|

Taxation In Ireland

Taxation in Ireland in 2017 came from Personal Income taxes (40% of Exchequer Tax Revenues, or ETR), and Consumption taxes, being VAT (27% of ETR) and Excise and Customs duties (12% of ETR). Corporation taxes (16% of ETR) represents most of the balance (to 95% of ETR), but Ireland's Corporate Tax System (CT) is a central part of Ireland's economic model. Ireland summarises its taxation policy using the OECD's ''Hierarchy of Taxes'' pyramid (see graphic), which emphasises high corporate tax rates as the most harmful types of taxes where economic growth is the objective. The balance of Ireland's taxes are Property taxes (<3% of ETR, being Stamp duty and LPT) and Capital taxes (<3% of ETR, being CGT and CAT). An issue in comparing the Irish tax system to other economies is adjusting for the artificial inflation of Irish GDP by the |

OECD Hierarchy Of Taxes

The Organisation for Economic Co-operation and Development (OECD; french: Organisation de coopération et de développement économiques, ''OCDE'') is an intergovernmental organisation with 38 member countries, founded in 1961 to stimulate economic progress and world trade. It is a forum whose member countries describe themselves as committed to democracy and the market economy, providing a platform to compare policy experiences, seek answers to common problems, identify good practices, and coordinate domestic and international policies of its members. The majority of OECD members are high-income economies with a very high Human Development Index (HDI), and are regarded as developed countries. Their collective population is 1.38 billion. , the OECD member countries collectively comprised 62.2% of global nominal GDP (US$49.6 trillion) and 42.8% of global GDP ( Int$54.2 trillion) at purchasing power parity. The OECD is an official United Nations observer. In April 1948, the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Distribution Of Irish Exchequer Tax (2000 To 2017)

Distribution may refer to: Mathematics *Distribution (mathematics), generalized functions used to formulate solutions of partial differential equations * Probability distribution, the probability of a particular value or value range of a variable **Cumulative distribution function, in which the probability of being no greater than a particular value is a function of that value *Frequency distribution, a list of the values recorded in a sample *Inner distribution, and outer distribution, in coding theory *Distribution (differential geometry), a subset of the tangent bundle of a manifold *Distributed parameter system, systems that have an infinite-dimensional state-space *Distribution of terms, a situation in which all members of a category are accounted for *Distributivity, a property of binary operations that generalises the distributive law from elementary algebra * Distribution (number theory) *Distribution problems, a common type of problems in combinatorics where the goal ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Irish Personal Tax System - OECD Progressivity Ratio (2015)

Irish may refer to: Common meanings * Someone or something of, from, or related to: ** Ireland, an island situated off the north-western coast of continental Europe ***Éire, Irish language name for the isle ** Northern Ireland, a constituent unit of the United Kingdom of Great Britain and Northern Ireland ** Republic of Ireland, a sovereign state * Irish language, a Celtic Goidelic language of the Indo-European language family spoken in Ireland * Irish people, people of Irish ethnicity, people born in Ireland and people who hold Irish citizenship Places * Irish Creek (Kansas), a stream in Kansas * Irish Creek (South Dakota), a stream in South Dakota * Irish Lake, Watonwan County, Minnesota * Irish Sea, the body of water which separates the islands of Ireland and Great Britain People * Irish (surname), a list of people * William Irish, pseudonym of American writer Cornell Woolrich (1903–1968) * Irish Bob Murphy, Irish-American boxer Edwin Lee Conarty (1922–1961) * Irish McCal ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Effective Employment Tax (Ireland Vs OECD Average, 2017)

Effectiveness is the capability of producing a desired result or the ability to produce desired output. When something is deemed effective, it means it has an intended or expected outcome, or produces a deep, vivid impression. Etymology The origin of the word "effective" stems from the Latin word effectīvus, which means creative, productive or effective. It surfaced in Middle English between 1300 and 1400 A.D. Usage In mathematics and logic, ''effective'' is used to describe metalogical methods that fit the criteria of an effective procedure. In group theory, a group element acts ''effectively'' (or ''faithfully'') on a point, if that point is not fixed by the action. In physics, an effective theory is, similar to a phenomenological theory, a framework intended to explain certain (observed) effects without the claim that the theory correctly models the underlying (unobserved) processes. In heat transfer, ''effectiveness'' is a measure of the performance of a heat exchange ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Wedge

The tax wedge is the deviation from the equilibrium price and quantity (P^* and Q^*, respectively) as a result of the taxation of a good. Because of the tax, consumers pay more for the good (P_c) than they did before the tax, and Vendor (supply chain), suppliers receive less for the good (P_s) than they did before the tax . Put differently, the tax wedge is the difference between the price consumers pay and the value producers receive (net of tax) from a transaction. The tax effectively drives a "wedge" between the price consumers pay and the price producers receive for a product. Following the Law of Supply and Demand, as the price to consumers increases, and the price received by suppliers decreases, the quantity that each wishes to trade will decrease. After a tax is introduced, a new equilibrium is reached, where consumers pay more (P^* \rightarrow P_c), suppliers receive less (P^* \rightarrow P_s), and the quantity exchanged falls (Q^* \rightarrow Q_t). The difference between ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Average Tax Wedge For Single Worker (OECD Vs Ireland, 2000 To 2017)

In ordinary language, an average is a single number taken as representative of a list of numbers, usually the sum of the numbers divided by how many numbers are in the list (the arithmetic mean). For example, the average of the numbers 2, 3, 4, 7, and 9 (summing to 25) is 5. Depending on the context, an average might be another statistic such as the median, or mode. For example, the average personal income is often given as the median—the number below which are 50% of personal incomes and above which are 50% of personal incomes—because the mean would be higher by including personal incomes from a few billionaires. For this reason, it is recommended to avoid using the word "average" when discussing measures of central tendency. General properties If all numbers in a list are the same number, then their average is also equal to this number. This property is shared by each of the many types of average. Another universal property is monotonicity: if two lists of numbers ''A'' and ' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

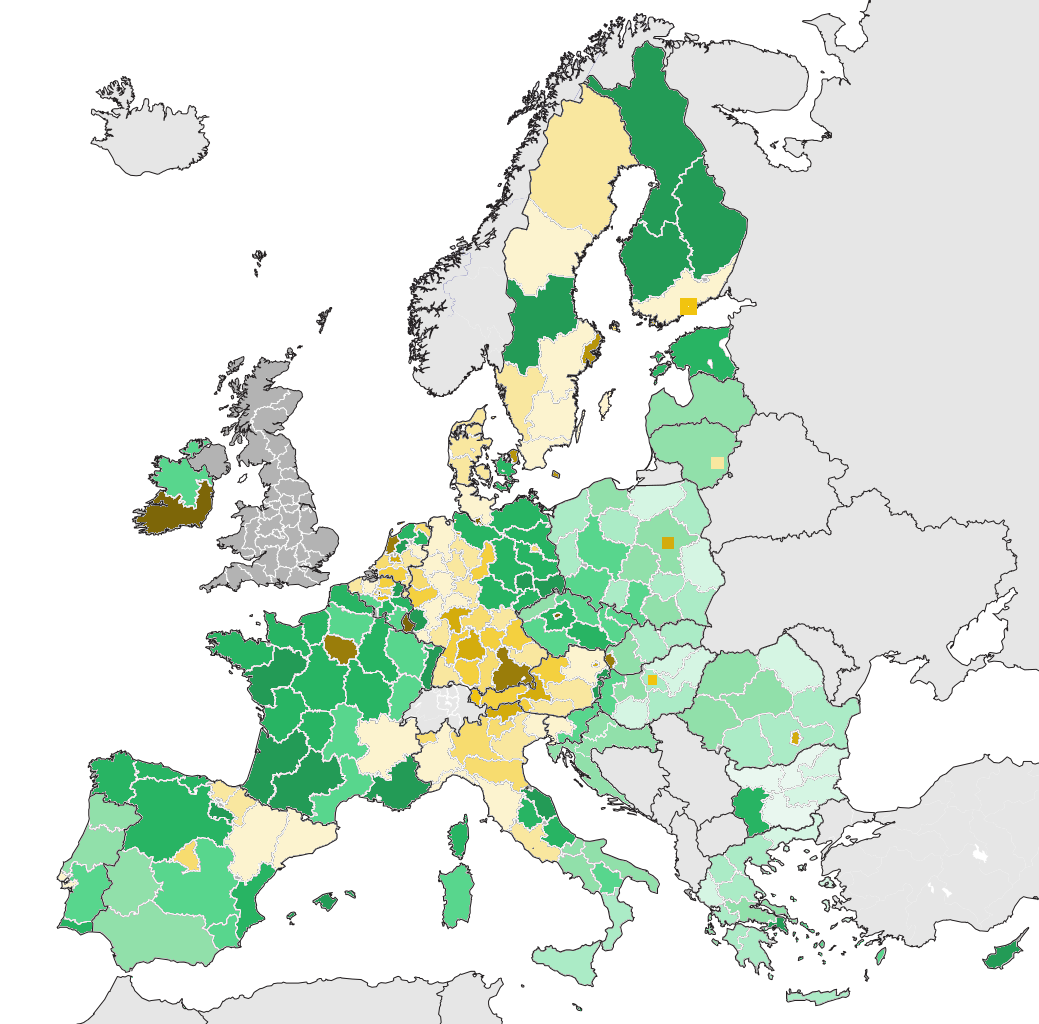

EuroStat

Eurostat ('European Statistical Office'; DG ESTAT) is a Directorate-General of the European Commission located in the Kirchberg, Luxembourg, Kirchberg quarter of Luxembourg City, Luxembourg. Eurostat's main responsibilities are to provide statistical information to the institutions of the European Union (EU) and to promote the harmonisation of statistical methods across its Member state of the European Union, member states and Enlargement of the European Union, candidates for accession as well as European Free Trade Association, EFTA countries. The organisations in the different countries that cooperate with Eurostat are summarised under the concept of the European Statistical System. Organisation Eurostat operates pursuant tRegulation (EC) No 223/2009 Since the swearing in of the von der Leyen Commission in December 2019, Eurostat is allocated to the portfolio of the European Commissioner for Economic and Financial Affairs, Taxation and Customs, European Commissioner for the Eco ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

OECD

The Organisation for Economic Co-operation and Development (OECD; french: Organisation de coopération et de développement économiques, ''OCDE'') is an intergovernmental organisation with 38 member countries, founded in 1961 to stimulate economic progress and world trade. It is a forum whose member countries describe themselves as committed to democracy and the market economy, providing a platform to compare policy experiences, seek answers to common problems, identify good practices, and coordinate domestic and international policies of its members. The majority of OECD members are high-income economies with a very high Human Development Index (HDI), and are regarded as developed countries. Their collective population is 1.38 billion. , the OECD member countries collectively comprised 62.2% of global nominal GDP (US$49.6 trillion) and 42.8% of global GDP ( Int$54.2 trillion) at purchasing power parity. The OECD is an official United Nations observer. In April 1948, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Irish Times

''The Irish Times'' is an Irish daily broadsheet newspaper and online digital publication. It launched on 29 March 1859. The editor is Ruadhán Mac Cormaic. It is published every day except Sundays. ''The Irish Times'' is considered a newspaper of record for Ireland. Though formed as a Protestant nationalist paper, within two decades and under new owners it had become the voice of British unionism in Ireland. It is no longer a pro unionist paper; it presents itself politically as "liberal and progressive", as well as being centre-right on economic issues. The editorship of the newspaper from 1859 until 1986 was controlled by the Anglo-Irish Protestant minority, only gaining its first nominal Irish Catholic editor 127 years into its existence. The paper's most prominent columnists include writer and arts commentator Fintan O'Toole and satirist Miriam Lord. The late Taoiseach Garret FitzGerald was once a columnist. Senior international figures, including Tony Blair and Bill Cl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Eurostat

Eurostat ('European Statistical Office'; DG ESTAT) is a Directorate-General of the European Commission located in the Kirchberg, Luxembourg, Kirchberg quarter of Luxembourg City, Luxembourg. Eurostat's main responsibilities are to provide statistical information to the institutions of the European Union (EU) and to promote the harmonisation of statistical methods across its Member state of the European Union, member states and Enlargement of the European Union, candidates for accession as well as European Free Trade Association, EFTA countries. The organisations in the different countries that cooperate with Eurostat are summarised under the concept of the European Statistical System. Organisation Eurostat operates pursuant tRegulation (EC) No 223/2009 Since the swearing in of the von der Leyen Commission in December 2019, Eurostat is allocated to the portfolio of the European Commissioner for Economic and Financial Affairs, Taxation and Customs, European Commissioner for the Eco ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

BEPS

Base erosion and profit shifting (BEPS) refers to corporate tax planning strategies used by multinationals to "shift" profits from higher-tax jurisdictions to lower-tax jurisdictions or no-tax locations where there is little or no economic activity, thus "eroding" the "tax-base" of the higher-tax jurisdictions using deductible payments such as interest or royalties. For the government, the tax base is a company's income or profit. Tax is levied as a percentage on this income/profit. When that income / profit is transferred to another country or tax haven, the tax base is eroded and the company does not pay taxes to the country that is generating the income. As a result, tax revenues are reduced and the government is detained. The Organization for Economic Co-operation and Development (OECD) define BEPS strategies as "exploiting gaps and mismatches in tax rules". While some of the tactics are illegal, the majority are not. Corporate tax havens offer BEPS tools to "shift" pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |