|

Stroud And Swindon Building Society

Stroud & Swindon Building Society was the 10th largest building society in the United Kingdom, with headquarters in Stroud, Gloucestershire and total assets of £2.7 billion as at 31 December 2009. It was a member of the Building Societies Association until its merger with the Coventry Building Society in 2010. Stroud & Swindon Building Society operated through a branch network of 22 offices and 22 agencies in Gloucestershire, Wiltshire, Somerset, Monmouthshire, Devon and Cornwall complemented by a call centre, contact centre based in Gloucester. Stroud & Swindon was a provider of both Mortgage loan, mortgages and Savings account, savings, as well as offering loans, credit cards and insurance. History Stroud and Swindon Building Society was originally established in 1850 as the Stroud Provident Benefit Building Society. The first head office was in Rowcroft in Stroud where the offices of Winterbothams solicitors are now and, indeed, Lyndsey Winterbotham was the first Chairman. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Building Society

A building society is a financial institution owned by its members as a mutual organization. Building societies offer banking and related financial services, especially savings and mortgage lending. Building societies exist in the United Kingdom, Australia and New Zealand, and used to exist in Ireland and several Commonwealth countries. They are similar to credit unions in organisation, though few enforce a common bond. However, rather than promoting thrift and offering unsecured and business loans, the purpose of a building society is to provide home mortgages to members. Borrowers and depositors are society members, setting policy and appointing directors on a one-member, one-vote basis. Building societies often provide other retail banking services, such as current accounts, credit cards and personal loans. The term "building society" first arose in the 19th century in Great Britain from cooperative savings groups. In the United Kingdom, building societies actively compete ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gloucestershire

Gloucestershire ( abbreviated Glos) is a county in South West England. The county comprises part of the Cotswold Hills, part of the flat fertile valley of the River Severn and the entire Forest of Dean. The county town is the city of Gloucester and other principal towns and villages include Cheltenham, Cirencester, Kingswood, Bradley Stoke, Stroud, Thornbury, Yate, Tewkesbury, Bishop's Cleeve, Churchdown, Brockworth, Winchcombe, Dursley, Cam, Berkeley, Wotton-under-Edge, Tetbury, Moreton-in-Marsh, Fairford, Lechlade, Northleach, Stow-on-the-Wold, Chipping Campden, Bourton-on-the-Water, Stonehouse, Nailsworth, Minchinhampton, Painswick, Winterbourne, Frampton Cotterell, Coleford, Cinderford, Lydney and Rodborough and Cainscross that are within Stroud's urban area. Gloucestershire borders Herefordshire to the north-west, Worcestershire to the north, Warwickshire to the north-east, Oxfordshire to the east, Wiltshire to the south, Bristol and Somerset ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurance

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. An entity which provides insurance is known as an insurer, insurance company, insurance carrier, or underwriter. A person or entity who buys insurance is known as a policyholder, while a person or entity covered under the policy is called an insured. The insurance transaction involves the policyholder assuming a guaranteed, known, and relatively small loss in the form of a payment to the insurer (a premium) in exchange for the insurer's promise to compensate the insured in the event of a covered loss. The loss may or may not be financial, but it must be reducible to financial terms. Furthermore, it usually involves something in which the insured has an insurable interest established by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Cards

A credit card is a payment card issued to users (cardholders) to enable the cardholder to pay a merchant for goods and services based on the cardholder's accrued debt (i.e., promise to the card issuer to pay them for the amounts plus the other agreed charges). The card issuer (usually a bank or credit union) creates a revolving account and grants a line of credit to the cardholder, from which the cardholder can borrow money for payment to a merchant or as a cash advance. There are two credit card groups: consumer credit cards and business credit cards. Most cards are plastic, but some are metal cards (stainless steel, gold, palladium, titanium), and a few gemstone-encrusted metal cards. A regular credit card is different from a charge card, which requires the balance to be repaid in full each month or at the end of each statement cycle. In contrast, credit cards allow the consumers to build a continuing balance of debt, subject to interest being charged. A credit card diffe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Loans

In finance, a loan is the lending of money by one or more individuals, organizations, or other entities to other individuals, organizations, etc. The recipient (i.e., the borrower) incurs a debt and is usually liable to pay interest on that debt until it is repaid as well as to repay the principal amount borrowed. The document evidencing the debt (e.g., a promissory note) will normally specify, among other things, the principal amount of money borrowed, the interest rate the lender is charging, and the date of repayment. A loan entails the reallocation of the subject asset(s) for a period of time, between the lender and the borrower. The interest provides an incentive for the lender to engage in the loan. In a legal loan, each of these obligations and restrictions is enforced by contract, which can also place the borrower under additional restrictions known as loan covenants. Although this article focuses on monetary loans, in practice, any material object might be lent. Act ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Savings Account

A savings account is a bank account at a retail bank. Common features include a limited number of withdrawals, a lack of cheque and linked debit card facilities, limited transfer options and the inability to be overdrawn. Traditionally, transactions on savings accounts were widely recorded in a passbook, and were sometimes called passbook savings accounts, and bank statements were not provided; however, currently such transactions are commonly recorded electronically and accessible online. People deposit funds in savings account for a variety of reasons, including a safe place to hold their cash. Savings accounts normally pay interest as well: almost all of them accrue compound interest over time. Several countries require savings accounts to be protected by deposit insurance and some countries provide a government guarantee for at least a portion of the account balance. There are many types of savings accounts, often serving particular purposes. These can include accounts fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mortgage Loan

A mortgage loan or simply mortgage (), in civil law jurisdicions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The loan is " secured" on the borrower's property through a process known as mortgage origination. This means that a legal mechanism is put into place which allows the lender to take possession and sell the secured property ("foreclosure" or " repossession") to pay off the loan in the event the borrower defaults on the loan or otherwise fails to abide by its terms. The word ''mortgage'' is derived from a Law French term used in Britain in the Middle Ages meaning "death pledge" and refers to the pledge ending (dying) when either the obligation is fulfilled or the property is taken through foreclosure. A mortgage can also be described as "a borrower giving consideration in the form ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gloucester

Gloucester ( ) is a cathedral city and the county town of Gloucestershire in the South West of England. Gloucester lies on the River Severn, between the Cotswolds to the east and the Forest of Dean to the west, east of Monmouth and east of the border with Wales. Including suburban areas, Gloucester has a population of around 132,000. It is a port, linked via the Gloucester and Sharpness Canal to the Severn Estuary. Gloucester was founded by the Romans and became an important city and '' colony'' in AD 97 under Emperor Nerva as '' Colonia Glevum Nervensis''. It was granted its first charter in 1155 by Henry II. In 1216, Henry III, aged only nine years, was crowned with a gilded iron ring in the Chapter House of Gloucester Cathedral. Gloucester's significance in the Middle Ages is underlined by the fact that it had a number of monastic establishments, including: St Peter's Abbey founded in 679 (later Gloucester Cathedral), the nearby St Oswald's Priory, Glo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

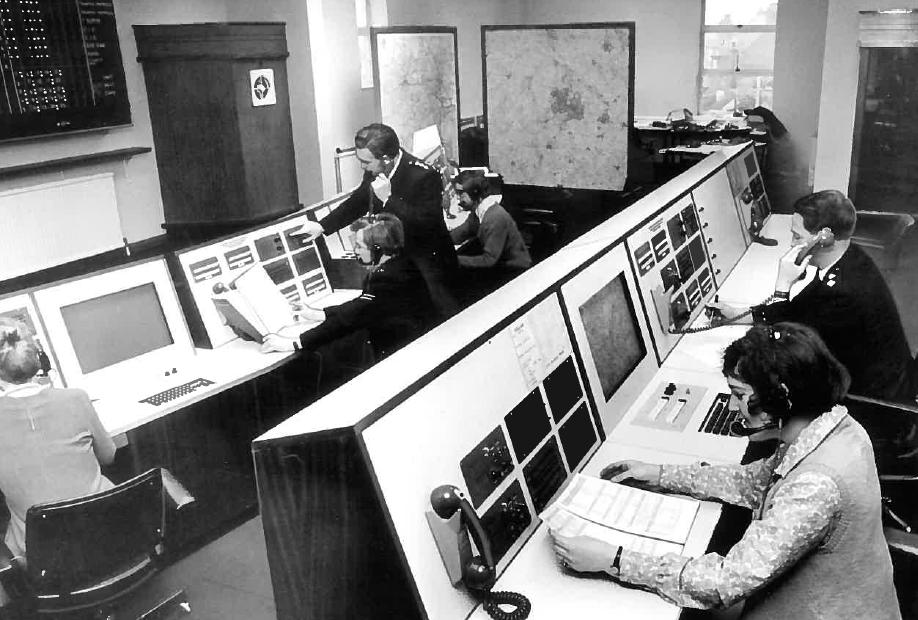

Call Centre

A call centre ( Commonwealth spelling) or call center (American spelling; see spelling differences) is a managed capability that can be centralised or remote that is used for receiving or transmitting a large volume of enquiries by telephone. An inbound call centre is operated by a company to administer incoming product or service support or information enquiries from consumers. Outbound call centres are usually operated for sales purposes such as telemarketing, for solicitation of charitable or political donations, debt collection, market research, emergency notifications, and urgent/critical needs blood banks. A contact centre is a further extension to call centres telephony based capabilities, administers centralised handling of individual communications, including letters, faxes, live support software, social media, instant message, and email. A call center was previously seen to be an open workspace for call center agents, with workstations that include a computer and d ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cornwall

Cornwall (; kw, Kernow ) is a historic county and ceremonial county in South West England. It is recognised as one of the Celtic nations, and is the homeland of the Cornish people. Cornwall is bordered to the north and west by the Atlantic Ocean, to the south by the English Channel, and to the east by the county of Devon, with the River Tamar forming the border between them. Cornwall forms the westernmost part of the South West Peninsula of the island of Great Britain. The southwesternmost point is Land's End and the southernmost Lizard Point. Cornwall has a population of and an area of . The county has been administered since 2009 by the unitary authority, Cornwall Council. The ceremonial county of Cornwall also includes the Isles of Scilly, which are administered separately. The administrative centre of Cornwall is Truro, its only city. Cornwall was formerly a Brythonic kingdom and subsequently a royal duchy. It is the cultural and ethnic origin of the Cornish dias ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Devon

Devon ( , historically known as Devonshire , ) is a ceremonial and non-metropolitan county in South West England. The most populous settlement in Devon is the city of Plymouth, followed by Devon's county town, the city of Exeter. Devon is a coastal county with cliffs and sandy beaches. Home to the largest open space in southern England, Dartmoor (), the county is predominately rural and has a relatively low population density for an English county. The county is bordered by Somerset to the north east, Dorset to the east, and Cornwall to the west. The county is split into the non-metropolitan districts of East Devon, Mid Devon, North Devon, South Hams, Teignbridge, Torridge, West Devon, Exeter, and the unitary authority areas of Plymouth, and Torbay. Combined as a ceremonial county, Devon's area is and its population is about 1.2 million. Devon derives its name from Dumnonia (the shift from ''m'' to ''v'' is a typical Celtic consonant shift). During the Briti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monmouthshire

Monmouthshire ( cy, Sir Fynwy) is a county in the south-east of Wales. The name derives from the historic county of the same name; the modern county covers the eastern three-fifths of the historic county. The largest town is Abergavenny, with other towns and large villages being: Caldicot, Chepstow, Monmouth, Magor and Usk. It borders Torfaen, Newport and Blaenau Gwent to the west; Herefordshire and Gloucestershire to the east; and Powys to the north. Historic county The historic county of Monmouthshire was formed from the Welsh Marches by the Laws in Wales Act 1535 bordering Gloucestershire to the east, Herefordshire to the northeast, Brecknockshire to the north, and Glamorgan to the west. The Laws in Wales Act 1542 enumerated the counties of Wales and omitted Monmouthshire, implying that the county was no longer to be treated as part of Wales. However, for all purposes Wales had become part of the Kingdom of England, and the difference had little practical effect. F ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

_drawn_and_engraved_under_the_direction_of_Edward_Wedlake_Brayley.jpg)