In

economics

Economics () is a behavioral science that studies the Production (economics), production, distribution (economics), distribution, and Consumption (economics), consumption of goods and services.

Economics focuses on the behaviour and interac ...

, utility is a measure of a certain person's satisfaction from a certain state of the world. Over time, the term has been used with at least two meanings.

* In a

normative

Normativity is the phenomenon in human societies of designating some actions or outcomes as good, desirable, or permissible, and others as bad, undesirable, or impermissible. A Norm (philosophy), norm in this sense means a standard for evaluatin ...

context, utility refers to a goal or objective that we wish to maximize, i.e., an

objective function

In mathematical optimization and decision theory, a loss function or cost function (sometimes also called an error function) is a function that maps an event or values of one or more variables onto a real number intuitively representing some "cost ...

. This kind of utility bears a closer resemblance to the original

utilitarian

In ethical philosophy, utilitarianism is a family of normative ethical theories that prescribe actions that maximize happiness and well-being for the affected individuals. In other words, utilitarian ideas encourage actions that lead to the ...

concept, developed by moral philosophers such as

and

John Stuart Mill

John Stuart Mill (20 May 1806 – 7 May 1873) was an English philosopher, political economist, politician and civil servant. One of the most influential thinkers in the history of liberalism and social liberalism, he contributed widely to s ...

.

* In a

descriptive context, the term refers to an ''apparent'' objective function; such a function is

revealed by a person's behavior, and specifically by their preferences over

lotteries

A lottery (or lotto) is a form of gambling that involves the drawing of numbers at random for a prize. Some governments outlaw lotteries, while others endorse it to the extent of organizing a national or state lottery. It is common to find som ...

, which can be any quantified choice.

The relationship between these two kinds of utility functions has been a source of controversy among both

economists and

ethicists, with most maintaining that the two are distinct but generally related.

Utility function

Consider a set of alternatives among which a person has a preference ordering. A utility function represents that ordering if it is possible to assign a

real number

In mathematics, a real number is a number that can be used to measure a continuous one- dimensional quantity such as a duration or temperature. Here, ''continuous'' means that pairs of values can have arbitrarily small differences. Every re ...

to each alternative in such a manner that ''alternative a'' is assigned a number greater than ''alternative b'' if and only if the individual prefers ''alternative a'' to ''alternative b''. In this situation, someone who selects the most preferred alternative must also choose one that maximizes the associated utility function.

Suppose James has utility function

such that

is the number of apples and

is the number of chocolates. Alternative A has

apples and

chocolates; alternative B has

apples and

chocolates. Putting the values

into the utility function yields

for alternative A and

for B, so James prefers alternative B. In general economic terms, a utility function ranks preferences concerning a set of goods and services.

Gérard Debreu

Gérard Debreu (; 4 July 1921 – 31 December 2004) was a French-born economist and mathematician. Best known as a professor of economics at the University of California, Berkeley, where he began work in 1962, he won the 1983 Nobel Memorial Prize ...

derived the conditions required for a preference ordering to be representable by a utility function. For a finite set of alternatives, these require only that the preference ordering is complete (so the individual can determine which of any two alternatives is preferred or that they are indifferent), and that the preference order is

transitive.

Suppose the set of alternatives is not finite (for example, even if the number of goods is finite, the quantity chosen can be any real number on an interval). In that case, a continuous utility function exists representing a consumer's preferences if and only if the consumer's preferences are complete, transitive, and continuous.

Applications

Utility can be represented through sets of

indifference curve

In economics, an indifference curve connects points on a graph representing different quantities of two goods, points between which a consumer is ''indifferent''. That is, any combinations of two products indicated by the curve will provide the c ...

, which are

level curves of the function itself and which plot the combination of commodities that an individual would accept to maintain a given level of satisfaction. Combining indifference curves with budget constraints allows for individual

demand curves derivation.

A diagram of a general indifference curve is shown below (Figure 1). The vertical and horizontal axes represent an individual's consumption of commodity Y and X respectively. All the combinations of commodity X and Y along the same indifference curve are regarded indifferently by individuals, which means all the combinations along an indifference curve result in the same utility value.

Individual and social utility can be construed as the value of a utility function and a

social welfare function

In welfare economics and social choice theory, a social welfare function—also called a social ordering, ranking, utility, or choice function—is a function that ranks a set of social states by their desirability. Each person's preferences ...

, respectively. When coupled with production or commodity constraints, by some assumptions, these functions can be used to analyze

Pareto efficiency

In welfare economics, a Pareto improvement formalizes the idea of an outcome being "better in every possible way". A change is called a Pareto improvement if it leaves at least one person in society better off without leaving anyone else worse ...

, such as illustrated by

Edgeworth boxes in

contract curve

In microeconomics, the contract curve or Pareto set is the set of points representing final allocations of two goods between two people that could occur as a result of mutually beneficial trading between those people given their initial allocati ...

s. Such efficiency is a major concept in

welfare economics

Welfare economics is a field of economics that applies microeconomic techniques to evaluate the overall well-being (welfare) of a society.

The principles of welfare economics are often used to inform public economics, which focuses on the ...

.

Preference

While

preference

In psychology, economics and philosophy, preference is a technical term usually used in relation to choosing between alternatives. For example, someone prefers A over B if they would rather choose A than B. Preferences are central to decision the ...

s are the conventional foundation of choice theory in

microeconomics

Microeconomics is a branch of economics that studies the behavior of individuals and Theory of the firm, firms in making decisions regarding the allocation of scarcity, scarce resources and the interactions among these individuals and firms. M ...

, it is often convenient to represent preferences with a utility

function. Let ''X'' be the consumption set, the set of all mutually exclusive baskets the consumer could consume. The consumer's utility function

ranks each possible outcome in the consumption set. If the consumer strictly prefers ''x'' to ''y'' or is indifferent between them, then

.

For example, suppose a consumer's consumption set is ''X'' = , and his utility function is ''u''(nothing) = 0, ''u''(1 apple) = 1, ''u''(1 orange) = 2, ''u''(1 apple and 1 orange) = 5, ''u''(2 apples) = 2 and ''u''(2 oranges) = 4. Then this consumer prefers 1 orange to 1 apple but prefers one of each to 2 oranges.

In micro-economic models, there is usually a finite set of L commodities, and a consumer may consume an arbitrary amount of each commodity. This gives a consumption set of

, and each package

is a vector containing the amounts of each commodity. For the example, there are two commodities: apples and oranges. If we say apples are the first commodity, and oranges the second, then the consumption set is

and ''u''(0, 0) = 0, ''u''(1, 0) = 1, ''u''(0, 1) = 2, ''u''(1, 1) = 5, ''u''(2, 0) = 2, ''u''(0, 2) = 4 as before. For ''u'' to be a utility function on ''X'', however, it must be defined for every package in ''X'', so now the function must be defined for fractional apples and oranges too. One function that would fit these numbers is

Preferences have three main properties:

* Completeness

Assume an individual has two choices, A and B. By ranking the two choices, one and only one of the following relationships is true: an individual strictly prefers A (A > B); an individual strictly prefers B (B>A); an individual is indifferent between A and B (A = B).

Either ''a'' ≥ ''b'' OR ''b'' ≥ ''a'' (OR both) for all (''a'',''b'')

* Transitivity

Individuals' preferences are consistent over bundles. If an individual prefers bundle A to bundle B and bundle B to bundle C, then it can be assumed that the individual prefers bundle A to bundle C.

(If ''a'' ≥ ''b'' and ''b'' ≥ ''c'', then ''a'' ≥ ''c'' for all (''a'',''b'',''c'')).

* Non-satiation or monotonicity

If bundle A contains all the goods that a bundle B contains, but A also includes more of at least one good than B. The individual prefers A over B. If, for example, bundle A = , and bundle B = , then A is preferred over B.

Revealed preference

It was recognized that utility could not be measured or observed directly, so instead economists devised a way to infer relative utilities from observed choice. These 'revealed preferences', as termed by

Paul Samuelson

Paul Anthony Samuelson (May 15, 1915 – December 13, 2009) was an American economist who was the first American to win the Nobel Memorial Prize in Economic Sciences. When awarding the prize in 1970, the Swedish Royal Academies stated that he "h ...

, were revealed e.g. in people's willingness to pay:

Utility is assumed to be correlative to Desire or Want. It has been argued already that desires cannot be measured directly, but only indirectly, by the outward phenomena which they cause: and that in those cases with which economics is mainly concerned the measure is found by the price which a person is willing to pay for the fulfillment or satisfaction of his desire.

Utility functions, expressing utility as a function of the amounts of the various goods consumed, are treated as either ''cardinal'' or ''ordinal'', depending on whether they are or are not interpreted as providing more information than simply the rank ordering of preferences among bundles of goods, such as information concerning the strength of preferences.

Cardinal

Cardinal utility states that the utilities obtained from consumption can be measured and ranked objectively and are representable by numbers.

There are fundamental assumptions of cardinal utility. Economic agents should be able to rank different bundles of goods based on their preferences or utilities and sort different transitions between two bundles of goods.

A cardinal utility function can be transformed to another utility function by a positive linear transformation (multiplying by a positive number, and adding some other number); however, both utility functions represent the same preferences.

When cardinal utility is assumed, the magnitude of utility differences is treated as an ethically or behaviorally significant quantity. For example, suppose a cup of orange juice has utility of 120 "utils", a cup of tea has a utility of 80 utils, and a cup of water has a utility of 40 utils. With cardinal utility, it can be concluded that the cup of orange juice is better than the cup of tea by the same amount by which the cup of tea is better than the cup of water. This means that if a person has a cup of tea, they would be willing to take any bet with a probability, p, greater than .5 of getting a cup of juice, with a risk of getting a cup of water equal to 1-p. One cannot conclude, however, that the cup of tea is two-thirds of the goodness of the cup of juice because this conclusion would depend not only on magnitudes of utility differences but also on the "zero" of utility. For example, if the "zero" of utility were located at -40, then a cup of orange juice would be 160 utils more than zero, a cup of tea 120 utils more than zero. Cardinal utility can be considered as the assumption that quantifiable characteristics, such as height, weight, temperature, etc can measure utility.

Neoclassical economics

Neoclassical economics is an approach to economics in which the production, consumption, and valuation (pricing) of goods and services are observed as driven by the supply and demand model. According to this line of thought, the value of a go ...

has largely retreated from using cardinal utility functions as the basis of economic behavior. A notable exception is in the context of analyzing choice with conditions of risk (see

below).

Sometimes cardinal utility is used to aggregate utilities across persons, to create a

social welfare function

In welfare economics and social choice theory, a social welfare function—also called a social ordering, ranking, utility, or choice function—is a function that ranks a set of social states by their desirability. Each person's preferences ...

.

Ordinal

Instead of giving actual numbers over different bundles, ordinal utilities are only the rankings of utilities received from different bundles of goods or services.

For example, ordinal utility could tell that having two ice creams provide a greater utility to individuals in comparison to one ice cream but could not tell exactly how much extra utility received by the individual. Ordinal utility, it does not require individuals to specify how much extra utility they received from the preferred bundle of goods or services in comparison to other bundles. They are only needed to tell which bundles they prefer.

When ordinal utilities are used, differences in utils (values assumed by the utility function) are treated as ethically or behaviorally meaningless: the utility index encodes a full behavioral ordering between members of a choice set, but tells nothing about the related ''strength of preferences''. For the above example, it would only be possible to say that juice is preferred to tea to water. Thus, ordinal utility utilizes comparisons, such as "preferred to", "no more", "less than", etc.

If a function

is ordinal and non-negative, it is equivalent to the function

, because taking the square is an increasing

monotone (or monotonic) transformation. This means that the ordinal preference induced by these functions is the same (although they are two different functions). In contrast, if

is cardinal, it is not equivalent to

.

Examples

In order to simplify calculations, various alternative assumptions have been made concerning details of human preferences, and these imply various alternative utility functions such as:

*

CES (''constant elasticity of substitution'').

*

Isoelastic utility

In economics, the isoelastic function for utility, also known as the isoelastic utility function, or power utility function, is used to express utility in terms of consumption or some other economic variable that a decision-maker is concerned wit ...

*

Exponential utility

*

Quasilinear utility

*

Homothetic preferences

*

Stone–Geary utility function

*

Gorman polar form

**

Greenwood–Hercowitz–Huffman preferences Greenwood–Hercowitz–Huffman preferences are a particular functional form of utility developed by Jeremy Greenwood (economist), Jeremy Greenwood, Zvi Hercowitz, and Gregory Huffman, in their 1988 paper ''Investment, Capacity Utilization, and the ...

**

King–Plosser–Rebelo preferences

*

Hyperbolic absolute risk aversion

Most utility functions used for modeling or theory are well-behaved. They are usually monotonic and quasi-concave. However, it is possible for rational preferences not to be representable by a utility function. An example is

lexicographic preferences which are not continuous and cannot be represented by a continuous utility function.

Marginal utility

Economists distinguish between total utility and marginal utility. Total utility is the utility of an alternative, an entire consumption bundle or situation in life. The rate of change of utility from changing the quantity of one good consumed is termed the marginal utility of that good. Marginal utility therefore measures the slope of the utility function with respect to the changes of one good.

Marginal utility usually decreases with consumption of the good, the idea of "diminishing marginal utility". In calculus notation, the marginal utility of good X is

. When a good's marginal utility is positive, additional consumption of it increases utility; if zero, the consumer is satiated and indifferent about consuming more; if negative, the consumer would pay to reduce his consumption.

Law of diminishing marginal utility

Rational individuals only consume additional units of goods if it increases the marginal utility. However, the law of diminishing marginal utility means an additional unit consumed brings a lower marginal utility than that carried by the previous unit consumed. For example, drinking one bottle of water makes a thirsty person satisfied; as the consumption of water increases, he may feel begin to feel bad which causes the marginal utility to decrease to zero or even become negative. Furthermore, this is also used to analyze progressive taxes as the greater taxes can result in the loss of utility.

Marginal rate of substitution (MRS)

Marginal rate of substitution is the absolute value of the slope of the indifference curve, which measures how much an individual is willing to switch from one good to another. Using a mathematic equation,

keeping ''U''(''x''

1,''x''

2) constant. Thus, MRS is how much an individual is willing to pay for consuming a greater amount of ''x''

1.

MRS is related to marginal utility. The relationship between marginal utility and MRS is:

:

Expected utility

Expected utility theory deals with the analysis of choices among risky projects with multiple (possibly multidimensional) outcomes.

The

St. Petersburg paradox was first proposed by

Nicholas Bernoulli in 1713 and solved by

Daniel Bernoulli

Daniel Bernoulli ( ; ; – 27 March 1782) was a Swiss people, Swiss-France, French mathematician and physicist and was one of the many prominent mathematicians in the Bernoulli family from Basel. He is particularly remembered for his applicati ...

in 1738, although the Swiss mathematician

Gabriel Cramer

Gabriel Cramer (; 31 July 1704 – 4 January 1752) was a Genevan mathematician.

Biography

Cramer was born on 31 July 1704 in Geneva, Republic of Geneva to Jean-Isaac Cramer, a physician, and Anne Mallet. The progenitor of the Cramer family i ...

proposed taking the expectation of a square-root utility function of money in an 1728 letter to N. Bernoulli. D. Bernoulli argued that the paradox could be resolved if decision-makers displayed

risk aversion

In economics and finance, risk aversion is the tendency of people to prefer outcomes with low uncertainty to those outcomes with high uncertainty, even if the average outcome of the latter is equal to or higher in monetary value than the more c ...

and argued for a logarithmic cardinal utility function. (Analysis of international survey data during the 21st century has shown that insofar as utility represents happiness, as for

utilitarianism

In ethical philosophy, utilitarianism is a family of normative ethical theories that prescribe actions that maximize happiness and well-being for the affected individuals. In other words, utilitarian ideas encourage actions that lead to the ...

, it is indeed proportional to log of income.)

The first important use of the expected utility theory was that of

John von Neumann

John von Neumann ( ; ; December 28, 1903 – February 8, 1957) was a Hungarian and American mathematician, physicist, computer scientist and engineer. Von Neumann had perhaps the widest coverage of any mathematician of his time, in ...

and

Oskar Morgenstern

Oskar Morgenstern (; January 24, 1902 – July 26, 1977) was a German-born economist. In collaboration with mathematician John von Neumann, he is credited with founding the field of game theory and its application to social sciences and strategic ...

, who used the assumption of expected utility maximization in their formulation of

game theory

Game theory is the study of mathematical models of strategic interactions. It has applications in many fields of social science, and is used extensively in economics, logic, systems science and computer science. Initially, game theory addressed ...

.

In finding the probability-weighted average of the utility from each possible outcome:

:

Von Neumann–Morgenstern

Von Neumann and Morgenstern addressed situations in which the outcomes of choices are not known with certainty, but have probabilities associated with them.

A notation for a ''

lottery

A lottery (or lotto) is a form of gambling that involves the drawing of numbers at random for a prize. Some governments outlaw lotteries, while others endorse it to the extent of organizing a national or state lottery. It is common to find som ...

'' is as follows: if options A and B have probability ''p'' and 1 − ''p'' in the lottery, we write it as a linear combination:

:

More generally, for a lottery with many possible options:

:

where

.

By making some reasonable assumptions about the way choices behave, von Neumann and Morgenstern showed that if an agent can choose between the lotteries, then this agent has a utility function such that the desirability of an arbitrary lottery can be computed as a linear combination of the utilities of its parts, with the weights being their probabilities of occurring.

This is termed the ''expected utility theorem''. The required assumptions are four axioms about the properties of the agent's

preference relation over 'simple lotteries', which are lotteries with just two options. Writing

to mean 'A is weakly preferred to B' ('A is preferred at least as much as B'), the axioms are:

# completeness: For any two simple lotteries

and

, either

or

(or both, in which case they are viewed as equally desirable).

# transitivity: for any three lotteries

, if

and

, then

.

# convexity/continuity (Archimedean property): If

, then there is a

between 0 and 1 such that the lottery

is equally desirable as

.

# independence: for any three lotteries

and any probability ''p'',

if and only if

. Intuitively, if the lottery formed by the probabilistic combination of

and

is no more preferable than the lottery formed by the same probabilistic combination of

and

then and only then

.

Axioms 3 and 4 enable us to decide about the relative utilities of two assets or lotteries.

In more formal language: A von Neumann–Morgenstern utility function is a function from choices to the real numbers:

:

which assigns a real number to every outcome in a way that represents the agent's preferences over simple lotteries. Using the four assumptions mentioned above, the agent will prefer a lottery

to a lottery

if and only if, for the utility function characterizing that agent, the expected utility of

is greater than the expected utility of

:

:

.

Of all the axioms, independence is the most often discarded. A variety of

generalized expected utility Generalized expected utility is a decision theory, decision-making metric based on any of a variety of theories that attempt to resolve some discrepancies between expected utility theory and empirical observations, concerning choice under risk (stat ...

theories have arisen, most of which omit or relax the independence axiom.

Indirect utility

An indirect utility function gives the

optimal attainable value of a given utility function, which depends on the prices of the goods and the income or wealth level that the individual possesses.

Money

One use of the indirect utility concept is the notion of the utility of money. The (indirect) utility function for money is a nonlinear function that is

bounded and asymmetric about the origin. The utility function is

concave in the positive region, representing the phenomenon of

diminishing marginal utility

Marginal utility, in mainstream economics, describes the change in ''utility'' (pleasure or satisfaction resulting from the consumption) of one unit of a good or service. Marginal utility can be positive, negative, or zero. Negative marginal utilit ...

. The boundedness represents the fact that beyond a certain amount money ceases being useful at all, as the size of any economy at that time is itself bounded. The asymmetry about the origin represents the fact that gaining and losing money can have radically different implications both for individuals and businesses. The non-linearity of the utility function for money has profound implications in decision-making processes: in situations where outcomes of choices influence utility by gains or losses of money, which are the norm for most business settings, the optimal choice for a given decision depends on the possible outcomes of all other decisions in the same time-period.

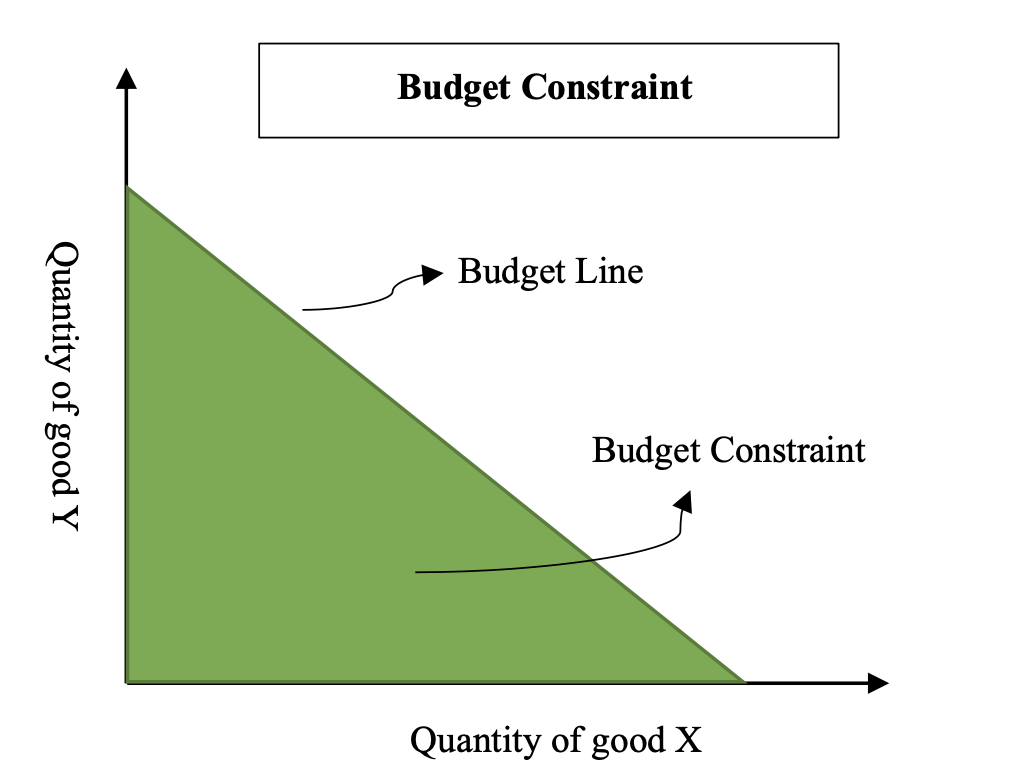

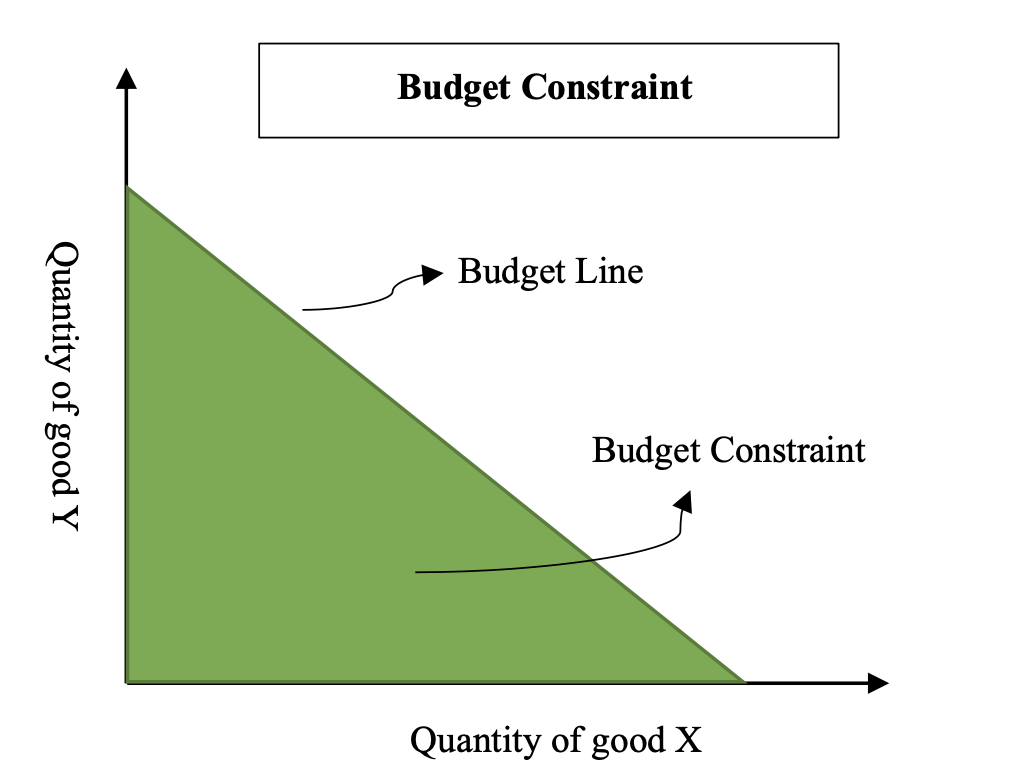

Budget constraints

Individuals' consumptions are constrained by their budget allowance. The graph of budget line is a linear, downward-sloping line between X and Y axes. All the bundles of consumption under the budget line allow individuals to consume without using the whole budget as the total budget is greater than the total cost of bundles (Figure 2). If only considers prices and quantities of two goods in one bundle, a budget constraint could be formulated as

, where

and

are prices of the two goods,

and

are quantities of the two goods.

:

Constrained utility optimisation

Rational consumers wish to maximise their utility. However, as they have budget constraints, a change of price would affect the quantity of demand. There are two factors could explain this situation:

* Purchasing power. Individuals obtain greater purchasing power when the price of a good decreases. The reduction of the price allows individuals to increase their savings so they could afford to buy other products.

* Substitution effect. If the price of good A decreases, then the good becomes relatively cheaper with respect to its substitutes. Thus, individuals would consume more of good A as the utility would increase by doing so.

Discussion and criticism

Cambridge economist

Joan Robinson

Joan Violet Robinson ( Maurice; 31 October 1903 – 5 August 1983) was a British economist known for her wide-ranging contributions to economic theory. One of the most prominent economists of the century, Robinson incarnated the "Cambridge Sc ...

famously criticized utility for being a circular concept: "Utility is the quality in

commodities

In economics, a commodity is an economic good, usually a resource, that specifically has full or substantial fungibility: that is, the market treats instances of the good as equivalent or nearly so with no regard to who produced them.

Th ...

that makes individuals want to buy them, and the fact that individuals want to buy commodities shows that they have utility". Robinson also stated that because the theory assumes that preferences are fixed this means that utility is not a

testable assumption. This is so because if we observe changes of peoples' behavior in relation to a change in prices or a change in budget constraint we can never be sure to what extent the change in behavior was due to the change of price or budget constraint and how much was due to a change of preference. This criticism is similar to that of the philosopher

Hans Albert who argued that the ''

ceteris paribus

' (also spelled ') (Classical ) is a Latin phrase, meaning "other things equal"; some other English translations of the phrase are "all other things being equal", "other things held constant", "all else unchanged", and "all else being equal". ...

'' (all else equal) conditions on which the

marginalist theory of demand rested rendered the theory itself a meaningless

tautology, incapable of being tested experimentally. In essence, a curve of demand and supply (a theoretical line of quantity of a product which would have been offered or requested for given price) is purely

ontological

Ontology is the philosophical study of being. It is traditionally understood as the subdiscipline of metaphysics focused on the most general features of reality. As one of the most fundamental concepts, being encompasses all of reality and every ...

and could never have been demonstrated

empirically

In philosophy, empiricism is an Epistemology, epistemological view which holds that true knowledge or justification comes only or primarily from Sense, sensory experience and empirical evidence. It is one of several competing views within ...

.

Other questions of what arguments ought to be included in a utility function are difficult to answer, yet seem necessary to understanding utility. Whether people gain utility from coherence of

wants,

beliefs

A belief is a subjective Attitude (psychology), attitude that something is truth, true or a State of affairs (philosophy), state of affairs is the case. A subjective attitude is a mental state of having some Life stance, stance, take, or opinion ...

or a sense of

duty

A duty (from "due" meaning "that which is owing"; , past participle of ; , whence "debt") is a commitment or expectation to perform some action in general or if certain circumstances arise. A duty may arise from a system of ethics or morality, e ...

is important to understanding their behavior in the utility

organon

The ''Organon'' (, meaning "instrument, tool, organ") is the standard collection of Aristotle's six works on logical analysis and dialectic. The name ''Organon'' was given by Aristotle's followers, the Peripatetics, who maintained against the ...

. Likewise, choosing between alternatives is itself a process of determining what to consider as alternatives, a question of choice within uncertainty.

An

evolutionary psychology

Evolutionary psychology is a theoretical approach in psychology that examines cognition and behavior from a modern evolutionary perspective. It seeks to identify human psychological adaptations with regard to the ancestral problems they evolved ...

theory is that utility may be better considered as due to preferences that maximized evolutionary

fitness in the ancestral environment but not necessarily in the current one.

Measuring utility functions

There are many empirical works trying to estimate the form of utility functions of agents with respect to money.

See also

*

Happiness economics

The economics of happiness or happiness economics is the theoretical, qualitative and quantitative study of happiness and quality of life, including positive and negative Affect (psychology), affects, well-being, life satisfaction and related co ...

*

Law of demand

In microeconomics, the law of demand is a fundamental principle which states that there is an inverse relationship between price and quantity demanded. In other words, "conditional on ceteris paribus, all else being equal, as the price of a Goods, ...

*

Marginal utility

Marginal utility, in mainstream economics, describes the change in ''utility'' (pleasure or satisfaction resulting from the consumption) of one unit of a good or service. Marginal utility can be positive, negative, or zero. Negative marginal utilit ...

*

Utility maximization problem

Utility maximization was first developed by utilitarian philosophers Jeremy Bentham and John Stuart Mill. In microeconomics, the utility maximization problem is the problem consumers face: "How should I spend my money in order to maximize my uti ...

- a problem faced by consumers in a market: how to maximize their utility given their budget.

*

Utility assessment - processes for estimating the utility functions of human subjects.

References

Further reading

*

*

*

*

*

*

*

*

*

* Viner, Jacob (1925). "The Utility Concept in Value Theory and Its Critics". ''Journal of Political Economy''. 33 (4): 369–387.

* Viner, Jacob (1925). "The Utility Concept in Value Theory and Its Critics". ''Journal of Political Economy''. 33 (6): 638–659.

External links

Definition of Utility by InvestopediaSimpler Definition with example from InvestopediaMaximization of Originality - redefinition of classic utility

and perhaps als

{{Authority control

Choice modelling

Concepts in ethics

Value (ethics)

Individual and social utility can be construed as the value of a utility function and a

Individual and social utility can be construed as the value of a utility function and a  :

: