|

Bank Muamalat

Bank Muamalat Indonesia (BMI) is a commercial bank in Indonesia operating on the principles of Islamic banking. The bank was founded in 1991, based on the initiative of the Indonesian Council of Ulamas (MUI) and under the auspices of the Government of Indonesia. Operations began in 1992. foreign exchange service began in 1994. Funding products apply the principles of wadiah (deposit) and mudarabah (profit-sharing). Financing products apply the principles of bai’ (buy and sell), musharakah (equity sharing), mudarabah, and ijarah (rent). Bank Muamalat serves nearly 3,000,000 customers throughout Indonesia and Malaysia. Currently 82.65% stake of Bank Muamalat is owned by a government agency Hajj Fund Management Agency (BPKH), followed by Andre Mirza Hartawan (commissioner of the bank, 5.19%) and the public (12.16%). Network To date, the Bank has 239 service offices and also supported by an extensive service network consisting of 568 Muamalat ATM units, 120,000 ATM Bersama ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Company

A public company is a company whose ownership is organized via shares of stock which are intended to be freely traded on a stock exchange or in over-the-counter markets. A public (publicly traded) company can be listed on a stock exchange ( listed company), which facilitates the trade of shares, or not ( unlisted public company). In some jurisdictions, public companies over a certain size must be listed on an exchange. In most cases, public companies are ''private'' enterprises in the ''private'' sector, and "public" emphasizes their reporting and trading on the public markets. Public companies are formed within the legal systems of particular states, and therefore have associations and formal designations which are distinct and separate in the polity in which they reside. In the United States, for example, a public company is usually a type of corporation (though a corporation need not be a public company), in the United Kingdom it is usually a public limited company (plc), ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wadiah

Islamic banking, Islamic finance ( ar, مصرفية إسلامية), or Sharia-compliant finance is banking or financing activity that complies with Sharia (Islamic law) and its practical application through the development of Islamic economics. Some of the modes of Islamic banking/finance include '' Mudarabah'' (profit-sharing and loss-bearing), ''Wadiah'' (safekeeping), '' Musharaka'' (joint venture), '' Murabahah'' (cost-plus), and ''Ijara'' (leasing). Sharia prohibits ''riba'', or usury, defined as interest paid on all loans of money (although some Muslims dispute whether there is a consensus that interest is equivalent to ''riba''). Investment in businesses that provide goods or services considered contrary to Islamic principles (e.g. pork or alcohol) is also ''haram'' ("sinful and prohibited"). These prohibitions have been applied historically in varying degrees in Muslim countries/communities to prevent un-Islamic practices. In the late 20th century, as part of the re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banks Established In 1991

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in the an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Islamic Banks Of Indonesia

Islam (; ar, ۘالِإسلَام, , ) is an Abrahamic monotheistic religion centred primarily around the Quran, a religious text considered by Muslims to be the direct word of God (or ''Allah'') as it was revealed to Muhammad, the main and final Islamic prophet.Peters, F. E. 2009. "Allāh." In , edited by J. L. Esposito. Oxford: Oxford University Press. . (See alsoquick reference) " e Muslims' understanding of Allāh is based...on the Qurʿān's public witness. Allāh is Unique, the Creator, Sovereign, and Judge of mankind. It is Allāh who directs the universe through his direct action on nature and who has guided human history through his prophets, Abraham, with whom he made his covenant, Moses/Moosa, Jesus/Eesa, and Muḥammad, through all of whom he founded his chosen communities, the 'Peoples of the Book.'" It is the world's second-largest religion behind Christianity, with its followers ranging between 1-1.8 billion globally, or around a quarter of the world's pop ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banks Of Indonesia

This is a list of major banks in Indonesia. There are 120 commercial banks in Indonesia (4 state owned banks and 117 private banks). Two of the state owned banks have Islamic banking units. Of the 26 government regional banks, 15 have Islamic banking units, while of 86 private national banks, 7 have Islamic banking unit, and there are five Islamic commercial banks. Top 10 banks ranked by total assets ''As of Q2 2022:'' #Bank Mandiri #Bank Rakyat Indonesia (BRI) # Bank Central Asia (BCA) #Bank Negara Indonesia (BNI) # Bank Tabungan Negara (BTN) # Bank CIMB Niaga #Bank Syariah Indonesia (BSI) # Permata Bank # Bank OCBC NISP # Panin Bank Central Bank *Bank Indonesia Conventional banks Government-owned banks State-owned Regional-owned banks Regional-owned banks are formally instituted as ''Bank Pembangunan Daerah'' (Regional Development Bank, abbreviated as BPD). Private banks Foreign banks Islamic Banks Sharia bank Government-owned sharia banks Bank BNI Sya ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Malaysia

Malaysia ( ; ) is a country in Southeast Asia. The federation, federal constitutional monarchy consists of States and federal territories of Malaysia, thirteen states and three federal territories, separated by the South China Sea into two regions: Peninsular Malaysia and Borneo's East Malaysia. Peninsular Malaysia shares a land and maritime Malaysia–Thailand border, border with Thailand and Maritime boundary, maritime borders with Singapore, Vietnam, and Indonesia. East Malaysia shares land and maritime borders with Brunei and Indonesia, and a maritime border with the Philippines and Vietnam. Kuala Lumpur is the national capital, the country's largest city, and the seat of the Parliament of Malaysia, legislative branch of the Government of Malaysia, federal government. The nearby Planned community#Planned capitals, planned capital of Putrajaya is the administrative capital, which represents the seat of both the Government of Malaysia#Executive, executive branch (the Cabine ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Kuala Lumpur

, anthem = ''Maju dan Sejahtera'' , image_map = , map_caption = , pushpin_map = Malaysia#Southeast Asia#Asia , pushpin_map_caption = , coordinates = , subdivision_type = Country , subdivision_name = , subdivision_type1 = Administrative areas , subdivision_name1 = , established_title = Establishment , established_date = 1857 , established_title2 = City status , established_date2 = 1 February 1972 , established_title3 = Transferred to federal jurisdiction , established_date3 = 1 February 1974 , government_type = Federal administrationwith local government , governing_body = Kuala Lumpur City Hall , leader_title = Mayor , leader_name = Mahadi bin Che Ngah , total_type = Federal territory , area_footnotes = , area_total_km2 = ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ijarah

''Ijarah'', ( ar, الإجارة , al-Ijārah, "to give something on rent" or "providing services and goods temporarily for a wage" Jamaldeen, ''Islamic Finance For Dummies'', 2012:157 (a noun, not a verb)), is a term of ''fiqh'' (Islamic jurisprudence) Usmani, ''Introduction to Islamic Finance'', 1998: p.109 and product in Islamic banking and finance. In traditional ''fiqh'', it means a contract for the hiring of persons or renting/leasing of the services or the “usufruct” of a property, generally for a fixed period and price. In hiring, the employer is called ''musta’jir'', while the employee is called ''ajir''. ''Ijarah'' need not lead to purchase. In conventional leasing an "operating lease" does not end in a change of ownership, nor does the type of ''ijarah'' known as ''al-ijarah (tashghiliyah)''. In Islamic finance, ''al Ijarah'' does lead to purchase (''Ijara wa Iqtina'', or "rent and acquisition") and usually refers to a leasing contract of property (such as land, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Musharakah

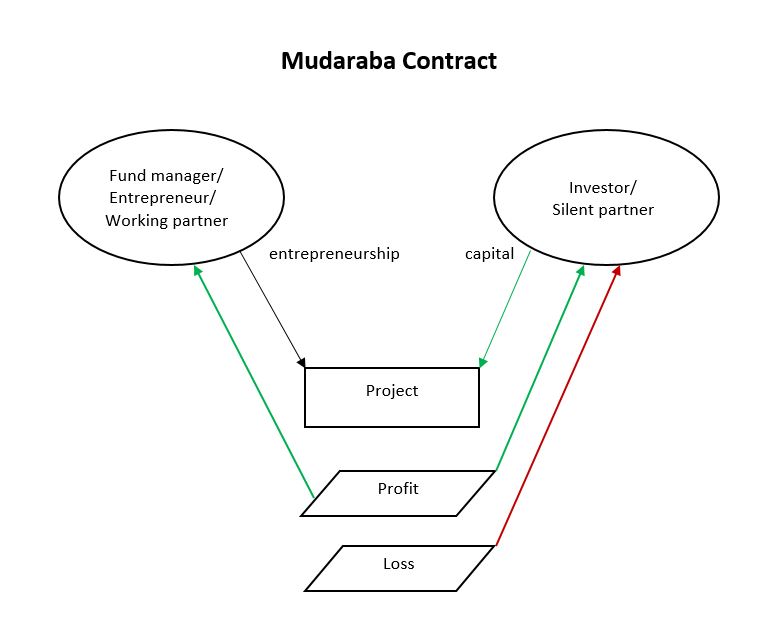

Profit and Loss Sharing (also called PLS or participatory banking) refers to Sharia-compliant forms of equity financing such as mudarabah and musharakah. These mechanisms comply with the religious prohibition on interest on loans that most Muslims subscribe to. ''Mudarabah'' (مضاربة) refers to "trustee finance" or passive partnership contract, while ''Musharakah'' (مشاركة or مشركة) refers to equity participation contract. Other sources include sukuk (also called "Islamic bonds") and direct equity investment (such as purchase of common shares of stock) as types of PLS. Khan, ''Islamic Banking in Pakistan'', 2015: p.91 The profits and losses shared in PLS are those of a business enterprise or person which/who has obtained capital from the Islamic bank/financial institution (the terms "debt", "borrow", "loan" and "lender" are not used). As financing is repaid, the provider of capital collects some agreed upon percentage of the profits (or deducts if there are losses) ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Foreign Currency Exchange

A bureau de change (plural bureaux de change, both ) ( British English) or currency exchange (American English) is a business where people can exchange one currency for another. Nomenclature Although originally French, the term "bureau de change" is widely used throughout Europe and French-speaking Canada, where it is common to find a sign saying "exchange" or "change". Since the adoption of the euro, many exchange offices have started incorporating its logotype prominently on their signage. In the United States and English-speaking Canada the business is described as "currency exchange" and sometimes "money exchange", sometimes with various additions such as "foreign", "desk", "office", "counter", "service", etc.; for example, "foreign currency exchange office". Location A bureau de change is often located at a bank, at a travel agent, airport, main railway station or large stores—namely, anywhere there is likely to be a market for people needing to convert ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Jakarta

Jakarta (; , bew, Jakarte), officially the Special Capital Region of Jakarta ( id, Daerah Khusus Ibukota Jakarta) is the capital and largest city of Indonesia. Lying on the northwest coast of Java, the world's most populous island, Jakarta is the largest city in Southeast Asia and serves as the diplomatic capital of ASEAN. The city is the economic, cultural, and political centre of Indonesia. It possesses a province-level status and has a population of 10,609,681 as of mid 2021.Badan Pusat Statistik, Jakarta, 2022. Although Jakarta extends over only , and thus has the smallest area of any Indonesian province, its metropolitan area covers , which includes the satellite cities Bogor, Depok, Tangerang, South Tangerang, and Bekasi, and has an estimated population of 35 million , making it the largest urban area in Indonesia and the second-largest in the world (after Tokyo). Jakarta ranks first among the Indonesian provinces in human development index. Jakar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)