|

Isoelastic Utility

In economics, the isoelastic function for utility, also known as the isoelastic utility function, or power utility function, is used to express utility in terms of consumption or some other economic variable that a decision-maker is concerned with. The isoelastic utility function is a special case of hyperbolic absolute risk aversion and at the same time is the only class of utility functions with constant relative risk aversion, which is why it is also called the CRRA (constant relative risk aversion) utility function. In statistics, the same function is called the Box-Cox transformation. It is : u(c) = \begin \frac & \eta \ge 0, \eta \neq 1 \\ \ln(c) & \eta = 1 \end where c is consumption, u(c) the associated utility, and \eta is a constant that is positive for risk averse agents. Since additive constant terms in objective functions do not affect optimal decisions, the –1 is sometimes omitted in the numerator (although it should be kept if one wishes to preserve mathema ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk

In simple terms, risk is the possibility of something bad happening. Risk involves uncertainty about the effects/implications of an activity with respect to something that humans value (such as health, well-being, wealth, property or the environment), often focusing on negative, undesirable consequences. Many different definitions have been proposed. One ISO standard, international standard definition of risk is the "effect of uncertainty on objectives". The understanding of risk, the methods of assessment and management, the descriptions of risk and even the definitions of risk differ in different practice areas (business, economics, Environmental science, environment, finance, information technology, health, insurance, safety, security, security, privacy, etc). This article provides links to more detailed articles on these areas. The international standard for risk management, ISO 31000, provides principles and general guidelines on managing risks faced by organizations. Defi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk Aversion

In economics and finance, risk aversion is the tendency of people to prefer outcomes with low uncertainty to those outcomes with high uncertainty, even if the average outcome of the latter is equal to or higher in monetary value than the more certain outcome. Risk aversion explains the inclination to agree to a situation with a lower average payoff that is more predictable rather than another situation with a less predictable payoff that is higher on average. For example, a risk-averse investor might choose to put their money into a bank account with a low but guaranteed interest rate, rather than into a stock that may have high expected returns, but also involves a chance of losing value. Example A person is given the choice between two scenarios: one with a guaranteed payoff, and one with a risky payoff with same average value. In the former scenario, the person receives $50. In the uncertain scenario, a coin is flipped to decide whether the person receives $100 or nothing. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exponential Utility

In economics and finance, exponential utility is a specific form of the utility function, used in some contexts because of its convenience when risk (sometimes referred to as uncertainty) is present, in which case expected utility is maximized. Formally, exponential utility is given by: :u(c) = \begin (1-e^)/a & a \neq 0 \\ c & a = 0 \\ \end c is a variable that the economic decision-maker prefers more of, such as consumption, and a is a constant that represents the degree of risk preference (a>0 for risk aversion, a=0 for risk-neutrality, or a of final wealth ''W'' subject to :W = x'r + (W_0 - x'k) \cdot r_f where the prime sign indicates a vector transpose and where W_0 is initial wealth, ''x'' is a column vector of quantities placed in the ''n'' risky assets, ''r'' is a random vector of stochastic returns on the ''n'' assets, ''k'' is a vector of ones (so W_0 - x'k is the quantity placed in the risk-free asset), and ''r''''f'' is the known scalar return on the risk-free asset ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Constant Elasticity Of Substitution

Constant elasticity of substitution (CES) is a common specification of many production functions and utility function In economics, utility is a measure of a certain person's satisfaction from a certain state of the world. Over time, the term has been used with at least two meanings. * In a Normative economics, normative context, utility refers to a goal or ob ...s in neoclassical economics. CES holds that the ability to substitute one input factor with another (for example labour with capital) to maintain the same level of production stays constant over different production levels. For utility functions, CES means the consumer has constant preferences of how they would like to substitute different goods (for example labour with consumption) while keeping the same level of utility, for all levels of utility. What this means is that both producers and consumers have similar input structures and preferences no matter the level of output or utility. The vital economic element o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Isoelastic Function

In mathematical economics, an isoelastic function, sometimes constant elasticity function, is a function that exhibits a constant elasticity, i.e. has a constant elasticity coefficient. The elasticity is the ratio of the percentage change in the dependent variable to the percentage causative change in the independent variable, in the limit as the changes approach zero in magnitude. For an elasticity coefficient r (which can take on any real value), the function's general form is given by : f(x) = , where k and r are constants. The elasticity is by definition :\text = \frac \frac = \frac , which for this function simply equals ''r''. Derivation Elasticity of demand is indicated by = \frac \frac , where r is the elasticity, Q is quantity, and P is price. Rearranging gets us: \frac = \frac Then integrating \int\frac =\int \frac r \ln(P) + C = \ln(Q) Simplify e^ = e^ (e^)^re^C = Q kP^r = Q Q(P) = kP^r Examples Demand functions An example in mic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

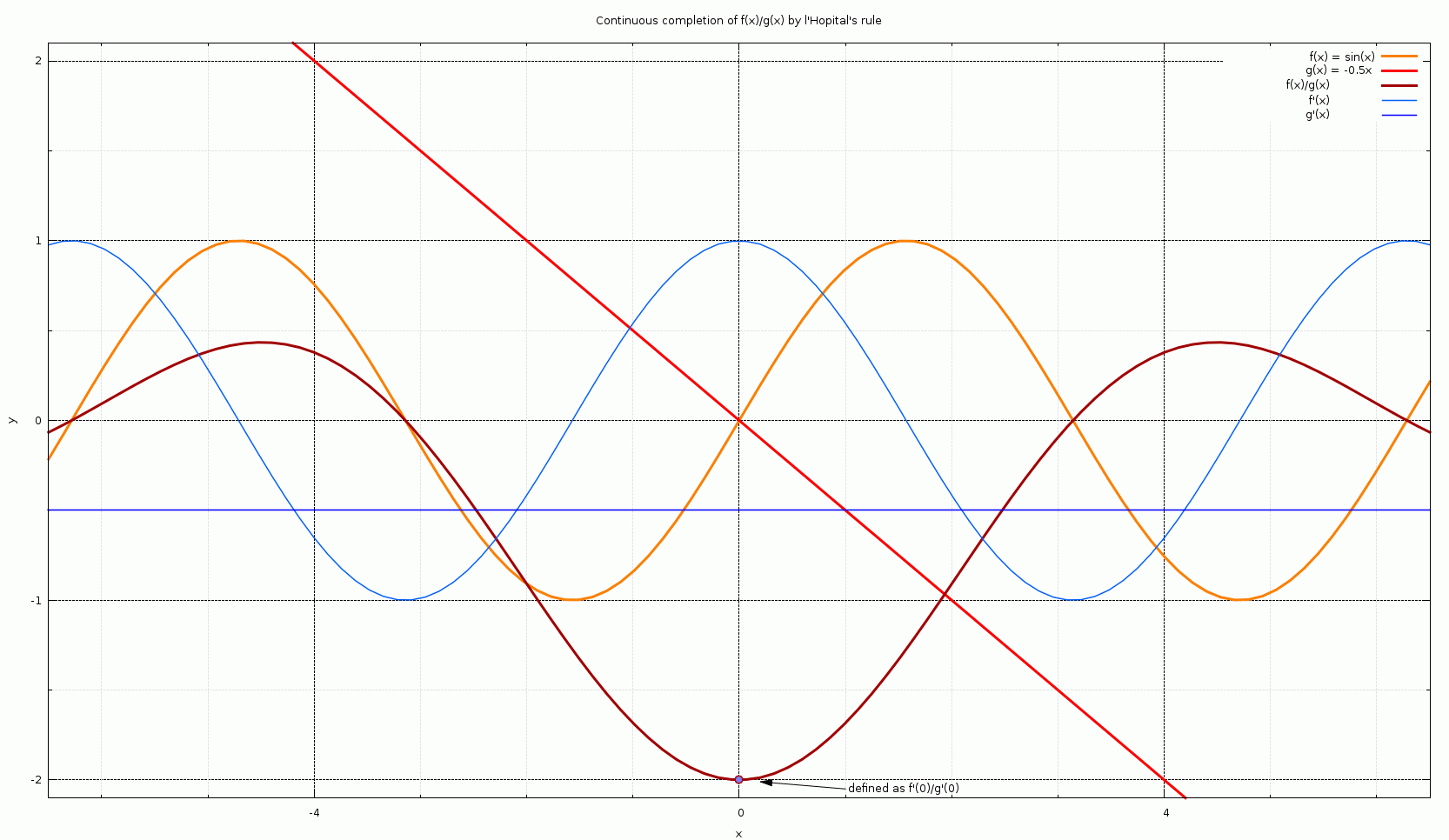

L'Hôpital's Rule

L'Hôpital's rule (, ), also known as Bernoulli's rule, is a mathematical theorem that allows evaluating limits of indeterminate forms using derivatives. Application (or repeated application) of the rule often converts an indeterminate form to an expression that can be easily evaluated by substitution. The rule is named after the 17th-century French mathematician Guillaume de l'Hôpital. Although the rule is often attributed to de l'Hôpital, the theorem was first introduced to him in 1694 by the Swiss mathematician Johann Bernoulli. L'Hôpital's rule states that for functions and which are defined on an open interval and differentiable on I\setminus \ for a (possibly infinite) accumulation point of , if \lim \limits_f(x)=\lim \limits_g(x)=0 \text\pm\infty, and g'(x)\ne 0 for all in I\setminus \, and \lim \limits_\frac exists, then :\lim_\frac = \lim_\frac. The differentiation of the numerator and denominator often simplifies the quotient or converts it to a limit t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk Neutrality

In simple terms, risk is the possibility of something bad happening. Risk involves uncertainty about the effects/implications of an activity with respect to something that humans value (such as health, well-being, wealth, property or the environment), often focusing on negative, undesirable consequences. Many different definitions have been proposed. One international standard definition of risk is the "effect of uncertainty on objectives". The understanding of risk, the methods of assessment and management, the descriptions of risk and even the definitions of risk differ in different practice areas (business, economics, environment, finance, information technology, health, insurance, safety, security, privacy, etc). This article provides links to more detailed articles on these areas. The international standard for risk management, ISO 31000, provides principles and general guidelines on managing risks faced by organizations. Definitions of risk Oxford English Dictionary ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Econometrica

''Econometrica'' is a peer-reviewed academic journal of economics, publishing articles in many areas of economics, especially econometrics. It is published by Wiley-Blackwell on behalf of the Econometric Society. The current editor-in-chief is Guido Imbens. History ''Econometrica'' was established in 1933. Its first editor was Ragnar Frisch, recipient of the first Nobel Memorial Prize in Economic Sciences in 1969, who served as an editor from 1933 to 1954. Although ''Econometrica'' is currently published entirely in English, the first few issues also contained scientific articles written in French. Indexing and abstracting ''Econometrica'' is abstracted and indexed in: * Scopus * EconLit * Social Sciences Citation Index According to the ''Journal Citation Reports'', the journal has a 2020 impact factor The impact factor (IF) or journal impact factor (JIF) of an academic journal is a type of journal ranking. Journals with higher impact factor values are considered mo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Northwestern Europe, off the coast of European mainland, the continental mainland. It comprises England, Scotland, Wales and Northern Ireland. The UK includes the island of Great Britain, the north-eastern part of the island of Ireland, and most of List of islands of the United Kingdom, the smaller islands within the British Isles, covering . Northern Ireland shares Republic of Ireland–United Kingdom border, a land border with the Republic of Ireland; otherwise, the UK is surrounded by the Atlantic Ocean, the North Sea, the English Channel, the Celtic Sea and the Irish Sea. It maintains sovereignty over the British Overseas Territories, which are located across various oceans and seas globally. The UK had an estimated population of over 68.2 million people in 2023. The capital and largest city of both England and the UK is London. The cities o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Von Neumann–Morgenstern Utility Function

The expected utility hypothesis is a foundational assumption in mathematical economics concerning decision making under uncertainty. It postulates that rational agents maximize utility, meaning the subjective desirability of their actions. Rational choice theory, a cornerstone of microeconomics, builds this postulate to model aggregate social behaviour. The expected utility hypothesis states an agent chooses between risky prospects by comparing expected utility values (i.e., the weighted sum of adding the respective utility values of payoffs multiplied by their probabilities). The summarised formula for expected utility is U(p)=\sum u(x_k)p_k where p_k is the probability that outcome indexed by k with payoff x_k is realized, and function ''u'' expresses the utility of each respective payoff. Graphically the curvature of the u function captures the agent's risk attitude. For example, imagine you’re offered a choice between receiving $50 for sure, or flipping a coin to win $100 if ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economics

Economics () is a behavioral science that studies the Production (economics), production, distribution (economics), distribution, and Consumption (economics), consumption of goods and services. Economics focuses on the behaviour and interactions of Agent (economics), economic agents and how economy, economies work. Microeconomics analyses what is viewed as basic elements within economy, economies, including individual agents and market (economics), markets, their interactions, and the outcomes of interactions. Individual agents may include, for example, households, firms, buyers, and sellers. Macroeconomics analyses economies as systems where production, distribution, consumption, savings, and Expenditure, investment expenditure interact; and the factors of production affecting them, such as: Labour (human activity), labour, Capital (economics), capital, Land (economics), land, and Entrepreneurship, enterprise, inflation, economic growth, and public policies that impact gloss ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |