|

Murabaha

''Murabaḥah'', ''murabaḥa'', or ''murâbaḥah'' ( ar, مرابحة, derived from ''ribh'' ar, ربح, meaning profit) was originally a term of ''fiqh'' (Islamic jurisprudence) for a sales contract where the buyer and seller agree on the markup (profit) or "cost-plus" price for the item(s) being sold. In recent decades it has become a term for a very common form of Islamic (i.e., "shariah compliant") financing, where the price is marked up in exchange for allowing the buyer to pay over time—for example with monthly payments (a contract with deferred payment being known as ''bai-muajjal''). ''Murabaha'' financing is similar to a rent-to-own arrangement in the non-Muslim world, with the intermediary (e.g., the lending bank) retaining ownership of the item being sold until the loan is paid in full. There are also Islamic investment funds and ''sukuk'' (Islamic bonds) that use ''murabahah'' contracts. Jamaldeen, ''Islamic Finance For Dummies'', 2012:188-9, 220-1 The purpose o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Murabaha

''Murabaḥah'', ''murabaḥa'', or ''murâbaḥah'' ( ar, مرابحة, derived from ''ribh'' ar, ربح, meaning profit) was originally a term of ''fiqh'' (Islamic jurisprudence) for a sales contract where the buyer and seller agree on the markup (profit) or "cost-plus" price for the item(s) being sold. In recent decades it has become a term for a very common form of Islamic (i.e., "shariah compliant") financing, where the price is marked up in exchange for allowing the buyer to pay over time—for example with monthly payments (a contract with deferred payment being known as ''bai-muajjal''). ''Murabaha'' financing is similar to a rent-to-own arrangement in the non-Muslim world, with the intermediary (e.g., the lending bank) retaining ownership of the item being sold until the loan is paid in full. There are also Islamic investment funds and ''sukuk'' (Islamic bonds) that use ''murabahah'' contracts. Jamaldeen, ''Islamic Finance For Dummies'', 2012:188-9, 220-1 The purpose o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Islamic Banking And Finance

Islamic banking, Islamic finance ( ar, مصرفية إسلامية), or Sharia-compliant finance is banking or financing activity that complies with Sharia (Islamic law) and its practical application through the development of Islamic economics. Some of the modes of Islamic banking/finance include ''Mudarabah'' (profit-sharing and loss-bearing), ''Wadiah'' (safekeeping), ''Musharaka'' (joint venture), ''Murabahah'' (cost-plus), and ''Ijara'' ( leasing). Sharia prohibits ''riba'', or usury, defined as interest paid on all loans of money (although some Muslims dispute whether there is a consensus that interest is equivalent to ''riba''). Investment in businesses that provide goods or services considered contrary to Islamic principles (e.g. pork or alcohol) is also ''haram'' ("sinful and prohibited"). These prohibitions have been applied historically in varying degrees in Muslim countries/communities to prevent un-Islamic practices. In the late 20th century, as part of the revi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Islamic Banking

Islamic banking, Islamic finance ( ar, مصرفية إسلامية), or Sharia-compliant finance is banking or financing activity that complies with Sharia (Islamic law) and its practical application through the development of Islamic economics. Some of the modes of Islamic banking/finance include ''Mudarabah'' (profit-sharing and loss-bearing), ''Wadiah'' (safekeeping), ''Musharaka'' (joint venture), ''Murabahah'' (cost-plus), and ''Ijara'' ( leasing). Sharia prohibits ''riba'', or usury, defined as interest paid on all loans of money (although some Muslims dispute whether there is a consensus that interest is equivalent to ''riba''). Investment in businesses that provide goods or services considered contrary to Islamic principles (e.g. pork or alcohol) is also ''haram'' ("sinful and prohibited"). These prohibitions have been applied historically in varying degrees in Muslim countries/communities to prevent un-Islamic practices. In the late 20th century, as part of the revi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

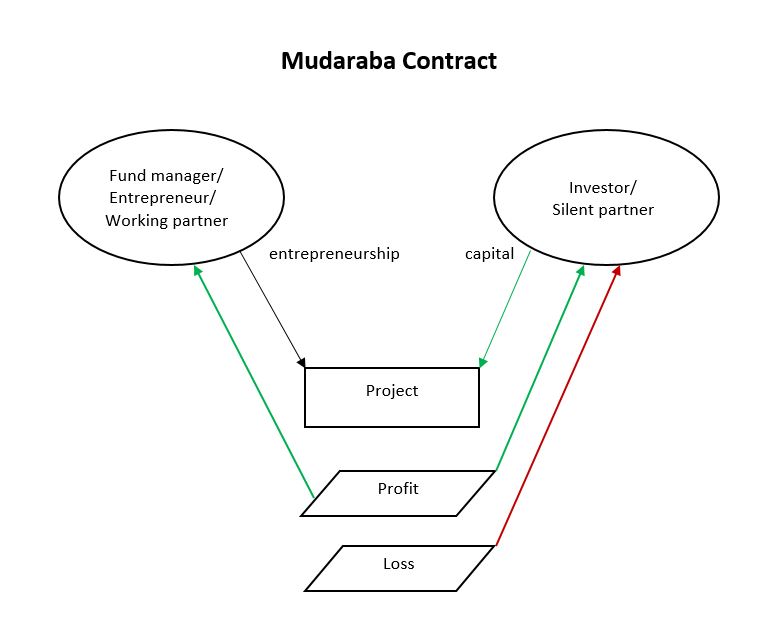

Profit And Loss Sharing

Profit and Loss Sharing (also called PLS or participatory banking) refers to Sharia-compliant forms of equity financing such as mudarabah and musharakah. These mechanisms comply with the religious prohibition on interest on loans that most Muslims subscribe to. ''Mudarabah'' (مضاربة) refers to "trustee finance" or passive partnership contract, while ''Musharakah'' (مشاركة or مشركة) refers to equity participation contract. Other sources include sukuk (also called "Islamic bonds") and direct equity investment (such as purchase of common shares of stock) as types of PLS. Khan, ''Islamic Banking in Pakistan'', 2015: p.91 The profits and losses shared in PLS are those of a business enterprise or person which/who has obtained capital from the Islamic bank/financial institution (the terms "debt", "borrow", "loan" and "lender" are not used). As financing is repaid, the provider of capital collects some agreed upon percentage of the profits (or deducts if there are losses) ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Profit And Loss Sharing

Profit and Loss Sharing (also called PLS or participatory banking) refers to Sharia-compliant forms of equity financing such as mudarabah and musharakah. These mechanisms comply with the religious prohibition on interest on loans that most Muslims subscribe to. ''Mudarabah'' (مضاربة) refers to "trustee finance" or passive partnership contract, while ''Musharakah'' (مشاركة or مشركة) refers to equity participation contract. Other sources include sukuk (also called "Islamic bonds") and direct equity investment (such as purchase of common shares of stock) as types of PLS. Khan, ''Islamic Banking in Pakistan'', 2015: p.91 The profits and losses shared in PLS are those of a business enterprise or person which/who has obtained capital from the Islamic bank/financial institution (the terms "debt", "borrow", "loan" and "lender" are not used). As financing is repaid, the provider of capital collects some agreed upon percentage of the profits (or deducts if there are losses) ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

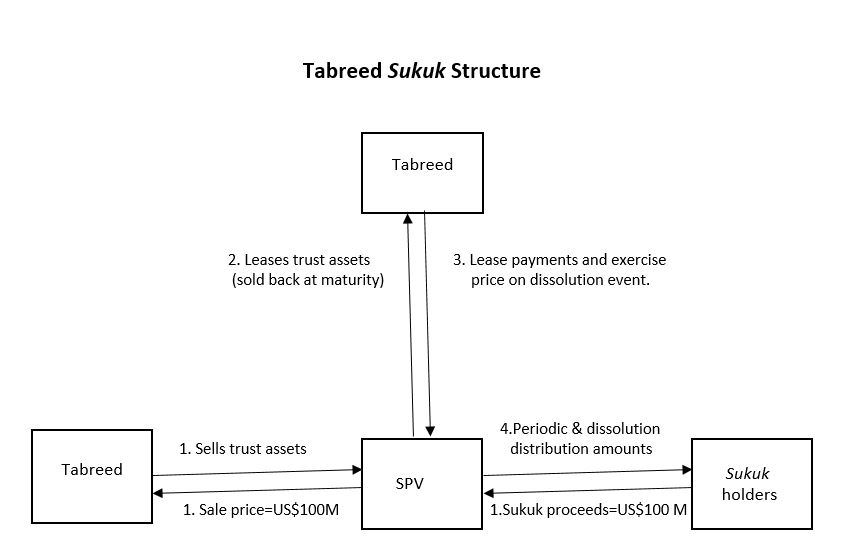

Sukuk

Sukuk ( ar, صكوك, ṣukūk; plural of ar, صك, ṣakk, legal instrument, deed, cheque, links=no) is the Arabic name for financial certificates, also commonly referred to as "sharia compliant" bonds. Sukuk are defined by the AAOIFI ( Accounting and Auditing Organization for Islamic Financial Institutions) as "securities of equal denomination representing individual ownership interests in a portfolio of eligible existing or future assets." The Fiqh academy of the OIC legitimized the use of sukuk in February 1988.Visser, Hans. 2009. ''Islamic finance: Principles and practice.'' Cheltenham, UK and Northampton MA, Edward Elgar. p.63 Khan, ''What Is Wrong with Islamic Economics?'', 2013: p.251 Sukuk were developed as an alternative to conventional bonds which are not considered permissible by many Muslims as they pay interest (prohibited or discouraged as Riba, or usury), and also may finance businesses involved in activities not permitted under Sharia (gambling, alcohol, pork ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

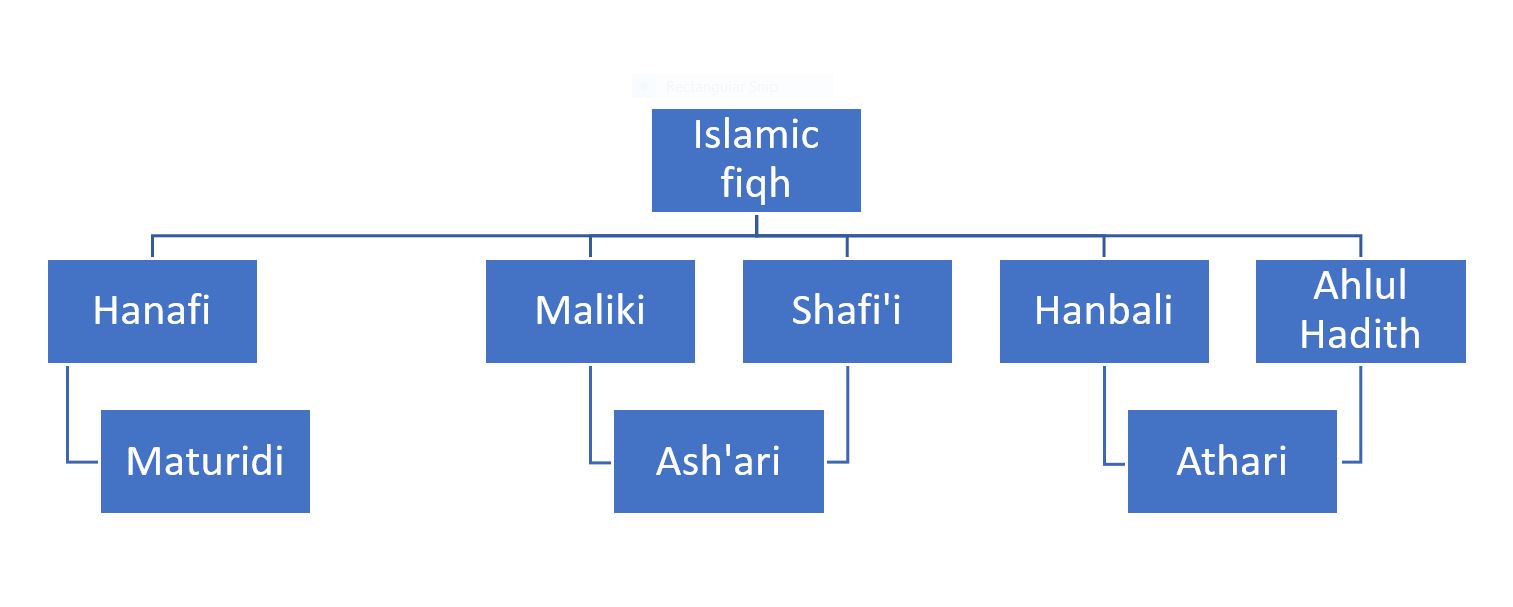

Fiqh

''Fiqh'' (; ar, فقه ) is Islamic jurisprudence. Muhammad-> Companions-> Followers-> Fiqh. The commands and prohibitions chosen by God were revealed through the agency of the Prophet in both the Quran and the Sunnah (words, deeds, and examples of the Prophet passed down as hadith). The first Muslims (the Sahabah or Companions) heard and obeyed, and passed this essence of Islam to succeeding generations (''Tabi'un'' and ''Tabi' al-Tabi'in'' or successors/followers and successors of successors), as Muslims and Islam spread from West Arabia to the conquered lands north, east, and west, Hoyland, ''In God's Path'', 2015: p.223 where it was systematized and elaborated Hawting, "John Wansbrough, Islam, and Monotheism", 2000: p.513 The history of Islamic jurisprudence is "customarily divided into eight periods": El-Gamal, ''Islamic Finance'', 2006: pp. 30–31 *the first period ending with the death of Muhammad in 11 AH. *second period "characterized by personal interp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hadith

Ḥadīth ( or ; ar, حديث, , , , , , , literally "talk" or "discourse") or Athar ( ar, أثر, , literally "remnant"/"effect") refers to what the majority of Muslims believe to be a record of the words, actions, and the silent approval of the Islamic prophet Muhammad as transmitted through chains of narrators. In other words, the ḥadīth are transmitted reports attributed to what Muhammad said and did. Hadith have been called by some as "the backbone" of Islamic civilization, J.A.C. Brown, ''Misquoting Muhammad'', 2014: p.6 and for many the authority of hadith as a source for religious law and moral guidance ranks second only to that of the Quran (which Muslims hold to be the word of God revealed to Muhammad). Most Muslims believe that scriptural authority for hadith comes from the Quran, which enjoins Muslims to emulate Muhammad and obey his judgements (in verses such as , ). While the number of verses pertaining to law in the Quran is relatively few, hadith are co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sunni

Sunni Islam () is the largest branch of Islam, followed by 85–90% of the world's Muslims. Its name comes from the word '' Sunnah'', referring to the tradition of Muhammad. The differences between Sunni and Shia Muslims arose from a disagreement over the succession to Muhammad and subsequently acquired broader political significance, as well as theological and juridical dimensions. According to Sunni traditions, Muhammad left no successor and the participants of the Saqifah event appointed Abu Bakr as the next-in-line (the first caliph). This contrasts with the Shia view, which holds that Muhammad appointed his son-in-law and cousin Ali ibn Abi Talib as his successor. The adherents of Sunni Islam are referred to in Arabic as ("the people of the Sunnah and the community") or for short. In English, its doctrines and practices are sometimes called ''Sunnism'', while adherents are known as Sunni Muslims, Sunnis, Sunnites and Ahlus Sunnah. Sunni Islam is sometimes referre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Microfinance

Microfinance is a category of financial services targeting individuals and small businesses who lack access to conventional banking and related services. Microfinance includes microcredit, the provision of small loans to poor clients; savings and checking accounts; microinsurance; and payment systems, among other services. Microfinance services are designed to reach excluded customers, usually poorer population segments, possibly socially marginalized, or geographically more isolated, and to help them become self-sufficient.Christen, Robert Peck Christen; Rosenberg, Richard; Jayadeva, Veena. ''Financial institutions with a double-bottom line: Implications for the future of microfinance''. CGAP, Occasional Papers series, July 2004, pp. 2–3. ID Ghana is an example of a microfinance institution. Microfinance initially had a limited definition: the provision of microloans to poor entrepreneurs and small businesses lacking access to credit. The two main mechanisms for the delive ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)