|

Carnegie Investment Bank

Carnegie Investment Bank AB is a Swedish financial services group with activities in securities brokerage, investment banking and private banking. Founded in 1803, Carnegie is headquartered in Stockholm with offices across the Nordic region, as well as in London, New York, and Luxembourg. The company has market leading positions in equities research and brokerage, corporate finance advisory and private wealth management. Carnegie’s customers include institutional investors, corporates, financial institutions, private equity firms, governments and high-net-worth individuals. In 2018 Carnegie had revenues of SEK 2.4 billion and as of 31 December 2018 assets of SEK 12.6 billion. Assets under management amounts to SEK 110 billion and the number of employees is approximately 600 as of Q2 2019. In the wake of the economic crisis of 2008 Carnegie Investment Bank AB was nationalized on 10 November 2008. In May 2009, the bank was acquired in a joint venture by the private equi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Privately Held Company

A privately held company (or simply a private company) is a company whose shares and related rights or obligations are not offered for public subscription or publicly negotiated in the respective listed markets, but rather the company's stock is offered, owned, traded, exchanged privately, or Over-the-counter (finance), over-the-counter. In the case of a closed corporation, there are a relatively small number of shareholders or company members. Related terms are closely-held corporation, unquoted company, and unlisted company. Though less visible than their public company, publicly traded counterparts, private companies have major importance in the world's economy. In 2008, the 441 list of largest private non-governmental companies by revenue, largest private companies in the United States accounted for ($1.8 trillion) in revenues and employed 6.2 million people, according to ''Forbes''. In 2005, using a substantially smaller pool size (22.7%) for comparison, the 339 companies on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Equity Research

Securities research is a discipline within the financial services industry. Securities research professionals are known most generally as "analysts", "research analysts", or "securities analysts"; all the foregoing terms are synonymous. Research analysts produce research reports and typically issue a recommendation: buy ("overweight"), hold, or sell ("underweight"); see target price and trade idea. These reports can be accessed from a number of sources, and brokerages will often offer the reports free to their customers. Research can be categorized by the security type, as well as by whether it is buy-side research or sell-side research; analysts further focus on particular industries. Although usually associated with fundamental analysis, research also focuses on technical analysis, and reports will often include both. See also Financial analyst #Securities firms. Analyst specialization Securities analysts are commonly divided between the two basic kinds of securities: ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

David Carnegie Jr

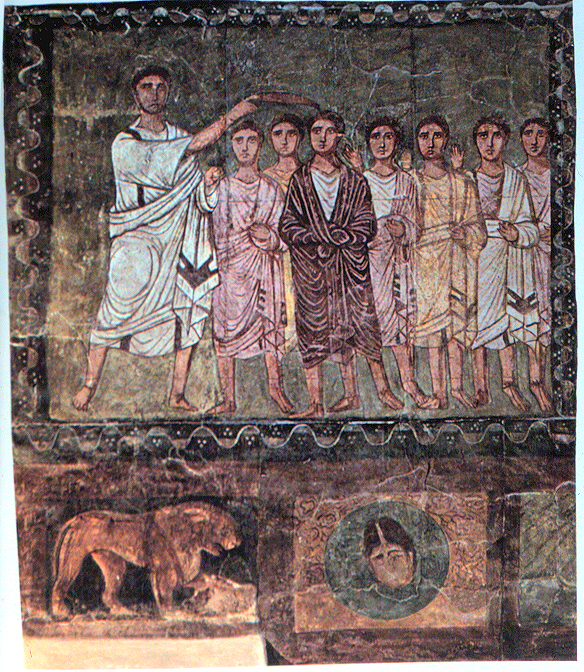

David (; , "beloved one") (traditional spelling), , ''Dāwūd''; grc-koi, Δαυΐδ, Dauíd; la, Davidus, David; gez , ዳዊት, ''Dawit''; xcl, Դաւիթ, ''Dawitʿ''; cu, Давíдъ, ''Davidŭ''; possibly meaning "beloved one". was, according to the Hebrew Bible, the third king of the United Kingdom of Israel. In the Books of Samuel, he is described as a young shepherd and harpist who gains fame by slaying Goliath, a champion of the Philistines, in southern Canaan. David becomes a favourite of Saul, the first king of Israel; he also forges a notably close friendship with Jonathan, a son of Saul. However, under the paranoia that David is seeking to usurp the throne, Saul attempts to kill David, forcing the latter to go into hiding and effectively operate as a fugitive for several years. After Saul and Jonathan are both killed in battle against the Philistines, a 30-year-old David is anointed king over all of Israel and Judah. Following his rise to power, David ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gothenburg

Gothenburg (; abbreviated Gbg; sv, Göteborg ) is the second-largest city in Sweden, fifth-largest in the Nordic countries, and capital of the Västra Götaland County. It is situated by the Kattegat, on the west coast of Sweden, and has a population of approximately 590,000 in the city proper and about 1.1 million inhabitants in the metropolitan area. Gothenburg was founded as a heavily fortified, primarily Dutch, trading colony, by royal charter in 1621 by King Gustavus Adolphus. In addition to the generous privileges (e.g. tax relaxation) given to his Dutch allies from the ongoing Thirty Years' War, the king also attracted significant numbers of his German and Scottish allies to populate his only town on the western coast. At a key strategic location at the mouth of the Göta älv, where Scandinavia's largest drainage basin enters the sea, the Port of Gothenburg is now the largest port in the Nordic countries. Gothenburg is home to many students, as the city incl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Scotland

Scotland (, ) is a country that is part of the United Kingdom. Covering the northern third of the island of Great Britain, mainland Scotland has a border with England to the southeast and is otherwise surrounded by the Atlantic Ocean to the north and west, the North Sea to the northeast and east, and the Irish Sea to the south. It also contains more than 790 islands, principally in the archipelagos of the Hebrides and the Northern Isles. Most of the population, including the capital Edinburgh, is concentrated in the Central Belt—the plain between the Scottish Highlands and the Southern Uplands—in the Scottish Lowlands. Scotland is divided into 32 administrative subdivisions or local authorities, known as council areas. Glasgow City is the largest council area in terms of population, with Highland being the largest in terms of area. Limited self-governing power, covering matters such as education, social services and roads and transportation, is devolved from the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bure Equity

Bure Equity is a Swedish investment company involved in communications, textiles, training, and education. It is the largest private school operator in Sweden. This role gained it international attention in connection to the rise of independent schools in Sweden. Bure Equity owns Vittra, a company that runs schools in Sweden and other countries. On the 11 February 2009 Altor Fund III and Bure Equity AB signed an agreement to acquire Carnegie Investment Bank, a leading independent Nordic investment bank, from the Swedish National Debt Office The Swedish National Debt Office ( sv, Riksgäldskontoret or shortly ''Riksgälden'') was founded by Gustav III at the Riksdag of the Estates in 1789, through the Act of union and security. It is a Swedish Government agency. The first task of the .... The total net asset value on 31 December 2016 amounted to six billion kroner and the largest holdings were in the companies Mycronic and Vitrolife. The company also has shares in, among others, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Altor Equity Partners

Altor Equity Partners is a private equity firm focused on leveraged buyout and growth capital investments in Sweden, Denmark, Finland, Norway and the DACH region. History The firm, which is based in Stockholm, Sweden, was founded in 2003 by a team led by , formerly a partner at Industri Kapital, another Nordic-focused private equity firm. As of 2015, the firm has raised approximately €6.2 billion since inception across three funds. The firm completed fundraising for its first investment vehicle, the Altor 2003 Fund in May 2003 with €650 million of investor commitments. Altor Fund II was closed in March 2006 €1.2 billion of capital and Altor Fund III closed in August 2008 with €2.0 billion of commitments. Altor closed its fourth fund in July 2014, also with €2 billion in commitments. Altor closed its most recent fifth fund in 2019, with €2.5 billion in commitments. Notable Investments In 2006, Altor purchased Norwegian outdoor clothing retailer Helly Hansen from I ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Crisis Of 2008

The Great Recession was a period of marked general decline, i.e. a recession, observed in national economies globally that occurred from late 2007 into 2009. The scale and timing of the recession varied from country to country (see map). At the time, the International Monetary Fund (IMF) concluded that it was the most severe economic and financial meltdown since the Great Depression. One result was a serious disruption of normal international relations. The causes of the Great Recession include a combination of vulnerabilities that developed in the financial system, along with a series of triggering events that began with the bursting of the United States housing bubble in 2005–2012. When housing prices fell and homeowners began to abandon their mortgages, the value of mortgage-backed securities held by investment banks declined in 2007–2008, causing several to collapse or be bailed out in September 2008. This 2007–2008 phase was called the subprime mortgage crisis. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

High-net-worth Individual

High-net-worth individual (HNWI) is a term used by some segments of the financial services industry to designate persons whose investible wealth (assets such as stocks and bonds) exceeds a given amount. Typically, these individuals are defined as holding financial assets (excluding their primary residence) with a value greater than US$1 million. "Very-HNWI" (VHNWI) can refer to someone with a net worth of at least US$5 million. The Capgemini World Wealth Report 2020 defines an additional class of ultra-high-net-worth individuals (UHNWIs), those with US$30 million in investible assets. According to The Knight Frank Wealth Report, HNWI can refer to someone with a net worth of at least US$1 million while UHNWI can refer to someone with a net worth of at least US$30 million. , there were estimated to be just over 15 million HNWIs in the world according to the Global Citizens Report by Henley & Partners. The United States had the highest number of HNWIs (5,325,000) of any co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Equity

In the field of finance, the term private equity (PE) refers to investment funds, usually limited partnerships (LP), which buy and restructure financially weak companies that produce goods and provide services. A private-equity fund is both a type of ownership of assets ( financial equity) and is a class of assets (debt securities and equity securities), which function as modes of financial management for operating private companies that are not publicly traded in a stock exchange. Private-equity capital is invested into a target company either by an investment management company (private equity firm), or by a venture capital fund, or by an angel investor; each category of investor has specific financial goals, management preferences, and investment strategies for profiting from their investments. Each category of investor provides working capital to the target company to finance the expansion of the company with the development of new products and services, the restructurin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Institutional Investors

An institutional investor is an entity which pools money to purchase securities, real property, and other investment assets or originate loans. Institutional investors include commercial banks, central banks, credit unions, government-linked companies, insurers, pension funds, sovereign wealth funds, charities, hedge funds, REITs, investment advisors, endowments, and mutual funds. Operating companies which invest excess capital in these types of assets may also be included in the term. Activist institutional investors may also influence corporate governance by exercising voting rights in their investments. In 2019, the world's top 500 asset managers collectively managed $104.4 trillion in Assets under Management (AuM). Although institutional investors appear to be more sophisticated than retail investors, it remains unclear if professional active investment managers can reliably enhance risk-adjusted returns by an amount that exceeds fees and expenses of investment managemen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |