|

ATM Bersama

ATM Bersama () is one of the interbank networks in Indonesia, connecting the ATM networks of twenty-one banks in Indonesia. It was established 1993 and is based on the model adopted by MegaLink, an interbank network in the Philippines. ATM Bersama has over 70 members with 17,000 ATMs throughout Indonesia. The network is owned by PT Artajasa Pembayaran Elektronis. Services ATM Bersama provides many interbank facilities, including balance inquiry, cash withdrawal and real time-online transfer to other accounts of members of the shared network. In 2004, ARTAJASA made a cross-border ATM Bersama with partner provider MEPS, Malaysia. Singapore and Thailand have been linked to the ATM Bersama network with NETS and ITMX respectively. Members The following banks are the members of ATM Bersama network: *ANZ *Bank Agroniaga *Bank Jago Tbk. *Bank Bengkulu *Bank Bukopin *Bank Capital * Commonwealth Bank *Bank DKI *Bank Ganesha * Bank HSBC *Bank Ina Perdana *Bank Index *Bank Jabar Ban ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

ATM Bersama 2016

ATM or atm often refers to: * Atmosphere (unit) or atm, a unit of atmospheric pressure * Automated teller machine, a cash dispenser or cash machine ATM or atm may also refer to: Computing * ATM (computer), a ZX Spectrum clone developed in Moscow in 1991 * Adobe Type Manager, a computer program for managing fonts * Accelerated Turing machine, or Zeno machine, a model of computation used in theoretical computer science * Alternating Turing machine, a model of computation used in theoretical computer science * Asynchronous Transfer Mode, a telecommunications protocol used in networking ** ATM adaptation layer ** ATM Adaptation Layer 5 Media * ''Amateur Telescope Making'', a series of books by Albert Graham Ingalls * ''ATM'' (2012 film), an American film * '' ATM: Er Rak Error'', a 2012 Thai film * ''Azhagiya Tamil Magan'', a 2007 Indian film * "ATM" (song), a 2018 song by J. Cole from ''KOD'' People and organizations * Abiding Truth Ministries, anti-LGBT organization in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

CIMB Niaga

PT Bank CIMB Niaga Tbk is Indonesia's sixth largest bank by assets, established in 1955. CIMB Niaga, which is majority-owned by CIMB Group, is the largest payment bank in terms of transaction value under the Indonesian Central Securities Depository. With 11% of market share, CIMB Niaga is the third largest mortgage provider in Indonesia. History Bank Niaga The bank was first established in 1955 as a national private bank. In 1969 when crisis hit the private sector in Indonesia, Bank Niaga remained sound and was eligible for Bank Indonesia’s Guarantee. Then in November 1974, Bank Niaga revamped its business plans and became a full service public bank to better meet the demands of customers. After a merger period with several other commercial banks, the function and individuality of the Bank were restored in 1975. The status was resumed to that of a state-run commercial bank. The official name was changed to "Bank Niaga 1955". In 1976, the bank launched a Professional Loan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Link (Indonesia)

LinkAja! is an Indonesian digital wallet service. The service was originally launched in 2007 by an Indonesian mobile operator Telkomsel as Telkomsel Cash, branded as TCASH. It is developed by PT Fintek Karya Nusantara, a company owned by various state-owned companies; including Telkomsel – itself a subsidiary of Telkom Indonesia, state-owned banks (Bank Mandiri, BRI, BNI, and BTN), Pertamina, Jiwasraya, and Danareksa. On March 26, 2020, LinkAja partnered with Telcoin, an instant, low-cost blockchain powered remittance service. This partnership is set to explore cashless opportunities in LinkAjas area of operation. The name "Link" comes from an interbank network An interbank network, also known as an ATM consortium or ATM network, is a computer network that enables ATM cards issued by a financial institution that is a member of the network to be used to perform ATM transactions through ATMs that belon ... in Indonesia with the same name. The network is owned by State ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

PRIMA (Indonesia)

PRIMA is one of the interbank networks in Indonesia. PRIMA is owned by PT Rintis Sejahtera. PT Rintis Sejahtera is a Satellite Communication services provider that transmitting digital information within the region and around the world. Before the creation of ATM PRIMA, this network was known as ATM BCA network that worked as the ATM network for Bank Central Asia. Services * PRIMAMESH * PRIMALINK * PRIMASTAR * PRIMANET * EFT SWITCHING, the Interbank network * BROADBAND Members * Bank Central AsiaRintis.co.id * * Bank Jabar Banten * |

ALTO (interbank Network)

ALTO is an interbank network in Indonesia. It was founded in August 1993. History In 1997, Asian Economic Crisis invaded Indonesian banking industry. Many banks closed, merged or recapitalized. In 2007, ALTO expanded the business to Money Transfer Operation. In 2009, ALTO developed Mobile Air Time Top Up for all telecommunication provider in Indonesia. The newest business start up from ALTO is Boston School of Banking and Finance, which focused in education for the future banking employers. The other start up is a payment service named ALTO Cash. In November 2013, ALTO made a joint venture with Seven Bank, who is a Japanese ATM network, named PT. ATM. The goal is to developing ATM business in Indonesia. Timeline * 1994 – Shared ATM Network * 2004 – ATM Acquiring * 2007 – Money Transfer Operation * 2009 – Biller, Top Up Mobile * 2011 – Front End Processing Switching Outsourcing * 2011 – NSICCS Function Lab 2012 * 2011 – Core Banking Outsourcing * 2011 – Alto Cash ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

ATM Usage Fees

ATM usage fees are the fees that many banks and interbank networks charge for the use of their automated teller machines (ATMs). In some cases, these fees are assessed solely for non-members of the bank; in other cases, they apply to all users. Two types of consumer charges exist: the surcharge and the foreign fee. The surcharge fee may be imposed by the ATM owner (the ''deployer'' or independent sales organization) and will be charged to the consumer using the machine. The foreign fee or transaction fee is a fee charged by the card issuer (financial institution, stored value provider) to the consumer for conducting a transaction outside of their network of machines in the case of a financial institution. Australia A number of ATM networks are operated in Australia, the largest are: Commonwealth Bank / Bankwest network with 3,400 machines, Westpac / St George Bank / BankSA / Bank of Melbourne with 2,800 machines, ANZ with 2,300 machines, the rediATM network with 1,800 machine ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United Overseas Bank

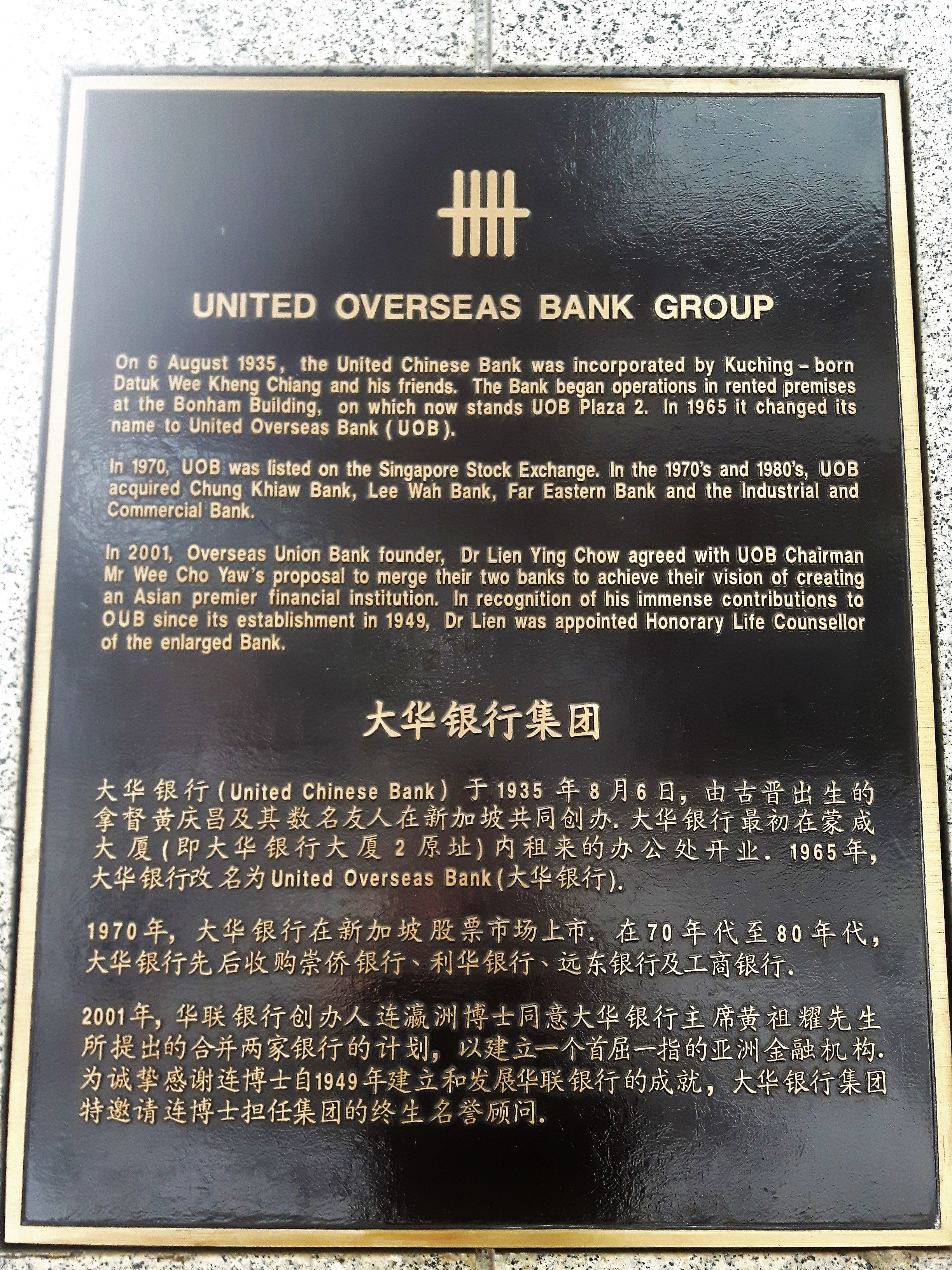

United Overseas Bank Limited (), often known as UOB, is a Singaporean multinational banking corporation headquartered in Singapore, with branches mostly found in most Southeast Asian countries. Founded in 1935 as United Chinese Bank (UCB) by Sarawak businessman Chew Teck Weng, the bank was set up together with a group of Chinese-born businessmen. The bank is the third largest bank in Southeast Asia by total assets. UOB provides commercial and corporate banking services, personal financial services, private banking and asset management services, as well as corporate finance, venture capital, investment, and Insurance services. It has 68 branches in Singapore and a network of more than 500 offices in 19 countries and territories in Asia Pacific, Western Europe and North America. History On 6 August 1935, businessman Wee Kheng Chiang, together with six other friends, established the bank after raising S$1 million. The bank was named ''United Chinese Bank (UCB)'' to emphasi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Standard Chartered

Standard Chartered plc is a multinational bank with operations in consumer, corporate and institutional banking, and treasury services. Despite being headquartered in the United Kingdom, it does not conduct retail banking in the UK, and around 90% of its profits come from Asia, Africa, and the Middle East. Standard Chartered has a primary listing on the London Stock Exchange and is a constituent of the FTSE 100 Index. It has secondary listings on the Hong Kong Stock Exchange, the National Stock Exchange of India, and OTC Markets Group Pink. Its largest shareholder is the Government of Singapore-owned Temasek Holdings. The Financial Stability Board considers it a systemically important bank. José Viñals is the Group Chairman of Standard Chartered. Bill Winters is the current Group Chief Executive. Name The name Standard Chartered comes from the names of the two banks that merged in 1969 to create it: The Chartered Bank of India, Australia and China, and Standard Bank of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Permata

Permata Bank (or Bank Permata) is a bank in Indonesia, headquartered in the capital city Jakarta. It has officially become a BUKU IV bank after receiving confirmation from the Financial Services Authority (OJK) on 20 January 2021. Serving nearly four million customers in 62 cities in Indonesia, it has 304 branch offices and two mobile branches; currently, the bank is led by Meliza Musa Rusli as the CEO. As a pioneer in mobile banking and mobile cash technology in the Indonesian market, in 2018, Permata Bank launched its PermataMobile X super application with 200 innovative features, and is currently one of the digital mobile banking leaders in the Indonesian market. History Bank Permata was formed with merger of five banks under the management of the Indonesian Bank Restructuring Agency (IBRA), namely: * PT Bank Bali Tbk - established in 1954, then center of a corruption scandal; * PT Bank Universal Tbk; * PT Bank Prima Express; * PT Bank Artamedia; and * PT Bank Patriot ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Mandiri

PT Bank Mandiri (Persero) Tbk or Bank Mandiri, headquartered in Jakarta, is the largest bank in Indonesia in terms of assets, loans and deposits. Total assets as of March 2021, were IDR 1.58 quadrillion (around US$110.56 billion). As of March 2021, Bank Mandiri was the largest bank in Indonesia by total assets. As of December 2020, the bank had 2,511 branches spread across three different time zones in Indonesia and 7 branches abroad, about 13,217 Automatic Teller Machines (ATMs), and five principal subsidiaries: Mandiri Sekuritas, Mandiri Tunas Finance, AXA Mandiri Financial Services, Bank Mandiri Taspen, and Mandiri AXA General Insurance. History Pre-merger Bank Mandiri is the result of the merger made by Indonesian government from four older government-owned banks that failed in 1998. Those four banks were Bank Bumi Daya, Bank Dagang Negara, Bank Ekspor Impor Indonesia, and Bank Pembangunan Indonesia. During the amalgamation and reorganisation, the government r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Danamon

PT Bank Danamon Indonesia Tbk is an Indonesian bank established in 1956. It is the sixth largest bank of Indonesia by asset size. History Bank Danamon was established on July 16, 1956, as PT Bank Kopra Indonesia. In 1976, the bank's name was changed to PT Bank Danamon Indonesia. It began focusing on foreign exchange transactions in 1976 and listed its shares on the Jakarta Stock Exchange in 1989. Suffering liquidity problems amid the Asian financial crisis, Danamon was in 1997 placed by the government under the supervision of the Indonesian Bank Restructuring Agency (IBRA). In 1999, the government through IBRA, recapitalized Danamon with Rp 32 billion in Government Bonds. In the same year, some banks taken over by the government merged with Bank Danamon as one part of IBRA's restructuring plan. In 2000, Bank Danamon merged with another eight banks taken over by the government, further increasing Danamon's size. Over the next three years, Danamon underwent a massive restructur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Citibank

Citibank, N. A. (N. A. stands for " National Association") is the primary U.S. banking subsidiary of financial services multinational Citigroup. Citibank was founded in 1812 as the City Bank of New York, and later became First National City Bank of New York. The bank has 2,649 branches in 19 countries, including 723 branches in the United States and 1,494 branches in Mexico operated by its subsidiary Banamex. The U.S. branches are concentrated in six metropolitan areas: New York, Chicago, Los Angeles, San Francisco, Washington, D.C., and Miami. It was founded as City Bank of New York and became National City Bank of New York. It has had an important role in war bonds. It has had a role in international events including the U.S. invasion of Haiti. History Early history The City Bank of New York was founded on June 16, 1812. The first president of the City Bank was the statesman and retired Colonel, Samuel Osgood. After Osgood's death in August 1813, William Few beca ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |