|

Pareto Efficiency

In welfare economics, a Pareto improvement formalizes the idea of an outcome being "better in every possible way". A change is called a Pareto improvement if it leaves at least one person in society better off without leaving anyone else worse off than they were before. A situation is called Pareto efficient or Pareto optimal if all possible Pareto improvements have already been made; in other words, there are no longer any ways left to make one person better off without making some other person worse-off. In social choice theory, the same concept is sometimes called the unanimity principle, which says that if ''everyone'' in a society (strict inequality, non-strictly) prefers A to B, society as a whole also non-strictly prefers A to B. The Pareto frontier, Pareto front consists of all Pareto-efficient situations. In addition to the context of efficiency in ''allocation'', the concept of Pareto efficiency also arises in the context of productive efficiency, ''efficiency in prod ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Welfare Economics

Welfare economics is a field of economics that applies microeconomic techniques to evaluate the overall well-being (welfare) of a society. The principles of welfare economics are often used to inform public economics, which focuses on the ways in which government intervention can improve social welfare. Additionally, welfare economics serves as the theoretical foundation for several instruments of public economics, such as cost–benefit analysis. The intersection of welfare economics and behavioral economics has given rise to the subfield of behavioral welfare economics. Two fundamental theorems are associated with welfare economics. The first states that competitive markets, under certain assumptions, lead to Pareto efficient outcomes. This idea is sometimes referred to as Adam Smith's invisible hand. The second theorem states that with further restrictions, any Pareto efficient outcome can be achieved through a competitive market equilibrium, provided that a social ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

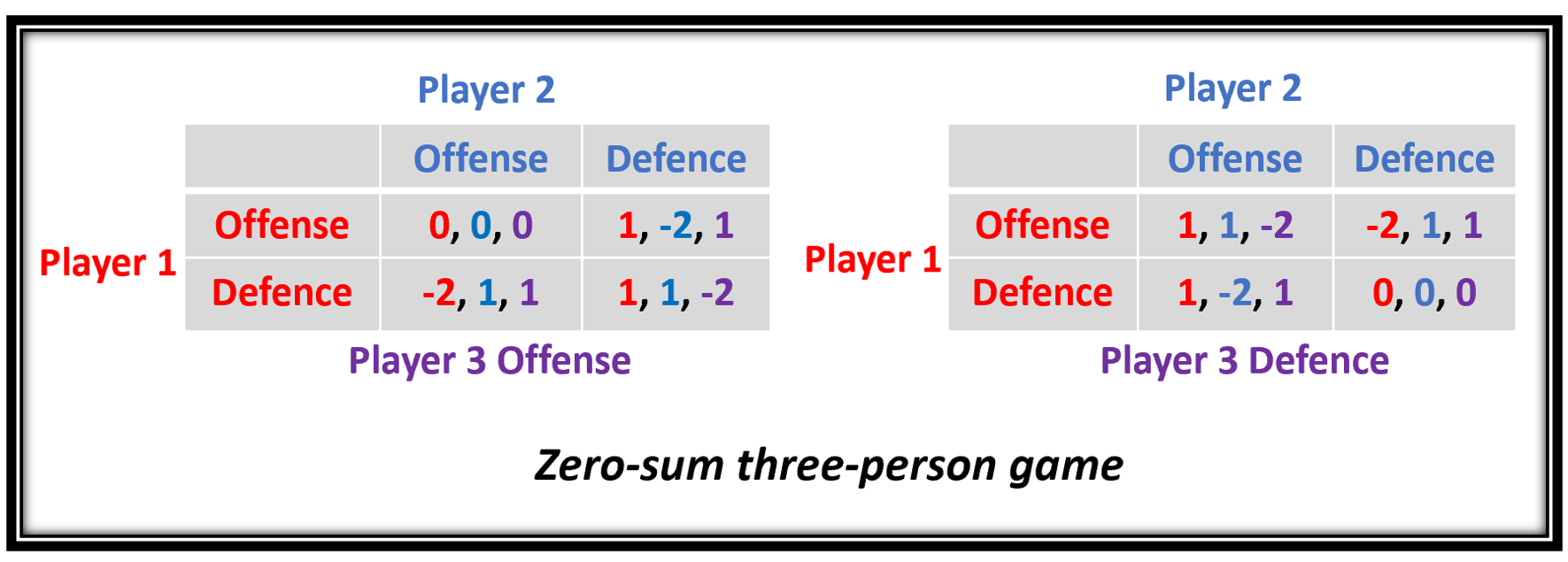

Zero-sum Games

Zero-sum game is a mathematical representation in game theory and economic theory of a situation that involves two competing entities, where the result is an advantage for one side and an equivalent loss for the other. In other words, player one's gain is equivalent to player two's loss, with the result that the net improvement in benefit of the game is zero. If the total gains of the participants are added up, and the total losses are subtracted, they will sum to zero. Thus, cutting a cake, where taking a more significant piece reduces the amount of cake available for others as much as it increases the amount available for that taker, is a zero-sum game if all participants value each unit of cake equally. Other examples of zero-sum games in daily life include games like poker, chess, sport and bridge where one person gains and another person loses, which results in a zero-net benefit for every player. In the markets and financial instruments, futures contracts and options are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Failure

In neoclassical economics, market failure is a situation in which the allocation of goods and services by a free market is not Pareto efficient, often leading to a net loss of economic value.Paul Krugman and Robin Wells Krugman, Robin Wells (2006). ''Economics'', New York, Worth Publishers. The first known use of the term by economists was in 1958,Francis M. Bator (1958). "The Anatomy of Market Failure," ''Quarterly Journal of Economics'', 72(3) pp351–379(press +). but the concept has been traced back to the Victorian writers John Stuart Mill and Henry Sidgwick.Steven G. Medema (2007). "The Hesitant Hand: Mill, Sidgwick, and the Evolution of the Theory of Market Failure," ''History of Political Economy'', 39(3)pp. 331��358. 200Online Working Paper. Market failures are often associated with public goods, time-inconsistent preferences, Information asymmetry, information asymmetries, Market structure, failures of competition, principal–agent problems, externalities,Jean-Jacques L ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lump-sum

A lump sum is a single payment of money, as opposed to a series of payments made over time (such as an annuity). The United States Department of Housing and Urban Development distinguishes between " price analysis" and " cost analysis" by whether the decision maker compares lump sum amounts, or subjects contract prices to an itemized cost breakdown. In 1911, American union leaders including Samuel Gompers of the American Federation of Labor expressed opposition to lump sums being awarded to their members pursuant to a new workers compensation law by saying that when they received lump sums rather than periodic payments, the risk of them squandering the money was greater. ''The Financial Times'' reported in July 2011 that research by Prudential had found that 79% of polled pensioners in the UK collecting a company or private pension that year took a tax-free lump sum as part of their retirement benefits, as compared to 76% in 2008. Prudential was of the view that for many ret ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Free Market

In economics, a free market is an economic market (economics), system in which the prices of goods and services are determined by supply and demand expressed by sellers and buyers. Such markets, as modeled, operate without the intervention of Forms of government, government or any other external authority. Proponents of the free market as a normative ideal contrast it with a regulated market, in which a government intervenes in supply and demand by means of various methods such as taxes or regulations. In an idealized free market economy, prices for goods and services are set solely by the bids and offers of the participants. Scholars contrast the concept of a free market with the concept of a Coordinated market economy, coordinated market in fields of study such as political economy, new institutional economics, economic sociology, and political science. All of these fields emphasize the importance in currently existing market systems of rule-making institutions external to th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Competitive Equilibrium

Competitive equilibrium (also called: Walrasian equilibrium) is a concept of economic equilibrium, introduced by Kenneth Arrow and Gérard Debreu in 1951, appropriate for the analysis of commodity markets with flexible prices and many traders, and serving as the benchmark of efficiency in economic analysis. It relies crucially on the assumption of a competitive environment where each trader decides upon a quantity that is so small compared to the total quantity traded in the market that their individual transactions have no influence on the prices. Competitive markets are an ideal standard by which other market structures are evaluated. Definitions A competitive equilibrium (CE) consists of two elements: * A price function P. It takes as argument a vector representing a bundle of commodities, and returns a positive real number that represents its price. Usually the price function is linear - it is represented as a vector of prices, a price for each commodity type. * An allocation ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Second Welfare Theorem

There are two fundamental theorems of welfare economics. The first states that in economic equilibrium, a set of complete markets, with complete information, and in perfect competition, will be Pareto optimal (in the sense that no further exchange would make one person better off without making another worse off). The requirements for perfect competition are these: # There are no externalities and each actor has perfect information. # Firms and consumers take prices as given (no economic actor or group of actors has market power). The theorem is sometimes seen as an analytical confirmation of Adam Smith's "invisible hand" principle, namely that ''competitive markets ensure an efficient allocation of resources''. However, there is no guarantee that the Pareto optimal market outcome is equitative, as there are many possible Pareto efficient allocations of resources differing in their desirability (e.g. one person may own everything and everyone else nothing). The second theorem s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Joseph Stiglitz

Joseph Eugene Stiglitz (; born February 9, 1943) is an American New Keynesian economist, a public policy analyst, political activist, and a professor at Columbia University. He is a recipient of the Nobel Memorial Prize in Economic Sciences (2001) and the John Bates Clark Medal (1979). He is a former senior vice president and chief economist of the World Bank. He is also a former member and chairman of the U.S. Council of Economic Advisers. He is known for his support for the Georgist public finance theory and for his critical view of the management of globalization, of ''laissez-faire'' economists (whom he calls " free-market fundamentalists"), and of international institutions such as the International Monetary Fund and the World Bank. In 2000, Stiglitz founded the Initiative for Policy Dialogue (IPD), a think tank on international development based at Columbia University. He has been a member of the Columbia faculty since 2001 and received the university's highest academ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Perfect Information

Perfect information is a concept in game theory and economics that describes a situation where all players in a game or all participants in a market have knowledge of all relevant information in the system. This is different than complete information, which implies Common knowledge (logic), common knowledge of each agent's utility functions, payoffs, strategies and "types". A system with perfect information may or may not have complete information. In economics this is sometimes described as "no hidden information" and is a feature of perfect competition. In a market with perfect information all consumers and producers would have complete and instantaneous knowledge of all market prices, their own utility and cost functions. In game theory, a sequential game has perfect information if each player, when making any decision, is perfectly informed of all the events that have previously occurred, including the "initialization event" of the game (e.g. the starting hands of each player ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Externality

In economics, an externality is an Indirect costs, indirect cost (external cost) or indirect benefit (external benefit) to an uninvolved third party that arises as an effect of another party's (or parties') activity. Externalities can be considered as unpriced components that are involved in either consumer or producer consumption. Air pollution from motor vehicles is one example. The Air pollution#Health effects, cost of air pollution to society is not paid by either the producers or users of motorized transport. Water pollution from mills and factories are another example. All (water) consumers are made worse off by pollution but are not compensated by the market for this damage. The concept of externality was first developed by Alfred Marshall in the 1890s and achieved broader attention in the works of economist Arthur Cecil Pigou, Arthur Pigou in the 1920s. The prototypical example of a negative externality is environmental pollution. Pigou argued that a tax, equal to the m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gérard Debreu

Gérard Debreu (; 4 July 1921 – 31 December 2004) was a French-born economist and mathematician. Best known as a professor of economics at the University of California, Berkeley, where he began work in 1962, he won the 1983 Nobel Memorial Prize in Economic Sciences. Biography His father was the business partner of his maternal grandfather in lace manufacturing, a traditional industry in Calais. Debreu was orphaned at an early age, as his father committed suicide and his mother died of natural causes. Prior to the start of World War II, he received his baccalauréat and went to Ambert to begin preparing for the entrance examination of a grande école. Later on, he moved from Ambert to Grenoble to complete his preparation, both places being in Vichy France during World War II. In 1941, he was admitted to the École Normale Supérieure in Paris, along with Marcel Boiteux. He was influenced by Henri Cartan and the Bourbaki writers. When he was about to take the final examinati ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Kenneth Arrow

Kenneth Joseph Arrow (August 23, 1921 – February 21, 2017) was an American economist, mathematician and political theorist. He received the John Bates Clark Medal in 1957, and the Nobel Memorial Prize in Economic Sciences in 1972, along with John Hicks. In economics, Arrow was a major figure in postwar neoclassical economic theory. Four of his students (Roger Myerson, Eric Maskin, John Harsanyi, and Michael Spence) went on to become Nobel laureates themselves. His contributions to social choice theory, notably his " impossibility theorem", and his work on general equilibrium analysis are significant. His work in many other areas of economics, including endogenous growth theory and the economics of information, was also foundational. Education and early career Arrow was born on August 23, 1921, in New York City. Arrow's mother, Lilian (Greenberg), was from Iași, Romania, and his father, Harry Arrow, was from nearby Podu Iloaiei. The family was of Romanian-Jewish desc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |