|

Devolvement

In the investment banking sector, particularly in India, devolvement is a process whereby if an investment issue is undersubscribed, an underwriter is required to subscribe to the remaining shares. The outstanding unsubscribed amount ''devolves'' onto the underwriter. This is also known as hard underwriting. The Securities and Exchange Board of India The Securities and Exchange Board of India (SEBI) is the Regulatory agency, regulatory body for securities and commodity market in India under the administrative domain of Ministry of Finance (India), Ministry of Finance within the Government ... publishes guidelines and a recommended method of computation relating to the extent of the devolvement onto a particular underwriter in the case where there are multiple underwriters, or sub-underwriters. Notes References * * Further reading * Monetary policy Public finance Capital markets of India Investment banking Underwriting {{finance-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment Banking

Investment banking is an advisory-based financial service for institutional investors, corporations, governments, and similar clients. Traditionally associated with corporate finance, such a bank might assist in raising financial capital by underwriting or acting as the client's agent in the issuance of debt or equity securities. An investment bank may also assist companies involved in mergers and acquisitions (M&A) and provide ancillary services such as market making, trading of derivatives and equity securities FICC services (fixed income instruments, currencies, and commodities) or research (macroeconomic, credit or equity research). Most investment banks maintain prime brokerage and asset management departments in conjunction with their investment research businesses. As an industry, it is broken up into the Bulge Bracket (upper tier), Middle Market (mid-level businesses), and boutique market (specialized businesses). Unlike commercial banks and retail banks, inves ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

India

India, officially the Republic of India, is a country in South Asia. It is the List of countries and dependencies by area, seventh-largest country by area; the List of countries by population (United Nations), most populous country since 2023; and, since its independence in 1947, the world's most populous democracy. Bounded by the Indian Ocean on the south, the Arabian Sea on the southwest, and the Bay of Bengal on the southeast, it shares land borders with Pakistan to the west; China, Nepal, and Bhutan to the north; and Bangladesh and Myanmar to the east. In the Indian Ocean, India is near Sri Lanka and the Maldives; its Andaman and Nicobar Islands share a maritime border with Thailand, Myanmar, and Indonesia. Modern humans arrived on the Indian subcontinent from Africa no later than 55,000 years ago., "Y-Chromosome and Mt-DNA data support the colonization of South Asia by modern humans originating in Africa. ... Coalescence dates for most non-European populations averag ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Underwriter

Underwriting (UW) services are provided by some large financial institutions, such as banks, insurance companies and investment houses, whereby they guarantee payment in case of damage or financial loss and accept the financial risk for liability arising from such guarantee. An underwriting arrangement may be created in a number of situations including insurance, issues of security in a public offering, and bank lending, among others. The person or institution that agrees to sell a minimum number of securities of the company for commission is called the underwriter. History The term "underwriting" derives from the Lloyd's of London insurance market. Financial backers (or risk takers), who would accept some of the risk on a given venture (historically a sea voyage with associated risks of shipwreck) in exchange for a premium, would literally write their names under the risk information that was written on a Lloyd's slip created for this purpose. Securities underwriting In the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

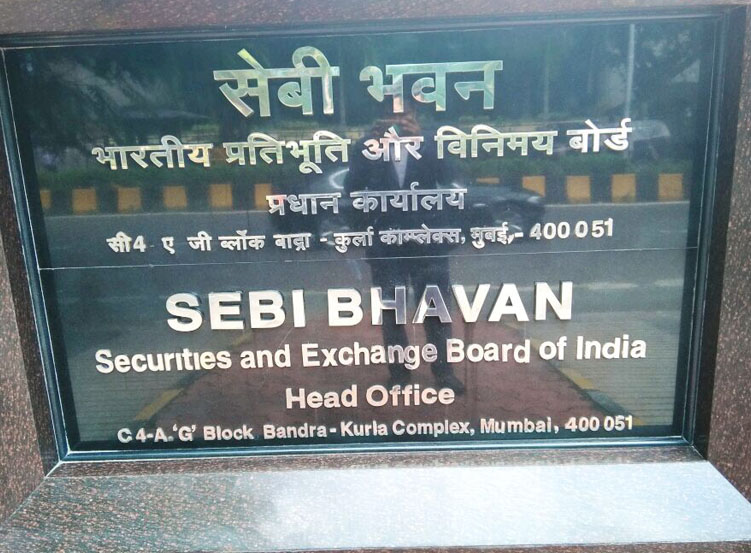

Securities And Exchange Board Of India

The Securities and Exchange Board of India (SEBI) is the Regulatory agency, regulatory body for securities and commodity market in India under the administrative domain of Ministry of Finance (India), Ministry of Finance within the Government of India. It was established on 12 April 1988 as an executive body and was given Statutory body, statutory powers on 30 January 1992 through the Securities and Exchange Board of India Act, 1992, SEBI Act, 1992. History The Securities and Exchange Board of India (SEBI) was first established in 1988 as a non-statutory body for regulating the securities market. Before it came into existence, the Controller of Capital Issues was the market's regulatory authority, and derived power from the Capital Issues (Control) Act, 1947. SEBI became an autonomous body on 30 January 1992 and was accorded Statutory body, statutory powers with the passing of the SEBI Act, 1992 by the Parliament of India. It has its headquarters at the Central business distr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Competition Commission (United Kingdom)

The Competition Commission was a non-departmental public body responsible for investigating mergers, markets and other enquiries related to regulated industries under competition law in the United Kingdom. It was a competition regulator under the Department for Business, Innovation and Skills (BIS). It was tasked with ensuring healthy competition between companies in the UK for the ultimate benefit of consumers and the economy. The Competition Commission replaced the Monopolies and Mergers Commission on 1 April 1999. It was created by the Competition Act 1998, although the majority of its powers were governed by the Enterprise Act 2002. The Enterprise Act 2002 gave the Competition Commission wider powers and greater independence than the MMC had previously, so that it could make decisions on inquiries rather than giving recommendations to Government, and was also responsible for taking appropriate actions and measures (known as remedies) following inquiries which had ident ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monetary Policy

Monetary policy is the policy adopted by the monetary authority of a nation to affect monetary and other financial conditions to accomplish broader objectives like high employment and price stability (normally interpreted as a low and stable rate of inflation). Further purposes of a monetary policy may be to contribute to economic stability or to maintain predictable exchange rates with other currencies. Today most central banks in developed countries conduct their monetary policy within an inflation targeting framework, whereas the monetary policies of most developing countries' central banks target some kind of a fixed exchange rate system. A third monetary policy strategy, targeting the money supply, was widely followed during the 1980s, but has diminished in popularity since then, though it is still the official strategy in a number of emerging economies. The tools of monetary policy vary from central bank to central bank, depending on the country's stage of development, inst ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Finance

Public finance refers to the monetary resources available to governments and also to the study of finance within government and role of the government in the economy. Within academic settings, public finance is a widely studied subject in many branches of political science, political economy and public economics. Research assesses the government revenue and government expenditure of the public authorities and the adjustment of one or the other to achieve desirable effects and avoid undesirable ones. The purview of public finance is considered to be threefold, consisting of governmental effects on: # The efficient allocation of available resources; # The distribution of income among citizens; and # The stability of the economy. American public policy advisor and economist Jonathan Gruber put forth a framework to assess the broad field of public finance in 2010:Gruber, J. (2010) Public Finance and Public Policy (Third Edition), Worth Publishers, Pg. 3, Part 1 # When shoul ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Markets Of India

Capital and its variations may refer to: Common uses * Capital city, a municipality of primary status ** Capital region, a metropolitan region containing the capital ** List of national capitals * Capital letter, an upper-case letter Economics and social sciences * Capital (economics), the durable produced goods used for further production * Capital (Marxism), a central concept in Marxian critique of political economy * Economic capital * Financial capital, an economic resource measured in terms of money * Capital good * Human capital * Natural capital * Public capital * Social capital Architecture and buildings * Capital (architecture), the topmost member of a column or pilaster * The Capital (building), a commercial building in Mumbai, India * Capital (fortification), a proportion of a bastion Arts, entertainment and media Literature Books * ''Capital'' (novel), by John Lanchester, 2012 * ''Das Kapital'' ('Capital: Critique of Political Economy'), a foundationa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |