|

Ministry Of Budget, Public Accounts And Civil Administration

The Ministry of Public Action and Accounts ( French: ''Ministère de l'Action et des Comptes publics'') is a ministry of the Government of France. It was created by President Nicolas Sarkozy in 2007, when he split the Ministry of Finance and the Economy into the Ministry of Budget, Public Accounts and Civil Administration and the Ministry of the Economy, Industry and Employment. Éric Woerth became the first Budget Minister to have a dedicated ministry since Sarkozy himself in 1995. History Woerth was entrusted with several missions and reforms to be led. The main reforms were to modify the statute of civil servants, to reduce the number of civil servants, to merge the taxation direction and the public compatibility services, to lead a general review of public policies, to reduce the budget deficit, to elaborate a new legislation on online bets. Budget Minister Jérôme Cahuzac was reattached to the Ministry of the Economy and Finance in 2012; the ministry took its current na ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gabriel Attal

Gabriel Attal (born 16 March 1989) is a French politician of La République En Marche! (LREM) who has been serving as Ministry of Public Action and Accounts, Minister of Public Action and Accounts in the Borne government, government of Prime Minister of France, Prime Minister Élisabeth Borne since 2022. He was the List of Government spokespeople of France, government spokesperson under President Emmanuel Macron from 2020 to 2022. Early life and education Attal was born on 16 March 1989 in Clamart. He grew up in the 13th and 14th arrondissements of Paris with three sisters. His father was a lawyer and film producer and his mother worked as an employee of a film production company. Attal studied at the École alsacienne. His political activity started when he participated in the 2006 youth protests in France. From 2007 to 2013, he studied at Sciences Po. In his first year he created the support committee for Íngrid Betancourt and coordinated support for the Franco-Colombian hos ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Seine

) , mouth_location = Le Havre/Honfleur , mouth_coordinates = , mouth_elevation = , progression = , river_system = Seine basin , basin_size = , tributaries_left = Yonne, Loing, Eure, Risle , tributaries_right = Ource, Aube, Marne, Oise, Epte The Seine ( , ) is a river in northern France. Its drainage basin is in the Paris Basin (a geological relative lowland) covering most of northern France. It rises at Source-Seine, northwest of Dijon in northeastern France in the Langres plateau, flowing through Paris and into the English Channel at Le Havre (and Honfleur on the left bank). It is navigable by ocean-going vessels as far as Rouen, from the sea. Over 60 percent of its length, as far as Burgundy, is negotiable by large barges and most tour boats, and nearly its whole length is available for recreational boating; excursion boats offer sightseeing tours of the river banks in the capital city, Paris. There are 37 bridges in P ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Direction Générale Des Douanes Et Des Droits Indirects

The Directorate-General of Customs and Indirect Taxes (french: Direction générale des douanes et droits indirects, DGDDI), commonly known as ''les douanes'' (Customs), is the customs service of the French Republic. It is responsible for levying indirect taxes, preventing smuggling, surveilling borders and investigating counterfeit money. The agency acts as a coast guard, border guard, sea rescue organisation, and customs service. In addition, since 1995, the agency has replaced the Border Police units of the National Police in carrying out immigration control at smaller border checkpoints, in particular at maritime borders and regional airports. The Directorate-general is controlled by the Minister for the Budget, Public Accounts and the Civil Service (french: Ministère du Budget, des Comptes publics et de la Fonction publique) at the Ministry of the Economy, Industry and Employment. It is normally known simply as "''la douane''", individual officers being referred to as "''dou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. The tax rate may increase as taxable income increases (referred to as graduated or progressive tax rates). The tax imposed on companies is usually known as corporate tax and is commonly levied at a flat rate. Individual income is often taxed at progressive rates where the tax rate applied to each additional unit of income increases (e.g., the first $10,000 of income taxed at 0%, the next $10,000 taxed at 1%, etc.). Most jurisdictions exempt local charitable organizations from tax. Income from investments may be taxed at different (generally lower) rates than other types of income. Credits of various sorts may be allowed that reduce tax. Some jurisdicti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Tax

A corporate tax, also called corporation tax or company tax, is a direct tax imposed on the income or capital of corporations or analogous legal entities. Many countries impose such taxes at the national level, and a similar tax may be imposed at state or local levels. The taxes may also be referred to as income tax or capital tax. A country's corporate tax may apply to: * corporations incorporated in the country, * corporations doing business in the country on income from that country, * foreign corporations who have a permanent establishment in the country, or * corporations deemed to be resident for tax purposes in the country. Company income subject to tax is often determined much like taxable income for individual taxpayers. Generally, the tax is imposed on net profits. In some jurisdictions, rules for taxing companies may differ significantly from rules for taxing individuals. Certain corporate acts or types of entities may be exempt from tax. The incidence of corporate ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Value-added Tax

A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally. It is levied on the price of a product or service at each stage of production, distribution, or sale to the end consumer. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services, it can reclaim the tax paid. It is similar to, and is often compared with, a sales tax. VAT is an indirect tax because the person who ultimately bears the burden of the tax is not necessarily the same person as the one who pays the tax to the tax authorities. Not all localities require VAT to be charged, and exports are often exempt. VAT is usually implemented as a destination-based tax, where the tax rate is based on the location of the consumer and applied to the sales price. The terms VAT, GST, and the more general consumption tax are sometimes used interchangeably. VAT raises about a fifth of total tax revenues bo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trésor Public

The Trésor public ( en, Public treasury) is the national administration of the Treasury in France. It is headed by the general directorate of public finances (''Direction générale des finances publiques'') in the Ministry of the Economy, Finance and Industry. The ''Trésor Public'' is responsible for: * the accountancy of the state; * the control and help in the accountancy of public administrations and local governments; * the perception of direct taxes such as the income tax (the computation of those taxes is vested in a separate administration); Until the 2012 reform, the Treasury was headed in each department by the Treasurer-Paymaster General (''Trésorier-Payeur Général''), a high-ranking official. In Paris, the function used to be divided into the Paymaster General of the Treasury (''Payeur Général du Trésor''), and the Receiver General of the Finances (''Receveur Général des Finances''). Each region had its own Treasurer-Paymaster General, the one for the ''dép ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal person, legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or national), and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax reliefs. The first known taxation took place in Ancient Egypt around 3000–2800 BC. A failure to pay in a timely manner (Tax noncompliance, non-compliance), along with evasion of or resistance to taxation, is punishable by law. Taxes consist of direct tax, direct or indirect taxes and may be paid in money or as its labor equivalent. Most countries have a tax system in place, in order to pay for public, common societal, or agreed national needs and for the functions of government. Some levy a flat tax, flat percentag ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

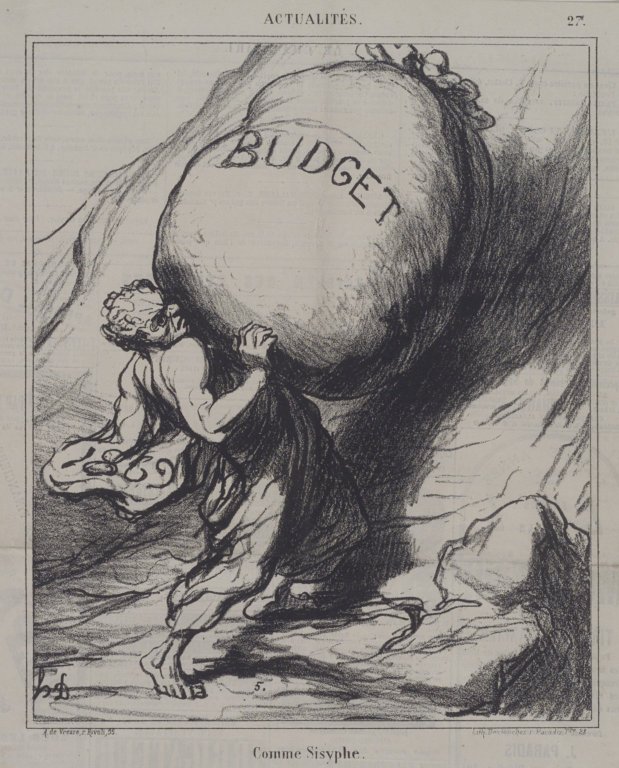

Budget

A budget is a calculation play, usually but not always financial, for a defined period, often one year or a month. A budget may include anticipated sales volumes and revenues, resource quantities including time, costs and expenses, environmental impacts such as greenhouse gas emissions, other impacts, assets, liabilities and cash flows. Companies, governments, families, and other organizations use budgets to express strategic plans of activities in measurable terms. A budget expresses intended expenditures along with proposals for how to meet them with resources. A budget may express a surplus, providing resources for use at a future time, or a deficit in which expenditures exceed income or other resources. Government The budget of a government is a summary or plan of the anticipated resources (often but not always from taxes) and expenditures of that government. There are three types of government budget: the operating or current budget, the capital or investment budget, a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bruno Le Maire

Bruno Le Maire (; born 15 April 1969) is a French politician and former diplomat who has served as Minister of the Economy and Finance since 2017 under President Emmanuel Macron. A former member of The Republicans (LR), which he left in 2017 to join La République En Marche! (LREM), he was Secretary of State for European Affairs from 2008 to 2009 and Minister of Food, Agriculture and Fishing from 2009 to 2012 under President Nicolas Sarkozy.Webpage Le Maire is also a noted writer, with his book ''Des hommes d'Etat'' winning the 2008 Edgar Faure Prize. Early life and education Bruno Le Maire was born on 15 April 1969 in |

Olivier Dussopt

Olivier Dussopt (born 16 August 1978 in Annonay, Ardèche) is French politician who has been serving as the minister of labour, employment and integration in the government of Prime Minister Élisabeth Borne since 2022. He previously served as the minister of public action and accounts in the governments of successive prime ministers Édouard Philippe and Jean Castex from 2019 to 2022. He was a member of the National Assembly from 2007 to 2017 Career Dussopt was a member of the Socialist Party from 2000 to 2017. From 2007 until 2017, he was a member of the National Assembly. In parliament, he served on the Committee on Economic Affairs (2007-2009) and the Committee on Legal Affairs (2009-2017). In addition to his parliamentary activities, Dussopt worked on Manuel Valls’ campaign team in the Socialist Party's primaries for the 2017 presidential election. Following the 2017 French legislative election, he was among a minority that voted against the Philippe government's propo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

_1950_-_2010.gif)

.jpg)