|

Fundamental Psychological Law

According to Keyne’s Psychological Law of Consumption, Consumption is a function of income. In his words; “Human is disposal by nature, as income increases, consumption expenditure also increases but increase in consumption is smaller than the increase in income”. Mathematically C= f(y) ; i.e. C = a + b(y), Where a = Autonomous Consumption, b = MPC and Y = Income In Keynesian macroeconomics, the Fundamental Psychological Law underlying the consumption function states that marginal propensity to consume (MPC) and marginal propensity to save The marginal propensity to save (MPS) is the fraction of an increase in income that is not spent and instead used for saving. It is the slope of the line plotting saving against income. For example, if a household earns one extra dollar, and the ... (MPS) are greater than zero(0) but less than one(1) MPC+MPS = 1 e.g. Whenever national income rises by $1 part of this will be consumed and part of this will be saved References *. * * * {{ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Keynesian

Keynesian economics ( ; sometimes Keynesianism, named after British economist John Maynard Keynes) are the various macroeconomic theories and models of how aggregate demand (total spending in the economy) strongly influences economic output and inflation. In the Keynesian view, aggregate demand does not necessarily equal the productive capacity of the economy. Instead, it is influenced by a host of factors – sometimes behaving erratically – affecting production, employment, and inflation. Keynesian economists generally argue that aggregate demand is volatile and unstable and that, consequently, a market economy often experiences inefficient macroeconomic outcomes – a recession, when demand is low, or inflation, when demand is high. Further, they argue that these economic fluctuations can be mitigated by economic policy responses coordinated between government and central bank. In particular, fiscal policy actions (taken by the government) and monetary policy actions (tak ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Macroeconomics

Macroeconomics (from the Greek prefix ''makro-'' meaning "large" + ''economics'') is a branch of economics dealing with performance, structure, behavior, and decision-making of an economy as a whole. For example, using interest rates, taxes, and government spending to regulate an economy's growth and stability. This includes regional, national, and global economies. According to a 2018 assessment by economists Emi Nakamura and Jón Steinsson, economic "evidence regarding the consequences of different macroeconomic policies is still highly imperfect and open to serious criticism." Macroeconomists study topics such as Gross domestic product, GDP (Gross Domestic Product), unemployment (including Unemployment#Measurement, unemployment rates), national income, price index, price indices, output (economics), output, Consumption (economics), consumption, inflation, saving, investment (macroeconomics), investment, Energy economics, energy, international trade, and international finance. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumption Function

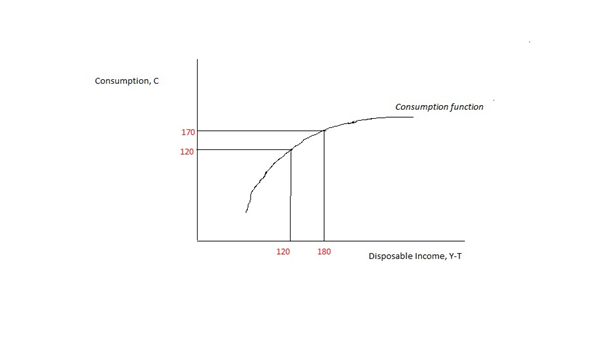

In economics, the consumption function describes a relationship between consumption and disposable income. The concept is believed to have been introduced into macroeconomics by John Maynard Keynes in 1936, who used it to develop the notion of a government spending multiplier. Details Its simplest form is the ''linear consumption function'' used frequently in simple Keynesian models: :C = a + b \cdot Y_ where a is the autonomous consumption that is independent of disposable income; in other words, consumption when disposable income is zero. The term b \cdot Y_ is the induced consumption that is influenced by the economy's income level Y_. The parameter b is known as the marginal propensity to consume, i.e. the increase in consumption due to an incremental increase in disposable income, since \partial C / \partial Y_ = b. Geometrically, b is the slope of the consumption function. Keynes proposed this model to fit three stylized facts: * People typically spend a part, but not ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Marginal Propensity To Consume

In economics, the marginal propensity to consume (MPC) is a metric that quantifies induced consumption, the concept that the increase in personal consumer spending (consumption) occurs with an increase in disposable income (income after taxes and transfers). The proportion of disposable income which individuals spend on consumption is known as propensity to consume. MPC is the proportion of additional income that an individual consumes. For example, if a household earns one extra dollar of disposable income, and the marginal propensity to consume is 0.65, then of that dollar, the household will spend 65 cents and save 35 cents. Obviously, the household cannot spend ''more'' than the extra dollar (without borrowing or using savings). If the extra money accessed by the individual gives more economic confidence, then the MPC of the individual may well exceed 1, as they may borrow or utilise savings. The MPC is higher in the case of poorer people than in rich. According to John Mayna ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Marginal Propensity To Save

The marginal propensity to save (MPS) is the fraction of an increase in income that is not spent and instead used for saving. It is the slope of the line plotting saving against income. For example, if a household earns one extra dollar, and the marginal propensity to save is 0.35, then of that dollar, the household will spend 65 cents and save 35 cents. Likewise, it is the fractional decrease in saving that results from a decrease in income. The MPS plays a central role in Keynesian economics as it quantifies the saving-income relation, which is the flip side of the consumption-income relation, and according to Keynes it reflects the fundamental psychological law. The marginal propensity to save is also a key variable in determining the value of the multiplier. Calculation MPS can be calculated as the change in savings divided by the change in income. :MPS=\frac Or mathematically, the marginal propensity to save (MPS) function is expressed as the derivative of the savings ( ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Quarterly Journal Of Economics

''The Quarterly Journal of Economics'' is a peer-reviewed academic journal published by the Oxford University Press for the Harvard University Department of Economics. Its current editors-in-chief are Robert J. Barro, Lawrence F. Katz, Nathan Nunn, Andrei Shleifer, and Stefanie Stantcheva. History It is the oldest professional journal of economics in the English language, and covers all aspects of the field—from the journal's traditional emphasis on micro-theory to both empirical and theoretical macroeconomics. Reception According to the ''Journal Citation Reports'', the journal has a 2015 impact factor of 6.662, ranking it first out of 347 journals in the category "Economics". It is generally regarded as one of the top 5 journals in economics, together with the American Economic Review, Econometrica, the Journal of Political Economy, and the Review of Economic Studies. Notable papers Some of the most influential and well-read papers in economics have been published in th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |