|

Lottery (decision Theory)

In expected utility theory, a lottery is a discrete distribution of probability on a set of ''states of nature''. The elements of a lottery correspond to the probabilities that each of the states of nature will occur, (e.g. Rain: 0.70, No Rain: 0.30). Much of the theoretical analysis of choice under uncertainty involves characterizing the available choices in terms of lotteries. In economics, individuals are assumed to rank lotteries according to a rational system of preferences, although it is now accepted that people make irrational choices systematically. Behavioral economics studies what happens in markets in which some of the agents display human complications and limitations. Choice under risk According to expected utility theory, someone chooses among lotteries by multiplying his subjective estimate of the probabilities of the possible outcomes by a utility attached to each outcome by his personal utility function. Thus, each lottery has an expected utility, a linea ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Expected Utility Hypothesis

The expected utility hypothesis is a foundational assumption in mathematical economics concerning decision making under uncertainty. It postulates that rational agents maximize utility, meaning the subjective desirability of their actions. Rational choice theory, a cornerstone of microeconomics, builds this postulate to model aggregate social behaviour. The expected utility hypothesis states an agent chooses between risky prospects by comparing expected utility values (i.e., the weighted sum of adding the respective utility values of payoffs multiplied by their probabilities). The summarised formula for expected utility is U(p)=\sum u(x_k)p_k where p_k is the probability that outcome indexed by k with payoff x_k is realized, and function ''u'' expresses the utility of each respective payoff. Graphically the curvature of the u function captures the agent's risk attitude. For example, imagine you’re offered a choice between receiving $50 for sure, or flipping a coin to win $100 i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Behavioral Economics

Behavioral economics is the study of the psychological (e.g. cognitive, behavioral, affective, social) factors involved in the decisions of individuals or institutions, and how these decisions deviate from those implied by traditional economic theory. Behavioral economics is primarily concerned with the bounds of rationality of economic agents. Behavioral models typically integrate insights from psychology, neuroscience and microeconomic theory. Behavioral economics began as a distinct field of study in the 1970s and 1980s, but can be traced back to 18th-century economists, such as Adam Smith, who deliberated how the economic behavior of individuals could be influenced by their desires. The status of behavioral economics as a subfield of economics is a fairly recent development; the breakthroughs that laid the foundation for it were published through the last three decades of the 20th century. Behavioral economics is still growing as a field, being used increasingly in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ternary Plot

A ternary plot, ternary graph, triangle plot, simplex plot, or Gibbs triangle is a barycentric plot on three variables which sum to a constant. It graphically depicts the ratios of the three variables as positions in an equilateral triangle. It is used in physical chemistry, petrology, mineralogy, metallurgy, and other physical sciences to show the compositions of systems composed of three species. Ternary plots are tools for analyzing compositional data in the three-dimensional case. In population genetics, a triangle plot of genotype frequencies is called a de Finetti diagram. In game theory and convex optimization,Boyd, S. and Vandenberghe, L., 2004. Convex optimization. Cambridge university press. it is often called a simplex plot. In a ternary plot, the values of the three variables , , and must sum to some constant, . Usually, this constant is represented as 1.0 or 100%. Because for all substances being graphed, any one variable is not independent of the others, so ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Independence Axiom

Independence of irrelevant alternatives (IIA) is an axiom of decision theory which codifies the intuition that a choice between A and B (which are both related) should not depend on the quality of a third, unrelated outcome C. There are several different variations of this axiom, which are generally equivalent under mild conditions. As a result of its importance, the axiom has been independently rediscovered in various forms across a wide variety of fields, including economics, cognitive science, social choice, fair division, rational choice, artificial intelligence, probability, and game theory. It is closely tied to many of the most important theorems in these fields, including Arrow's impossibility theorem, the Balinski–Young theorem, and the money pump arguments. In behavioral economics, failures of IIA (caused by irrationality) are called menu effects or menu dependence. Motivation This is sometimes explained with a short story by philosopher Sidney Morgenbesser:Mor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Maurice Allais

Maurice Félix Charles Allais (31 May 19119 October 2010) was a French physicist and economist, the 1988 winner of the Nobel Memorial Prize in Economic Sciences "for his pioneering contributions to the theory of markets and efficient utilization of resources", along with John Hicks (Value and Capital, 1939) and Paul Samuelson (The Foundations of Economic Analysis, 1947), to neoclassical synthesis. They formalize the self-regulation of markets, which Keynes refuted but reiterated some of Allais's ideas. Born in Paris, France, Allais attended the Lycée Lakanal, graduated from the École Polytechnique in Paris and studied at the École nationale supérieure des mines de Paris. His academic and other posts have included being Professor of Economics at the École Nationale Supérieure des Mines de Paris (since 1944) and Director of its Economic Analysis Centre (since 1946). In 1949, he received the title of doctor-engineer from the University of Paris, Faculty of Science. He also ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Rationality (economics)

The term ''Homo economicus'', or economic man, is the portrayal of humans as agents who are consistently rational and narrowly self-interested, and who pursue their subjectively defined ends optimally. It is a wordplay on ''Homo sapiens'', used in some economic theories and in pedagogy. In game theory, ''Homo economicus'' is often (but not necessarily) modelled through the assumption of perfect rationality. It assumes that agents always act in a way that maximize utility as a consumer and profit as a producer, and are capable of arbitrarily complex deductions towards that end. They will always be capable of thinking through all possible outcomes and choosing that course of action which will result in the best possible result. The rationality implied in ''Homo economicus'' does not restrict what sort of preferences are admissible. Only naive applications of the ''Homo economicus'' model assume that agents know what is best for their long-term physical and mental health. For ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Daniel Bernoulli

Daniel Bernoulli ( ; ; – 27 March 1782) was a Swiss people, Swiss-France, French mathematician and physicist and was one of the many prominent mathematicians in the Bernoulli family from Basel. He is particularly remembered for his applications of mathematics to mechanics, especially fluid mechanics, and for his pioneering work in probability and statistics. His name is commemorated in the Bernoulli's principle, a particular example of the conservation of energy, which describes the mathematics of the mechanism underlying the operation of two important technologies of the 20th century: the carburetor and the aeroplane wing. Early life Daniel Bernoulli was born in Groningen (city), Groningen, in the Netherlands, into a Bernoulli family, family of distinguished mathematicians.Murray Rothbard, Rothbard, MurrayDaniel Bernoulli and the Founding of Mathematical Economics, ''Mises Institute'' (excerpted from ''An Austrian Perspective on the History of Economic Thought'') The Bernou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Utility Function

In economics, utility is a measure of a certain person's satisfaction from a certain state of the world. Over time, the term has been used with at least two meanings. * In a Normative economics, normative context, utility refers to a goal or objective that we wish to maximize, i.e., an objective function. This kind of utility bears a closer resemblance to the original Utilitarianism, utilitarian concept, developed by moral philosophers such as Jeremy Bentham and John Stuart Mill. * In a Positive economics, descriptive context, the term refers to an ''apparent'' objective function; such a function is Revealed preference, revealed by a person's behavior, and specifically by their preferences over Lottery (decision theory), lotteries, which can be any quantified choice. The relationship between these two kinds of utility functions has been a source of controversy among both Economics, economists and Ethics, ethicists, with most maintaining that the two are distinct but generally re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Rational Choice Theory

Rational choice modeling refers to the use of decision theory (the theory of rational choice) as a set of guidelines to help understand economic and social behavior. The theory tries to approximate, predict, or mathematically model human behavior by analyzing the behavior of a rational actor facing the same costs and benefits.Gary Browning, Abigail Halcli, Frank Webster (2000). ''Understanding Contemporary Society: Theories of the Present'', London: Sage Publications. Rational choice models are most closely associated with economics, where mathematical analysis of behavior is standard. However, they are widely used throughout the social sciences, and are commonly applied to cognitive science, criminology, political science, and sociology. Overview The basic premise of rational choice theory is that the decisions made by individual actors will collectively produce aggregate social behaviour. The theory also assumes that individuals have preferences out of available choice ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

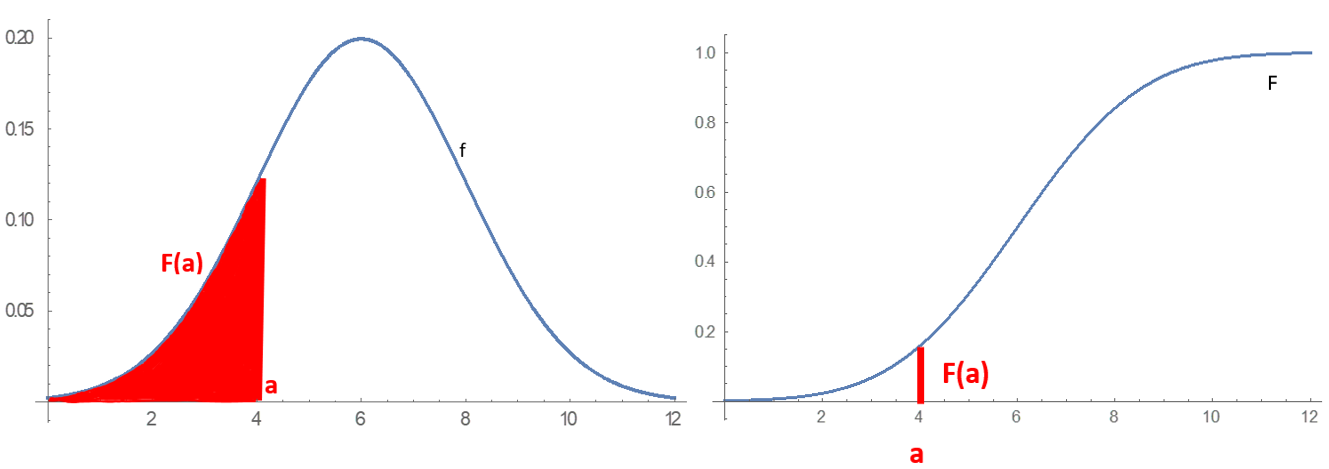

Probability Distribution

In probability theory and statistics, a probability distribution is a Function (mathematics), function that gives the probabilities of occurrence of possible events for an Experiment (probability theory), experiment. It is a mathematical description of a Randomness, random phenomenon in terms of its sample space and the Probability, probabilities of Event (probability theory), events (subsets of the sample space). For instance, if is used to denote the outcome of a coin toss ("the experiment"), then the probability distribution of would take the value 0.5 (1 in 2 or 1/2) for , and 0.5 for (assuming that fair coin, the coin is fair). More commonly, probability distributions are used to compare the relative occurrence of many different random values. Probability distributions can be defined in different ways and for discrete or for continuous variables. Distributions with special properties or for especially important applications are given specific names. Introduction A prob ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economics

Economics () is a behavioral science that studies the Production (economics), production, distribution (economics), distribution, and Consumption (economics), consumption of goods and services. Economics focuses on the behaviour and interactions of Agent (economics), economic agents and how economy, economies work. Microeconomics analyses what is viewed as basic elements within economy, economies, including individual agents and market (economics), markets, their interactions, and the outcomes of interactions. Individual agents may include, for example, households, firms, buyers, and sellers. Macroeconomics analyses economies as systems where production, distribution, consumption, savings, and Expenditure, investment expenditure interact; and the factors of production affecting them, such as: Labour (human activity), labour, Capital (economics), capital, Land (economics), land, and Entrepreneurship, enterprise, inflation, economic growth, and public policies that impact gloss ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Choice Under Uncertainty

Decision theory or the theory of rational choice is a branch of probability, economics, and analytic philosophy that uses expected utility and probability to model how individuals would behave rationally under uncertainty. It differs from the cognitive and behavioral sciences in that it is mainly prescriptive and concerned with identifying optimal decisions for a rational agent, rather than describing how people actually make decisions. Despite this, the field is important to the study of real human behavior by social scientists, as it lays the foundations to mathematically model and analyze individuals in fields such as sociology, economics, criminology, cognitive science, moral philosophy and political science. History The roots of decision theory lie in probability theory, developed by Blaise Pascal and Pierre de Fermat in the 17th century, which was later refined by others like Christiaan Huygens. These developments provided a framework for understanding risk and uncerta ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |