|

Rahn Curve

The Rahn curve is a graph used to illustrate an economic theory, proposed in 1996 by American economist Richard W. Rahn, which suggests that there is a level of government spending that maximizes economic growth. The theory is used by classical liberals to argue for a decrease in overall government spending and taxation. The inverted-U-shaped curve suggests that the optimal level of government spending is 15–25% of GDP.with subtitles dotsub.com See also * Government spending * Laffer curve * Tax cut A tax cut represents a decrease in the amount of money taken from taxpayers to go towards government revenue. Tax cuts decrease the revenue of the government and increase the disposable income of taxpayers. Tax cuts usually refer to reductions i ... References {{reflist * Pettinger, Tejvan: The Rahn Curve – Economic Growth and Level of Spending', economicshelp.org, April 23, 2008. External links search "Rahn" freedomandprosperity.org Economics curves Fiscal policy< ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Rahn Curve

The Rahn curve is a graph used to illustrate an economic theory, proposed in 1996 by American economist Richard W. Rahn, which suggests that there is a level of government spending that maximizes economic growth. The theory is used by classical liberals to argue for a decrease in overall government spending and taxation. The inverted-U-shaped curve suggests that the optimal level of government spending is 15–25% of GDP.with subtitles dotsub.com See also * Government spending * Laffer curve * Tax cut A tax cut represents a decrease in the amount of money taken from taxpayers to go towards government revenue. Tax cuts decrease the revenue of the government and increase the disposable income of taxpayers. Tax cuts usually refer to reductions i ... References {{reflist * Pettinger, Tejvan: The Rahn Curve – Economic Growth and Level of Spending', economicshelp.org, April 23, 2008. External links search "Rahn" freedomandprosperity.org Economics curves Fiscal policy< ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Graph Of A Function

In mathematics, the graph of a function f is the set of ordered pairs (x, y), where f(x) = y. In the common case where x and f(x) are real numbers, these pairs are Cartesian coordinates of points in two-dimensional space and thus form a subset of this plane. In the case of functions of two variables, that is functions whose domain consists of pairs (x, y), the graph usually refers to the set of ordered triples (x, y, z) where f(x,y) = z, instead of the pairs ((x, y), z) as in the definition above. This set is a subset of three-dimensional space; for a continuous real-valued function of two real variables, it is a surface. In science, engineering, technology, finance, and other areas, graphs are tools used for many purposes. In the simplest case one variable is plotted as a function of another, typically using rectangular axes; see '' Plot (graphics)'' for details. A graph of a function is a special case of a relation. In the modern foundations of mathematics, and, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Theory

Economics () is the social science that studies the production, distribution, and consumption of goods and services. Economics focuses on the behaviour and interactions of economic agents and how economies work. Microeconomics analyzes what's viewed as basic elements in the economy, including individual agents and markets, their interactions, and the outcomes of interactions. Individual agents may include, for example, households, firms, buyers, and sellers. Macroeconomics analyzes the economy as a system where production, consumption, saving, and investment interact, and factors affecting it: employment of the resources of labour, capital, and land, currency inflation, economic growth, and public policies that have impact on these elements. Other broad distinctions within economics include those between positive economics, describing "what is", and normative economics, advocating "what ought to be"; between economic theory and applied economics; between rational an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Richard W

Richard is a male given name. It originates, via Old French, from Old Frankish and is a compound of the words descending from Proto-Germanic ''*rīk-'' 'ruler, leader, king' and ''*hardu-'' 'strong, brave, hardy', and it therefore means 'strong in rule'. Nicknames include "Richie", "Dick", "Dickon", " Dickie", " Rich", "Rick", " Rico", " Ricky", and more. Richard is a common English, German and French male name. It's also used in many more languages, particularly Germanic, such as Norwegian, Danish, Swedish, Icelandic, and Dutch, as well as other languages including Irish, Scottish, Welsh and Finnish. Richard is cognate with variants of the name in other European languages, such as the Swedish "Rickard", the Catalan "Ricard" and the Italian "Riccardo", among others (see comprehensive variant list below). People named Richard Multiple people with the same name * Richard Andersen (other) * Richard Anderson (other) * Richard Cartwright (other) ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

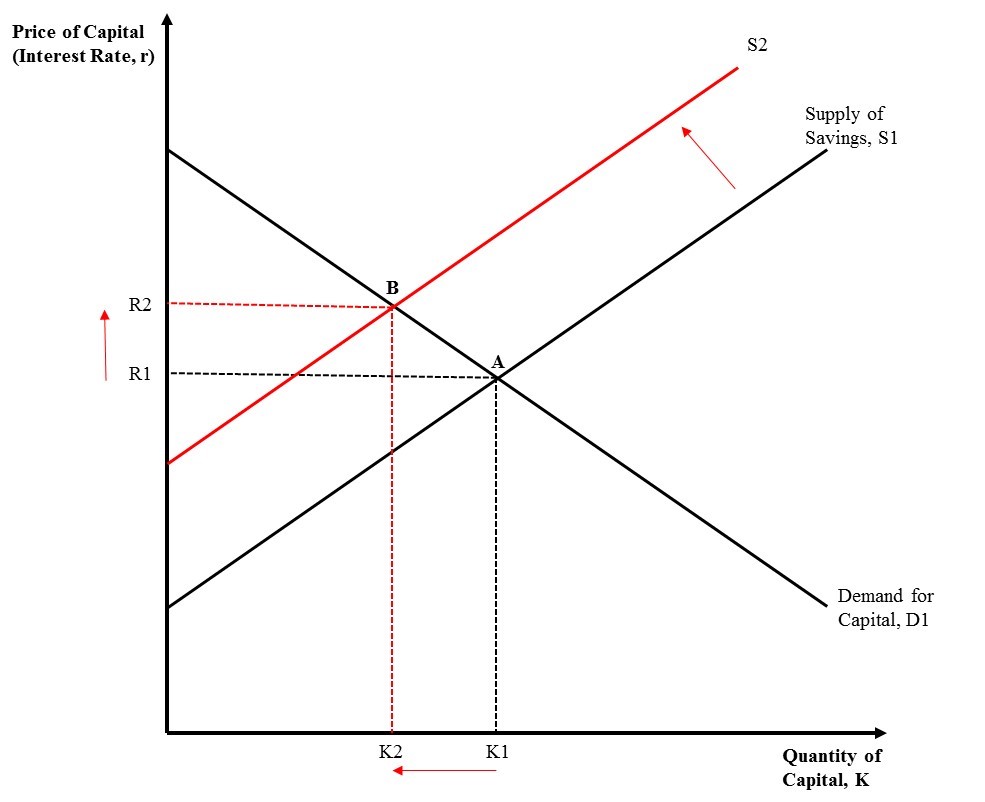

Government Spending

Government spending or expenditure includes all government consumption, investment, and transfer payments. In national income accounting, the acquisition by governments of goods and services for current use, to directly satisfy the individual or collective needs of the community, is classed as government final consumption expenditure. Government acquisition of goods and services intended to create future benefits, such as infrastructure investment or research spending, is classed as government investment (government gross capital formation). These two types of government spending, on final consumption and on gross capital formation, together constitute one of the major components of gross domestic product. Government spending can be financed by government borrowing, taxes, custom duties, the sale or lease of natural resources, and various fees like national park entry fees or licensing fees. When Governments choose to borrow money, they have to pay interest on the money bor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Growth

Economic growth can be defined as the increase or improvement in the inflation-adjusted market value of the goods and services produced by an economy in a financial year. Statisticians conventionally measure such growth as the percent rate of increase in the real gross domestic product, or real GDP. Growth is usually calculated in real terms – i.e., inflation-adjusted terms – to eliminate the distorting effect of inflation on the prices of goods produced. Measurement of economic growth uses national income accounting. Since economic growth is measured as the annual percent change of gross domestic product (GDP), it has all the advantages and drawbacks of that measure. The economic growth-rates of countries are commonly compared using the ratio of the GDP to population (per-capita income). The "rate of economic growth" refers to the geometric annual rate of growth in GDP between the first and the last year over a period of time. This growth rate represents the trend ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Classical Liberals

Classical liberalism is a political tradition and a branch of liberalism that advocates free market and laissez-faire economics; civil liberties under the rule of law with especial emphasis on individual autonomy, limited government, economic freedom, political freedom and freedom of speech. It gained full flowering in the early 18th century, building on ideas stemming at least as far back as the 13th century within the Iberian, Anglo-Saxon, and central European contexts and was foundational to the American Revolution and "American Project" more broadly. Notable liberal individuals whose ideas contributed to classical liberalism include John Locke,Steven M. Dworetz (1994). ''The Unvarnished Doctrine: Locke, Liberalism, and the American Revolution''. Jean-Baptiste Say, Thomas Malthus, and David Ricardo. It drew on classical economics, especially the economic ideas as espoused by Adam Smith in Book One of '' The Wealth of Nations'' and on a belief in natural law, prog ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or national), and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax reliefs. The first known taxation took place in Ancient Egypt around 3000–2800 BC. A failure to pay in a timely manner ( non-compliance), along with evasion of or resistance to taxation, is punishable by law. Taxes consist of direct or indirect taxes and may be paid in money or as its labor equivalent. Most countries have a tax system in place, in order to pay for public, common societal, or agreed national needs and for the functions of government. Some levy a flat percentage rate of taxation on personal annual income, bu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Center For Freedom And Prosperity

The Center for Freedom and Prosperity (CFP or CF&P) is an American nonprofit organization that advocates for flat taxes, territorial taxation systems, and offshore tax havens. The organization and its subsidiary, Center for Freedom and Prosperity Foundation (a tax-exempt organization), publish studies and conduct seminars analyzing the benefits of jurisdictional tax competition, financial privacy and fiscal sovereignty. Background The stated objectives of the CFP are: * Thwarting the Organisation for Economic Co-operation and Development (OECD)'s attempts to create a cartel of high-tax nations – arguing that tax competition should be celebrated, not persecuted, and advocating that high tax regimes should not be able to shield themselves from globalisation. * Protecting world commerce and open trade – it asserts that discriminatory financial protectionism against low-tax nations is a bad idea in principle and should be stopped. * Preserving the ability of sovereign jurisdict ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Spending

Government spending or expenditure includes all government consumption, investment, and transfer payments. In national income accounting, the acquisition by governments of goods and services for current use, to directly satisfy the individual or collective needs of the community, is classed as government final consumption expenditure. Government acquisition of goods and services intended to create future benefits, such as infrastructure investment or research spending, is classed as government investment (government gross capital formation). These two types of government spending, on final consumption and on gross capital formation, together constitute one of the major components of gross domestic product. Government spending can be financed by government borrowing, taxes, custom duties, the sale or lease of natural resources, and various fees like national park entry fees or licensing fees. When Governments choose to borrow money, they have to pay interest on the money bor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Laffer Curve

In economics, the Laffer curve illustrates a theoretical relationship between rates of taxation and the resulting levels of the government's tax revenue. The Laffer curve assumes that no tax revenue is raised at the extreme tax rates of 0% and 100%, meaning that there is a tax rate between 0% and 100% that maximizes government tax revenue. The shape of the curve is a function of taxable income elasticity – i.e., taxable income changes in response to changes in the rate of taxation. As popularized by supply-side economist Arthur Laffer, the curve is typically represented as a graph that starts at 0% tax with zero revenue, rises to a maximum rate of revenue at an intermediate rate of taxation, and then falls again to zero revenue at a 100% tax rate. However, the shape of the curve is uncertain and disputed among economists. One implication of the Laffer curve is that increasing tax rates beyond a certain point is counter-productive for raising further tax revenue. In ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Cut

A tax cut represents a decrease in the amount of money taken from taxpayers to go towards government revenue. Tax cuts decrease the revenue of the government and increase the disposable income of taxpayers. Tax cuts usually refer to reductions in the percentage of tax paid on income, goods and services. As they leave consumers with more disposable income, tax cuts are an example of an expansionary fiscal policy. Tax cuts also include reduction in tax in other ways, such as tax credit, deductions and loopholes. How a tax cut affects the economy depends on which tax is cut. Policies that increase disposable income for lower- and middle-income households are more likely to increase overall consumption and "hence stimulate the economy". Tax cuts in isolation boost the economy because they increase government borrowing. However, they are often accompanied by spending cuts or changes in monetary policy that can offset their stimulative effects. Types Tax cuts are typically cuts in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |