|

Private Foundation (United States)

Until 1969, the term ''private foundation'' was not defined in the United States Internal Revenue Code. Since then, every U.S. charity that qualifies under Section 501(c)(3) of the Internal Revenue Service Code as tax-exempt is a "private foundation" unless it demonstrates to the IRS that it falls into another category such as public charity. Unlike nonprofit corporations classified as a public charity, private foundations in the United States are subject to a 1.39% excise tax or endowment tax on any net investment income. The US-based Foundation Center uses a more specific definition of private foundation which hinges in part on the existence of an Financial endowment, endowment: a private foundation is a nongovernmental, nonprofit organization, which has a principal fund managed by its own trustees or directors. Hopkins (2013) listed four characteristics that make up a private foundation, also including an endowment as a condition for private foundations: * It is a charitable org ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Internal Revenue Code

The Internal Revenue Code (IRC), formally the Internal Revenue Code of 1986, is the domestic portion of federal statutory tax law in the United States, published in various volumes of the United States Statutes at Large, and separately as Title 26 of the United States Code (USC). It is organized topically, into subtitles and sections, covering income tax in the United States, payroll taxes, estate taxes, gift taxes, and excise taxes; as well as procedure and administration. The Code's implementing federal agency is the Internal Revenue Service. Origins of tax codes in the United States Prior to 1874, U.S. statutes (whether in tax law or other subjects) were not codified. That is, the acts of Congress were not separately organized and published in separate volumes based on the subject matter (such as taxation, bankruptcy, etc.). Codifications of statutes, including tax statutes, undertaken in 1873 resulted in the Revised Statutes of the United States, approved June 22, 1874, effe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Rockefeller Foundation

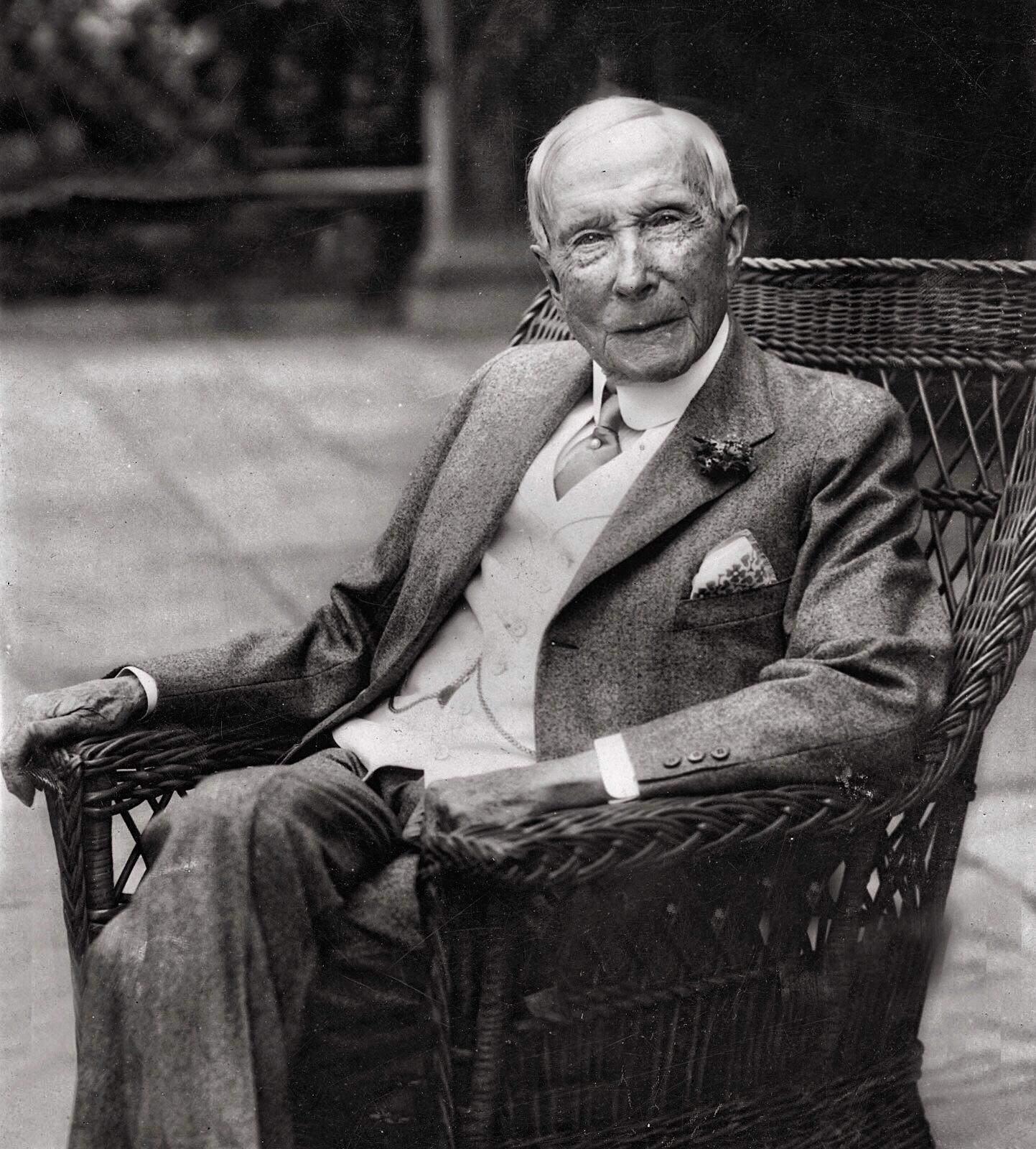

The Rockefeller Foundation is an American private foundation and philanthropic medical research and arts funding organization based at 420 Fifth Avenue, New York City. The second-oldest major philanthropic institution in America, after the Carnegie Corporation, the foundation was ranked as the 39th largest U.S. foundation by total giving as of 2015. By the end of 2016, assets were tallied at $4.1 billion (unchanged from 2015), with annual grants of $173 million. According to the OECD, the foundation provided US$103.8 million for development in 2019. The foundation has given more than $14 billion in current dollars. The foundation was started by Standard Oil magnate John D. Rockefeller ("Senior") and son "Junior", and their primary business advisor, Frederick Taylor Gates, on May 14, 1913, when its charter was granted by New York. The foundation has had an international reach since the 1930s and major influence on global non-governmental organizations. The World Health Organiza ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation In The United States

The United States, United States of America has separate Federal government of the United States, federal, U.S. state, state, and Local government in the United States, local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, Capital gains tax in the United States, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2020, taxes collected by federal, state, and local governments amounted to 25.5% of GDP, below the OECD average of 33.5% of GDP. The United States had the seventh-lowest tax revenue-to-GDP ratio among OECD countries in 2020, with a higher ratio than Mexico, Colombia, Chile, Ireland, Costa Rica, and Turkey. Taxes fall much more heavily on labor income than on capital income. Divergent taxes and subsidies for different forms of income and spending can also constitute a form of indirect taxation of some activities over others. For example, individual spending on higher education can ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Philanthropy

Philanthropy is a form of altruism that consists of "private initiatives, for the Public good (economics), public good, focusing on quality of life". Philanthropy contrasts with business initiatives, which are private initiatives for private good, focusing on material gain; and with government endeavors, which are public initiatives for public good, notably focusing on provision of public services. A person who practices philanthropy is a List of philanthropists, philanthropist. Etymology The word ''philanthropy'' comes , from ''phil''- "love, fond of" and ''anthrōpos'' "humankind, mankind". In the second century AD, Plutarch used the Greek concept of ''philanthrôpía'' to describe superior human beings. During the Middle Ages, ''philanthrôpía'' was superseded in Europe by the Christian theology, Christian cardinal virtue, virtue of ''charity'' (Latin: ''caritas''); selfless love, valued for salvation and escape from purgatory. Thomas Aquinas held that "the habit of charity ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of Wealthiest Charitable Foundations

This is a list of wealthiest charitable foundations worldwide. It consists of the 45 largest charitable foundations, private foundations engaged in philanthropy, and other charitable organizations such as charitable trusts that have disclosed their assets. In many countries, asset disclosure is not legally required or made public. Only nonprofit foundations are included in this list. Organizations that are part of a larger company are excluded, such as holding companies. The entries are ordered by the size of the organization's financial endowment. The endowment value is a rounded estimate measured in United States dollars, based on the exchange rates December 31, 2020. Due to fluctuations in holdings, currency exchange and asset values, this list only represents the valuation of each foundation on a single day. Wealthiest foundations by endowment value See also * List of charitable foundations This is a list of notable charitable foundations. A * AARP Foundation * ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Foundation (nonprofit)

A foundation (also a charitable foundation) is a category of nonprofit organization or charitable trust that typically provides funding and support for other charitable organizations through grants, but may also engage directly in charitable activities. Foundations include public charitable foundations, such as community foundations, and private foundations, which are typically financial endowment, endowed by an individual or family. However, the term "foundation" may also be used by such organizations that are not involved in public grantmaking. Description Legal entities existing under the status of "foundations" have a wide diversity of structures and purposes. Nevertheless, there are some common structural elements. * Legal requirements followed for establishment * Purpose of the foundation * Economic activity * Supervision and management provisions * Accountability and auditing provisions * Provisions for the amendment of the statutes or articles of incorporation * Provisio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Foundation

A private foundation is a tax-exempt organization not relying on broad public support and generally claiming to serve humanitarian purposes. The Bill & Melinda Gates Foundation is the largest private foundation in the U.S. with over $38 billion in assets.National Center for Charitable Statistics Most private foundations are much smaller. Out of the 84,000 private foundations that filed with the IRS in 2008, approximately 66% have less than $1 million in assets, and 93% have less than $10 million in assets. In aggregate, private foundations in the U.S. control over $628 billion in assets and made more than $44 billion in charitable contributions in 2007. Unlike a charitable foundation, a private foundation does not generally solicit funds from the public or have the legal requirements and reporting responsibilities of a registered, non-profit or charitable foundation. Not all foundations engage in philanthropy: some private foundations are used for estate planning purposes. Des ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Foundation (United States Law)

A foundation in the United States is a type of charitable organization. However, the Internal Revenue Code distinguishes between private foundations (usually funded by an individual, family, or corporation) and charitable organization, public charities (community foundations and other nonprofit groups that raise money from the general public). Private foundations have more restrictions and fewer tax benefits than public charities like community foundations. History The two most famous philanthropists of the Gilded Age pioneered the sort of large-scale private philanthropy of which foundations are a modern pillar: John D. Rockefeller and Andrew Carnegie. The businessmen each accumulated private wealth at a scale previously unknown outside of royalty, and each in their later years decided to give much of it away. Carnegie gave away the bulk of his fortune in the form of one-time gifts to build libraries and museums before divesting almost the entirety of his remaining fortune in the C ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bill And Melinda Gates Foundation

The Bill & Melinda Gates Foundation (BMGF), a merging of the William H. Gates Foundation and the Gates Learning Foundation, is an American private foundation founded by Bill Gates and Melinda French Gates. Based in Seattle, Washington, it was launched in 2000 and is reported as of 2020 to be the second largest charitable foundation in the world, holding $49.8 billion in assets. On his 43rd birthday, Bill Gates gave the foundation $1 billion. The primary stated goals of the foundation are to enhance healthcare and reduce extreme poverty across the world, and to expand educational opportunities and access to information technology in the U.S. Key individuals of the foundation include Bill Gates, Melinda French Gates, Warren Buffett, chief executive officer Mark Suzman, and Michael Larson. The BMGF had an endowment of approximately $50 billion . The scale of the foundation and the way it seeks to apply business techniques to giving makes it one of the leaders in venture philanth ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wall Street Journal

''The Wall Street Journal'' is an American business-focused, international daily newspaper based in New York City, with international editions also available in Chinese and Japanese. The ''Journal'', along with its Asian editions, is published six days a week by Dow Jones & Company, a division of News Corp. The newspaper is published in the broadsheet format and online. The ''Journal'' has been printed continuously since its inception on July 8, 1889, by Charles Dow, Edward Jones, and Charles Bergstresser. The ''Journal'' is regarded as a newspaper of record, particularly in terms of business and financial news. The newspaper has won 38 Pulitzer Prizes, the most recent in 2019. ''The Wall Street Journal'' is one of the largest newspapers in the United States by circulation, with a circulation of about 2.834million copies (including nearly 1,829,000 digital sales) compared with ''USA Today''s 1.7million. The ''Journal'' publishes the luxury news and lifestyle magazine ' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

501(c)(3)

A 501(c)(3) organization is a United States corporation, trust, unincorporated association or other type of organization exempt from federal income tax under section 501(c)(3) of Title 26 of the United States Code. It is one of the 29 types of 501(c) nonprofit organizations in the US. 501(c)(3) tax-exemptions apply to entities that are organized and operated exclusively for religious, charitable, scientific, literary or educational purposes, for testing for public safety, to foster national or international amateur sports competition, or for the prevention of cruelty to children or animals. 501(c)(3) exemption applies also for any non-incorporated community chest, fund, cooperating association or foundation organized and operated exclusively for those purposes.IR ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Wall Street Journal

''The Wall Street Journal'' is an American business-focused, international daily newspaper based in New York City, with international editions also available in Chinese and Japanese. The ''Journal'', along with its Asian editions, is published six days a week by Dow Jones & Company, a division of News Corp. The newspaper is published in the broadsheet format and online. The ''Journal'' has been printed continuously since its inception on July 8, 1889, by Charles Dow, Edward Jones, and Charles Bergstresser. The ''Journal'' is regarded as a newspaper of record, particularly in terms of business and financial news. The newspaper has won 38 Pulitzer Prizes, the most recent in 2019. ''The Wall Street Journal'' is one of the largest newspapers in the United States by circulation, with a circulation of about 2.834million copies (including nearly 1,829,000 digital sales) compared with ''USA Today''s 1.7million. The ''Journal'' publishes the luxury news and lifestyle magazine ' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |