|

Marginal Propensity To Save

The marginal propensity to save (MPS) is the fraction of an increase in income that is not spent and instead used for saving. It is the slope of the line plotting saving against income. For example, if a household earns one extra dollar, and the marginal propensity to save is 0.35, then of that dollar, the household will spend 65 cents and save 35 cents. Likewise, it is the fractional decrease in saving that results from a decrease in income. The MPS plays a central role in Keynesian economics as it quantifies the saving-income relation, which is the flip side of the consumption-income relation, and according to Keynes it reflects the fundamental psychological law. The marginal propensity to save is also a key variable in determining the value of the multiplier. Calculation MPS can be calculated as the change in savings divided by the change in income. :MPS=\frac Or mathematically, the marginal propensity to save (MPS) function is expressed as the derivative of the savings ( ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income

Income is the consumption and saving opportunity gained by an entity within a specified timeframe, which is generally expressed in monetary terms. Income is difficult to define conceptually and the definition may be different across fields. For example, a person's income in an economic sense may be different from their income as defined by law. An extremely important definition of income is Haig–Simons income, which defines income as ''Consumption + Change in net worth'' and is widely used in economics. For households and individuals in the United States, income is defined by tax law as a sum that includes any wage, salary, profit, interest payment, rent, or other form of earnings received in a calendar year.Case, K. & Fair, R. (2007). ''Principles of Economics''. Upper Saddle River, NJ: Pearson Education. p. 54. Discretionary income is often defined as gross income minus taxes and other deductions (e.g., mandatory pension contributions), and is widely used as a basis to co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Saving

Saving is income not spent, or deferred consumption. Methods of saving include putting money aside in, for example, a deposit account, a pension account, an investment fund, or as cash. Saving also involves reducing expenditures, such as recurring costs. In terms of personal finance, saving generally specifies low-risk preservation of money, as in a deposit account, versus investment, wherein risk is a lot higher; in economics more broadly, it refers to any income not used for immediate consumption. Saving does not automatically include interest. ''Saving'' differs from ''savings''. The former refers to the act of not consuming one's assets, whereas the latter refers to either multiple opportunities to reduce costs; or one's assets in the form of cash. Saving refers to an activity occurring over time, a flow variable, whereas savings refers to something that exists at any one time, a stock variable. This distinction is often misunderstood, and even professional economists an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Keynesian Economics

Keynesian economics ( ; sometimes Keynesianism, named after British economist John Maynard Keynes) are the various macroeconomic theories and models of how aggregate demand (total spending in the economy) strongly influences economic output and inflation. In the Keynesian view, aggregate demand does not necessarily equal the productive capacity of the economy. Instead, it is influenced by a host of factors – sometimes behaving erratically – affecting production, employment, and inflation. Keynesian economists generally argue that aggregate demand is volatile and unstable and that, consequently, a market economy often experiences inefficient macroeconomic outcomes – a recession, when demand is low, or inflation, when demand is high. Further, they argue that these economic fluctuations can be mitigated by economic policy responses coordinated between government and central bank. In particular, fiscal policy actions (taken by the government) and monetary policy actions (t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Keynes

John Maynard Keynes, 1st Baron Keynes, ( ; 5 June 1883 – 21 April 1946), was an English economist whose ideas fundamentally changed the theory and practice of macroeconomics and the economic policies of governments. Originally trained in mathematics, he built on and greatly refined earlier work on the causes of business cycles. One of the most influential economists of the 20th century, he produced writings that are the basis for the school of thought known as Keynesian economics, and its various offshoots. His ideas, reformulated as New Keynesianism, are fundamental to mainstream macroeconomics. Keynes's intellect was evident early in life; in 1902, he gained admittance to the competitive mathematics program at King's College at the University of Cambridge. During the Great Depression of the 1930s, Keynes spearheaded a revolution in economic thinking, challenging the ideas of neoclassical economics that held that free markets would, in the short to medium term, automa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

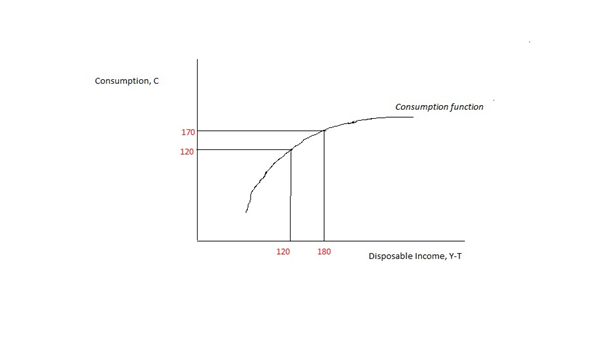

Fundamental Psychological Law

According to Keyne’s Psychological Law of Consumption, Consumption is a function of income. In his words; “Human is disposal by nature, as income increases, consumption expenditure also increases but increase in consumption is smaller than the increase in income”. Mathematically C= f(y) ; i.e. C = a + b(y), Where a = Autonomous Consumption, b = MPC and Y = Income In Keynesian macroeconomics, the Fundamental Psychological Law underlying the consumption function states that marginal propensity to consume (MPC) and marginal propensity to save The marginal propensity to save (MPS) is the fraction of an increase in income that is not spent and instead used for saving. It is the slope of the line plotting saving against income. For example, if a household earns one extra dollar, and the ... (MPS) are greater than zero(0) but less than one(1) MPC+MPS = 1 e.g. Whenever national income rises by $1 part of this will be consumed and part of this will be saved References *. * * * {{ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Multiplier (economics)

In macroeconomics, a multiplier is a factor of proportionality that measures how much an endogenous variable changes in response to a change in some exogenous variable. For example, suppose variable ''x'' changes by ''k'' units, which causes another variable ''y'' to change by ''M'' × ''k'' units. Then the multiplier is ''M''. Common uses Two multipliers are commonly discussed in introductory macroeconomics. Commercial banks create money, especially under the fractional-reserve banking system used throughout the world. In this system, money is created whenever a bank gives out a new loan. This is because the loan, when drawn on and spent, mostly finishes up as a deposit back in the banking system and is counted as part of money supply. After putting aside a part of these deposits as mandated bank reserves, the balance is available for the making of further loans by the bank. This process continues multiple times, and is called the multiplier effect. The multiplier may v ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

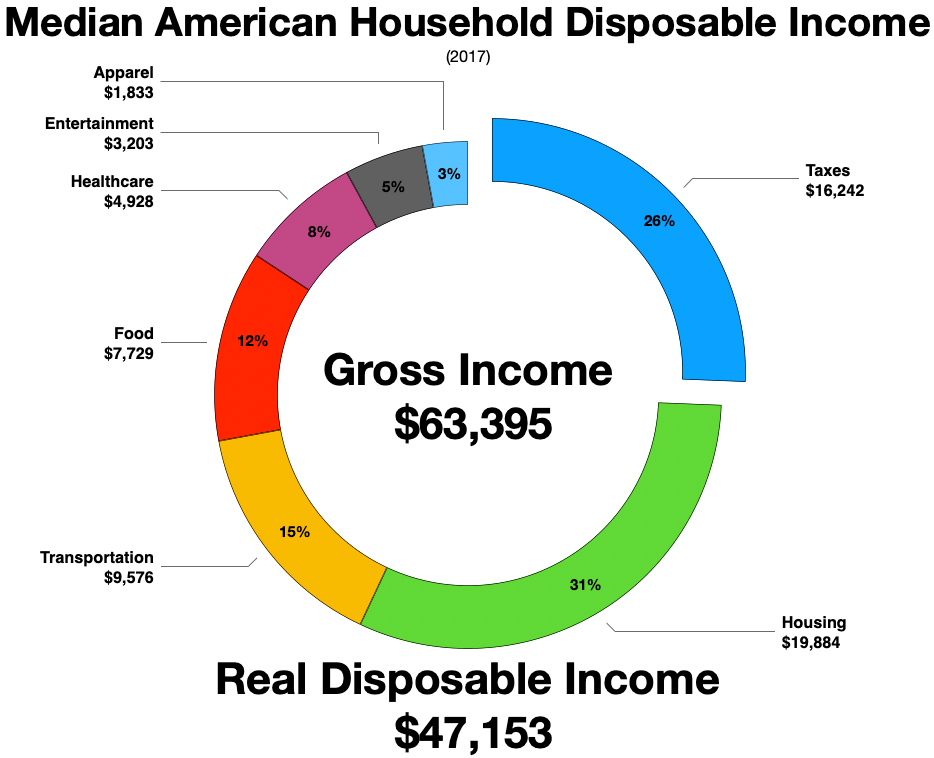

Disposable Income

Disposable income is total personal income minus current income taxes. In national accounts definitions, personal income minus personal current taxes equals disposable personal income. Subtracting personal outlays (which includes the major category of personal r privateconsumption expenditure) yields personal (or, private) savings, hence the income left after paying away all the taxes is referred to as disposable income. Restated, consumption expenditure plus savings equals disposable income after accounting for transfers such as payments to children in school or elderly parents’ living and care arrangements. The marginal propensity to consume (MPC) is the fraction of a change in disposable income that is consumed. For example, if disposable income rises by $100, and $65 of that $100 is consumed, the MPC is 65%. Restated, the marginal propensity to save is 35%. For the purposes of calculating the amount of income subject to garnishments, United States' federal law defin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Savings Function

''The'' () is a grammatical Article (grammar), article in English language, English, denoting persons or things already mentioned, under discussion, implied or otherwise presumed familiar to listeners, readers, or speakers. It is the definite article in English. ''The'' is the Most common words in English, most frequently used word in the English language; studies and analyses of texts have found it to account for seven percent of all printed English-language words. It is derived from gendered articles in Old English which combined in Middle English and now has a single form used with pronouns of any gender. The word can be used with both singular and plural nouns, and with a noun that starts with any letter. This is different from many other languages, which have different forms of the definite article for different genders or numbers. Pronunciation In most dialects, "the" is pronounced as (with the voiced dental fricative followed by a schwa) when followed by a consonant s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Marginal Propensity To Consume

In economics, the marginal propensity to consume (MPC) is a metric that quantifies induced consumption, the concept that the increase in personal consumer spending (consumption) occurs with an increase in disposable income (income after taxes and transfers). The proportion of disposable income which individuals spend on consumption is known as propensity to consume. MPC is the proportion of additional income that an individual consumes. For example, if a household earns one extra dollar of disposable income, and the marginal propensity to consume is 0.65, then of that dollar, the household will spend 65 cents and save 35 cents. Obviously, the household cannot spend ''more'' than the extra dollar (without borrowing or using savings). If the extra money accessed by the individual gives more economic confidence, then the MPC of the individual may well exceed 1, as they may borrow or utilise savings. The MPC is higher in the case of poorer people than in rich. According to John Mayna ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Marginal Propensity To Import

The marginal propensity to import (MPM) is the fractional change in import expenditure that occurs with a change in disposable income (income after taxes and transfers). For example, if a household earns one extra dollar of disposable income, and the marginal propensity to import is 0.2, then the household will spend 20 cents of that dollar on imported goods and services. Mathematically, the marginal propensity to import (MPM) function is expressed as the derivative of the import (M) function with respect to disposable income (Y).\mathrm=\fracIn other words, the marginal propensity to import is measured as the ratio of the change in imports to the change in income, thus giving us a figure between 0 and 1. Imports are also considered to be automatic stabilisers that work to lessen fluctuations in real GDP. The UK government assumes that UK citizens have a high marginal propensity to import and thus will use a decrease in disposable income as a tool to control the current accou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Average Propensity To Consume

Average propensity to consume (as well as the marginal propensity to consume) is a concept developed by John Maynard Keynes to analyze the consumption function, which is a formula where total consumption expenditures (C) of a household consist of autonomous consumption (Ca) and income (Y) (or disposable income (YD)) multiplied by marginal propensity to consume (c or MPC). According to Keynes, the individual´s real income determines saving and consumption decisions. Consumption function: C=+cY The average propensity to consume is referred to as the percentage of income spent on goods and services. It is the proportion of income that is consumed and it is calculated by dividing total consumption expenditure (C) by total income (Y): APC=\frac=\frac+c It can be also explained as spending on every monetary unit of income. Moreover Keynes´s theory claims that wealthier people spend less of their income on consumption than less wealthy people. This is caused by autonomous consumptio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Average Propensity To Save

In Keynesian economics, the average propensity to save (APS), also known as the savings ratio, is the proportion of income which is saved, usually expressed for household savings as a fraction of total household disposable income (taxed income). APS=\frac The ratio differs considerably over time and between countries. The savings ratio for an entire economy can be affected by (for example) the proportion of older people (as they have less motivation and capability to save), and the rate of inflation (as expectations of rising prices can encourage people to spend now rather than later) or current interest rates. APS can express the social preference for investing in the future over consuming in the present. The complement (1 minus the APS) is the average propensity to consume (APC). Low average propensity to save might be the indicator of a large percentage of old people or high percentage of irresponsible young people in the population. With income level changes, APS becomes an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.png)