|

Consumer Leverage Ratio

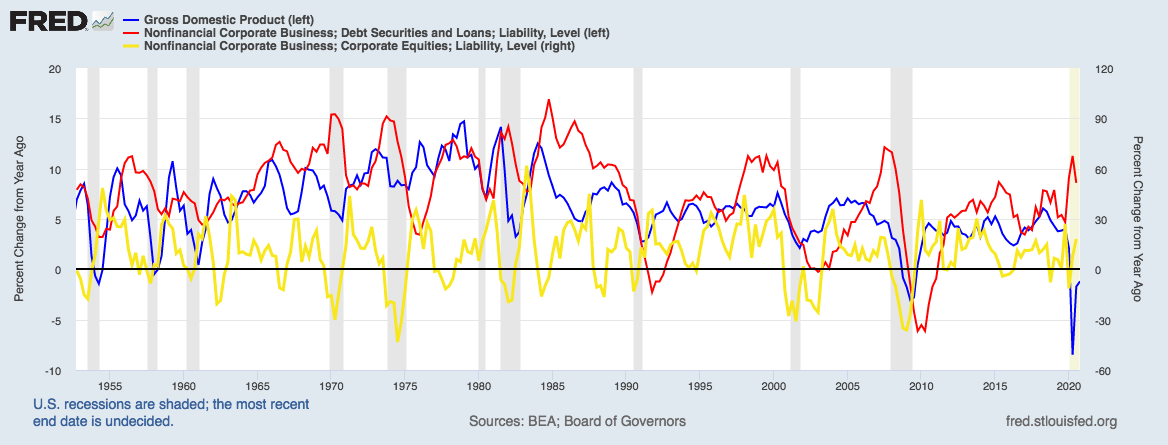

The consumer leverage ratio, a concept popularized by William Jarvis and Dr. Ian C MacMillan in a series of articles in the Harvard Business Review, is the ratio of total household debt, as reported by the Federal Reserve System, to disposable personal income, as reported by the US Department of Commerce, Bureau of Economic Analysis. The ratio has been used in economic analysis and reporting and has been compared to other relevant economic variables since the 1970s. Overview The concept in a variety of other forms has been used to quantify the amount of debt the average American consumer has, relative to his/her disposable income. As of the fourth quarter of 2016, the ratio in the US stood at 1.04x, down from highs of 1.29x seen in 2007. The historical average ratio since late 1975 is approximately 0.9x. Many economists argue the rapid growth in consumer leverage has been the primary fuel of corporate earnings growth in the past few decades and thus represents significant economi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Harvard Business Review

''Harvard Business Review'' (''HBR'') is a general management magazine published by Harvard Business Publishing, a wholly owned subsidiary of Harvard University. ''HBR'' is published six times a year and is headquartered in Brighton, Massachusetts. ''HBR'' covers a wide range of topics that are relevant to various industries, management functions, and geographic locations. These include leadership, negotiation, strategy, operations, marketing, and finance. ''Harvard Business Review'' has published articles by Clayton Christensen, Peter F. Drucker, Michael E. Porter, Rosabeth Moss Kanter, John Hagel III, Thomas H. Davenport, Gary Hamel, C. K. Prahalad, Vijay Govindarajan, Robert S. Kaplan, Rita Gunther McGrath and others. Several management concepts and business terms were first given prominence in ''HBR''. ''Harvard Business Review''s worldwide English-language circulation is 250,000. HBR licenses its content for publication in thirteen languages besid ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Household Debt

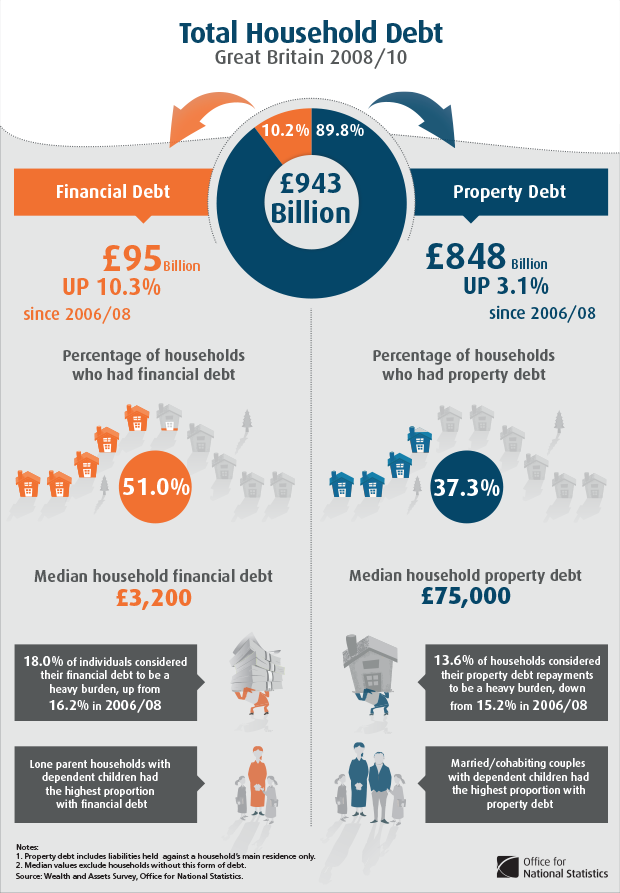

Household debt is the combined debt of all people in a household, including consumer debt and mortgage loans. A significant rise in the level of this debt coincides historically with many severe economic crises and was a cause of the U.S. and subsequent European economic crises of 2007–2012. Several economists have argued that lowering this debt is essential to economic recovery in the U.S. and selected Eurozone countries. Overview Household debt can be defined in several ways, based on what types of debt are included. Common debt types include home mortgages, home equity loans, auto loans, student loans, and credit cards. Household debt can also be measured across an economy, to measure how indebted households are relative to various measures of income (e.g., pre-tax and disposable income) or relative to the size of the economy (GDP). The burden of debt can also be measured in terms of the amount of interest it generates relative to the income of the borrower. For example, t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reserve System

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States of America. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of financial panics (particularly the panic of 1907) led to the desire for central control of the monetary system in order to alleviate financial crises. Over the years, events such as the Great Depression in the 1930s and the Great Recession during the 2000s have led to the expansion of the roles and responsibilities of the Federal Reserve System. Congress established three key objectives for monetary policy in the Federal Reserve Act: maximizing employment, stabilizing prices, and moderating long-term interest rates. The first two objectives are sometimes referred to as the Federal Reserve's dual mandate. Its duties have expanded over the years, and currently also include supervising and regulating banks, maintaining the sta ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Disposable Income

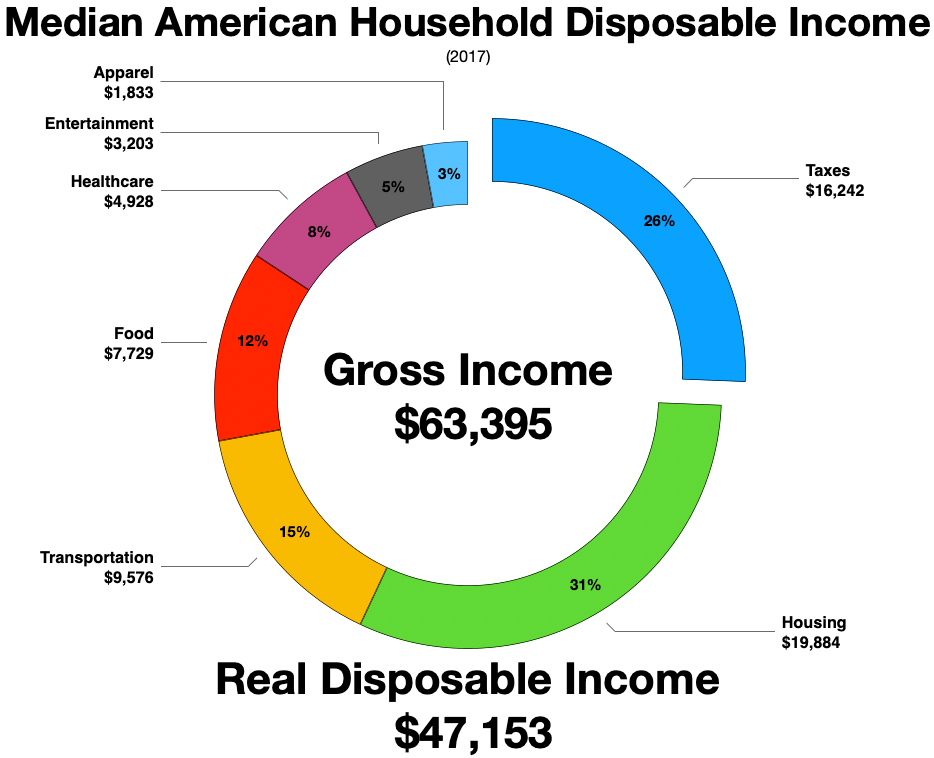

Disposable income is total personal income minus current income taxes. In national accounts definitions, personal income minus personal current taxes equals disposable personal income. Subtracting personal outlays (which includes the major category of personal r privateconsumption expenditure) yields personal (or, private) savings, hence the income left after paying away all the taxes is referred to as disposable income. Restated, consumption expenditure plus savings equals disposable income after accounting for transfers such as payments to children in school or elderly parents’ living and care arrangements. The marginal propensity to consume (MPC) is the fraction of a change in disposable income that is consumed. For example, if disposable income rises by $100, and $65 of that $100 is consumed, the MPC is 65%. Restated, the marginal propensity to save is 35%. For the purposes of calculating the amount of income subject to garnishments, United States' federal law de ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bureau Of Economic Analysis

The Bureau of Economic Analysis (BEA) of the United States Department of Commerce is a U.S. government agency that provides official macroeconomic and industry statistics, most notably reports about the gross domestic product (GDP) of the United States and its various units—states, cities/towns/townships/villages/counties, and metropolitan areas. They also provide information about personal income, corporate profits, and government spending in their National Income and Product Accounts (NIPAs). The BEA is one of the principal agencies of the U.S. Federal Statistical System. Its stated mission is to "promote a better understanding of the U.S. economy by providing the most timely, relevant, and accurate economic data in an objective and cost-effective manner". BEA has about 500 employees and an annual budget of approximately $101 million. National accounts BEA's national economic statistics (National Economic Accounts) provide a comprehensive view of U.S. production, consu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economy

An economy is an area of the production, distribution and trade, as well as consumption of goods and services. In general, it is defined as a social domain that emphasize the practices, discourses, and material expressions associated with the production, use, and management of scarce resources'. A given economy is a set of processes that involves its culture, values, education, technological evolution, history, social organization, political structure, legal systems, and natural resources as main factors. These factors give context, content, and set the conditions and parameters in which an economy functions. In other words, the economic domain is a social domain of interrelated human practices and transactions that does not stand alone. Economic agents can be individuals, businesses, organizations, or government A government is the system or group of people governing an organized community, generally a state. In the case of its broad associative defini ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investopedia

Investopedia is a financial media website headquartered in New York City. Founded in 1999, Investopedia provides investment dictionaries, advice, reviews, ratings, and comparisons of financial products such as securities accounts. Investopedia has more than 32,000 articles and reaches 20 million unique monthly viewers and posts paid advertisements as investing information. It is part of the Dotdash Meredith family of brands owned by IAC. Investopedia offers educational technology into day trading, asset management, foreign exchange markets, as well as financial educational courses. It also hosts a stock market simulator. Self-paced, online courses from expert instructors are available on Investopedia Academy. History Founding and early history Investopedia was founded in 1999 by Cory Wagner and Cory Janssen in Edmonton, Alberta. At the time, Janssen was a business student at the University of Alberta. Wagner focused on business development and research and development, wh ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Leverage (finance)

In finance, leverage (or gearing in the United Kingdom and Australia) is any technique involving borrowing funds to buy things, hoping that future profits will be many times more than the cost of borrowing. This technique is named after a lever in physics, which amplifies a small input force into a greater output force, because successful leverage amplifies the comparatively small amount of money needed for borrowing into large amounts of profit. However, the technique also involves the high risk of not being able to pay back a large loan. Normally, a lender will set a limit on how much risk it is prepared to take and will set a limit on how much leverage it will permit, and would require the acquired asset to be provided as collateral security for the loan. Leveraging enables gains to be multiplied.Brigham, Eugene F., ''Fundamentals of Financial Management'' (1995). On the other hand, losses are also multiplied, and there is a risk that leveraging will result in a loss if financ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumer

A consumer is a person or a group who intends to order, or uses purchased goods, products, or services primarily for personal, social, family, household and similar needs, who is not directly related to entrepreneurial or business activities. The term most commonly refers to a person who purchases goods and services for personal use. Consumer rights “Consumers, by definition, include us all," said President John F. Kennedy, offering his definition to the United States Congress on March 15, 1962. This speech became the basis for the creation of World Consumer Rights Day, now celebrated on March 15. In his speech : John Fitzgerald Kennedy outlined the integral responsibility to consumers from their respective governments to help exercise consumers' rights, including: *The right to safety: To be protected against the marketing of goods that are hazardous to health or life. *The right to be informed: To be protected against fraudulent, deceitful, or grossly misleading informat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumer Debt

In economics, consumer debt is the amount owed by consumers (as opposed to amounts owed by businesses or governments). It includes debts incurred on purchase of goods that are consumable and/or do not appreciate. In macroeconomic terms, it is debt which is used to fund consumption rather than investment. The most common forms of consumer debt are credit card debt, payday loans, student loans and other consumer finance, which are often at higher interest rates than long-term secured loans, such as mortgages. Long-term consumer debt is often considered fiscally suboptimal. While some consumer items such as automobiles may be marketed as having high levels of utility that justify incurring short-term debt, most consumer goods are not. For example, incurring high-interest consumer debt through buying a big-screen television "now", rather than saving for it, cannot usually be financially justified by the subjective benefits of having the television early. In many countries, the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumer Economics

Consumer economics is a branch of economics. It is a broad field, principally concerned with microeconomic analysis behavior in units of consumers, families, or individuals (in contrast to traditional economics, which primarily government or business units). It sometimes also encompasses family financial planning and policy analysis. The term largely describes what was more commonly called " home economics" in the past. History The traditional economists had little interest in analyzing family units. When economic theory was insufficient to explain the phenomenon of women starting to enter the labor force ''en masse'', consumer economics both gained attention and received important contributions from economic theorists. Major theoretical cornerstones include Gary Becker's Household Production Model, time allocation models and Stigler's information search theory. Consumer economics concludes the family-unit economists were strongly influenced by the most recent "consumer e ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Indicators

An economic indicator is a statistic about an economic activity. Economic indicators allow analysis of economic performance and predictions of future performance. One application of economic indicators is the study of business cycles. Economic indicators include various indices, earnings reports, and economic summaries: for example, the unemployment rate, quits rate (quit rate in American English), housing starts, consumer price index (a measure for inflation), Inverted yield curve, consumer leverage ratio, industrial production, bankruptcies, gross domestic product, broadband internet penetration, retail sales, price index, and money supply changes. The leading business cycle dating committee in the United States of America is the private National Bureau of Economic Research. The Bureau of Labor Statistics is the principal fact-finding agency for the U.S. government in the field of labor economics and statistics. Other producers of economic indicators includes the United S ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

_per_capita_in_2020.png)

_(14597240757).jpg)