenue Code (sections 1361 through 1379). The United States Congre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trickle-down Economics

Trickle-down economics is a term used in critical references to economic policies that favor the upper income brackets, corporations, and individuals with substantial wealth or capital. In recent history, the term has been used by critics of supply-side economics. Whereas general supply-side theory favors lowering taxes overall, trickle-down theory more specifically advocates for a lower tax burden on the upper end of the economic spectrum. Major examples of US Republicans supporting what critics call "trickle-down economics" include the Reagan tax cuts, the Bush tax cuts and the Tax Cuts and Jobs Act of 2017. In each of the aforementioned tax reforms, taxes were cut across all income brackets, but the biggest reductions were given to the highest income earners, although the Reagan Era tax reforms also introduced the earned income tax credit which has received bipartisan praise for poverty reduction and is largely why the bottom half of workers pay no federal income tax. S ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Starve The Beast

"Starve the beast" is a political strategy employed by American conservatives to limit government spending by cutting taxes, to deprive the federal government of revenue in a deliberate effort to force it to reduce spending. The term "the beast", in this context, refers to the United States federal government and the programs it funds, using mainly American taxpayer dollars, particularly social programs such as education, welfare, Social Security, Medicare, and Medicaid. On July 14, 1978, economist and future Federal Reserve chairman Alan Greenspan testified to the Senate Finance Committee: "Let us remember that the basic purpose of any tax cut program in today's environment is to reduce the momentum of expenditure growth by restraining the amount of revenue available and trust that there is a political limit to deficit spending." Before his election as President, then-candidate Ronald Reagan foreshadowed the strategy during the 1980 US Presidential debates, saying " John ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

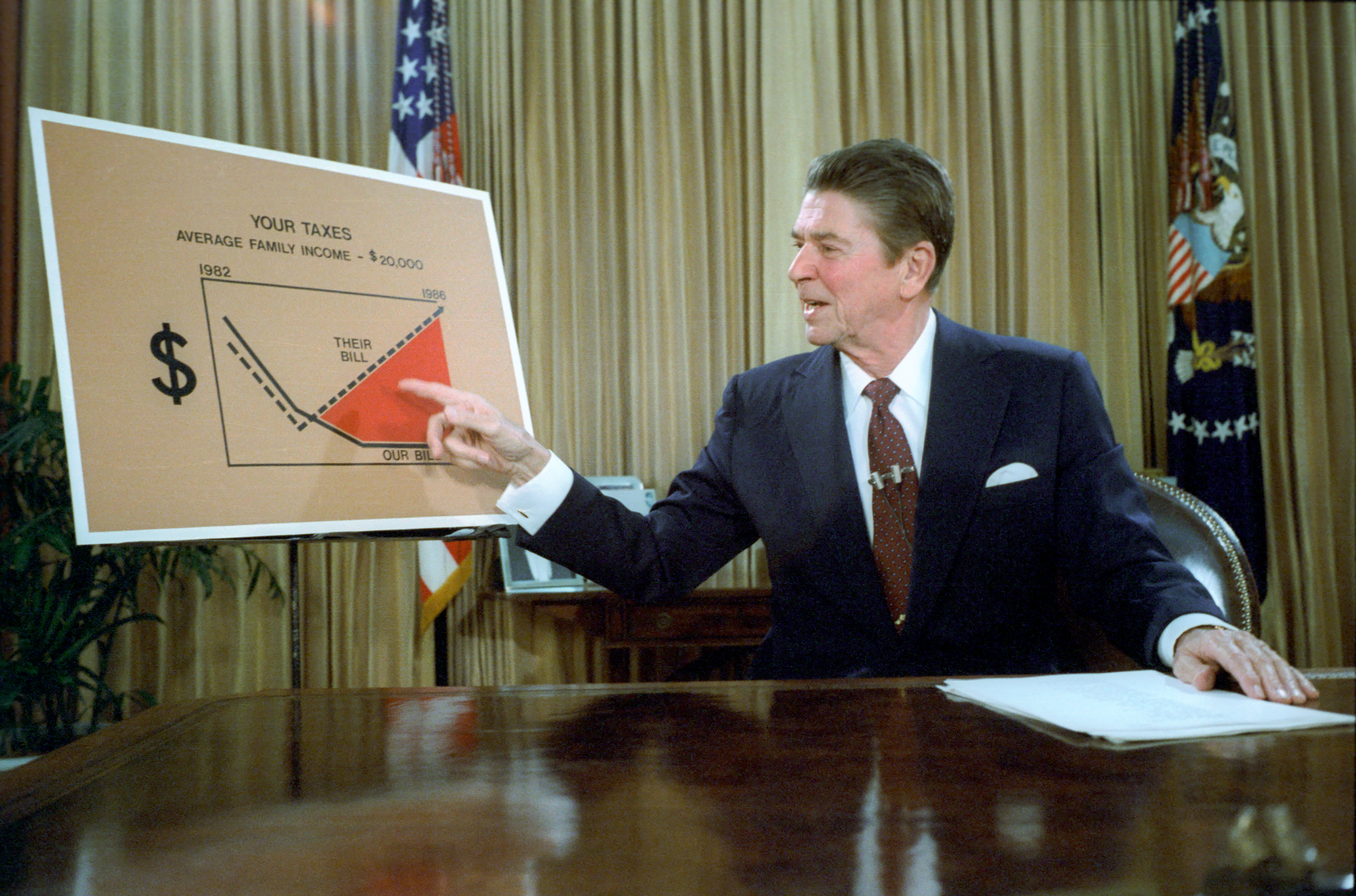

Reaganomics

Reaganomics (; a portmanteau of ''Reagan'' and ''economics'' attributed to Paul Harvey), or Reaganism, refers to the neoliberal economic policies promoted by U.S. President Ronald Reagan during the 1980s. These policies are commonly associated with and characterized as supply-side economics, trickle-down economics, or "voodoo economics" by opponents, while Reagan and his advocates preferred to call it free-market economics. The pillars of Reagan's economic policy included increasing defense spending, balancing the federal budget and slowing the growth of government spending, reducing the federal income tax and capital gains tax, reducing government regulation, and tightening the money supply in order to reduce inflation. The results of Reaganomics are still debated. Supporters point to the end of stagflation, stronger GDP growth, and an entrepreneurial revolution in the decades that followed. Critics point to the widening income gap, what they described as an atmosphere of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Rahn Curve

The Rahn curve is a graph used to illustrate an economic theory, proposed in 1996 by American economist Richard W. Rahn, which suggests that there is a level of government spending that maximizes economic growth. The theory is used by classical liberals to argue for a decrease in overall government spending and taxation. The inverted-U-shaped curve suggests that the optimal level of government spending is 15–25% of GDP.with subtitles dotsub.com See also * Government spending * Laffer curve * Tax cut A tax cut represents a decrease in the amount of money taken from taxpayers to go towards government revenue. Tax cuts decrease the revenue of the government and increase the disposable income of taxpayers. Tax cuts usually refer to reductions i ... References {{reflist * Pettinger, Tejvan: The Rahn Curve – Economic Growth and Level of Spending', economicshelp.org, April 23, 2008. External links search "Rahn" freedomandprosperity.org Economics curves Fiscal policy< ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Laffer Curve

In economics, the Laffer curve illustrates a theoretical relationship between rates of taxation and the resulting levels of the government's tax revenue. The Laffer curve assumes that no tax revenue is raised at the extreme tax rates of 0% and 100%, meaning that there is a tax rate between 0% and 100% that maximizes government tax revenue. The shape of the curve is a function of taxable income elasticity – i.e., taxable income changes in response to changes in the rate of taxation. As popularized by supply-side economist Arthur Laffer, the curve is typically represented as a graph that starts at 0% tax with zero revenue, rises to a maximum rate of revenue at an intermediate rate of taxation, and then falls again to zero revenue at a 100% tax rate. However, the shape of the curve is uncertain and disputed among economists. One implication of the Laffer curve is that increasing tax rates beyond a certain point is counter-productive for raising further tax revenue. In ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gross Domestic Product

Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced and sold (not resold) in a specific time period by countries. Due to its complex and subjective nature this measure is often revised before being considered a reliable indicator. GDP (nominal) per capita does not, however, reflect differences in the cost of living and the inflation rates of the countries; therefore, using a basis of GDP per capita at purchasing power parity (PPP) may be more useful when comparing living standards between nations, while nominal GDP is more useful comparing national economies on the international market. Total GDP can also be broken down into the contribution of each industry or sector of the economy. The ratio of GDP to the total population of the region is the per capita GDP (also called the Mean Standard of Living). GDP definitions are maintained by a number of national and international economic organizations. The Org ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

COVID-19

Coronavirus disease 2019 (COVID-19) is a contagious disease caused by a virus, the severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2). The first known case was identified in Wuhan, China, in December 2019. The disease quickly spread worldwide, resulting in the COVID-19 pandemic. The symptoms of COVID‑19 are variable but often include fever, cough, headache, fatigue, breathing difficulties, loss of smell, and loss of taste. Symptoms may begin one to fourteen days after exposure to the virus. At least a third of people who are infected do not develop noticeable symptoms. Of those who develop symptoms noticeable enough to be classified as patients, most (81%) develop mild to moderate symptoms (up to mild pneumonia), while 14% develop severe symptoms (dyspnea, hypoxia, or more than 50% lung involvement on imaging), and 5% develop critical symptoms (respiratory failure, shock, or multiorgan dysfunction). Older people are at a higher risk of developing se ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Personal Exemption

Under United States tax law, a personal exemption is an amount that a resident taxpayer is entitled to claim as a tax deduction against personal income in calculating taxable income and consequently federal income tax. In 2017, the personal exemption amount was $4,050, though the exemption is subject to phase-out limitations. The personal exemption amount is adjusted each year for inflation. The Tax Cuts and Jobs Act of 2017 eliminates personal exemptions for tax years 2018 through 2025. The exemption is composed of personal exemptions for the individual taxpayer and, as appropriate, the taxpayer's spouse and dependents, as provided in Internal Revenue Code at . Overview Section 151 of the Internal Revenue Code was enacted in August 1954, and provided for deductions equal to the "personal exemption" amount in computing taxable income. The exemption was intended to insulate from taxation the minimal amount of income someone would need receive to live at a subsistence level ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

State And Local Tax Deduction

The United States federal state and local tax (SALT) deduction is an itemized deduction that allows taxpayers to deduct certain taxes paid to state and local governments from their adjusted gross income. The Tax Cuts and Jobs Act of 2017 put a $10,000 cap on the SALT deduction for the years 2018–2025. The SALT deduction reduces the cost of state and local taxes to taxpayers. It disproportionately benefits wealthy and high-earning taxpayers in areas with comparatively high state and local taxes. The Tax Policy Center estimated in 2016 that fully eliminating the SALT deduction would increase federal revenue by nearly $1.3 trillion over 10 years. Definition For United States Federal Income Tax purposes, state and local taxes are defined in section 170(a) of the Internal Revenue Code as taxes paid to states and localities in the forms of: (i) real property taxes; (ii) personal property taxes; (iii) income, war profits, and excess profits taxes; and (iv) general sales taxes. The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |