Budget on:

[Wikipedia]

[Google]

[Amazon]

A budget is a calculation play, usually but not always financial, for a defined period, often one year or a month. A budget may include anticipated

, Bureau of Labor Statistics a specialized financial analyst role. This usually sits within the company's financial management area in general, sometimes, specifically, in " FP&A" (Financial planning and analysis); see also .

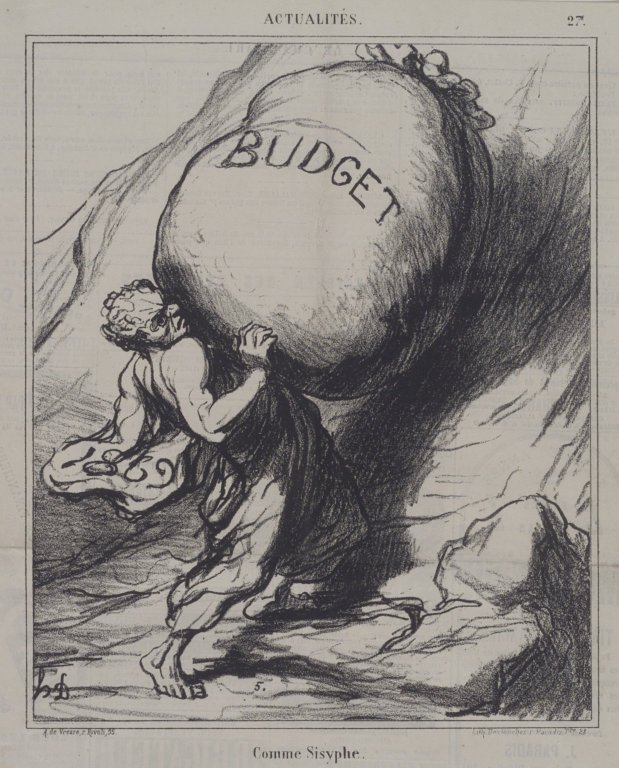

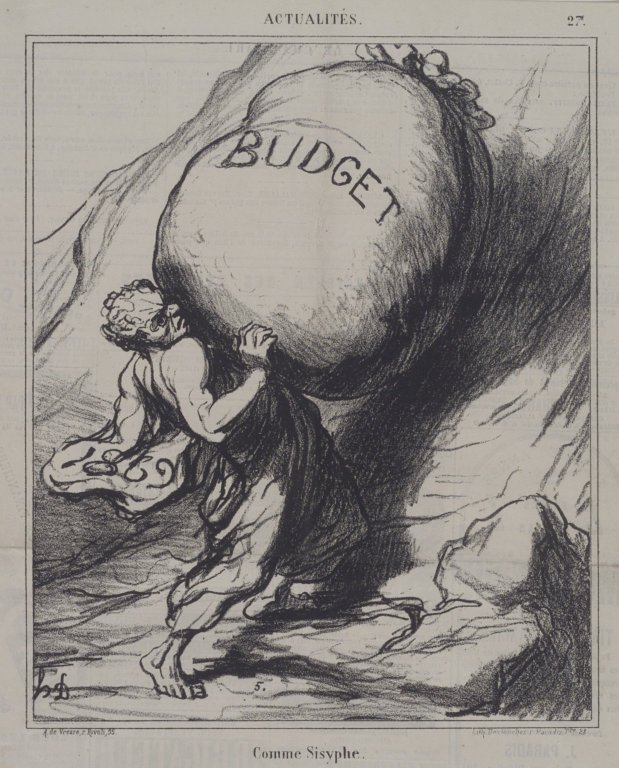

Origin of the word

{{Authority control Home economics

sales

Sales are activities related to selling or the number of goods sold in a given targeted time period. The delivery of a service for a cost is also considered a sale.

The seller, or the provider of the goods or services, completes a sale in ...

volumes and revenue

In accounting, revenue is the total amount of income generated by the sale of goods and services related to the primary operations of the business.

Commercial revenue may also be referred to as sales or as turnover. Some companies receive rev ...

s, resource quantities including time, cost

In Production (economics), production, research, retail, and accounting, a cost is the value of money that has been used up to produce something or deliver a service, and hence is not available for use anymore. In business, the cost may be one o ...

s and expense

An expense is an item requiring an outflow of money, or any form of fortune in general, to another person or group as payment for an item, service, or other category of costs. For a tenant, rent is an expense. For students or parents, tuition ...

s, environmental impacts such as greenhouse gas emissions, other impacts, asset

In financial accounting, an asset is any resource owned or controlled by a business or an economic entity. It is anything (tangible or intangible) that can be used to produce positive economic value. Assets represent value of ownership that ca ...

s, liabilities and cash flow

A cash flow is a real or virtual movement of money:

*a cash flow in its narrow sense is a payment (in a currency), especially from one central bank account to another; the term 'cash flow' is mostly used to describe payments that are expected ...

s. Companies, governments, families, and other organizations use budgets to express strategic plans of activities in measurable terms.

A budget expresses intended expenditures along with proposals for how to meet them with resources. A budget may express a surplus

Surplus may refer to:

* Economic surplus, one of various supplementary values

* Excess supply, a situation in which the quantity of a good or service supplied is more than the quantity demanded, and the price is above the equilibrium level determ ...

, providing resources for use at a future time, or a deficit in which expenditures exceed income or other resources.

Government

The budget of agovernment

A government is the system or group of people governing an organized community, generally a state.

In the case of its broad associative definition, government normally consists of legislature, executive, and judiciary. Government ...

is a summary or plan of the anticipated resources (often but not always from taxes) and expenditures of that government. There are three types of government budget: the operating or current budget, the capital or investment budget, and the cash or cash flow budget.

United Kingdom, Canada, Australia and New Zealand

United States

The federal budget is prepared by theOffice of Management and Budget

The Office of Management and Budget (OMB) is the largest office within the Executive Office of the President of the United States (EOP). OMB's most prominent function is to produce the president's budget, but it also examines agency programs, pol ...

, and submitted to Congress for consideration. Invariably, Congress makes many and substantial changes. Nearly all American states are required to have balanced budgets, but the federal government is allowed to run deficits.

India

The budget is prepared by the Budget Division Department of Economic Affairs of the Ministry of Finance annually. The Finance Minister is the head of the budget making committee. The present Indian Finance minister is Nirmala Sitharaman. The Budget includes supplementary excess grants and when a proclamation by the President as to failure of Constitutional machinery is in operation in relation to a State or a Union Territory, preparation of the Budget of such State. The first budget of India was submitted on 18 February 1860 by James Wilson. P C Mahalanobis is known as the father of Indian budget.Philippines

The Philippine budget is considered the most complicated in the world, incorporating multiple approaches in one single budget system: line-item (budget execution), performance (budget accountability), and zero-based budgeting. The Department of Budget and Management (DBM) prepares the National Expenditure Program and forwards it to the Committee on Appropriations of the House of Representatives to come up with a General Appropriations Bill (GAB). The GAB will go through budget deliberations and voting; the same process occurs when the GAB is transmitted to the Philippine Senate. After both houses of Congress approves the GAB, the President signs the bill into a General Appropriations Act (GAA); also, the President may opt toveto

A veto is a legal power to unilaterally stop an official action. In the most typical case, a president or monarch vetoes a bill to stop it from becoming law. In many countries, veto powers are established in the country's constitution. Veto ...

the GAB and have it returned to the legislative branch or leave the bill unsigned for 30 days and lapse into law. There are two types of budget bill veto: the line-item veto and the veto of the whole budget.

Personal

A personal budget or home budget is a finance plan that allocates future personal income towardsexpense

An expense is an item requiring an outflow of money, or any form of fortune in general, to another person or group as payment for an item, service, or other category of costs. For a tenant, rent is an expense. For students or parents, tuition ...

s, savings and debt

Debt is an obligation that requires one party, the debtor, to pay money or other agreed-upon value to another party, the creditor. Debt is a deferred payment, or series of payments, which differentiates it from an immediate purchase. The d ...

repayment. Past spending and personal debt are considered when creating a personal budget. There are several methods and tools available for creating, using, and adjusting a personal budget. For example, jobs are an income source, while bills and rent payments are expenses. A third category (other than income and expenses) may be assets (such as property, investments, or other savings or value) representing a potential reserve for funds in case of budget shortfalls.

Corporate Budget

The budget of a business or corporation is a financial forecast for the near-term future, aggregating the expected revenues and expenses of the various departments - operations, human resources, IT, etc - and is then a key element in integrated business planning, with targets correspondingly devolved to departmental managers (and becoming KPIs). The budgeting process typically requires considerable effort, often involving dozens of staff; final sign off resides with both the financial director andoperations director

The role of operations director generally encompasses the oversight of operational aspects of company strategy with responsibilities to ensure operation information is supplied to the chief executive and the board of directors as well as external ...

.

The budget is typically compiled on an annual basis, although this may be quarterly; the monitoring here is on an ongoing basis.

Re the latter: if the actual figures delivered come close to those budgeted, this suggests that managers understand their business and have been successful in "delivering".

On the other hand, if the figures diverge, this sends an "out of control" signal;

additionally, the share price could suffer where these figures have been communicated to analysts.

Professionals employed in this role are often designated "Budget Analyst",

Budget Analysts, Bureau of Labor Statistics a specialized financial analyst role. This usually sits within the company's financial management area in general, sometimes, specifically, in " FP&A" (Financial planning and analysis); see also .

Types

* Sale budget – an estimate of future sales, often broken down into both units. It is used to create company and sales goals. * Production budget – an estimate of the number of units that must be manufactured to meet the sales goals. The production budget also estimates the various costs involved with manufacturing those units, including labour and material. Created by product oriented companies. * Capital budget – used to determine whether an organization's long-term investments such as new machinery, replacement machinery, new plants, new products, and research development projects are worth pursuing. * Cash flow/cash budget – a prediction of future cash receipts and expenditures for a particular time period. It usually covers a period in the short-term future. The cash flow budget helps the business to determine when income will be sufficient to cover expenses and when the company will need to seek outside financing. * Conditional budgeting is a budgeting approach designed for companies with fluctuating income, high fixed costs, or income depending on sunk costs, as well as NPOs and NGOs. * Marketing budget – an estimate of the funds needed for promotion, advertising, and public relations in order to market the product or service. * Project budget – a prediction of the costs associated with a particular company project. These costs include labour, materials, and other related expenses. The project budget is often broken down into specific tasks, with task budgets assigned to each. A cost estimate is used to establish a project budget. * Revenue budget – consists ofrevenue

In accounting, revenue is the total amount of income generated by the sale of goods and services related to the primary operations of the business.

Commercial revenue may also be referred to as sales or as turnover. Some companies receive rev ...

receipts of government

A government is the system or group of people governing an organized community, generally a state.

In the case of its broad associative definition, government normally consists of legislature, executive, and judiciary. Government ...

and the expenditure met from these revenues. Revenues are made up of taxes

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, o ...

and other duties

A duty (from "due" meaning "that which is owing"; fro, deu, did, past participle of ''devoir''; la, debere, debitum, whence "debt") is a commitment or expectation to perform some action in general or if certain circumstances arise. A duty may ...

that the government levies. Various countries and unions have created four types of tax jurisdiction

Jurisdiction (from Latin 'law' + 'declaration') is the legal term for the legal authority granted to a legal entity to enact justice. In federations like the United States, areas of jurisdiction apply to local, state, and federal levels.

Ju ...

s: interstate, state

State may refer to:

Arts, entertainment, and media Literature

* ''State Magazine'', a monthly magazine published by the U.S. Department of State

* ''The State'' (newspaper), a daily newspaper in Columbia, South Carolina, United States

* '' Our ...

, local and tax jurisdictions with a special status ( Free-trade zones). Each of them provides a money

Money is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular country or socio-economic context. The primary functions which distinguish money ar ...

flow to the corresponding revenue budget levels.

* Expenditure budget – includes spending data items.

* Flexibility budget – it is established for fixed cost and variable rate is determined per activity measure for variable cost.

* Appropriation budget – a maximum amount is established for certain expenditure based on management judgment.

*Performance budget – it is mostly used by organization and ministries involved in the development activities. This process of budget takes into account the end results.

* Zero based budget – A budget type where every item added to the budget needs approval and no items are carried forward from the prior years budget. This type of budget has a clear advantage when the limited resources are to be allocated carefully and objectively. Zero based budgeting takes more time to create as all pieces of the budget need to be reviewed by management.

*Personal budget – A budget type focusing on expenses for self or for home, usually involves an income to budget.

References

External links

* * *Origin of the word

{{Authority control Home economics