|

BEPS

Base erosion and profit shifting (BEPS) refers to corporate tax planning strategies used by multinationals to "shift" profits from higher-tax jurisdictions to lower-tax jurisdictions or no-tax locations where there is little or no economic activity, thus "eroding" the "tax-base" of the higher-tax jurisdictions using deductible payments such as interest or royalties. For the government, the tax base is a company's income or profit. Tax is levied as a percentage on this income/profit. When that income / profit is transferred to another country or tax haven, the tax base is eroded and the company does not pay taxes to the country that is generating the income. As a result, tax revenues are reduced and the government is detained. The Organization for Economic Co-operation and Development (OECD) define BEPS strategies as "exploiting gaps and mismatches in tax rules". While some of the tactics are illegal, the majority are not. Corporate tax havens offer BEPS tools to "shift" p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Tax Haven

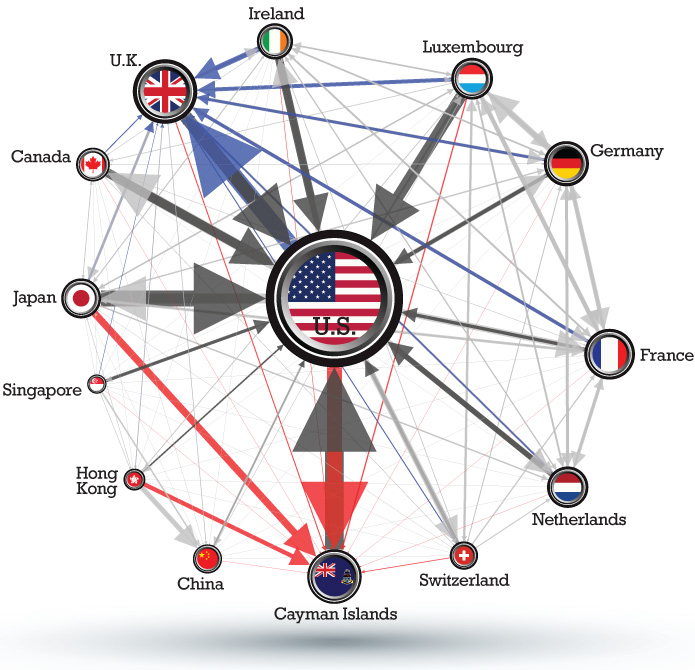

Corporate haven, corporate tax haven, or multinational tax haven is used to describe a jurisdiction that multinational corporations find attractive for establishing subsidiaries or incorporation of regional or main company headquarters, mostly due to favourable tax regimes (not just the headline tax rate), and/or favourable secrecy laws (such as the avoidance of regulations or disclosure of tax schemes), and/or favourable regulatory regimes (such as weak data-protection or employment laws). Unlike traditional tax havens, modern corporate tax havens reject they have anything to do with near-zero effective tax rates, due to their need to encourage jurisdictions to enter into bilateral tax treaties which accept the haven's base erosion and profit shifting (BEPS) tools. CORPNET show each corporate tax haven is strongly connected with specific traditional tax havens (via additional BEPS tool "backdoors" like the double Irish, the dutch sandwich, and single malt). Corporate tax h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Double Irish

The Double Irish arrangement was a base erosion and profit shifting (BEPS) corporate tax avoidance tool used mostly by United States multinationals since the late 1980s to avoid corporate taxation on non-U.S. profits. It was the largest tax avoidance tool in history and by 2010 was shielding US$100 billion annually in US multinational foreign profits from taxation, and was the main tool by which US multinationals built up untaxed offshore reserves of US$1 trillion from 2004 to 2018. Traditionally, it was also used with the Dutch Sandwich BEPS tool; however, 2010 changes to tax laws in Ireland dispensed with this requirement. Despite US knowledge of the Double Irish for a decade, it was the European Commission that in October 2014 forced Ireland to close the scheme, starting in January 2015. However, users of existing schemes, such as Apple, Google, Facebook and Pfizer, were given until January 2020 to close them. At the announcement of the closure it was known that multi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Allowances For Intangible Assets

The Double Irish arrangement was a base erosion and profit shifting (BEPS) corporate tax avoidance tool used mostly by United States multinationals since the late 1980s to avoid corporate taxation on non-U.S. profits. It was the largest tax avoidance tool in history and by 2010 was shielding US$100 billion annually in US multinational foreign profits from taxation, and was the main tool by which US multinationals built up untaxed offshore reserves of US$1 trillion from 2004 to 2018. Traditionally, it was also used with the Dutch Sandwich BEPS tool; however, 2010 changes to tax laws in Ireland dispensed with this requirement. Despite US knowledge of the Double Irish for a decade, it was the European Commission that in October 2014 forced Ireland to close the scheme, starting in January 2015. However, users of existing schemes, such as Apple, Google, Facebook and Pfizer, were given until January 2020 to close them. At the announcement of the closure it was known that multin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ireland As A Tax Haven

Ireland has been labelled as a tax haven or corporate tax haven in multiple financial reports, an allegation which the state has rejected in response. Ireland is on all academic " tax haven lists", including the , and tax NGOs. Ireland does not meet the 1998 OECD definition of a tax haven, but no OECD member, including Switzerland, ever met this definition; only Trinidad & Tobago met it in 2017. Similarly, no EU–28 country is amongst the 64 listed in the 2017 EU tax haven blacklist and greylist. In September 2016, Brazil became the first G20 country to "blacklist" Ireland as a tax haven. Ireland's base erosion and profit shifting (BEPS) tools give some foreign corporates ' of 0% to 2.5% on global profits re-routed to Ireland via their tax treaty network. Ireland's ''aggregate '' for foreign corporates is 2.2–4.5%. Ireland's BEPS tools are the world's largest BEPS flows, exceed the entire Caribbean system, and artificially inflate the US–EU trade deficit. Ireland's t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Leprechaun Economics

Leprechaun economics was a term coined by economist Paul Krugman to describe the 26.3 per cent rise in Irish 2015 GDP, later revised to 34.4 per cent, in a 12 July 2016 publication by the Irish Central Statistics Office (CSO), restating 2015 Irish national accounts. At that point, the distortion of Irish economic data by tax-driven accounting flows reached a climax. In 2020, Krugman said the term was a feature of all tax havens. While the event that caused the artificial Irish GDP growth occurred in Q1 2015, the Irish CSO had to delay its GDP revision and redact the release of its regular economic data in 2016–2017 to protect the source's identity, as required by Irish law. Only in Q1 2018 could economists confirm Apple as the source, and that this was the largest ever base erosion and profit shifting (BEPS) action, and the largest hybrid– tax inversion of a U.S. corporation. The event marked the replacement of Ireland's prohibited BEPS tool, the Double Irish, with ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Intellectual Property

Intellectual property (IP) is a category of property that includes intangible creations of the human intellect. There are many types of intellectual property, and some countries recognize more than others. The best-known types are patents, copyrights, trademarks, and trade secrets. The modern concept of intellectual property developed in England in the 17th and 18th centuries. The term "intellectual property" began to be used in the 19th century, though it was not until the late 20th century that intellectual property became commonplace in the majority of the world's legal systems."property as a common descriptor of the field probably traces to the foundation of the World Intellectual Property Organization (WIPO) by the United Nations." in Mark A. Lemley''Property, Intellectual Property, and Free Riding'', Texas Law Review, 2005, Vol. 83:1031, page 1033, footnote 4. The main purpose of intellectual property law is to encourage the creation of a wide variety of intellectual g ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Transfer Pricing

In taxation and accounting, transfer pricing refers to the rules and methods for pricing transactions within and between enterprises under common ownership or control. Because of the potential for cross-border controlled transactions to distort taxable income, tax authorities in many countries can adjust intragroup transfer prices that differ from what would have been charged by unrelated enterprises dealing at arm’s length (the arm’s-length principle). The OECD and World Bank recommend intragroup pricing rules based on the arm’s-length principle, and 19 of the 20 members of the G20 have adopted similar measures through bilateral treaties and domestic legislation, regulations, or administrative practice.World Bank pp. 35-51 Countries with transfer pricing legislation generally follow th''OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations''in most respects, although their rules can differ on some important details. Where adopted, transfe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gabriel Zucman

Gabriel Zucman (born 30 October 1986) is a French economist who is currently an associate professor of public policy and economics at the University of California, Berkeley‘s Goldman School of Public Policy. The author of '' The Hidden Wealth of Nations: The Scourge of Tax Havens'' (2015), Zucman is known for his research on tax havens and corporate tax havens. Zucman's research has found that the leading corporate tax havens are all OECD–compliant, and that tax disputes between high–tax locations and havens are very rare. His papers are some of the most cited papers on research into tax havens. Zucman is also known for his work on the quantification of the financial scale of base erosion and profit shifting (BEPS) tax avoidance techniques employed by multinationals in corporate tax havens, through which he identified Ireland as the world's largest corporate tax haven in 2018. In 2018, Zucman was the recipient of the Prize for the Best Young Economist in France, awa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Justice Network

The Tax Justice Network (or TJN) is an advocacy group consisting of a coalition of researchers and activists with a shared concern about tax avoidance, tax competition, and tax havens. Empirical results The TJN has reported on the OECD Base erosion and profit shifting (BEPS) projects and conducted their own research that the scale of corporate taxes being avoided by multinationals is an estimated $660bn in 2012 (a quarter of US multinationals’ gross profits), which is equivalent to 0.9% of World GDP. In July 2012, following a study into wealthy individuals with offshore accounts, the Tax Justice Network published claims regarding deposits worth at least $21 trillion (£13 trillion), potentially even $32 trillion, in secretive tax havens. As a result, governments suffer a lack of income taxes of up to $280 billion. In November 2020, the TJN published "The State of Tax Justice 2020" report. It claims $427 billion is lost every year to tax abuse. Focus Financial Secrecy Index ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

OECD

The Organisation for Economic Co-operation and Development (OECD; french: Organisation de coopération et de développement économiques, ''OCDE'') is an intergovernmental organisation with 38 member countries, founded in 1961 to stimulate economic progress and world trade. It is a forum whose member countries describe themselves as committed to democracy and the market economy, providing a platform to compare policy experiences, seek answers to common problems, identify good practices, and coordinate domestic and international policies of its members. The majority of OECD members are high-income economies with a very high Human Development Index (HDI), and are regarded as developed countries. Their collective population is 1.38 billion. , the OECD member countries collectively comprised 62.2% of global nominal GDP (US$49.6 trillion) and 42.8% of global GDP (Int$54.2 trillion) at purchasing power parity. The OECD is an official United Nations observer. In April 1948, th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)